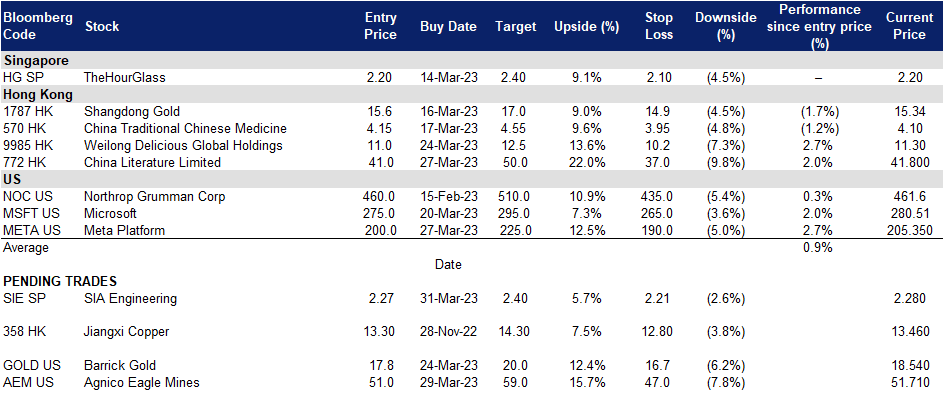

31 March 2023: SIA Engineering Co Ltd (SIE SP), Jiangxi Copper Company Limited (358 HK), Meta Platforms Inc (META US)

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

SIA Engineering Co Ltd (SIE SP): Continuous service

- BUY Entry 2.27 – Target – 2.40 Stop Loss – 2.21

- SIA Engineering Co Ltd provides airframe and component overhaul services, line maintenance and technical ground handling services. The Company also manufactures aircraft cabin equipment, refurbishes aircraft galleys, repairs and overhauls hydromechanical aircraft equipment.

- S$1.14bn agreement. SIA Engineering announced on March 29th its new service agreement with Singapore Airlines, which replaces the previous agreement signed in April 2019. The new agreement, effective from April 1st, 2023, has a two-year term and an option to extend for an additional year. With this new agreement, SIA Engineering is expected to generate S$1.14 billion in revenue over the three-year term.

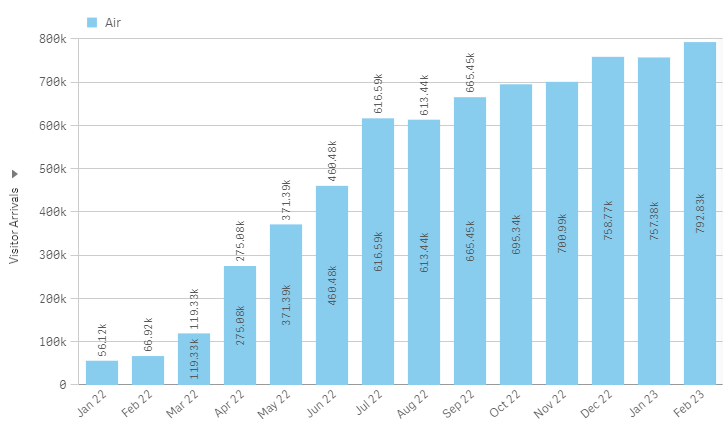

- Recovery in flight traffic. Based on recent data from the Singapore Tourism Board (STB), Singapore’s international visitor arrivals in February reached a new record high of 957,605 since the pandemic began. However, it is worth noting that these figures still fall below the pre-pandemic levels of 1.7 million visitors recorded in January 2020. With projected international visitor arrivals to Singapore ranging from 12mn to 14mn in 2023 and full tourism recovery expected by 2024, flight activities will continue to recover alongside the increasing tourism demand.

Visitor Arrivals by Air Travel trend

(Source: Singapore Tourism Analytics Network)

- Development of new talents. Through signing the Memorandum of Understanding (MOU), SIA Engineering Company (SIAEC) will collaborate with seven Institutes of Higher Learning (IHLs) to curate training curricula for industry-relevant skills, provide structured internships and industry attachments, increase employment placement opportunities, and engage in interdisciplinary projects and research with IHL students and academic staff. This partnership is an extension of SIAEC’s existing programs to support lifelong learning and ensure a continuous talent pipeline.

- 3Q22 results review. Revenue rose 48.6% YoY to S$208.1mn. Net profit declined by 61.4% YoY to S$12.8mn from S$33.2mn in 3Q21.

- Updated market consensus of the EPS in FY23/24 is -5.56%/66.47% respectively, which translates to 40.0x/24.3x forward PE. Current PER is 34.11x. Bloomberg consensus average 12-month target price is S$2.63.

(Source: Bloomberg)

TheHourGlass (HG SP): The clock is ticking

- RE-ITERATE BUY Entry 2.20 – Target – 2.40 Stop Loss – 2.10

- The Hour Glass Limited retails and wholesales watches, jewelry and related products through its subsidiaries. The Company also manufactures watches and invests in properties. Having established itself in Singapore as a premier watch boutique, the Group expanded worldwide. The Group holds exclusive agency and distribution rights to Gerald Genta, Breguet, Daniel Roth, Bertolucci, Burberrys, Christian Dior, Revue Thommen, Hublot and Montega.

- Revival of Daniel Roth. The Swiss watch brand, Daniel Roth, owned by LVMH, is making a comeback as an independent company, with its first new model set to be sold exclusively on a subscription basis at a retail price of 140,000 CHF. The delivery of the watch is expected in early 2024. However, those looking to purchase the brand’s watches will need to go through The Hour Glass as they hold exclusive distribution rights in Singapore.

- Post-Covid boom. Last year, there were about 6.3 million visitors arriving in Singapore, a YoY increase of 1,810.5%. China lifted its overseas travelling restrictions in early January 2023, and Singapore is expected to see a spike in Chinese tourist influx this year. In February 2023, there were 957,605 visitors (up 1,412.1% YoY) in Singapore. According to a market survey from travel agents in China, Southeast Asian countries are among the top cross-border travelling preferences after a three-year lockdown.

- Luxury spending. Despite the challenging economic climate characterized by surging inflation, rising interest rates, and the looming possibility of recession, the demand for luxury goods has remained steady. This demand is largely driven by affluent individuals who have benefited from the recent wealth accumulation and the savings accrued during the Covid lockdown periods. Additionally, the return of Chinese shoppers – the primary source of profits for luxury companies before the pandemic – is expected to bolster the industry, with Chinese consumers saving one-third of their income and depositing 17.8 trillion yuan (US$2.6 trillion) into banks last year.

- Retail sales. Singapore’s retail industry, and other service sectors, are expected to reap the rewards of the ongoing revival of leisure and business air travel, as well as China’s decision to reopen its borders. Data from Singapore Tourism Board shows approximately 49% of tourists receipts from Mainland China in 2019 (pre-pandemic) were from shopping. According to the department of statistics Singapore, retail sales on watches and jewellery increased by 13.1% YoY in December 2022 and 10.8% MoM. In 1H23, it expects retail trade to improve by 8% and operating revenue to increase by 2% in the first quarter.

- 1H23 results review. Revenue rose 18% YoY for the six months ended Sept 30 to S$555.5mn from S$472.4mn. Net profit jumped 35% YoY from S$62.6mn to S$84.6mn, despite higher operating costs.

- Updated market consensus of the EPS in FY24/25 is 4.35%/4.17% respectively, which translates to 9.2x/8.8x forward PE. Current PER is 8.46x and the 5 year historical PER is 8.8x.

(Source: Bloomberg)

Jiangxi Copper Company Limited (358 HK): Rising Property Expectations

- BUY Entry – 13.3 Target – 14.3 Stop Loss – 12.8

- Jiangxi Copper Company Limited is a China-based company, principally engaged in the mining, smelting and processing of copper. The Company is also engaged in the extraction and processing of precious metals and dissipated metals, sulfur chemical industry business, and financial and trading businesses. The company’s products include cathode copper, gold, silver, sulfuric acid, copper rods, copper foils, selenium, tellurium, rhenium, bismuth and others. The Company mainly conducts its businesses within Mainland China and Hongkong.

- Improving China’s property markert expectations. China’s housing market is experiencing positive developments, as the expectations for the property market are on the rise due to a decrease in first-home interest rates and an acceleration in bank lending. The market is witnessing a reduction in first-home loan interest rates, a decrease in the down payment ratio, and a significant narrowing of the sales decline. In March of this year, the average mainstream mortgage interest rates slightly decreased by 2 basis points to 4.02% compared to the previous month.

- Infrastructure expansion. The expansion of infrastructure is set to continue this year with massive investments that will serve as a major driver for economic growth. The city has already commenced major infrastructure projects with a total investment of approximately 50 billion yuan ($7.4 billion), including 25 major projects in new materials, new energy, and next-generation information technology. It is anticipated that the momentum of infrastructure development will persist in 2023, helping to boost economic recovery.

- Copper futures seasonality. Copper delivers gains from February to April based on the last 15-year’s track record.

(Source: Bloomberg)

(Source: Bloomberg)

- The updated market consensus of the EPS growth in FY23/24 is -14.26%/16.73% YoY respectively, which translates to 7.95x/6.81x forward PE. Current PER is 6.82x. Bloomberg consensus average 12-month target price is HK$14.28.

(Source: Bloomberg)

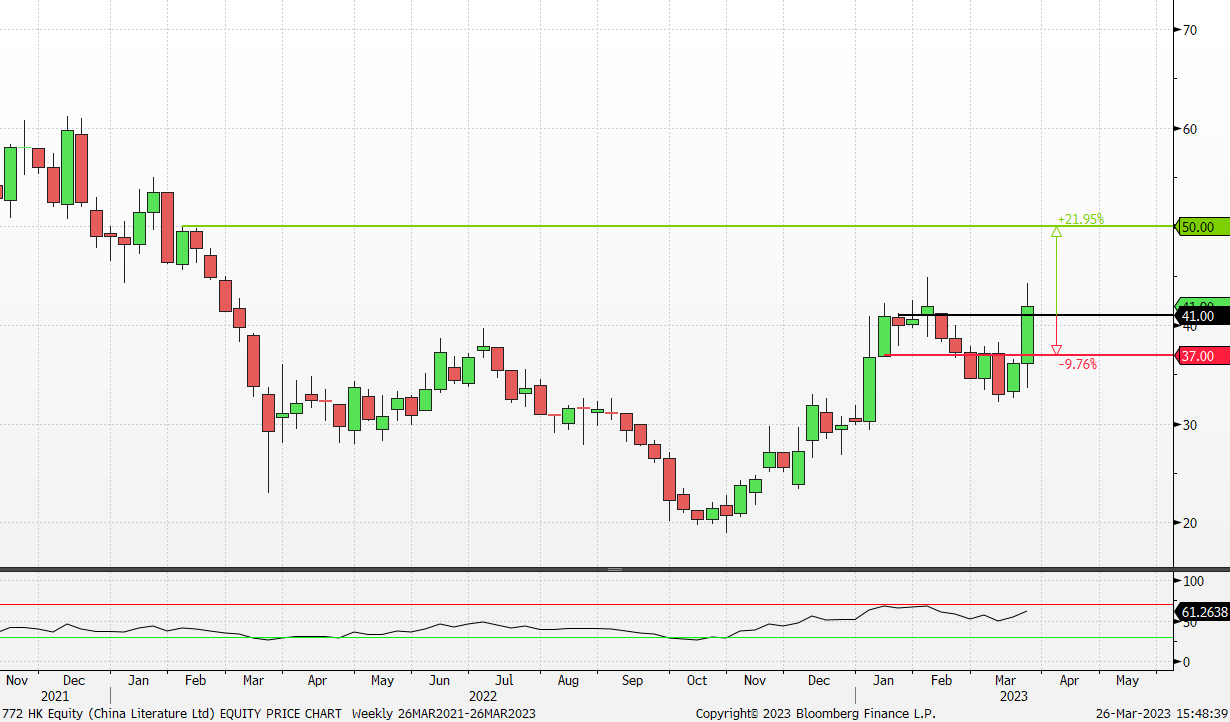

China Literature Limited (772 HK): Exploring AIGC-theme

- RE-ITERATE BUY Entry – 41.0 Target – 50.0 Stop Loss – 37.0

- CHINA LITERATURE LIMITED is a company principally engaged in the operation of online literature platform. The Company’s platform provides online readers with easy access to Company’s vast and diverse content library and enables a greater number of writers to create and publish original literary content online. Additionally, the Company able to extend the monetization lifecycle of Company’s content for our writers through Company’s intellectual property operation by managing and licensing Company’s content for adaptation into other entertainment formats.

- A new model to monetise digital content. The most disruptive technological product, ChatGPT created a new direction of artificial development. The AI generative content (AIGC) requires abundant content input for the AI engine to train. The intellectual properties (IPs) owned by the company is a gold mine for AI companies which are developing large language model engine. AIGC technology + IPs could be a new business model for the company to commercialize and monetize its assets.

- FY22 business review. The company’s online reading platform added approximately 540,000 writers, 950,000 literacy works and over 39bn Chinese characters. The number of online literary works that newly reached 3,000 average subscribers per chapter in 2022 increased by more than 50% YoY.

- FY22 earnings review. Revenue declined by 12% YoY to RMB7.6bn. Gross profit declined by 12.4% YoY to RMB4.0bn. Profit attributable to equity holders of the company dropped by 67.1% YoY to RMB608mn. Non-IFRS profit attributable to equity holders of the company grew by 9.6% YoY to RMB1.3bn.

- The updated market consensus of the EPS growth in FY23/24 is 152.9%/15.1% YoY respectively, which translates to 24.2x/21.0x forward PE. Current PER is 60.5x. Bloomberg consensus average 12-month target price is HK$45.01.

(Source: Bloomberg)

Meta Platforms Inc (META US): Benefit from indirect policy tailwinds

- RE-ITEREATE BUY Entry – 200 Target – 225 Stop Loss – 190

- Meta Platforms, Inc. engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality headsets, and wearables worldwide. It operates in two segments, Family of Apps and Reality Labs.

- Benefiting from the potential TikTok ban. The TikTok CEO’s congressional testimony last Thursday did not convince the US lawmakers that the short video platform has no threat to US national security. With the backdrop of deteriorating US-China relations, TikTok’s overseas operation will face more headwinds. However, other social media peers will take a big breath. Meta’s Reels as one of the benefactors is favoured indirectly by the policy tailwinds as Americans could be forced to switch from TikTok to Reels. In fact, Reels plays more than doubled in 2022.

- Back to the right direction. Meta has toned down the development of Metaverse which the market sees too ahead of the current trend. The company announced another round of layoff of 10,000 employees, following the previous round of 11,000 job cuts. The right-sizing accounts for 25% of the total employment. Meanwhile, Meta is one of a strong rivals to ChatGPT. It announced its latest AI language model, LLAMA, which is an open-source package that anyone in the AI community can request access to.

- 4Q22 earnings review. Revenue dropped by 4.5% YoY to US$32.2bn. GAAP EPS was US$1.76. 1Q23 revenue guidance ranges between US$26.0bn and US$28.5bn.

- The updated market consensus of the EPS growth in FY23/24 is 40.8%/23.1%, respectively, which translates to 20.7x/16.7x forward PE. Current PER is 18.7x. Bloomberg consensus average 12-month target price is US$225.63.

(Source: Bloomberg)

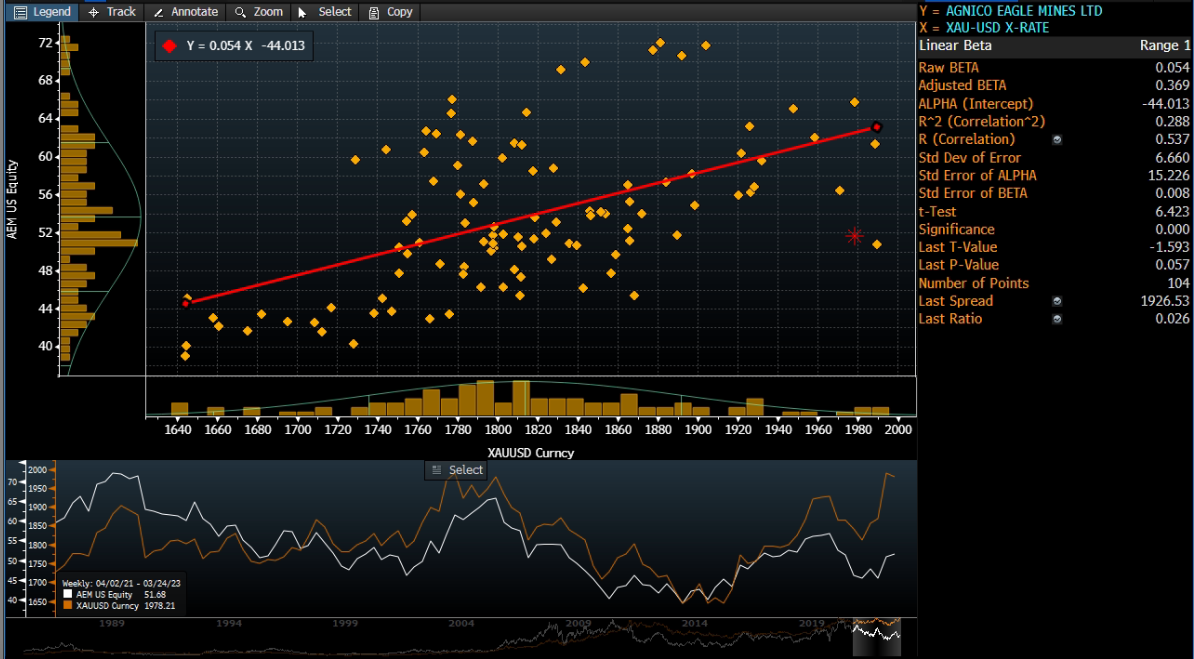

Agnico Eagle Mines Limited (AEM US): Gold back up

- BUY Entry – 51.0 Target – 59.0 Stop Loss – 47.0

- Agnico Eagle Mines Limited engages in the exploration, development, and production of mineral properties in Canada, Australia, Mexico, and Finland. The company primarily produces and sells gold deposits, as well as explores for silver, zinc, and copper deposits.

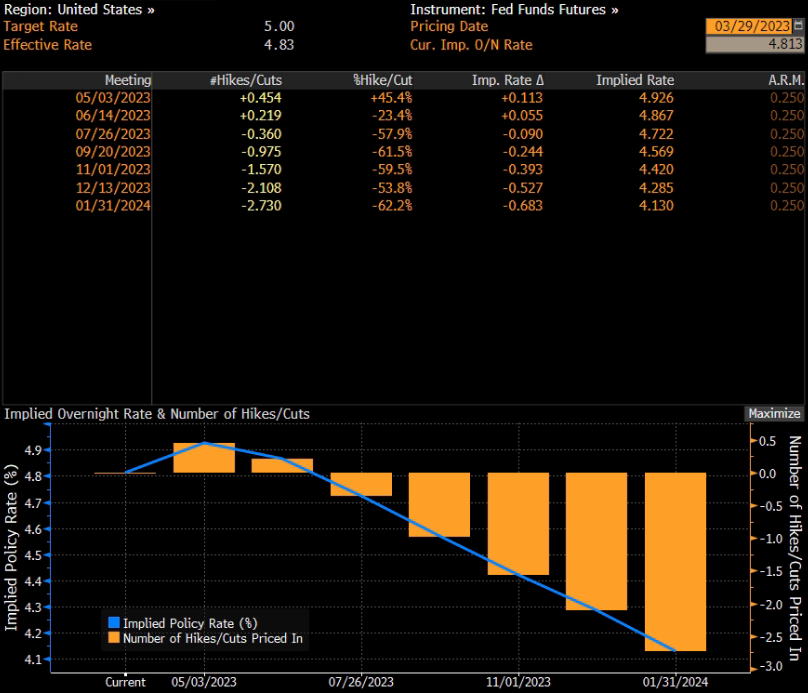

- Malfunction of the monetary system. The cent banking crisis in the US and Europe was due to liquidity concerns which led to a bank run. Though central banks reacted immediately to provide liquidity, the problem has not been resolved. Now, both the economy and markets are suffering from the backfire of decades of cheap credit. Central banks are confronting a dilemma between continual rate hikes to cool down inflation and pause/stop rate hikes from maintaining financial stability. The credibility of central banks is questioned, and investors’ confidence weakens gradually. Gold outshines on such a backdrop.

- Central banks are increasing gold reserves. According to Bloomberg, the People’s Bank of China raised its gold holdings by 30 tonnes in December 2022, and China’s central bank held a total amount of 2,010 tonnes of gold reserves as of January 2023. Russia increased its gold reserve by 1mn ounce to 74.9mn ounces as of February 2022. The Monetary Authority of Singapore’s bullion reserves rose to 6.4mn ounces at the end of January, up from 4.9mn ounces a month earlier.

The Fed recently hiked rates by 25 basis points. The market expects the Fed to stop raising interest rates and begin to cut rates in the second half of 2023.

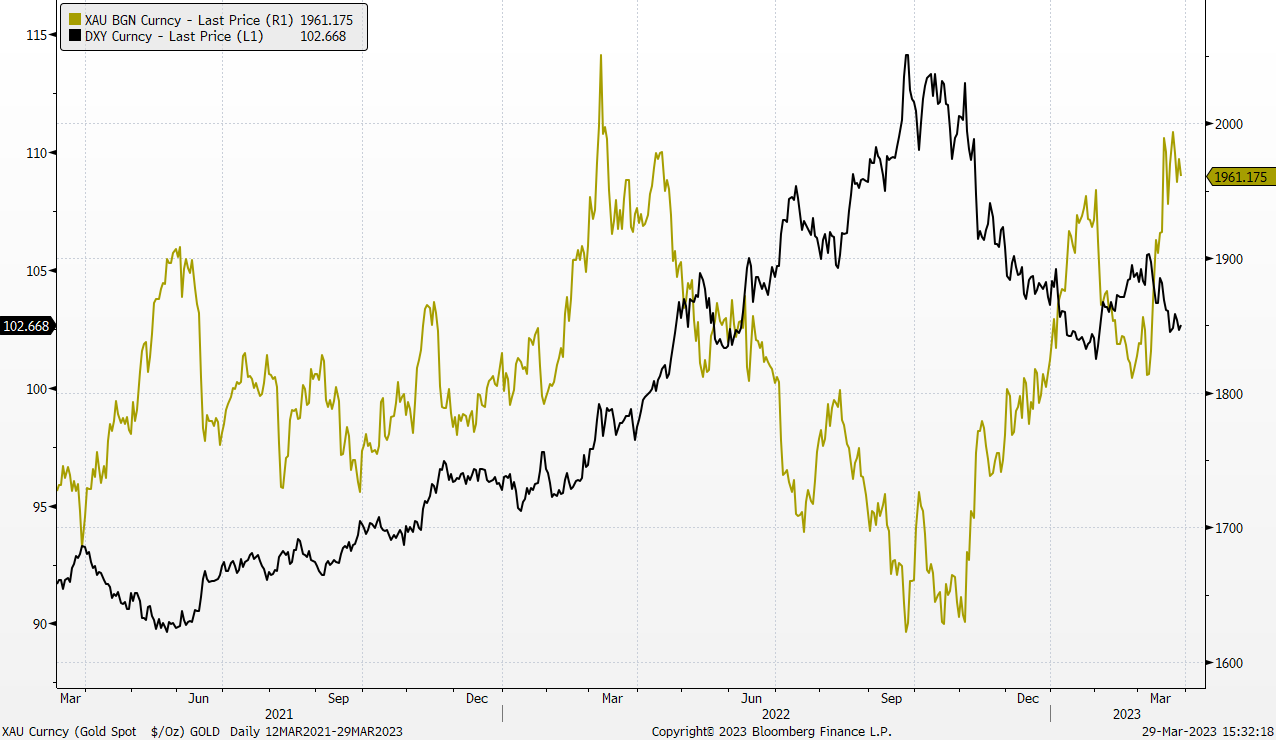

- Better outlook for gold price in 2023. There are several factors that impact gold prices, and the key ones are the trend of the US dollar and global geopolitical risk. The broad market has expected that US dollars peaked last year as inflation has been on a downswing. Even though recent macro data such as CPI and core PCE prices showed overall prices were declining. The US job market started showing some weaknesses as the unemployment rate rose to 3.6% in February. The market expects Fed to cut rates in 2H23. On the other hand, geopolitical tensions remain high and probably escalate anytime as China-US confrontations are more frequent. Gold is the good old safe haven.

Gold Price and Dollar Index Trend  (Source: Bloomberg)

(Source: Bloomberg)

- Mixed 4Q23 results. Revenue jumped by 45% YoY to US$1.38bn, missing estimates by US$40mn. Non-GAAP EPS was US$0.4, in line with estimates. The company guided gold production for 2023 to be 3.24mn to 3.44mn ounces, with total cash costs and all-in sustaining costs forecast at US$840-US$890/oz and US$1,140-US$1,190/oz, respectively.

- The updated market consensus of the EPS growth in FY23/24 is -8.9%/18.6%, respectively, which translates to 28.8x/24.3x forward PE. Bloomberg consensus average 12-month target price is US$59.83.

Agnico Eagle Mines VS Gold price  (Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)

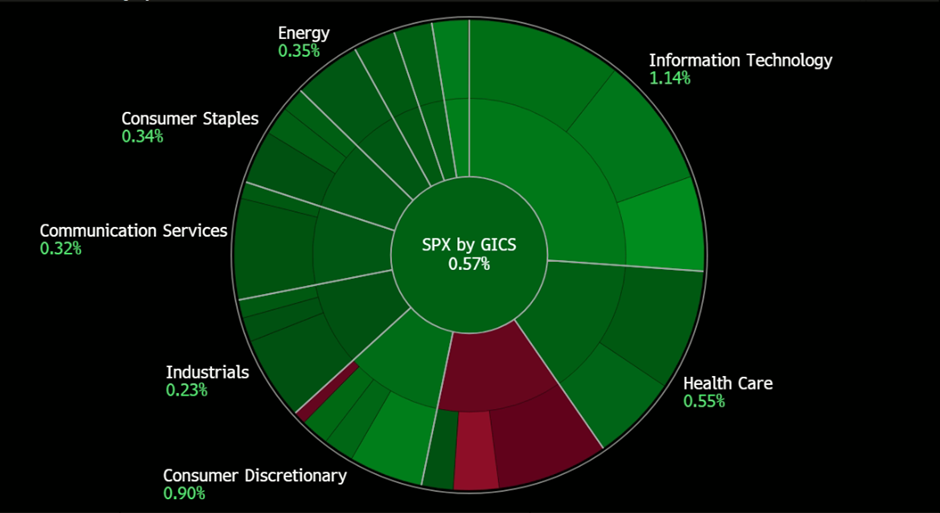

United States

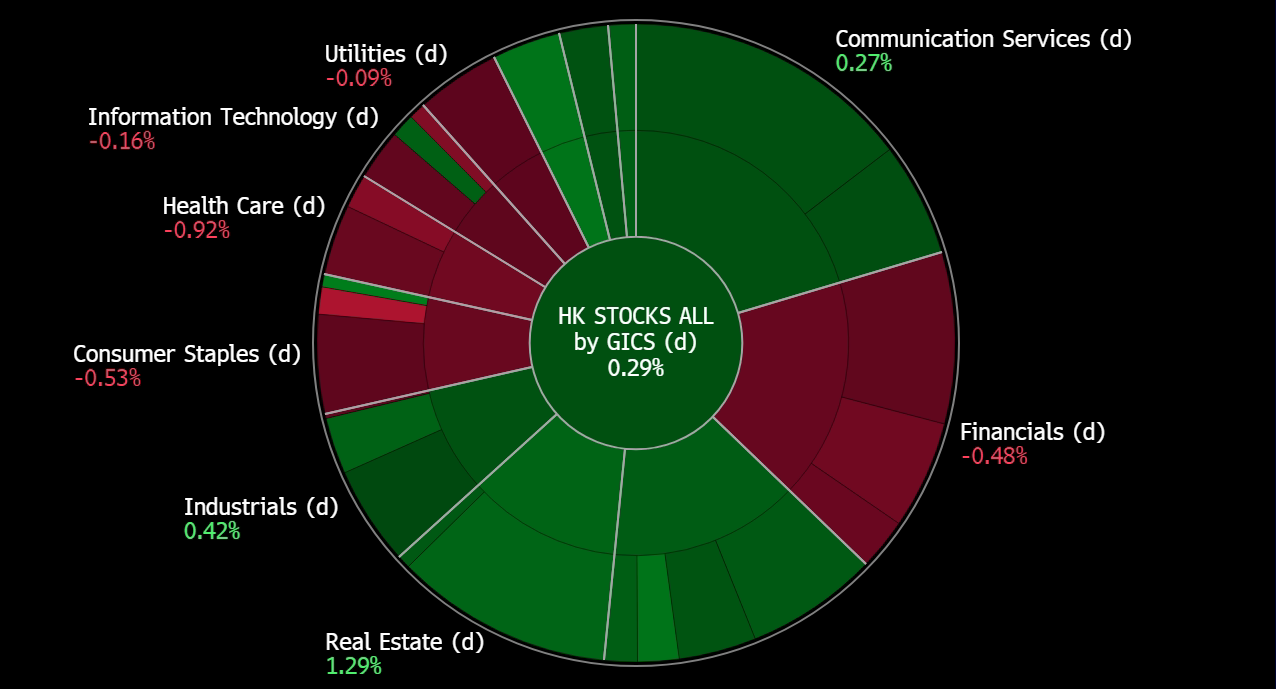

Hong Kong

Trading Dashboard Update: Take profit on Raffles Medical (RFMD SP) at S$1.50 and Frencken Group (FRKN SP) at S$1.12.