7 March 2024: Wealth Product Ideas

Fund Name (Ticker) | iShares MSCI Japan ETF (EWJ US) |

Description | The iShares MSCI Japam ETF seeks to track the investment results of an index composed of Japanese Equities. |

Asset Class | Equity |

30-Day Average Volume (as of 4 Mar) | 7,663,916 |

Net Assets of Fund (as of 5 Mar) | US$16,599,095,930 |

12-Month Yield (as of 5 Mar) | 25.12 |

P/E Ratio (as of 4 Mar) | 17.97 |

P/B Ratio (as of 4 Mar) | 1.74 |

Management Fees (Annual) | 0.50% |

- Nikkei Stock Index all-time high. The Nikkei stock index recently closed at an all-time high and above the 40,000 mark for the first time in 34 years. The index, which consists of the top 225 leading Japanese stocks, has recently gained over 1,000 points since Feb. 22 when it topped record highs marked in 1989. This is fuelled by strong domestic and foreign investment in strong corporate earnings, low-interest rates, and better expectations for the economy emerging from deflation. The Japanese stock market’s reviving fortunes also come amid a sustained rally in US shares fuelled by excitement surrounding advances in artificial intelligence.

- Central bank’s loose policy and a cheap yen. The Japanese Yen has been in constant depreciation, with the Japanese central bank keeping interest rates at rock-bottom levels while the Federal Reserve and other central banks have been on a hiking cycle, Just in 2023, the Yen has fallen about 11% against the USD, being one of the worst performers amongst major currencies. This makes other currencies or other asset classes such as equities much more attractive than the Japanese Yen.

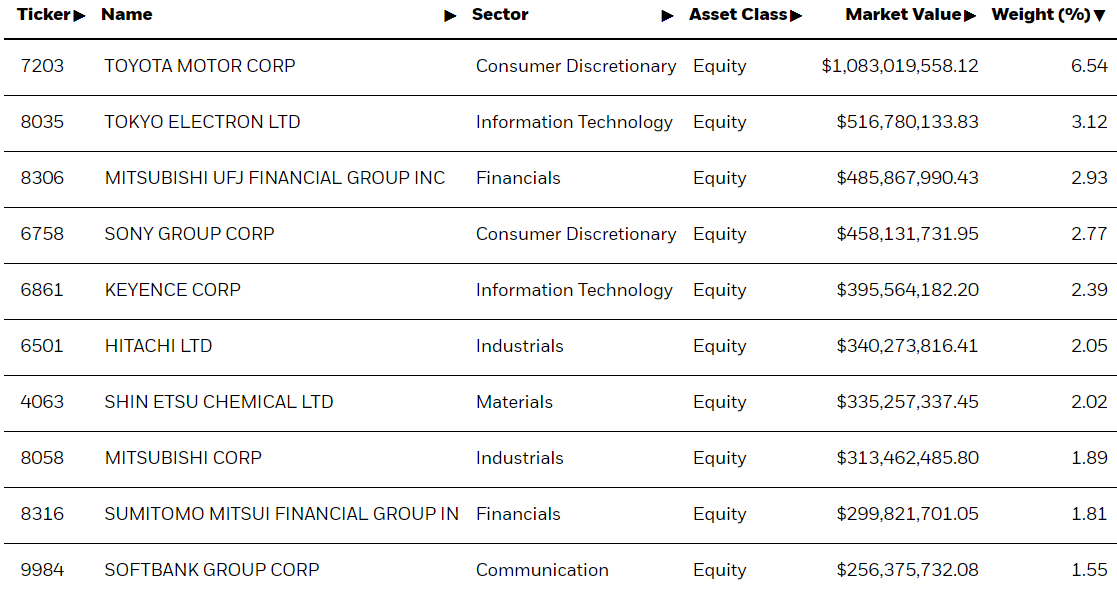

Top 10 Holdings

(as of 04 March 2024)

(Source: Bloomberg)

Fund Name (Ticker) | iShares BBB Rated Corporate Bond ETF (LQDB) |

Description | The iShares BBB Rated Corporate Bond ETF seeks to track the investment results of an index composed of BBB (or its equivalent) fixed rate U.S. dollar-denominated bonds issued by U.S. and non-U.S. corporate issuers. |

Asset Class | Fixed Income |

30-Day Average Volume (as of 4 Mar) | 1,592 |

Net Assets of Fund (as of 5 Mar) | US$34,048,766 |

12-Month Trailing Yield (as of 4 Mar) | 4.17% |

Weighted Average Maturity (as of 4 Mar) | 9.97 yrs |

Weighted Average Coupon (as of 4 Mar) | 4.02% |

Management Fees (Annual) | 0.15% |

- Upside potential in rate-decreasing periods: The Fed turns to timing of rate cuts, and bond prices are expected to benefit from it. The higher a bond’s maturity/duration, the more its value will increase as interest rates fall.

- Diversify your exposure to a basket of rated bonds from various sectors: Target a specific segment of the investment-grade corporate bond market.

- US Treasuries: Yields have rebounded in the short term but will remain lower in the medium and long term. Government bonds and investment-grade bonds can be allocated.

- Emerging bonds: Capital inflows and interest spreads have converged, investment value has improved, and allocations can be increased appropriately.

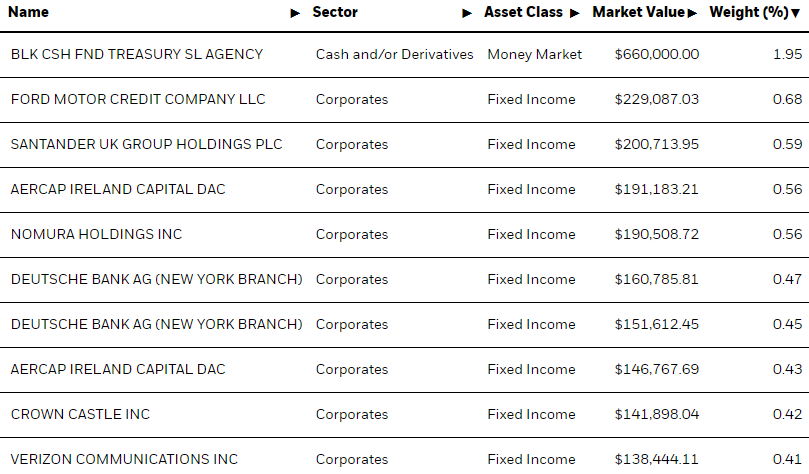

Top 10 Holdings

(as of 4 March 2024)

(Source: Bloomberg)