9 May 2024: Wealth Product Ideas

Consumer Staples Sector

- During the recent May meeting, the US Federal Reserve kept rates unchanged at 5.25% to 5.50% for the sixth consecutive time due to ongoing inflationary pressures and a tight labour market. These have also led investors to believe that the Fed will continue to hold rates steady in June as inflation has yet to see a slowdown back to its 2% target.

- The extended period of inflation combined with high interest rates has affected the amount of money people are willing to spend on non-essential items. As a result, this has negatively impacted the financial results of companies in the consumer discretionary sector during recent quarters. On the other hand, consumer staples have shown greater resilience due to their defensive nature. Consumers tend to prioritize spending on essential household products, including food, beverages, tobacco, and personal care items, which has helped these companies maintain their financial stability.

|

Fund Name (Ticker) |

Consumer Staples Select Sector SPDR® Fund (XLP US) |

|

Description |

The Consumer Staples Select Sector SPDR Fund seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Consumer Staples Select Sector Index. |

|

Asset Class |

Equity |

|

30-Day Average Volume (as of 7 May) |

13,759,400 |

|

Net Assets of Fund (as of 7 May) |

USD14,952.5mn |

|

12-Month Yield (as of 6 May) |

2.46% |

|

P/E Ratio (as of 6 May) |

23.44 |

|

P/B Ratio (as of 6 May) |

5.23 |

|

Management Fees (Annual) |

0.09% |

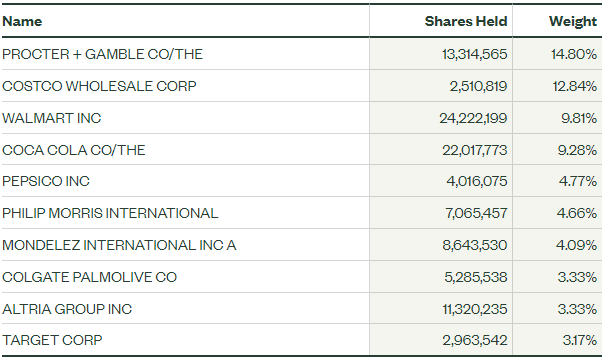

Top 10 Holdings

(as of 6 May 2024)

(Source: Bloomberg)

- Signs of stagflation. The US economy grew at an annualized rate of 1.6% in 1Q24 versus a growth rate of 3.4% in 4Q23. Consequently, the personal consumption expenditures price index showed prices ticked up to a 3.4% annualized rate in 1Q24 compared to 1.8% in 4Q23. This may potentially signify that the US economy is experiencing slower growth while prices are still rising, a sign of stagflation. This may prompt a prolonged interest rate environment, or a rate hike to prevent the onset of hyperinflation.

- Sticky inflation. In the recent May FOMC meeting, the US Fed maintained interest rates at their current level and indicated a continued inclination towards eventual reductions in borrowing costs. However, the Fed also underscored recent disappointing inflation figures, hinting at a potential slowdown in efforts to achieve greater economic equilibrium. Given the persistently high inflation, Fed Chair Jerome Powell remarked that it would likely take longer than initially anticipated for central bank officials to attain the necessary “greater confidence” to initiate interest rate cuts. Nevertheless, the Fed anticipates a gradual easing of inflation rates throughout 2024.

|

Fund Name (Ticker) |

iShares 20+ Year Treasury Bond ETF (TLT US) |

|

Description |

The iShares 20+ Year Treasury Bond ETF seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities greater than twenty years. |

|

Asset Class |

Fixed Income |

|

30-Day Average Volume (as of 7 May) |

45,070,265 |

|

Net Assets of Fund (as of 7 May) |

US$47,274,149,919 |

|

12-Month Trailing Yield (as of 6 May) |

3.89% |

|

P/E Ratio |

NA |

|

P/B Ratio |

NA |

|

Management Fees (Annual) |

0.15% |

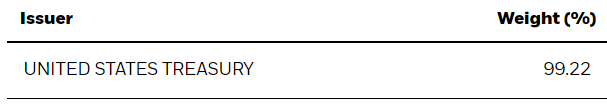

Top Holding

(as of 6 May 2024)

(Source: Bloomberg)