25 March 2024: Banyan Tree Holdings Ltd (BTH SP), Xtep International Holdings Ltd. (1368 HK), Goldman Sachs Group Inc (GS US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

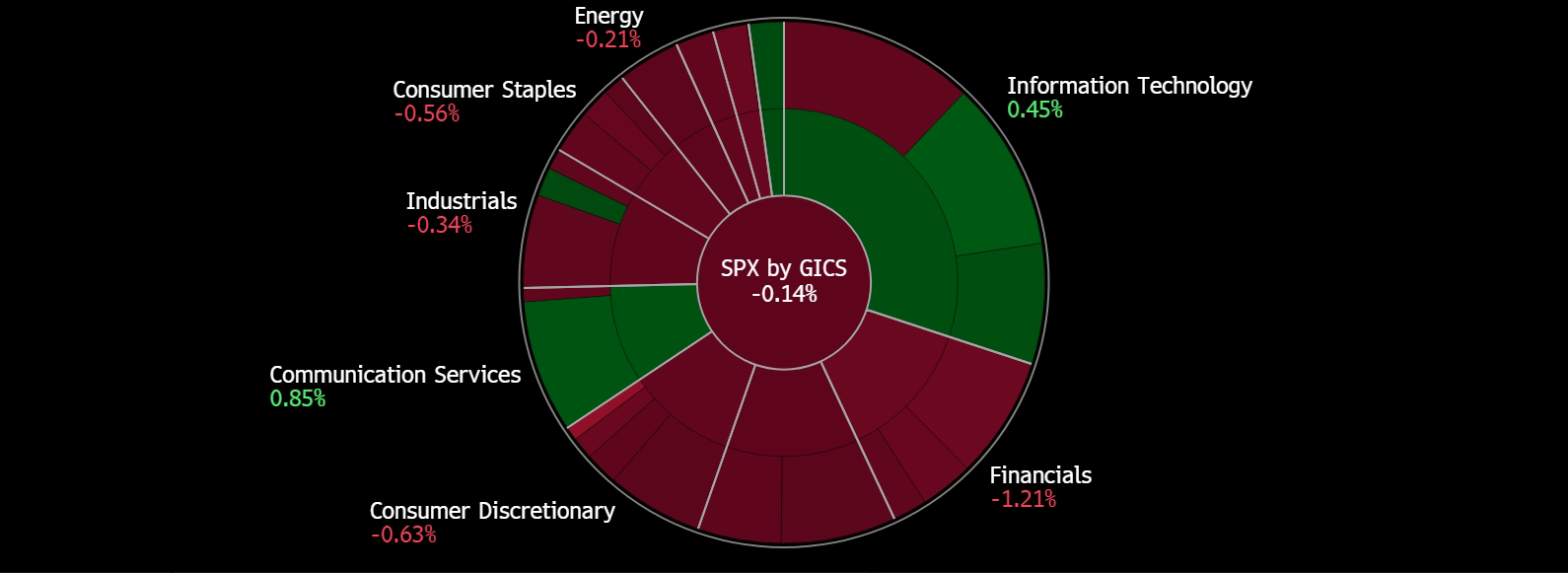

United States

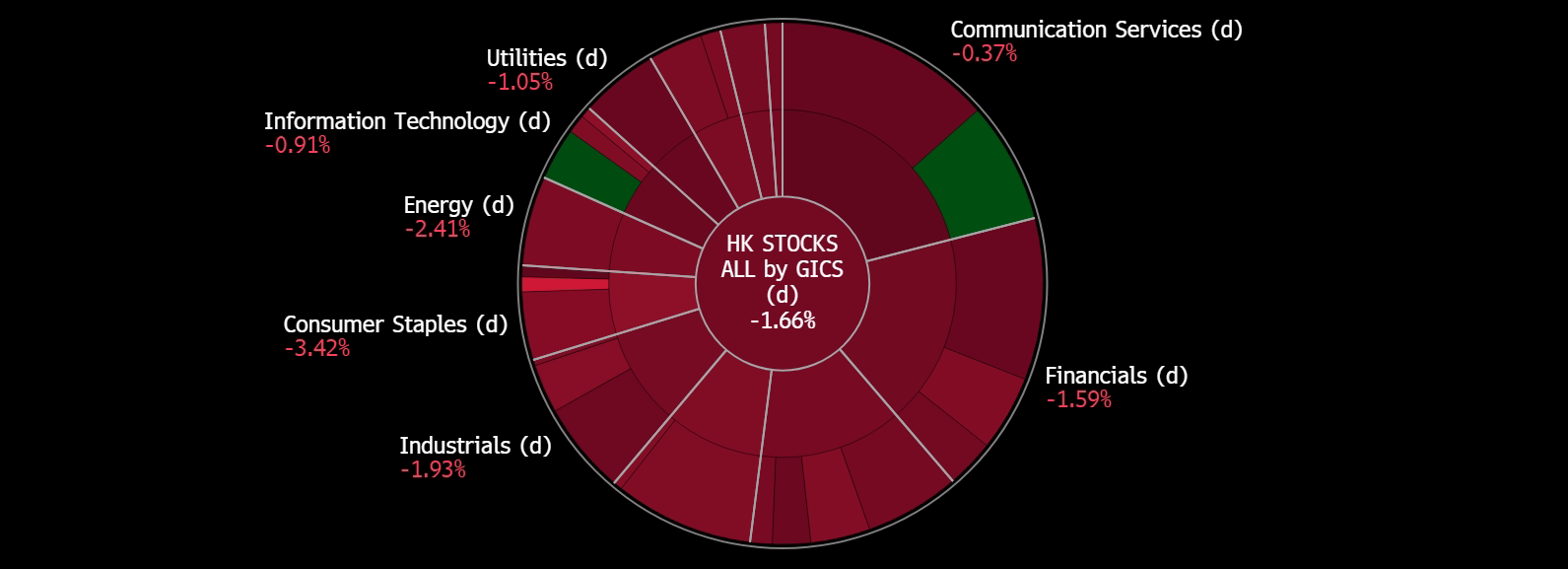

Hong Kong

News Feed |

2. China Scrutinizes PwC Role in $78 Billion Evergrande Fraud Case |

4. China boosts supervision of fund firms, launches inspections, newspaper reports |

Banyan Tree Holdings Ltd (BTH SP): Doubling profits

- Entry – 0.365 Target– 0.390 Stop Loss – 0.350

- Banyan Tree Holdings Limited operates as a holding company. The Company, through its subsidiaries, owns and manages hotel groups. The Company focuses on hotels, resorts, spas, galleries, golf courses, and residences, as well as provides investments, design, construction, and project management services. Banyan Tree Holdings serves customers worldwide.

- Success in joint venture. Banyan Tree Residences Creston Hill, the inaugural luxury branded residences near Khao Yai National Park, celebrated the success of its presales phase valued at THB17bn. Managed by Banyan Tree in partnership with Creston Holding Ltd., the venture reflects a rising demand for upscale residences in Thailand. With presales surpassing THB1bn, its Managing Director anticipates increased interest with the unveiling of fully furnished display units. The project caters to the growing trend of luxury living amidst nature, appealing to permanent residents and holidaymakers. The strategic location, near the upcoming Motorway 6, enhances accessibility. The development offers 21 pool villas and 16 condominium buildings, designed to blend seamlessly with the serene landscape. Future phases will introduce additional villas and condominiums. Buyers benefit from Banyan Tree’s exclusive owner programme, “The Sanctuary Club,” granting privileges across global properties. Situated just 200km from Bangkok, Khao Yai offers diverse activities, making Creston Hill an ideal second home. The on-site sales gallery welcomes prospective buyers with exclusive promotions during the presales period.

- 30th anniversary new launches. Banyan Tree announced a robust pipeline of 19 new property openings. Under the new corporate brand umbrella, Banyan Group, the company expanded beyond its luxury offerings with brands like Angsana, Cassia, and Dhawa. New destinations include Japan, Saudi Arabia, Vietnam, and South Korea. Sustainability commitments include a 2030 Sustainability Roadmap aligned with UN targets. Laguna Lakelands in Phuket promises immersive living with nature-integrated development. New initiatives include Beyond, a digital companion for holistic experiences, and withBanyan, an experiential members program.

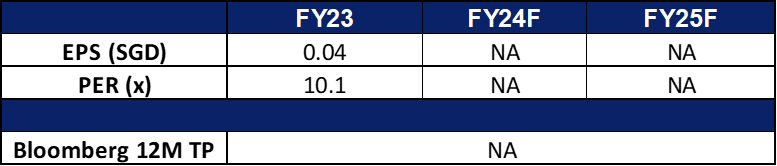

- FY23 results review. FY23 revenue inclined by 21% to S$327.9mn. Net profit rose significantly to S$31.7mn, compared to S$767,000 in FY22. FY23 operating profit more than doubled to S$90.1mn. It declared a final dividend of S$0.012 for FY23.

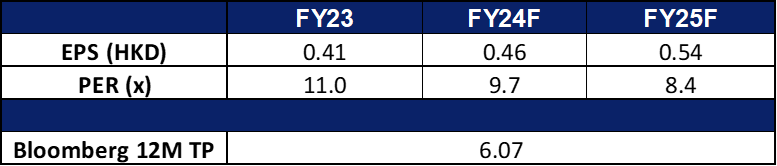

- Market Consensus

(Source: Bloomberg)

Bumitama Agri Ltd (BAL SP): Palm oil rebounding

- RE-ITERATE Entry – 0.67 Target– 0.71 Stop Loss – 0.65

- Bumitama Agri Ltd. produces CPO and PK, with its oil palm plantations located in Indonesia. The Company’s primary business activities are cultivating and harvesting our oil palm trees, processing FFB from its oil palm plantations, its plasma plantations and third parties into CPO and PK and selling CPO and PK in Indonesia.

- Palm oil prices on the rise. Malaysian palm oil futures rose to a 52-week high recently, from around MYR 3,700/T since Jan, to its current level of around MYR 4,250/ T, driven by current low stockpiles which led to a mini rally in palm oil prices. Palm oil inventory in Malaysia for February dropped to just over 1.9 mn tonnes from 2.0mn tonnes in January. Demand for palm oil also has remained strong, especially from the largest importer India, where inclement weather has prompted higher imports of edible oils.

- Expectation of strong demand for palm oil amidst stagnant supply. The outlook for the palm oil market in 2024 appears optimistic, as indicated by Malaysia’s Plantation and Commodities Minister. Strong demand is anticipated from key export destinations such as India, China, and the European Union. However, projections suggest that crude palm oil (CPO) production in Indonesia is likely to remain largely unchanged at 49 million tonnes in 2024 compared to the previous year. This stability is attributed to factors like adverse weather conditions and a slower pace of re-planting activities. As a result, palm oil supply is expected to remain constrained in the first quarter of 2024, primarily due to seasonally lower production levels and recent inclement weather hampering harvesting operations.

- Expected increased demand from Ramadan fasting period. The ongoing Ramadan fasting period and preparations for the Eid-al Fitr festival is likely to indirectly spur a higher demand for palm oil as families and communities gather for elaborate meals. This upsurge in food preparation naturally leads to a higher demand for cooking oil, and palm oil is a popular choice due to its versatility and affordability.

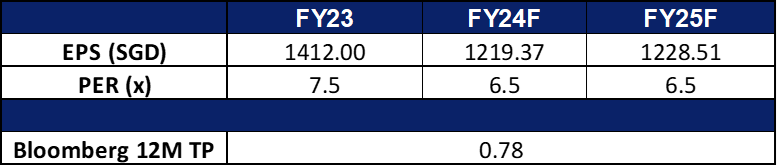

- FY23 results review. FY23 revenue declined by 2.4% to IDR15,442bn, compared to IDR15,829bn in FY22. Net profit declined 13.8% YoY to IDR2,931bn, compared to IDR3,398bn in FY22. Basic EPS fell to IDR 1,412 in FY23 compared to IDR1,618 in FY22.

- Market Consensus

(Source: Bloomberg)

Xtep International Holdings Ltd. (1368 HK): Marathon season

- BUY Entry – 4.80 Target – 5.20 Stop Loss – 4.60

- Xtep International Holdings Ltd is a China-based company principally engaged in the design, development, manufacturing, sales, marketing, and brand management of sports products, including footwear, apparel, and accessories. The Company operates its businesses through three segments. The Mass Market segment’s signature brand is Xtep. The Athleisure segment’s signature brands are mainly K-Swiss and Palladium. The Professional Sports segment’s signature brands are Saucony and Merrell. The Company distributes its products both in the domestic market and to overseas markets.

- Marathon season. As spring arrives, China gears up for its marathon season, marking a significant resurgence in outdoor events as the nation emerges fully from the COVID-19 pandemic. Over the next two months, numerous marathons are scheduled across the country, including the Chengdu Panda Marathon at the end of March 2024, the Beijing Half Marathon in April 2024, and the Great Wall of China Marathon in May, among others. The Beijing Half Marathon has already garnered immense interest, with a record-breaking 97,988 participants from 42 countries and regions pre-registered for the event. Many marathon enthusiasts in China are expected to invest in new running or training shoes in preparation for these races. As a major player in the sportswear industry, Xtep International stands poised to capitalize on the opportunities presented by the upcoming Marathon Season.

- Strong earnings despite a weak economy. Xtep International has recently announced its earnings, revealing a 10.9% year-on-year increase in revenue and an 11.8% rise in net profit in China. These strong financial results reflect the company’s robust business model and successful rebranding efforts across its brands, including K-Swiss and Palladium. Despite challenging economic conditions characterized by weak consumer spending, Xtep achieved impressive sales figures in China. This stands in stark contrast to other major sportswear brands such as Nike, which recently reported a slower sales growth of approximately 5% in China.

- Expected resurgence of the sports industry in China. Recently, China’s top sports official highlighted ongoing efforts to combat corruption and illegal gambling, aiming to rejuvenate the sports industry. Moreover, Chinese authorities are striving to position China as a comprehensive sports powerhouse by 2035, with plans to host major international competitions like the 2025 Asian Winter Games, 2027 World Athletics Championships, and 2029 World Aquatics Championships. Throughout the past year, China’s sports sector has experienced consistent and robust expansion, marked by diverse mass participation events such as National Fitness Day and grassroots initiatives in ice and snow sports. Furthermore, there has been significant progress in the development of sports infrastructure, with the per capita sports venue area reaching 2.89 square meters in 2023, representing a remarkable 107% increase from 2019.

- FY23 earnings. Total revenue rose 10.9% YoY to RMB14.35bn in FY23, compared to RMB12.93bn in FY22. Net profit increased 11.75% YoY to RMB1.03bn in FY23, compared to RMB921.7mn in FY22. Basic earnings per share rose to RMB40.76 in FY23, compared to RMB36.61 in FY22.

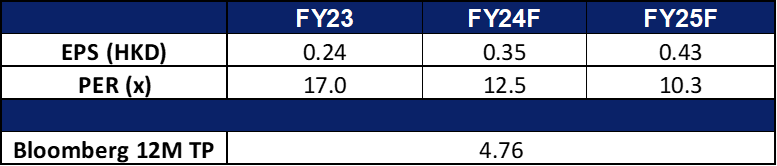

- Market consensus.

(Source: Bloomberg)

Aluminium Corp of China Ltd (2600 HK): Aluminium rebound

- RE-ITERATE BUY Entry – 4.65 Target – 5.05 Stop Loss – 4.45

- Aluminum Corp of China Ltd is a China-based company principally engaged in the production and sales of alumina, primary aluminum and aluminum alloy products. The Company operates businesses through five segments. The Alumina segment is engaged in the production and sales of alumina, fine alumina and aluminum ore. The Primary Aluminum segment is engaged in the production and sales of primary aluminum, carbon products, aluminum alloys and other electrolytic aluminum products. The Energy segment is mainly engaged in coal mining, thermal power generation, wind power generation, photovoltaic power generation and new energy equipment manufacturing. The Trading segment mainly provides alumina, primary aluminum, aluminum processed products and other non-ferrous metal products and coal and other raw materials, auxiliary materials trading and logistics services. The Headquarters and Other Operating segment is engaged in other research and development of aluminum business and other activities.

- Aluminium price rebound. The price of aluminum has surged to its highest level in three months, climbing from approximately US$2200 per metric ton at the end of February to its current rate of US$2300 per metric ton. This uptick is attributed to renewed indications of economic stimulus measures in China, specifically targeting demand stimulation. While there are apprehensions regarding escalating inventory levels in China, some suggest that this might follow a seasonal trend as the country readies itself for heightened consumption in the second quarter of the year.

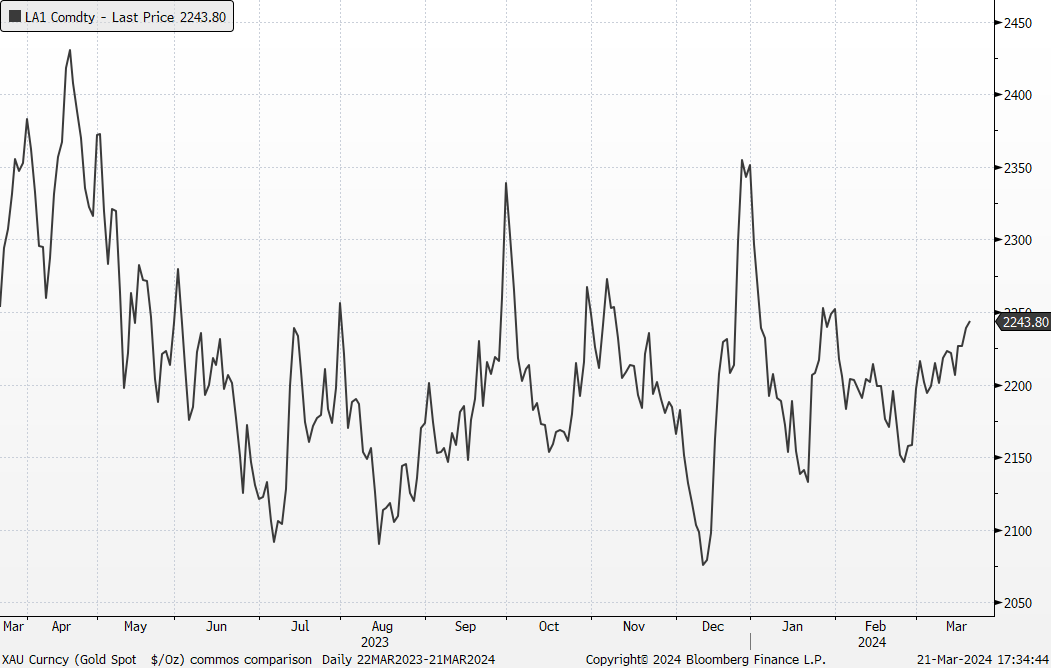

Aluminium spot price (RMB/tonne)

(Source: Bloomberg)

- Record aluminium manufacturing activity. In January-February 2024, China’s industrial activity witnessed a remarkable 7% year-on-year surge, surpassing market projections of 5%. Notably, primary aluminum output experienced a notable 5.5% increase, reaching 7.1 million tonnes. This growth was propelled by heightened prices, incentivizing production as smelters sought to capitalize on improved profit margins. Furthermore, Yunnan’s aluminum output is anticipated to see growth in March, aided by enhanced power supply conditions. Additionally, China’s imports of unwrought aluminum and related products surged by an impressive 93.6% during the same period compared to the previous year, totaling 720,000 tons.

- Growing EV uses. Despite a year-on-year slowdown in overall electric vehicle (EV) sales during January-February, sales of battery-powered EVs surged by 18.2%, as reported by the China Passenger Car Association. Additionally, new energy vehicle (NEV) sales witnessed a significant 37.5% increase over the same period. The robust growth of the EV market surpassed the overall passenger vehicle market’s growth rate of 16.3%, fueled by widespread discounts that stimulated demand. This trend is anticipated to further bolster the demand for aluminum in China.

- 3Q23 earnings. Total revenue fell 20.85% YoY to RMB54.34bn in 3Q23, compared to RMB68.66bn in 3Q22. Net profit increased 105.35% YoY to RMB1.94bn in 3Q23, compared to RMB942mn in 3Q22. Basic earnings per share rose to RMB0.111 in 3Q23, compared to RMB0.052 in 3Q22.

- Market consensus.

(Source: Bloomberg)

Goldman Sachs Group Inc (GS US): Fundamentals improving

- BUY Entry – 410 Target – 450 Stop Loss – 390

- The Goldman Sachs Group, Inc., a bank holding company, is a global investment banking and securities firm specializing in investment banking, trading and principal investments, asset management and securities services. The Company provides services to corporations, financial institutions, governments, and high-net-worth individuals.

- Potential cut in interest rates. On 20 March, the US Federal Reserve maintained its key interest rate but signalled three rate cuts in 2024 which could stimulate increased borrowing and investment activity, potentially benefiting Goldman. The lowered interest rates may encourage companies to issue debt, increasing underwriting opportunities for Goldman Sachs, and it will generate fees for facilitating such transactions. Additionally, the decline in interest rates could spur demand for various financial products and services offered, potentially boosting revenue for its trading desks. However, it’s worth noting that a decline in interest rates may also lead to a reduction in the net interest margin for Goldman Sachs.

- New fund in action. Goldman Sachs Asset Management raised approximately US$700mn for Union Bridge Partners I, a fund that invests alongside hedge funds and private credit firms. The closed-end fund, part of the firm’s External Investing Group, aims to allocate capital into high-conviction ideas from external managers. Co-investments have become popular in the hedge fund industry, offering flexibility amid tough capital-raising conditions. The fund has already deployed 40% of its raised capital across various sectors in North America and Europe.

- 4Q23 earnings review. Revenue rose by 6.9% YoY to US$11.32bn, beating estimates by US$360mn. GAAP EPS was US$5.48, beating estimates by US$1.55. In FY23, it reported net revenue of US$46.25bn and net earnings of US$8.52bn. Diluted EPS was US$22.87 for FY23.

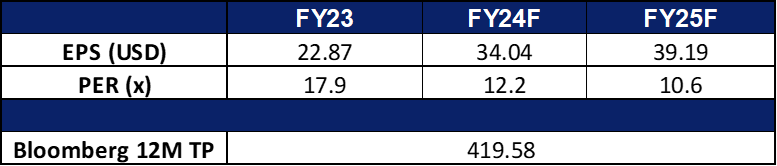

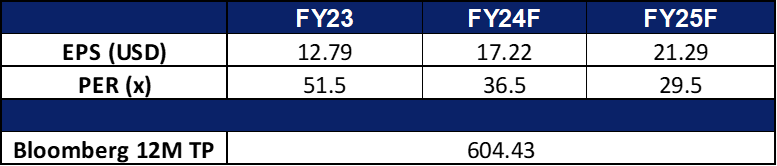

- Market consensus.

(Source: Bloomberg)

Netflix Inc (NFLX US): Signalling more price hikes

- RE-ITERATE BUY Entry – 620 Target – 670 Stop Loss – 595

- Netflix, Inc. operates as a subscription streaming service and production company. The Company offers a wide variety of TV shows, movies, anime, and documentaries on internet-connected devices. Netflix serves customers worldwide.

- Prices increasing once again. Netflix has warned investors and users of potential price hikes in 2024, aiming to reflect improvements and drive further investment in its service. Despite offering an ad tier at US$6.99 per month since 2022, uptake has been modest, with 23mn monthly active users reported. With over 260mn global subscribers, Netflix added 13.1mn in its recent fourth quarter, signalling satisfaction with current pricing. The company’s recent acquisition of WWE’s Raw for over US$5bn and plans to increase content investment suggest potential leverage for future price increases. While a specific timeline for hikes was not disclosed, Netflix’s pattern suggests it’s inevitable. While Netflix has not disclosed a specific timeline for price hikes, its historical pattern suggests they are inevitable. The company has experienced positive subscriber growth following its crackdown on password sharing and previous price increases. It is expected that price hikes will continue across countries as Netflix deems it has delivered sufficient additional entertainment value. Netflix Singapore recently announced a price hike across its tiers.

- Stepping into live sports action. Netflix is set to host a highly anticipated boxing match between Mike Tyson and Jake Paul, streaming exclusively on the platform on 20 July. This event marks Netflix’s ambitious venture into live sports and entertainment. Tyson, a former heavyweight champion known for his ferocity in the ring, will face off against Paul, a YouTuber-turned-fighter with a burgeoning boxing career. The match will take place at AT&T Stadium in Texas and signifies Netflix’s commitment to becoming a premier destination for at-home entertainment. This move follows Netflix’s recent acquisition of streaming rights to WWE’s “Raw” and highlights the platform’s growing presence in sports programming.

- 4Q23 earnings review. Revenue rose by 12.5% YoY to US$8.83bn, beating estimates by US$120mn. GAAP EPS was US$2.11, missing estimates by US$0.11. In 1Q24 revenue is expected to be US$9.24bn vs consensus of US$9.26bn, and EPS of US$4.49 vs US$4.14 consensus. Expect global average revenue per member (ARM) to be up YoY on a F/X neutral basis in Q1.

- Market consensus.

Trading Dashboard Update: No stocks additions/deletions.