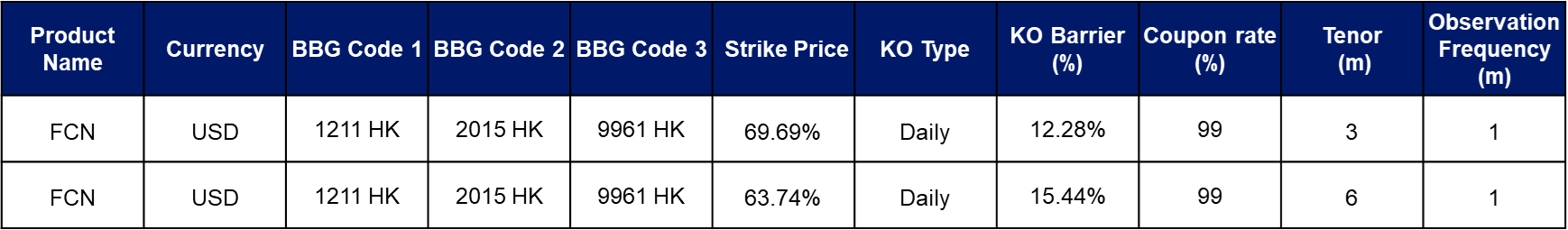

18 May 2023: Wealth Product Ideas

Chinese Stocks Investment Theme

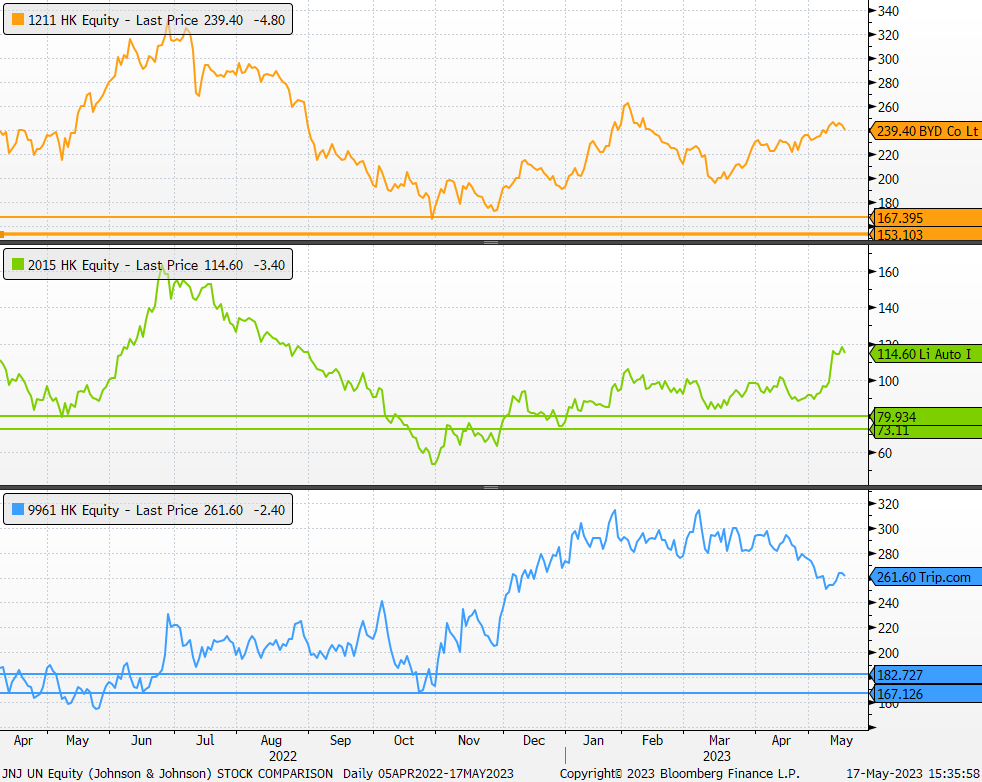

BYD:

- BYD is China’s largest electric vehicle (EV) maker and a leading automaker, positioning itself well in the rapidly growing EV market.

- BYD is narrowing the gap with Tesla in the EV market, indicating potential market share growth.

- Strong performance in the first quarter with significant increases in net profit and revenue showcases the company’s operational strength.

- BYD’s expansion plans, including increasing production capacity and entering new markets, are expected to drive further growth.

Li Auto (LI):

- Li Auto is a Chinese manufacturer of premium hybrid SUVs, catering to the growing demand for electric vehicles.

- The company has demonstrated rapid expansion and profitability, highlighting its strong market position.

- Strong earnings and revenue growth in the first quarter indicate the company’s ability to capture market share and generate sustainable profits.

- Increasing deliveries and a positive outlook for future growth indicate the company’s potential for further expansion.

Trip.com:

- Trip.com is a Chinese online travel company operating in multiple countries, making it a key player in the travel industry.

- The company is expected to benefit from China’s reopening and the increased travel demand as COVID-19 restrictions ease.

- Strong earnings growth in the first quarter exceeded expectations.

- The positive outlook for travel growth in 2023-2024 provides an opportunity for Trip.com to expand its market share.

Payout Scenarios:

- KO Early Redemption: Principal + KO returns (KO event occurs only when the closing price of all underlying securities is higher than the knock-out price)

- Maturity Redemption: Investors receive corresponding interest payments every month, and if no KO event occurs, the payout will be:

- If the final price is higher than or equal to the strike price, investors will receive 100% cash return on their principal, along with the final interest.

- If the final price is lower than the strike price, investors will receive 100% of their principal in the form of shares of the worst-performing stock and will also receive the final interest.

(Source: Bloomberg)