KGI DAILY TRADING IDEAS – 14 April 2021

Play the potential correction in the S&P 500 Index

While April has historically been the best month over the past 20 years, the next 1-2 weeks present a shorting opportunity.

The recent market performance has been quite divided since the US$2.25tn infrastructural and tax hike plan was announced at the end of March.

The S&P 500 index increased by 3.85% MTD to a new high of 4,128.

S&P 500 Index

IPO WATCH

TRIP.COM (TCOM US / 9961 HK): IPO pricing at HK$268

- The dual listing in Hong Kong is priced at HK$268, 19.52% discount to the initial price of HK$333.

- The public tranche subscription rate is 16x.

- Shares will start trading on Monday, 19 April.

Coinbase (COIN US): The largest American cryptocurrency exchange is about to get bigger

- COIN is one of the top 3 cryptocurrency exchanges in the world, boasting 56 million verified users and over US$200 billion of crypto assets (>10% of the entire crypto market cap).

- As the first major cryptocurrency exchange to be listed on the US markets, COIN has received major investor attention, especially after February’s cryptocurrency rout where Bitcoin surpassed the US$50,000 mark.

- COIN’s catalysts include further positive price action in major cryptocurrencies, which will lead to rising interest in the asset class. Specifically, rising institutional interest in the crypto asset class can drive up COIN, as it is the largest of few regulated cryptocurrency exchanges in the US.

- COIN has set a reference price of US$250/share for its direct listing, with a diluted market valuation of around US$65.3 billion. However, COIN’s stock futures on the FTX exchange are now north of US$600/share, as Bitcoin prices flirt with the US$60,000 mark on Tuesday.

- COIN is expected to start trading on Wednesday, 14 April.

Grab (AGC US): The next South-east Asian giant to list in the US

- Grab runs one of the largest ride sharing and food delivery services, focusing on the ASEAN region, with a potential digital banking business in Singapore partnered with Singtel.

- Grab has now officially confirmed the reverse merger with Altimeter Growth Corp (AGC US) at a pro-forma equity value of US$39.6 billion. AGC now trades around US$15, indicating US$60bn market valuation by the market.

UNITED STATES

Lululemon Athletica Inc (LULU US): Growth at reasonable prices

- BUY Entry – 319 Target – 366 Stop Loss – 294

- LULU is a high-growth retailer of athletic clothing products, pioneering the athleisure movement with their fitness pants, shorts, top and jackets for yoga, dance, running and general fitness.

- LULU had beat street consensus estimates for 4Q20, but share price momentum remains in a downtrend as the current investing environment continues to favour value plays. With the recent rotation back into high growth stocks, LULU has broke above its 60 and 200 EMA.

- We identify a trading range of US$300 – 370 in the near term and recommend a long position near the 200 EMA.

Zoom (ZM US): Stick with the pandemic winner

- RE-ITERATE BUY Entry – 340.5 (BUY STOP) Target – 408 Stop Loss – 298

- ZM is the fastest growing modern enterprise video communications software, growing more than 4x in 2020 as it became a household name amidst COVID-19.

- ZM’s shares have faced selling pressure since late October as the pandemic subsides and the investment narrative focuses on its lofty valuations.

- We expect ZM to remain relevant in a post-COVID world as corporations seek to maintain reduced administrative expenses and adopt more flexible working arrangements. ZM’s latest product, Zoom Phone, is also experiencing good growth and can tap on ZM’s large existing user base.

- ZM gained 6.6% on Wednesday on news behind vaccination delays in the US, entering our buy-stop position.

SINGAPORE

SingPost (SPOST SP): Hunting for the next GLC to embark on strategic review

- BUY Entry – 0.74 Target – 0.82 Stop Loss – 0.70

- SingPost is the national postal service provider in Singapore. The company provides domestic and international postal and courier service. SingTel is the largest shareholder with a 22% stake, followed by Alibaba Group with 15%.

- Expectations aren’t very high for SingPost given its underperformance over the last few years. Consensus has 2 BUYS, 3 HOLDS, 1 SELL, and an average target price of US$0.75. Its shares have a total 5-year return of -54%, or an annualised loss of 15%.

- However, we think SingPost’s shares at current levels provide an attractive risk-reward for a short-term trade amid the ongoing corporate actions undertaken by other government-linked companies. Most recently, shares of SPH (SPH SP) have gained 65% year-to-date, and was triggered by the strategic review it announced last month. Meanwhile, shares of Sembcorp Industries (SCI SP) have surged 138% year-on-year following the demerger of Sembcorp Marine (SMM SP), its offshore & marine business.

- On a fundamental level, SingPost is making strides toward growing its eCommerce-related business, and this segment is now estimated to make up around 65% of overall group revenues. CouriersPlease, Quantium Solutions and SP eCommerce experienced robust growth as a result of increased adoption of eCommerce activities in Asia-Pacific. In particular, CouriersPlease saw solid volume growth in Australia, with revenue rising 48% YoY for the half-year.

- Underlying net profit has also stabilised at around S$100mn over the last two financial years, after dropping from FY2015 (S$154mn), FY2016 (S$116mn) and FY2017 (S$106mn).

Aztech Global (AZTECH SP): IoT achieving mass adoption

- RE-ITERATE BUY Entry – 1.26 Target – 1.45 Stop Loss – 1.16

- Aztech Global provides integrated manufacturing solutions. Its products include consumer electronics (HomePlugs, Smart Security Cameras), telecommunications (Satellite modems), healthcare, LED lighting (IoT Lighting) and other technology-related devices (Climate controlled mattresses, Tracking Devices). Its in-house R&D spans industrial design, electronics, mechanical, hardware, firmware and software design.

- Almost 60% of sales is derived from North America, 30% from Europe, and the remaining from Taiwan, Japan and South Korea. In FY2020, sales to North America and Europe surged 20% YoY. The company is expected to benefit from exposure to fast growing sectors such as IoT, Data communications and LED lighting industries, as well as the accomodative fiscal and monetary stimulus in its key markets.

- FY2020 profits rose 18% YoY to S$55.7mn, implying an 18x historical P/E and a premium to peers, but this will likely improve as earnings continue to grow this year amid the strong order intake. Going into 2021, earnings are likely to be driven by technology-related products for the healthcare industry which management has highlighted is increasingly embracing the use of IoT and data-communication devices.

- Orderbook shows a robust year ahead. As at 2 January 2021, the company’s orderbook was S$271mn and since then until 21 March 2021, it received additional orders worth S$228mn. Our trading TP of S$1.45 implies a 20x historical P/E and 17x forward P/E assuming a conservative 20% YoY EPS growth in FY2021. Other major OEM and ODM players are forecasted to grow EPS by 20-50% YoY in FY2021.

HONG KONG

Ganfeng Lithium (1772 HK): Only 4 times to enter below HK$90 YTD, and the fifth one is coming soon

- Buy Entry –86 Target – 100 Stop Loss – 80

- Ganfeng Lithium Co., Ltd is a China-based company principally engaged in the research, development, production and sales of deeply processed lithium products. The company’s main products include lithium compounds, lithium metal and lithium batteries. The company’s products are mainly used in electrical vehicles, chemicals and pharmaceuticals. The company distributes its products in the domestic market and to overseas markets.

- Previously, the company announced an Investment Contract with the Management Committee of Yichun Economic and Technological Development Zone. The company plans to invest and construct an annual output of 7,000 tonnes of lithium metal and lithium material project in Yichun.

- The average lithium iron phosphate prices in 1Q21 jumped 29.7% YoY to RMB11,000/tonne. The tight supply which was insufficient to cater domestic demand will last at least till 2Q21. Hence, we expect prices to continue to climb up.

- Electric vehicle sector has been hit hard since February as investors are primarily concerned about the high valuation of EV makers. However, we still believe that only a few EV producers will survive in the future, and that the ultimate winners will be the lithium and related compounds providers. In this scenario, Ganfeng will remain the market leader moving forward.

- Updated market consensus of the estimated growth of net profit in FY21 and FY22 are 77.5% and 55.7% respectively, which translates to 55.5x and 35.7x forward PE. The current PE is 100.5x. Bloomberg consensus average 12-month target price is HK$125.98.

Jiangxi Copper Company Limited (358 HK): Short-term price stimulus came

- BUY Entry – 14.9 Target – 18 Stop Loss 13.5

- Jiangxi Copper Company Limited is a China-based company, principally engaged in the mining, smelting and processing of copper. The company is also engaged in the extraction and processing of precious metals and dissipated metals, sulfur chemical industry business, and financial and trading businesses. The company’s products include cathode copper, gold, silver, sulfuric acid, copper rods, copper foils, selenium, tellurium, rhenium, bismuth and others. The Company mainly conducts its businesses within Mainland China and Hongkong.

- Previously, the company announced its FY20 full-year results. Revenue grew by 32.6% YoY to RMB317.8bn. Net profit dropped by 8.6% YoY to RMB2.2bn.

- Operation highlights in FY20:

| Products | FY20 | FY19 | YoY growth |

| Copper cathode (mn tonnes) | 1.64 | 1.56 | 5.54% |

| Gold (tonnes) | 78.59 | 50.16 | 56.68% |

| Silver (tonnes) | 1,126.39 | 646.82 | 74.14% |

| Copper processed products (mn tonnes) | 5.12 | 4.63 | 10.60% |

| Copper contained in self-produced (thousand tonnes) | 208.6 | 209.2 | -0.29% |

| Standard sulphuric concentrate (mn tonnes) | 2.65 | 2.75 | -3.85% |

| Conversion of molybdenum concentrate (45%) (thousand tonnes) | 8.0 | 7.78 | 2.78% |

- The latest catalyst is Chile, the world largest producer of copper, which reported a big surge in new COVID cases recently. The government reintroduced lockdown restrictions across the whole of Santiago, Concepcion and other major cities. Hence, the recovery of copper supply will slow down again. In the near term, we expect copper prices to resume its upward trend.

- Market consensus of net profit growth in FY21 and FY22 are 71.2% YoY and -3.8% YoY, which implies forward PERs of 9.9x and 10.3x. Current PER is 19.1x. Bloomberg consensus average 12-month target price is HK$19.02.

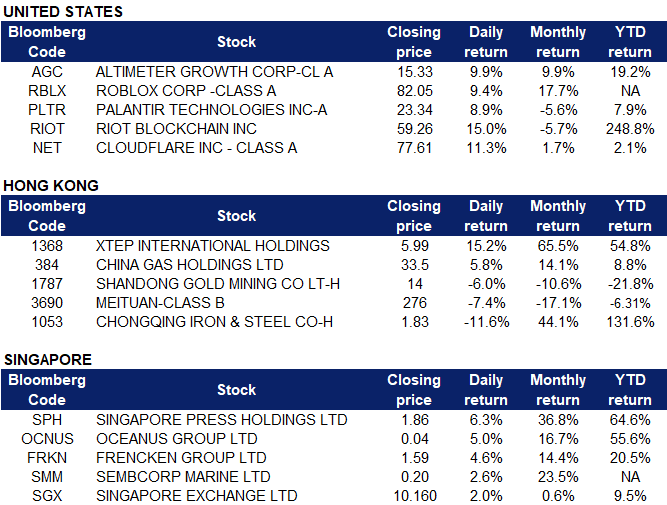

Market Movers

United States

- Altimeter Growth Corp (AGC US) whipsawed but closed at a 2-month high behind official confirmation that Grab will reverse merge with the SPAC at a US$39.6 billion valuation.

- Roblox (RBLX US) reached a new high in the market after Hasbro (HAS US) announced a partnership with the internet gaming company to introduce a range of Roblox-related toys, such as Nerf blasters and a Roblox version of Monopoly. Additionally, US House Speaker Nancy Pelosi’s husband, Paul Pelosi, disclosed the personal purchase of 10,000 RBLX shares on its first day of trading, which could have contributed to the bullish momentum of the stock.

- Palantir (PLTR US), Zoom (ZM US), Crowdstrike (CRWD US) and Docusign (DOCU US) were amongst various high-growth stocks that saw an outsized daily gain, indicating a possible return of investor interest for high-growth technology stocks.

- Riot Blockchain (RIOT US) soared as Bitcoin breaks the US$60,000 mark and achieves a new high on the market.

- Cloudflare Inc (NET US) spiked, with the majority of gains after 1pm US time as the company announced that it will work with NVIDIA (NVDA US) to bring artificial intelligence to its global edge network.

- Trading Dashboard: Include Zoom (ZM US) at US$340.50. Take profit on Citigroup at US$72.06.

Earnings Watch: Major banks report earnings through the week. JP Morgan, Wells Fargo and Goldman Sachs (Wednesday); CitiGroup, Bank of America, TSMC, Pepsi Co (Thursday); Ehang, Morgan Stanley (Friday)

Hong Kong

- Xtep International Holdings Limited (1368 HK). Sportswear sector jumped today. Even though the Xinjiang cotton disputes tapper, the uptrend momentum is intact. Compared to the other two leading peers, namely Li Ning (2331 HK, +1.68%) and Anta Sports Products (2020 HK, +1.27%), Xtep’s valuation is much lower.

- China Gas Holdings Limited (384 HK). The company and CNOOC Gas and Power Group entered into a cooperation framework agreement to enhance the cooperation in hydrogen and integrated energy.

- Shandong Gold Mining (1787 HK). The company announced a profit warning for 1Q21. Net loss attributable to the shareholders is expected to range between RMB250mn to RMB350mn. Comparatively, 1Q20 net profit attributable to the shareholders was RMB563mn.

- Meituan (3690 HK). The YTD gain was wiped out. Market sentiment on Chinese big tech companies is negative as investors are concerned that the authority will probe into the technology sector. Meituan is believed to be the next target as it had some records of violating the new anti-trust regulations.

- Chongqing Iron & Steel Company Limited (1053 HK). The plunge is due to some profit-taking movements after 5 consecutive days’ jump. The stocks touched a 52-week high of HK$2.31 in the morning session.

Singapore

- The top five non-STI stocks to receive the highest net institutional and prop trading flows in 2021 YTD were SPH (SPH SP), Sembcorp Marine (SMM SP), Thomson Medical (TMG SP), UMS (UMSH SP) and iFAST (IFAST SP). The five stocks averaged a 2021 YTD total return of 71%.

- SPH was among yesterday’s top gainers on continued interest over its strategic review. SPH currently still trades at a 20% discount to its book value.

- Oceanus (OCNUS SP) traded at an intraday high of 4.4 SG cents yesterday after that it submitted a request to exit the SGX watchlist. Oceanus has been on the SGX watchlist since 2015, and would be eligible to be removed if it records consolidated pre-tax profit for the most recently completed financial year and has an average daily market cap of S$40mn or more over the last six months. As of yesterday’s closing, it has a market cap of S$1.0bn.

- SGX (SGX SP). Total market turnover on the SGX reached S$38.75bn in March 2021, an increase of 50% from February 2021. Turnover for the Jan-Mar 2021 period rose 12% YoY to S$94.2bn. Total derivatives traded volume increased 31% month-on-month to 23.2mn contracts in March, the highest since July 2020. Quarter-on-quarter, derivatives volume was up 13% to 60.6mn contracts. Trading volumes for FX markets gained 27% month-on-month to 2.9mn contracts in March. SGX set monthly volume records for its USD/SGD, INR/USD and USD/INR (USD) futures in March, reflecting strong demand among institutional investors to risk-manage Asian currencies.

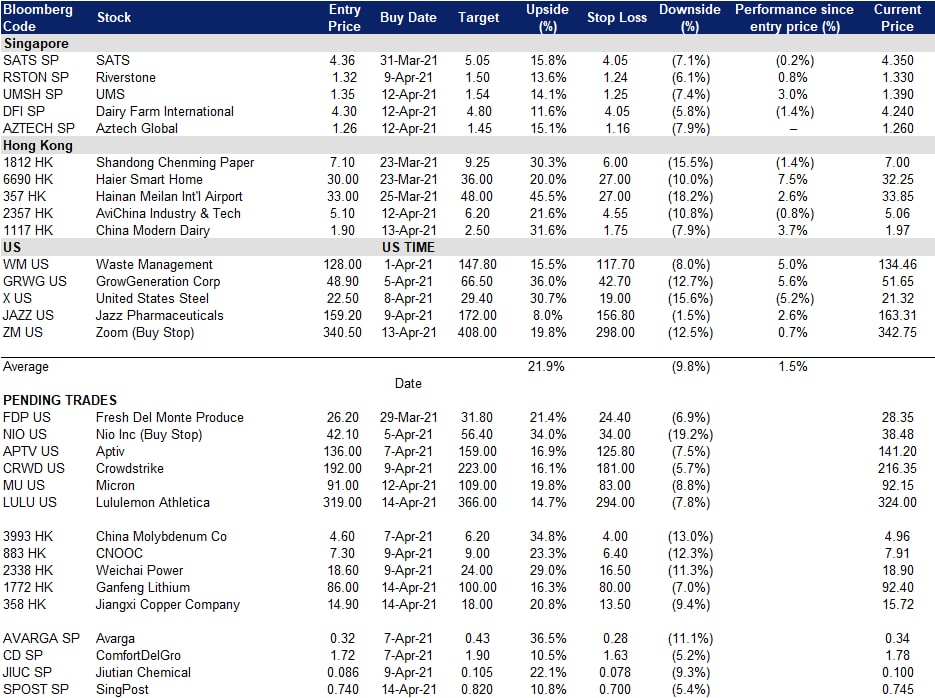

TRADING DASHBOARD