25 October 2023: DBS Group Holdings Ltd (DBS SP), Sunny Optical Technology Group (2382 HK), Lockheed Martin Corp (LMT US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

United States

Hong Kong

Geo Energy Resources Limited (GERL SP): Profit off from seasonality

- BUY Entry 0.260 – Target – 0.305 Stop Loss – 0.240

- Geo Energy Resources Limited is an integrated coal mining specialist. The Company owns and operates coal mines, offers mine contracting services to third-party mine owners, and sells coal to coal traders and export companies.

- War chest secured. The company announced that it has secured US$200mn term loan facilities with an 8.5% p.a. Interest rate and tenor of up to 5 years from Bank Mandiri. The loan is used for potential acquisitions, working capital and other expenditures.

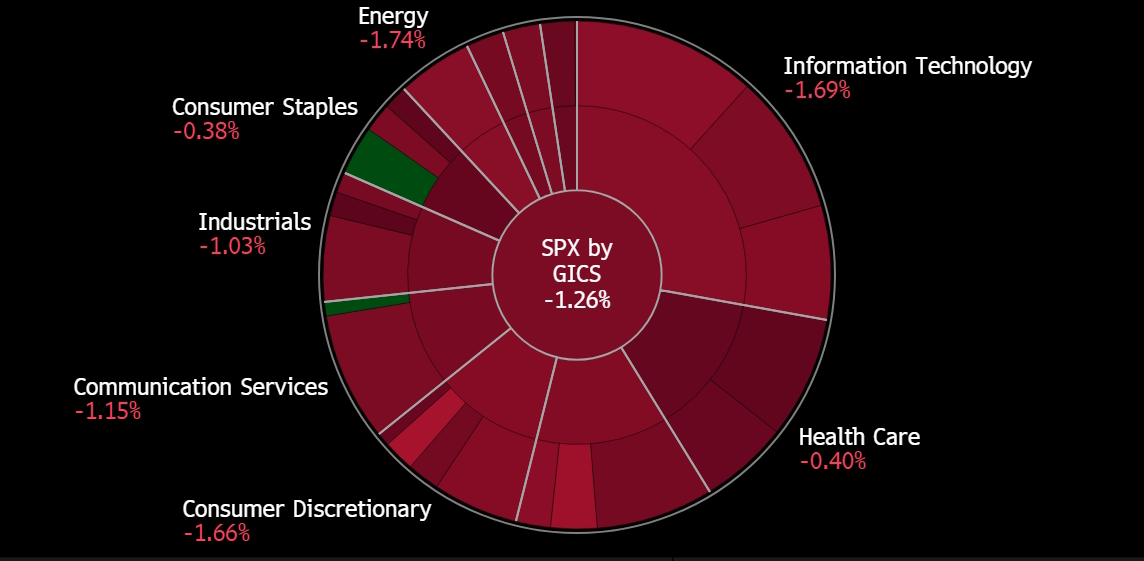

- Re-stocking season coming. China’s economic recovery has been lukewarm since its reopening in 4Q22. However, its coal demand remains resilient as higher electricity consumption is driven by the recovery in the service sectors. Meanwhile, the increasing penetration of electric vehicles also drives power demand higher. Seasonally, 4Q is the peak season of both electricity and coal demand, and hence, power companies start restocking their coal inventories for the coming winter. Accordingly, coal prices are expected to edge up higher.

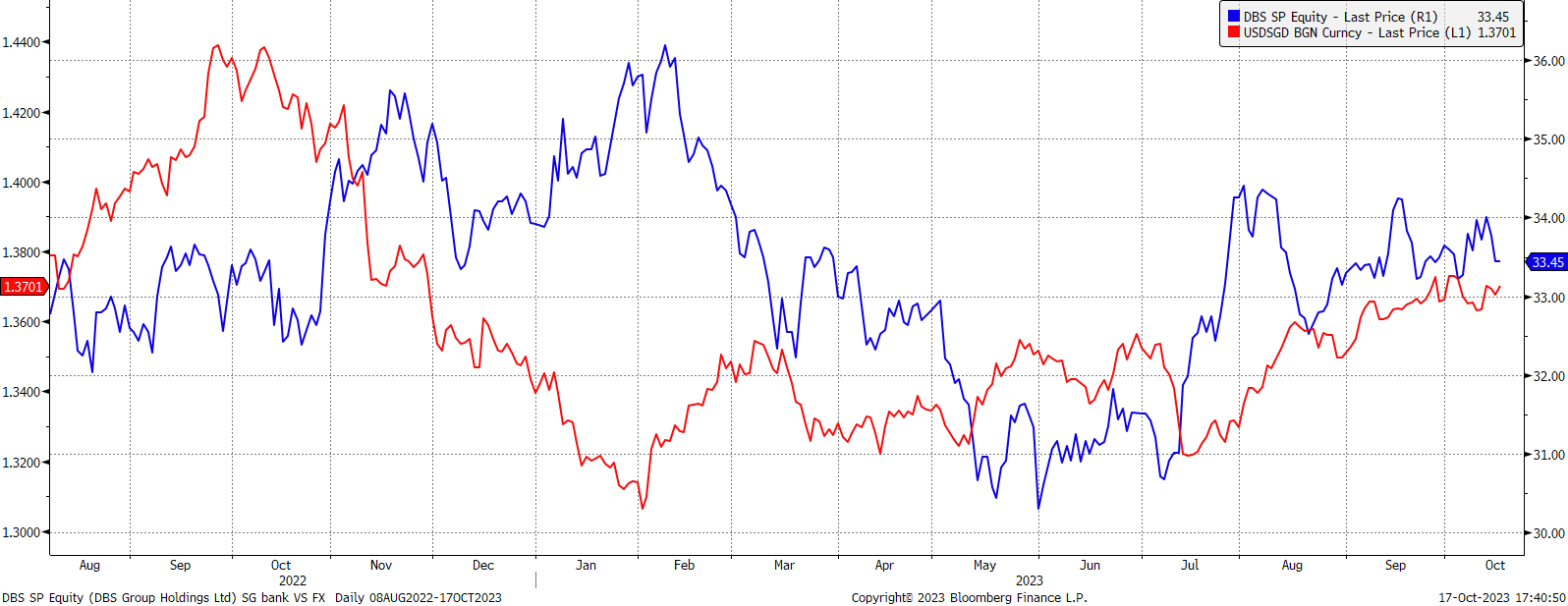

Indonesia’s coal exports to China seasonality

(Source: Bloomberg)

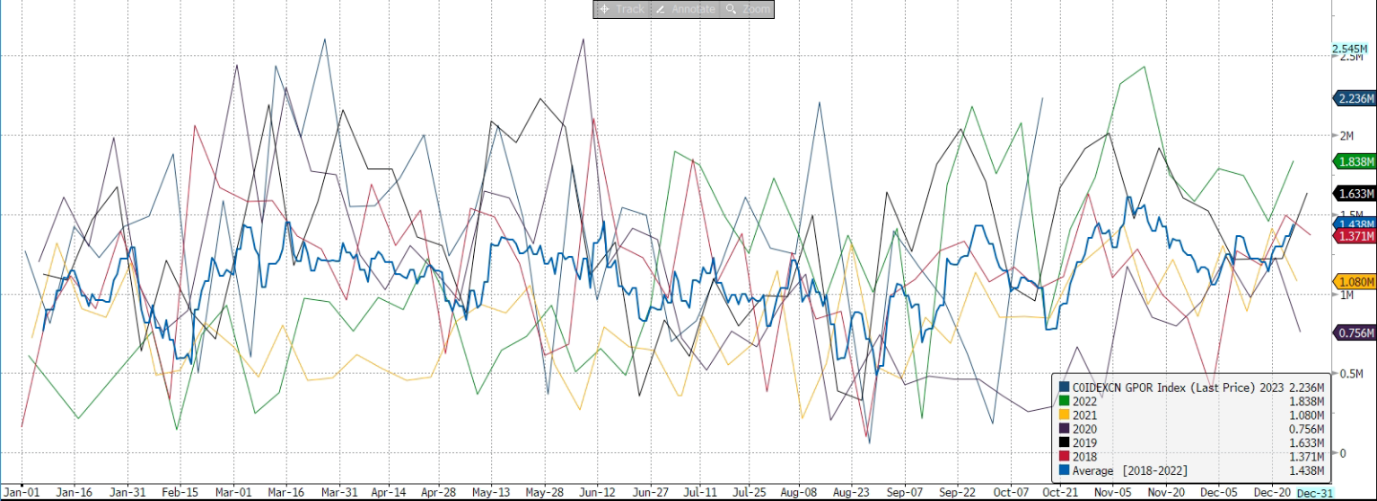

China port coal stocks

(Source: Bloomberg)

Indonesia 4,200 GAR coal futures

(Source: Bloomberg)

- Attractive dividend yield. Geo Energy has been paying consistent quarterly dividends. The current trailing 12M dividend yield is 24%.

(Source: Bloomberg)

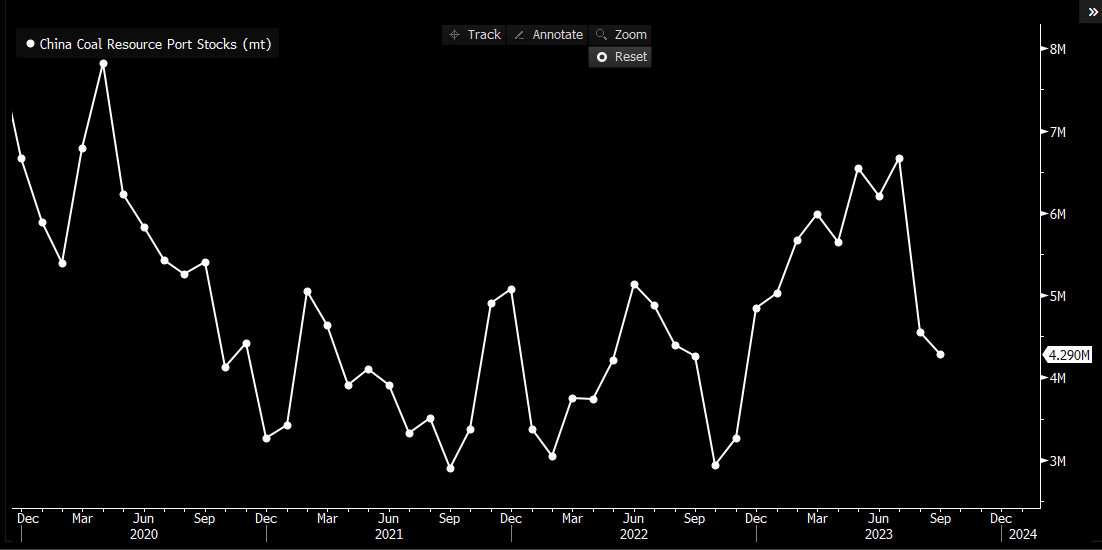

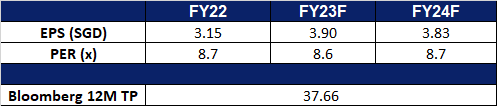

DBS Group Holdings Ltd (DBS SP): SGD strengthens again

- RE-ITERATE BUY Entry 33.10 – Target – 34.50 Stop Loss –32.35

- DBS Group Holdings Limited and its subsidiaries provide a variety of financial services. The Company offers services including mortgage financing, lease and hire purchase financing, nominee and trustee, funds management, corporate advisory and brokerage . DBS Group also acts as the primary dealer in Singapore government securities.

- New feature coming soon. OCBC, DBS, and UOB are introducing a new security feature to lock up customers savings in response to scams in Singapore. DBS recently announced the upcoming roll-out of a new banking account, “digiVault” that will adopt a “digitally in, only physically out” approach. DBS will launch its digiVault feature on their Digital app by the end of November, and will be made available after customers verify their identity physically. Customers will be able to make fund transfers digitally into this new account, but not out of the account.This feature aims to empower customers to secure their funds, reducing the risk of falling victim to scams while maintaining the convenience of digital banking.

- Jumping into the metaverse. DBS Bank is developing a metaverse game called DBS BetterWorld to raise awareness of sustainability issues, particularly global food waste. The game will be available later this year on The Sandbox platform and will allow players to interact with characters, take part in activities, and earn in-game rewards. DBS is partnering with sustainable companies to create the game and is using the metaverse to engage with its younger customers and promote its brand values.

- Largest foreign bank in Taiwan. DBS Bank recently acquired Citigroup’s consumer banking business in Taiwan, becoming the largest foreign bank by assets in the market. The deal effectively doubled DBS’ consumer banking customers in Taiwan and its credit card accounts climbed nearly fivefold. DBS paid a lower premium for the purchase than originally expected, and said the deal would accelerate its consumer business growth in Taiwan by at least 10 years. The acquisition is part of DBS’ strategy to build meaningful scale in its core Asian markets.

Share price and USD/SGD correlation

(Source: Bloomberg)

(Source: Bloomberg)

- 2Q23 results review. Profit rose 48% YoY to S$2.69bn from S$1.82bn in 2Q22, beating forecast. This jump in profit was due to higher interest rates and strong inflow of wealth into Singapore.

- Market consensus.

(Source: Bloomberg)

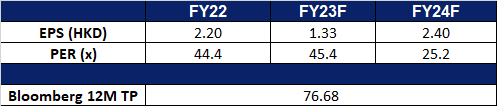

Sunny Optical Technology Group (2382 HK): A smart recovery

- BUY Entry – 63.0 Target – 69.0 Stop Loss – 60.0

- Sunny Optical Technology (Group) Company Limited is an investment holding company principally engaged in the design, research and development, manufacture and sale of optical and optical related products and scientific instruments. The Company operates its business through three segments: Optical Components, Optoelectronic Products and Optical Instruments. Through its subsidiaries, the Company is also engaged in the research and development of infrared technologies. The Company distributes its products in domestic market and to overseas market.

- Recovery of China’s smartphone market. China’s smartphone market, which has been declining since the beginning of the year, is showing signs of recovery, thanks to strong demand for Huawei’s new 5G phones and Apple’s recently launched iPhone 15 series. The recent “golden week” holiday saw a 15% YoY growth in smartphone sales in China. The global smartphone market also underwent a slight drop of 1% in 3Q23, signalling a slowdown in its decline, and also recorded double-digit sequential growth in 3Q23, ahead of the sales seasons, supported by regional recoveries and new product upgrade demand. Sunny Optical would be able to tap on the recovery of the smartphone market to drive sales to its customers.

- Huawei’s Mate 60 Pro handsets surging sales. Huawei Technologies reportedly sold 1.6mn of its Mate 60 Pro handsets in 6 weeks, despite a slowdown in the global smartphone market. Huawei also saw strong demand for its high-end smartphone renaissance over the same period in which Apple launched the iPhone 15 in mainland China, with its stocks being swiftly bought up as soon as it became available. With Huawei being one of Sunny Optical’s biggest customer for camera modules, Sunny Optical is bound to benefit from the strong demand for high-end Huawei’s products.

- 1H23 earnings. Revenue fell by 15.9% YoY to RMB14.28bn, compared to RMB16.97bn in 1H22. Net profit fell by 66.7% YoY to RMB459.4mn, compared to RMB1.38bn in 1H22. Basic EPS fell by 67.8% YoY to RMB39.99, compared to RMB124.13 in 1H22.

- Market Consensus.

(Source: Bloomberg)

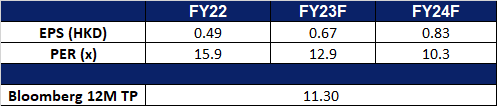

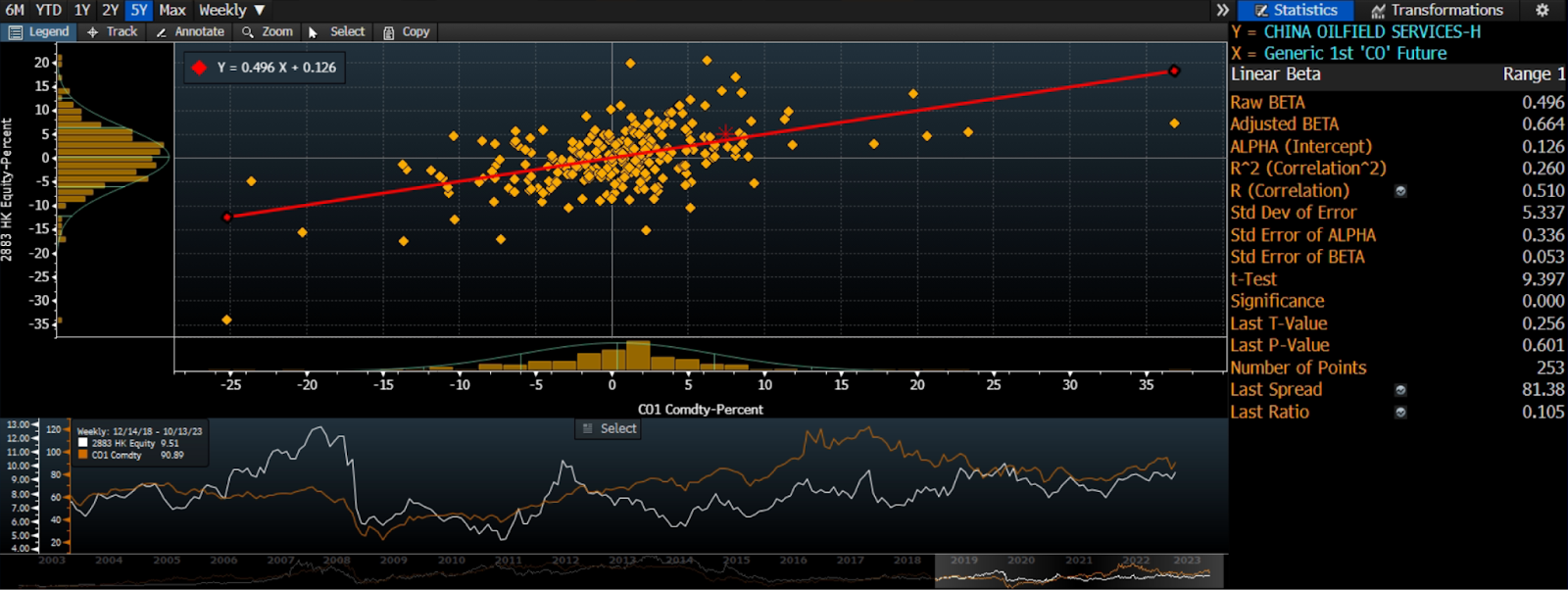

China Oilfield Services (2883 HK): Capturing Oil Demand

- RE-ITERATE BUY Entry – 9.00 Target – 9.70 Stop Loss – 8.60

- China Oilfield Services Limited is a comprehensive oilfield service provider. The Company mainly operates through four business segments. The Drilling Services segment is mainly engaged in the provision of oilfield drilling services. The Oil Field Technical Services segment is mainly engaged in the provision of oilfield technical services, including the logging, drilling fluids and directional drilling services. The Geophysical and Engineering Exploration Services segment is mainly engaged in the provision of seismic prospecting and engineering exploration services. The Marine Support Services segment is engaged in the transportation of supplies, including the delivery of crude oil, as well as refined oil and gas products. The Company mainly operates its businesses in domestic and overseas markets.

- New Contract. China Oilfield Services recently secured a contract to deliver comprehensive onshore oilfield services to an undisclosed major oil company in Mexico, with the contract bring valued at around US$123mn. This contract will be executed through its Mexican subsidiary, signifying a strategic shift for the Chinese company. This shift aims to facilitate a transition from primarily focusing on its drilling business to giving equal attention to equipment and technology in Mexico.

- New jack-up drilling rigs. China Oilfield Services recently announced that the company has agreed to buy 4 jack-up drilling rigs from Dalian Shipbuilding Offshore, at a total contract price of around US$445.3mn excluding tax. This purchase would allow the company to meet its operating needs, enhancing their market competitiveness, and further improve the quality of large-scale equipment.

- Demand for oil to outgrow supply. World oil demand is surging to record levels, with growth being driven by a number of factors, including a rebound in air travel, increased oil use in power generation, and strong demand from China’s petrochemical industry. Demand is expected to rise by 2.3 mb/d in 2023, reaching 101.9 mb/d, according to the latest IEA Oil Market Report. China is expected to account for more than 70% of this growth. Additionally, major oil-producing countries, including Saudi Arabia, also recently announced that they would be extending the voluntary oil cuts to year-end, putting more constraints on oil supply, and driving up oil prices in the near term. Saudi Arabia will be extending its voluntary oil cut of 1mn barrels per day to the end of 2023, and Moscos will be extending its voluntary oil cut of 300,000 barrels per day to end of 2023, with both countries to still review the cuts monthly. Consequently, the cost of oil is anticipated to increase within the market.

- 1H23 earnings. Revenue rose by 24.1% YoY to RMB18.9bn, compared to RMB15.2bn in 1H22. Net profit rose 31.0% YoY to RMB1.46bn, compared to RMB1.11bn in 1H22. Basic EPS rose by 21.1% YoY to RMB28.06, compared to RMB23.17 in 1H22.

- Market Consensus.

Share price and Brent crude oil price correlation

(Source: Bloomberg)

(Source: Bloomberg)

Lockheed Martin Corp (LMT US): Increasing safeguards due to worsening conflict

- BUY Entry – 446 Target – 480 Stop Loss – 429

- Lockheed Martin Corporation is a global security company that primarily researches, designs, develops, manufactures, and integrates advanced technology products and services. The Company’s operations span space, telecommunications, electronics, information and services, aeronautics, energy, and systems integration. Lockheed Martin operates worldwide.

- Israeli-Hamas conflict impact. The Israel-Hamas conflict, which has recently escalated and extended for more than a week, is causing significant regional uncertainty in the Middle East. This heightened conflict raises concerns about the defence industry. It can impact this industry by driving an increased demand for military equipment, potentially leading to higher weapon sales, fostering innovation and technological development in defense, creating export opportunities for nations supporting Israel, and influencing broader geopolitical dynamics that can affect global defense strategies and investments. Conflict situations often stimulate growth and innovation in the defence sector, with potential ripple effects across the industry. Israel’s close relationship with the U.S. may lead to additional support from American defence companies, potentially boosting defence contracts and sales. This regional instability could also create export opportunities for defence companies in supporting nations, further influencing global defence industry dynamics.

- US supplying arms to Israel. The Pentagon plans to send tens of thousands of 155mm artillery shells to Israel. Originally, these shells were intended for Ukraine but will now be diverted to Israel. The Israel Defense Forces and the Israeli Ministry of Defense expressed the urgent need for these artillery shells to prepare for potential conflicts in Gaza and along the Israel-Lebanon border. US officials believe that redirecting the shells to Israel will not immediately impact Ukraine’s capabilities in its conflict with Russia. While there’s concern about potential regional conflicts, the Pentagon is confident it can support both Ukraine and Israel in meeting their defence needs. This decision follows Israel’s increased use of artillery in response to recent hostilities. The ammunition was part of a US weapons stockpile in Israel, and the US agreed to send it back to Israel in response to the urgent request.

- Better expectations ahead. Lockheed Martin saw strong demand for its military equipment amid geopolitical tensions in Q3. The company reported weak sales in the F-35 fighter jet unit but the ongoing conflict in Ukraine has led to increased demand for weapons like shoulder-fired missiles and artillery, benefiting defense companies. Lockheed’s weapons, including the multiple launch rocket system and Javelin anti-tank missiles, have been crucial in Ukraine’s defense. However, pandemic-related labour and supply chain disruptions, particularly in the aeronautics business, have impacted the company’s performance. Sales in the aeronautics unit declined by 5.2% in the third quarter, while revenue from the Missiles and Fire Control unit increased by 3.8%. With the recent Israeli-Hamas conflict, it is anticipated that there will be an increase in sales demand.

- 3Q23 results. Revenue rose 1.8% year-over-year to US$16.88bn, beating estimates by US$160mn. Non-GAAP EPS of $6.77 beat expectations by $0.15. FY2023 outlook: Net sales of $66.25bn – $66.75bn vs. consensus of $66.64bn; Diluted EPS of $27 to $27.2 vs. consensus of $27.11. Increased share repurchase authority by $6.0bn to a total authorisation of $13.0bn.

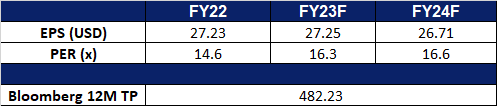

- Market consensus.

(Source: Bloomberg)

Coinbase 全球 (COIN US):牛市可能已经开始了

- 重申买入:买入价:75,目标价:87,止损价:69

- Coinbase全球公司提供金融解决方案。该公司提供买卖加密货币的平台。

- 已取得主要支付机构牌照。Coinbase新加坡获得了新加坡金融管理局颁发的主要支付机构许可证,允许该交易所将其数字支付代币服务扩展到新加坡的个人和机构。

- 比特币重回2.8万美元。在26,000美元左右横盘后,比特币价格小幅上涨,在27,000美元至28,000美元之间波动。比特币每4年减半一次,下一次减半日期是2024年4月25日。比特币减半导致挖矿产量放缓。换句话说,减半日期之后的比特币供应量将会减少。基于前两次减半,比特币经历了18个月的牛市周期(前两次减半日期:2016年7月9日和2020年5月11日)。从历史上看,比特币的上涨势头始于减半日期前6个月。因此,比特币的上涨周期可能已经开始。

比特币减半

(Source: Bloomberg)

- 市场预期还会有一次加息。当前增长型/风险型资产的抛售可归因于长期的高利率预期。鉴于美国强劲的劳动力市场和居高不下的通胀,预计美联储将在2023年底前再加息25个基点。与此同时,美国10年期国债收益率升至近4.9%,为2007年以来的高点。然而,油价暴跌和消费支出疲软减轻了通胀压力。利率峰值预期依然存在,风险型资产预计将在近期反弹。

- 23财年第二季业绩。营收增长至7.079亿美元,同比下降12.4%,超出预期7,010万美元。GAAP每股亏损为0.42美元,比预期高出0.36美元。

- 市场共识。

(Source: Bloomberg)

Trading Dashboard Update: Add Geo Energy Resources (GERL SP) at S$0.285, CNOOC Ltd. (883 HK) at HK$13.3, Sunny Optical Technology Group (2382 HK) at HK$63 and Lockheed Martin Corp (LMT US) at US$446.