28 June 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Oil & Gas Production | +3.66% | Why Shares of Occidental Petroleum Were Up Over 2% Today Occidental Petroleum Corp (OXY US) |

| Integrated Oil | +2.65% | ExxonMobil chief predicts continuing surge in oil markets Exxon Mobil Corporation(XOM US) |

| Managed Health Care | +1.98% | Health insurance premiums poised to jump next year for 13 million people unless Congress extends expanded subsidies for marketplace coverage Oscar Health Inc(OSCR US) |

Top Sector Losers

| Sector | Loss | Related News |

| Internet Retail | -1.96% | Amazon will have two Prime shopping events this year, second one coming in Q4 Amazon.com Inc(AMZN US) |

| Apparel/Footwear | -1.86% | Nike forecasts downbeat quarterly revenue on lingering China worries Nike Inc(NKE US) |

| Packaged Software | -1.47% | Wall Street ends down, pulled lower by growth stocks Microsoft Corp(MSFT US) |

- Spirit Airlines Inc (SAVE US) shares fell nearly 8.0% amid news that advisory firm Institutional Shareholder Services told Spirit shareholders to vote for the proposed merger with Frontier Airlines. It comes after Frontier Airlines upped the cash portion of its offer by $2 a share and increased the reverse breakup fee.

- Robinhood Markets Inc (HOOD US) surged 14.0% on Monday, with trading briefly halting, after a Bloomberg News report said crypto exchange FTX was considering acquiring the trading platform. Robinhood declined to comment. Earlier in the day, Goldman Sachs upgraded the stock trading company’s shares to neutral from sell. That upgrade came despite the release of a congressional report detailing its difficulties in handling the meme-stock frenzy of January 2021.

- Coinbase Global Inc (COIN US) shares fell 10.8% after Goldman Sachs downgraded it to sell from neutral, highlighting the pressure that cryptocurrency prices are putting on Coinbase’s exchange business and saying the company needs to reduce costs to slow its cash burn.

- Digital World Acquisition Corp (DWAC US) connected to former President Donald Trump’s social media venture saw its shares sink 9.6% after it revealed in a filing that its board of directors received subpoenas from a federal grand jury. DWAC, which is already under investigation by the SEC, said the probes and subpoenas could affect its merger with Trump’s media company.

- BioNTech SE – ADR (BNTX US) shares jumped 7.2% following news that its Covid-19 booster shots with Pfizer to combat omicron, improved immune response to the variant. Pfizer shares rose about 1% on the news.

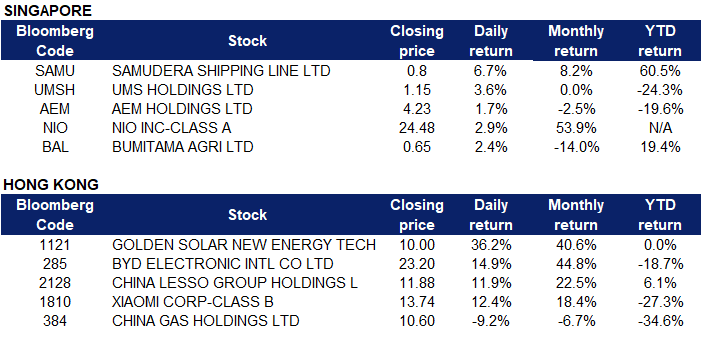

Singapore

- Samudera Shipping Line Ltd (SAMU SP) rose by 6.7% yesterday. The dislocation of global fuel markets after Russia’s invasion of Ukraine has boosted the cost of shipping products such as diesel by sea. Rates to haul fuels such as petrol and diesel have more than doubled this year to the highest since April 2020, according to Baltic Exchange data. On one key route in Asia, ship owners are now earning more than US$49,000 (S$68,000) a day transporting products from South Korea to the distribution hub of Singapore, compared with US$98 a day prior to the war.

- UMS Holdings Ltd (UMSH SP) and AEM Holdings Ltd (AEM SP) shares rose 3.6% and 1.7% respectively yesterday. Singapore’s factory output in May beat analysts’ expectations to grow at a much faster clip on the back of a surge in semiconductor production, according to data from the Singapore Economic Development Board on Friday (Jun 24). Industrial production grew 13.8 per cent year on year, up from a revised 6.4 per cent in April.

- NIO Inc (NIO SP) shares rose 2.9% yesterday. The moves come amid expectations that global EV demand is set to rise, with analysts from Nomura projecting growth of 32% a year through to 2025.Sales in China “should be underpinned by price-competitive, technologically advanced, and attractively-designed EV models,” they said in a note. U.S. and European sales are also set to get a boost from increasing consumer preferences for low-emission vehicles and mounting regulatory pressure to cut carbon emissions, the analysts said.

- Bumitama Agri Ltd (BAL SP) shares rose 2.4% yesterday. Malaysian palm oil futures were trading around the MYR 4,600-a-tonne level, near a six-month low of MYR 4,500 hit earlier in a week as supply concerns eased. Indonesia has recently announced an export acceleration scheme to ship at least 1 million tonnes of crude palm oil and derivatives.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Gamble | +5.46% | Macau legislators pass landmark casino reform bill Sands China Ltd (1928 HK) |

Precious Metal | +3.85% | Gold Price Forecast: XAU/USD sees upside above $1830 ahead of downbeat US Durable Goods Orders Zijin Mining Group Co Ltd (2899 HK) |

Airline Services | +3.58% | Beijing, Shanghai Ease More Curbs: China Lockdown Tracker Cathay Pacific Airways Ltd (293 HK) |

Top Sector Losers

Sector | Loss | Related News |

Consumer Electronics | -1.39% | N/A Smoore International Holdings Ltd (6969 HK) |

Soft Drinks | -1.15% | N/A Nayuki Holdings Ltd |

Electricity Supply | -0.35% | N/A China Resources Power Holdings Co Ltd (838 HK) |

- Golden Solar New Energy Technology Holdings (1121 HK) shares rose 36.2% yesterday. It announced plans to inject AUD104,100 into IEnergy to acquire a 51% controlling stake to expand the residential photovoltaic power station business in Australia, allowing them to successfully carry out the group’s photovoltaic business industry vertical integration plan.

- BYD Electronics Intl Co Ltd (0285 HK) shares rose 14.9% yesterday. The company will be shifting some of its remaining Android production capacity to areas such as automotive electronics, and it is expected to gradually take effect in Q2. SPDB International predicts that in 2022, the growth rate of net profit of the automotive electronics sector is expected to achieve a high growth rate of 104%.

- China Lesso Group Holdings Ltd (2128 HK) shares rose 11.9% yesterday. Their plastic piping system business revenue accounts for more than 85% of the total revenue. Haitong Securities said that major water conservancy projects are important for the steady growth of infrastructure this year, and water conservancy construction is expected to accelerate, increasing the demand for pipes.

- Xiaomi Corporation (1810 HK) shares rose 12.4% yesterday. Lei Jun, the CEO of Xiaomi, announced at the end of May that the new smartphone – Xiaomi 12 Ultra will be equipped with “Snapdragon 8+” and is expected to be released in July.

- China Gas Holdings Ltd (0384 HK) shares fell 9.2% yesterday, after it reported a 27% decline in its fiscal year net profit. Earnings were dragged by slower new gas pipeline connections due to disruptions caused by the Covid-19 restrictions in China. Although the sales volume of urban gas increased by 17.2% year-on-year to 21,919 million cubic metres, the net profit of shareholders fell by 26.9% year-on-year to HKD 7.66 billion, mainly due to the average purchase price of urban gas projects year-on-year. The increase of 22.5% was higher than the 13.9% increase in the average selling price, resulting in the average gross margin (RMB/m3) falling from 0.60 to 0.50.

Trading Dashboard Update: Cut loss on UnUsUal Ltd (UNU SP) at S$0.134. Add Tianjin Pharmaceutical Da Ren Tang (TIAN US) at S$1.10, Capitaland Investment (CLI SP) at $S$3.85, and Fuyao Glass Industry (3606 HK) at HK$40.5.