KGI DAILY TRADING IDEAS – 15 March 2021

IPO Watch

Baidu (9888 HK): IPO pricing at the max price of HK$295 (Dual listing)

- Public tranche subscription starts from Friday (12 March) to Wednesday (17 March).

- Final price for Baidu’s Hong Kong shares will be set on Wednesday (17 March) and trading will begin on Tuesday (23 March).

- This will be a dual listing. Its shares currently trade on NASDAQ and has reasonable valuations of 26x/22x/18x FY2021/22/23F P/E. EPS growth is forecasted at 4%/19%/22% over the next three years.

- Baidu operates an Internet search engine. The company offers algorithmic search, enterprise search, news, MP3, and image searches, voice assistance, online storage, and navigation services. Baidu serves clients globally.

- In the prospectus, Baidu defines itself as an AI company. According to the CIC report, Baidu has the largest portfolio of AI patents and AI patent applications in China as of October 2020. The deep learning framework, PaddlePaddle, is the No. 1 deep learning framework in China and No. 2 globally behind Facebook Pytorch in terms of cumulative pull requests as of December 2020. Baidu Open AI Platform, with a developer community of over 2.65 million members, is the largest open AI platform in China, based on the number of developers as of December 2020. Baidu OSChina, which runs on Baidu cloud infrastructure, is the largest development platform for open source activities in China and No. 3 globally (behind GitHub and Gitlab), in terms of the number of developers as of December 2020.

Tuya(TUYA US): Smart home pure-play, initial IPO price of US$17-20

- TUYA is a Platform-as-a-Service provider for smart devices, boasting over 5,000 customers and 204mn connected devices on their ecosystem.

- Tuya’s merits come from a 181% dollar-based net retention rate and having no debt in a market leadership position for IoT. The IPO has attracted strong institutional interest with Tencent, GIC and Tiger Global Management signalling their interest.

- Initial price range of US$17-20 indicate a market cap of US$10.4bn at the midpoint, and 57.6x Price/Sales multiple.

- Given the strong institutional backing, we expect 70-80x Price/Sales multiple (US$22-26) to be an achievable target, while 100x Price/Sales (US$32) is also possible if market sentiment is strong.

IPO Performance Review

Aztech Global (AZTECH SP): Muted first day trading

- Shares of Aztech opened at S$1.37, or 7% above its IPO price, but lost momentum to close at S$1.29, less than 1% higher on its first trading day last Friday, 12 March.

- Based on its last closing price of S$1.29, AZTECH trades at 21x FY2019 P/E, which is the middle range between Venture Corp (16x FY2021F P/E) and Nanofilm Technologies (37x FY2021F P/E).

- However, AZTECH’s P/E valuations are around 30-50% higher than semiconductor plays such as AEM, Frencken and UMS Holdings.

US Trading Ideas

United States Steel Corp (X US): Regroup, refocus, rebuild

- RE-ITERATE BUY Entry – 25 (BUY STOP) Target – 30 Stop Loss – 22

- Since pitching X on 8 March, the stock has continued gaining throughout the week, ending at US$24.17 on Friday.

- As the US government’s attention shifts to the infrastructure bill, we expect infrastructure plays to gain momentum on the markets, and cyclical stocks like X to revisit past year highs. We set the next Fibonacci resistance as the price target for this trade.

Target (TGT US): How about a new US$1,400 fridge?

- RE-ITERATE BUY Entry – 180 (BUY STOP) Target – 192.5 Stop Loss – 171

- TGT is the US’s 2nd discount chain store behind Walmart (WMT US), operating over 1,800 Target Stores across the US.

- RSI has bottomed out below 30 on 4th March and TGT, together with the Vaneck Vectors Retail ETF (RTH US) have posted a rally since.

- We pick TGT over RTH and other discount stores as TGT is positioned towards consumer discretionary goods, which we expect to see stronger spending from the recovering economy. The release of US retail sales data this week serves as a catalyst for TGT.

HK Trading Ideas

Shandong Chenming Paper Holdings (1812 HK): Paper is expensive; Big are getting bigger

- Buy Entry – 6.5 Target – 8.5 Stop Loss – 5.5

- Shandong Chenming Paper Holdings is a China-based company principally engaged in paper making and finance lease businesses. The company’s paper products mainly consist of duplex press paper, copperplate paper, white paper boards, electrostatic paper, anti-sticking base paper, newsprint, tissue paper, light weight coated paper, writing paper and other machine-made paper. The Company is also involved in the provision of electricity and steam, construction materials and chemicals for paper making, as well as the operation of hotels. The company distributes its products in the domestic market and to overseas markets.

- Paper pulp price rose by 58.7% YoY to RMB6,404/tonne in the last week ended on 28th February. Recently, various paper products prices were raised by RMB500 to 1,700/tonne in China. The demand for paper products has moderately recovered but inventory is falling faster than expected as rising raw material prices have lengthened the turnover for SMEs. Hence, market leaders will benefit as their inventory and receivables turnover days are still intact.

- Market consensus of estimated net profit growth in FY21 and FY22 are 106.5% and 13.3% respectively, which translates to 4.4x and 3.9x forward PE. The current PE is 9.2x. The expected dividend yield in FY21 and FY22 are 5.7% and 6.0% respectively. Bloomberg consensus average 12-month target price is HK$10.6.

- The company will announce FY20 full year results on 25 March.

Li Ning Company Limited (2331 HK): An Olympic Games play

- BUY Entry – 40 Target – 50 Stop Loss – 36

- Li Ning Company Limited is principally engaged in brand development, design, manufacture and sale of sport-related footwear, apparel, equipment and accessories in the People’s Republic of China (the PRC). The Company is also engaged in the manufacture, development, marketing, distribution and sales of sports products under several other brands, including Double Happiness (table tennis), AIGLE (outdoor sports) and Lotto (sports fashion). Through its subsidiaries, the Company is also engaged in the provision of information technology service.

- China’s sportswears consumption has been growing steadily. Due to COVID-19, most brick and mortar stores were forced to shut. However, the online sales, especially live-streaming sales helped sportswear companies to thrive during the pandemic period. Therefore, Li Ning 1H20 earnings dipped slightly YoY. But the recovery of consumption in 2H20 due to pent-up demand was expected to boost the sales.

- The upcoming catalyst is the summer Olympic Games in July and August 2021. This is the first international sports event after COVID-19. We believe that this Olympic Games will indirectly stimulate sportswear sales, especially Chinese brands. Li Ning is one of the top domestic brands that sponsors Chinese athletes.

- Market consensus of net profit growth in FY21 and FY22 are 38.5% YoY and 29.4% YoY, which implies forward PERs of 42.7x and 33.0x. Current PER is 59.1x. Bloomberg consensus average 12-month target price is HK$56.5.

The company will announce FY20 full year results on 18 March.

SG Trading Ideas

Yangzijiang (YZJSGD SP): Going for record order wins this year

- BUY Entry – 1.15 Target – 1.40 Stop Loss – 1.05

- The company riding on strong order win momentum. On 5 March, the shipbuilder announced that it had secured new shipbuilding contracts worth a total of US$1.7bn for 31 vessels. The vessels are scheduled for delivery between 2022 to 2023.

- The company has secured a total of 60 shipbuilding contracts worth US$3.0bn year-to-date, and is likely to reach its historical peak of US$5.0bn orders that it won in 2007.

- Yangzijiang currently offers an attractive dividend yield of 4-5% for FY2021-2023 and trades at only 6-8x forward PEs. Consensus has a target price of S$1.41 vs its current price of S$1.15.

Hongkong Land (HKL SP): Still a bargain despite price run-up

- BUY Entry –5.00 Target – 5.50 Stop Loss – 4.75

- HKL owns and manages more than 850,000sqm of prime office and retail properties in Hong Kong, Singapore, Beijing and Jakarta. Its portfolio of prime Hong Kong Central office space makes up around 50% of the company’s gross asset value.

- Valuations are still cheap despite the 20-25% run-up of its share price YTD as HKL trades at only 0.34x historical P/B.

- The company offers one of the highest dividend yield among Singapore-listed property developer. Bloomberg consensus is forecasting dividend yields of 4-5% for the next three years.

- The ongoing consolidation exercise of the Jardine Group of companies could be a short/medium rerating catalyst for HKL, as parent company, Jardine Matheson (JM SP), may seek to unlock value in its prime Hong Kong properties. Jardine Matheson is the only major shareholder of HKL with a 50.4% ownership.

Market Movers – What’s Hot

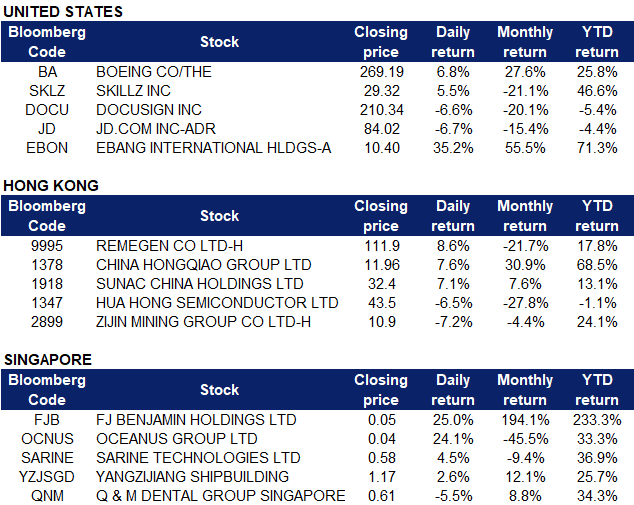

United States

- S&P 500 and Dow reached another record high on Friday despite the rise in the 10-year bond yield to 1.623%. Nasdaq 100 was down 0.9% but is still up 2.1% for the week. Investors will focus on the upcoming Federal Reserve meeting for commentary on the recent surge in 10 year treasury yields, as well as US retail sales data.

- Boeing (BA US), as cyclical and industrial plays continue to gain traction in view of vaccination progress leading to the reopening of the economy. Despite gaining over 30% year-to-date, BA and airline companies are still largely down from their pre-COVID levels.

- SkillZ Inc (SKLZ US), up 6.8% for the week after outperforming in its earnings result and addressing Wolfpack Research’s short seller report on 8th March.

- DocuSign (DOCU US), despite beating consensus estimates with 57% year-on-year sales growth. Guidance of 35% revenue growth may have disappointed investors, sending share prices down on Friday. However, DocuSign is still +3% for the week after the recent tech stocks rout.

- JD.com (JD US), with a similar performance to Docusign, beating consensus estimates yet dropping to a new low for the year.

- Ebang International (EBON US), after setting a launch date for their new cryptocurrency exchange. Bullishness on cryptocurrency related stocks remains at a high as Bitcoin reaches the US$60,000 mark over the weekend.

- Earnings Watch: FuelCell (15 Mar); Lennar, Futu, Coupa (16 Mar); Pinduoduo, Sundial Growers, Crowdstrike (17 Mar); Nike, Accenture, FedEx, Dollar General (18 Mar)

Trading Dashboard Update: Raising EBON’s entry/target/stop loss to 6.5/11.8/5.0, to improve chances of catching the next pullback.

Hong Kong

- RemeGen Co Ltd (9995 HK). Previously, the company announced that telitacicept, the dual targeted TACI-Fc fusion protein independently developed in-house by the company, has been granted conditional marketing approval by the National Medical Products Administration of the People’s Republic of China for the treatment of patients with Systemic Lupus Erythematosus (SLE).

- China Hongqiao Group Limited (1378 HK). The stock closed at an all-time high, up 18.63% in three consecutive days as southbound funds were accumulating shares. This could be a short squeeze movement. On March 11, trading volume spiked up to 467mn shares, more than 10 times the average in the past 10 trading days.

- Sunac China Holdings Limited (1918 HK). The company announced its FY20 full year results. Revenue grew by 36.2% YoY to RMB 230.6bn, and net profit grew by 36.9% YoY to RMB35.6bn. Net gearing ratio was 96%; Non-restricted cash to current borrowing ratio was 1.08; Liabilities to assets ratio after excluding receipt in advance was 78.3%. Based on the three regulatory indicators set by the authority last year, the company was no more in the top high-risk group on the watchlist.

- Hua Hong Semiconductor Ltd (1347 HK). Market news said the Federal Communications Commission could further tighten restrictions on supplies to Hua Wei. Semiconductor sector turned south again last Friday.

- Zijin Mining Group Company Limited (2899 HK). LME copper futures dropped by 0.98% to US$9,003/tonne.

Singapore

- FJ Benjamin (FJB SP) rallied to a three-year high after announcing it had secured the exclusive rights to distribute Airfree purifiers, a Portuguese brand, in Indonesia. FJB had earlier set up a health and wellness division to distribute Airfree products in Singapore and said it will be launching the Airfree products in Malaysia and Indonesia next month.

- Oceanus (OCNUS SP) issued a clarification last Friday (12 Mar) to correct misleading information circulating on the internet. The company clarified it is not applying to transfer from the Mainboard to the Catalist of the SGX. It is also not under investigations by the Commercial Affairs Department and is not seeking a mandatory suspension of trading of the company’s shares. The company also stated that the management of the company is not colluding with institutional investors in a “pump-and-dump” scheme.

- Yangzijiang (YZJSGD SP) is riding on strong order win momentum. Earlier this month, the shipbuilder announced that it had secured new shipbuilding contracts worth a total of US$1.7bn for 31 vessels. The company has secured a total of 60 shipbuilding contracts worth US$3.0bn year-to-date, and is likely to reach its historical peak of US$5.0bn orders that it won in 2007.

- Q&M Dental (QNM SP) dropped due to profit-taking on Friday, paring back gains from an earlier price surge. Shares of QNM touched a year-to-date high of S$0.685 on Thursday (11 Mar) after CGS-CIMB initiated coverage of Q&M Dental Group with an ADD rating and target price of S$0.92.

- Semiconductor companies Frencken (FRKN SP) and UMS Holdings (UMSH SP) gained 11-13% for the week on bargain hunting. FRKN remains our Top Trading Idea among Singapore’s semiconductor plays given its attractive valuations and diversified client base.

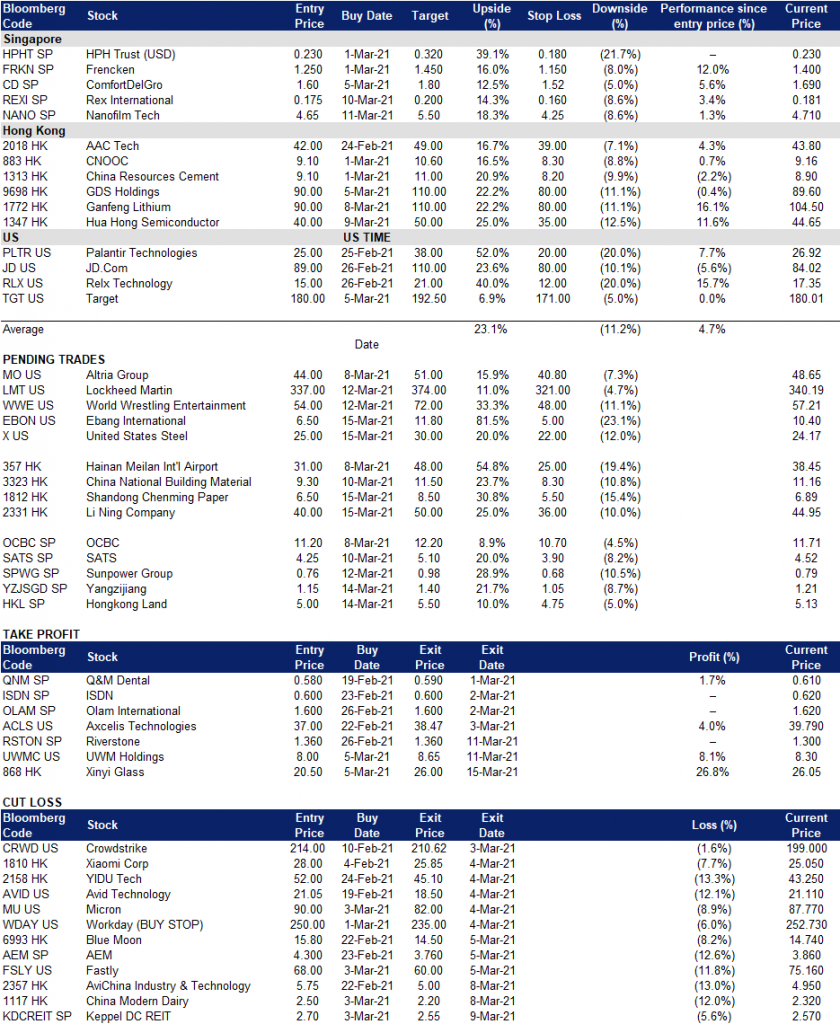

Trading Dashboard