KGI Daily Trading Ideas – 8 February 2021

IPO Watch

Bumble (BMBL US) – Initial IPO pricing at US$28-30

- BMBL is known for its namesake dating app, Bumble, which champions a “women-first” approach, in which females must make the first contact with men. BMBL also runs a second dating app called Badoo.

- Bumble is the second highest grossing dating app after Tinder from Match Group (MTCH US), according to Sensor Tower, boasting 12.3mn Monthly Active Users (MAU). BMBL has 42.1mn MAU across both apps, boasting 19% year-on-year sales growth in 2020 and 22% increase in paying users.

- BMBL founder Whitney Wolfe Herd is a co-founder of Tinder, whom left Tinder to create BMBL with the goal of reducing harassment that women have faced on dating apps.

- BMBL is looking to raise a potential US$343.9mn with its initial IPO of up to 39.7mn shares. Initial market cap is set to around US$5.5bn, at a 9.5x Price/Sales multiple. Given Match Group’s 16x+ P/S multiple, we expect Bumble to reprice their IPO range upwards, or to have a significant first-day trading pop.

IPO Performance Review

Kuaishou (1024 HK) – Fast becoming another tech giant

- The stock opened at HK$338, traded to an intraday high of HK$345, but closed at the day’s low of HK$300 (+160.87% compared to the IPO price of HK$115).

- As of the closing price, the market cap was HK$1.23tn, making it the 8th largest Chinese company and 4th largest Chinese technology company listed in Hong Kong. The current valuation is at 22.7x Price-to-FY20 annualized sales. Based on 483mn monthly active users (MAU) as of 3Q20, market cap per MAU is at HK$2552, which is equivalent to US$329, compared to Alibaba’s US$810, JD’s US$435, PDD’s US$368, and Bilibili’s US$235.

- MSCI announced that it will add the stock to its Standard All Shares Index and China All Shares Index effectively from 1st March 2021.

US Trading Ideas

Twitter (TWTR US): Still the hottest platform for quick takes in a post-Trump world

- BUY Entry – 55.5 Target – 65 Stop Loss – 51.2

- TWTR is a social media platform known for its tweets, which are short posts by users. TWTR has at least 145mn Daily Active Users.

- While investor sentiment on TWTR was fairly poor after the decision to ban previous US president Donald Trump, the share price has rallied since then to new highs, as subsequent events (Reddit short squeeze, Elon Musk’s tweets) proved that TWTR remains a key platform in spreading influence.

- TWTR will post earnings on 9th February, Tuesday with a subsequent Analyst Day event on 25th February. Given the earnings and share price performance for ad-dependent social media peers such as Pinterest (PINS US) and Snapchat (SNAP US), we believe TWTR will see similar upside.

Lam Research (LRCX US): Year of the semiconductor

- BUY Entry – 501 Target – 575 Stop Loss – 459

- LRCX is a semiconductor capital equipment company, manufacturing wafer processing equipment for the major semiconductor manufacturers such as Micron, Samsung, SK Hynix and Taiwan Semiconductor Manufacturing Company.

- LRCX and various other semiconductor companies have experienced a strong run up in 2020, bolstered by strong year-on-year revenue and earnings growth as the semiconductor industry emerges from a downcycle in 2019.

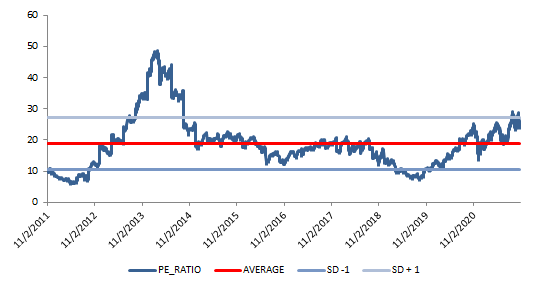

- Despite a 50% run-up since November, we expect a continued uptrend for semiconductor names. LRCX’s valuations are at the higher end, but have not reached prior over-valuations levels akin to 2013-2014 which was the prior upcycle.

HK Trading Ideas

AAC Technologies Holdings Inc (2018 HK): Do not just hear but listen

- BUY Entry – 40.8 Target – 49 Stop Loss – 38

- AAC Technologies Holdings is an investment holding company principally engaged in the manufacture and sale of miniaturized acoustic components. The company’s main products include speaker boxes, speakers, receivers and Micro Electro-Mechanical System (MEMS) microphones. The company’s products are used in smart phones, tablets, wearables and notebooks. The company also delivers integrated solutions, including haptics vibrators, Radio Frequency (RF) Mechanical and optical components. The company distributes its products in the domestic market and to overseas markets.

- The unpleasant 9M20 financial performance was due mainly to the overall slide of smartphone shipments during the COVID period. However, the smartphone market is expected to recover this year, especially Apple which delayed the launch of iPhone 12 to 4Q20. With the rollout of 5G, the smartphone market will embrace a new wave of upgrading and replacement. Hence, fundamentals will improve this year.

- The company has proposed spin-off and separate listing of its optics business, which will be held through AAC Optics on a stock exchange in the PRC. This is expected to unlock shareholders’ value and potentially boost share price upwards.

- Market consensus of the estimated growth of net profit in FY21 and FY22 are 65.6% and 21.2% respectively, which translates to 16.4x and 13.6x forward PE. The current PE is 23.6x.

Jiangxi Copper Co Ltd (358): Bronze (bounce) back soon

BUY Entry – 12.8 Target – 15.5 Stop Loss – 11.5

- Jiangxi Copper Company Limited is a China-based company, principally engaged in the mining, smelting and processing of copper. The Company is also engaged in the extraction and processing of precious metals and dissipated metals, sulfur chemical industry business, and financial and trading businesses. The company’s products include cathode copper, gold, silver, sulfuric acid, copper rods, copper foils, selenium, tellurium, rhenium, bismuth and others. The Company mainly conducts its businesses within Mainland China and Hongkong.

- The recent price correction is due mainly to the top-out of copper prices. In early January, LME copper prices reached an 8-year high of above US$8,000/mt, driven by a depreciating USD and expectations of a large US stimulus. However, it had slightly dipped recently on doubts whether the US$1.9tn stimulus will go through. We believe that the prolonged COVID pandemic and soft economic data will accelerate the process of approving the stimulus bill.

- In China, new infrastructure expansion remains one of the main themes. Electric vehicles, 5G, clean energy developments create large demand for copper. As the largest copper company in China, it will continue to benefit from rising copper volumes and prices.

- Market consensus of the estimated growth of net profit in FY21 is 69.3%%, which translates to 9.6x forward PE, compared to its current PE of 19.6x.

SG Trading Ideas

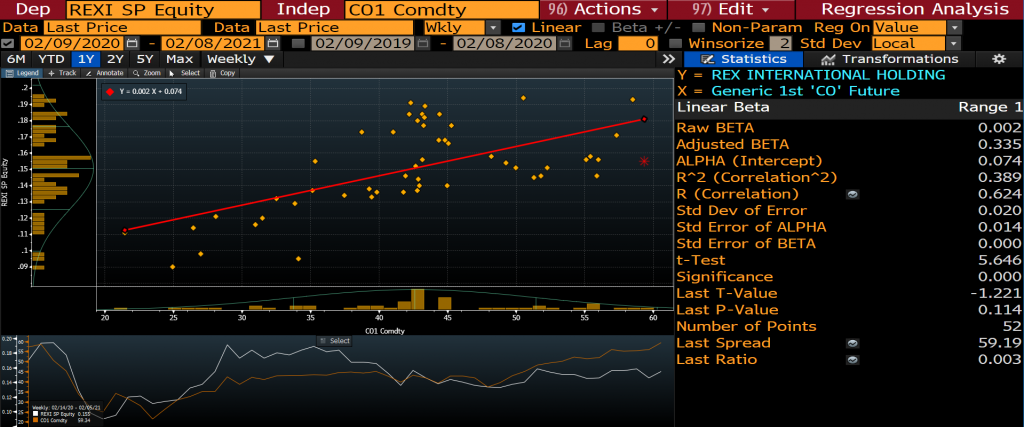

Rex International (REXI SP): Direct beneficiary of higher oil prices

- BUY Entry – 0.15 Target – 0.175 Stop Loss – 0.14

- REXI is an oil and gas exploration and production company with assets mainly in Oman and Norway. As one of Singapore’s only publicly listed oil producing company, its share price is highly correlated to the movement in oil prices.

- This is a pivotal year for REXI as the group ramps up production in Oman. Its Oman field started producing 9,000 barrels of oil last year and the company is in the process of upgrading its maximum processing capacity to handle up to 30,000 barrels per day.

- Meanwhile, industry outlook is improving as the market is now clearing the overhang in oil inventories. We believe we could possibly see Brent above US$60 per barrel by 2Q or 3Q of this year.

CIVMEC (CVL SP): Engineered for success downunder as orderbook surpasses A$1bn

- BUY Entry – 0.52 Target – 0.775 Stop Loss – 0.400

- Civmec is listed on both SGX and the Australian Stock Exchange (ASX).

- Civmec is an SGX-listed company providing engineering solutions in Australia. While CIVMEC has traditionally been seen as an engineering company, it has expanded its capabilities to build/maintain defense-related vessels (e.g., Patrol vessels, maintenance for submarines) for the Australian government.

- Civmec’s main business is still closely tied to Australia’s commodity sector, which is seeing a revival. Civmec’s orderbook stood at A$1.1bn as at end December 2020 as the group won orders. Fundamentally, we believe Civmec is a high conviction small-mid cap stock overlooked by the markets.

Market Movers – What’s Hot

Global/Macro

- On Friday, WTI crude oil prices gained 1.3% to trade at US$56.98 a barrel, while Brent prices jumped 1.1% to US$59.45 a barrel. OPEC+ stuck to their supply tightening policy at a meeting on Wednesday. Brent prices rose 6% for the week, trading close to $60 a barrel for the first time in a year.

- The price of bitcoin (BTC) rose above US$40,000 on Saturday as the leading cryptocurrency has nearly regained all its losses suffered since reaching an all-time high in early January

United States

- Microvision (MVIS US) +11.7% closing at US$11.54, and is up more than 100% year-to-date, as a follow-up Reddit stock play.

- Activision Blizzard (ATVI US) +9.6% closing at US$101.61, an all-time high for the company after posting results above consensus and guiding for a stronger 2021 and 2022.

- Digital Turbine (APPS US) +14.1% closing at US$88.08, 2 days after its earnings release, as analysts upgrade target prices, factoring in accelerating revenue and earnings growth.

- Earnings watch: TTWO Monday, CSCO TWTR ENPH TOT Tuesday.

Hong Kong

- HengTen Networks Group Ltd. (0136) +21.63%, closing at HK5.68. Livestream platform companies are attracting investors’ interests owing to Kuaishou Tech’s successful IPO. The company is backed by China Evergrand Group (3333 HK) and Tencent Holdings (700 HK).

- Cansino Biologics Inc (6185 HK) +11.36%, closing at a new high of HK$335.2. JP Morgan increased its stakes by 34,257 shares at an average price of HK$295.3. Previously, the company announced that the phase III clinical trial of its Recombinant COVID-19 Vaccine (Adenovirus Type 5 Vector) had successfully met its pre-specified primary safety and efficacy criteria at the interim analysis.

- XD Inc. (2400 HK) +10.77%, closing at a new high of HK$92.05. The entire mobile gaming sector jumped last week. Previously, Bank of America Securities initiated with an OVERWEIGHT rating and a TP of HK$72. The company has the largest gaming community called TapTap in China. Net profit is forecasted to grow 39% in 2021 to 2022.

- Semiconductor Manufacturing International Corp (981 HK) -10.16%, closing at HK$24.4. The company announced 4Q20 results where revenues grew by 10.3% YoY to US$981mn, and net profit grew by 289.7% YoY to US$257mn. But GPM dropped by 6.2ppt QoQ and 5.8ppt YoY to 18% in 4Q20. However, the two headwinds from the US sanctions and the resignation of ex-CEO Mr. Leung are expected to negatively impact ongoing operations.

Singapore

- Sarine Tech (SARINE SP) +16.4% to S$0.64 ahead of its full-year results that will be announced in the last week of February. Its shares have gained 198% over the last six months on a better outlook for the diamond industry in 2021.

- ThaiBev (THBEV SP) +3.1% to S$0.82 after it confirmed its intention to list its brewery business unit BeerCo on the SGX mainboard. The company said last Friday that it had received a no-objection letter from SGX for the listing of almost 20% of BeerCo. BeerCo has three breweries in Thailand as well as an interest in a network of 26 breweries in Vietnam. Its business includes the production, distribution and sales of beer brands such as Chang and Bia Saigon.

- Credit Bureau Asia (CBA SP) +2.9% to S$1.42 ahead of its maiden full-year results later this month. CBA listed on SGX on 3 December 2020 and has outperformed the broader market by gaining 53% since listing date.

- Civmec (CVL SP) +8.3% to S$0.59 ahead of its 2Q FY2021 results that is scheduled to be released in the next two weeks. Civmec’s main business is closely tied to Australia’s commodity sector, which is seeing a revival. Civmec’s orderbook stood at A$1.1bn as at end December 2020 as the group diversified into Australia’a deefnse sector.

- Earnings watch: HPH Trust (8 Feb), while DBS and SATS reports this Wednesday (10 Feb).

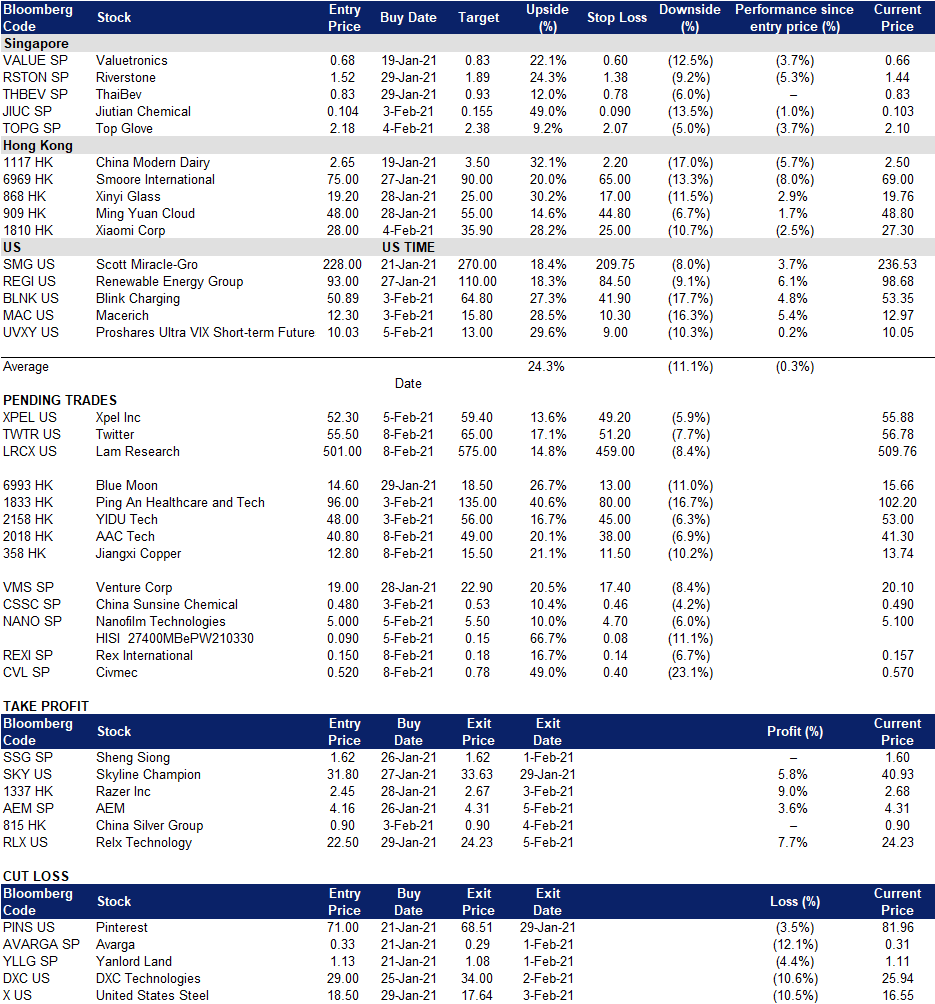

Trading Dashboard