05 May 2023:Banyan Tree Holdings Ltd. (BTH SP), Ping An Insurance Group (2318 HK), Barrick Gold Corporation (GOLD US)

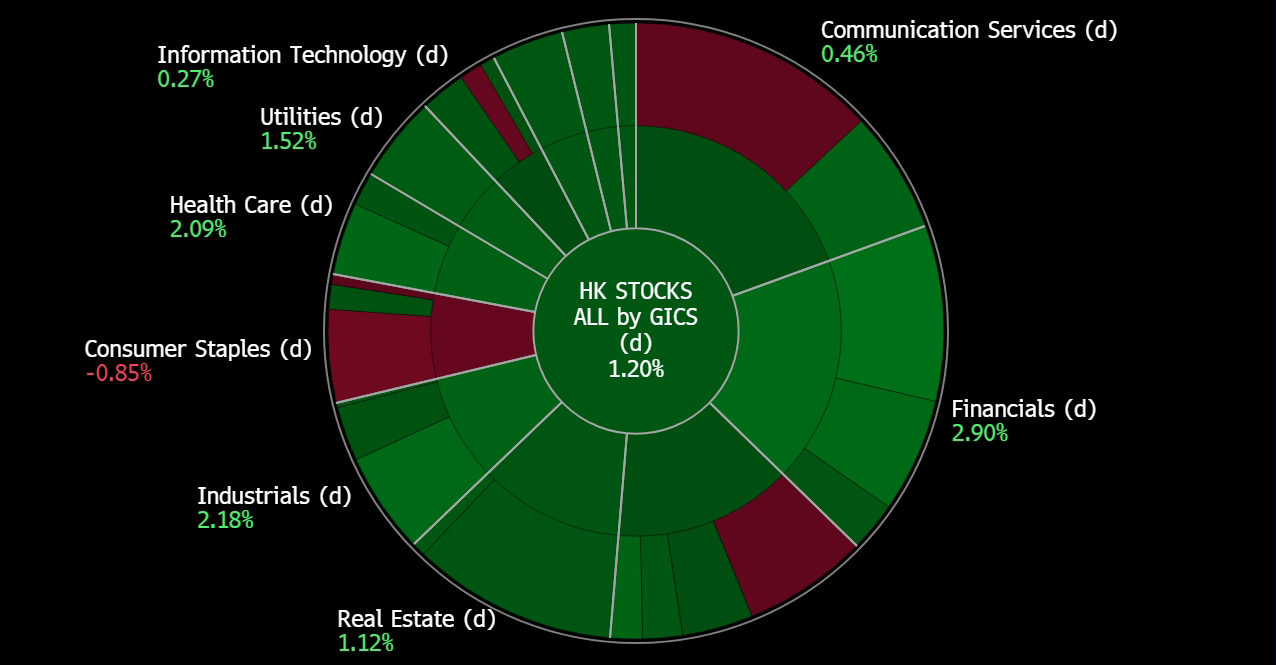

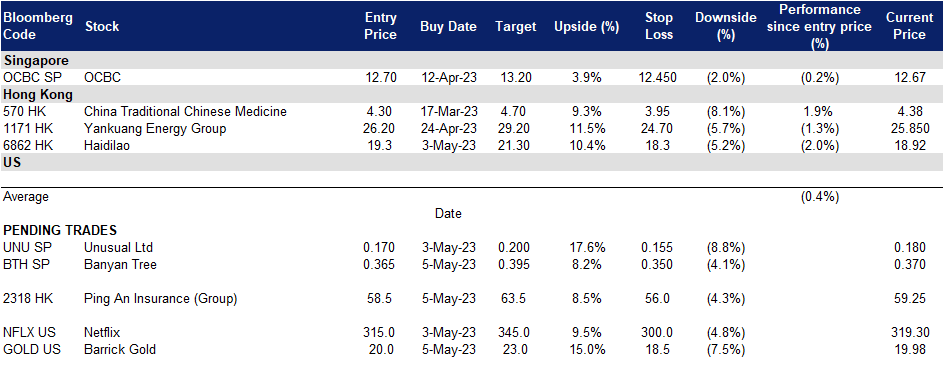

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

Banyan Tree Holdings Ltd. (BTH SP): On-track expansion amid tourism recovery

- BUY Entry 0.365 – Target – 0.395 Stop Loss – 0.350

- Banyan Tree Holdings Limited operates as a holding company. The Company, through its subsidiaries, owns and manages hotel groups. The Company focuses on hotels, resorts, spas, galleries, golf courses, and residences, as well as provides investments, design, construction, and project management services. Banyan Tree Holdings serves customers worldwide.

- Plans for further expansion. Banyan Tree is on track to meet its goal set in 2021 of doubling its hotel portfolio by the end of 2025. Last year, it launched five new hospitality brands and eight hotels. Banyan Tree plans to expand its global presence by opening more properties in new and existing destinations over the next three years. This includes the launch of Banyan Tree resorts in various locations in China, South Korea, the Philippines, Saudi Arabia, Singapore, and Japan. Additionally, the group will introduce the Banyan Tree Veya brand to Baja California in Mexico in 2023, and the Banyan Tree Escape concept will launch in Sumatra, Indonesia in the next two years. The Angsana brand will also expand with new resorts in Vietnam, Cambodia, Taiwan, and Spain by 2025. Furthermore, the Cassia, Dhawa, Homm, and Garrya brands will all have new hotel launches in various locations across Asia.

- May Day holiday tourism rebound. According to the Ministry of Culture and Tourism, the number of domestic trips reached 274mn during the five-day holiday, a 70.8% increase YoY and up 19% from 2019 levels, resulting in a total domestic tourism spending of 148bn yuan (US$21bn), rising 128.9% YoY and on par with pre-Covid levels. Furthermore, with overseas flights still below 2019 levels and China’s May Day holiday being the first travel season without Covid curbs in China boosting domestic tourism so significantly, it could be signalling a sustained recovery in China’s tourism sector. During this period hotels in China saw a surge in demand raising both their occupancy and average daily room rates.

- China’s recovery to contribute to revenue growth. Due to the lifting of travel restrictions and the issuance of all types of visas in China, Banyan Tree is well-positioned to benefit in FY23. With 14 hotels already operating in the country and four more scheduled to open this year, the group stands to attract a growing number of tourists to its properties in China and capitalise on the country’s recovering tourism sector and economy.

- FY22 results review. Revenue for FY22 increased 23% to S$271.3mn, from S$221.2mn a year ago. Return to profitability in 2022, from the previous year’s loss after tax and minority interests of S$55.2mn to a profit of S$0.8mn.

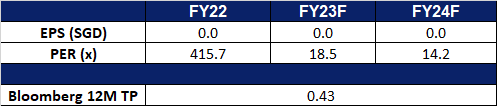

- Market consensus.

- Read the full fundamentals-based report here.

(Source: Bloomberg)

Unusual Ltd (UNU SP): More concerts to come

Unusual Ltd (UNU SP): More concerts to come

- RE-ITERATE BUY Entry 0.170 – Target – 0.200 Stop Loss – 0.155

- UnUsUaL Limited operates as a production and promotion service provider for events and concerts. The Company provides services in staging, Sound Light and Visual for an event and a concert, and organises and promotes concerts.

- Jacky Cheung shows sold out. Jacky Cheung will be performing in Singapore for a total of nine nights at the Singapore Indoor Stadium in a single concert tour. This is after the sale of tickets for the scheduled six nights were snapped up within hours and three more shows were added to go on sale on May 3 (Wednesday) at 12pm.

- Live events are back. As Covid-19 regulations are lifted worldwide and travel resumes, artists are increasingly scheduling concert tours this year. With restrictions easing, concert organisers can now hold shows at larger venues, accommodating more people. Additionally, demand for live events held in Asia has grown significantly and is expected to continue an upward trend.

- Events lined up. Unusual had a successful year-end in 2022, organising and selling out multiple concerts featuring renowned artists such as JJ Lin, Air Supply, and Westlife. In 2023, Unusual has already lined up several performances by big names like Jacky Cheung and Eric Chou, as well as other popular artists such as Grasshopper, Wakin Chau, and Aaron Kwok. Additionally, more events are expected to be organised in the second half of the year.

- 1H23 results review. Group revenue increased by approximately 1475%, from S$0.4mn in 1H22 to S$6.3 million in 1H23. Gross profit rose 580% to S$2.4mn from S$0.5mn in 1H22. The Group generated a net profit of S$1.0mn in 1H23 compared to a net loss of S$1.6mn in the same period the year before.

Ping An Insurance (Group) (2318 HK): A shelter from US banking fears

- BUY Entry – 58.5 Target – 63.5 Stop Loss – 56.0

- Ping An Insurance (Group) Company of China, Ltd. is a personal financial services provider. The Company provides insurance, banking, investment, and Internet finance products and services. The Company operates its businesses through four segments. The Insurance segment provides life insurance and property insurance, including term, whole-life, endowment, annuity, automobile and health insurance. The Banking segment is engaged in loan and intermediary businesses with corporate customers and retail business. The Assets management segment is engaged in security, trust and other assets management businesses, including investment, brokerage, trading and asset management services. The Internet Financing segment is engaged in the provision of Internet finance products and services.

- Funds rotation from US to China Stocks. Global funds are gradually returning to China’s onshore stock market as the nation emerges from Covid restrictions and pivots to pro-growth policies. The banking crisis in the US sparked by the downfall of SVB brought fears to investors, resulting in the capital rotation from the US financial sector to China one. Recently, shares of Chinese fincial stocks are outperforming American peers amid concerns over the global banking sector, emerging as an oasis shielded from volatility abroad.

MSCI China Financials (red) vs MSCI US Financials (blue)

(Source: Bloomberg)

(Source: Bloomberg)

- Home sales recovering. In April, China’s real estate sector continued to show signs of recovery as home sales by the country’s 100 biggest real estate developers increased for the third consecutive month. This growth is attributed to the financial support provided by regulators to the sector, including lowered mortgage rates and eased buying curbs in many large cities such as Shanghai. Preliminary data from China Real Estate Information Corp shows that the value of new home sales by the 100 biggest developers rose by 31.6% from the previous year to reach RMB566.5bn (US$81.9bn). This indicates a significant rebound in the real estate market, which had been struggling due to a slowing economy and tighter regulations in recent years.

- FY22 earnings. Revenue declined to RMB985.7bn compared to RMB1,057.6bn in FY2021 (-6.7% YoY). Net profit dropped to RMB83.8bn in FY2022, representing a decline by 17.6% compared to RMB101.6bn in FY2021. FY2022 EPS was RMB4.80.

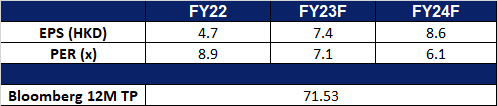

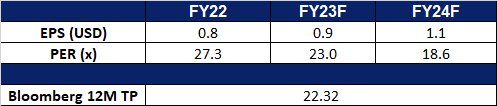

- Market Consensus

(Source: Bloomberg)

Haidilao International Holding Ltd. (6862 HK): China’s huge appetite

- RE-ITERATE BUY Entry – 19.3 Target – 21.3 Stop Loss – 18.3

- Haidilao International Holding Ltd is a China-based company principally engaged in the restaurant operation business. The Company is mainly engaged in the operation of hotpot chain restaurants under the brand of Haidilao. The Company is also involved in the takeaway business, as well as the sales of condiments and ingredients. The Company operates its businesses mainly in the domestic market.

- Re-opening of China Food and Drinks Fair. China Food and Drinks Fair (CFDF) has re-opened, providing a much needed boost to the F&B industry after challenging years due to the Covid-19 pandemic. The 320,000 square metres of exhibition space is expects to see over 6,500 exhibitors from over 40 countries and regions over 300,000 customers and merchants are expected to participate in the event.

- Labour Day holiday consumption frenzy. Consumer spending surged noticeably during China’s five-day Labor Day Holiday that started on April 29. China saw record passenger flow over the period, as consumers embarked on “revenge spending” following the easing of Covid-19 restrictions. The 1st day of the Labour Day holiday saw a huge volume of travellers, with almost 57 million passenger trips nationwide. This resumption of traffic is bound to drive growth for Haidilao, which has over 1,300 stores across China, as well as over 114 stores overseas.

- Better domestic consumption in 1Q23. According to the National Bureau of Statistics, China’s domestic consumption kept warming up, with the retail sales of consumer goods increasing by 5.8% YoY. in the first three months, totaling around 11.49 trillion yuan. In March alone, retail sales jumped 10.6% YoY.

- FY22 earnings. Revenue from continuing operations was RMB31,038.6mn, representing a decrease of 20.6% YoY, and profit for the year from continuing operations was RMB1,637.3mn, as compared to a loss of RMB3,247.8mn in FY21. FY22 EPS was HK$ 0.28.

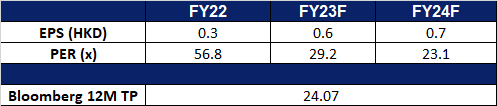

- Market Consensus

(Source: Bloomberg)

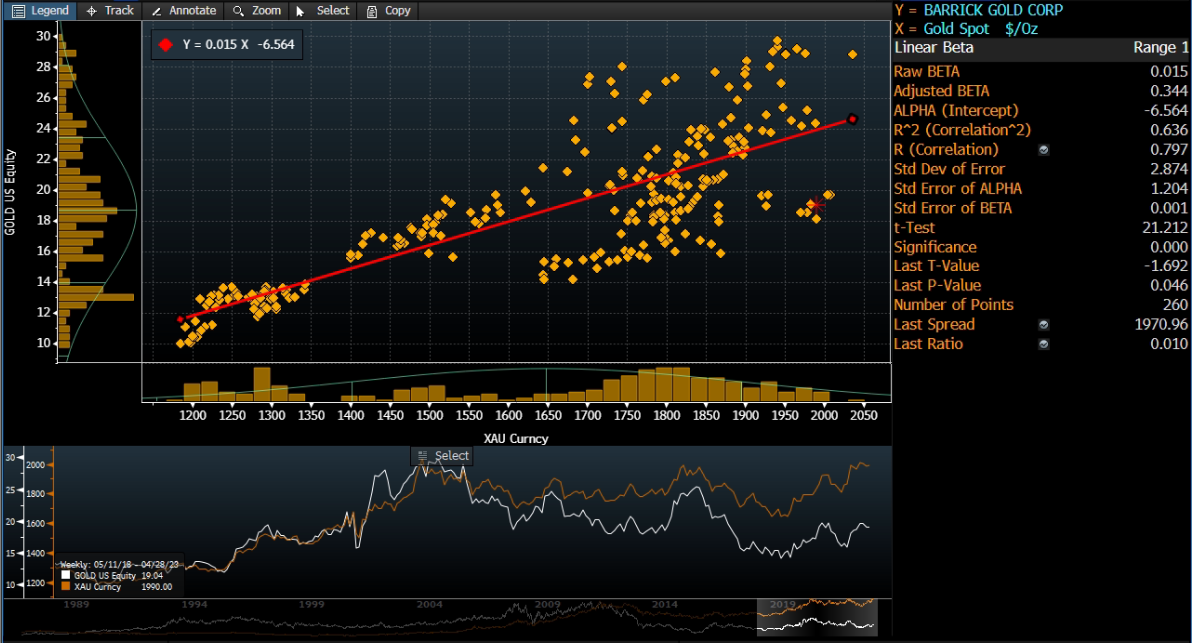

Barrick Gold Corporation (GOLD US): Hedging against upcoming crisis

- BUY Entry – 20.0 Target – 23.0 Stop Loss –18.5

- Barrick Gold Corporation engages in the exploration, mine development, production, and sale of gold and copper properties. It has ownership interests in producing gold mines that are located in Argentina, Canada, Côte d’Ivoire, the Democratic Republic of Congo, the Dominican Republic, Mali, Tanzania, and the United States.

- Banking crisis persists. Fed hikes another 25bps of the Fed fund rate in the May FOMC meeting, and Fed Chairman Powell says that the banking system is sound and resilient. However, the sell-off in the US regional banks continues as the withdrawal of deposits accelerates and investors worry about more bank failures coming. Regional banks will continue to suffer from the ongoing high-interest rates due to the mismatch of asset/liability duration. Moreover, these banks are heavily exposed to the commercial real estate market which bears another potential crisis. Vacancy rates in US office buildings and shopping malls are rising, resulting in the increase in the delinquency of commercial property loans and the ensuing defaults on commercial mortgage-back securities.

- Reaching debt ceiling soon. US Treasury Secretary Yellen warned that the US may run out of cash by June if Congress fails to raise or remove the debt ceiling. Given the current economic situation, the potential government shutdown will accelerate the US to fall into recession. Meanwhile, investors could see financial market turmoil in the short term.

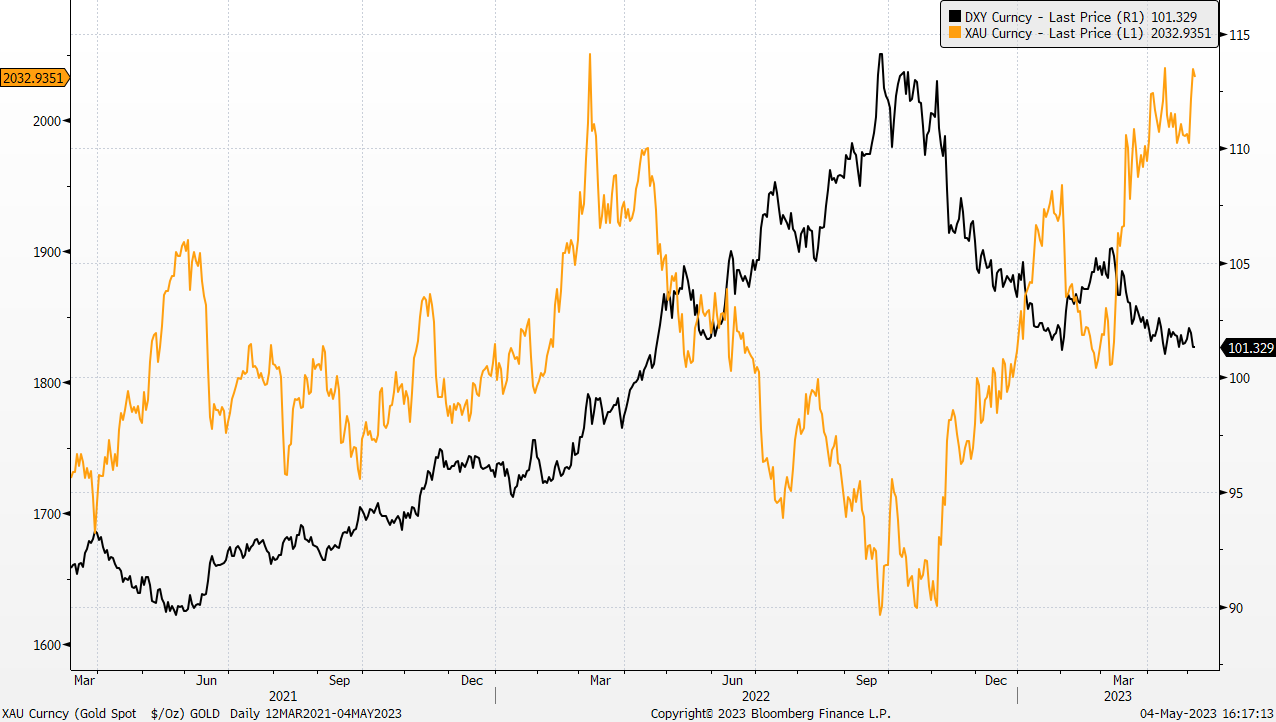

- Better outlook for gold price in 2023. There are several factors impact gold prices, and the key ones are the trend of the US dollars and global geopolitical risk. The broad market has expected that US dollars peaked last year as inflation has been on a downswing. Even though recent macro data such as March CPI and core PCE price were higher than expected, both showed overall prices were declining. The market expects Fed to cut rates by the end of 3Q23. On the other hand, geopolitical tensions remain high and probably escalate anytime as China-US confrontations are more frequent. Gold is the good old safe haven.

Gold Price and Dollar Index Trend

(Source: Bloomberg)

(Source: Bloomberg)

- 1Q23 earnings review. Revenue dropped by 7.4% YoY to US$2.64bn, beating estimates by US$70mn. Non-GAAP EPS was US$0.14, beating estimates by US$0.02. It remains on track to achieve its 2023 guidance, which previously targeted production of 4.2mn-4.6mn oz of gold and 420mn-470mn lbs of copper, compared with FY 2022 output of 4.14mn oz of gold and 440mn lbs of copper.

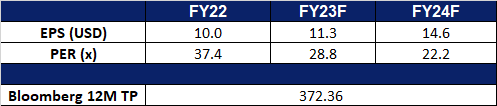

- Market consensus.

Barrick Gold VS Gold price

(Source: Bloomberg)

(Source: Bloomberg)

Netflix, Inc. (NFLX US): Ignore noises

- RE-ITERATE BUY Entry – 315 Target – 345 Stop Loss –300

- Netflix, Inc. provides entertainment services. It offers TV series, documentaries, feature films, and mobile games across various genres and languages. The company provides members the ability to receive streaming content through a host of internet-connected devices, including TVs, digital video players, television set-top boxes, and mobile devices.

- Hollywood writer strike is a dip-buying opportunity. Hollywood writers voted to strike after six weeks of negotiating with major entertainment and filming companies including Netflix. This is a strike since 2007, and it cost billions of dollars in lost output and a quarter of prime-time programming for the network TV season back then. However, this is a buying opportunity as Netflix’s productions are more diversified. In recent years, Korean films and dramas which increasingly gains attraction, and previously the company was set to invest US$2.5bn in Korean content over the next 4 years. The strike has a limited impact on those productions. Besides, the main crowd of the strike is scriptwriters but actors, hence, productions are expected to continue even when the strike is on.

- 1Q23 earnings review. 1Q23 revenue grew by 3.7% YoY to US$8.16bn, missing estimates by US$20mn. 1Q23 GAAP EPS was US$2.88, beating estimates by US$0.01. Average paid memberships grew by 4% YoY to 1.75mn.

- Market consensus.

United States

News Feed |

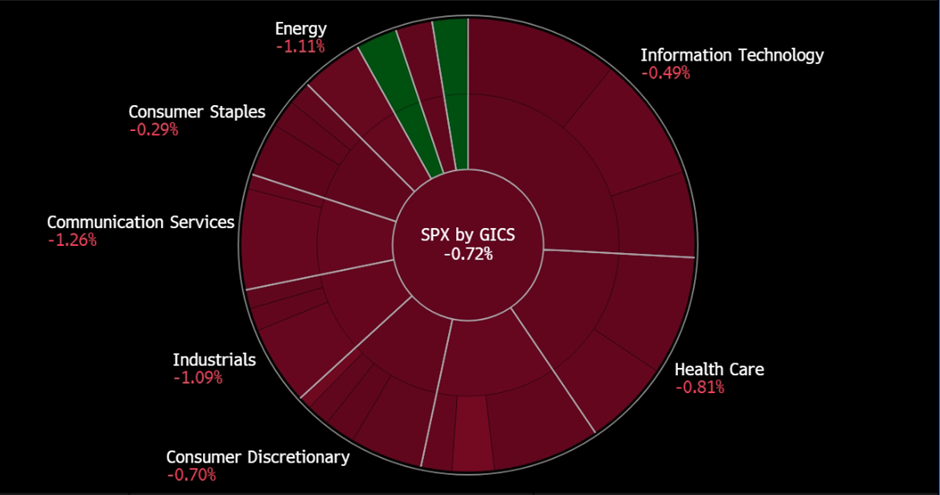

1. Stocks fall, dollar rises as investors eye weakening economy |

2. Short selling comes under fire as regional banks sell off |

3. Gold flirts with all-time highs as banking concerns deepen |

Hong Kong

Trading Dashboard Update: Cut loss on Samsonite International (1910 HK) at HK$23.3. Add Haidilao (6862 HK) at HK$19.3.

(Source: Bloomberg)

(Source: Bloomberg)