24 November 2023: Sasseur REIT (SASSR SP), Sunny Optical Technology Group (2382 HK), Shopify Inc (SHOP US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

United States

The US market was closed yesterday on 23 November for the Thanksgiving public holiday. Market will reopen today on 24 November and will close early at 2:00 am (SG time).

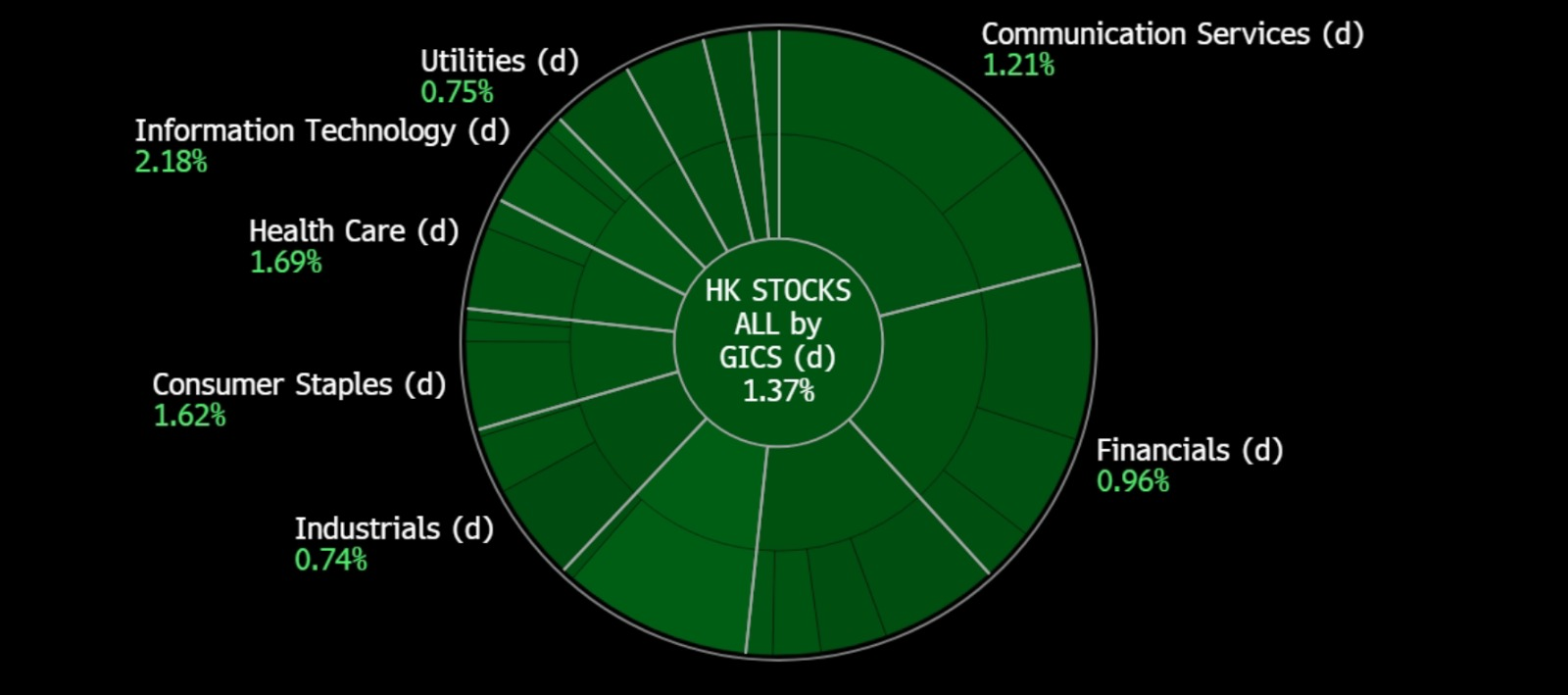

Hong Kong

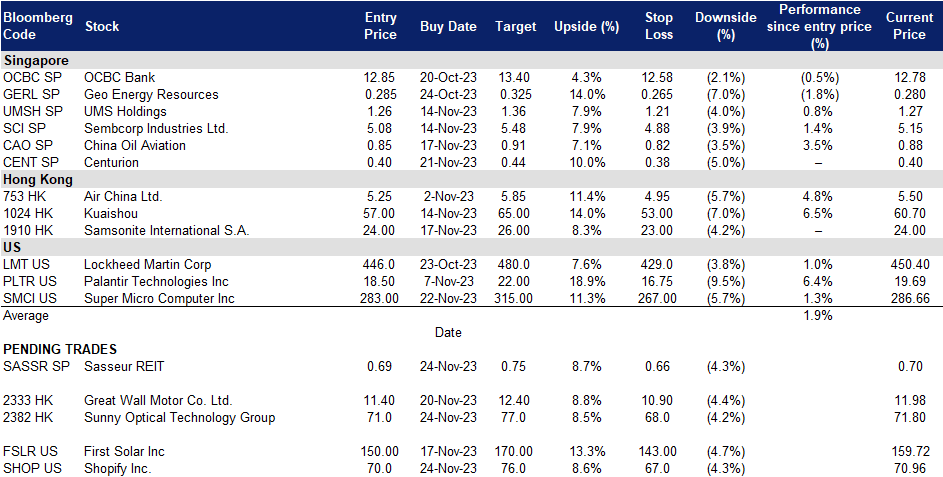

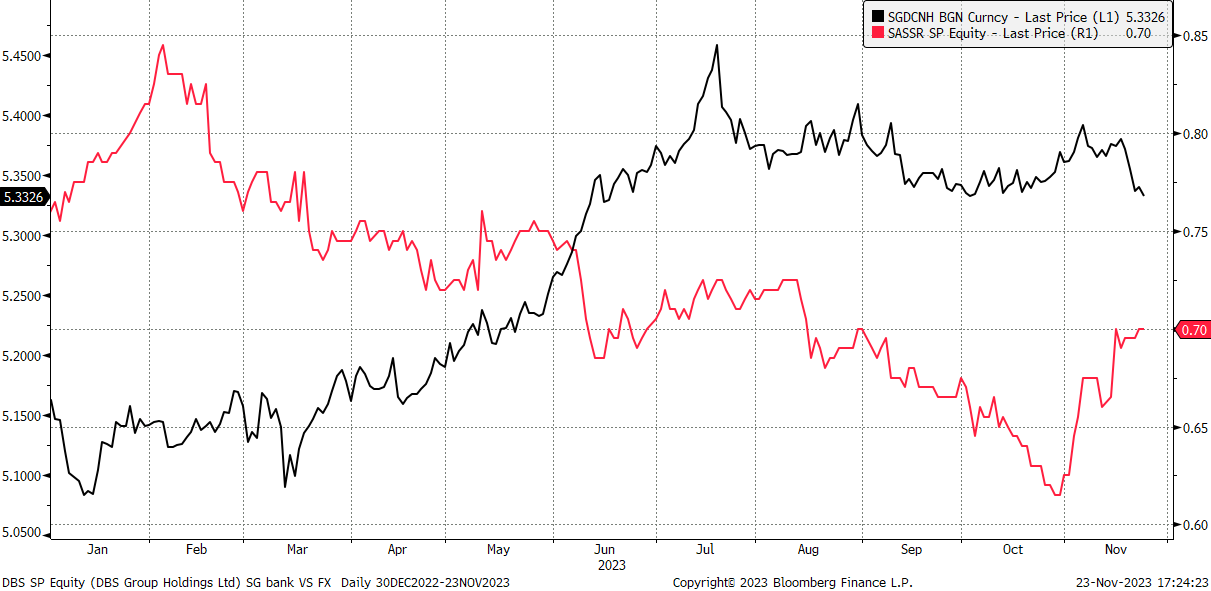

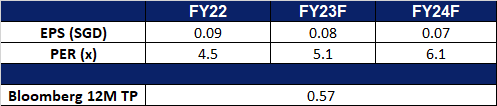

Sasseur REIT (SASSR SP): RMB strengthening

- BUY Entry 0.69 – Target – 0.75 Stop Loss – 0.66

- Sasseur Real Estate Investment Trust operates as a real estate investment trust. The Company invests in a diversified portfolio of retail real estate assets. Sasseur Real Estate Investment Trust serves customers in Asia.

- RMB strengthening against SGD. Recently, the Chinese government has taken more aggressive steps to support its economy, such as lowering interest rates, releasing reserve requirements for banks, and increasing spending on infrastructure. These measures have helped to boost economic growth in recent quarters and may help the weakened Chinese yuan to continue to strengthen against the Singapore dollar. FX changes are a key impact on Sasseur’s earnings and dividend as RMB is the operational currency and SGD is the reporting currency.

SGD/RMB price chart

(Source: Bloomberg)

- Retail market recovery in China. The retail market in China experienced a robust recovery in 3Q23, supported by local authorities’ measures to boost domestic consumption. A notable 18.9% YoY increase in total outlet sales in RMB marked an all-time high since its listing, fuelled by the anniversary sales and consumption-boosting initiatives.

- Resilient 3Q23 performance. Despite a 17.7% YoY decline in total distributable income per unit (DPU) to 1.512 Scts, business performance showcased steady resilience in 3Q23. Outlet sales in RMB rose by an impressive 15.9% QoQ, with a consistent 15.8% YoY increase, driven by pent-up demand and supportive local measures.

- 3Q23 business updates. Total revenue declined by 1.5% YoY to S$30.3mn. 9M23 revenue decreased by 1.5% YoY to S$92.9mn. Despite growth in RMB for both outlet sales and EMA rental income for 3Q23 and 9M23, the decline in revenue was due to a weak RMB against SGD.

- Market Consensus. We have a fundamental coverage with a BUY recommendation and a TP of S$1.05. Please read the full report here.

(Source: Bloomberg)

Centurion Corp Ltd (CENT SP): Early signs of a re-rating catalyst

Centurion Corp Ltd (CENT SP): Early signs of a re-rating catalyst

- RE-ITEREATE BUY Entry 0.40 – Target – 0.44 Stop Loss – 0.38

- Centurion Corporation Limited specialises in owning and operating worker and student accommodation assets. It ranks among Singapore’s largest owner-operators of high-quality worker accommodations in Singapore and Malaysia. Additionally, the company manages student accommodation properties across Singapore, Australia, the United Kingdom, and the United States.

- Rate cut expectations. Global inflation is on track to decline, and major central banks increasingly signal peak rates. The October US inflation was unchanged, and the core CPI rose by 0.2% MoM and 4.0% YoY, further reinforcing the expectations of the end of rate hikes as the Fed weigh the inflation target as the key factor to decide its key rate path. The ECB signalled that it would maintain the current key rates for a couple of quarters. British inflation fell more than expected in October, mitigating the pressure of further rate hikes. Australia hiked another 25bps in November, and economists expected that this would be the last rate hike.

- Potential valuation pump-up and re-rating. Centurion remains its asset-heavy model, and hence, the peak rate and ensuing rate cut cycle is the largest tailwind for the company. Besides, the overall portfolio is healthy along with recovering cash flows as worker and student dormitories are in demand in the post-COVID period. Furthermore, the potential lower refinancing rate and interest burden will help improve profitability.

- 3Q23 business updates. Total revenue increased by 15% YoY to S$51.0mn. 9M23 revenue increased by 10% YoY to S$149.0mn. The respective 9M23 financial occupancy of PBWA and PBSA were 96% and 90%, up from 88% and 84% in 9M22. As of 3Q23, the total asset under management was S$1.9bn with 66,607 operations beds in 34 properties in 15 cities globally.

- Market Consensus. We have a fundamental coverage with a BUY recommendation and a TP of S$0.56. Please read the full report here.

(Source: Bloomberg)

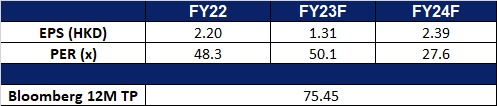

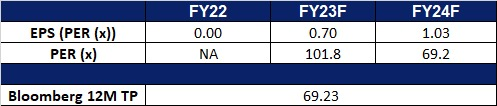

Sunny Optical Technology Group (2382 HK): Promising signs of recovery

- BUY Entry – 71.0 Target – 77.0 Stop Loss – 68.0

- Sunny Optical Technology (Group) Company Limited is an investment holding company principally engaged in the design, research and development, manufacture and sale of optical and optical related products and scientific instruments. The Company operates its business through three segments: Optical Components, Optoelectronic Products and Optical Instruments. Through its subsidiaries, the Company is also engaged in the research and development of infrared technologies. The Company distributes its products in the domestic market and to overseas markets.

- Recovery in the smartphone market. While China smartphone market shipments dipped slightly in 3Q23 compared to a quarter ago, the market saw a significant rebound in October, supported by regional recoveries and new product upgrade demand. Total shipments of smartphones rose by 11%, primarily fueled by an impressive 83% surge in Huawei sales. Xiaomi also reported a 33% increase in smartphone sales for October. The impressive performance of Huawei and Xiaomi indicates a potential rebound in the China smartphone market, which saw a decline over several quarters previously. Sunny Optical would be able to tap into this recovery of the smartphone market to drive sales to its customers.

- Demand exceeding supply. The launch of the Mate 60 Pro handsets by Huawei Technologies as well as the Xiaomi Mi 14 series saw a huge demand from consumers. Huawei Technologies reportedly sold 1.6mn of its Mate 60 Pro handsets in 6 weeks, while Xiaomi sold over 1.0mn of its Mi 14 series in the first week of its launch. Demand exceeded the supply of these handsets after its launch and suppliers are looking to restock them to cater to the high demand. With companies like Huawei being one of Sunny Optical’s biggest customers for camera modules, Sunny Optical is bound to benefit from the strong demand for high-end Huawei products.

- Breakthrough amidst US chip sanctions. The success of Semiconductor Manufacturing International Corp (SMIC) in delivering an advanced, 7-nanometer processor for Huawei paved the way for further technological advancements in China. This slightly reduced China’s dependence on the US for equipment to produce chips, which had faced many headwinds in China as a result of the constant chip sanctions that the US imposed on China.

- 1H23 earnings. Revenue fell by 15.9% YoY to RMB14.28bn, compared to RMB16.97bn in 1H22. Net profit fell by 66.7% YoY to RMB459.4mn, compared to RMB1.38bn in 1H22. Basic EPS fell by 67.8% YoY to RMB39.99, compared to RMB124.13 in 1H22.

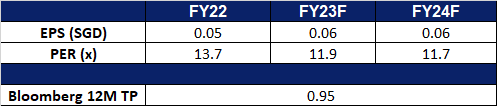

- Market Consensus.

(Source: Bloomberg)

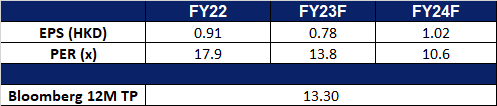

Great Wall Motor Co Ltd. (233 HK): Surging sales amidst uncertain demand

- RE-ITEREATE BUY Entry – 11.40 Target – 12.40 Stop Loss – 10.90

- Great Wall Motor Company Limited is a sport utility vehicle (SUV) manufacturer in the People’s Republic of China (the PRC). The Company is principally engaged in the design, research and development, manufacture and sale, as well as distribution of SUVs, sedans, pick-up trucks and automobile-related parts and components. The Company has three brands, Great Wall, Havel and WEY, and its products include SUVs, sedans and pick-up trucks. The Company also manufactures and supplies relative automotive parts and components. The Company’s vertically integrated parts and components production unit manufactures various products, including engines, transmissions, chassis, electronics, interior and exterior decoration parts and molds. The Company manufactures cars, which include Great Wall C50 and Great Wall C30. The Company’s SUVs include Great Wall H6, Great Wall H5-E and Great Wall M4. The Company’s pick-up vehicles are Wingle 5, Wingle 6 and Wingle 5 Upgrade.

- Surging sales of vehicles. Great Wall Motor recently released its production and sales data for October 2023, with the company selling 131,308 new vehicles, marking a significant YoY growth of 31.04%. For the first ten months of 2023, overseas sales reached 247,046 units, marking an 86.03% YoY growth, while GWM’s new energy vehicle sales reached 200,897 units, a spectacular 86.24% increase from the previous year. GWM saw record-high monthly sales of both the overseas markets and the new energy in October 2023. These figures show that GWM’s business is resilient and still poised to capture the demand for vehicles despite worries about a demand slowdown for EVs and other vehicles.

- Alliance with TikTok’s Chinese counterpart. The company recently announced a partnership with Douyin Group, TikTok’s Chinese counterparts, to explore collaboration in smart mobility. This partnership encompasses nine key areas, including big data utilization, cloud infrastructure development, and advancements in smart driving and onboard features. By leveraging Douyin’s extensive user data, Great Wall Motor aims to gain a deeper understanding of customer preferences and enhance its product development process.

- Commencing production of GWM POER in Ecuador. The company recently kickstarted the production of pick-up vehicle POER in Ecuador. Being the star product in GWM that sold 10,000 units in 37 months in China, the pick-up vehicle is expected to receive great popularity in the Ecuador market. By locally manufacturing the GWM POER in Ecuador, GWM enhances its ability to cater to local preferences and showcases its unwavering commitment to innovation and global reach.

- 3Q23 results. Revenue improved to RMB 49.53bn, up 32.6% YoY, compared to RMB 37.3bn in 3Q22. Net profit rose to RMB3.63bn in 3Q23, up 41.9% YoY, compared to RMB2.56bn in 3Q22. Basic EPS was RMB0.42 in 3Q23, compared to RMB0.28 in 3Q22.

- Market Consensus.

(Source: Bloomberg)

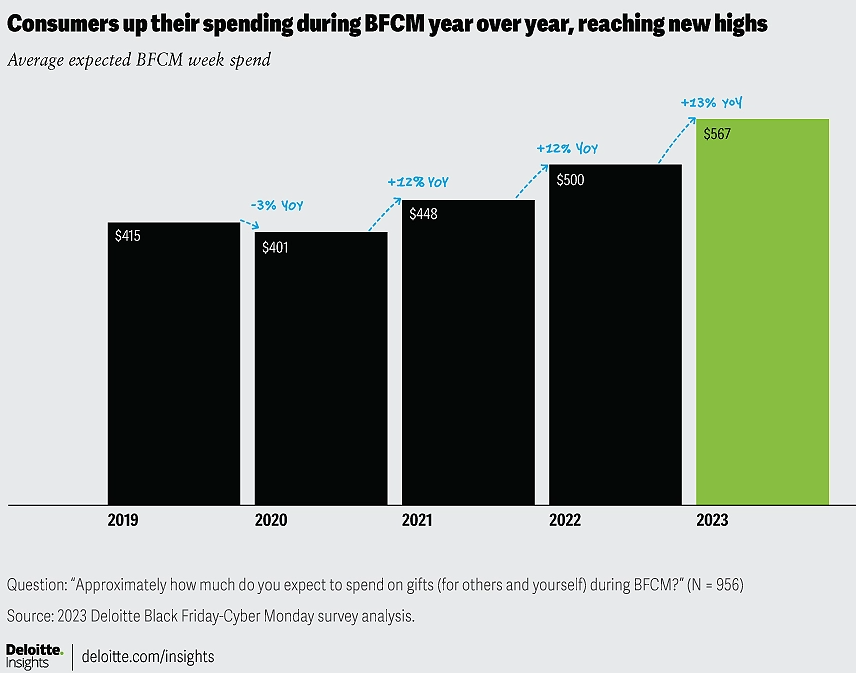

Shopify Inc (SHOP US): Shopping frenzy

- BUY Entry – 70 Target – 76 Stop Loss – 67

- Shopify Inc. provides a cloud-based commerce platform. The Company offers a platform for merchants to create an omni-channel experience that helps showcase the merchant’s brand. Shopify serves customers in Canada.

- Black Friday and Cyber Monday weekend frenzy. Shopify experienced a robust 13% YoY surge in Gross Merchandise Volume (GMV), reaching US$61.0bn in 4Q22, propelled by a successful Black Friday and Cyber Monday weekend. The company foresees sales surpassing 4Q22 in the current quarter. The Thanksgiving week, comprising Black Friday and Cyber Monday, kicks off the holiday shopping season, accounting for about 16.7% of retail sales during this period. The National Retail Federation (NRF) estimates that 19% of annual retail sales occur between Black Friday and Christmas. This year, 74% of Americans are expected to shop during this week, marking the highest since 2017. The NRF projects holiday spending to grow by 3-4%, reaching US$957.3bn to US$966.6bn. Deloitte predicts consumers will spend an average of US$567 during Black Friday to Cyber Monday, a 13% increase YoY, with Millennials driving 43% of sales. The surge in holiday spending is anticipated to bring sales back to pre-pandemic levels, creating a promising season for retailers and consumers. Despite economic concerns, the 2023 Deloitte holiday survey reveals that US consumers are determined to make this holiday season memorable by planning to spend an average of US$1,652, surpassing pre-pandemic figures for the first time. Emphasising value during key promotional events may be a winning strategy for retailers, given that 66% plan to shop during the week of Black Friday-Cyber Monday. The shortened shopping timeframe, reduced from 7.4 weeks to 5.8 weeks, underscores the importance of having the right products at the right prices during promotional periods.

Spending expected to incline over Black Friday, Cyber Monday (BFCM) weekend

(Source: Deloitte Consumer Industry Center)

Prediction of holiday consumption

(Source: National Retail Federation)

- Positive results and costs refinement. Shopify displayed a strong third-quarter performance that exceeded expectations. Shopify foresees a mid-twenties percentage growth in 2023 revenue YoY, driven by a robust fourth-quarter performance. GMV for the quarter rose by 22% to US$56.2bn. The company’s net income reached US$718mn, compared to a loss of US$158.4mn in the same period last year. Operating expenses declined 23% YoY to US$779mn, primarily due to its reduced headcount and the sale of its logistics business. Shopify’s solid results coincide with strategic moves, including workforce reductions and partnerships with Amazon and Faire.

- Partnership with Amazon. Shopify announced an open partnership with Amazon, allowing its merchants access to the Buy with Prime app for a complete e-commerce experience on their storefronts outside Amazon. This collaboration is available to all merchants using or interested in Amazon’s fulfillment network. Buy with Prime enables Prime members to shop on non-Amazon e-commerce sites using their Amazon account for checkout, with Amazon handling fulfillment. The partnership, announced in August 2023, resulted in the Shopify app offering easier integration and additional features like catalog syncing. The move targets the growing overlap of sellers on both Amazon and Shopify, providing a streamlined experience for brands with a presence on both platforms.

- 3Q23 results. Revenue rose to US$1.71bn, up 24.8% YoY, beating expectations by US$40mn. Non-GAAP EPS beat estimates by US$0.10 at US$0.24. Expect full-year revenue to grow by a mid-20s percentage rate YoY, driven by Q4 revenue growth in the high-teens on a GAAP basis.

- Market consensus.

(Source: Bloomberg)

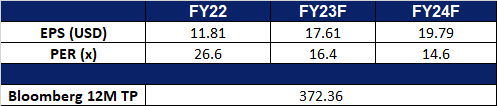

Super Micro Computer Inc (SMCI US): Building more high processing power severs

- RE-ITEREATE BUY Entry – 283 Target – 315 Stop Loss – 267

- Super Micro Computer, Inc. designs, develops, manufactures and sells server solutions based on modular and open-standard architecture. The Company offers servers, motherboards, chassis, and accessories. Super Micro Computer markets its products worldwide.

- Positive results. In 1Q24, the company reported revenue surpassing expectations despite challenges in AI GPU and component supply. The growth was primarily driven by demand for leading AI platforms, especially the LLM-optimised NVIDIA HGX-H100 solutions. The company is addressing the increasing demand for liquid-cooling solutions to tackle energy costs and thermal challenges. Despite component shortages, its net revenue showed a 14% YoY increase. The company anticipates continued growth, particularly in AI-related platforms for fiscal year 2024. The CEO highlighted the significance of AI technologies in various industries and the company’s focus on green computing. The strong Q1 results demonstrate the company’s leadership in the market, with plans for expansion and product development in the coming quarters.

- Rate pause expectations. The recent lower-than-expected consumer price index (CPI) data, showing slower demand, has ignited optimism amongst investors, The semiconductor and AI hardware sectors, known for their cyclicality, stand to gain from the prospect of easing inflation and lower interest rates, assuming a recession is avoided. The favourable market conditions, driven by hopes that the Federal Reserve is concluding interest rate hikes and with most traders eyeing rate cuts from May 2024, create a conducive environment for companies like SMCI. This will allow SMCI to raise funds at lower interest rates potentially, contributing to increased sales on its investments such as AI hardware. Furthermore, with a lower cost of capital, companies would be more willing to invest in AI technology, which would contribute to increased sales in the sector. The synergy between a lower-rate environment, reduced inflation, and the tech industry’s cyclical nature aligns well with the positive outlook for the semiconductor and AI hardware sector.

- 1Q24 results. Revenue rose to US$2.12bn, up 14.6% YoY, beating expectations by US$60mn. Non-GAAP EPS beat estimates by US$0.18 at US$3.43. Expect 2Q24 net sales of US$2.7bn to US$2.9bbn. Raised full-year net sales guidance from a range of US$10bn to US$11bn.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Add Super Micro Computer Inc (SMCI US) at US$283. Cut loss on Banyan Tree Holdings Ltd (BTH SP) at S$0.373.