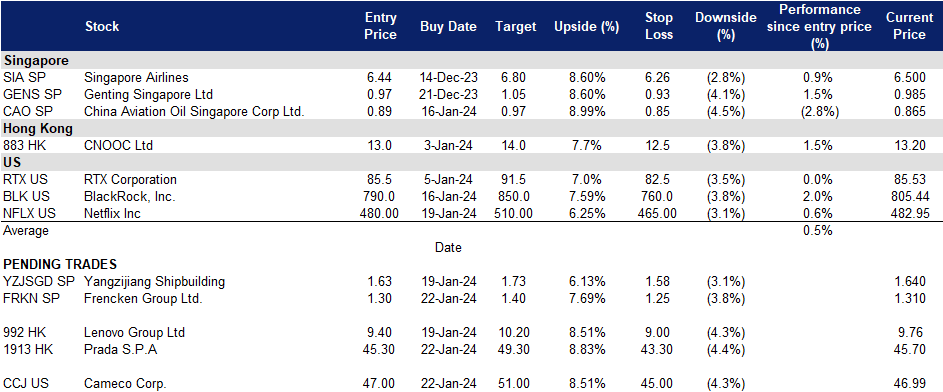

22 January 2024: Frencken Group Ltd (FRKN SP), Prada S.P.A. (1913 HK), Cameco Corp. (CCJ US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

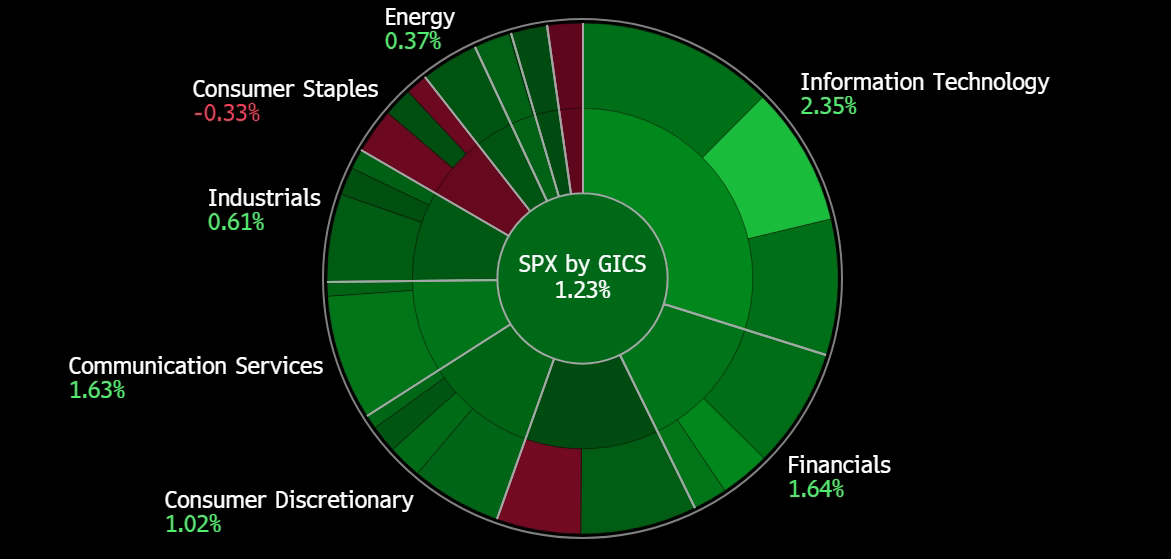

United States

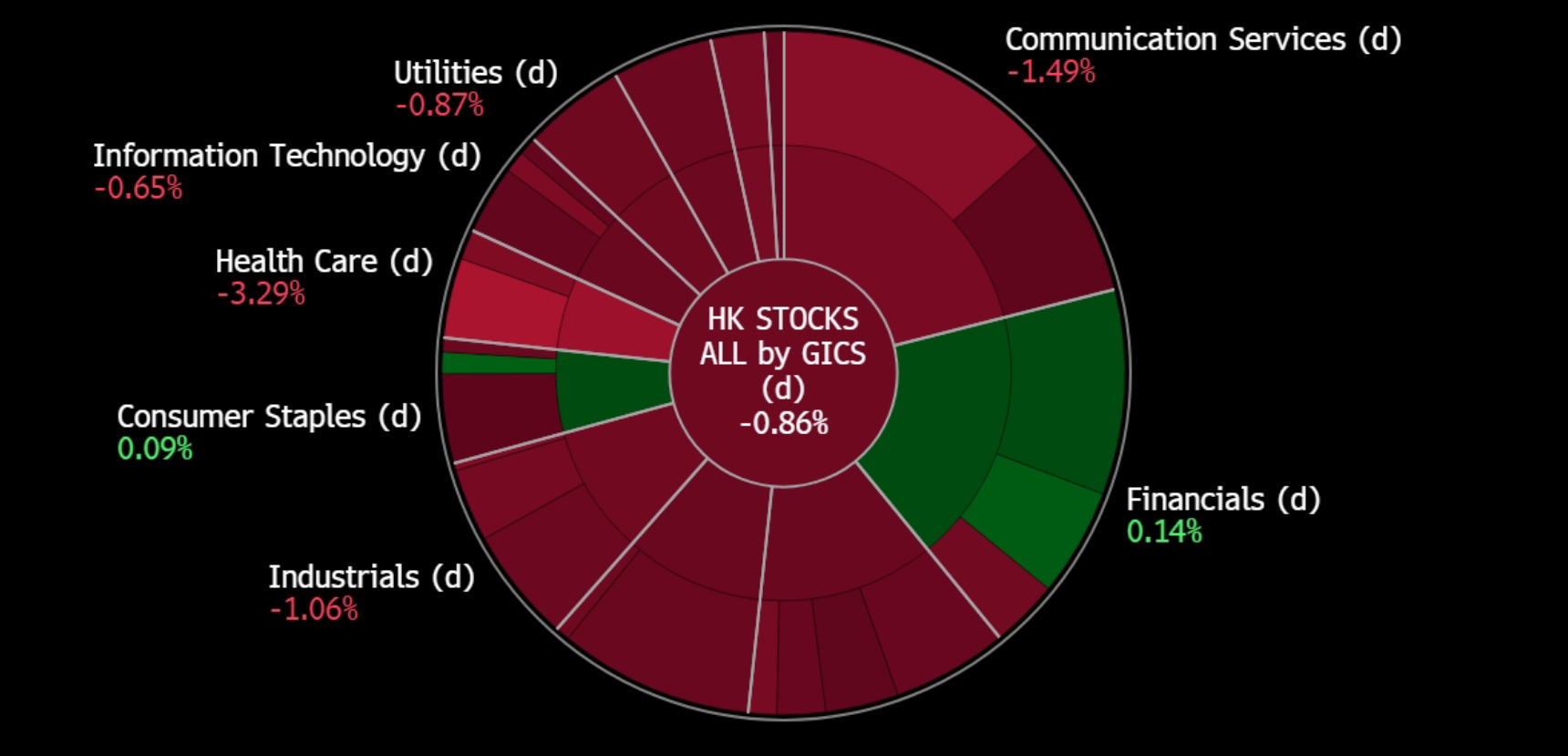

Hong Kong

Frencken Group Ltd (FRKN SP): Ride on the chip sector rally

- BUY Entry – 1.30 Target– 1.40 Stop Loss – 1.25

- Frencken Group Limited (“Frencken”) is a Global Integrated Technology Solutions Company that is listed on the Main Board of the Singapore Exchange. They provide comprehensive Original Design, Original Equipment and Diversified Integrated Manufacturing solutions for world-class multinational companies in the analytical & life sciences, automotive, healthcare, industrial and semiconductor industries.

- Strong AI chip demand signal from world’s largest semiconductor producer. Taiwan Semiconductor Manufacturing’s strong demand for high-end chips used in artificial intelligence (AI) has propelled the semiconductor index up, contributing to broader market gains. The positive outlook for AI demand in 2024 has driven optimism, with experts foreseeing substantial revenue growth for semiconductor companies, indicating the early stages of a technological revolution. Nvidia, a key player in AI computing, also experienced share gains, reaching a fresh record peak. We anticipate that this positive momentum will translate into revenue generated by Frencken’s semiconductor segment, which accounted for about 40% of its Q3 revenue.

- Anticipated decline in interest rates. The Federal Reserve is anticipated to keep its key interest rate steady within the 5.25%-5.5% range in the January meeting. Although the market’s implied probability of a March cut has decreased from the high of 75% to 53.8%, signalling reduced confidence in an imminent rate cut, the Federal Open Market Committee had previously outlined plans for at least three rate cuts in 2024. The expected decline in rates throughout the year could contribute to increased valuations in the semiconductor sector.

- 3Q23 results review. 3Q23 revenue declined by 5.6% to $184.4mn. Earnings plunged 35.1% YoY to $7.1mn due to challenging business conditions for the technology sector. Gross profit margin contracted to 12.4% from 13.7% in 3Q22, attributing it to lower revenue, inflationary cost pressures as well as increased depreciation expenses.

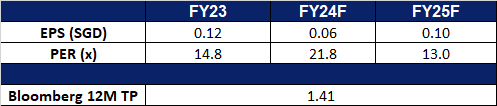

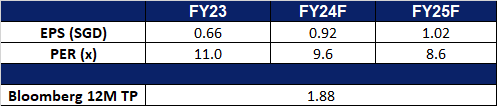

- Market Consensus.

(Source: Bloomberg)

Yangzijiang Shipbuilding (YZJSGD SP): A nice start in 2024

Yangzijiang Shipbuilding (YZJSGD SP): A nice start in 2024

- RE-ITEREATE BUY Entry– 1.63 Target– 1.73 Stop Loss – 1.58

- Yangzijiang Shipbuilding Holdings Limited builds a wide range of ships. The Company produces a wide range of commercial vessels, mini bulk carriers, multi-purpose cargo vessels, container ships, chemical tankers, offshore supply vessels, rescue and salvage vessels, and lifting vessels.

- Hedging against potential weakening RMB. The year-end rally in RMB against USD was due mainly to the pullback in US dollars as investors were optimistic about aggressive rate cuts from the Fed in 2024. However, the recent US labour market data showed the US economy remained strong, cooling down the previous rate-cut expectations. China’s economic recovery remains gloomy, and it will take longer to mitigate the impact of the property debt problem and rebuild confidence. Therefore, the RMB will weaken against the USD again once the previous positive expectations fail to be realised.

Share price and USD/RMB price trend comparison

(Source: Bloomberg)

- Growth in container vessel and tanker demand in 2024. According to Clarkson, 350 newly built container vessels were delivered in 2023, totalling 2.21mn TEU. China delivered more than 200 units. Clarkson estimates that the total container shipping capacity will grow by 7% and 5% in 2024 and 2025 respectively. According to shipbroker Xclusiv, the tankers market is expected to grow in 2024, mainly driven by the Asian oil demand. Southeast Asia and China will see 3.2% and 2.9% growth in oil demand this year.

- 1H23 orderbook exceeded the full-year target. As of June, the company has obtained orders for 72 vessels, amounting to a value of US$5.76 billion, surpassing its target of US$3 billion for 2023. This has resulted in the highest-ever outstanding orderbook value for Yangzijiang, standing at US$14.7 billion for 181 vessels. Among all ordered vessels, 91 are containerships, 29 are oil tankers, 53 are bulk carriers, and 8 are LNG/LPG/LEG.

- 1H23 results review. Revenue for 1H23 increased by 16% YoY to RMB11.3bn. Gross profit increased by 48% YoY to RMB2.1bn. GPM increased by 4ppts to 19%. PATMI increased by 26% YoY to RMB1.7bn.

- Market Consensus.

Prada S.P.A. (1913 HK): 90s fashion revives

- BUY Entry – 45.3 Target – 49.3 Stop Loss – 43.3

- Prada SpA is an Italy-based company engaged in fashion industry. The Company is a parent of the Prada Group. The Company, along with its subsidiaries, is engaged in the design, production and distribution of leather goods, handbags, clothing, eyewear, fragrances, footwear and accessories. Prada SpA manufactures jackets, trousers, skirts, dresses, sweaters, blouses, as well as perfumes and watches, among others. The Company trades its products through several brands, such as Prada, Miu Miu, The Church and The Car Shoe. Prada SpA operates in approximately 70 countries through directly operated stores, franchise operated stores, a network of selected multi-brand stores and department stores. Prada Spa operates through a numerous subsidiaries, including Artisans Shoes Srl, Angelo Marchesi Srl, Prada Far East BV, Tannerie Megisserie Hervy SAS and Prada SA, among others.

- Chinese New Year Campaign. Prada has recently launched its Chinese New Year campaign for the Year of the Dragon in 2024, drawing inspiration from the nostalgic charm of Wong Kar-wai’s iconic films. Infused with romanticism and vibrant red tones, the campaign features Du Juan, the latest muse prominently featured in Wong Kar-wai’s recently debuted TV series, Blossoms Shanghai. Notably, Zhao Lei, recognized as the face of Yang Fudong’s film, First Spring, is showcased at the Pradasphere II exhibition in Shanghai. The collection introduces Re-Nylon bucket hats, patent leather mini bags, and pouches in cherry red, as well as black leather wallets and belts. Additionally, Prada Home contributes to the ensemble with quirky porcelain cups, collectively capturing the essence of this thematic celebration. This well-curated selection provides consumers with several choices for wardrobe staples for the Year of the Dragon.

- Expanding presence. Prada recently expanded its global presence through the acquisition of Fifth Avenue Store in New York City, with the transaction valued at US$425mn. The company highlights the strategic importance of the property’s location on Fifth Avenue. With Fifth Avenue in New York standing tall as the world’s most expensive retail street, it is bound to attract many shoppers and drive revenue for the company. Prada Group also recently formed a joint venture with Store Specialist Inc. (SSI) to own and operate the retail stores of the luxury brand Prada in the country. Prada Philippines will be 60% owned by Prada S.p.A., and 40 percent owned by SSI. The store has already begun operation since the start of 2024.

- Topping Lyst Index. Miu Miu, a Italian high fashion women’s clothing and accessory brand and a fully-owned subsidiary of Prada, topped the Lyst Index in 3Q2023, which is a quarterly ranking of fashion’s hottest brands and products. The formula behind The Lyst Index takes into account Lyst shoppers’ behavior, including searches on and off the platform, product views, and sales. To track brand and product heat, the formula also incorporates social media mentions, activity and engagement statistics worldwide, over three months. With Miu Miu still releasing several products such as the recent’s Wander matelassé nappa leather hobo bag, Miu Miu is likely to top the Lyst Index for 4Q2023.

- 9M23 earnings. Revenue rose by 10.3% YoY at constant exchange rates to €3.34bn in 9M2023, compared to €2.98bn in 9M22. Retail Sales rose 10.4% YoY at constant exchange rates to €298bn in 9M23, compared with €2.65bn in 9M22, driven by like-for-like and full-price sales.

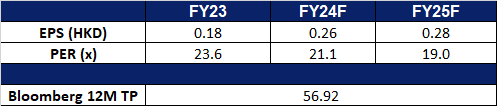

- Market consensus.

(Source: Bloomberg)

Lenovo Group Ltd. (992 HK): AI in PC

- RE-ITERATE BUY Entry – 9.40 Target – 10.20 Stop Loss – 9.00

- Lenovo Group Limited is an investment holding company principally engaged in personal computers and related businesses. The Company’s main products include Think-branded commercial personal computers and Idea-branded consumer personal computers, as well as servers, workstations and a family of mobile Internet devices, including tablets and smart phones. The Company operates its business through four geographical segments, including China, Asia Pacific (AP), Europe, the Middle East and Africa (EMEA) and Americas (AG). The Company also provides cloud service and other related services. The Company distributes its products in domestic market and to overseas markets.

- A new AI co-pilot keyboard function. Microsoft has recently unveiled a groundbreaking addition to Windows PC and laptop keyboards: a new key that summons Microsoft’s Copilot, an AI assistant. This innovative AI-powered chatbot assists users in tasks ranging from research and text drafting to image creation and even turning ideas into songs. This marks a significant departure from traditional keyboard design, reflecting Microsoft’s steadfast commitment to artificial intelligence. As businesses strive to adapt to the swiftly evolving technology landscape, this advancement in AI is anticipated to drive up demand for computer accessories and peripherals. Lenovo, a key customer of Microsoft, stands to benefit substantially from the surge in demand for these products spurred by advancements in AI technology.

- Unveiling new AI-Powered Creativity and Productivity Devices and Solutions. During the 2024 International CES, Lenovo made a significant debut by introducing over 40 new devices and solutions infused with AI, aligning with the company’s overarching vision of making AI accessible to everyone. The unveiled lineup encompasses innovative AI PC offerings spanning Lenovo’s Yoga™, ThinkBook™, ThinkPad™, ThinkCentre™, and Legion™ sub-brands, delivering a personalized computing experience unprecedented for both consumers and businesses. Complementing this, Lenovo presented two proof-of-concept products, a tablet, a software app, Motorola AI features, various accessories, and more, collectively forming a comprehensive and robust portfolio of cutting-edge technology solutions.

- PC demand recovery. PC demand has shown signs of recovery, and is expected to continue recovering in 2024, after a demand slump in 2023. This is also boosted by the boom in AI technology, which increase the demand for PCs equipped with new AI technologies. Furthermore, suppliers are also gearing up more for replacement demand, where many consumers are expected to replace their PCs, accessories and peripherals after more than 2 years of usage since the digital boom during the Covid-19 pandemic.

- 2Q23 earnings. Revenue fell by 15.7% YoY to US$14.4bn in 2Q2023, compared to US$17.1bn in 2Q22. Net profit fell YoY to US$289.1mn in 2Q2023, compared to US$553.8mn in 2Q22. Basic EPS fell YoY to US2.09 cents in 2Q23, compared to US4.54cents in 2Q22.

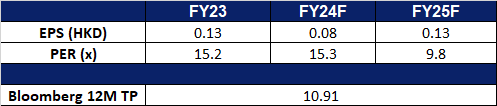

- Market consensus.

(Source: Bloomberg)

Cameco Corp. (CCJ US): Supplies running low

- BUY Entry – 47 Target – 51 Stop Loss – 45

- Cameco Corporation explores, develops, mines, refines, converts, and fabricates uranium. The Company offers uranium for sale as fuel for generating electricity in nuclear power reactors. Cameco operates worldwide.

- Prices sky rocketing. Uranium has soared to US$106 per pound, reaching its highest level since 2007. The market has faced pressure for the past five years due to a global crackdown on fossil fuels, particularly coal, leading to potential electricity supply constraints. Increased demand for electrification, especially in vehicles, and a shift in perception of nuclear power as a relatively benign form of energy generation contribute to the uranium market’s boom. Kazatomprom, a major producer of uranium, warned that it is likely to fall short of its output targets over the next two years due to raw material shortages and disruptions, driving uranium prices upwards. Despite historical incidents at nuclear power plants, ongoing strong demand has begun outstripping Uranium supply. Persistent supply limitations in the uranium market coincide with a rising demand for the metal, crucial for nuclear energy production. At the Dubai COP28 climate summit last year, 22 countries pledged to triple nuclear capacity by 2050 further underscoring this growth in demand.

- Uranium enrichment funding. Recently, the US Department of Energy’s top nuclear energy official, urged Congress to approve a White House supplemental funding request of US$2.16bn for nuclear fuel enrichment. The additional funding aims to expand domestic conversion and enrichment facilities, reducing dependence on Russian uranium. The move is crucial for ensuring a sufficient supply of fuel for current and future nuclear reactors in the US. The US Department of Energy (DOE) has been soliciting bids from contractors to establish a domestic supply of high assay low enriched uranium (HALEU) fuel enriched up to 20%, currently available commercially only from Russia. Contracts of up to 10 years are sought from enrichment service companies to produce HALEU fuel, and the DOE has approximately US$500mn in funding for this purpose. The program is aimed at procuring fuel supplies to support the next generation of reactors, including those developed by X-energy and TerraPower. The move aligns with President Biden’s climate change agenda, but concerns about nuclear proliferation risks have been raised by experts. The only US company with a license to produce HALEU is Centrus Energy, which hopes the request for proposals will lead to more production at its Ohio plant. European uranium enrichment company Urenco could potentially produce US HALEU but currently lacks a license.

- 3Q23 results. Revenue rose to US$575mn, up 47.8% YoY, beat expectations by US$51mn. Non-GAAP EPS beat estimates by US$0.22 at US$0.32.

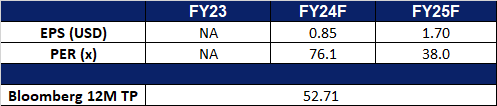

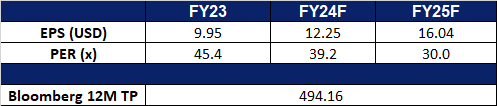

- Market consensus.

(Source: Bloomberg)

Netflix Inc. (NFLX US): Dominating your screens

- RE-ITEREATE BUY Entry – 480 Target – 510 Stop Loss – 465

- Netflix Inc. operates as a subscription streaming service and production company. The Company offers a wide variety of TV shows, movies, anime, and documentaries on internet-connected devices. Netflix serves customers worldwide.

- Levelling up. Netflix’s entry into gaming 2 years prior, appears to be paying off, with a reported 180% YoY increase in game downloads in 2023, totalling 81.2mn downloads worldwide. The company’s gaming portfolio, initially launched with casual and show-tied games, expanded with acquisitions like Night School Studio and Spry Fox. Grand Theft Auto: San Andreas became Netflix’s most-downloaded game of all time, driving up interest. All three GTA mobile games collectively racked up over 6.4mn downloads in less than a week after arriving on Netflix, making up about 17% of Netflix’s 2023 gaming downloads. Despite the success, the data suggests that Netflix needs regular releases and ongoing promotion to sustain gaming engagement as daily game downloads have been seen to taper off after a while even for popular games such as GTA. The company is also building an AAA studio for a multi-platform game based on unique IP. As of December 2023, Netflix had a total of 89 total games across its platforms and had nearly 90 more games in development.

- Ad tier highs. Netflix’s ad-supported tier which launched in November 2022, has attracted over 23mn global active users per month, according to its advertising chief, Amy Reinhard. This marks a significant increase from the 15mn active users reported a year after the ad tier’s launch. The move aims to tap into a new revenue stream amid growing competition for online viewers. With 85% of ad-supported customers streaming for over two hours daily, Netflix is leveraging this tier to boost revenue, particularly as it raises prices on its ad-free options. Furthermore, with continued price hikes on its ad-free tiers and password-sharing crackdowns, we anticipate more users to shift towards Netflix ad-supported plans. With this ongoing momentum, Netflix’s ad-supported plan may even surpass Disney+ in US advertising dollars next year.

- 3Q23 results. Revenue rose to US$8.54bn, up 7.7% YoY, in line with expectations. GAAP EPS beat estimates by US$0.23 at US$3.73. Expect Q4 revenue of US$8.69bn vs US$8.54bn consensus. Revised its full-year operating margin upwards to 20%. FY24 operating margin to be between 22% and 23%.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Add Netflix, Inc. (NFLX US) at US$480.