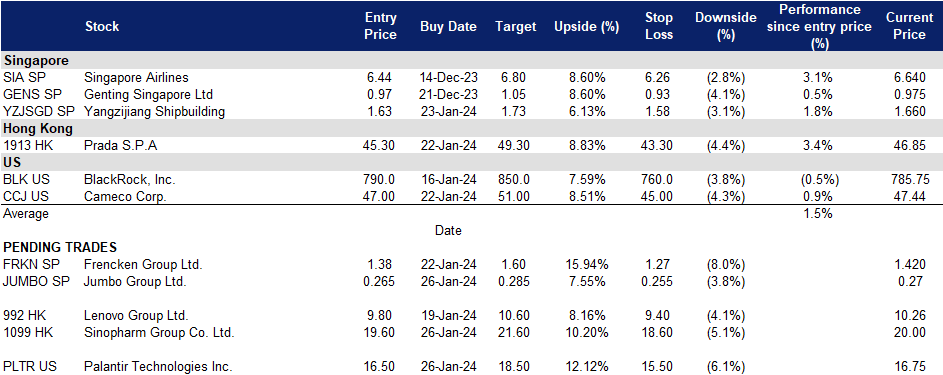

26 January 2024: Jumbo Group Ltd (JUMBO SP), Sinopharm Group Co. Ltd. (1099 HK), Palantir Technologies Inc (PLTR US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

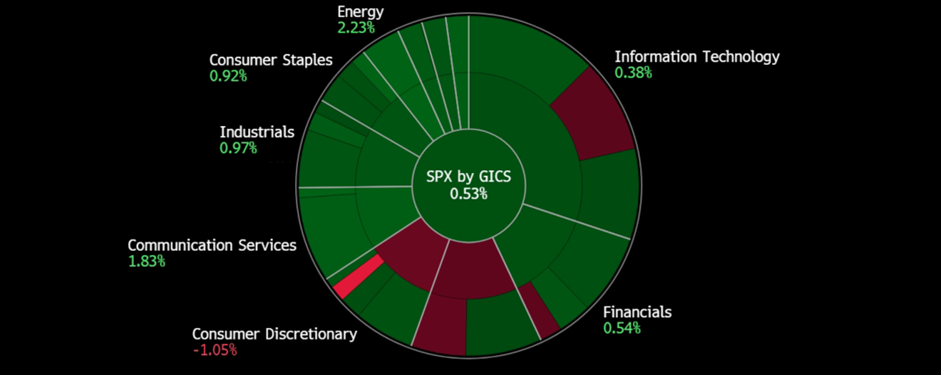

United States

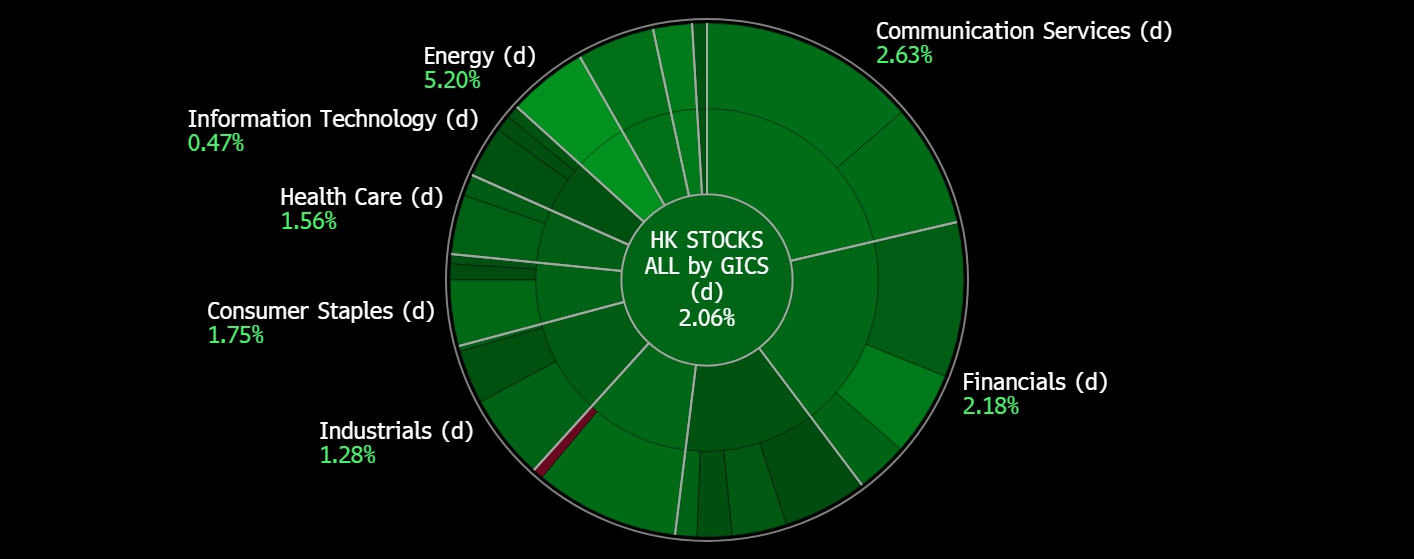

Hong Kong

Jumbo Group Ltd (JUMBO SP): Welcome more Chinese

- BUY Entry – 0.265 Target– 0.285 Stop Loss – 0.255

- Jumbo Group Ltd is a seafood restaurant group offering multiple dining concepts catering to all types of consumers. The Company offers restaurants in Singapore, China, and Japan.

- Mutual visa exemption. Starting on 9 February, Singapore and China will implement a 30-day visa-free arrangement, allowing ordinary passport holders from both countries to enter without a visa for up to 30 days. The agreement, signed on 25 January, aligns with the Chinese New Year holidays. China has similar comprehensive visa exemption arrangements with at least 22 countries, and this initiative aims to enhance travel between Singapore and China, particularly as the Chinese New Year falls on 10 February this year.

- Chinese tourism expected to rise. Despite weaker-than-expected consumer sentiment, analysts and survey data forecast a continued recovery of overseas travel by Chinese tourists in 2024. While China’s economic data suggests consumer caution, there is a notable rise in enthusiasm for travel and socializing in restaurants and bars. McKinsey predicts a shift from goods to services spending, contributing to the recovery of international travel. A forecast by Singapore-based China Trading Desk anticipates a 50% rise in international travel by Chinese tourists in 2024, reaching 62% of pre-pandemic levels. Singapore is expected to benefit from this tourism recovery, being the most popular destination among surveyed respondents. The impending 30-day mutual visa exemption arrangement between Singapore and China is seen as a positive development for boosting tourism. Jumbo is set to benefit from the increase in travellers and the shift to services spending.

- 2H23 results review. 2H23 revenue increased by 40.7% to S$92.8mn from S$66mn. Earnings rose 52% YoY to S$6.7mn from S$4.4mn due to a recovery in its sale of food and beverages sector. Cost of sales rose 46.5% to S$32.6mn, in tandem with revenue. In China, 2H23 revenue rose 15.3% to S$12.7mn due to the end of the country’s zero-Covid-19 policy in December 2022. In Taiwan, Jumbo’s top-line contributions rose 17.5% to S$1.9mn.

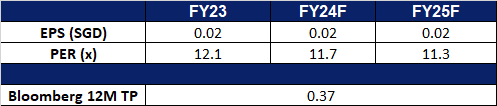

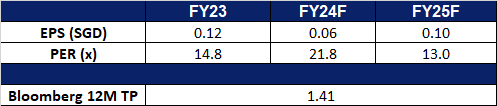

- Market Consensus.

(Source: Bloomberg)

Frencken Group Ltd (FRKN SP): Ride on the chip sector rally

Frencken Group Ltd (FRKN SP): Ride on the chip sector rally

- RE-ITEREATE BUY Entry – 1.38 Target– 1.60 Stop Loss – 1.27

- Frencken Group Limited (“Frencken”) is a Global Integrated Technology Solutions Company that is listed on the Main Board of the Singapore Exchange. They provide comprehensive Original Design, Original Equipment and Diversified Integrated Manufacturing solutions for world-class multinational companies in the analytical & life sciences, automotive, healthcare, industrial and semiconductor industries.

- Strong AI chip demand signal from world’s largest semiconductor producer. Taiwan Semiconductor Manufacturing’s strong demand for high-end chips used in artificial intelligence (AI) has propelled the semiconductor index up, contributing to broader market gains. The positive outlook for AI demand in 2024 has driven optimism, with experts foreseeing substantial revenue growth for semiconductor companies, indicating the early stages of a technological revolution. Nvidia, a key player in AI computing, also experienced share gains, reaching a fresh record peak. We anticipate that this positive momentum will translate into revenue generated by Frencken’s semiconductor segment, which accounted for about 40% of its Q3 revenue.

- Anticipated decline in interest rates. The Federal Reserve is anticipated to keep its key interest rate steady within the 5.25%-5.5% range in the January meeting. Although the market’s implied probability of a March cut has decreased from the high of 75% to 53.8%, signalling reduced confidence in an imminent rate cut, the Federal Open Market Committee had previously outlined plans for at least three rate cuts in 2024. The expected decline in rates throughout the year could contribute to increased valuations in the semiconductor sector.

- 3Q23 results review. 3Q23 revenue declined by 5.6% to $184.4mn. Earnings plunged 35.1% YoY to $7.1mn due to challenging business conditions for the technology sector. Gross profit margin contracted to 12.4% from 13.7% in 3Q22, attributing it to lower revenue, inflationary cost pressures as well as increased depreciation expenses.

- Market Consensus.

(Source: Bloomberg)

Sinopharm Group Co. Ltd. (1099 HK): Flu season

- BUY Entry – 19.6 Target – 21.6 Stop Loss – 18.6

- Sinopharm Group Co Ltd is a China-based company principally engaged in pharmaceutical and medical devices distribution business. The Company operates its business through four segments. Pharmaceutical Distribution segment is engaged in the distribution of pharmaceutical products to hospitals, other distributors, retail pharmacy stores and clinics. Medical Devices segment is engaged in the distribution of medical devices, as well as provides installation and maintenance services. Retail Pharmacy segment is engaged in the operation of chain pharmacy stores. Other Business segment is engaged in the distribution of laboratory supplies, manufacture and distribution of chemical reagents, production and sale of pharmaceutical products.

- Surge in flu cases. China has witnessed an increase in cases of acute infectious respiratory diseases since the onset of winter. According to JD Health, an online healthcare platform, sales of flu medication have experienced notable surges of 340% and 13%, respectively, in the initial 12 days of January when compared to figures from November and December. This heightened demand for respiratory disease medications in China has prompted major drug manufacturers to substantially ramp up their production. Industry experts anticipate a growing requirement for such remedies in the days ahead.

- Strategic Cooperations. Recently, the groundbreaking ceremony for the construction of the new Xinxiang Maternal and Child Health Hospital and Sinopharm Zhongyuan Children’s Hospital took place on the western side of Xinxiang Central Hospital’s east campus. This project marks a significant milestone in the ongoing medical reform collaboration between Sinopharm Group and the Xinxiang Municipal People’s Government, spanning over a decade. Sinopharm Group expresses its commitment to further deepen cooperation and engagement with the Xinxiang Municipal Party Committee and Municipal Government in the future. The company is dedicated to fulfilling the responsibilities of central enterprises, aiming to achieve even more fruitful and impactful collaborative outcomes.

- Increasing adoption of AI in healthcare technology. The influence of AI on healthcare is substantial, reshaping the delivery of medical services. The progress in healthcare technology through AI contributes to enhanced diagnostics, improving the efficiency and accuracy of treatments. Many companies are expected to embrace this trend in the near future. The ongoing development of AI in healthcare technology is likely to persist, driven by consumer preferences and the rise in chronic illnesses, particularly among a globally aging population, with China being a notable example.

- 9M23 earnings. Operating Revenue rose by 9.73% YoY to RMB445.9bn in 9M2023, compared to RMB406.4bn in 9M22. Net profit rose by 2.60% to RMB10.1bn in 9M2023, compared to RMB 9.81bn in 9M2022. Diluted EPS rose by 4.25% from RMB1.88 in 9M2022 to RMB1.96 in 9M2023.

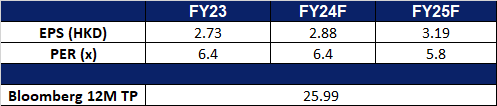

- Market consensus.

(Source: Bloomberg)

Prada S.P.A. (1913 HK): 90s fashion revives

- RE-ITEREATE BUY Entry – 45.3 Target – 49.3 Stop Loss – 43.3

- Prada SpA is an Italy-based company engaged in fashion industry. The Company is a parent of the Prada Group. The Company, along with its subsidiaries, is engaged in the design, production and distribution of leather goods, handbags, clothing, eyewear, fragrances, footwear and accessories. Prada SpA manufactures jackets, trousers, skirts, dresses, sweaters, blouses, as well as perfumes and watches, among others. The Company trades its products through several brands, such as Prada, Miu Miu, The Church and The Car Shoe. Prada SpA operates in approximately 70 countries through directly operated stores, franchise operated stores, a network of selected multi-brand stores and department stores. Prada Spa operates through a numerous subsidiaries, including Artisans Shoes Srl, Angelo Marchesi Srl, Prada Far East BV, Tannerie Megisserie Hervy SAS and Prada SA, among others.

- Chinese New Year Campaign. Prada has recently launched its Chinese New Year campaign for the Year of the Dragon in 2024, drawing inspiration from the nostalgic charm of Wong Kar-wai’s iconic films. Infused with romanticism and vibrant red tones, the campaign features Du Juan, the latest muse prominently featured in Wong Kar-wai’s recently debuted TV series, Blossoms Shanghai. Notably, Zhao Lei, recognized as the face of Yang Fudong’s film, First Spring, is showcased at the Pradasphere II exhibition in Shanghai. The collection introduces Re-Nylon bucket hats, patent leather mini bags, and pouches in cherry red, as well as black leather wallets and belts. Additionally, Prada Home contributes to the ensemble with quirky porcelain cups, collectively capturing the essence of this thematic celebration. This well-curated selection provides consumers with several choices for wardrobe staples for the Year of the Dragon.

- Expanding presence. Prada recently expanded its global presence through the acquisition of Fifth Avenue Store in New York City, with the transaction valued at US$425mn. The company highlights the strategic importance of the property’s location on Fifth Avenue. With Fifth Avenue in New York standing tall as the world’s most expensive retail street, it is bound to attract many shoppers and drive revenue for the company. Prada Group also recently formed a joint venture with Store Specialist Inc. (SSI) to own and operate the retail stores of the luxury brand Prada in the country. Prada Philippines will be 60% owned by Prada S.p.A., and 40 percent owned by SSI. The store has already begun operation since the start of 2024.

- Topping Lyst Index. Miu Miu, a Italian high fashion women’s clothing and accessory brand and a fully-owned subsidiary of Prada, topped the Lyst Index in 3Q2023, which is a quarterly ranking of fashion’s hottest brands and products. The formula behind The Lyst Index takes into account Lyst shoppers’ behavior, including searches on and off the platform, product views, and sales. To track brand and product heat, the formula also incorporates social media mentions, activity and engagement statistics worldwide, over three months. With Miu Miu still releasing several products such as the recent’s Wander matelassé nappa leather hobo bag, Miu Miu is likely to top the Lyst Index for 4Q2023.

- 9M23 earnings. Revenue rose by 10.3% YoY at constant exchange rates to €3.34bn in 9M2023, compared to €2.98bn in 9M22. Retail Sales rose 10.4% YoY at constant exchange rates to €298bn in 9M23, compared with €2.65bn in 9M22, driven by like-for-like and full-price sales.

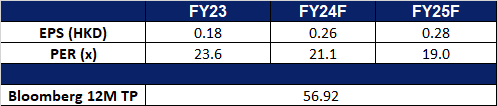

- Market consensus.

(Source: Bloomberg)

Palantir Technologies Inc (PLTR US): Lagging behind

- BUY Entry – 16.5 Target – 18.5 Stop Loss – 15.5

- Palantir Technologies Inc. develops software to analyze information. The Company offers solutions support many kinds of data including structured, unstructured, relational, temporal, and geospatial. Palantir Technologies serves customers worldwide.

- Good results expected. Palantir raised its guidance after strong Q3 earnings, with 33% YoY growth in US commercial revenue to $116 million, showcasing a shift from relying on government contracts. The company’s AI business is gaining traction, as seen in a 45% YoY increase in commercial customers and a robust 23% YoY growth in commercial revenue. The Artificial Intelligence Platform (AIP) has witnessed rapid adoption, with users nearly tripling in 3Q23, and Palantir plans to aggressively expand AIP to commercial customers through boot camps. The company’s redesigned go-to-market approach is accelerating commercial deal growth, with deal count and total contract value showing significant increases. The positive impact of AI is reflected in investors expectations for growth in revenue for the fourth quarter. Notably, the company’s third-quarter results mark its fourth-straight quarter of profitability, which makes it eligible for inclusion in the S&P 500.

- To catch up. The recent market surge in the S&P 500 and Nasdaq Composite, driven by strong results and guidance from major companies like Netflix and Taiwan Semiconductor. Small and mid-cap companies which belongs to the AI theme shall catch up the rally.

- 3Q23 earnings review. Revenue rose by 16.8% YoY to US$558mn, beating estimates by US$2.08mn. Non-GAAP EPS was US$0.07, beating estimates by US$0.01. It raised revenue guidance for FY23 to be between US$2.216bn – US$2.220bn vs. the consensus of US$2.21B.

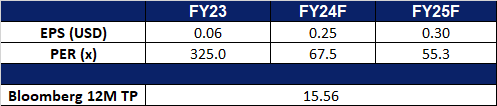

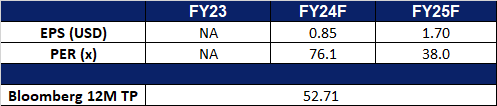

- Market consensus.

(Source: Bloomberg)

Cameco Corp. (CCJ US): Supplies running low

- RE-ITEREATE BUY Entry – 47 Target – 51 Stop Loss – 45

- Cameco Corporation explores, develops, mines, refines, converts, and fabricates uranium. The Company offers uranium for sale as fuel for generating electricity in nuclear power reactors. Cameco operates worldwide.

- Prices sky rocketing. Uranium has soared to US$106 per pound, reaching its highest level since 2007. The market has faced pressure for the past five years due to a global crackdown on fossil fuels, particularly coal, leading to potential electricity supply constraints. Increased demand for electrification, especially in vehicles, and a shift in perception of nuclear power as a relatively benign form of energy generation contribute to the uranium market’s boom. Kazatomprom, a major producer of uranium, warned that it is likely to fall short of its output targets over the next two years due to raw material shortages and disruptions, driving uranium prices upwards. Despite historical incidents at nuclear power plants, ongoing strong demand has begun outstripping Uranium supply. Persistent supply limitations in the uranium market coincide with a rising demand for the metal, crucial for nuclear energy production. At the Dubai COP28 climate summit last year, 22 countries pledged to triple nuclear capacity by 2050 further underscoring this growth in demand.

- Uranium enrichment funding. Recently, the US Department of Energy’s top nuclear energy official, urged Congress to approve a White House supplemental funding request of US$2.16bn for nuclear fuel enrichment. The additional funding aims to expand domestic conversion and enrichment facilities, reducing dependence on Russian uranium. The move is crucial for ensuring a sufficient supply of fuel for current and future nuclear reactors in the US. The US Department of Energy (DOE) has been soliciting bids from contractors to establish a domestic supply of high assay low enriched uranium (HALEU) fuel enriched up to 20%, currently available commercially only from Russia. Contracts of up to 10 years are sought from enrichment service companies to produce HALEU fuel, and the DOE has approximately US$500mn in funding for this purpose. The program is aimed at procuring fuel supplies to support the next generation of reactors, including those developed by X-energy and TerraPower. The move aligns with President Biden’s climate change agenda, but concerns about nuclear proliferation risks have been raised by experts. The only US company with a license to produce HALEU is Centrus Energy, which hopes the request for proposals will lead to more production at its Ohio plant. European uranium enrichment company Urenco could potentially produce US HALEU but currently lacks a license.

- 3Q23 results. Revenue rose to US$575mn, up 47.8% YoY, beat expectations by US$51mn. Non-GAAP EPS beat estimates by US$0.22 at US$0.32.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take profit on Netflix Inc (NFLX US) at US$537.75, RTX Corporation (RTX US) at US$91.5 and CNOOC Ltd (883 HK) at HK$14.