23 November 2023: Wealth Product Ideas

Trade Idea: Robust Growth in China’s Insurance Sector

- AIA reported a record-setting Q3, ending 30 September 2023, with a 35% growth in the value of new business (VONB) to US$994 million. This resulted in a robust VONB margin of 51.2%, an increase from the first half of 2023.

- The high VONB is attributed to the strength and diversity of AIA’s businesses, particularly in Mainland China, Hong Kong, ASEAN, and India. Mainland China contributed over 20% VONB growth in Q3, boosted by post-pandemic reopening and cross-border demand.

- Bloomberg suggests that AIA’s new-business value might still approach their above-consensus expectation of a 40% increase for the full year, with the mainland-visitor segment driving Hong Kong’s performance in Q4.

- The company has been authorized to upgrade its Shijiazhuang license to fully cover Hebei, indicating further expansion into China.

- Despite a general slowdown among peers, AIA’s new-business value (NBV) growth is impressive. However, Chinese life insurance companies such as Ping An, CPIC, and PICC are also expected to lead in NBV growth.

- Investors interested in the Chinese insurance sector might consider life insurers due to their expected sound recovery.

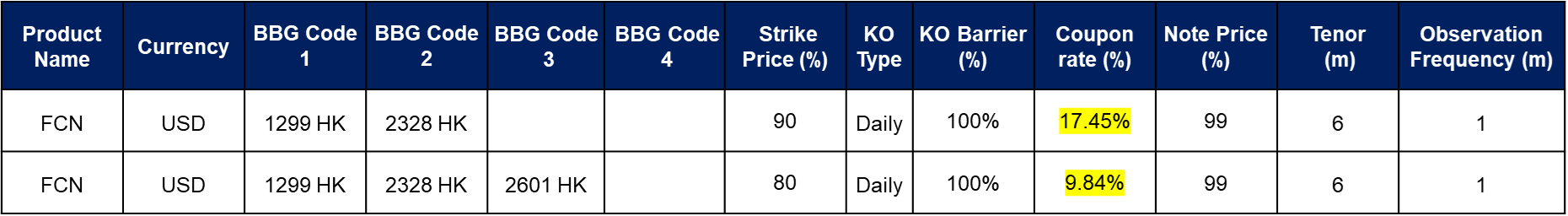

Note: Pricing provided is indicative only. For updated pricing, please contact us directly.

Payout Scenarios:

Investors receive corresponding interest payments every month and;

- KO Early Redemption: Principal + KO returns (KO event occurs only when the closing price of all underlying securities is higher than the knock-out price)

-

Maturity Redemption: If no KO event occurs, the payout will be:

- If the final price of all underlying is higher than or equal to the strike price, investors will receive 100% cash return on their principal, along with the final interest.

- If the final price of one or more underlying is lower than the strike price, investors will receive 100% of their principal in the form of shares of the worst-performing stock and will also receive the final interest.