KGI DAILY TRADING IDEAS – 6 September 2021

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SINGAPORE

ISDN (ISDN SP): Accelerating the pace of industrial automation

- BUY Entry – 0.63 Target –0.85 Stop Loss – 0.56

- ISDN is a leading provider of industrial automation solutions throughout Asia. The company has more than 10,000 customers, and 74 offices spanning key Asian growth markets, and has a 35-year history of innovating alongside the growing technology needs of its customers. Today, ISDN’s solutions power advanced industrial sectors including semiconductors, Industry 4.0 manufacturing, medical devices, aerospace, and clean energy. The group generates around 68% of sales from China.

- Record revenue and profits in 1H2021. ISDN 1H2021 rose 30% YoY to S$217mn while net profit surged 51% YoY to S$19mn. This was on the back of better gross profit margins which rose 2.1% points to 26.8%.

- Growing productivity. ISDN has continued its strategic buildout by expanding its solutions portfolio to include industrial internet-of-things (IoT) connectivity, deepening advanced engineering, growing industrial systems projects, and advancing software and cloud solutions. Covid-19 and geopolitical tensions have reduced global labour mobility and increased employee health risk, leading to an acceleration in labour automation for the group’s customer base.

- Riding on semiconductor wave. ISDN is set to benefit further from its semiconductor segment, where the group’s solutions power global semiconductor capital equipment and production.

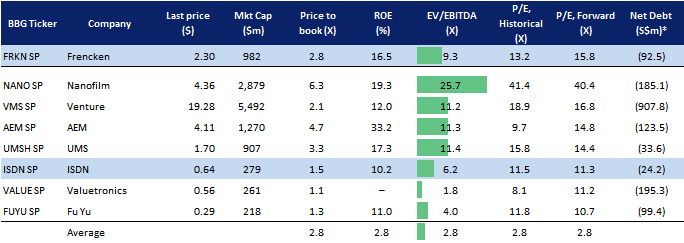

- Fundamental OUTPERFORM and TP to S$0.85. ISDN currently trades at only 6x forward EV/EBITDA, a significant discount to its international peers who are trading at around 10x EV/EBITDA.

Sunpower Group (SPWG SP): A purer play on clean energy going forward

- BUY Entry – 0.60 Target –1.22 Stop Loss – 0.52

- Sunpower invests, develops and operates centralised steam, heat and electricity generation plants. The group is strongly positioned to capitalise on the enormous market opportunities in the environmental protection sector in China and build a valuable portfolio of assets that generates attractive investment returns, as well as recurring, long-term and high-quality income and cash flows based on typically 30-year concession agreements.

- Carbon neutrality. China, Asia’s largest economy and biggest energy consumer, proposed a carbon neutrality target that aims to have CO2 emissions peak before 2030 and achieve carbon neutrality before 2060. On the one hand, China will gradually slow down dirty coal consumption and raise the clean energy supply in the energy mix over the next decade; on the other hand, it will also improve energy consumption efficiency, especially fossil fuels. In the draft 14th-Five-Year Plan, the authorities continue to promote the development of the circular economy industrial parks and centralised steam facilities. Therefore, Sunpower is set to continue benefiting from the policy tailwinds.

- We maintain our OUTPERFORM recommendation with an unchanged target price of $$1.22, based on the discounted cash flows of each project. As of June 2021, there were nine GI plants under operation, two new plants under construction and two existing plants being expanded. Most of the new capacity is expected to come onstream by end-2021, with Shanxi Xinjiang to be completed in early 2022.

- Read our full report here.

HONG KONG

Zoomlion Heavy Industry Science And Technology (1157 HK): Infrastructure plays never die

- Buy Entry – 7.6 Target – 9.2 Stop Loss – 6.8

- Zoomlion Heavy Industry Science And Technology Co., Ltd. is principally engaged in the research, development, manufacture and sales of engineering equipment, environmental sanitation equipment and agricultural equipment. The company operates through four segments. The Engineering Equipment segment includes concrete equipment, lifting equipment, earthmoving equipment, foundation construction equipment, road construction equipment and forklifts, which mainly serve the construction of infrastructure and real estate. The Environmental Industry segment is engaged in the production of sanitation equipment, as well as environmental management investment and operating business. The Agricultural Equipment segment consists of farming machinery, harvesting machinery, drying machinery and agricultural machinery, among others. The Financial segment provides financial leasing and other financial services.

- Previously, the company announced 1H21 interim results. Revenue jumped by 47.3% YoY to RMB42.5bn. Net profit attributable to the equity holders grew by 21.1% YoY to RMB4.9bn.

- The China July and August manufacturing PMI missed the expectations. Caixin manufacturing August PMI dropped below 50, implying the manufacturing sector contracted last month. Zoomlion shares jumped on the dates when these data was released. The rationale is investors expect China to resume infrastructure expansion to boost the economic growth as domestic consumptions and exports weakened.

- The market consensus of net profit growth in FY21/22/23 is 5.6%/13.5%/7.3% YoY, which implies forward PERs of 6.3x/5.6x/5.2x. The current PER is 6.5x. Bloomberg consensus average 12-month target price is HK$12.1.

KWG Living Group Holdings Ltd (3913 HK): Robust fundamentals and outlook

- BUY Entry – 6.2 Target – 7 Stop Loss – 5.8

- KWG Living Group Holdings Ltd is a holding company engaged in provision of property management services. The company operates two segments. The Residential Property Management Services segment provides pre-sale management services, property management services, community value-added services and public space value-added services. The Commercial Property Management and Operational Services segment provides pre-sale management services, commercial property management services, commercial operation services and other value-added services.

- Previously, the company announced 1H21 interim results. Revenue jumped by 83.1% YoY to RMB1.2bn. Gross profit jumped by 107.6% YoY to RMB534.4mn. Net profit jumped by 156.1% YoY to RMB318.9mn. The aggregate GFA under management and the aggregated contracted GFA amounted to approximately 165.1mn sqm and approximately 221.7mn sqm respectively, representing an increase of 617.8% YoY and 540.8% YoY respectively.

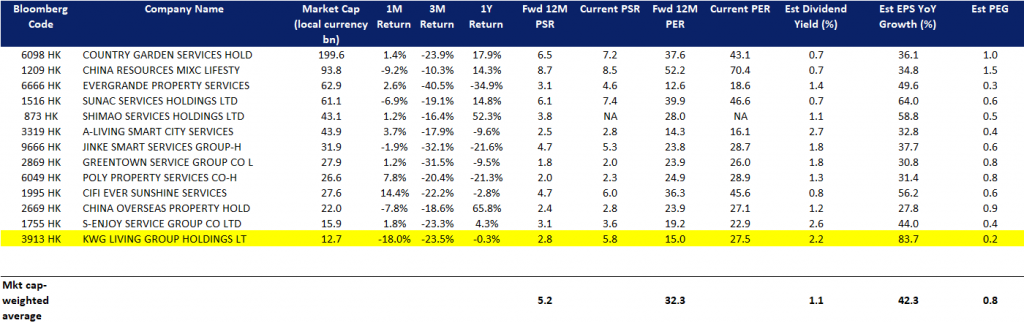

- The company has a relatively attractive valuation compared to peers in the property management sector. Its forward 12M PEG is the lowest among its peers, and the estimated dividend yield is decent compared to peers.

- The market consensus of net profit growth in FY21/22/23 is 83.7%/60.7%/42.6%, which implies forward PERs of 1.0x/9.3x/6.5x. The current PER is 27.5x. Bloomberg consensus average 12-month target price is HK$11.7.

Market Movers

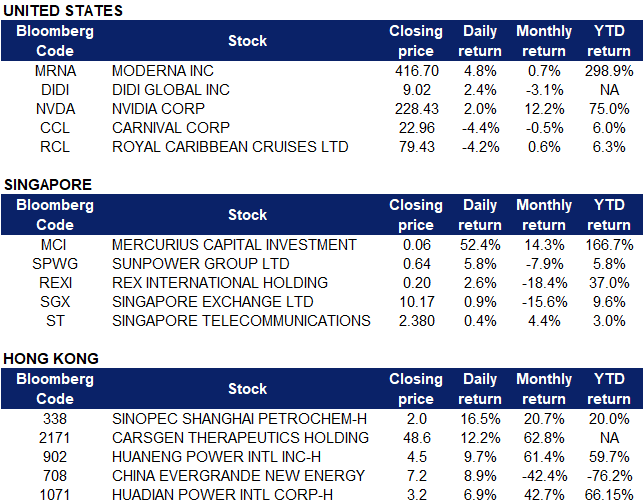

United States

- Moderna (MRNA US) shares rose 4.79% on Friday, after the company announced that it had submitted for a conditional marketing approval (CMA) with the European Medicines Agency (EMA) for the evaluation of a booster dose of the Moderna COVID-19 vaccine (mRNA-1273) at the 50 µg dose level. Chief Executive Officer Stephane Bancel said that the amended Phase 2 study “shows that a 50 µg booster dose of our COVID-19 vaccine induces robust antibody responses against the Delta variant”. Moderna’s share price is up over 280% so far this year.

- DiDi Global (DIDI US) shares rallied in the premarket, up as much as 4.3% before closing 2.38% after Bloomberg released a report saying that Beijing is considering taking a stake in the company, possibly bringing it under state control. DiDi has since denied reports of this, saying on Weibo that the company is “currently actively and fully cooperating with cybersecurity probe, foreign media reports that Beijing city government is coordinating companies to invest in it are incorrect”.

- Nvidia (NVDA US) closed 2% higher on Friday, on what looked to be a generally flat stock market after Jeffries analyst Mark Lipacis increased his target price from $233 to $260, while maintaining his buy recommendation on the company’s shares. Lipacis cited the company’s software and data-center business segments for Nvidia’s potential growth.

- Cruise Line stocks Carnival Corporate (CCL US) and Royal Caribbean (RCL US) sank on Friday, closing 4.4% and 4.2% lower respectively, as reopening stocks continue to see volatility as COVID-19 Delta variant concerns continue to plague the market. Additionally, dismal results from the August jobs report showed that only 235,000 jobs were added, less than 230,000 of the 720,000 new jobs that economists had forecast. This led to several travel companies taking losses in Friday trading.

Singapore

- Singtel (ST SP) traded as high as $2.39 on Friday after it announced that its joint venture company Telekomunikasi Selular (Telkomsel) has entered into a sale-and-purchase agreement for the sale of 4,000 telecommunication towers to Dayamitra Telekomunikasi (Mitratel) for 6.2 trillion rupiah (S$580 million). Telkomsel has also entered into a 10-year lease arrangement with Mitratel for rental of tower space, which will take effect from the transfer of the towers to Mitratel. The telco’s shares closed on Friday at $2.38, up 0.42%.

- Singapore Exchange (SGX SP) saw brisk trading on Friday, where shares were up as high as 1.2% before closing 0.89% higher at $10.17. SGX RegCo announced on Thursday that it would be the first Asian bourse to offer special purpose acquisition companies (Spac) listing on the SGX mainboard, with new rules taking effect on Friday, 3 September.

- Sunpower (SPWG SP) Shares rose 6% last Friday, likely on bargain hunting after its shares declined almost 20% following the recent 10 Sing cents dividend payout in mid-July. We maintain our Outperform rating in the stock with an unchanged TP of S$1.22.

- Mercurius Capital Investment (MCI SP) Shares surged 52% last Friday on higher-than-average trading value (S$13mn shares changing hands). This was following news that the company’s CFO had resigned for personal reasons last week. Earlier in July, the company issued 27mn new ordinary shares at S$0.055 per share in a private placement that raised a total of S$1.5mn, and was in the process of acquiring a Malaysian grocery business.

- Rex International (REXI SP) Shares of the oil producer continued to gain after its latest inroads into Malaysia’s oil and gas sector. Last week, the company announced that it was awarded two Production Sharing Contracts (PSCs) by Petroliam Nasional Berhad (PETRONAS), Malaysia’s national oil corporation. The two PSCs are related to the development and production of the Rhu-Ara and Diwangsa Clusters located in offshore Peninsular Malaysia. These previously discovered fields have a total estimated recoverables of 23.4 MMstb. The participating interests of Rex and Duta Marine Sdn Bhd (DMSB) are 95% and 5% respectively with Rex being the operator of the PSCs. We currently have an Outperform recommendation and a TP of S$0.33. Read our 18th August report here.

Hong Kong

- Sinopec Shanghai Petrochemical Co Ltd (338 HK) Shares closed at a 52-week high. There was no company-specific news. Previously, the company announced 1H21 interim results. Revenue grew by 4.13% YoY to RMB37.1bn. Net profit attributable to shareholders of the company arrived at RMB1.2bn compared to a net loss of RMB1.7bn during the same period in 2020.

- CARsgen Therapeutics Holdings Ltd (2171 HK) Shares closed at a 52-week high. There was no company-specific news. Previously, the company announced the first subject had been enrolled and dosed in the pivotal Phase II trial of CT053 in North America. CT053 is an upgraded, fully-human autologous BCMA CAR-T product candidate for the treatment of refractory and/or relapsed multiple myeloma (R/R MM). It incorporates an upgraded CAR construct we engineered that features a fully-human BCMA-specific single-chain fragment variant with lower immunogenicity and increased stability, which reduces the auto-activation of CAR-T cells in the absence of tumor associated targets.

- Huaneng Power International Inc (902 HK) and Huadian Power International Corp Ltd (1071 HK) Both shares closed at a 52-week high. The power sector jumped. JP Morgan issued a report, expecting more cities and provinces to raise electricity prices as coal prices surged. The overall EBITDA of the domestic power sector is expected to increase by 15% on average.

- China Evergrande New Energy Vehicle Group td (708 HK) Share had a technical rebound but remains depressed. Recent market news highlighted that its EV was on a road test recently. This is one of the most speculative stocks in Hong Kong as the market remains concerned over the debt issues of its parent Evergrande Group.

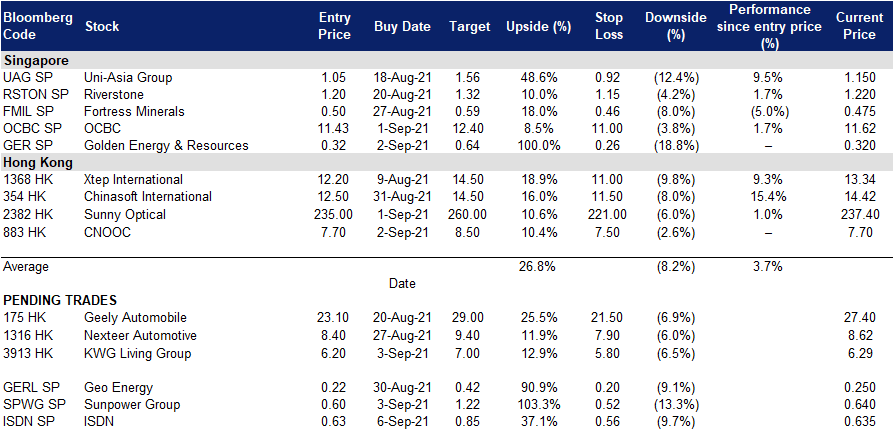

Trading Dashboard

Related Posts: