7 February 2023: Wealth Product Ideas

| Fund Name (Ticker) | AI Powered Equity ETF (AIEQ US) |

| Description | The AI Powered Equity ETF seeks long-term capital appreciation and targets a maximum risk-adjusted return versus the broader U.S. equity market. |

| Asset Class | Equity |

| 30-Day Average Volume (as of 4 Feb) | 38,711 |

| Net Assets of Fund (as of 4 Feb) | US$119,855,273 |

| 12-Month Trailing Yield | N.A. |

| P/E Ratio | N.A. |

| P/B Ratio | 3.641 |

| Management Fees (Annual) | 0.75% |

Top 10 Holdings

- BUY Entry –31.0 Target – 36.0 Stop Loss – 28.5

- Artificial intelligence-powered ETF that utilizes IBM Watson to equal a team of 1,000 research analysts, traders and quants working around the clock.

- AIEQ® applies AI technology to build predictive models on 6,000 U.S. companies, these models help identify approximately 30 to 200 companies with the greatest appreciation potential over the next twelve months.

- With ChatGPT’s viral success and Microsoft working to integrate the bot into its search engine, many big tech companies such as Google, Meta and Baidu, are following suit and plan to release or invest in other AI bots.

- Since AI is now garnering popularity and praise globally for its abilities, investors may decide to invest in this ETF which relies on AI capabilities to grow their invested capital.

Source: Bloomberg

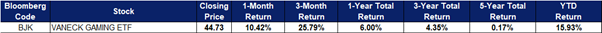

| Fund Name (Ticker) | VanEck Gaming ETF (BJK US) |

| Description | VanEck Gaming ETF (BJK®) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS® Global Gaming Index (MVBJKTR), which is intended to track the overall performance of companies involved in casinos and casino hotels, sports betting, lottery services, gaming services, gaming technology and gaming equipment. |

| Asset Class | Sector Equity |

| 30-Day Average Volume (as of 6 Feb) | 34,507 |

| Net Assets of Fund (as of 31 Jan) | US$97,370,000 |

| 12-Month Trailing Yield (as of 31 Dec) | 8.11% |

| P/E Ratio | 12.33 |

| P/B Ratio | 2.87 |

| Management Fees | 0.50% |

Top 10 Holdings

(as of 31 Jan 2023)

- BUY Entry – 44.0 Target – 48.0 Stop Loss – 42.0

- 2023 sees the recovery of the entertainment industry , with the increase in tourism level due to China’s re-opening after the COVID-19 pandemic. More wealthy China tourists are expected to travel, and this would drive growth within the entertain industry.

- Asia Pacific is seen as the fastest growing market for the entertainment industry, and would definitely benefit from China’s re-opening. Las Vegas Sands, has recently invested $6.8M in Macau and Singapore entertainment industry, showing the potential of the entertainment industry within APAC.

- The rise of technology has also reshaped the gaming and entertainment industry. The increasing prevalence of high-speed internet connection, especially in emerging economies, has made online gaming much more practical for more people in recent years. The gaming industry is booming and is expected to keep growing with a CAGR of 8.94%.

Source: Bloomberg