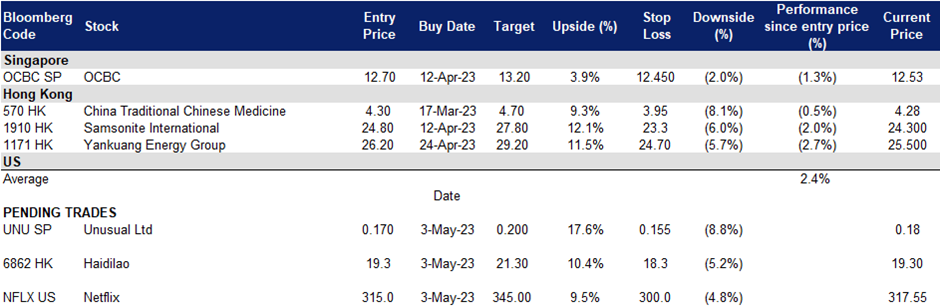

03 May 2023:Unusual Ltd (UNU SP), Haidilao International Holding Ltd. (6862 HK), Netflix, Inc. (NFLX US)

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

Unusual Ltd (UNU SP): More concerts to come

- BUY Entry 0.170 – Target – 0.200 Stop Loss – 0.155

- UnUsUaL Limited operates as a production and promotion service provider for events and concerts. The Company provides services in staging, Sound Light and Visual for an event and a concert, and organises and promotes concerts.

- Jacky Cheung shows sold out. Jacky Cheung will be performing in Singapore for a total of nine nights at the Singapore Indoor Stadium in a single concert tour. This is after the sale of tickets for the scheduled six nights were snapped up within hours and three more shows were added to go on sale on May 3 (Wednesday) at 12pm.

- Live events are back. As Covid-19 regulations are lifted worldwide and travel resumes, artists are increasingly scheduling concert tours this year. With restrictions easing, concert organisers can now hold shows at larger venues, accommodating more people. Additionally, demand for live events held in Asia has grown significantly and is expected to continue an upward trend.

- Events lined up. Unusual had a successful year-end in 2022, organising and selling out multiple concerts featuring renowned artists such as JJ Lin, Air Supply, and Westlife. In 2023, Unusual has already lined up several performances by big names like Jacky Cheung and Eric Chou, as well as other popular artists such as Grasshopper, Wakin Chau, and Aaron Kwok. Additionally, more events are expected to be organised in the second half of the year.

- 1H23 results review. Group revenue increased by approximately 1475%, from S$0.4mn in 1H22 to S$6.3 million in 1H23. Gross profit rose 580% to S$2.4mn from S$0.5mn in 1H22. The Group generated a net profit of S$1.0mn in 1H23 compared to a net loss of S$1.6mn in the same period the year before.

(Source: Bloomberg)

Oversea-Chinese Banking Corp Ltd (OCBC SP): Benefiting from weakening USD

- RE-ITEREATE BUY Entry 12.70 – Target – 13.20 Stop Loss – 12.45

- Oversea-Chinese Banking Corporation Limited offers a comprehensive range of financial services. The Company’s services include deposit-taking, corporate, enterprise and personal lending, international trade financing, investment banking, private banking, treasury, stockbroking, insurance, credit cards, cash management, asset management and other financial and related services.

- Stepping into a new dimension. OCBC is the first Singaporean bank to introduce a virtual banking experience for customers in the metaverse. Customers can access OCBC’s virtual branch in the blockchain-based decentraland platform, where they can open virtual savings accounts and interact with other customers in a virtual world. The virtual banking experience is part of OCBC’s efforts to reach out to the younger generation of customers and explore new channels for customer engagement.

- Benefit from rate cut expectations. Even though it is uncertain when rates will start to decline, Singapore banks will continue to thrive in this volatile environment as our local banking system is heavily regulated and conditioned under various stresses by the Monetary Authority of Singapore (MAS). MAS has also expressed its readiness to provide liquidity to maintain financial stability and orderly market functions. The overall market believes that the Feds will also attempt to decrease systemic risk in the financial sector by reducing interest-rate hikes and start to cut rates by 3Q23, with interest rates expected to peak at 4.75% to 5.00%. The expected decrease in interest rates could result in borrowers refinancing their loans, which were granted at higher rates.

- Growing wealth segment. Singapore is seeing an influx of wealthy individuals and family offices, which has led to a rise in assets under management at the country’s banks. The Monetary Authority of Singapore estimated there were about 700 family offices in 2021, but the current estimate is around 1,400, with mainland Chinese being the biggest drivers of growth. Although the family offices generate jobs indirectly through external finance, tax, and legal professionals, little of the money is being invested in funds or private equity firms. Despite this, the influx of wealth will still benefit banks in Singapore, particularly with the tax exemption programs for family offices, which have led to higher assets under management at banks in the country. Furthermore, with fear brewing due to the deteriorating US-China ties, the ultra-rich in Taiwan are considering setting up family offices in Singapore to protect their wealth. BDO Tax Advisory has reported an increase in inquiries from the ultra-rich in Taiwan. OCBC’s wealth management income contributed 33% to the Group’s total income in FY22. The group wealth management AUM was higher at S$258bn compared to S$257bn in FY21, driven by continued growth in net new money inflows which offset negative market valuation. As Singapore continues to attract a growing number of wealthy individuals, the country’s banks are expected to receive a boost in assets and deposits.

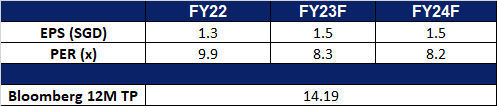

- FY22 results review. Group net profit for FY22 increased 18% to S$5.75bn, from S$4.86bn a year ago. Net interest income grew 31% to a record S$7.69bn from S$5.86bn in FY21.

- Market consensus.

(Source: Bloomberg)

Haidilao International Holding Ltd. (6862 HK): China’s huge appetite

- BUY Entry – 19.3 Target – 21.3 Stop Loss – 18.3

- Haidilao International Holding Ltd is a China-based company principally engaged in the restaurant operation business. The Company is mainly engaged in the operation of hotpot chain restaurants under the brand of Haidilao. The Company is also involved in the takeaway business, as well as the sales of condiments and ingredients. The Company operates its businesses mainly in the domestic market.

- Re-opening of China Food and Drinks Fair. China Food and Drinks Fair (CFDF) has re-opened, providing a much needed boost to the F&B industry after challenging years due to the Covid-19 pandemic. The 320,000 square metres of exhibition space is expects to see over 6,500 exhibitors from over 40 countries and regions over 300,000 customers and merchants are expected to participate in the event.

- Labour Day holiday consumption frenzy. Consumer spending surged noticeably during China’s five-day Labor Day Holiday that started on April 29. China saw record passenger flow over the period, as consumers embarked on “revenge spending” following the easing of Covid-19 restrictions. The 1st day of the Labour Day holiday saw a huge volume of travellers, with almost 57 million passenger trips nationwide. This resumption of traffic is bound to drive growth for Haidilao, which has over 1,300 stores across China, as well as over 114 stores overseas.

- Better domestic consumption in 1Q23. According to the National Bureau of Statistics, China’s domestic consumption kept warming up, with the retail sales of consumer goods increasing by 5.8% YoY. in the first three months, totaling around 11.49 trillion yuan. In March alone, retail sales jumped 10.6% YoY.

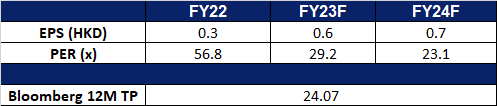

- FY22 earnings. Revenue from continuing operations was RMB31,038.6mn, representing a decrease of 20.6% YoY, and profit for the year from continuing operations was RMB1,637.3mn, as compared to a loss of RMB3,247.8mn in FY21. FY22 EPS was HK$ 0.28.

- Market Consensus

(Source: Bloomberg)

Yankuang Energy Group Co Ltd (1171 HK): Increase in factory activities

- RE-ITERATE BUY Entry – 26.2 Target – 29.2 Stop Loss – 24.7

- Yankuang Energy Group Co Ltd is a China-based international comprehensive energy company engaged in coal and coal chemical industry. The Company operates in five segments. The Coal Mining segment is engaged in underground and open-cut mining, preparation and sale of coal and potash mineral exploration. The Smart Logistics segment provides railway transportation services. The Electricity and Heating Supply segment provides electricity and related heat supply services. The Equipment Manufacturing segment is engaged in the manufacture of comprehensive coal mining and excavating equipment. The Chemical Products segment is engaged in the production and sale of chemical products. The coal products mainly include thermal coal, pulverized coal injection (PCI), and coking coal. The coal chemical products mainly include methanol, ethylene glycol, acetic acid, ethyl acetate and crude liquid wax, among others. The Company distributes products in the domestic market and to overseas markets.

- High demand for Coal in China. China’s coal imports have almost doubled in the first quarter of this year as its manufacturing sector got back into full swing following th pandemic. China’s consumption of coal is expected to pick up following the reopening of its economy from strict zero-COVID measures, supporting its activities such as railway maintenance, as well as to cater to the Electric Vehicle boom within China.

- Smart Mining Technologies to boost Coal production. China has called on coal-producing regions and enterprises to accelerate adoption of so-called ‘smart-mining’ technologies, replacingt human labour with unmanned mining vehicles controlled remotely from above-ground data centres. China has installed the technology at more than 1,000 working coal faces as part of this initiative, representing more than 620 million tonnes of annual coal production capacity.

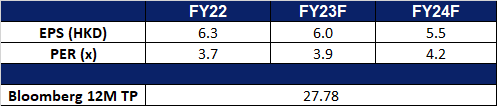

- FY22 estimated earnings. The company expects to realise a net profit attributable to the shareholders of about RMB30,800 mn, an increase of about RMB14,500 mn or approximately 89% YoY, from RMB16,259 mn in FY21.

- Market Consensus

(Source: Bloomberg)

Netflix, Inc. (NFLX US): Ignore noises

- BUY Entry – 315 Target – 345 Stop Loss –300

- Netflix, Inc. provides entertainment services. It offers TV series, documentaries, feature films, and mobile games across various genres and languages. The company provides members the ability to receive streaming content through a host of internet-connected devices, including TVs, digital video players, television set-top boxes, and mobile devices.

- Hollywood writer strike is a dip-buying opportunity. Hollywood writers voted to strike after six weeks of negotiating with major entertainment and filming companies including Netflix. This is a strike since 2007, and it cost billions of dollars in lost output and a quarter of prime-time programming for the network TV season back then. However, this is a buying opportunity as Netflix’s productions are more diversified. In recent years, Korean films and dramas which increasingly gains attraction, and previously the company was set to invest US$2.5bn in Korean content over the next 4 years. The strike has a limited impact on those productions. Besides, the main crowd of the strike is scriptwriters but actors, hence, productions are expected to continue even when the strike is on.

- 1Q23 earnings review. 1Q23 revenue grew by 3.7% YoY to US$8.16bn, missing estimates by US$20mn. 1Q23 GAAP EPS was US$2.88, beating estimates by US$0.01. Average paid memberships grew by 4% YoY to 1.75mn.

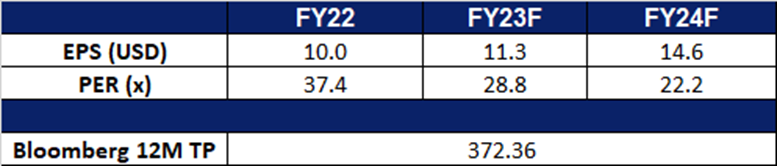

- Market consensus.

(Source: Bloomberg)

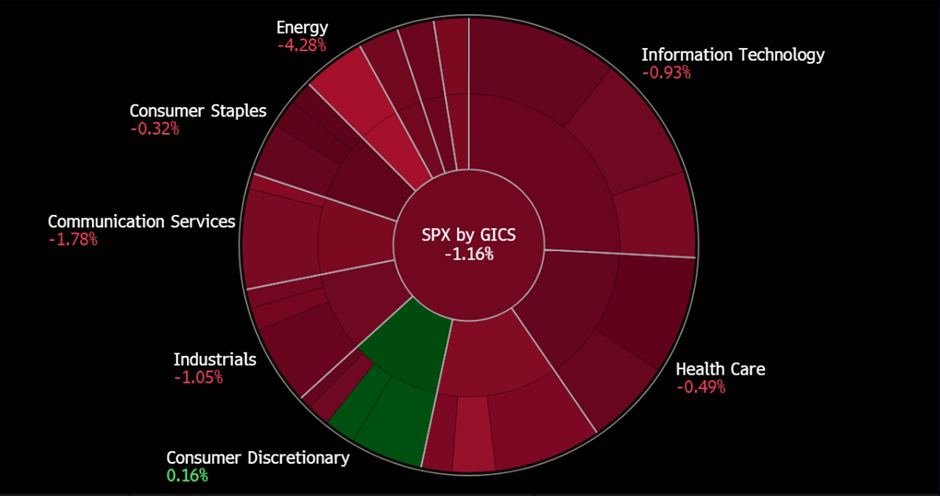

United States

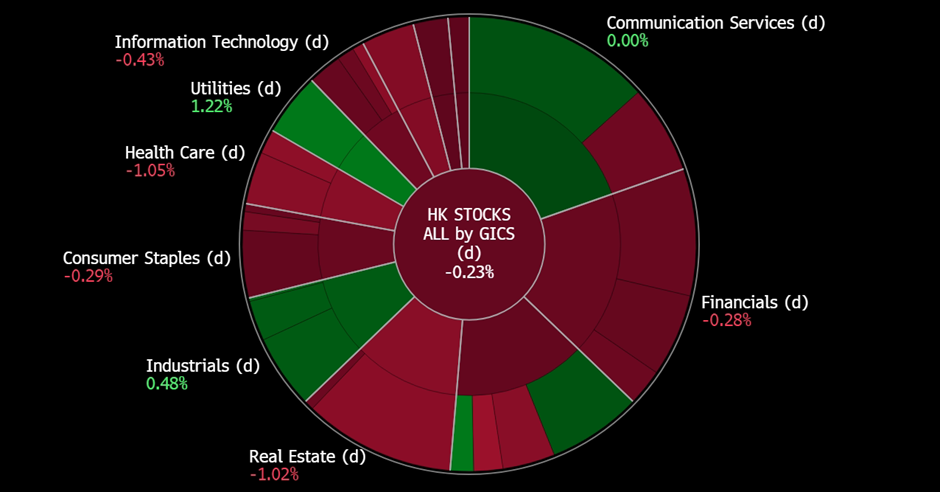

Hong Kong

Trading Dashboard Update: Take profit on Seatrium (STM SP) at SS$0.13 and Uber Technologies (UBER US) at US$34.80.