KGI DAILY MARKET MOVERS – 18 May 2021

IPO Watch: JD Logistics | IPO Watch: Squarespace | Market Movers | Trading Dashboard

IPO WATCH

JD Logistics (2618 HK): China’s largest integrated supply chain logistics provider; second largest HK IPO in 2021

- HK IPO application opens Monday, 17 May and closes this Friday, 21 May at 12:00PM. The company seeks to offer 609.2mn shares (public tranche: 18.3mn shares; global tranche: 591mn shares) to raise no more than US$3.4bn.

- The pricing range is between HK$39.36 and HK$43.36. The initial market cap is estimated at between HK$219.1bn and HK$241.4bn.

- JD Logistics is a subsidiary of China’s second largest e-commerce company JD.com Inc (JD US/9618 HK). JD Logistics is the leading technology-driven supply chain solutions and logistics services provider in China. It offers a full spectrum of supply chain solutions and high-quality logistics services enabled by technology, ranging from warehousing to distribution, spanning across manufacturing to end-customers, covering regular and specialized items. According to the CIC Report, JD Logistics is the largest player in China’s integrated supply chain logistics services market in terms of total revenue in 2019.

- Valuations are fairly valued when compared to peers. Assuming JD Logistics achieves 50% YoY revenue growth in FY2021, it will trade between 1.25x and 1.35x Price/Sales. Peers are trading at between 1.3x and 1.5x Price/Sales. However, given the strong demand for its IPO shares, JD Logistics could be a short-term trading play.

Squarespace (SQSP US): Another low-code player in the fray

- SQSP is a website development and hosting platform that benefits from the low-code/no-code momentum, helping non-technical users with designing websites

- The web development/hosting space is fairly competitive, with Shopify (SHOP US), Wix (WIX US) and GoDaddy (GDDY US) as publicly listed competitors. The sub-sector saw strong growth in 2020 thanks to the pandemic, with Wix growing sales 30% and Squarespace growing sales at 28%.

- Squarespace is likely to set the reference price of their direct listing at US$70, at 16.1x EV/Sales. Wix currently trades around 14.1x EV/Sales.

- We see Squarespace earning a premium over Wix as they have greater mindshare and are profitable, despite being smaller and growing slower than Wix. However, with recent bearish tech sentiment, we recommend watching for a better entry price.

Squarespace has announced 19 May, Wednesday to be its date for direct listing.

Market Movers

United States

- AT&T Inc (T US) and Discovery Inc (DISCA US) fell after the former announced plans to spin off WarnerMedia into the latter. This resizes AT&T to its core telecom business, while building a new media giant that will have more content to compete against Disney+ and Netflix.

- Coinbase Global (COIN US) fell to a new low below its US$250 reference price after announcing a convertible bond deal worth US$1.25bn, and behind general weakness in the cryptocurrency market.

- AMC Entertainment (AMC US) continued its uptrend, trading in after-hours above US$15 behind reopening momentum in the US and a return of retail trading into January’s meme stocks, as Gamestop and Express also closed with double digit daily gains.

- UEC Uranium (UEC US) saw the largest daily gain out of uranium-related stocks, which have largely positive momentum in the month of May. Most uranium stocks posted earnings surprises for 1Q21, while nuclear power demand remains strong as a form of alternative energy.

Singapore

- Medtecs International (MED SP) gained on tighter restrictions announced in Singapore and Taiwan due to rising Covid-19 cases. Medtecs’ Taiwan-listed shares (9103 TT) surged today to hit the 10% upside limit, the fifth consecutive day of hitting it (11 May to 17 May). Read our trading note which we published yesterday.

- LHN (LHN SP) Shares surged after the company reported that 1H2021 earnings rose to S$14.8mn from S$3.2mn in the prior year period. The company cited that it was able to convert its spaces into workers’ dormitories to house migrant workers last year. LHN currently trades at 5-6x FY2021-22F P/E.

- Frencken (FRKN SP) Shares rose 6% yesterday after analysts upgraded its share price following a strong 1Q2021 earnings performance. DBS maintained a BUY recommendation and raised its target price to S$1.98 from S$1.55, while Maybank maintained a BUY with a target price of S$1.73.

- Jiutian Chemical (JIUC SP) gained 6% after the company declared its first dividend since 2008. The company will be paying out a S$0.0035 interim dividend for 1Q2021. Yesterday, we also initiated on Jiutian Chemical with an Outperform recommendation and a target price of S$0.145. Read our full report here.

- ThaiBev (THBEV SP) Shares rebounded 4% today after the company announced a good set of 2Q FY2021 earnings. 2Q profit increased 20% YoY to 5.93bn baht (S$252.3mn), led by gains from the spirits and beer segment as well as cost management efforts. Consensus remains highly positive on the company; Maybank reiterates a BUY rating and S$0.99 TP (up from S$0.95 previously), UOB has a BUY rating and S$0.92 TP. In summary, there are 17 BUY / 1 HOLD / 0 SELL and an average 12-month TP of S$0.88.

- Trading Dashboard: Add Yangzijiang (YZJSGD SP) at S$1.40

Hong Kong

- Flat Glass Group Co Ltd (6865 HK) Solar sector jumped. Bank of America Securities upgraded TP to HK$33 from HK$31 and maintained its BUY rating. The stock will be included in MSCI China index effective from 27th May.

- HengTen Networks Group Ltd (136 HK) Previously, the company announced the Pumpkin Films APP recorded an increase of 6,277,017 newly registered members and an increase of 4,155,969 paying subscribers. Meanwhile, the stock will be included in MSCI China Index effective from 27th May.

- Smoore International Holdings Ltd (6969 HK) There was no company specific news. But there were rumors that the regulations of e-cigarette will be announced soon.

- Bilibili Inc (9626 HK) Previously the company announced 1Q21 results. Revenue grew by 68% YoY to RMB3.9bn. Gross profit grew by 77% YoY to RMB937.9mn. However, net loss increased by 68% YoY to RMB905mn. MAU grew by 30% YoY to 223mn. MPU grew by 53% YoY to 20.5mn.

- Linklogis Inc (9959 HK) Shares closed at the lowest level since IPO on 9th April. There was no company specific news. Investors are basically paring down their exposure to expensive growth stocks (i.e., companies with strong revenue growth but are still loss-making).

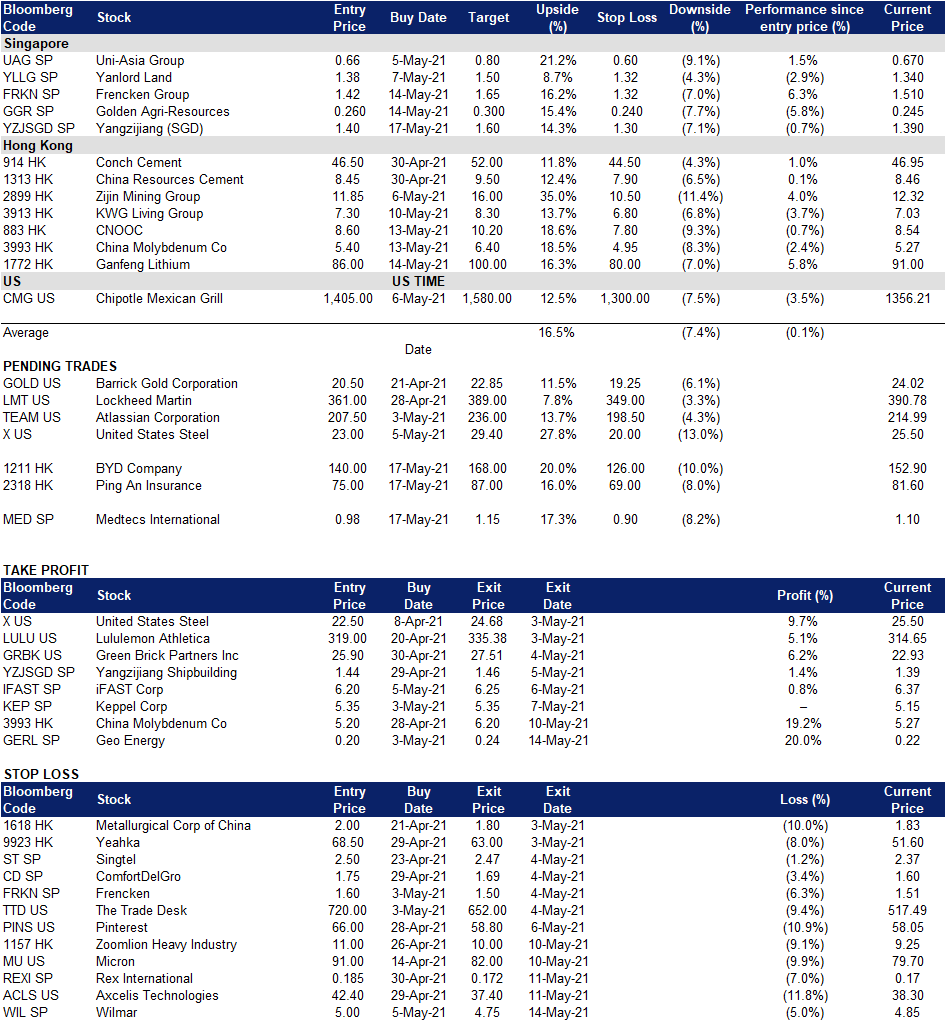

Trading Dashboard

Related Posts: