18 August 2023: Yangzijiang Shipbuilding (YZJSGD SP), CSC Financials Co. Ltd. (6066 HK), PDD Holdings Inc (PDD US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

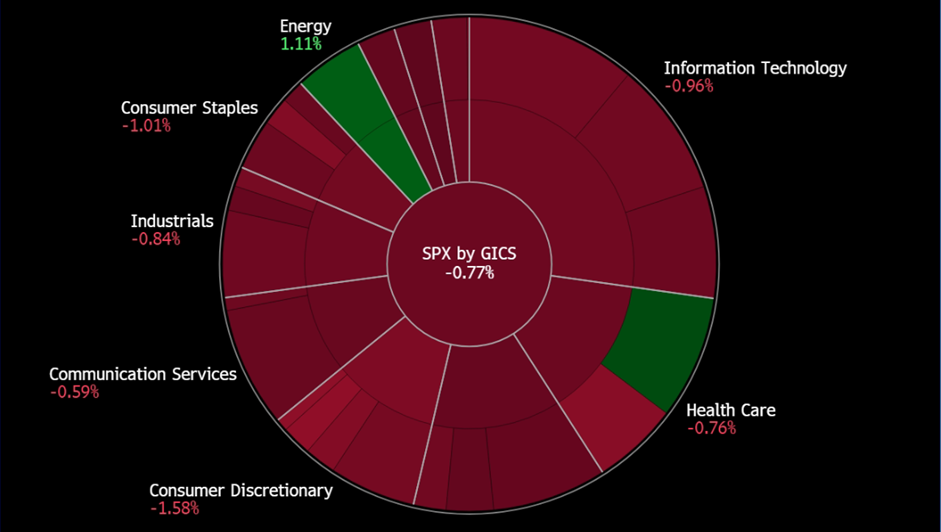

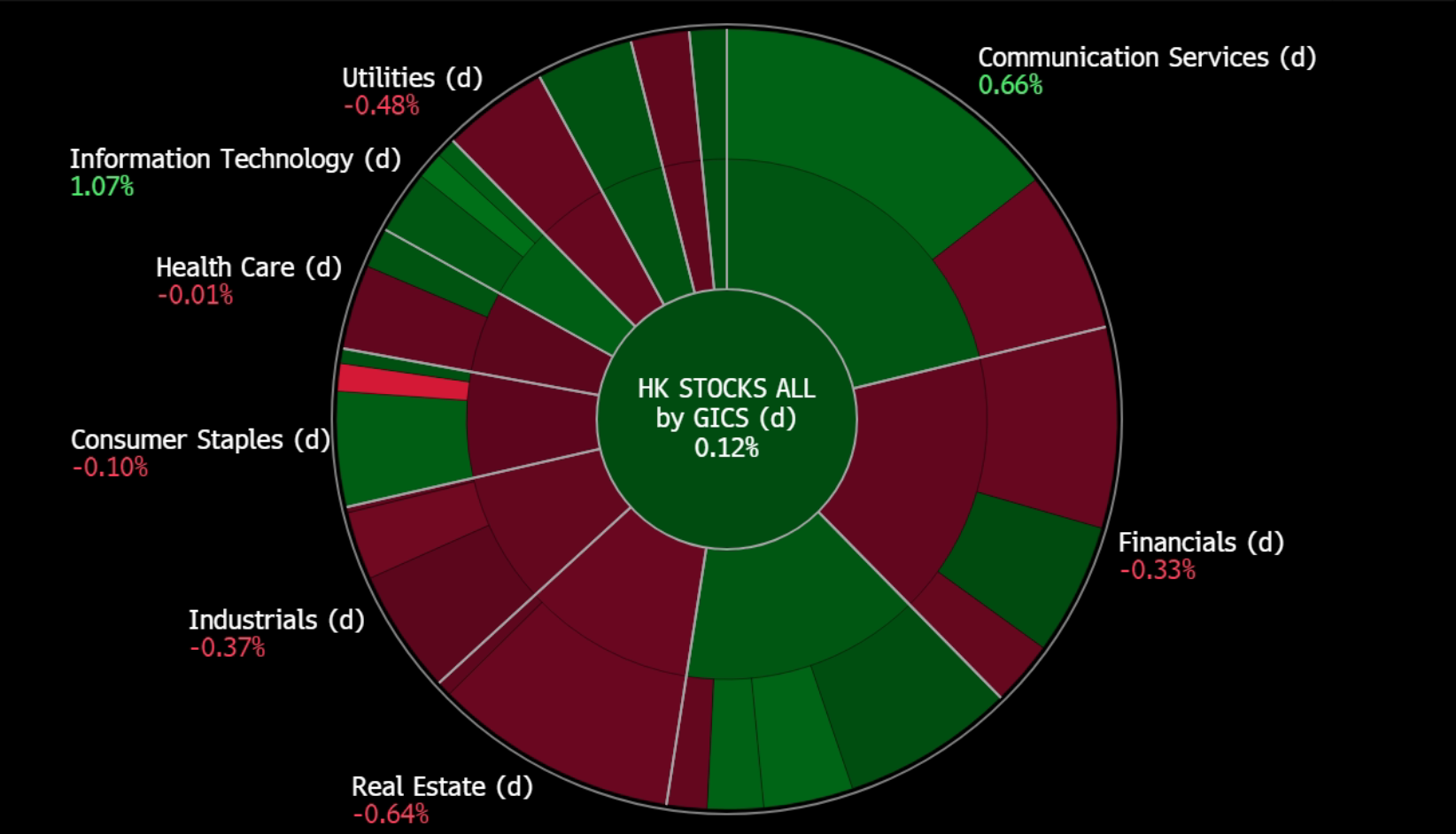

United States

Hong Kong

Yangzijiang Shipbuilding (YZJSGD SP): Double bonanzas-record order book and weak RMB

- BUY Entry 1.68 – Target 1.80– Stop Loss – 1.62

- Yangzijiang Shipbuilding Holdings Limited builds a wide range of ships. The Company produces a wide range of commercial vessels, mini bulk carriers, multi-purpose cargo vessels, container ships, chemical tankers, offshore supply vessels, rescue and salvage vessels, and lifting vessels.

- Hedging against weakening RMB. Recent macro figures released from China showed a gloomy outlook as soft domestic, exports and property crisis continues to weaken confidence. USD/RMB recently broke 7.3, a low since November 2022. The authority has released multiple stimuli, but all are ineffective. The US Fed remains hawkish towards fighting against inflation, and hence, the US will keep rates high for the rest of 2023. There is downside room for RMB if China’s economy further slows down in 3Q23.

Share price and USD/RMB price trend comparison

(Source: Bloomberg)

- Shipbuilding outshines other sectors. According to the China Association of the National Shipbuilding Industry, new contracts secured by Chinese shipyards surged by 67.7% YoY in 1H23 with 123.77m dwt orders on hand as of June. Containerships and LNG carriers dominate the new orders. The newly-received orders and orders on hand in deadweight tonnage accounted for 49.6%, 72.6% and 53.2% of the global market share; the amount in gross tonnage accounted for 47.3%, 67.2% and 46.8% of the world volume, both ranking as number one in the global market.

- YTD orderbook exceeded the full-year target. As of June, the company has obtained orders for 72 vessels, amounting to a value of US$5.76 billion, surpassing its target of US$3 billion for 2023. This has resulted in the highest-ever outstanding orderbook value for Yangzijiang, standing at US$14.7 billion for 181 vessels. Among all ordered vessels, 91 are containerships, 29 are oil tankers, 53 are bulk carriers, and 8 are LNG/LPG/LEG.

- 1H23 results review. Revenue for 1H23 increased by 16% YoY to RMB11.3bn. Gross profit increased by 48% YoY to RMB2.1bn. GPM increased by 4ppts to 19%. PATMI increased by 26% YoY to RMB1.7bn.

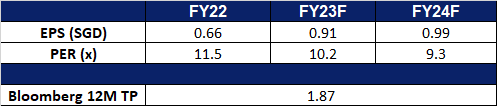

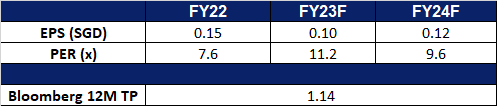

- Market consensus.

(Source: Bloomberg)

UMS Holdings (UMSH SP): Better outlook moving forward

- RE-ITEREATE BUY Entry 1.10 – Target – 1.25 Stop Loss –1.03

- UMS Holdings Limited provides equipment manufacturing and engineering services to Original Equipment Manufacturers (OEMs) of semiconductors and related products. The Company manufactures high precision components and complex electromechanical assembly and final testing services. UMS supports the electronic, machine tools and oil and gas industries.

- Semiconductor sector is bottoming out. The milestone development of artificial intelligence (AI) in 1H23 not only buffers the downcycle of the semiconductor sector but also kickstarts a new growth engine. The AI hype shadows the fall in demand for mobile/PC chips due to the normalisation of life and the drop in capex due to geopolitical factors. However, several market leaders projected that the sector will bottom out in 2H23 or 1H24 as both orders and capex will gradually recover. In the UMS’s 2Q23 press release, according to SEMI, global 300mm fab equipment spending for front-end facilities next year is expected to begin a growth streak to hit a US$119 billion record high in 2026 following a decline in 2023.

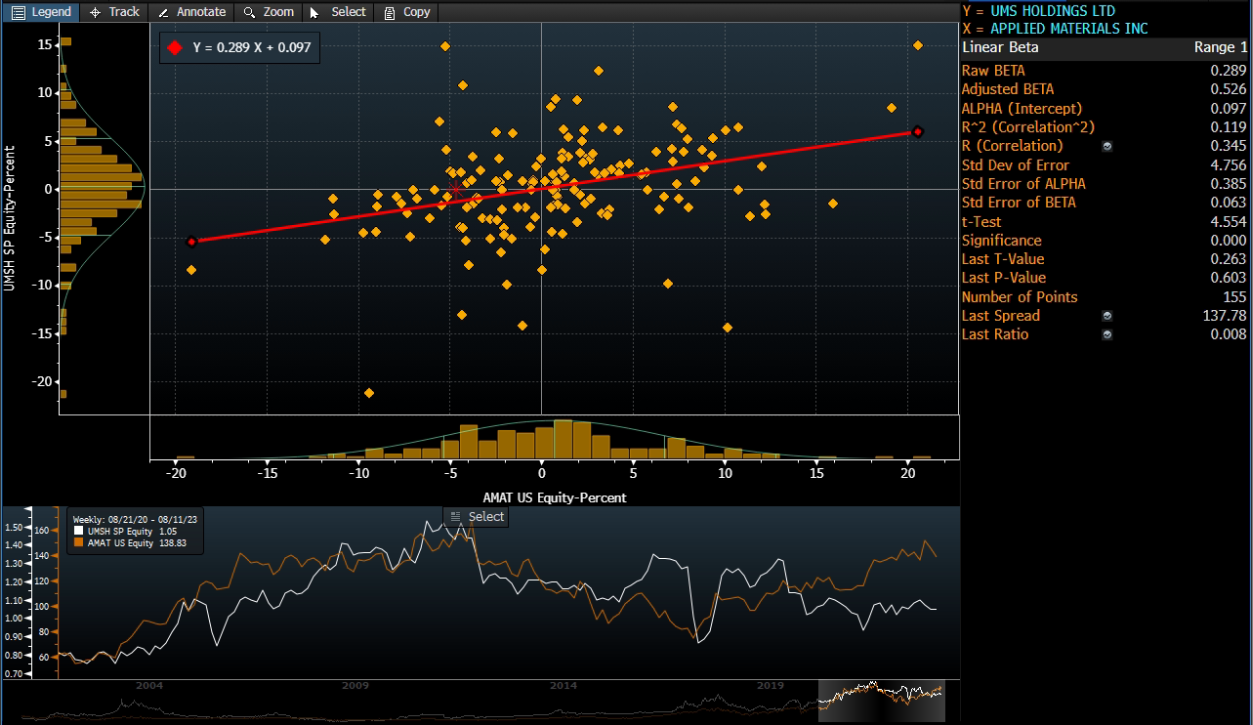

- Applied Materials 3Q23 earnings preview. Applied Materials (AMAT US) is a key customer to UMS, and it will release its 3Q23 results on 17th August. Previously, AMAT guided its 3Q23 net sales to be US$6.15bn (plus or minus US$400mn), compared to a consensus of US$6.05bn. Non-GAAP adjusted diluted EPS was guided to be between US$1.56 and US$1.92, compared to a consensus of US$1.64.

Weekly return correlation between UMS and AMAT

(Source: Bloomberg)

(Source: Bloomberg)

- 2Q23 results review. Revenue fell 14% YoY to S$74.4mn. Gross material margin decreased to 46.3% from 51.7%. PATMI plugged 42% YoY to S$11.6mn. Net margin fell to 15.4% from 23.2%. The new plant in Penang is expected to contribute at least US$30mn for FY24. The company declared an interim dividend of 1.2 SG cents.

- Market consensus.

CSC Financials Co. Ltd. (6066 HK): More support expected

- BUY Entry – 8.6 Target – 9.4 Stop Loss – 8.2

- China Securities Co., Ltd. is mainly engaged in securities brokerage, securities investment consulting, financial advisers related to securities trading and securities investment activities, securities underwriting and sponsor, securities self-management, securities asset management, securities investment fund agent distribution, providing futures companies with medium introduction services, margin financing, financial products agent distribution, insurances facultative agent, stock options market making, securities investment fund trusteeship and precious metal products sales businesses.

- Expectations of lower stamp duties. China is currently considering reducing its stamp duty on stock trades to support its stock market. This aims at encouraging trading activity and volume and provides a boost to the market’s overall performance.The potential reduction of the stamp duty on stock trades is a significant development for investors and market participants, as it is expected to lower transaction costs and, in turn, increase the attractiveness of trading stocks for all investors. This move is in line with China’s ongoing efforts to deepen its capital markets and attract more local and foreign investments.

- Loan Prime Rate (LPR) cut. China’s central bank cut key interest rates unexpectedly last Tuesday. This is the second time in three months that the bank has cut rates, a sign that the government is taking steps to boost the economy. The People’s Bank of China (PBOC) lowered the rate on one-year medium-term lending facilities (MLFs) by 15 basis points, from 2.65% to 2.5%. The PBOC also injected 400 billion yuan (US$55 billion) into the financial system through these facilities. The market expects a cut in the loan prime rate (LPR) by 15 basis points in August, to 3.4%, aimed at improving the profitability of businesses and banks, and encouraging them to lend more money. This will help to boost economic activity and growth.

- 1Q23 results. Revenue improved to RMB6.7bn, up 5.81% YoY. Net profit rose to RMB2.4bn in 1Q23, up 57.8% YoY. Basic and diluted EPS were RMB0.28.

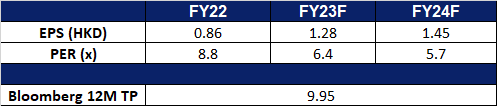

- Market Consensus.

(Source: Bloomberg)

PDD Holdings Inc (PDD US): Goods for cheap

- BUY Entry – 75 Target – 83 Stop Loss –71

- PDD Holdings Inc. is a multinational commerce group that owns and operates a portfolio of businesses. The Company focuses on the digital economy so that local communities and small businesses can benefit from the increased productivity and new opportunities. PDD Holdings has built a network of sourcing, logistics, and fulfilment capabilities for its underlying businesses.

- Defensive in the weak economic outlook. The economic outlook in China is looking bleak, with the country’s GDP growth forecast to slow down in 2023. Consumers will look towards purchasing cheaper substitutes. Chinese consumers, who have become more discerning, seek value for money and prioritise quality at reasonable prices. With attractive discounts and vouchers offered by domestic e-commerce platforms and brands, increased sales are expected, driven by pent-up demand and the preference for high-quality and new-generation products. The reported success of major Chinese e-commerce platforms during the last quarter further affirms the recovery in online consumer spending in China. PDD platform’s focus on fast-moving consumer goods (FMCG) and its unique approach of encouraging customers to join together in purchasing groups to maximise savings through bulk purchases will further contribute to its anticipated success ahead.

- Expanding its reach. Temu, PDD’s e-commerce platform, made its entry into the US market in September 2022. This Chinese-owned marketplace has expanded into around 27 countries, connecting predominantly Chinese merchants with customers in the US, Canada, Europe, and Australia; with recent expansions into Japan and South Korea. Temu distinguishes itself with its focus on ultra-low prices, achieved by reducing supply chain inefficiencies by sourcing products directly from manufacturers and cutting out middlemen; passing the savings to consumers. Its website and app heavily emphasise deals and discounts, allowing users to “shop like a billionaire”. This approach has led the platform to gain significant traction, surpassing popular platforms like Amazon, TikTok, and Instagram in download charts. Temu’s success is due to factors, including its appeal to budget-conscious customers, its focus on high-quality products, and its ability to offer competitive prices.

- Entrance to other Asian countries. Temu recently launched in South Korea. The app is offering coupons and discounts to attract new customers and is cooperating with third parties to provide logistics and delivery services. Temu is currently the No. 1 shopping app on Japan’s iOS store, and has not disclosed its next destination in Asia, but has sent out a survey to sellers asking about platforms in Japan, South Korea, and Southeast Asia. In South Korea, Temu will need to contend with other China-originated shopping apps such as Shein and AliExpress.

- 1Q23 earnings review. Revenue rose 58% year-over-year to US$5.48bn, beating estimates by US$920mn. Non-GAAP EPADS of $1.01 beat expectations by $0.38.

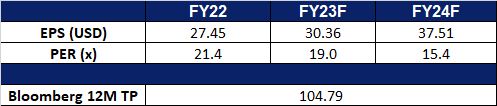

- Market consensus.

(Source: Bloomberg)

Amazon.com Inc (AMZN US): Dip-buying opportunity

Amazon.com Inc (AMZN US): Dip-buying opportunity

- RE-ITERATE BUY Entry – 132 Target – 142 Stop Loss – 127

- Amazon.com, Inc. is an online retailer that offers a wide range of products. The Company products include books, music, computers, electronics, and numerous other products. Amazon offers personalized shopping services, Web-based credit card payment, and direct shipping to customers. Amazon also operates a cloud platform offering services globally.

- Potential IPO anchor investor. Amazon is in talks to invest in Arm, a chip designer owned by SoftBank, as a cornerstone investors ahead of its IPO. Arm is expected to list on the Nasdaq in early September and is seeking to raise $8nn to $10nn. Amazon is one of about 10 technology companies that have been approached about investing in Arm. Amazon is interested in investing in Arm because it uses Arm’s chips in its cloud computing business. The IPO is expected to be a much-needed boon for SoftBank, which is battling to stabalise its massive Vision Fund.

- Leader in cloud. Amazon Web Services (AWS) revenue grew 12% YoY in 2Q23, beating analyst expectations. AWS is the leading cloud computing platform with a 40% market share in 2022, and it is still in the early stages of its growth. AWS is facing increasing competition from Microsoft Azure and Google Cloud Platform, but it is investing heavily in new technologies, such as generative AI, to stay ahead of the competition. AWS is also expanding its global footprint, with new regions opening up all the time. The most recent being, the $7.2bn investment in Israel through 2037. It includes opening AWS data centers in Israel, which will allow the Israeli government to run applications and store data in Israel; making it easier for Israeli companies to use AWS services, which are used by companies globally. Overall, AWS is still growing rapidly and is well-positioned to maintain its leadership position in the cloud infrastructure market.

- Introducing more services. Amazon Web Services (AWS) has expanded its Amazon Bedrock service to include new foundation model (FM) providers and a new capability for creating fully managed agents. This makes it easier for customers to build and scale generative AI applications with a wide range of FMs and to complete complex tasks that require access to external systems and up-to-date knowledge sources. Amazon Bedrock is a fully managed service that is secure, scalable, and easy to use, making it a great option for businesses of all sizes that want to get started with generative AI quickly and easily.

- 2Q23 earnings review. Revenue rose 10.8% YoY to $134.3bn, beating estimates by $2.96bn. Earning per share was $0.65, no comparable to expectations of $0.34.

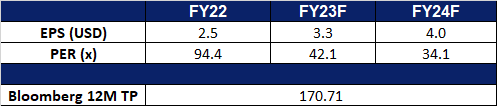

- Market consensus.

(Source: Bloomberg)

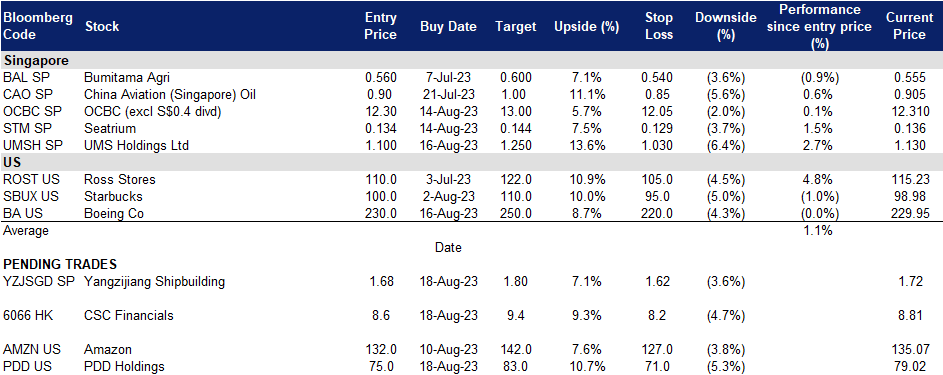

Trading Dashboard Update: Take profit on Samsonite International S.A. (1910 HK) at HK$26.2. Cut loss on Jiangxi Copper Co. (358 HK) at HK$12, Air China (753 HK) at HK$6.1, Alibaba Group (9988 HK) at HK$88 and Barrick Gold (GOLD US) at US$16.13.

(Source: Bloomberg)

(Source: Bloomberg)