17 August 2023: Wealth Product Ideas

Chinese Insurers Theme

- Enhanced compliance regulations are expected to positively impact the insurance industry. Chinese insurers are set to release their 1H23 results starting on 23rd Aug.

- Life insurers are expected to see significant growth in new business value, while property and casualty (P&C) insurers may experience some normalization in underwriting profitability. However, it’s the outlook for the second half of 2023 that will likely drive share prices.

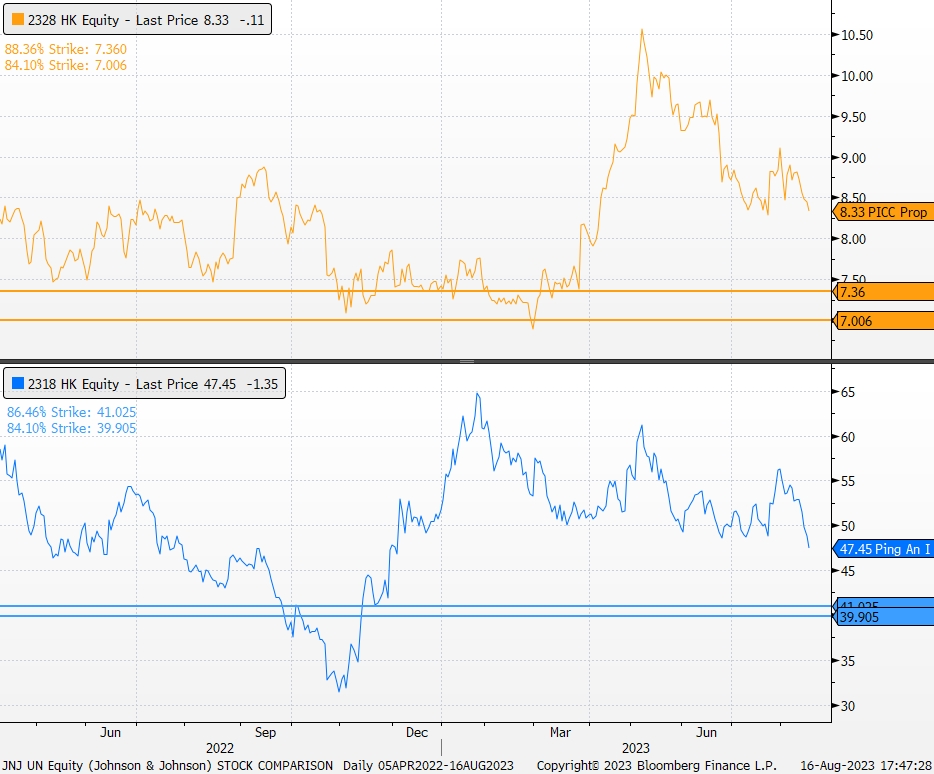

- Research suggests that P&C insurance is favored over life insurance, with PICC P&C (2328 HK) being the top pick.

- In the life insurance sector, Ping An (2318 HK) is well-positioned due to its effective interest risk management.

Note: Pricing provided is indicative only. For updated pricing, please contact us directly.

Payout Scenarios:

- KO Early Redemption: Principal + KO returns (KO event occurs only when the closing price of all underlying securities is higher than the knock-out price)

- Maturity Redemption: Investors receive corresponding interest payments every month, and if no KO event occurs, the payout will be:

- If the final price of all underlying is higher than or equal to the strike price, investors will receive 100% cash return on their principal, along with the final interest.

- If the final price of one or more underlying is lower than the strike price, investors will receive 100% of their principal in the form of shares of the worst-performing stock and will also receive the final interest.

(Source: Bloomberg)