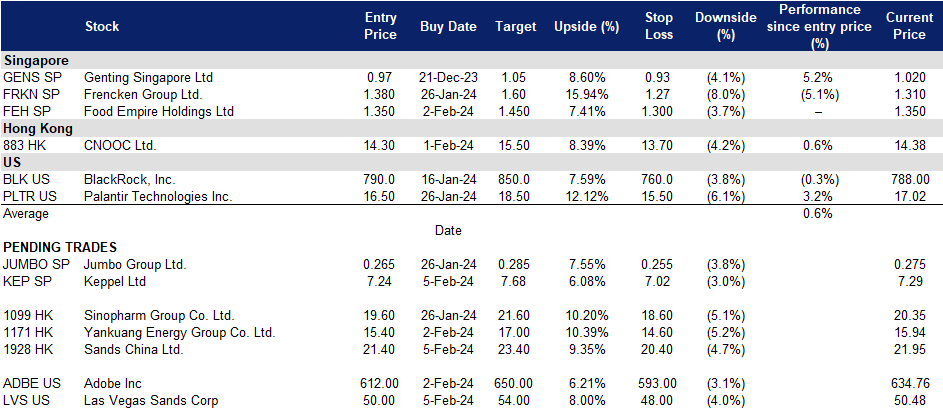

5 February 2024: Keppel Ltd (KEP SP), Sands China Ltd. (1928 HK), Las Vegas Sands Corp (LVS US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

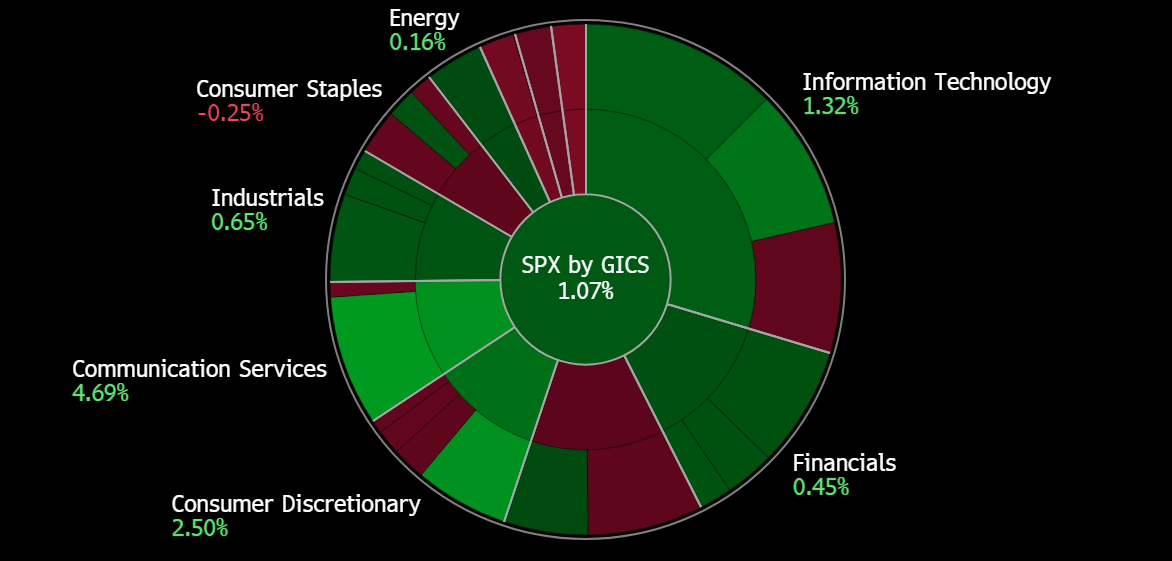

United States

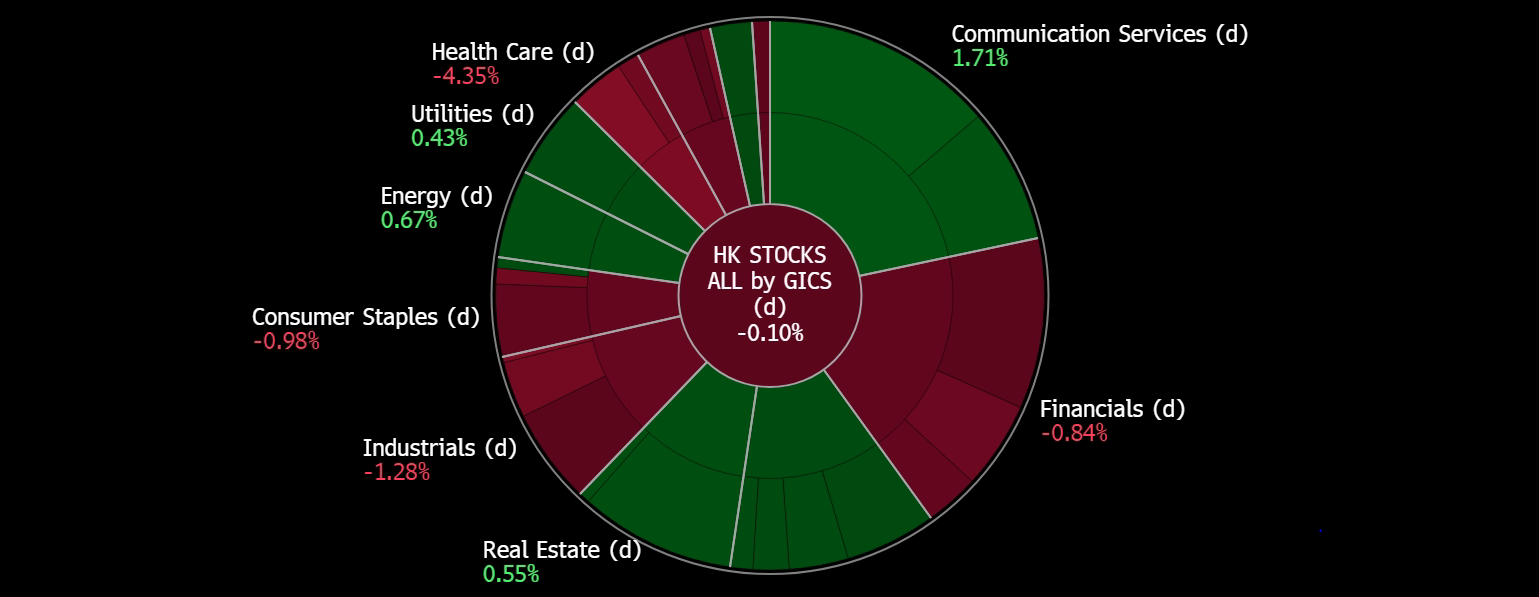

Hong Kong

Keppel Ltd (KEP SP): Continue to growth in 2024

- BUY Entry – 7.24 Target– 7.68 Stop Loss – 7.02

- Keppel Limited is an asset manager and operator. The Company focuses on sustainability solutions spanning the areas of energy and environment, urban development, and digital connectivity, as well as provides critical infrastructure and services through its investment platforms and asset portfolios. Keppel serves clients worldwide.

- Profitability on the rise. Keppel reported a record net profit of S$4.1bn for FY23, marking a more than 4 times increase from the previous year’s profit of S$927mn. The surge was attributed to gains from the divestment of Keppel Offshore & Marine, contributing S$3.3bn, and S$996mn from continuing operations. Return on equity rose to 37.9%, compared to 8.1% in FY22. 2H23 increased by 36% to S$551mn. Its three business segments of infrastructure, real estate, and connectivity performed well. Keppel plans to become a global asset manager and operator, delivering a total shareholder return of 61.1% for 2023. Infrastructure net profit rose by 135% to S$699mn. The proposed final cash dividend is 19 cents per share, bringing the total cash dividend for FY23 to 34 cents per share. Keppel’s CEO highlighted the transformative year, including the successful divestment of the offshore and marine business and the acquisition of a 50% stake in European asset manager Aermont Capital for S$517mn. The company aims to grow its funds under management to $200bn by 2030, leveraging Aermont’s expertise in real estate. Despite challenging conditions in certain markets, Keppel’s real estate segment contributed S$426mn to the net profit for FY23. Looking ahead, Keppel anticipates recurring income growth and expansion in fund management and deal-making volume in 2024.

- S$1bn of sustainability-linked loans. Keppel recently introduced a sustainability-linked financing framework and secured S$1bn in sustainability-linked revolving loans from DBS Bank and United Overseas Bank. The framework outlines key performance indicators and sustainability targets, including a 50% reduction in Keppel’s absolute scope 1 and 2 carbon emissions by 2030 compared to the 2020 baseline. The company also aims to increase its portfolio of renewable energy assets to 7GW by 2030, with an interim target of 4.9GW by the end of 2027. Keppel secured S$500mn in sustainability-linked revolving credit facilities from each bank, with tenures of up to three years.

- Power supply deal with large chipmaker. Keppel’s infrastructure business recently secured a multi-year agreement to supply electricity to contract chipmaker GlobalFoundries’ Singapore operations. The chipmaker operates a US$4bn semiconductor fabrication plant in Singapore serving 200 clients globally in the automotive and 5G technology sectors. Starting May, Keppel’s existing power plants will provide 150 to 180 megawatts of electricity annually to GlobalFoundries’ site. GlobalFoundries is expected to be a long-term buyer from Keppel Sakra Cogen Plant (KSC), which is being developed in collaboration with Mitsubishi Power and Jurong Engineering. GlobalFoundries is anticipated to contract about 25% of KSC’s total generation capacity for over 15 years. KSC, set to be completed in 2026 with a total annual capacity of about 600MW, aims to reduce up to 70,000 metric tons or 10% of annual carbon dioxide emissions at GlobalFoundries’ Singapore site. The plant’s use of hydrogen as feedstock enhances its potential to provide even lower-carbon power in the future. GlobalFoundries has the option to switch part of the power supplied by Keppel to renewable energy sources as part of its goal to achieve a 25% reduction in total greenhouse gas emissions by 2030.

- FY23 results review. FY23 revenue increased by 5% YoY to S$6,967mn from S$6,620mn. Net profit rose 339% YoY to S$4,067mn from S$927mn. Earnings per share rose 337% to 227.6 cents from 52.1 cents in FY22.

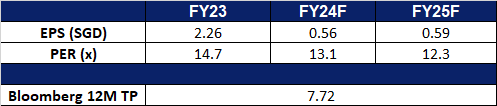

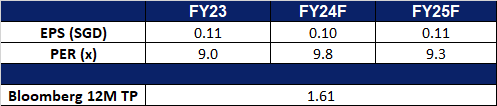

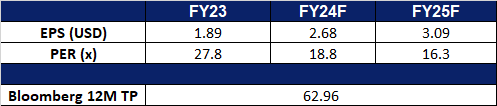

- Market Consensus.

(Source: Bloomberg)

Food Empire Holdings Ltd (FEH SP): A growing empire

Food Empire Holdings Ltd (FEH SP): A growing empire

- RE-ITEREATE BUY Entry – 1.35 Target– 1.45 Stop Loss – 1.30

- Food Empire Holdings Limited manufactures and markets instant beverage products, frozen convenience food, confectionery and snack food. The Company exports its products to markets such as Russia, Eastern Europe, Central Asia, the Middle East and Indochina.

- Expansion Plans. Food Empire is constantly seek opportunities to spearhead itself in a different market, mainly focusing on acquisitions. The company is currently exploring several new markets where they can grow its business, before diving into expanding its business into these new markets to prevent incurring additional losses. The company also recently proposed a dual primary listing on the main board of the stock exchange of Hong Kong Ltd. This can potentially help Food Empire to generate more capital to grow their business internationally.

- Resilient consumer demand. Consumer demand remained relatively steady despite ongoing geopolitical tensions worldwide, in a high-interest-rate environment. Demand for coffee remained strong across the company’s key markets. However, Russia saw a slight decline in revenue mainly due to the depreciation of the Russian Ruble against the US dollar.

- Completion of Malaysia’s NDC plant. The company expects its NDC plant in Malaysia to commence operation in 1Q24, pending approval and clearance from the Malaysian government. The new plant is expected to begin commercial production in the coming months but would still require more time to ramp up to full capacity. This plant would increase the production capacity for the group to generate more revenue.

- 3Q23 results review. 3Q23 revenue decreased by 1.6% YoY to US$106.8mn from US$108.6mn. Net profit fell 30.6% YoY to US$15.7mn from US$22.6mn. Net profit margin fell by 6.1 percentage points to 14.7% in 3Q23, compared with 20.8% in 3Q22.

- Market Consensus. We have a fundamental coverage with a BUY recommendation and a TP of S$1.45. Please read the full report here.

(Source: Bloomberg)

Sands China Ltd. (1928 HK): Expect more visits during Chinese New Year

- BUY Entry – 21.4 Target – 23.4 Stop Loss – 20.4

- Sands China Ltd. is an investment holding company principally engaged in the development and operation of integrated resorts in Macao. The Company operates many places, including gaming areas, meeting space, convention and exhibition halls, retail and dining areas and entertainment venues. The Company operates its business through six segments: The Venetian Macao, Sands Cotai Central, The Plaza Macao, Sands Macao, Ferry and Other Operations and The Parisian Macao. Through its subsidiaries, the Company is also engaged in the provision of high speed ferry transportation services. The Company’s subsidiaries include Cotai Ferry Company Limited, Hotel (Macau) Limited and Development Limited.

- Lunar New Year travel seasonality. Anticipating the upcoming Lunar New Year in early February, China is preparing for a surge in travel with an expected 9.0 billion domestic journeys as individuals travel to their hometowns to celebrate the festive season. Projections include 80 million air trips, reflecting a 9.8 percent increase compared to pre-pandemic levels in 2019. Beijing airports are expected to witness a significant 60 percent rise in passenger numbers during this travel rush. This heightened travel activity is likely to benefit Sands China, as the increased volume is expected to drive demand for hotel bookings.

- Macau Japan Spring Festival. Commencing on Thursday and extending until March 30, the CONTEMPO Macau Japan Spring Festival’s first edition is underway at Sands China’s integrated resorts. This two-month-long festival encompasses a diverse range of events, featuring popular idol performances, a captivating kimono culture exhibition, immersive culinary experiences, and art presentations. The primary objective is to foster cultural exchanges and collaboration between Macau and Japan, aiming to not only facilitate industry interactions but also encourage increased visitor flow between the two regions.

- Partnership with Tencent and Maoyan. Sands China has recently formed a strategic alliance with Tencent Video and Maoyan Entertainment, aiming to capitalize on their strengths to promote collaboration. This partnership will involve organizing significant offline events, developing lifestyle and entertainment content, and undertaking online marketing and promotional activities. These joint efforts are geared towards sustaining the diversification of Macau’s tourism industry and bolstering the city’s reputation as a premium destination.

- 1H23 earnings. Revenue increased by 216.4% YoY to US$2,895mn in 1H23, compared to US$915mn in 1H22. Net profit of US$175mn in 1H23, compared to a net loss of US$760mn in 1H22. Basic EPS of US2.16 cents in 1H23, compared to US9.39 cents in 1H22.

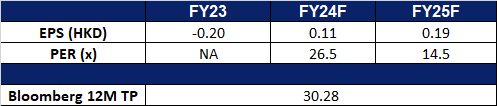

- Market consensus.

(Source: Bloomberg)

Yankuang Energy Group Co. Ltd. (1171 HK): A freezing winter

- RE-ITEREATE BUY Entry – 15.4 Target – 17.0 Stop Loss – 14.6

- Yankuang Energy Group Co Ltd is a China-based international comprehensive energy company engaged in coal and coal chemical industry. The Company operates in five segments. The Coal Mining segment is engaged in underground and open-cut mining, preparation and sale of coal and potash mineral exploration. The Smart Logistics segment provides railway transportation services. The Electricity and Heating Supply segment provides electricity and related heat supply services. The Equipment Manufacturing segment is engaged in the manufacture of comprehensive coal mining and excavating equipment. The Chemical Products segment is engaged in the production and sale of chemical products. The coal products mainly include thermal coal, pulverized coal injection (PCI), and coking coal. The coal chemical products mainly include methanol, ethylene glycol, acetic acid, ethyl acetate and crude liquid wax, among others. The Company distributes products in the domestic market and to overseas markets.

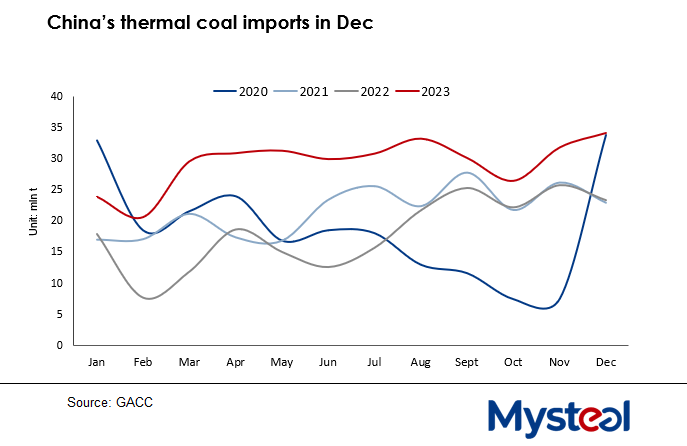

- Seasonality is driving record-high thermal coal imports. In December of the previous year, China’s thermal coal imports set a new record at 34.26 million tonnes, marking a 7% increase from November and a substantial 46% rise compared to the same month in 2022. The surge in fossil fuel imports was primarily driven by significant temperature drops across various regions, prompting heightened domestic demand for increased heating through devices and coal boilers. For the entire year of 2023, China’s thermal coal imports reached 353.65 million tonnes, a remarkable 62% surge from the previous year.

- China reinstates coal tariffs. At the start of 2024, China has reinstated tariffs on coal imports. The reinstated tariffs include a 6% levy on coal for electricity and heating and a 3% tariff on coking coal used in steelmaking. Russia, South Africa, Mongolia, and the United States will be impacted by these tariffs, while Indonesia and Australia remain exempt due to free trade agreements with China. The implementation of these tariffs is likely to drive up domestic coal production and demand as there is less competition from foreign coal companies. This allows domestic producers like Yankuang Energy to extend their competitive edge in the Chinese market.

- More coal use. Recently, China has initiated tests for producing ethanol using coal, as opposed to traditional crops like corn or sugar cane. This innovative approach enables China to generate “millions of tonnes” of grains annually, serving as valuable food resources.

- 3Q23 earnings. Revenue fell by 28.01% YoY to RMB40.34bn in 3Q23, compared to RMB56.03bn in 3Q22. Net profit fell 52.43% YoY to RMB4.52bn, compared to RMB9.49bn in 3Q22. Basic EPS fell by 55.36% YoY to RMB0.58, compared to RMB1.30 in 3Q22.

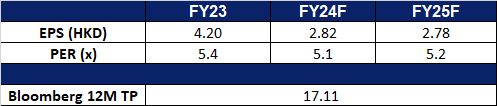

- Market consensus.

China’s thermal coal imports 2020-2023

(Source: General Administration of Customs)

(Source: Bloomberg)

Las Vegas Sands Corp (LVS US): Expanding its presence across Asia

- BUY Entry – 50 Target – 54 Stop Loss – 48

- Las Vegas Sands Corp owns and operates casino resorts and convention centers. The Company operates in the United States, Macau and Singapore. Las Vegas Sand offers a wide range of gaming activities and entertainment as well as overnight accommodations, while its expo centres host a wide range of entertainment shows, expositions, and other activities.

- Marina Bay Sands fourth tower in the making. Marina Bay Sands (MBS) has received approval from the Urban Redevelopment Authority (URA) to construct a fourth tower with 587 hotel rooms, situated adjacent to its existing three hotel towers. The new tower will encompass 153,100 sqm of hotel space and 12,185 sqm of retail space. Originally planned with 1,000 “all-suite” hotel rooms, a 15,000-seat entertainment arena, and additional amenities, the project faced delays and cost revisions due to the COVID-19 pandemic. In an earnings presentation, MBS’s parent company, Las Vegas Sands, indicated ongoing work on the expansion, emphasising a focus on enhancing Singapore’s tourism appeal. Despite budget and timing uncertainties, MBS reported a fourth-quarter 2023 adjusted property EBITDA of US$544mn, marking a 19% increase from pre-pandemic levels in the same period in 2019. The FY23 adjusted property EBITDA for MBS reached US$1.86bn, up from US$1.06bn in FY22.

- Livening up Marina Bay. Singapore Tourism Board (STB), MBS, and UOB have formed a pioneering partnership to enhance the Marina Bay precinct for locals and tourists. The collaboration aims to introduce over 50 exclusive experiences across hotels, attractions, retail shops, and dining establishments. Leveraging STB’s global “Made in Singapore” campaign, Marina Bay Sands’ Bay Precinct Strategy, and UOB’s strategy for exclusive access, the partnership seeks to create a compelling tourism narrative. The initiative includes a marketing campaign, “Masterpieces, Made in Singapore,” targeting key source markets. The partnership kicks off with a waterfront drone light show titled “The Legend of the Dragon Gate” for the Lunar New Year in February, followed by ongoing joint marketing initiatives and promotions. This partnership is expected to attract bother tourists and locals to the Marina Bay area, which will in turn encourage visitors to spend more time and money in the area contributing to MBS’s top lines.

- Improving performance. In Q4, LVS Macao reported US$654mn of EBITDA, with potential growth of US$40mn if the rolling segment had met expectations, indicating positive trends in gaming and non-gaming revenue. The company owns the largest share of EBITDA in Macao, anticipating future growth through a US$1.2bn reinvestment program. MBS in Singapore achieved its highest-ever quarterly EBITDA of US$544mn despite ongoing renovations, with expectations to reach at least US$2bn annually post-renovation. LVS is bidding for a New York license with a planned US$6bn investment for a five-star resort. Both Macao and MBS show positive revenue and EBITDA growth, with margin expansion in rolling volume segments, signalling sustained long-term growth through strategic investments.

- 4Q23 results. Revenue increased to US$2.92bn, an increase of 160.7% YoY, exceeding expectations by US$40mn. Non-GAAP earnings per share were $0.57, missing expectations by $0.04.

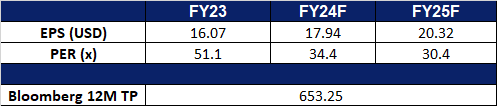

- Market consensus.

(Source: Bloomberg)

Adobe Inc (ADBE US): A lagging AI-themed stock

- RE-ITEREATE BUY Entry – 612 Target – 650 Stop Loss – 593

- Adobe Inc. develops, markets, and supports computer software products and technologies. The Company’s products allow users to express and use information across all print and electronic media. Adobe offers a line of application software products, type products, and content for creating, distributing, and managing information.

- Artificial intelligence application layer explodes. The artificial intelligence application layer explodes. Artificial intelligence stands at the forefront of the upcoming technological revolution, with distinct leaders emerging in various application domains. Microsoft dominates the office software realm, while Adobe leads in drawing and editing applications. The current surge of start-ups focused on short video and drawing artificial intelligence indicates a rapid evolution in this sector, suggesting it could be the first to achieve mature applications of AI.

- Abandoned the acquisition of Figma. In December of 2023, Adobe decided to halt its $20bn acquisition of Figma due to regulatory pressures from the EU and British authorities. This announcement was well-received by the market. While technological revolutions often spark waves of mergers and acquisitions among related startups, the subsequent return to market rationality often reveals overvaluations in many target companies. Therefore, the termination of Adobe’s acquisition of Figma may ultimately be beneficial for the company, allowing it to judiciously allocate cash toward acquisitions or stock buybacks.

- 4Q23 results. Revenue increased to US$5.05bn, an increase of 11.5% YoY, exceeding expectations by US$30mn. Non-GAAP earnings per share were $4.27, beating expectations by $0.13. Revenue in the first quarter of FY24 is expected to be US$5.1bn to US$5.15bn, compared with market expectations of US$5.15bn. Non-GAAP earnings per share were between $4.35 and $4.40, compared with consensus expectations of $4.27.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take profit on Cameco Corp (CCJ US) at US$47 and Singapore Airlines (SIA SP) at S$6.80. Add Food Empire Holdings Ltd (FEH SP) at S$1.35. Cut loss on Airbnb Inc (ABNB US) at US$142.