KGI DAILY TRADING IDEAS – 13 August 2021

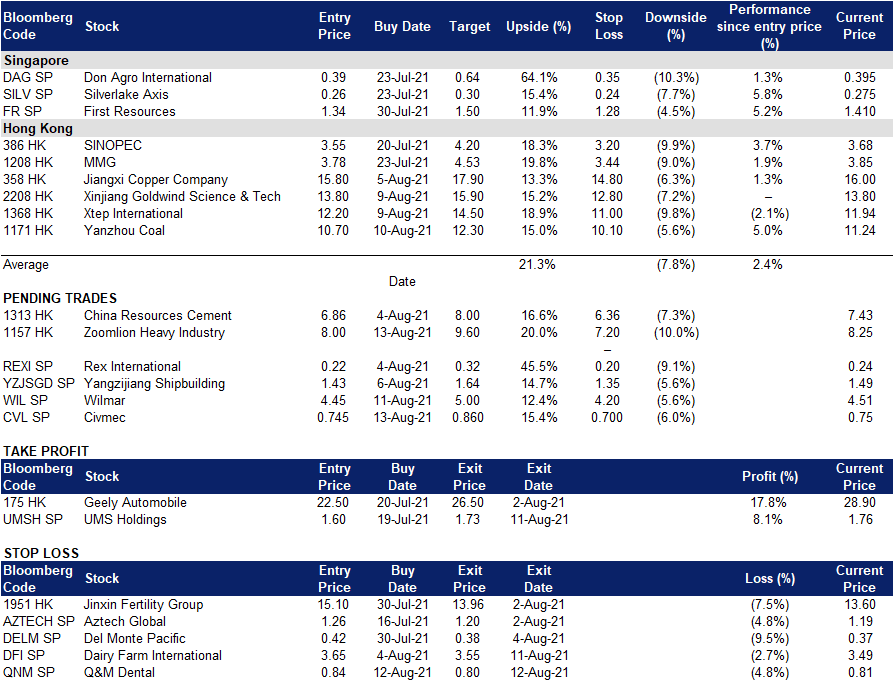

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SINGAPORE

Civmec (CVL SP): Well prepared for the ongoing commodity supercycle

- BUY Entry – 0.745 Target – 0.86 Stop Loss – 0.700

- Civmec is an integrated, multi-disciplinary construction and engineering service provider to the Oil & Gas, Metals & Minerals and Defence & Infrastructure sectors. The group provides services in Australia and its manufacturing facilities are located in Western Australia and New South Wales.

- Strong momentum. 9M2021 revenue and profit have already surpassed the full year 2020. We forecast FY2022F earnings to surpass the previous peak in 2013, during the last commodity supercycle. Civmec’s order book has now surpassed A$1bn this year, supported by strong cash flows and balance sheet, all underpinned by a superb management team.

- Short and mid-term catalysts. Favourable industry supply and demand dynamics driven by China’s appetite for iron ore.

- Long-term drivers. Likelihood of increased contract wins as the Australian government ramps up on defence and infrastructure spending. Civmec’s overall revenue is supported by approximately 20% recurring income from maintenance and upgrading works.

- Outperform. We initiate Civmec with an Outperform recommendation and a TP of S$0.86. Our TP is based on 12x P/E to its FY2022F EPS of S$0.72 (based on 0.9984 SGD/AUD). Read our full report here.

- Earnings to watch. Civmec is due to report its financial full-year results (YE June) either on 26 or 27 August.

Wilmar International (WIL SP): Time to buy the dip

- RE-ITERATE BUY Entry – 4.45 Target – 5.00 Stop Loss – 4.20

- Wilmar is ranked among the largest listed companies by market cap (S$28bn market cap as of 10 Aug) on SGX. The company’s business activities include oil palm cultivation, oilseed crushing, edible oils refining, sugar milling and refining, manufacturing of consumer products, specialty fats, oleochemicals, biodiesel and fertilisers as well as flour and rice milling.

- Down from the peak. Shares of Wimar have declined almost 20% from the 5-year peak of S$5.57 reached in February 2021. This rally and subsequent decline was driven by the IPO of its China subsidiary, Yihai Kerry Arawana (YKA), on the ChiNext board of the Shenzhen Stock Exchange.

- Another IPO to serve as a catalyst. Wilmar’s 50% JV with Adani Group in India has filed a draft red herring prospectus with the Securities & Exchange Board of India in relation to the proposed IPO for listing on the BSE and NSE. The proposed listing will raise around US$600mn via the issuance of new shares.

- Robust palm oil prices. Despite the recent decline in palm oil prices, they remain near all-time highs, driven by robust demand from India and China. Is it a consensus view that stockpiles are likely to remain low in China, thus supporting prices. Meanwhile, labour shortages may pose downside risk to supply in the second half of 2021.

- Bullish consensus forecast. There are 13 BUYS / 1 HOLD / 0 SELL and an average 12m TP of S$6.17. Wilmar currently trades at 13x and 12x FY2021 and FY2021 P/E, driven by 6-7% EPS growth in the next two years. Dividend yield is a decent 3-4%.

Palm oil prices (5 years)

HONG KONG

Zoomlion Heavy Industry Science And Technology (1157 HK): Infrastructure sector regains momentum

- Buy Entry – 8 Target – 9.6 Stop Loss – 7.2

- Zoomlion Heavy Industry Science And Technology Co., Ltd. is principally engaged in the research, development, manufacture and sales of engineering equipment, environmental sanitation equipment and agricultural equipment. The company operates through four segments. The Engineering Equipment segment includes concrete equipment, lifting equipment, earthmoving equipment, foundation construction equipment, road construction equipment and forklifts, which mainly serve the construction of infrastructure and real estate. The Environmental Industry segment is engaged in the production of sanitation equipment, as well as environmental management investment and operating business. The Agricultural Equipment segment consists of farming machinery, harvesting machinery, drying machinery and agricultural machinery, among others. The Financial segment provides financial leasing and other financial services.

- According to the China Construction Machinery Association, a total of 17,345 excavators were sold in July, down 9.24% YoY. Domestic sales fell 24.1% YoY, compared with a fall of 21.9% YoY in June. But exports grew 75.6% YoY in July. July was the third consecutive month of decline. In May and June, excavator sales fell 14.3% YoY and 6.19% YoY respectively. In 1H21, 26 Chinese companies exported 30,133 excavators, up 107% YoY.

- The US Senate on Tuesday approved a $1tn bipartisan infrastructure bill after months of negotiations. It could boost the company’s overseas sales of machineries in the next couple of months.

- With the ongoing clamp-down on the technology sector, funds try to find safe harbours. Traditional sectors have been seeing consistent fund flows for weeks.

- Market consensus of net profit growth in FY21 and FY22 are 10.3% YoY and 12.9% YoY, which implies forward PERs of 6.2x and 5.5x. Current PER is 7.0x. Bloomberg consensus average 12-month target price is HK$12.9.

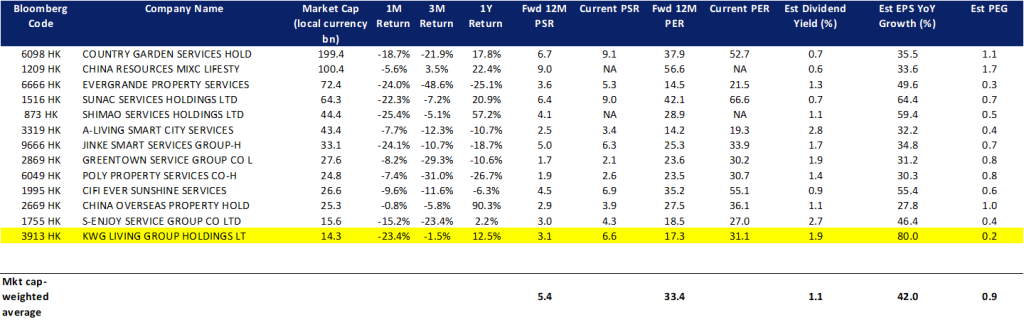

KWG Living Group Holdings Ltd (3913 HK): Fundamentals intact but just impacted by weak sentiment

- Buy Entry – 6.8 Target – 8.0 Stop Loss – 6.4

- KWG Living Group Holdings Ltd is a holding company engaged in provision of property management services. The company operates two segments. The Residential Property Management Services segment provides pre-sale management services, property management services, community value-added services and public space value-added services. The Commercial Property Management and Operational Services segment provides pre-sale management services, commercial property management services, commercial operation services and other value-added services.

- Counter-inflation remains the main investment theme for investors this year, and property management services are viewed as an indirect hedge against rate hikes. The sector has positive investment attributes such as low capex, net cash positions, and stable dividend payout. All these are in line with the value sectors that investors are currently looking out for.

- The company has a relatively attractive valuation compared to peers in the property management sector. Its forward 12M PEG is the lowest among its peers, and the estimated dividend yield is decent compared to peers.

- Market consensus of net profit growth in FY21 and FY22 are 61.1% YoY and 43.7% YoY, which implies forward PERs of 21.0x and 13.0x. Current PER is 38.1x. Bloomberg consensus average 12-month target price is HK$12.48.

Market Movers

United States

- Palantir (PLTR US) shares surged 11.36% on Thursday after the data analytics company reported quarterly revenue that topped analyst estimates. Palantir’s revenue rose 49% YOY to $376 million, while its adjusted earnings per share quadrupled to $0.04. The company said it remains on track to increase its revenue by at least 30% annually through 2025.

- Coinbase (COIN US) shares plunged 7.87%, as the price of bitcoin slipped below the $45,000 mark. The stock previously jumped on Wednesday after the company reported stellar second quarter results.

- Bumble (BMBL US) shares gained 6.63% after the company reported mixed second quarter results. The online dating platform reported a loss of 6 cents per share, while analysts expected earnings of 1 cent per share. However, revenue came in at $186.2 million, topping analyst expectations of $178.7 million; this was largely attributed to the jump in the number of its paying users.

- Micron (MU US) shares dropped 6.37% after Morgan Stanley published a reported titled “Winter is Coming” and downgraded the stock to equal weight and cut their price target by $30 to $75. Analyst Joseph Moore sees a weak environment coming for the global memory chip sector, where DRAM prices start to decline.

- Disney (DIS US) shares jumped more than 4% in after-hours trading after reporting blowout fiscal third quarter earnings that beat analyst expectations on subscriber growth, revenue and earnings. The media giant also topped subscriber estimates for Disney+, coming in at 116 million. Disney’s Parks, Experiences and Products segment returned to profitability for the first time since the COVID-19 pandemic began, with revenue jumping 308% to $4.3 billion.

Singapore

- Fu Yu Corporation Limited (FUYU SP) Shares rose by 10.2% and closed at its highest since 29 April after the company announced a positive 1H21 results on 11 August. Even though the group recorded a decrease in revenue from S$71.6mn in 1H20 to S$70.4mn in 1H21, gross profit margin improved from 21.4% to 23.8% and net profit increased by 20.1% YoY to S$8.9mn in 1H21. The company also declared a higher ordinary interim dividend of 0.4 Sing cents per share and special dividend of 3.3 Sing cents per share for 1H21. Additionally, Group Managing Director, Mr Seow commented that beyond Fu Yu’s core manufacturing business, the company has recently formed a new business arm by acquiring 100% equity interest in Avantgarde Enterprise Ptd Ltd (AGE). AGE is engaged in the business of providing supply chain management services for commodities. Read the full announcement here. There are currently 4 BUY ratings and a consensus TP of S$0.38 (+19% upside).

- Broadway Industrial Group Limited (BWAY SP) Shares rose by 4.7% and closed at a 6-month high as the company announced positive 1H21 results yesterday. The group recorded an increase in revenue from S$191.1mn in 1H20 to S$211.4mn in 1H21 and an improvement in gross profit margin from 6.7% to 7.0%. Net profit also rose by 14.7% YoY to S$7.8mn in 1H21. In addition, the company had a rather positive outlook for 2H21, stating that near term demand for HDD products remains strong with focus on executing efficiency, productivity and cost improvement initiatives, and maximising capacity utilization, whereas for the Robotics business arm, the company will continue to build market awareness and improve functionality. Risks include the rising COVID-19 cases in Southeast Asian countries which may cause supply chain constraint. Read the full announcement here.

- Abundance International Limited (ADI SP) Shares fell by 17.6% yesterday after a rally from last Friday, 6 August saw its price surged by as much as 44% as investors aggressively bought ahead of the company’s earnings. The company announced a positive 1H2021 results on 11 August, where it reported a net profit of US$5.4mn, a complete turnaround from 1H2020’s losses of US$799k. However, the turnaround was mainly from other income, with a large contribution from the fair value gain of US$4mn in 1H21.

- Golden Energy and Resources (GERL SP) Shares declined 10.1% after its 62.5%-owned Indonesian subsidiary PT Golden Energy Mines Tbk (GEMS) reported a drop in 2Q21 earnings. GEMS’ 2Q21 profits declined to US$46mn from US$100mn in 1Q21, a drop of almost 54% QoQ.

- Geo Energy Resources Limited (GER SP) Shares tumbled by 11.1% yesterday after rising to a 3-year high of S$0.27 on 11 August, Wednesday. Geo Energy announced positive earnings results, achieving record half-yearly revenue of US$220.3mn and PATMI of US$48.1mn in 1H2021. However, comparing QoQ, profit for the 3 months ended 31 June 21 was approximately S$19.8mn, lower than the 3 months ended 31 March 21 which came in at S$28.5mn. The company declared an interim dividend of S$0.005 per share, the same as in the previous quarter.

- Trading Dashboard: Cut loss on Q&M Dental (QNM SP) at S$0.80

Hong Kong

- Techtronic Industries Co Ltd. (669 HK) Shares closed at an all-time high. The company announced 1H21 results. Sales grew by 52.0% YoY to US$6.4bn. Gross margin improved for the 13th consecutive first half to 38.6%, and the growth in EBIT, net profit, and earnings per share all outpaced sales growth. EBIT increased 57.4% YoY to US$572mn, net profit rose 57.9% YoY to US$524mn. Management declared an interim dividend of HK85.00 cents.

- China Everbright Environment Group Ltd(257 HK) Shares closed at a 4-month high. The company announced 1H21 results. Revenue increased by 44% YoY to HK$26.5bn. EBITDA increased by 29% YoY to HK$8.2bn. Profit attributable to equity holders of the Company increased by 28% YoY to HK$3.9bn. The company declared an Interim dividend of HK19.0 cents per share.

- COSCO Shipping Holdings Co Ltd (1919 HK) Shares closed at a one-month high. Container shipping rates from China and Southeast Asia to the east coast of North America have surpassed $20,000 per twenty-foot equivalent unit, or TEU, CCTV reported on Wednesday. It was the first time for the number to surpass $20,000, up from $16,000 per TEU on Aug 2, according to the report, citing the global container freight index.

- Shanghai Electric Group Co Ltd (2727 HK) Shares closed at a 3-month high. Previously, the top management suspected to be involved in corruption were under investigation. The executive director and president passed away a week ago.

- ZhongAn Online P & C Insurance Co Ltd (6060 HK) Shares closed at its lowest since January 2021. China’s banking and insurance regulator will step up its scrutiny of online insurance companies, the state-backed Shanghai Securities News reported on Thursday, widening a drive to rein in the country’s internet platforms. The campaign, which targets misleading marketing practices, forced sales and inflated fees, is aimed at “purifying the market environment” and “protecting the legal interests of consumers,” the paper reported, citing unnamed sources.

Trading Dashboard

Related Posts: