In the Spotlight: Play the potential correction in the S&P 500 Index Futures

15 April 2021

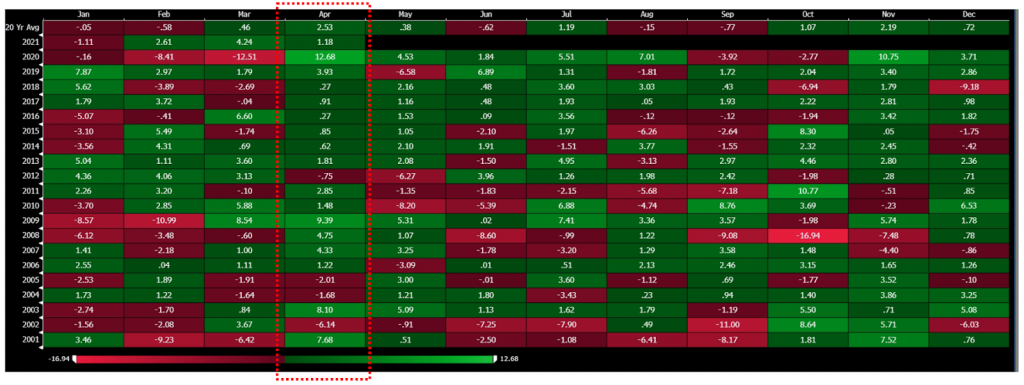

While April has historically been the best month over the past 20 years, the next 1-2 weeks present a shorting opportunity.

The recent market performance has been quite divided since the US$2.25tn infrastructural and tax hike plan was announced at the end of March. The S&P 500 index increased by 3.82% MTD and hit a new high of 4,151. However, the increase was mainly driven by the mega market cap technology stocks, namely Facebook, Apple, Amazon, Microsoft, and Google (FAAMG) with respective MTD returns of 2.81%, 8.09%, 7.72%, 8.41%, and 9%. Tesla, the 7th largest weight in the index, delivered the best MTD return of 9.63%. After more than a month of sector rotation towards the value sector, fund flows are back to Big Tech as they are less impacted by the upcoming corporate tax hike.

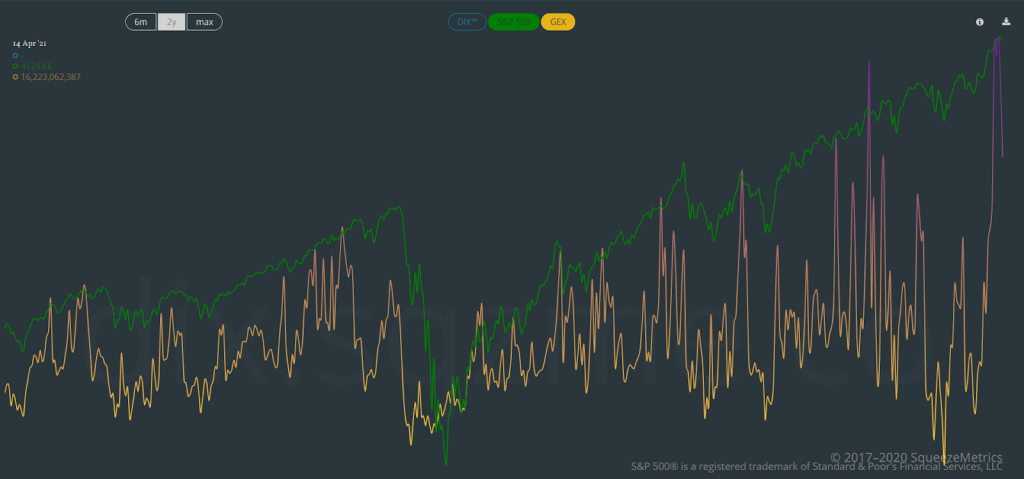

However, it is worth noting that the 12 consecutive days of closing green was along with declining trading volumes. Gamma exposure (GEX), which measures the sensitivity of existing option contracts to changes in the underlying price, climbed to another new high. We believe that the recent uptick of the index could be driven by options-related activity, and hence, market makers are largely backing the recent uptrend move of the index. Technically, when GEX tops out, S&P 500 corrects within 1 to 2 weeks. Moreover, the RSI shows the S&P 500 index has reached the overbought levels at the moment. Therefore, investors should bear in mind that a short-term correction could come soon.

S&P 500 Index

S&P 500 Index Monthly Returns – 2001-2020

S&P 500 Index and GEX comparison

One thought on “In the Spotlight: Play the potential correction in the S&P 500 Index Futures”

Comments are closed.