17 May 2022: Stocks making the biggest moves

Market Movers | Trading Dashboard

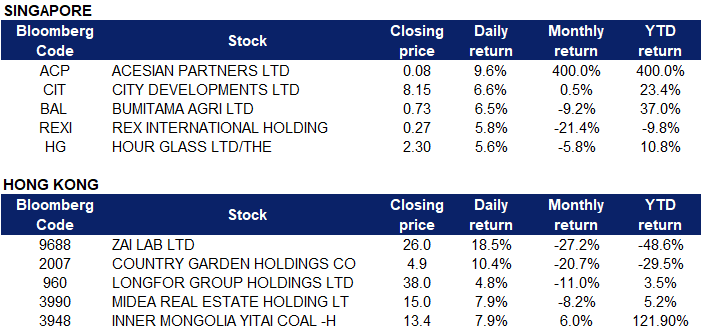

Singapore

- Acesian Partners Ltd (ACP SP) shares rose 9.59% and closed at another new 52-week high last Friday. There was no company-specific news. Previously, the company announced that the manufacturing business unit of the group has received several significant new sales orders from existing customers, for the supply of coated ducts and fittings with an aggregate value of approximately S$16.7mn from the commencement of FY22. The orders are expected to be fulfilled and delivered progressively, from FY22 until 1Q23.

- City Developments Limited (CIT SP) shares rose 6.65% last Friday. There was no company-specific news. According to The Business Times, residential property rentals hit their highest levels in April, surpassing their last peaks in 2013, with rents expected to keep rising as Singapore reopens and foreigners return to work here. Meanwhile, over the weekend of May 7 and 8, joint-venture developers City Developments Ltd and MCL Land sold 315 out of 407 units (77%) at Piccadilly Grand. The average price for the city fringe project located at Farrer Park was $2,150 psf, setting a new price benchmark for the area.

- Bumitama Agri Ltd (BAL SP) shares rose 6.48% last Friday. The company reported earnings of IDR873bn (S$87.3 million) for the 1Q22 ended March, 424% higher than earnings of IDR167bn in the corresponding period the year before. Revenue for the quarter increased by 69%YoY to IDR3.9tn. The higher figures were attributable to sales from both crude palm oil and palm kernel, which enjoyed higher average selling prices.

- Rex International Holding Ltd (REXI SP) shares rose 5.77% last Friday. There was no company-specific news. Both Brent and WTI rebounded to US$110/bbl last Friday.

- Hour Glass Ltd (HG SP) share rose 5.61% last Friday. There was no company-specific news. The price movement could be due to the share buybacks.

Hong Kong

Top Sector Gainers

|

Sector |

Gain |

Related News |

|

Agricultural, Poultry & Fishing Production |

+3.37% |

China Starch Holdings Limited (3838 HK) |

|

Gamble |

+1.57% |

Macau mulls casino tax cut as gaming revenue plummets SJM Holdings Limited (880 HK) |

|

Conglomerates |

+1.32% |

Hong Kong Becomes World’s Must-Watch Market as Easy Money Ends Fosun International Limited (656 HK) |

Top Sector Losers

|

Sector |

Loss |

Related News |

|

Software |

-1.26% |

JPMorgan Analysts Behind ‘Uninvestable’ Call Upgrade China Tech Qingdao AInnovation Tech Grp Co Ltd (2121 HK) |

|

Construction Materials |

-0.98% |

Xi’s Economic Agenda: Charting roadmap for China’s modern infrastructure system China Lesso Group Holdings Ltd (2128 HK) |

|

Restaurants & Fast Food Shops |

-0.82% |

China stimulates consumption as retail sales fell 11.1% in April Haidilao International Holding Ltd (6862 HK) |

- Zai Lab Ltd (9688 HK) shares rose 18.5% yesterday. JP Morgan released a research report saying that it gave Zai Lab-SB an “overweight” rating. However, the target price was lowered from HK$105.9 to HK$90. Based on the company’s first-quarter performance, the adjusted loss per share forecast for this year and next year was adjusted from $6.87/3.88 to a loss of $3.55/1.1. The company’s quarterly revenue more than doubled from last year, helped by Y/Y growth in sales for the following products: Zejula, Optune, Qinlock and Nuzyra. In addition, Repotrectinib, introduced by Zai Lab, was granted breakthrough therapy designation by the FDA and the company expects to have discussions with regulators on its listing application in Q4 this year.

- Country Garden Holdings Co Ltd (2007 HK), Longfor Group Holdings Ltd (960 HK) and Midea Real Estate Holding Ltd (3990 HK) shares rose 10.4%, 4.8% and 7.9% respectively yesterday. Three major private Chinese property developers who are financially healthy were asked by the authorities to issue bonds this week to help boost market sentiment, and two sources with direct knowledge of the matter said on Monday. The authorities informed Country Garden, Longfor Group and Midea Real Estate about the plan late last week, the sources said. President Xi Jinping also called for a stable and healthy real estate market at a late April Politburo meeting. Chinese authorities stepped up efforts to revive sluggish property demand by further cutting mortgage loan interest rates for first-time homebuyers on Sunday.

- Inner Mongolia Yitai Coal Company Ltd (3948 HK) shares rose 7.9% yesterday. Newcastle coal futures, the benchmark for top consuming region Asia, consolidated above the $390-per-tonne mark and more than doubled in value since 2022, supported by continued robust demand against a tightening market backdrop. Along with increasing demand for power generation with a resumption in economic activity after the coronavirus-induced slump, soaring natural gas prices in Europe and Asia in late 2021 boosted coal consumption.

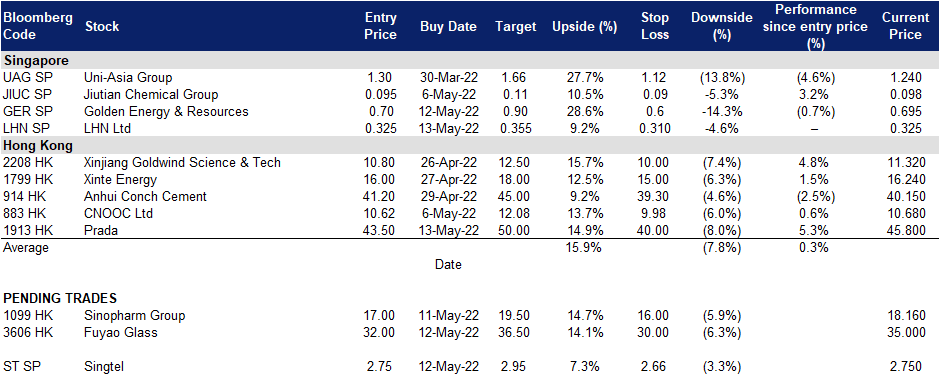

Trading Dashboard Update: Add LHN Ltd (LHN SP) at S$0.325 and Prada S.P.A. (1913 HK) at HK$43.5