21 June 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

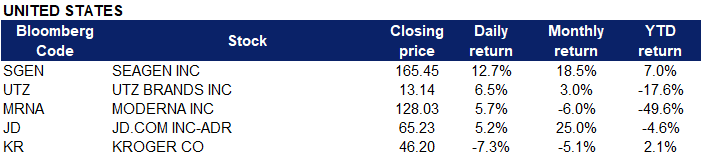

United States

Top Sector Gainers

Sector | Gain | Related News |

Biotechnology | +3.40% | US approves Pfizer, Moderna COVID-19 vaccines for children under five Moderna Inc (MRNA US) |

Other Consumer Services | +3.11% | N/A Booking Holdings Inc (BKNG US) |

Internet Retail | +2.33% | JD.com Inc (JD US) |

Top Sector Losers

Sector | Loss | Related News |

Oil & Gas Production | -6.77% | Oil prices fall after US rate hike, but tight supply still in focus ConocoPhillips (COP US) |

Integrated Oil | -4.91% | Oil prices fall after US rate hike, but tight supply still in focus Exxon Mobil Corp (XOM US) |

Oil & Gas Pipelines | -2.24% | Oil prices fall after US rate hike, but tight supply still in focus Enbridge Inc (ENB US) |

- Seagen Inc (SGEN US) shares surged 12.7% following a Wall Street Journal report that pharmaceutical company Merck is considering buying Seagen. The report, citing people familiar with the matter, said the two companies have been in discussions for a while about a potential deal.

- Utz Brands Inc (UTZ US) shares jumped 6.5% after Goldman Sachs upgraded Utz to buy from neutral. The investment firm said in a note to clients that Utz was gaining market share in a product category that should be relatively sheltered from inflation concerns.

- Moderna (MRNA US) shares jumped 5.7% after the Food and Drug Administration authorised Moderna’s and Pfizer’s Covid-19 shots for children as young as 6 months old. The move makes nearly every person in the U.S. eligible for vaccination.

- JD.com (JD US) stock rose 5.2% after CEO Xin Lijun divulged a possible expansion into food delivery in a Bloomberg interview.

- Kroger Co (KR US) shares dropped 7.3% after the grocery store chain said in its most recent quarterly report that rising inflation is spurring consumers to choose cheaper store brands.

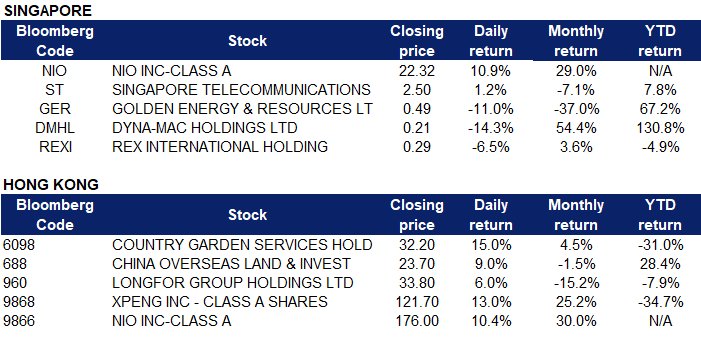

Singapore

- Nio Inc (NIO SP) shares extended their rally and rose 10.9% yesterday. The continued bullish sentiment followed after the company’s announcement of the launch of its ES7 SUV last week. Nio has had a string of progress on new vehicles recently. It began deliveries of its flagship smart luxury sedan just over a month ago. The company delivered more than 1,700 ET7s in May, out of the 7,024 total vehicle shipments. The midsize ET5 sedan is scheduled to begin shipments later this year, and the company announced a new SUV last week as well.

- Singtel (ST SP) shares rose 1.2% yesterday. Globe Board, a joint venture company (JVCo) of Singapore Telecommunications (Singtel), has approved a stock rights offer on June 20. The company’s principal shareholders, Singapore Telecom International, a wholly-owned subsidiary of Singtel, and Ayala Corporation have both indicated their support for the offer. Under the offer, the company says it expects to raise up to 32 billion pesos ($826.8 million), which will be used for the expansion of the mobile and broadband network as well as debt repayment.

- Golden Energy & Resources Ltd (GER SP) shares lost 11.0% yesterday. Newcastle coal futures, the benchmark for top consuming region Asia, were trading below the $400-per-tonne mark, a level not seen in more than a month, as surging inventories and weaker demand continued to pressure the market. Still, coal prices remained elevated, rallying to as high as $430 in late May, supported by a tightening market as Russia’s invasion of Ukraine and the unprecedented economic sanctions, including the EU’s ban on oil and coal imports from Russia, have thrown the global energy market into chaos.

- Dyna-Mac Holdings Ltd (DMHL SP) and Rex International Holding (REXI SP) shares lost 14.3% and 6.5% respectively yesterday. WTI crude futures held around $109.5 per barrel on Monday after a sharp drop in the previous session, with volatility set to continue as investors weighed concerns about slowing global economic growth and fuel demand against expectations of higher near-term consumption and ongoing supply issues. The US oil benchmark tumbled almost 7% on Friday as concerns about the economic fallout from higher interest rates rattled financial markets. Last week, the Federal Reserve led a global wave of monetary tightening by raising its benchmark rate by 75 basis points to combat surging inflation, stoking fears of a possible recession.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Airline Services | +3.53% | Air China will take control of Shandong Airlines Air China (753 HK) |

Property Management & Agency | +2.86% | Chinese Developers Rally After PBOC Holds Lending Rates Steady Ke Holdings Inc (2423 HK) |

Property Development | +2.30% | Chinese Developers Rally After PBOC Holds Lending Rates Steady China Overseas Land & Investment Ltd (688 HK) |

Top Sector Losers

Sector | Loss | Related News |

Coal | -2.57% | China’s May coal imports from Russia jump 51% from April China Shenhua Energy Co Ltd (1088 HK) |

Other Support Services | -1.85% | N/A New Oriental Education & Techlgy Grp Inc (9901 HK) |

Gamble | -0.92% | Hong Kong-Listed Casino Stocks Fall on Macau Covid-19 Outbreak Galaxy Entertainment Group Ltd (27 HK) |

- Country Garden Services Holdings Co Ltd (6098 HK), China Overseas Land & Investment Ltd (0688 HK) and Longfor Group Holdings Ltd (0960 HK) shares rose 15.0%, 9.0% and 6.0% respectively yesterday. Shares of Chinese developers rallied after the People’s Bank of China kept benchmark lending rates steady and new sales data suggested an improving outlook for the sector. The gains came after China’s central bank on Monday kept its five-year loan prime rate, which is the reference rate for mortgages, unchanged at 4.45% as expected.

- Xpeng Inc (9868 HK) shares rose 13.0% yesterday. China has launched a series of favourable policies to boost the sales of automobiles amid the country’s efforts to resume car production and stabilise supply chains. In the latest move, the country has decided to slash the purchase tax by half for passenger cars no more than 300,000 yuan (about 44,800 US dollars) with engine displacements within 2 litres purchased between June 1 and December 31 this year. The tax, which usually stands at 10% of a vehicle’s sticker price, has now been cut to 5%. Fellow EV peer, NIO Inc (9866 HK) shares rose 10.4% yesterday.

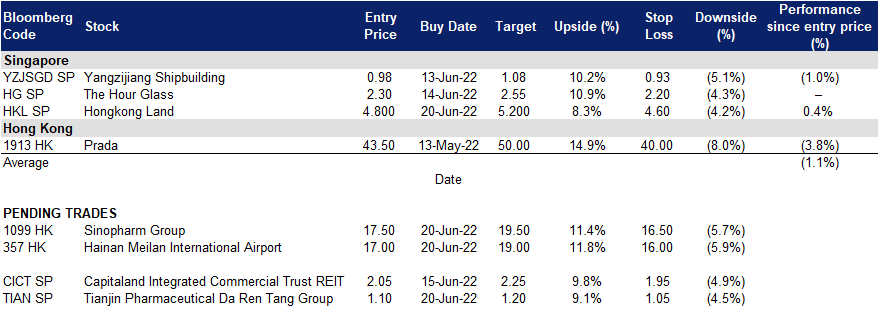

Trading Dashboard Update: Add Hongkong Land (HKL SP) at S$4.80. Take profit on Xinjiang Goldwind Science & Tech (2208 HK) at HK$13.5.