23 February 2023: Wealth Product Ideas

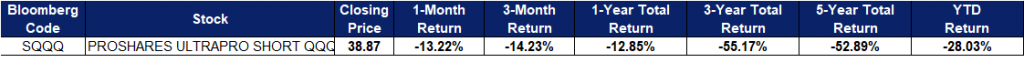

| Fund Name (Ticker) | ProShares UltraPro Short QQQ ETF (SQQQ US) |

| Description | ProShares UltraPro Short QQQ is an exchange-traded fund incorporated in the USA. The Fund seeks investment results which correspond to three times (300%) the inverse of the daily performance of the NASDAQ-100 Index. |

| Asset Class | Equity |

| 30-Day Average Volume (as of 22 Feb) | 135,745,808 |

| Net Assets of Fund (as of 31 Dec) | US$4,310,000,000 |

| 12-Month Trailing Yield (as of 21 Feb) | -9.96% |

| P/E Ratio (as of 31 Dec) | 22.30 |

| P/B Ratio (as of 31 Dec) | 5.73 |

| Management Fees (Annual) | 0.95% |

Top 10 Holdings

(as of 30 Dec 2022)

- BUY Entry –38.0 Target – 42.0 Stop Loss – 36.0

- Rate hikes expectations. Although the world is likely past peak inflation rates, the continued rising of certain prices suggests that more work is needed for inflation to hit the Federal Reserve’s 2% goal. Markets now view it as probable that the Fed Funds rate reaches 5.25% to 5.50% in 2023. The Fed is now expected to hike rates at upcoming meetings in March, May and June according to interest rate futures.

- Rising bond yields. Trader sentiment is cautious as they observe benchmark bond yields near their highs of the year on expectations recent robust economic data will encourage the Federal Reserve to keep borrowing costs higher for longer.

- Increasing Tensions and geopolitical risks. Tensions over Russia’s invasion of Ukraine, as President Joe Biden visits Poland and a Chinese delegation goes to Moscow, are adding to the anxiety. This adds on to the already high tension between US and China due to the Chinese balloon incident which took place in early Feb.

- These uncertainties in the market would lead to a near-term market correction, with SQQQ US ETF benefitting from this correction amidst harsh macroeconomic environments.

Source: Bloomberg

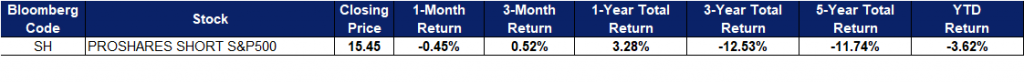

| Fund Name (Ticker) | ProShares Short S&P500 ETF (SH US) |

| Description | ProShares Short S&P500 is an exchange-traded fund incorporated in the USA. The Fund seeks daily investment results that correspond to the inverse (opposite) of the daily performance of the S&P 500 Index. |

| Asset Class | Equity |

| 30-Day Average Volume (as of 15 Feb) | 33,361,166 |

| Net Assets of Fund (as of 31 Dec) | US$3,120,000,000 |

| 12-Month Trailing Yield (as of 22 Feb) | 4.79% |

| P/E Ratio (as of 31 Dec) | 17.98 |

| P/B Ratio (as of 31 Dec) | 3.87 |

| Management Fees | 0.89% |

Top 10 Holdings

(as of 30 Dec 2022)

- BUY Entry – 15.4 Target – 16.1 Stop Loss – 15.0

- Rate hikes expectations. Although the world is likely past peak inflation rates, the continued rising of certain prices suggests that more work is needed for inflation to hit the Federal Reserve’s 2% goal. Markets now view it as probable that the Fed Funds rate reaches 5.25% to 5.50% in 2023. The Fed is now expected to hike rates at upcoming meetings in March, May and June according to interest rate futures.

- Rising bond yields. Trader sentiment is cautious as they observe benchmark bond yields near their highs of the year on expectations recent robust economic data will encourage the Federal Reserve to keep borrowing costs higher for longer.

- Increasing Tensions and geopolitical risks. Tensions over Russia’s invasion of Ukraine, as President Joe Biden visits Poland and a Chinese delegation goes to Moscow, are adding to the anxiety. This adds on to the already high tension between US and China due to the Chinese balloon incident which took place in early Feb.

- These uncertainties in the market would lead to a near-term market correction, with SH US ETF benefitting from this correction amidst harsh macroeconomic environments.

Source: Bloomberg