26 July 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Oil & Gas Production | +4.83% | Crude Oil Price Caught in Crosswinds Ahead of the Fed. Will Recession Fears Weigh on WTI? Occidental Petroleum Corp (OXY US) |

| Integrated Oil | +3.41% | Oil rises $2 as dollar eases, market wary of Fed Exxon Mobil Corp (XOM US) |

| Steel | +3.35% | NextEra Energy beats profit estimates on surging clean energy demand Nextera Energy Inc (NEE US) |

Top Sector Losers

| Sector | Loss | Related News |

| Catalogue/Specialty Distribution | -4.63% | N/A Yunji Inc (YJ US) |

| Precious Metals | -4.20% | Newmont Trades Lower Following An Earnings Miss Newmont Corp (NEM US) |

| Restaurants | -1.75% | Restaurant Stocks Fall Ahead of Major Earnings Chipotle Mexican Grill Inc (CMG US) |

- Newmont Corp (NEM US) tumbled 13.2% after the mining company reported a disappointing second-quarter profit. The company reported earnings of 46 cents per share, compared with a Refinitiv consensus forecast of 63 cents per share.

- World Wrestling Entertainment Inc (WWE US) jumped 8.4% after Loop Capital upgraded and raised its price target on them “based on a greater likelihood that the company is sold with Vince McMahon stepping down.” McMahon, WWE’s top shareholder, is being investigated for sexual misconduct claims and stepped down as CEO on Friday.

- Energy stocks surged on the back or rising oil prices Monday. Diamondback Energy Inc (FANG US) jumped 5.8%, while Marathon Oil Corp (MRO US) advanced 6.6%.

- Koninklijke Philips NV (PHG US) fell 7.2% after the company reported weaker-than-expected quarterly earnings, citing lockdowns in China and supply chain issues. It also cut its estimate for full-year sales growth to between 1% and 3%, down from 3% to 5%.

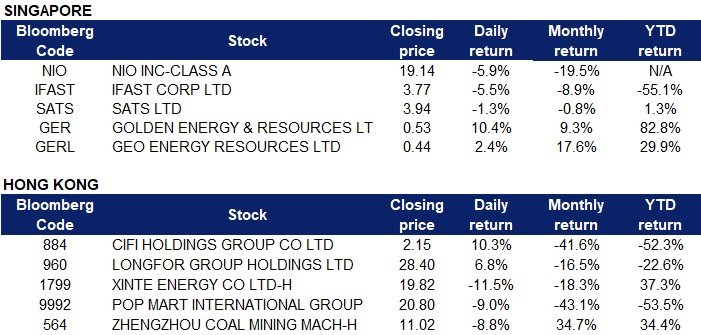

Singapore

- NIO Inc (NIO SP) shares fell 5.9% yesterday. It is facing significant problems, which could worsen in 2022. Despite profiting from a delivery bounce in June, NIO has underperformed in terms of both delivery growth and stock price performance in 2022. With increased hurdles in the electric-vehicle market such as increasing competition, suggestions to slash electric-vehicle subsidies in China by up to 30%, Covid-19 outbreaks, and supply-chain problems, NIO’s outlook for setting a new delivery record in 2022 has drastically deteriorated.The Securities and Exchange Commission recently short-listed NIO as a potential de-listing contender.

- iFAST Corp Ltd (IFAST SP) shares fell 5.5% yesterday. The Board of Directors of iFAST Corporation Ltd announced that iFAST India Holdings Pte Ltd, an associate company of the Company, has decided to exit its onshore platform service business in India and pivot to focus on providing global Fintech solutions. The Company’s 41.5 percent-owned associated company, iFAST India Holdings, is an investment holding company which owns iFAST India Investments Pte Ltd, a Singapore incorporated company, which in turn owns a majority stake of iFAST Financial India Pvt Ltd (“IFI”), an India-incorporated company engaged in the distribution of investment products including mutual funds in India. With the restructuring of the IFI business, iFAST Corp has provided a one-time estimated impairment allowance of S$ 5.2 million which is reflected in the Group’s second quarter and half year 2022 Financial Statements Announcement.

- SATS Ltd (SATS SP) shares fell 1.3% yesterday. Analysts on Monday cut their target prices on SATS after the inflight caterer’s first-quarter results missed expectations. The group attributed the net loss for the quarter to lower government grants and increased costs that were booked as the group invested in resources ahead of a full recovery by the aviation sector. Excluding government reliefs, losses for Q1 FY2023 would have stood at S$31.9 million, versus a net loss of S$35.6 million in Q1 FY2022. Teams from CGS-CIMB and DBS Group Research warned of potential near-term weakness on the counter as cost pressure continues to weigh on the mainboard-listed group.

- Golden Energy & Resources Ltd (GER SP) and Geo Energy Resources Ltd (GERL SP) shares rose 10.4% and 2.4% yesterday. Global coal-fired electricity generators are producing more power than ever before in response to booming electricity demand after the pandemic and the surging price of gas following Russia’s invasion of Ukraine. Coal-fuelled generation is on course to set an even higher record in 2022 as generators in Europe and Asia minimise the use of expensive gas following Russia’s invasion and U.S. and EU sanctions imposed in response. Coal production and generation is set to continue rising through at least 2027 as the rising demand for electricity overwhelms efficiency improvements in combustion and the deployment of gas and renewables as alternatives.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Toys | +1.07% | NA Pop Mart International Group Ltd (9992 HK) |

Property Management & Agency | +0.76% | China plans real estate fund worth up to $44 billion for distressed sector -source Greentown Service Group Co Ltd (2869 HK) |

System Applications & IT Consulting | +0.55% | China plans three-tier data strategy to avoid US delistings Chinasoft International Limited (354 HK) |

Top Sector Losers

Sector | Loss | Related News |

Gas Supply | -2.45% | China Belt & Road spending dips in H1, with no investment in Russia – research China Suntien Green Energy Corporation Limited (956 HK) |

Dairy Products | -2.24% | China Feihe Ltd (6186 HK) |

Biotechnology | -2.11% | China Says Xi, Leaders Got Local Shots in Rare Disclosure WuXi AppTec Co., Ltd (2359 HK) |

- CIFI Holdings (Group) Co Ltd (0884 HK) shares rose 10.3% yesterday. On the morning of July 25, CIFI Holdings announced that the company’s major shareholders purchased a total of 500,000 company shares in the open market to increase their shareholdings, and are confident in its future prospects. In addition to major shareholders, CIFI’s independent directors and executives are also continuing to increase their holdings of the company’s stocks and purchase bonds, conveying their confidence in the company’s development to the market with practical actions.

- Longfor Group Holdings Ltd (0960 HK) shares rose 6.8% yesterday. According to the report of China Merchants Securities on July 24, tracking the weekly sales data of sample cities, the sales volume in the third week of July improved compared to the first half of the month. On July 21, the State Council pointed out that city-specific policies should be adopted to promote the steady and healthy development of the real estate market, ensure rigid housing demand, and reasonably support improvement needs. China National Financial Securities also commented that the mortgage interest rate in Baicheng hit a new low since 2019, laying a demand and a credit foundation for the recovery of the industry.

- Xinte Energy Co Ltd (1799 HK) shares fell 11.5% yesterday. In the news, Lv Jinbiao, deputy director of the Expert Committee of the Silicon Industry recently stated that, using the end of 2021 as a reference, the retail transaction price of silicon materials will fall in the fourth quarter of this year, driving the price of longer term contract orders to decrease monthly, and with the increase in supply next year, prices will fall. Lv Jinbiao predicts that the price of long-term contract orders will drop in the second half of next year, and the price adjustment of silicon materials may be relatively large.

- Pop Mart International Group Ltd (9992 HK) shares fell 9.0% yesterday. It announced that the group’s revenue in the first half of the year may increase by about 30% year-on-year; profit will decrease by no more than 35% compared with the same period last year. The board of directors of Pop Mart believes that the fluctuations in performance are mainly due to factors such as repeated epidemics, the impact of the epidemic on passenger flow and consumer spending, and the increase in expenses compared to the same period last year due to business expansion.

- Zhengzhou Coal Mining Machinery Group Co Ltd (0564 HK) shares fell 8.8% yesterday. It recently issued an announcement that the company’s shareholders Jiao Chengyao, Xiang Jiayu, Wang Xinying, Zhang Minglin, Jia Hao, Fu Zugang, Fu Qi, Zhang Haibin, Huang Hua, and Li Weiping reduced their holdings of the company’s shares by a total of 5.5929 million shares in a centralised bidding transaction. For A shares, the price range during this reduction was 13.44-17.7 yuan per share, and the total cash withdrawn was 90.7699 million yuan.

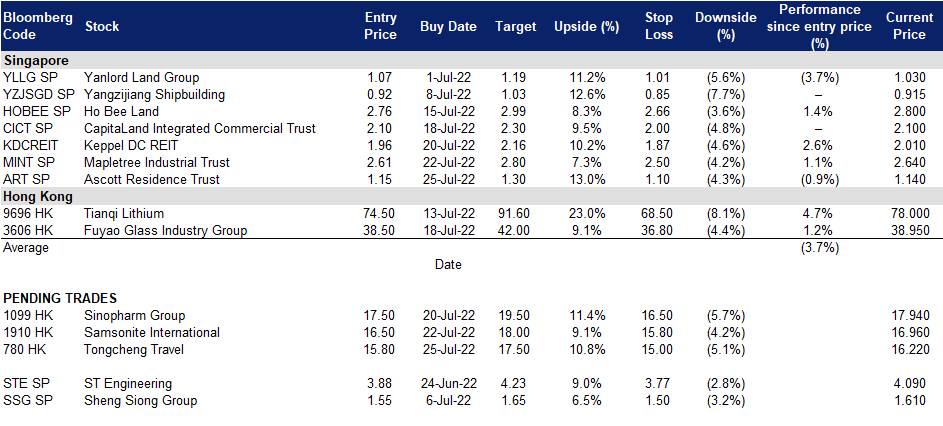

Trading Dashboard Update: Cut loss on China Resources Power (836 HK) at HK$14.7. Add Ascott Residence Trust (ART SP) at S$1.15.  ^ Back To Top

^ Back To Top