31 May 2023: Fortress Minerals Ltd. (FMIL SP), Kuaishou Technology (1024 HK), Taiwan Semiconductor Manufacturing Co. Ltd. (TSM US)

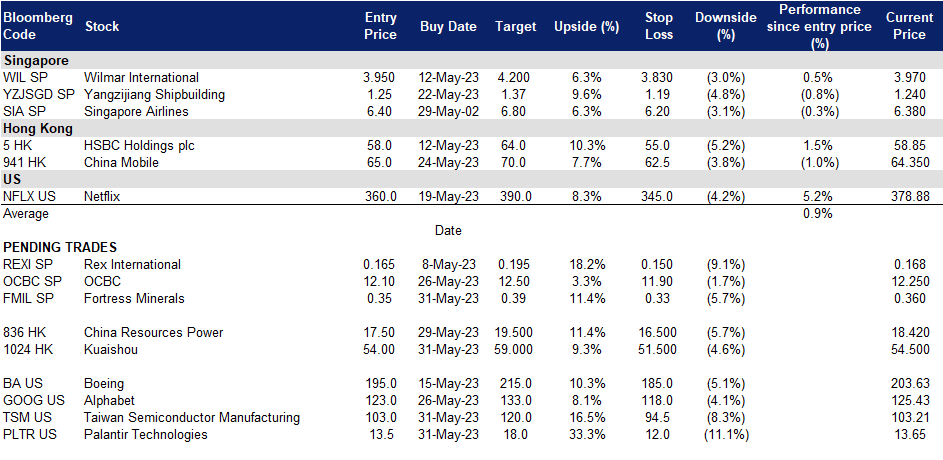

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

Fortress Minerals Ltd. (FMIL SP): More resources to discover

- BUY Entry 0.35 – Target – 0.39 Stop Loss – 0.33

- Fortress Minerals Limited mines, processes, and distributes iron ore. The Company focuses on exploration, mining, production, and distribution of iron ore concentrates. Fortress Minerals serves customers in Singapore and Malaysia.

- Abundant Iron Ore Resources and Reserves. Fortress Mineral has crafted a solid foundation within the industry within the Southeast Asia region, with 2 current big projects at hand to drive revenue. Their mines at Bukit Besi and Mengapur make up a total of 1477.88ha of available mining and exploration land, an indicated and inferred iron resource of 8.83 MT, as well as an indicated and inferred copper resource of 35.89 MT. To date, about 15% of the surface has been explored at Bukit Besi, and only top layer of soil has been processed at its’ CASB mine.

- Potential to upscale. The company also announced 2 new projects in the state of Sabah, East Malaysia. This adds an additional exploration land of 44,000ha for the company, as well as 4 new key minerals to drive revenue in the future. This potentially provides the company with an additional 3000% of land space to generate more revenue streams for the company coming from the extraction of 4 new key minerals, alongside Iron Ore and Copper.

- Diversification of products. Fortress Minerals’ 2 new projects expose the company to new minerals in their portfolio, namely, Nickel, Cobalt, Zinc, and Galena, alongside the existing iron and copper. This adds the potential for new revenue drivers for the company in the long term. Fortress Minerals has plans to begin its sales of copper within 2 to 3 years as well, aside from its current sales of iron ore.

- FY23 results review. The company reported stronger FY2023 results on higher revenues and sales volumes. Revenue rose by 23.5% YoY to US$53.5mn, compared to US$43.4mn in revenue in FY2022. Sales volume rose 52.8% to 546,000 DMT in FY2023 compared to 357,000 DMT in FY2022 as production capabilities are normalized.

- Technical TP of S$0.35; fundamental TP of S$0.46. While we have a Technical TP of S$0.35 based on short-term technical factors, we maintain our fundamental-based TP of S$0.46 based on blended valuation, using Discounted Cash Flow (DCF), with a terminal growth rate of 2% and a WACC of 10%, as well as a comparable multiples Valuation using an industry EV/Resource multiple of 3.6x. Read the full fundamentals-based report here.

Oversea-Chinese Banking Corp Ltd (OCBC SP): Growth in wealth business buffers other headwinds

- RE-ITERATE BUY Entry 12.1 – Target – 12.5 Stop Loss – 11.9

- Oversea-Chinese Banking Corporation Limited offers a comprehensive range of financial services. The Company’s services include deposit-taking, corporate, enterprise and personal lending, international trade financing, investment banking, private banking, treasury, stockbroking, insurance, credit cards, cash management, asset management and other financial and related services.

- Distribution of first tokenised equity-linked structured note. In partnership with ADDX, OCBC has launched its first tokenised equity-linked structured note. These notes pay regular distributions at pre-defined intervals, subject to the terms of the notes and the absence of any extraordinary or trigger events. Fixed coupon notes provide an opportunity for investors to generate additional cash flow while gaining potential exposure to underlying securities or a basket of securities based on their specific market views, as stated by OCBC. This marks the debut of many upcoming equity-linked notes that OCBC intends to introduce.

- Benefit from rate cut expectations. Even though it is uncertain when rates will start to decline, Singapore banks will continue to thrive in this volatile environment as our local banking system is heavily regulated and conditioned under various stresses by the Monetary Authority of Singapore (MAS). MAS has also expressed its readiness to provide liquidity to maintain financial stability and orderly market functions. The overall market believes that the Feds will also attempt to decrease systemic risk in the financial sector by reducing interest-rate hikes and start to cut rates by 3Q23, with interest rates expected to peak at 5.25% to 5.5%. The expected decrease in interest rates could result in borrowers refinancing their loans, which were granted at higher rates.

- Growing wealth segment. Singapore is seeing an influx of wealthy individuals and family offices, which has led to a rise in assets under management at the country’s banks. The Monetary Authority of Singapore estimated there were about 700 family offices in 2021, but the current estimate is around 1,400, with mainland Chinese being the biggest drivers of growth. Although the family offices generate jobs indirectly through external finance, tax, and legal professionals, little of the money is being invested in funds or private equity firms. Despite this, the influx of wealth will still benefit banks in Singapore, particularly with the tax exemption programs for family offices, which have led to higher assets under management at banks in the country. Furthermore, with fear brewing due to the deteriorating US-China ties, the ultra-rich in Taiwan are considering setting up family offices in Singapore to protect their wealth. BDO Tax Advisory has reported an increase in inquiries from the ultra-rich in Taiwan. OCBC’s wealth management income contributed 33% to the Group’s total income in FY22. The group wealth management AUM was higher at S$258bn compared to S$257bn in FY21, driven by continued growth in net new money inflows which offset negative market valuation. As Singapore continues to attract a growing number of wealthy individuals, the country’s banks are expected to receive a boost in assets and deposits.

- Dividend yield and share buyback. OCBC’s dividend yield is expected to be 6.3% in FY23.It also has been buying back its share with a mandate.

- 1Q23 results review. Record net profit S$1.88bn for the first quarter, 39% YoY increase from S$1.36bn a year ago and rose 44% QoQ from S$1.31bn the previous quarter. Net interest income grew 56% YoY to S$2.34bn from S$1.50bn in 1Q22, a slight decline of 2% QoQ from 4Q22 S$2.39bn.

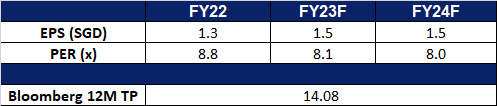

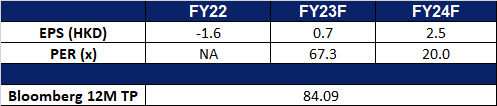

- Market consensus.

Kuaishou Technology (1024 HK): Expecting a sales boom in the upcoming online shopping spree

- BUY Entry – 54.0 Target – 59.0 Stop Loss – 51.5

- Kuaishou Technology is a China-based investment holding company mainly engaged in the operation of content communities and social platforms. The Company mainly provides live streaming services, online marketing services and other services. The online marketing solutions include advertising services, Kuaishou fans headline services and other marketing services. Other services include e-commerce, online games and other value-added services. The Company mainly conducts business within the domestic market.

- Online live-streaming sales growth. The online live-streaming shopping market in China is experiencing significant growth, reaching a total of $497 billion in 2022, as reported by Coresight Research. This upward trend can be attributed to consumers who are increasingly valuing their time and opting for the convenience of watching live stream shopping from anywhere, rather than simply browsing products online or visiting physical stores for purchases.

- Upcoming June 18th shopping festival. In anticipation of the annual June 18 shopping carnival, major e-commerce platforms in China have already initiated presales. This year, these platforms have introduced more extensive promotional events and direct subsidies, streamlining their promotional methods. Buyers no longer need to perform complex calculations or combine multiple orders to avail discounts. Additionally, live-streaming sessions continue to play a crucial role during the June 18 shopping festival. Short-video platforms like Douyin and Kuaishou have increased subsidies in an effort to attract more traffic and compete with e-commerce platforms. Overall, this promotional event is expected to stimulate consumption growth in the second quarter.

- 1Q23 earnings. The company swung to an adjusted net profit of 42mn yuan (HK$46.8mn) in the first quarter, the first time since its listing in Hong Kong in 2021, compared to a net loss of 3.7bn yuan a year ago. Revenue rose to 25.2bn yuan, a 20% increase YoY. The company also revealed plans to buy back up to HK$4 bn worth of shares over the period till the conclusion of the company’s AGM.

- Market Consensus

(Source: Bloomberg)

China Resources Power Holdings Company Limited (836 HK): A seasonality trade

- RE-ITERATE BUY Entry – 17.5 Target – 19.5 Stop Loss – 16.5

- China Resources Power Holdings Company Limited is a Hong Kong-based investment holding company principally engaged in the investment, development and operation of power plants. The Company operates through three segments. Thermal Power segment is engaged in the investment, development, operation and management of coal-fired power plants and gas-fired power plants, as well as the sales of heat and electricity. Renewable Energy segment is engaged in wind power generation, hydroelectric power generation and photovoltaic power generation, as well as the sales of electricity. Coal Mining segment is engaged in the mining of coal mines, as well as the sales of coal. The Company mainly operates businesses in China.

- Decline in thermal coal prices. The decline in global coal prices is expected to have significant benefits for the company’s coal-fired power plants and gas-fired power plants. With prices stabilising around $200 per tonne, lower fuel costs for coal-fired power plants translate into improved profitability and a competitive advantage in the market. While China Resources Powers does have its own coal production plants, energy consumption during summer typically skyrockets for China, this means that the company will be required to buy coal from other suppliers to further supplement its energy production and will therefore benefit from the lower prices. Additionally, the predictability of prices enables better operational planning and mitigates risks associated with volatility. The declining prices also create opportunities for the company’s gas-fired power plants, as natural gas becomes a more cost-effective alternative. This diversification and cost advantage contribute to improved financial performance, market competitiveness, and the ability to offer competitive electricity prices to consumers. Overall, the decline in coal prices presents favourable conditions for the company’s power generation operations, enhancing profitability and sustainability.

Thermal coal price

(Source: Bloomberg)

- Summer peak consumption period. As the summer season approaches in China, spanning from June to August, there is a significant increase in electricity demand during this peak consumption period. Previous records indicate that Chinese localities have witnessed surges in electricity usage due to soaring temperatures and robust factory operations, driven by the ongoing economic recovery following recent COVID-19 outbreaks.

19-year historical monthly returns

- Increase in coal demand. China is taking steps to meet its growing energy demand by fast-tracking the approval and construction of new coal mines, according to an official from the National Energy Administration (NEA). With peak energy demand predicted to exceed 1.36 billion kilowatts this summer, a significant increase from last year, there is a possibility of power cuts in certain provinces. Coal plays a crucial role in China’s energy mix, especially during the summer when households rely heavily on air conditioning and hydroelectric power generation decreases due to limited rainfall. These actions underscore China’s commitment to ensuring energy security while transitioning to a more renewable-powered system.

- FY22 earnings. Revenue rose to HK$103.3bn, a 15.0% increase YoY. Net Income of HK$7.04bn was up 342% compared to FY2021.Net profit Margin rose to 6.8%, compared to 1.8% in FY2021.

- Market Consensus.

(Source: Bloomberg)

Taiwan Semiconductor Manufacturing Co. Ltd. (TSM US): Riding the AI wave

- BUY Entry – 103.0 Target – 120.0 Stop Loss – 94.5

- Taiwan Semiconductor Manufacturing Company, Ltd. manufactures and markets integrated circuits. The Company provides the following services: wafer manufacturing, wafer probing, assembly and testing, mask production, and design services. TSMC’s ICs are used in computer, communication, consumer electronics, automotive, and industrial equipment industries.

- Surging orders from Nvidia, Apple, and Advanced Micro Device. TSMC has benefited from the strong performance of Nvidia and Advanced Micro Devices, as these semiconductor companies are in the absolute lead in the wave of artificial intelligence in the next few years and take up most of the market share. The rapid growth of demand for GPUs will make up for the decline in the growth of mobile phone chips. TSMC is the main manufacturer of GPUs for Nvidia and will continue to enjoy the tailwinds in the upstream of the semiconductor supply chain.

- Ramping up production. TSMC is ramping up its effort to up its production capabilities, recently being in talks to receive German government subsidies to build a new fab in the country. The company is also already constructing new fabs in Japan and U.S. to address national security concerns as well as to increase their production capabilities.

- 1Q23 earnings review. Revenue fell 4.8% YoY to US$16.72bn, missing expectations by US$170 mn. GAAP earnings per share came in at $1.31, beating estimates by $0.11. 5nm shipments accounted for 31% of total wafer revenue; 7-nm accounted for 20%. Advanced process products of 7nm and lower nanometers accounted for 51% of total wafer revenue.

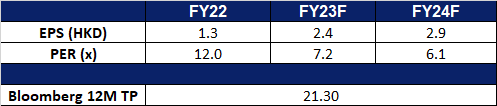

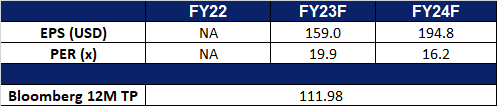

- Market consensus.

(Source: Bloomberg)

Palantir Technologies Inc (PLTR US): The importance of digitalisation security

Palantir Technologies Inc (PLTR US): The importance of digitalisation security

- BUY Entry – 13.5 Target – 18.0 Stop Loss – 12.0

- Palantir Technologies Inc develops software to analyze information. The Company offers solutions support many kinds of data including structured, unstructured, relational, temporal, and geospatial. Palantir Technologies serves customers worldwide.

- Regulations for the deployment of responsible artificial intelligence (AI). The Biden-Harris Administration has introduced measures to regulate the progress of AI technology in order to safeguard individuals, manage risks, and address national security concerns. These efforts include the establishment of an AI Bill of Rights, the development of an AI risk management framework, and the creation of a roadmap for a National AI research resource. The administration also aims to address security concerns, invest in research and development, gather public input on important AI issues, and explore the risks and opportunities of AI in education. Given Plantir’s established work with the government, it is likely to benefit from these initiatives.

- Cybersecurity remains resilient. The importance of cybersecurity has grown significantly due to rapid digital transformation in various industries. Despite a slowdown in tech spending, the demand for cybersecurity services remains strong and essential. Recent security threats, including a Chinese cyber-espionage campaign targeting US military and government targets, have further increased the need for robust cybersecurity measures. Market analysts predict a 12.1% increase in global cybersecurity spending, reaching £219 billion in 2023. Enterprises are consolidating their cybersecurity vendors to simplify operations and protect against attacks. Comprehensive cybersecurity solutions help clients analyze security data, integrate applications, reduce costs, and improve risk management.

- 1Q23 earnings review. Revenue rose 17.8% year-over-year to US$525mn, beating estimates by US$19.25mn. Non-GAAP EPS of $0.05 beat expectations by $0.01. The number of U.S. business customers grew 50% year-over-year, from 103 to 155.

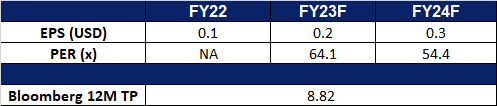

- Market consensus.

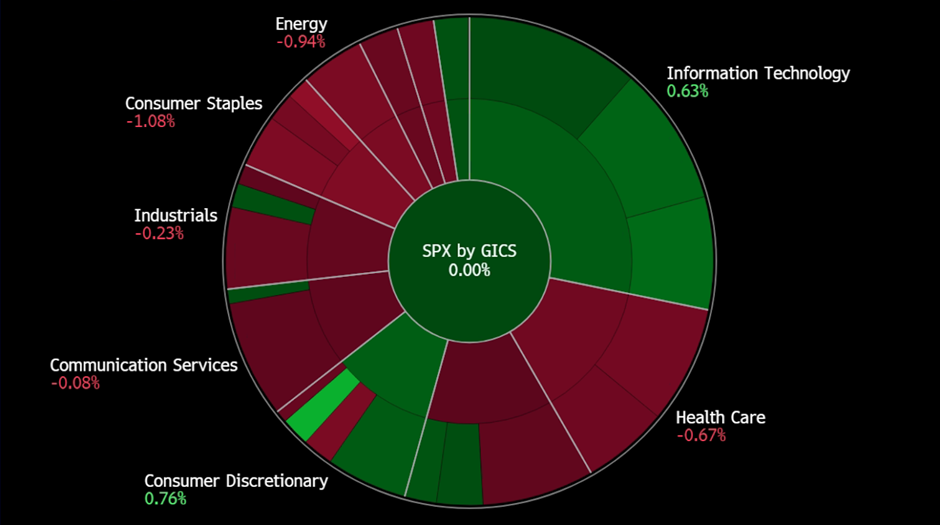

United States

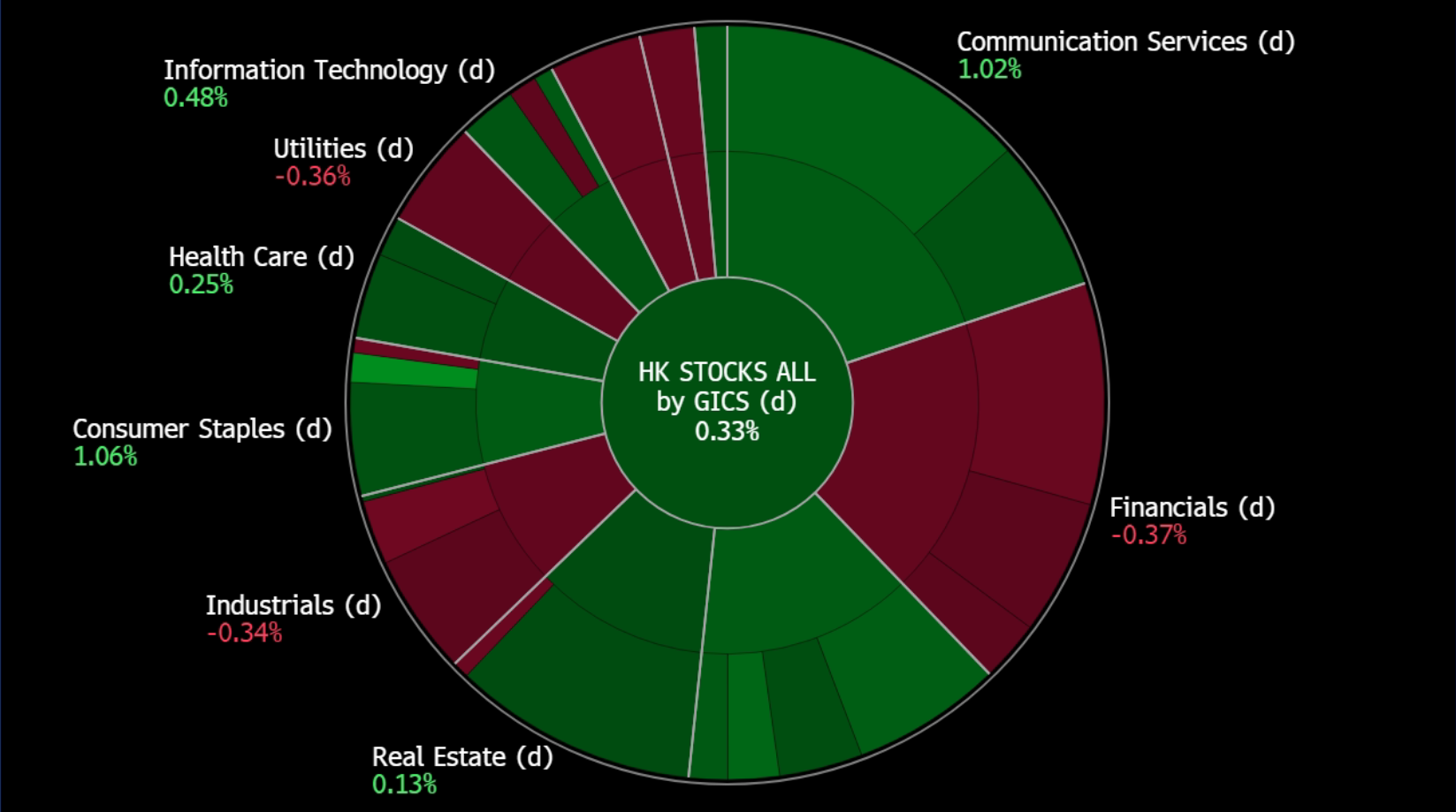

Hong Kong

Trading Dashboard Update: Add Singapore Airlines (SIA SP) at S$6.40.