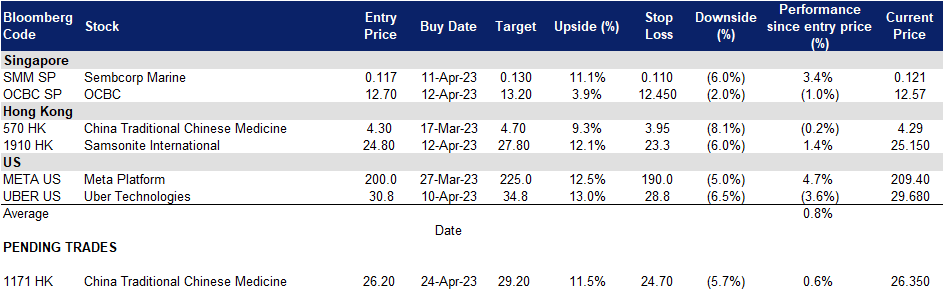

28 April 2023: Oversea-Chinese Banking Corp Ltd (OCBC SP), Yankuang Energy Group Co Ltd (1171 HK), Meta Platforms Inc (META US)

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

Oversea-Chinese Banking Corp Ltd (OCBC SP): Benefiting from weakening USD

- RE-ITEREATE BUY Entry 12.70 – Target – 13.20 Stop Loss – 12.45

- Oversea-Chinese Banking Corporation Limited offers a comprehensive range of financial services. The Company’s services include deposit-taking, corporate, enterprise and personal lending, international trade financing, investment banking, private banking, treasury, stockbroking, insurance, credit cards, cash management, asset management and other financial and related services.

- Stepping into a new dimension. OCBC is the first Singaporean bank to introduce a virtual banking experience for customers in the metaverse. Customers can access OCBC’s virtual branch in the blockchain-based decentraland platform, where they can open virtual savings accounts and interact with other customers in a virtual world. The virtual banking experience is part of OCBC’s efforts to reach out to the younger generation of customers and explore new channels for customer engagement.

- Benefit from rate cut expectations. Even though it is uncertain when rates will start to decline, Singapore banks will continue to thrive in this volatile environment as our local banking system is heavily regulated and conditioned under various stresses by the Monetary Authority of Singapore (MAS). MAS has also expressed its readiness to provide liquidity to maintain financial stability and orderly market functions. The overall market believes that the Feds will also attempt to decrease systemic risk in the financial sector by reducing interest-rate hikes and start to cut rates by 3Q23, with interest rates expected to peak at 4.75% to 5.00%. The expected decrease in interest rates could result in borrowers refinancing their loans, which were granted at higher rates.

- Growing wealth segment. Singapore is seeing an influx of wealthy individuals and family offices, which has led to a rise in assets under management at the country’s banks. The Monetary Authority of Singapore estimated there were about 700 family offices in 2021, but the current estimate is around 1,400, with mainland Chinese being the biggest drivers of growth. Although the family offices generate jobs indirectly through external finance, tax, and legal professionals, little of the money is being invested in funds or private equity firms. Despite this, the influx of wealth will still benefit banks in Singapore, particularly with the tax exemption programs for family offices, which have led to higher assets under management at banks in the country. Furthermore, with fear brewing due to the deteriorating US-China ties, the ultra-rich in Taiwan are considering setting up family offices in Singapore to protect their wealth. BDO Tax Advisory has reported an increase in inquiries from the ultra-rich in Taiwan. OCBC’s wealth management income contributed 33% to the Group’s total income in FY22. The group wealth management AUM was higher at S$258bn compared to S$257bn in FY21, driven by continued growth in net new money inflows which offset negative market valuation. As Singapore continues to attract a growing number of wealthy individuals, the country’s banks are expected to receive a boost in assets and deposits.

- FY22 results review. Group net profit for FY22 increased 18% to S$5.75bn, from S$4.86bn a year ago. Net interest income grew 31% to a record S$7.69bn from S$5.86bn in FY21.

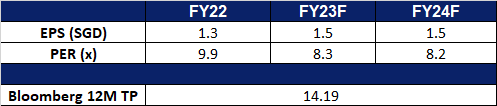

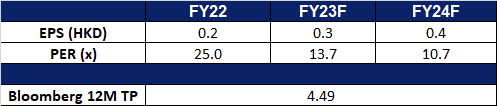

- Market consensus.

(Source: Bloomberg)

Sembcorp Marine Ltd (SMM SP): Oil rebound

- RE-ITERATE BUY Entry 0.117 – Target – 0.130 Stop Loss – 0.111

- Sembcorp Marine Ltd offers engineering solutions for the offshore, marine, and energy industries. The Company provides rigs and floaters, repairs and upgrades, offshore platforms, and specialized shipbuilding. Sembcorp Marine serves customers worldwide.

- Oil rebound. Crude oil rose on Thursday after losing nearly 6% in the past two sessions. Growing recession fears and renewed concerns about the banking sector outweighed falling US inventories and the prospect of weaker global supplies. Brent traded around US$78/bbl, and WTI held below US$75/bbl. Meanwhile, the latest EIA report showed US crude inventories dropped 5.054 million barrels last week, far exceeding expectations of a 1.486 million barrel decline. Furthermore, more output cuts planned by OPEC+ from May could constrict global markets further.

- New projects acquired. On March 30, Sembcorp Marine has won a multi-billion-dollar contract with GE Renewable Energy’s Grid Solutions to construct and deliver three high-voltage direct current (HVDC) electrical transmission systems for offshore wind farms in the Netherlands. The deal is worth €6 bn (S$8.68 bn), and construction is set to commence in Q3 2024 at Sembcorp Marine’s Singapore and Batam yards; marking the company’s third HVDC offshore platform project.

- Merger complete. Sembcorp Marine has completed its merger with Keppel Offshore & Marine (Keppel O&M) in a S$4.5 billion deal on 28 February 2023, with a total order book of about S$18bn. The combined group is expected to be better positioned to capture growth opportunities in the face of falling oil prices and the global transition to renewable energy. With the merger, the enlarged Sembcorp Marine will benefit from greater synergies from the broader geographical footprint, larger operational scale, and enhanced capabilities.

- FY22 results review. Revenue rose 4.6% YoY to S$1,947mn from S$1,862mn the prior year. Net loss declined by 78.0% YoY to -S$261mn from -S$1,171mn in FY21. With positive EBITDA for 2H22, the FY22 EBITDA was -S$7mn a 99% decrease YoY from the previous -S$1,028mn.

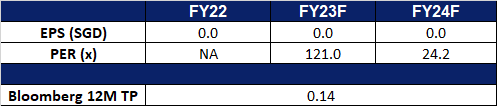

- Market consensus.

(Source: Bloomberg)

Yankuang Energy Group Co Ltd (1171 HK): Increase in factory activities

- RE-ITERATE BUY Entry – 26.2 Target – 29.2 Stop Loss – 24.7

- Yankuang Energy Group Co Ltd is a China-based international comprehensive energy company engaged in coal and coal chemical industry. The Company operates in five segments. The Coal Mining segment is engaged in underground and open-cut mining, preparation and sale of coal and potash mineral exploration. The Smart Logistics segment provides railway transportation services. The Electricity and Heating Supply segment provides electricity and related heat supply services. The Equipment Manufacturing segment is engaged in the manufacture of comprehensive coal mining and excavating equipment. The Chemical Products segment is engaged in the production and sale of chemical products. The coal products mainly include thermal coal, pulverized coal injection (PCI), and coking coal. The coal chemical products mainly include methanol, ethylene glycol, acetic acid, ethyl acetate and crude liquid wax, among others. The Company distributes products in the domestic market and to overseas markets.

- High demand for Coal in China. China’s coal imports have almost doubled in the first quarter of this year as its manufacturing sector got back into full swing following th pandemic. China’s consumption of coal is expected to pick up following the reopening of its economy from strict zero-COVID measures, supporting its activities such as railway maintenance, as well as to cater to the Electric Vehicle boom within China.

- Smart Mining Technologies to boost Coal production. China has called on coal-producing regions and enterprises to accelerate adoption of so-called ‘smart-mining’ technologies, replacingt human labour with unmanned mining vehicles controlled remotely from above-ground data centres. China has installed the technology at more than 1,000 working coal faces as part of this initiative, representing more than 620 million tonnes of annual coal production capacity.

- FY22 estimated earnings. The company expects to realise a net profit attributable to the shareholders of about RMB30,800 mn, an increase of about RMB14,500 mn or approximately 89% YoY, from RMB16,259 mn in FY21.

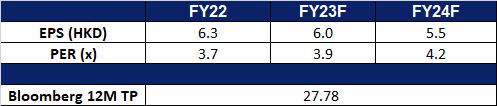

- Market Consensus

(Source: Bloomberg)

China Traditional Chinese Medicine Holdings Co. Ltd (570 HK): Health is Wealth

- RE-ITERATE BUY Entry – 4.30 Target – 4.70 Stop Loss – 4.10

- China Traditional Chinese Medicine Holdings Co. Limited is principally engaged in the manufacture and sales of traditional Chinese medicine (TCM) through its 12 subsidiaries.

- Reformed Healthcare insurance systems. Local governments recently announced reforming China’s healthcare system to improve the use of medical funds and help vulnerable populations like the elderly and those with chronic diseases, which is managed by the China authorities. The demand for and expenses associated with outpatient services are increasing as society develops. More individuals paying out of their pocket for common illnesses would be able to make use to these funds for treatment, hence increasing the demand for healthcare in China.

- Better medical and health systems. Chinese authorities has recently issued a set of guidelines to promote the sound development of the medical and health system in the country’s rural areas. The guideline highlighted the application of smart and digitalized technologies and the use of traditional Chinese medicine to allow residents to enjoy access to fairer and more systematical medical services in their vicinity.

- A defensive stock amidst a market downturn. The Hong Kong market has been hammered by both a slowdown in China’s economic recovery and banking crisis. Growth, value, and cyclical sectors, as well as other thematic stocks, have been sold off indiscriminately. However, this stock is relatively outperforming the rest as its business is largely immune to inflation and systemic risks. The business driver is the sales volume rather than profit margins.

- 1H22 earnings. Revenue rose by 41.9% YoY to RMB431.18mn. Gross profit increased by 108.2% YoY to RMB27.41mn. GPM was at 6.4% for 1H22 compared to 4.3% for 1H21.

- Market consensus.

(Source: Bloomberg)

Meta Platforms Inc (META US): Benefit from indirect policy tailwinds

- RE-ITEREATE BUY Entry – 200 Target – 225 Stop Loss – 190

- Meta Platforms, Inc. engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality headsets, and wearables worldwide. It operates in two segments, Family of Apps and Reality Labs.

- Benefiting from the potential TikTok ban. The TikTok CEO’s congressional testimony last Thursday did not convince the US lawmakers that the short video platform has no threat to US national security. With the backdrop of deteriorating US-China relations, TikTok’s overseas operation will face more headwinds. However, other social media peers will take a big breath. Meta’s Reels as one of the benefactors is favoured indirectly by the policy tailwinds as Americans could be forced to switch from TikTok to Reels. In fact, Reels plays more than doubled in 2022.

- Back to the right direction. Meta has toned down the development of Metaverse which the market sees too ahead of the current trend. The company announced another round of layoff of 10,000 employees, following the previous round of 11,000 job cuts. The right-sizing accounts for 25% of the total employment. Meanwhile, Meta is one of a strong rivals to ChatGPT. It announced its latest AI language model, LLAMA, which is an open-source package that anyone in the AI community can request access to.

- 4Q22 earnings review. Revenue dropped by 4.5% YoY to US$32.2bn. GAAP EPS was US$1.76. 1Q23 revenue guidance ranges between US$26.0bn and US$28.5bn.

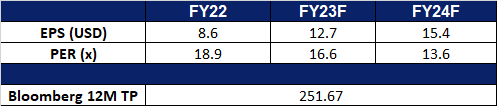

- Market Consensus

(Source: Bloomberg)

Uber Technologies, Inc. (UBER US): Year of turnaround

Uber Technologies, Inc. (UBER US): Year of turnaround

- RE-ITERATE BUY Entry – 30.8 Target – 34.8 Stop Loss –28.8

- Uber Technologies, Inc. develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and Asia excluding China and Southeast Asia. It operates through three segments: Mobility, Delivery, and Freight.

- Mobility business expansion. The company recently announced that it would make electric and common bicycles on its app in Latin America together with the Brazilian bike-sharing company Tembici. By the end of 2023, Uber expects 30,000 bicycles to run in Latin America, one-third out of which is electric.

- Ongoing restructuring. Previously, Uber was reported to consider a spin-off of its Freight logistics arm. Listing the freight business is more likely instead of selling to peers. On the other hand, the company also planned to remove 5,000 virtual brands from its Uber Eats delivery. According to the main press, these virtual brands are delivery businesses that do not have physical locations, make up more than 8% of Uber Eats’ storefront in the US and Canada, but less than 2% of bookings.

- Ready for recession. The abovementioned actions show that the company is preparing for the upcoming recession. Both bicycle-sharing development and the potential spin-off can be viewed as a way to reserve capital, and the removal of virtual brands is to optimise operating costs.

- 4Q22 earnings beat estimates. 4Q22 revenue jumped by 48.8% YoY to US$8.6bn, beating estimates by US$90mn. 4Q22 GAAP EPS was US$0.45, beating estimates by US$0.29. Gross Bookings grew by 19%YoY and 26% YoY (constant currency basis). The company guided 1Q23 Gross Bookings to grow by 20%-24% YoY on a constant currency basis.

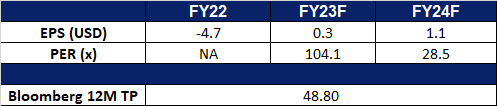

- Market consensus.

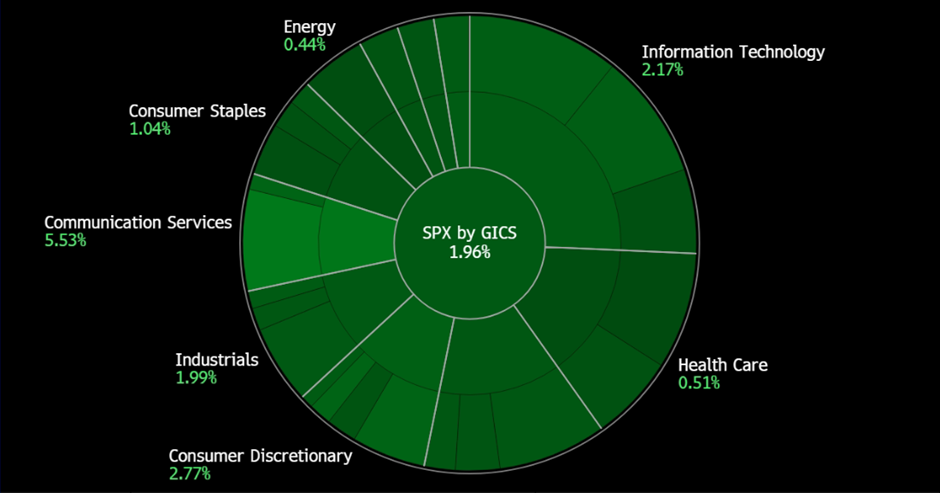

United States

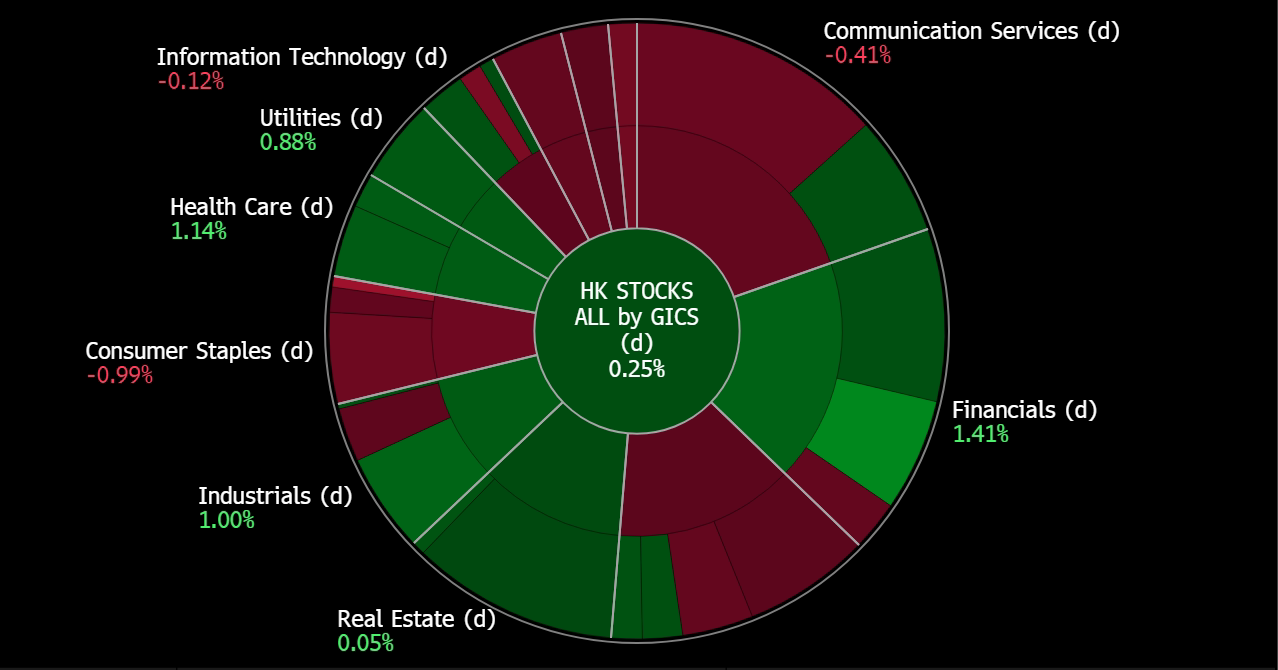

Hong Kong

Trading Dashboard Update: Take profit on Microsoft (MSFT US) at US$295.0. Cut loss on TheHourGlass (HG SP) at S$2.10 and SIA Engineering (SIE SP) at S$2.21.