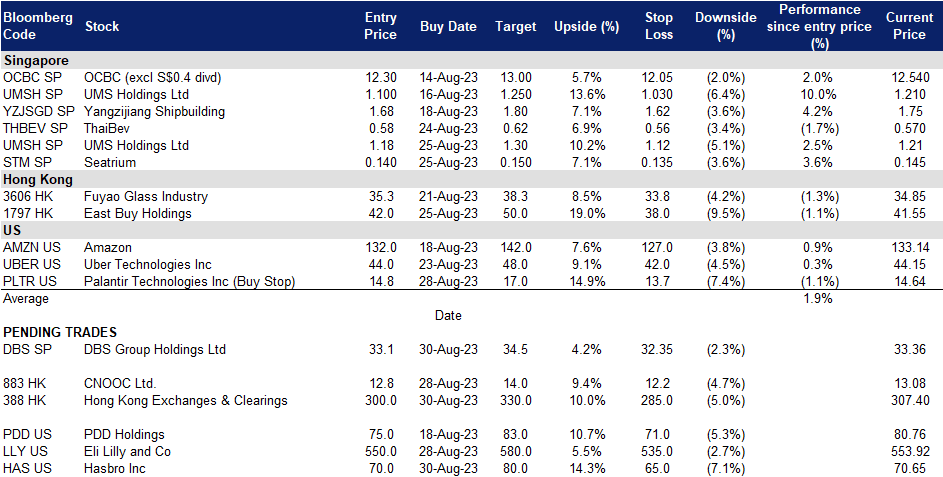

30 August 2023: DBS Group Holdings Ltd (DBS SP), CNOOC Ltd. (883 HK), Eli Lilly and Co (LLY US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

United States

Hong Kong

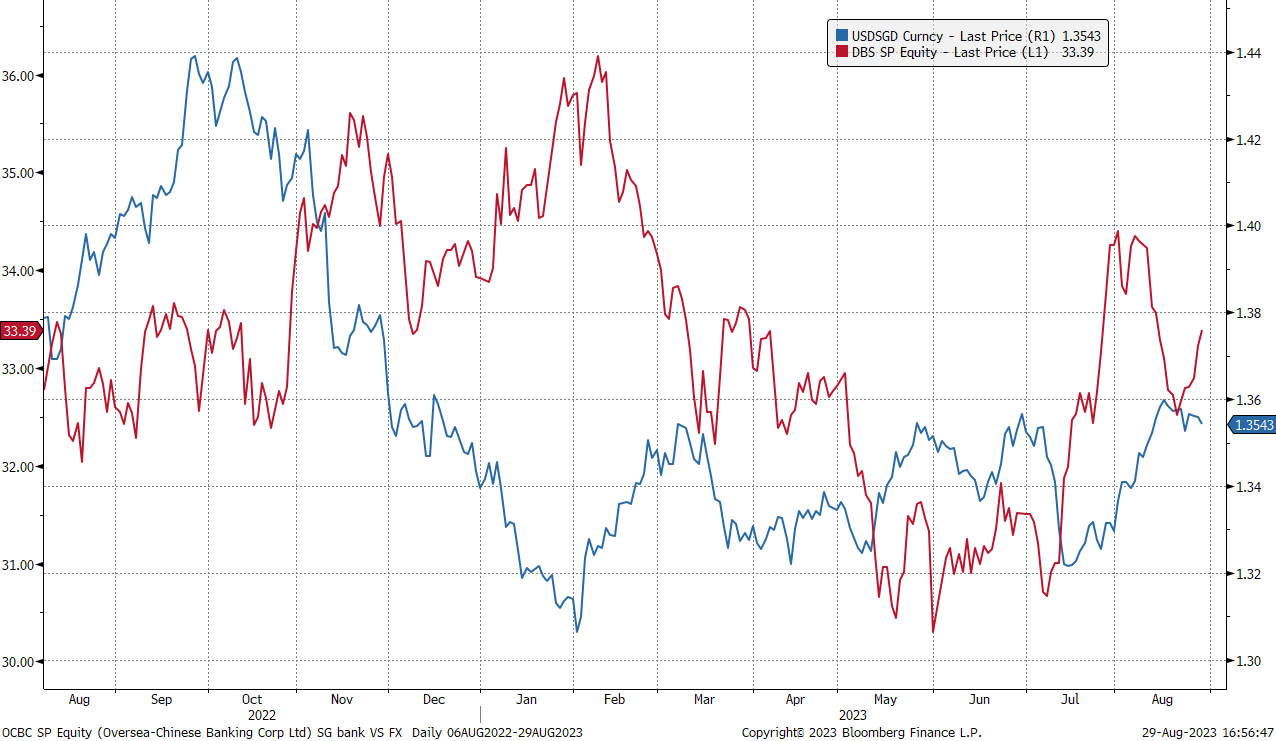

DBS Group Holdings Ltd (DBS SP): SGD strengthens again

- BUY Entry 33.10 – Target – 34.50 Stop Loss –32.35

- DBS Group Holdings Limited and its subsidiaries provide a variety of financial services. The Company offers services including mortgage financing, lease and hire purchase financing, nominee and trustee, funds management, corporate advisory and brokerage . DBS Group also acts as the primary dealer in Singapore government securities.

- Jumping into the metaverse. DBS Bank is developing a metaverse game called DBS BetterWorld to raise awareness of sustainability issues, particularly global food waste. The game will be available later this year on The Sandbox platform and will allow players to interact with characters, take part in activities, and earn in-game rewards. DBS is partnering with sustainable companies to create the game and is using the metaverse to engage with its younger customers and promote its brand values.

- Largest foreign bank in Taiwan. DBS Bank recently acquired Citigroup’s consumer banking business in Taiwan, becoming the largest foreign bank by assets in the market. The deal effectively doubled DBS’ consumer banking customers in Taiwan and its credit card accounts climbed nearly fivefold. DBS paid a lower premium for the purchase than originally expected, and said the deal would accelerate its consumer business growth in Taiwan by at least 10 years. The acquisition is part of DBS’ strategy to build meaningful scale in its core Asian markets.

Share price and USD/SGD correlation

(Source: Bloomberg)

(Source: Bloomberg)

- 2Q23 results review. Profit rose 48% YoY to S$2.69bn from S$1.82bn in 2Q22, beating forecast. This jump in profit was due to higher interest rates and strong inflow of wealth into Singapore.

- Market consensus.

(Source: Bloomberg)

Seatrium Limited (STM SP): Resilient creude oil performance

Seatrium Limited (STM SP): Resilient creude oil performance

- RE-ITERATE BUY Entry 0.140 – Target – 0.150 Stop Loss – 0.135

- Seatrium Limited provides offshore and marine engineering solutions. It operates through two segments: Rigs & Floaters, Repairs & Upgrades, Offshore Platforms, and Specialised Shipbuilding; and Ship Chartering.

- Order book remains strong. It secured new contract wins of S$4.3bn ytd with solid orders pipeline. It’s net order book of S$19.7bn with projects lined up to 2030, comprising 40% renewables and cleaner/green solutions. Additionally it showed strong operational performance with track record of projects delivered.

- Share buyback. Seatrium bought back shares for the second time. The company bought back 20mn shares on August 4 for 13.4 SG cents each. This follows its first buyback on June 12, when it bought 1.2mn shares for 12.4 SG cents each.

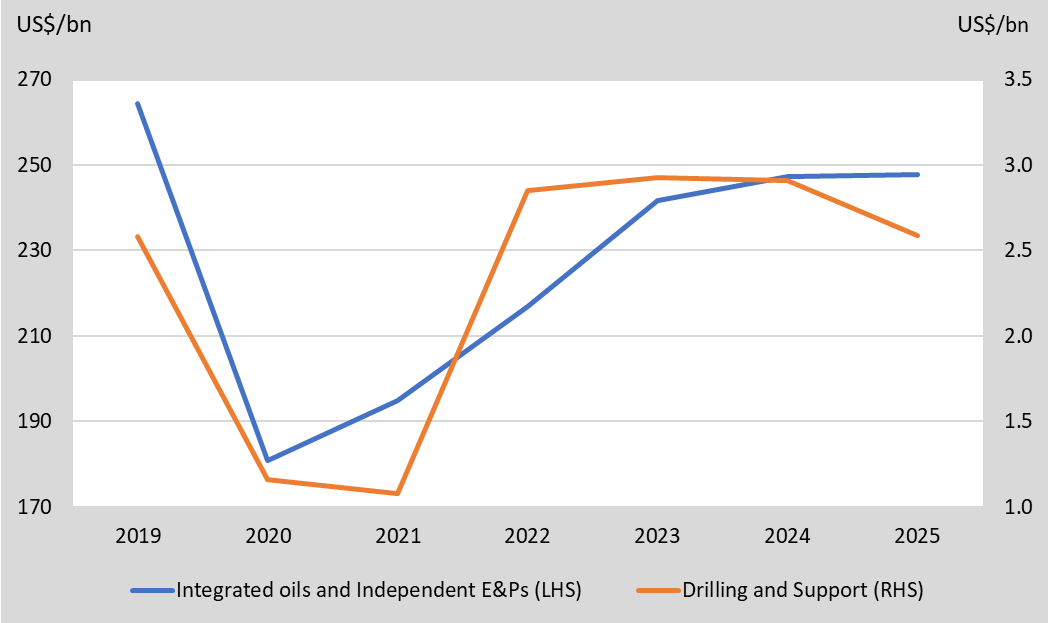

- Offshore market expected to strengthen. Seatrium is expected to benefit from the strengthening offshore market. The industry estimates that offshore oil and gas capital expenditure will continue to grow in 2023 and 2024, supported by data showing that day rates for latest generation drillships are now over $500,000 per day, and the number of active offshore rigs has increased by 8% YoY. The company has a strong order book, access to new markets, and the capacity to accept more projects and is looking to fill its 2028/29 production schedule. Furthermore, the normalisation of economic activity should also result in a greater volume of shipping activities, which will positively impact Seatrium’s repair/upgrade segment. These factors will help to drive Seatrium’s growth and share price in the future.

- Expecting mild growth in the upstream oil and gas capex. Oil prices have been showing signs of resilience despite a weakening economy, contribution by deflation in China. Yet, these concerns are offset by a steep drawdown in U.S. fuel stockpiles and Saudi and Russian output cuts, sending oil prices to a high since January 2023. The oil and gas upstream spending also continues. Oil majors accelerated to explore and develop oil resources outside Russia after the sanction. Hence, there still be mild growth in the upstream capex during 2023/2024.

Global upstream oil and gas capex

(Source: Bloomberg)

(Source: Bloomberg)

- 1H23 results review. Revenue rose 164% YoY to S$2.9bn from S$1.1bn the prior year. Net loss amounted to -S$264mn due to provision for contracts and merger expenses. The Group’s EBITDA of S$27mn in 1H2023 was higher than the negative S$19mn in the same period last year. EBITDA before provision for contracts and merger expenses amounted to a creditable S$258mn.

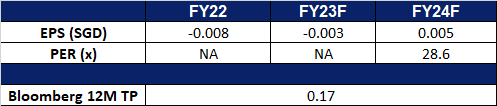

- Market consensus.

(Source: Bloomberg)

Hong Kong Exchanges & Clearings. (388 HK): Expect to follow the mainland to lower stamp duties

- BUY Entry – 300 Target – 330 Stop Loss – 285

- Hong Kong Exchanges and Clearing Limited is principally engaged in the operation of stock exchanges. The Company operates through five business segments. The Cash segment includes various equity products traded on the Cash Market platforms, the Shanghai Stock Exchange and the Shenzhen Stock Exchange. The Equity and Financial Derivatives segment includes derivatives products traded on Hong Kong Futures Exchange Limited (HKFE) and the Stock Exchange of Hong Kong Limited (SEHK) and other related activities. The Commodities segment includes the operations of the London Metal Exchange (LME). The Clearing segment includes the operations of various clearing houses, such as Hong Kong Securities Clearing Company Limited, the SEHK Options Clearing House Limited, HKFE Clearing Corporation Limited, over the counter (OTC) Clearing Hong Kong Limited and LME Clear Limited. The Platform and Infrastructure segment provides users with access to the platform and infrastructure of the Company.

- Expectations towards lowering stamp duty. China recently announced that the country will be halving its stamp duties on securities transactions. This lowers the margin requirement for buying stocks, which as a result boosts investor confidence. Investors expect Hong Kong to follow suit in the footsteps of China, to reduce the stamp duty within the Hong Kong Stock Exchange to provide a boost and increase transaction volumes.

- Taskforce to boost stock market liquidity. Hong Kong recently announced that it is setting up a task force to improve the liquidity of its stock market, which will help to boost its performance and strengthen its competitiveness as an international financial center. The task force would thoroughly examine the factors influencing market liquidity and provide recommendations to the chief executive office. This would allow Hong Kong with a broader scope of alternatives to boost its stock market liquidity.

- Lower loan prime rate. China recently cut its one-year loan prime rate by another 10bps to 3.45%, from 3.55% previously. The lower loan prime rate would make it more attractive for investors to buy stocks, as they can earn a higher return on their investment. This can lead to increased demand and hence volume for stocks.

- 1H23 earnings. Revenue rose by 13.4% YoY to HK$10.8bn in 1H23, compared to HK$8.9bn in 1H22. Net profit rose 31.9% YoY to HK$6.3bn, compared to HK$4.8bn in 1H22. Basic EPS rose by 30.6% YoY to HK$4.99 in 1H23, compared to HK$3.82 in 1H22.

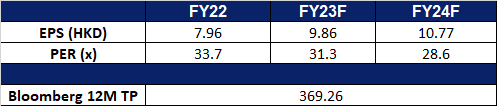

- Market Consensus.

Monthly Market Highlights – July

(Source: Bloomberg)

CNOOC Ltd. (883 HK): High dividend yield amidst market downturn

- RE-ITERATE BUY Entry – 12.8 Target – 14.0 Stop Loss – 12.2

- CNOOC Ltd is a China-based investment holding company principally engaged in the exploration, production and sales of crude oil and natural gas. The Company operates three segments. Exploration and Production segment is engaged in conventional oil and gas business, shale oil and gas business, oil sands business and other unconventional oil and gas businesses. Trading segment is engaged in entrepot trade of crude oil in overseas areas. Corporate segment is engaged in headquarter management, assets management, research & development, and other businesses. The Company mainly operates businesses in China, Canada, the United Kingdom, Nigeria, and Brazil, among others.

- Demand for oil to outgrow supply. According to the International Energy Agency (IEA), global oil demand reached record levels of 103mn barrels per day in June and is poised to peak again in August. The increase in the oil demand is attributed to stronger-than-expected economic growth in developed countries, robust summer air travel, and surging oil consumption in China, particularly for petrochemical production. Additionally, major oil-producing countries, including Saudi Arabia, have implemented significant oil production cuts, further driving up oil prices in the near future. Saudi Arabia will also be likely to roll over a voluntary oil cut of 1mn barrels per day for a third consecutive month into October, amid uncertainty about supplies and as the kingdom targets drawing down global inventories further. Consequently, the cost of oil is anticipated to increase within the market.

- Opening doors for bunkering operations. CNOOC and Pavillion Energy successfully completed their first ship-to-ship LNG bunkering operation in China recently. The operation was conducted at an anchorage in Chinese waters and involved the delivery of LNG to Maran Dione, a new-built dual-fuel VLCC. This is a significant milestone for CNOOC, as it is the company’s first delivery to an LNG-powered VLCC at an anchorage in Chinese waters. The success of this operation could pave the way for more bulk carriers and product tankers to conduct LNG bunkering operations at anchorages in Chinese ports, potentially bringing more sales volume for CNOOC.

- Uncovering more oil supply. CNOOC intends to initiate offshore exploration in Tanzania, as part of a recent plan. This plan arises from an agreement between CNOOC and the Tanzania Petroleum Development Corporation (TPDC). The collaboration between the two companies will involve conducting seismic studies in deep-sea blocks owned by TPDC. Tanzania is actively pursuing the development of its natural gas resources and has recently secured a partnership with major oil and gas firms to construct a large liquefied natural gas (LNG) export terminal. The purpose of establishing the LNG export terminal is to fulfil the growing demand for LNG in Europe, as the region aims to diversify its gas supplies away from Russian pipelines by 2027, which has been facing pressures from oil supply cuts recently.

- 1H23 earnings. Revenue FELL BY 14.1% YoY to RMB151.69bn. Net profit fell 11.3% YoY to RMB63.76bn. Diluted and Basic EPS is at RMB1.34, down 14.7% YoY.

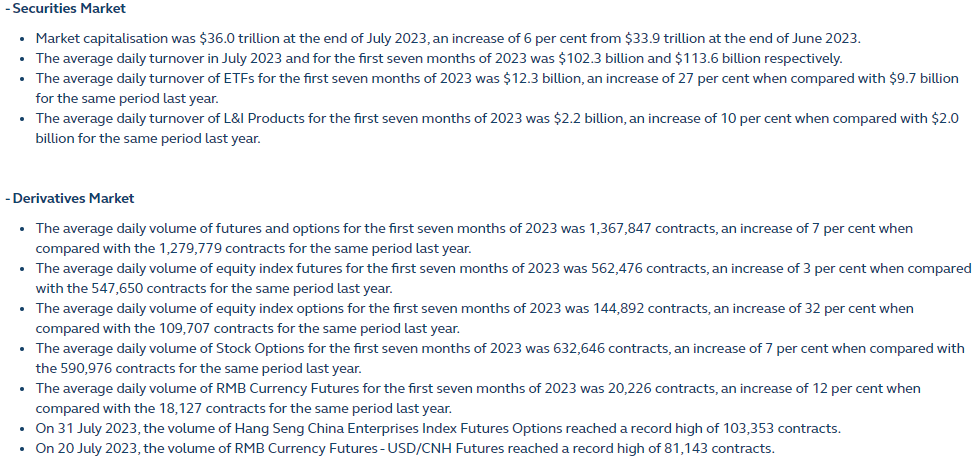

- Market Consensus. FY23F/24F dividend yield is 9.9%/10%。

Share price and Brent crude oil price correlation

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)

Hasbro Inc (HAS US): Passing GO

- BUY Entry – 70 Target – 80 Stop Loss – 65

- Hasbro, Inc. designs, manufactures, and markets toys, games, interactive software, puzzles, and infant products. The Company’s products include a variety of games, including traditional board, card, hand-held electronic, trading card, role-playing, and DVD games, as well as electronic learning aids and puzzles.

- Monopoly GO! success. The digital version of Monopoly GO!, launched in mid-April 2023, has generated $200mn in revenue and is the highest-grossing iOS app in the United States. It is expected to contribute to Hasbro’s profits and is ranked in the top five free mobile game charts in more than 100 countries based on downloads. The game is similar to the board game Monopoly but with some twists. It is a social game that can be played with players globally and is designed to be played anywhere and anytime, without having to commit a lot of time. Players can purchase dice, in-game currency, and stickers needed to complete challenges. These purchases will continue to contribute to its revenue as more players join the game and make in-app purchases.

- Realign focus on it’s priority brands. Hasbro has sold its eOne production studio to Lionsgate for $500mn. The deal is expected to close by the end of 2023. Hasbro will use the proceeds to pay down debt and focus on its toy and game businesses. The company will continue to licence its intellectual property to studios for film and TV projects, but will no longer be involved in production. It is also heavily investing in digital gaming, with successful releases such as Magic: The Gathering Arena and Baldur’s Gate 3. Hasbro believes that this will be a major growth driver for the future.

- 2Q23 earnings review. Revenue fell 9.7% year-over-year to US$1.21bn, beating estimates by US$90mn. Non-GAAP EPS of $0.49 miss expectations by $0.08.

- Market consensus.

(Source: Bloomberg)

Eli Lilly and Co (LLY US): R&D successes

Eli Lilly and Co (LLY US): R&D successes

- RE-ITERATE BUY Entry – 550 Target – 580 Stop Loss – 535

- Eli Lilly and Company discovers, develops, manufactures, and sells pharmaceutical products for humans and animals. The Company products are sold in countries around the world. Eli Lilly products include neuroscience, endocrine, anti-infectives, cardiovascular agents, oncology, and animal health products.

- Smooth progression for thyroid cancer drug. Eli Lilly’s cancer drug Retevmo has passed Phase 3 of the progression-free survival (PFS) test in a study for thyroid cancer. The trial, LIBRETTO-531, showed that patients taking Retevmo had better results in terms of cancer not getting worse compared to those taking other treatments. The trial focused on patients with advanced thyroid cancer. Retevmo’s safety was as expected. Eli Lilly plans to share the results with other experts and health authorities. Retevmo was approved by the FDA in 2022 for certain types of advanced cancers. With continued success and progression in their development of drugs, the company will likely to increase their toplines.

- Drug success. Eli Lilly’s diabetes drug Mounjaro achieved $979.7mn in 2Q23 sales, a substantial increase from the $16mn it made in the same period last year. Mounjaro, originally for diabetes, is also being explored for weight reduction. Supply challenges are expected due to high demand, despite efforts to increase manufacturing capacity. Revenue growth was also driven by breast cancer pill Verzenio’s 57% rise to $926.8mn and Jardiance’s 45% climb to $668.3mn in sales. However, cancer drug Alimta’s sales dropped by 73% to $60.9mn due to patent expiration. Sales of Covid-19 antibody treatments were absent due to FDA action. Eli Lilly expects strong growth ahead as challenges ease.

- 2Q23 earnings review. Revenue rose 28.0% year-over-year to US$8.31bn, beating estimates by US$700mn. Non-GAAP EPS of $2.11 beat expectations by $0.11. New Products contributed $1.0bn to revenue in 2Q23, led by Mounjaro. Growth Products revenue increased 16% to $4.93bn in 2Q23, led by Verzenio, Jardiance and Taltz.

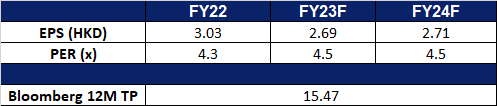

- Market consensus.

(Source: Bloomberg)

(Source: Bloomberg)

Trading Dashboard Update: Take profit on CSC Financials (6066 HK) at HK$9.4. Add Palantir Technologies Inc (PLTR US) at US$14.8.