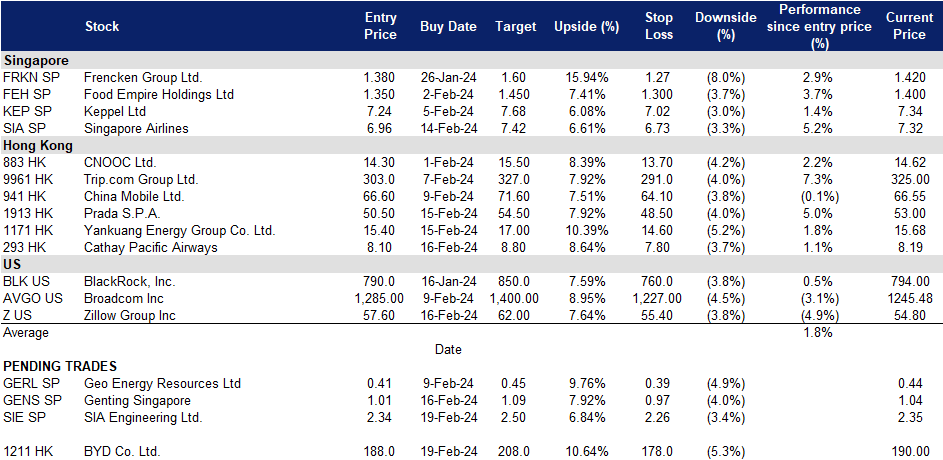

19 February 2024: SIA Engineering Co Ltd (SIESP), BYD Co. Ltd. (1211 HK)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

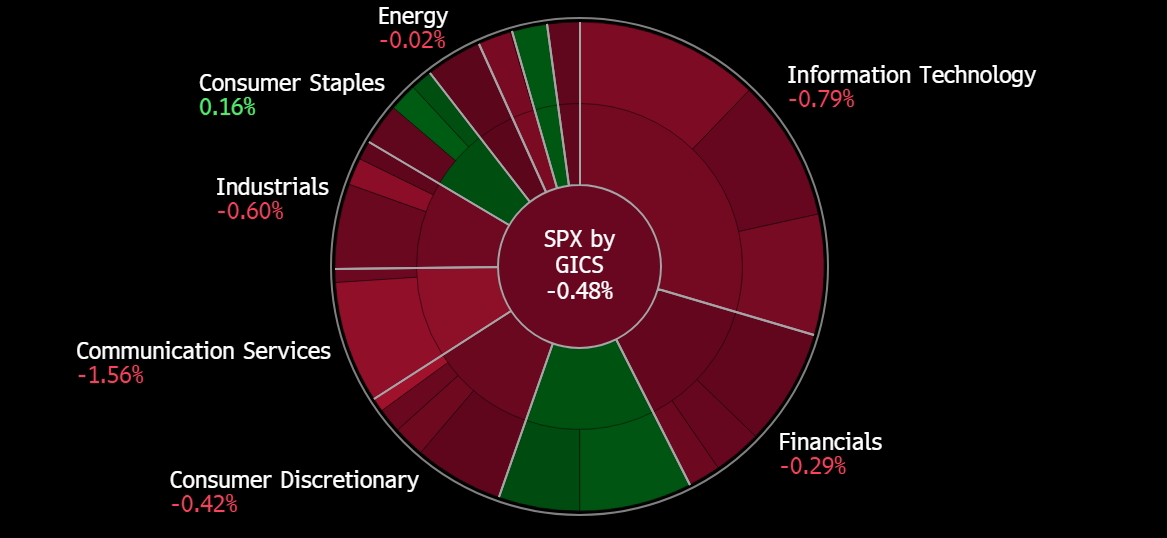

United States

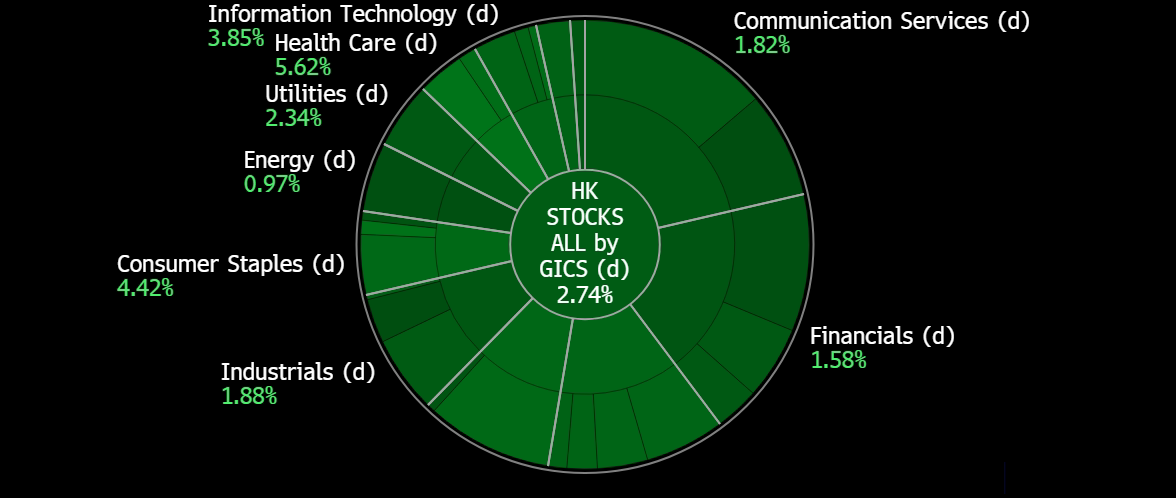

Hong Kong

SIA Engineering Co Ltd (SIESP): Aviation resilience

- Entry – 2.34 Target– 2.50 Stop Loss – 2.26

- SIA Engineering Co Ltd provides airframe and component overhaul services, line maintenance and technical ground handling services. The Company also manufactures aircraft cabin equipment, refurbishes aircraft galleys, repairs and overhauls hydromechanical aircraft equipment.

- Doubled in profits. SIA Engineering reported a significant increase in net profit to S$26.9mn for Q3 more than double compared to the same period last year. This growth was driven by a 40.2% YoY rise in revenue to S$291.7mn, attributed to healthy demand for aircraft maintenance services as global flight activities approached pre-pandemic levels. Despite supply-chain challenges affecting turnaround times and output rates, the line maintenance unit in Singapore saw a recovery to 94% of pre-pandemic levels. Increased expenditure, mainly due to higher manpower and material costs, was managed at a lower rate of 33.8%. For 9M24, net profit rose by 90.3% YoY to S$86.2mn, with revenue increasing by 41.3% YoY to S$805.7mn from S$570.3mn in 3Q23. During the quarter, SIA Engineering also established a third base maintenance hub in the Asia-Pacific region and acquired an additional 10% stake in Jamco Aero Design and Engineering to enhance cabin maintenance and retrofit services. Despite macroeconomic and geopolitical uncertainties, along with tight labour market conditions, impacting near-term operating margins, the company remains focused on cost management, productivity, and strategic investments to ensure sustainable growth.

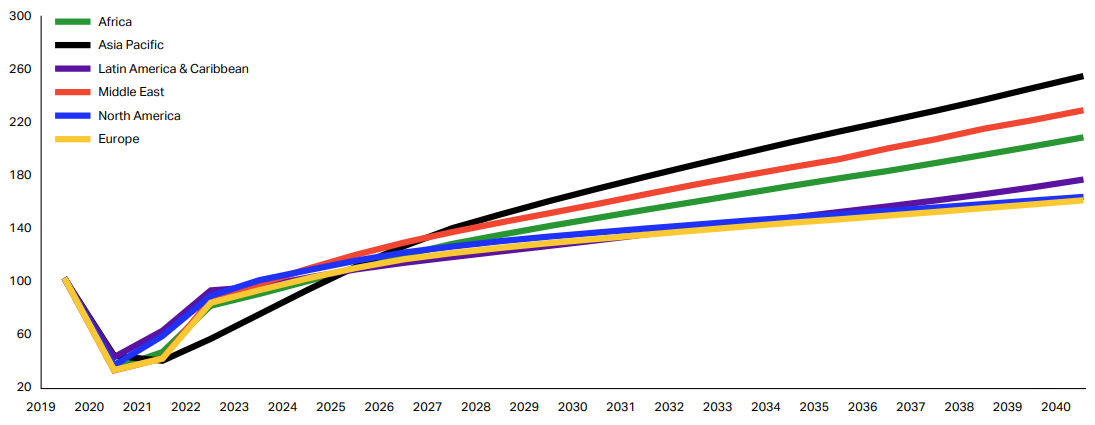

Yearly regional passenger totals (index 2019=100)

(Source: IATA – Global Outlook for Air Transport)

- Full recovery on the horizon. Global air travel is anticipated to surpass pre-Covid levels in 2024, with the Asia-Pacific region leading the recovery. Industry experts foresee strong demand driving profits for airlines, despite challenges such as persistent supply issues and thin profit margins. The International Air Transport Association (IATA) predicts airlines to generate US$25.7bn in profits in 2024, with Asia-Pacific projected to achieve full recovery in early 2024. While supply chain disruptions and production delays continue to constrain aircraft availability, demand remains resilient, although thin profit margins and external factors like fuel prices and regional conflicts may impact the industry’s fortunes in 2024. Overall, while challenges persist, the outlook for air travel recovery remains optimistic. This will be beneficial for SIA Engineering as it will be able to garner more business for its various service segments.

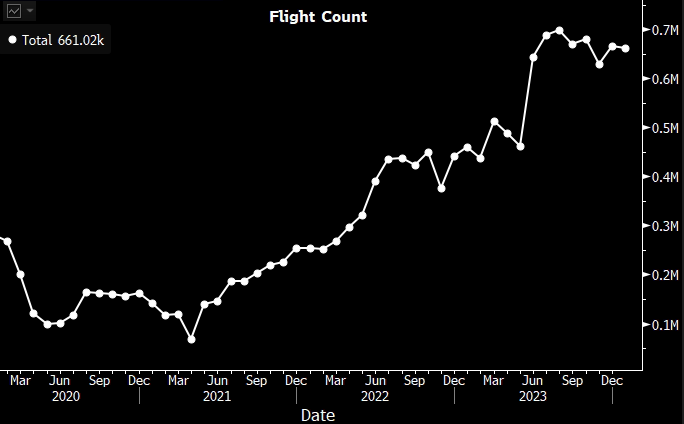

Monthly total flight count in Asia

- 2023 proven air travel demand. The International Air Transport Association (IATA) reported a significant recovery in global air travel demand in 2023, with total traffic reaching 94.1% of pre-pandemic levels. December 2023 traffic stood at 97.5% of December 2019 levels, indicating a strong rebound towards the end of the year. International traffic rose by 41.6% compared to 2022, reaching 88.6% of 2019 levels, while domestic traffic increased by 30.4% and surpassed 2019 levels by 3.9%. Asian-Pacific airlines experienced the strongest growth in international traffic, while Latin American airlines had the highest domestic load factor. Despite these positive trends, challenges such as supply-chain disruptions and geopolitical uncertainties persist.

- 3Q24 earnings. The company revenue for the period was S$291.7mn rising 40.2% YoY from the previous S$208.1mn. The company’s net profit rose to S$26.9mn, +110% YoY compared to S$12.8mn in 3Q23. Basic EPS rose from 1.14 cents in 3Q23 to 2.4 cents. The number of flights handled by its line maintenance unit in Singapore recovered to 94% of pre-pandemic levels compared to 75% a year ago.

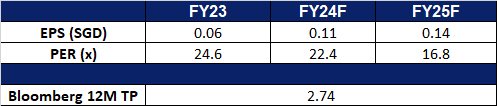

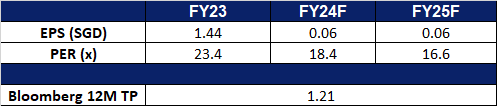

- Market Consensus.

(Source: Bloomberg)

Genting Singapore Ltd (GENS SP): Tourism on the rise

Genting Singapore Ltd (GENS SP): Tourism on the rise

- RE-ITEREATE Entry – 1.01 Target– 1.09 Stop Loss – 0.97

- Genting Singapore Limited, through its subsidiaries, develops resort properties as well as operates casinos. The Company has casinos and integrated resorts in different parts of the world, including Australia, the Americas, Malaysia, the Philippines and the United Kingdom.

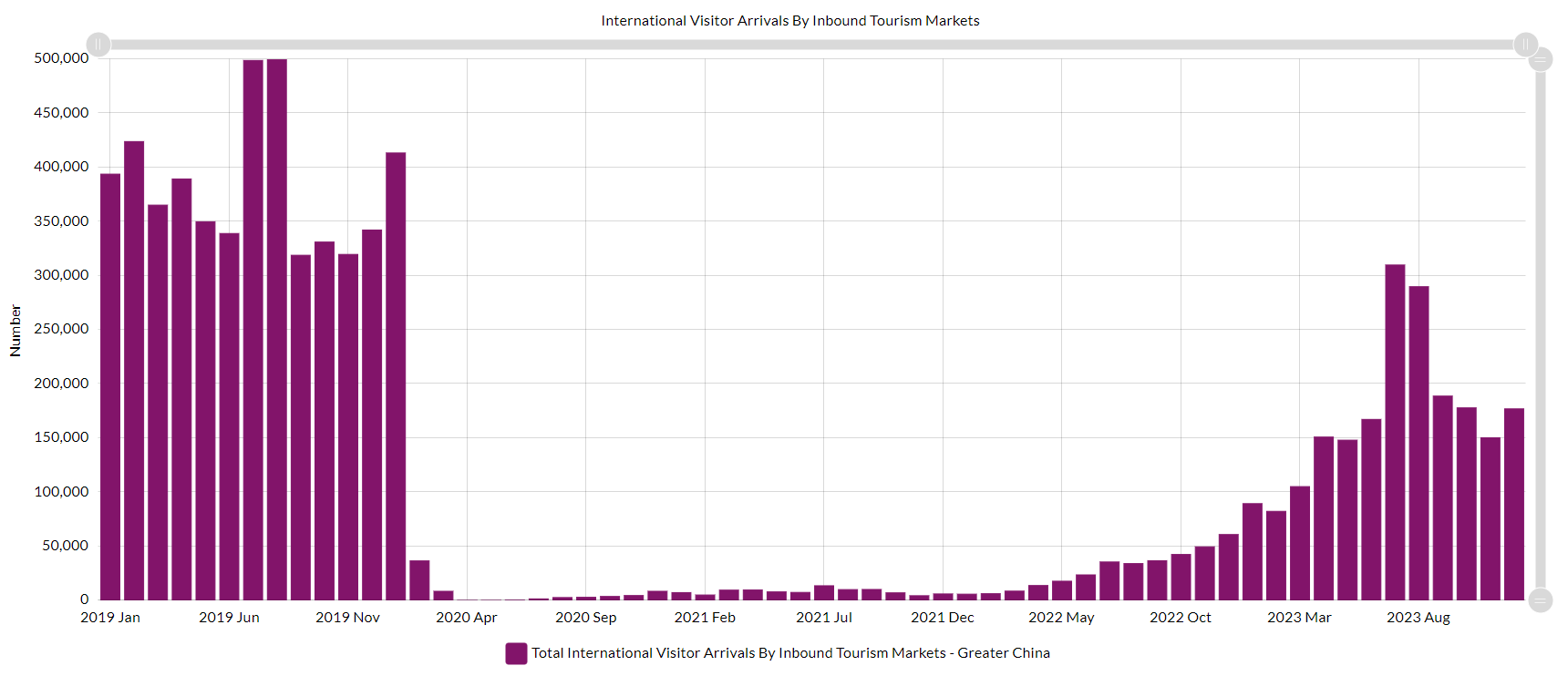

- 30-day mutual visa exemption. The mutual 30-day visa-free arrangement between Singapore and China, effective from 9 February, has sparked increased interest in travel between the two countries. Tour agencies, booking websites, and airlines have reported rising inquiries and bookings, anticipating a surge in travel demand. The new scheme is expected to encourage more Chinese travellers to visit Singapore, complementing the already growing interest among Singaporeans in exploring Chinese cities. While challenges such as language barriers remain, the agreement is seen as a positive step in boosting tourism between the two nations. Despite the economic uncertainties, there is optimism in the potential for growth in travel activities, driven by enhanced connectivity, cultural exchanges, and more affordable fares.

Monthly Visitor Arrivals from China – For the period between Jan 2019 to Dec 2023

(Source: Department of Statistics Singapore)

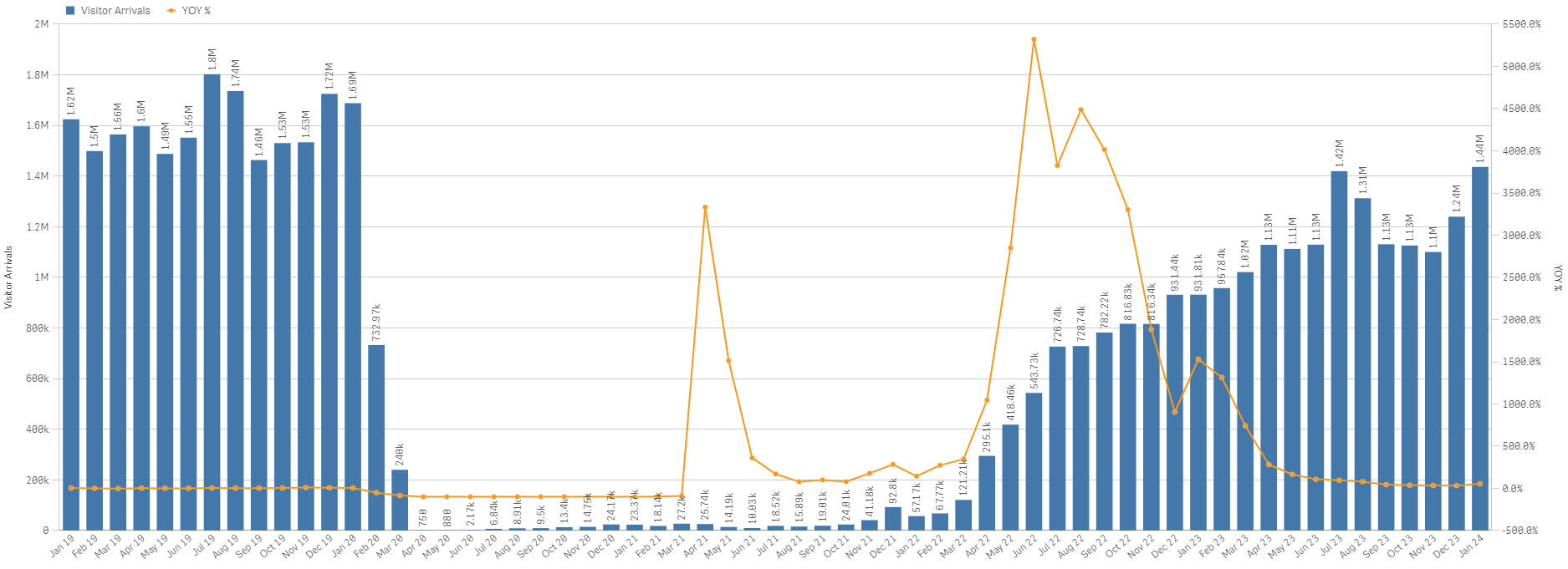

- More quality experiences for tourists. The Singapore Tourism Board (STB) projects continued tourism recovery in 2024, anticipating 15-16mn visitor arrivals and tourism receipts of S$26-27.5bn. Although pre-pandemic arrival numbers are not expected, tourist spending is anticipated to nearly match 2019 levels. In January, Singapore welcomed 1.44mn visitors, a 54.2% YoY increase and a 16.1% sequential rise, with 1.07mn being overnight visitors. The surge is credited to improved flight connectivity, factors like the mutual visa-free travel arrangement with China, and ongoing efforts to attract diverse visitors. The sector’s resilience is underscored by 2023’s strong performance, characterized by longer stays, expanded hotel capacity, and successful event hosting. STB’s strategy focuses on enhancing visitor experiences and prolonging stays to attract higher-spending tourists, prioritizing quality over quantity. This approach aligns with Singapore’s reputation for premium experiences and top-notch connectivity. Despite potential economic challenges, an emphasis on value-added experiences could help to sustain tourist spending, even if arrival numbers do not rebound to pre-pandemic levels until 2025.

Singapore monthly visitor arrivals trend – Jan 2019 to Jan 2024

(Source: Singapore Tourism Analytics Network)

- RWS expansion on track. On 2 March, the Hard Rock Hotel Singapore at Resorts World Sentosa will close to undergo renovations for the complex’s planned expansion. The 360-room hotel will receive a complete overhaul. This aligns with Genting Singapore’s previously announced plans to invest around S$6.8bn to revamp and enlarge the resort, which includes the development of a new luxury hotel and waterfront complex with 700 hotel rooms. Other ongoing projects include the transformation of The Forum shopping area, the development of a new Minion Land attraction, and the rebranding of SEA Aquarium to the Singapore Oceanarium, all of which are expected to partially open in early 2025.

- 3Q23 earnings. The company revenue for the period was S$689.9mn rising 33% YoY from the previous S$519.7mn. The company’s net profit rose to S$216.3mn, +59% YoY compared to S$135.8mn in 3Q22. Its gaming revenue rose 20% YoY to S$459.6mn and its non-gaming revenue jumping 68% to S$230.1mn.

- Market Consensus.

(Source: Bloomberg)

BYD Co. Ltd. (1211 HK): Geographic expansions

- BUY Entry – 188 Target – 208 Stop Loss – 178

- BYD COMPANY LIMITED is a China-based company principally engaged in the manufacture and sales of transportation equipment. The Company is also engaged in the manufacture and sales of electronic parts and components and electronic devices for daily use. The Company’s products include rechargeable batteries and photovoltaic products, mobile phone parts and assembly, and automobiles and related products. The Company mainly conducts its businesses in China, the United States and Europe.

- New factory in Mexico. BYD has revealed intentions to establish a new electric vehicle (EV) factory in Mexico, aligning with the company’s goal to create an export hub for the United States. This move is part of BYD’s global expansion strategy, involving the establishment of new plants abroad alongside the expansion of Chinese exports. BYD is currently in the initial stages, conducting a feasibility study for the Mexican plant and engaging in negotiations with officials regarding various terms, including the factory’s location. If successfully implemented, this plan will enable BYD to increase production, lower export costs to overseas markets, and advance its expansion into various markets.

- Launch of BYD Seal in India. BYD is set to release its Seal mid-size sedan in India on March 5, 2024, following considerable delays attributed to geopolitical tensions between India and China. This launch, delayed by the hindrances to BYD’s mega factory plans in India, will introduce the Seal EV as the third vehicle in the company’s Indian lineup, alongside the Atto 3 SUV and e6 MPV. The introduction of the BYD Seal in India is expected to boost sales for the company, capitalizing on the growing EV market in the country.

- EV battery giants partnership. Chinese automotive and battery industry leaders, such as BYD, CATL, and NIO, are collaborating to create an “all-star” coalition dedicated to advancing the development of all solid-state EV batteries. This strategic alliance among China’s prominent auto and battery manufacturers aims to revolutionize the EV market by commercializing innovative all-solid-state battery technology. Given China’s current dominance in the global EV battery market, where BYD and CATL collectively hold over 50%, this collaboration underscores their commitment to maintaining leadership through increased research and development in next-gen EV battery technologies, particularly all-solid-state batteries.

- 3Q23 earnings. Operating revenue rose 38.49% YoY to RMB162.2bn in 3Q23, compared with with RMB117.1bn in 3Q22. Net profit rose 82.16% to RMB10.4bn in 3Q23, compared to RMB5.72bn in 3Q22. Basic earnings per share was RMB 3.58 in 3Q23, compared to RMB1.97 in 3Q22.

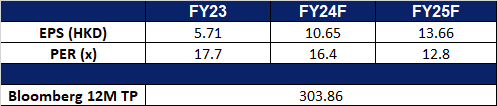

- Market consensus.

(Source: Bloomberg)

Cathay Pacific Airways Ltd. (293 HK): Resumption of key flights

- RE-ITEREATE BUY Entry – 8.10 Target – 8.80 Stop Loss – 7.80

- Cathay Pacific Airways Ltd is a company mainly engaged in the provision of international passenger and cargo air transportation. Together with its subsidiaries, the Company operates business through its four operating segments. The Cathay Pacific and Cathay Dragon segment provides full service international passenger and cargo air transportation under the Cathay Pacific and Cathay Dragon brands. The Air Hong Kong segment provides express cargo air transportation offering scheduled services within Asia. The HK Express segment provides a low-cost passenger air transportation offering scheduled services within Asia. The Airline Services segment provides supporting airline operations services include catering, cargo terminal operations, ground handling services and commercial laundry operations.

- Resuming more flights. Cathay Pacific Airways has recently declared its decision to recommence daily flights between Singapore and Bangkok from March 31, 2024, following a four-year hiatus prompted by the COVID-19 pandemic. Alongside its existing fifth freedom service, Cathay Pacific presently operates up to eight flights daily from Singapore to Hong Kong. The revival of the Singapore to Bangkok flight route, which was once one of the region’s most frequented paths, is anticipated to draw numerous passengers for the airline. This is particularly noteworthy given that Singapore Changi Airport and Suvarnabhumi Airport in Bangkok rank among the top airports with the highest passenger traffic in the Asia-Pacific region. The company also recently announced the resumption of other flight paths from Hong Kong to Perth, Sri Lanka, as well as Chennai.

- Lunar New Year travel rush. Anticipated to reach unprecedented heights, the Lunar New Year travel in China is poised to make history, with Chinese citizens joyously marking the festive season. In the initial four days of the Lunar New Year, Chinese travelers embarked on over 230 million “cross-regional” journeys, and a record-breaking nine billion domestic trips are projected to occur during the 40-day travel surge surrounding the Chinese New Year holidays. Additionally, there has been a notable increase in tourist numbers as individuals flock to renowned domestic tourist destinations to partake in the festive celebrations.

- High passenger traffic in Hong Kong. In 2023, Hong Kong’s airport secured the fourth position as the Asia-Pacific region’s busiest for international passengers. Anticipated to maintain its bustling status in 2024, Hong Kong continues to serve as the prominent financial hub in the region, with Singapore closely trailing. China has recently intensified its backing for Hong Kong’s role as a financial center for wealth products, bonds, and green finance, fostering increased business and investment in the city. Additionally, with China reopening post-pandemic, there is a projected surge in tourism to Hong Kong.

- 1H23 earnings. Revenue rose 135.0% YoY to HK$43.6bn in 1H23, compared with with HK$18.6bn in 1H22. Net profit was HK$4.3bn in 1H23, compared to net loss of HK$5.0bn in 1H22. Basic earnings per share was 61.5 HK cents in 1H23, compared to -82.3 HK cents in 1H22.

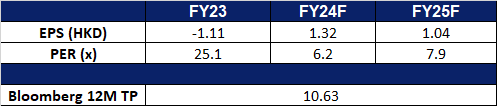

- Market consensus.

The United States market is closed today in observance of a public holiday (Washington’s Birthday). Trading resumes on Tuesday, 20 Feb.

Trading Dashboard Update: Add Cathay Pacific Airways (293 HK) at HK$8.10 and Zillow Group Inc (Z US) at US$57.60.