8 March 2023: Wilmar International Ltd. (WIL SP), China Shenhua Energy Co Ltd (1088 HK), Daqo New Energy Corp (DQ US)

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

Wilmar International Ltd. (WIL SP): Rising Soft Commodities prices

- BUY Entry 3.95 – Target – 4.15 Stop Loss – 3.85

- Wilmar International Limited operates as a food processing company. The Company offers oil palm cultivation, edible oil refining, crushing, and gains processing services, as well as provides sugar, flour, and rice. Wilmar International serves customers worldwide.

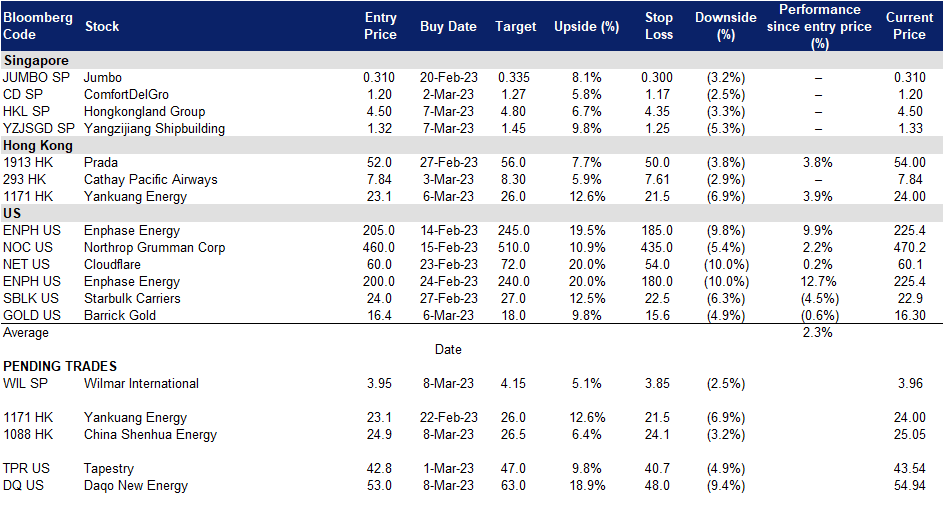

- Sugar Futures prices. Raw sugar futures hovers at the 21 cents/pound range, and recently reached a 6-year high of 22.1 cents/pound due to a tight supply concerns, supported by a strong demand expectation boosted by China’s recent re-opening, as well as a worsening production outlook by India and Europe. The latest estimates showed that the world’s second-largest sugar exporter is likely to produce 34mn tonnes of the commodity in 2023, down 7% from a previous forecast.

- Palm Oil Futures Prices. Short-term weather disruptions will likely support Malaysia’s crude palm oil prices in the short term as supply takes a hit from the ongoing floods. Asian palm oil buyers also recently seek stable export policies from producers to reduce the volatily of the supply chain. Palm oil production is also expected to be higher in FY23 than FY22 due to improved labour supply.

Raw sugar (red) and crude palm oil (brown) futures price trend

(Source: Bloomberg)

(Source: Bloomberg)

- FY22 results review. The company announced record earnings of US$2.4bn (S$3.2 bn) for FY22, a 27.1% growth from US$1.9bn in FY21; core net profit for FY22 improved 31% to US$2.42bn.

- Updated market consensus of the EPS in FY23/24 is US$0.309/US$0.329 respectively, which translates to 9.52x/8.94x forward PE. Current PER is 7.68x. Bloomberg consensus average 12-month target price is S$5.24.

(Source: Bloomberg)

HongKong Land (HKL SP): Benefiting from “World of Winners”

HongKong Land (HKL SP): Benefiting from “World of Winners”

- RE-ITERATE BUY Entry 4.50 – Target – 4.80 Stop Loss – 4.35

- Hongkong Land is a major listed property investment, management and development group. The Group owns and manages more than 850,000 sq. m. of prime office and luxury retail property in key Asian cities, principally Hong Kong, Singapore, Beijing and Jakarta. The Group also has a number of high quality residential, commercial and mixed-use projects under development in cities across China and Southeast Asia, including a 43% interest in a 1.1 million sq. m. mixed-use project in West Bund, Shanghai.

- Improving tourism sector sentiments. Cathay Pacific will provide 80,000 free round-trip air tickets to Hong Kong for residents throughout Southeast Asia as part of the “World of Winners” campaign sponsored by Airport Authority Hong Kong, which offers 500,000 free tickets to global visitors. The objective of this initiative is to support the “Hello Hong Kong” campaign of the Hong Kong Tourism Board, which aims to welcome tourists back to the city following the lifting of travel restrictions. This would definitely be an additional and effectively booster to drive tourism demand for Hong Kong.

- Removal of COVID-19 mask mandates. Hong Kong announced recently that the city will lift its COVID-19 mask mandate. This decision is aimed at attracting visitors and business and resuming normal life, more than three years after strict regulations were initially put in place in the financial hub. This shows confidence and strength in that the country is emerging from the pandemic. This is bound to drive the level of tourism within Hong Kong as well, as more activities resume as per pre-pandemic times.

- FY22 results review. Underlying profit fell 20% YoY to S$776mn in FY22 from S$966mn in FY21.Net profit came in at US$203 million for the year, after including net non-cash losses of US$573.4 million due to lower valuations of the group’s investment properties.

- Updated market consensus of the EPS growth in FY23/24 is 14.8%/5.2% respectively, which translates to 11.5x/10.9x forward PE. Current PER is 13.5x. Bloomberg consensus average 12-month target price is S$5.19.

China Shenhua Energy Co Ltd (1088 HK): Policy supports

- BUY Entry – 24.9 Target – 26.5 Stop Loss – 24.1

- China Shenhua Energy Co Ltd is a China-based comprehensive energy company. The Company operates its businesses through six segments. The Coal Business segment is engaged in coal mining and sales of surface and underground coal mines. The Power Generation Business segment is engaged in coal power generation, wind power generation, hydropower generation, gas power generation and power sales business. The Railway Business segment provides railway transportation services. The Port Business segment provides port cargo handling, handling and storage services. The Shipping Business segment provides shipping and transportation services. The Coal Chemical Business segment is engaged in the manufacturing and sales of olefin products. The Company conducts its businesses both in the domestic market and overseas markets.

- Support for SOEs. Chinese authorities plan to boost China’s state-owned enterprises (SOEs) valuations with more support for such firms. They have been encouraged by the government to expand globally and are also tasked to carry out research based on national strategic and industrial upgradng needs. With governmental support, SOEs will be able to better fortify international deals and attain more international infrastructural projects. In 2022, these SOEs have already seen their net profit grow to RMB1.9tn, a 35.7% growth compared to 2020.

- Coal demand. With China continuing its transition to green energy, they plan to promote clean and efficient utilization of coal to generate energy alongside building new renewable energy systems. As such they will continue to ramp up coal production which will be beneficial to China Shenhua Energy.

- FY22 earnings gudiance. The estimated profit attributable to the shareholders is between RMB71.9bn to RMB73.9bn, about a 39.3% to 43.2% YoY increase from RMB51.6bn in FY21.

- The updated market consensus of the EPS growth in FY23/24 is -8.0%/-1.9%, respectively, which translates to 6.4x/6.5x forward PE. FY23F/24F dividend yield is 12.4%/11.9%, respectively. Current PER is 6.08x. Bloomberg consensus average 12-month target price is HK$29.21.

(Source: Bloomberg)

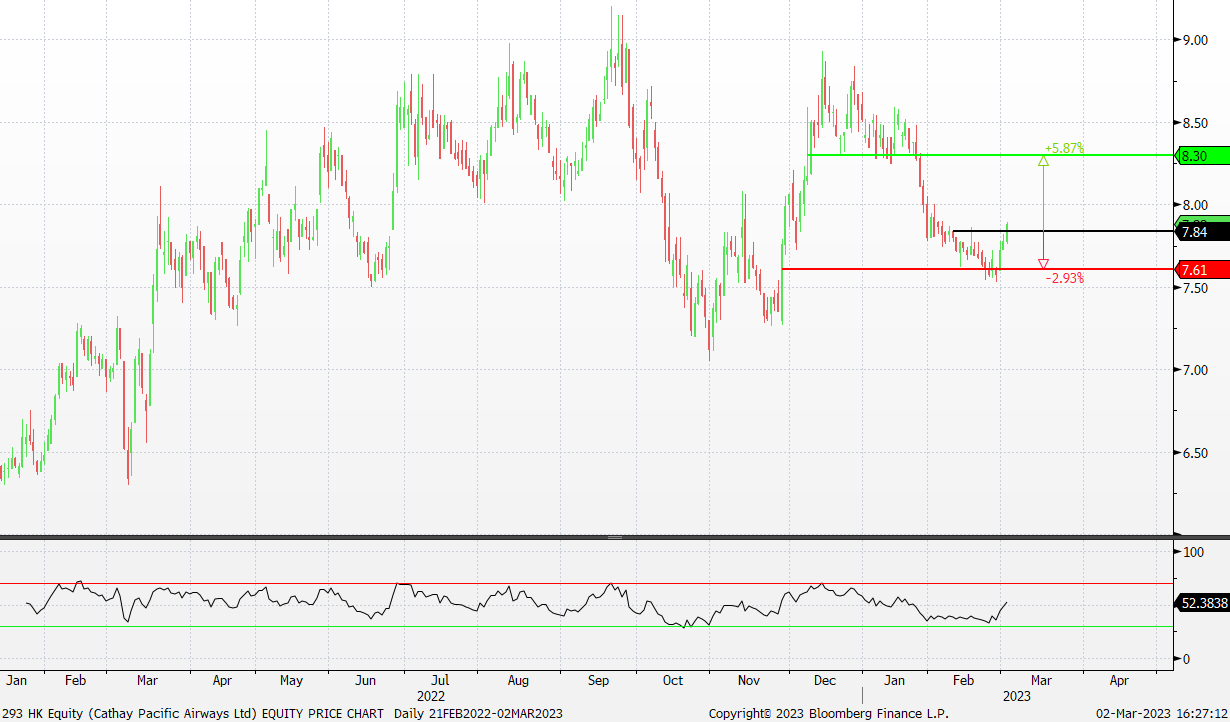

Cathay Pacific Airways Ltd (293 HK): Free air tickets

Cathay Pacific Airways Ltd (293 HK): Free air tickets

- RE-ITERATE BUY Entry – 7.84 Target – 8.30 Stop Loss – 7.61

- Cathay Pacific Airways Ltd is a company mainly engaged in the provision of international passenger and cargo air transportation. Together with its subsidiaries, the Company operates business through its four operating segments. The Cathay Pacific and Cathay Dragon segment provides full service international passenger and cargo air transportation under the Cathay Pacific and Cathay Dragon brands. The Air Hong Kong segment provides express cargo air transportation offering scheduled services within Asia. The HK Express segment provides a low-cost passenger air transportation offering scheduled services within Asia. The Airline Services segment provides supporting airline operations services include catering, cargo terminal operations, ground handling services and commercial laundry operations.

- Promoting tourism. The Hong Kong Tourism Board launched the “Hello, Hong Kong” campaign offering 500,000 air tickets and over a million Hong Kong Goodies visitor consumption vouchers to attract visitors, businesses, and investors to the city after Covid-19 curbs. Part of this initiative is the HKIA’s “World of Winners” Tickets Giveaway Campaign to stimulate air traffic and promote the recovery of Hong Kong’s aviation industry, tourism, and economy. Majority of the tickets will be distributed in phases by three home-based airlines, Cathay Pacific Airways, Hong Kong Express and Hong Kong Airlines, through their respective channels in major passenger markets by different mechanisms such as lucky draw, first-come-first-served, “Buy 1 or more – Get 1 Free”, or games. Additionally, some tickets will be provided to travel trade and government bodies for promoting tourism in Hong Kong. Around 80,000 tickets will be given away to Hong Kong residents in summer 2023, and some tickets will be given away in the Guangdong-Hong Kong-Macao Greater Bay Area. A total of more than 700,000 tickets will be given away across various markets through different channels. The distribution of the tickets will be 65% through airlines and their agents, with the remaining reserved for tourism-related sectors to support inbound tourism and promote Hong Kong.

- “World of Winners” in Singapore. The Tickets Giveaway Campaign will be rolled out in phases with the first phase starting from 1 March 2023 at Southeast Asia market. Cathay Pacific is offering 12,500 round-trip air tickets to tourists from Singapore between noon on 2 March and 11:59pm on 8 March.

- 1H22 earnings. Revenue in 1H22 was HK$18,551mn , up 17.0% YoY from HK$15,854mn. Loss attributable to the shareholders reduced by 33.9% from HK$7,565mn to HK$4,999mn.

- The updated market consensus of EPS in FY23/24 is HK$0.54/HK$0.67 respectively, which translates to 14.7x/11.8x forward PE. Bloomberg consensus average 12-month target price is HK$9.54.

(Source: Bloomberg)

Daqo New Energy Corp (DQ US): Gridlock alleviated

- BUY Entry – 53 Target – 63 Stop Loss – 48

- Daqo New Energy Corporation manufactures polysilicon. The Company markets its polysilicon to photovoltaic product manufacturers who process it into ingots, wafers, cells and modules for solar power products.

- Loosening restriction of solar panel imports. According to Reuters, the US custom officials clarified rules around complying with the law banning goods made with forced labor. Accordingly, solar panel imports from China rose. The clearance of the gridlock which lasted for months helps the recovery in the demand for solar panels and the prices of polusilicon in the near term.

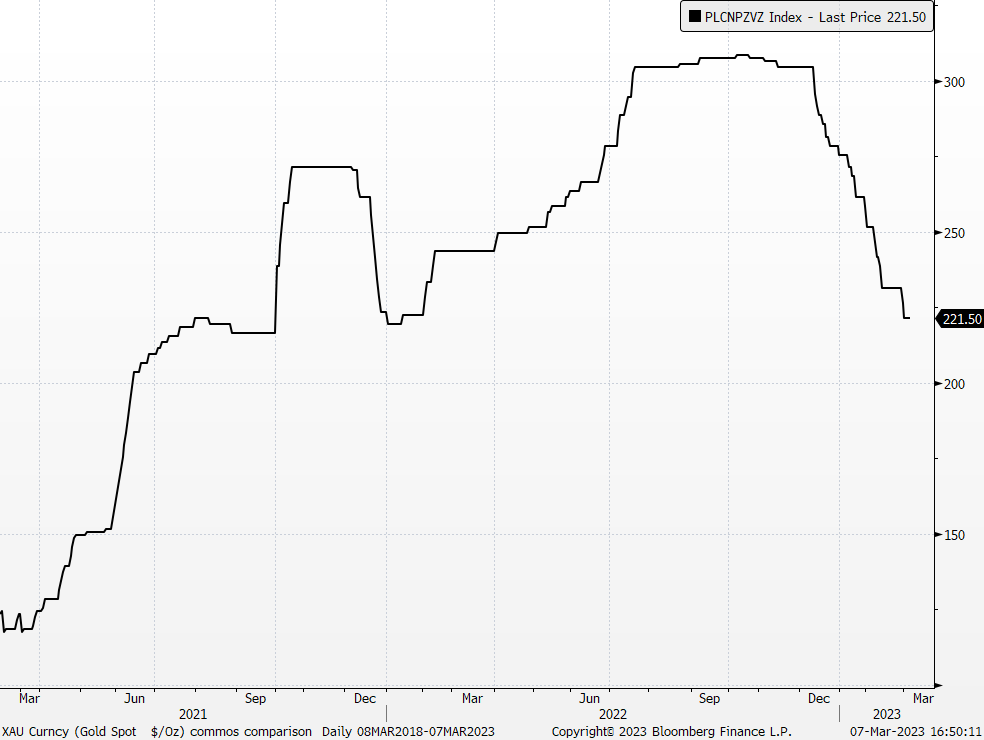

China polysilicon 9N delivered (RMB/kg)

(Source: Bloomberg)

(Source: Bloomberg)

- China reiterated renewable energy development. The government work report 2023 released during the two sessions a few days ago mentioned the general goals and proposals that China will strenthern the construction of urban and rural environmental infrastructure, and continuing to implement major projects for the protection and restoration of important ecosystems.

- 4Q22 results reveiw. Revenue jumped by 118.5% YoY to US$864.3mn. Non-GAAP EPS was US$5.17. Polysilicon production volume was 33,702 MT in 4Q22, compared to 33,401 MT in 3Q22. Polysilicon sales volume was 23,400 MT in 4Q22, compared to 33,126 MT in 3Q22. Polysilicon average selling price was US$37.41/kg in 4Q22, compared to US$36.44/kg in 3Q22.

- The updated market consensus of the EPS growth in FY23/24 is -37.9%/-32.6%, respectively, which translates to 3.2x/4.7x forward PE. Current PER is 2.3x. Bloomberg consensus average 12-month target price is US$61.73.

(Source: Bloomberg)

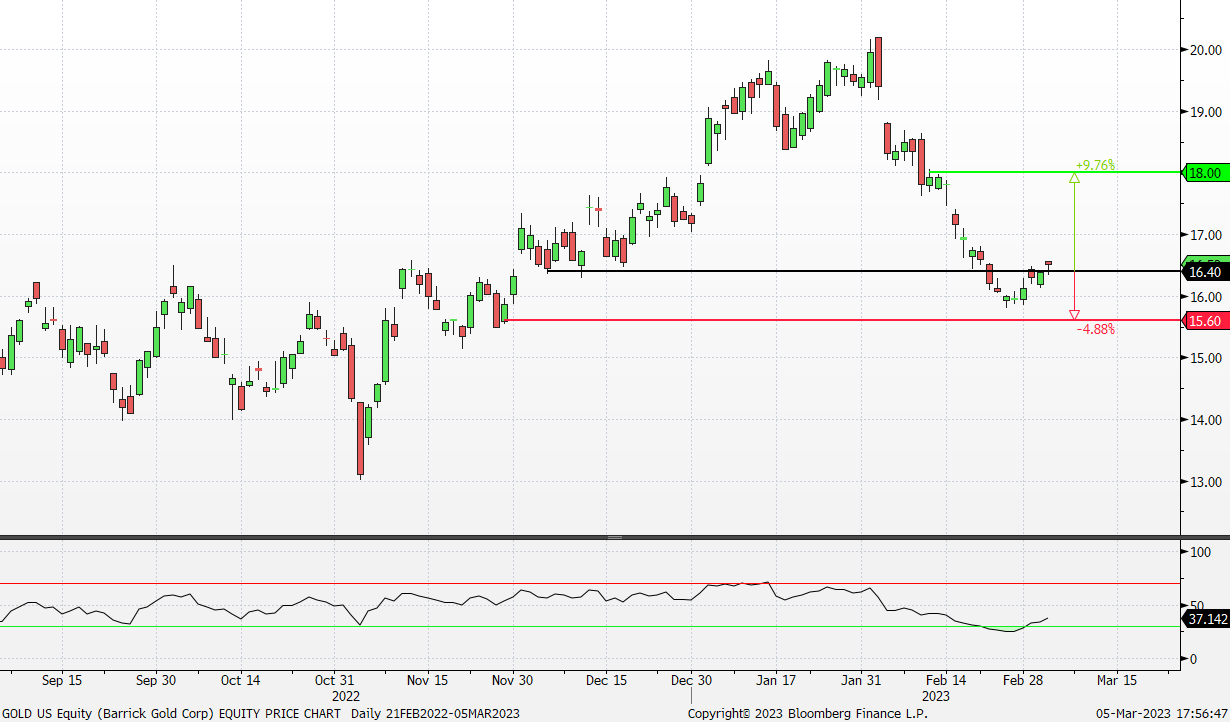

Barrick Gold Corporation (GOLD US): Safe haven

Barrick Gold Corporation (GOLD US): Safe haven

- RE-ITERATE BUY Entry – 16.4 Target – 18.0 Stop Loss – 15.6

- Barrick Gold Corporation engages in the exploration, mine development, production, and sale of gold and copper properties. It has ownership interests in producing gold mines that are located in Argentina, Canada, Côte d’Ivoire, the Democratic Republic of Congo, the Dominican Republic, Mali, Tanzania, and the United States.

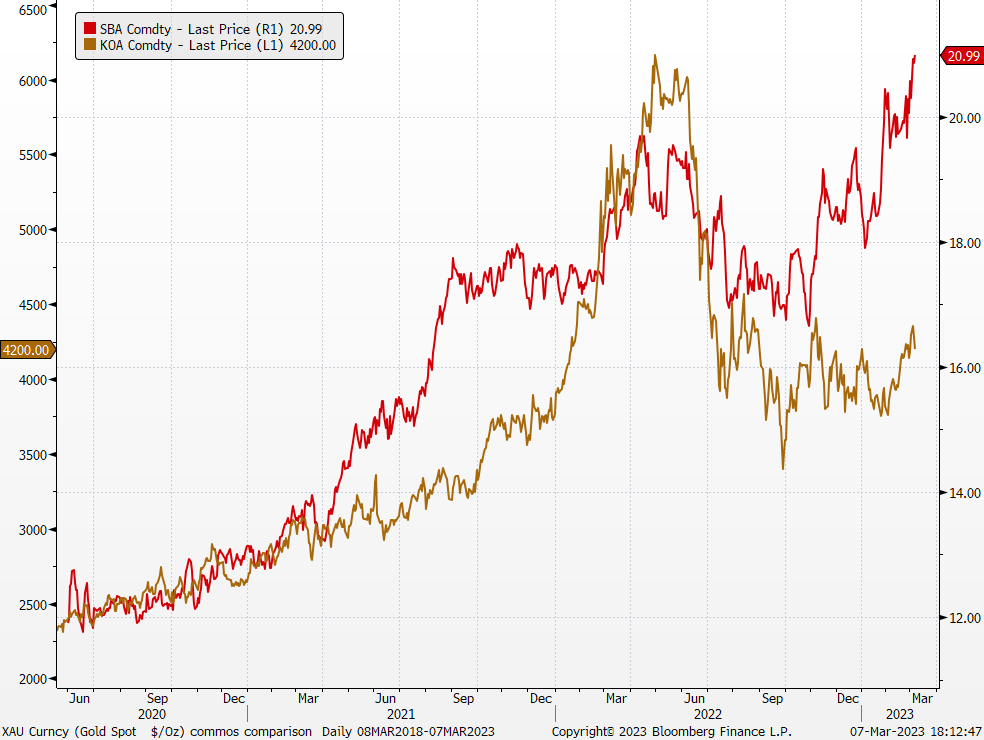

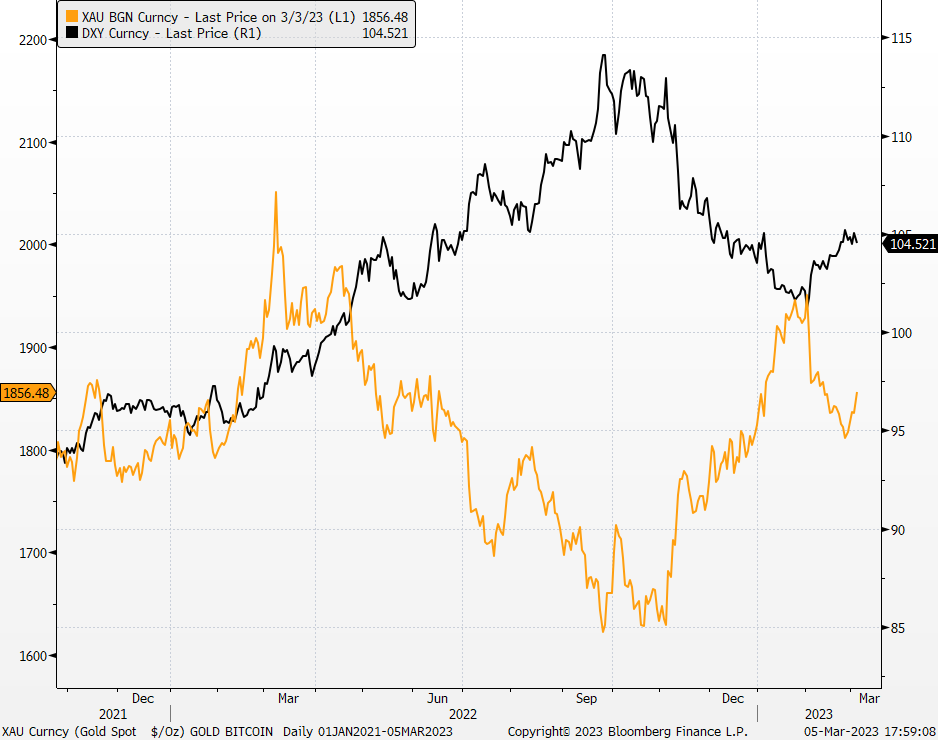

- Better outlook for gold price in 2023. There are several factors impact gold prices, and the key ones are the trend of the US dollars and global geopolitical risk. The broad market has expected that US dollars peaked at last year as inflation has been on a downswing. Even though recent macro data such as January CPI and core PCE price were higher than expected, both showed overall prices were declining. The market still expects Fed to cut rate by the end of after the peak in 3Q23. On the other hand, geopolitical tensions remain high and probably escalate anytime as China-US confrontations are more frequent. Gold is the good old safe haven.

Gold price and Dollar index trend

(Source: Bloomberg)

(Source: Bloomberg)

- Mixed 4Q23 results. Revenue dropped by 16.3% YoY to US$2.77bn, missing estimates by US$20mn. Non-GAAP net loss per share was US$0.13. 4Q22 gold and copper production was 1.12mn oz and 96mn pounds, respectively. Gold and copper prices averaged at US$1,728/oz and US$3.81/pound respectively.

- US$750mn share buyback. The company authorized a share buyback program of up to US$750mn in 2023, compared to US$1.6bn of dividends and buybacks in 2022.

- The updated market consensus of the EPS growth in FY23/24 is 8.8%/24.2%, respectively, which translates to 20.3x/16.3x forward PE. Current PER is 19.5x. Bloomberg consensus average 12-month target price is US$21.6.

United States

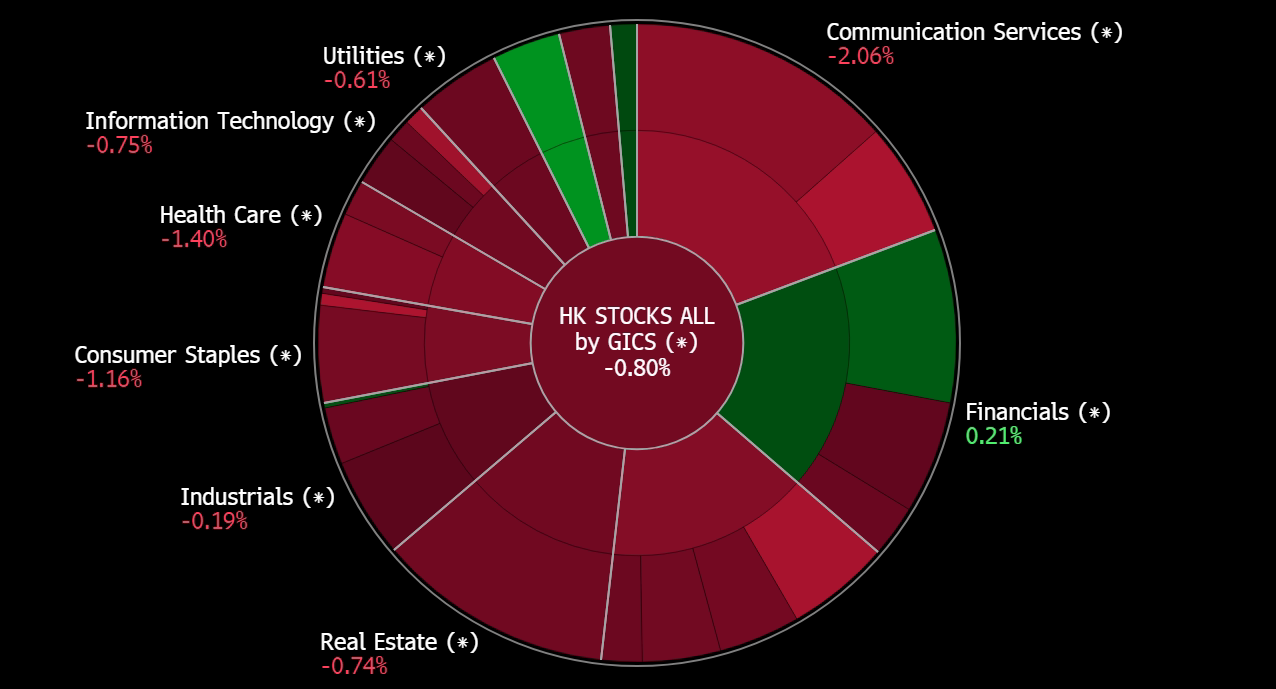

Hong Kong

Trading Dashboard Update: Add Hongkongland (HKL SP) at S$4.50, YZJ Shipbuildding (YZJSGD SP) at S$1.32, Yankuang Energy (1171 HK) at HK$23.1, and Barrick Gold (GOLD US) at US$16.4. Take profit on CNOOC (883 HK) at HK$12.5. Cut loss on TheHourGlass (HG SP) at S$2.15 and ANTA Sports (2020 HK) at HK$107.