23 September 2022: Singapore Airlines Ltd (SIA SP), WH Group Ltd (288 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

Singapore Airlines Ltd (SIA SP): Robust tourism demand

- RE-ITERATE BUY Entry 5.28 – Target – 5.50 Stop Loss – 5.17

- The Singapore Airlines Group has over 20 subsidiaries, covering a range of airline-related services, from cargo to engine overhaul. Its subsidiaries also include SIA Engineering Company, Scoot, Tiger Airways, Singapore Flying College and Tradewinds Tours and Travel. Principal activities of the Group consist of air transportation, engineering services and other airline related activities.

- Post-Covid boom. In 2022, according to statistics collated by Singapore Tourism Board, there has been an exponential increase in visitor arrivals since the reopening of our borders to vaccinated travellers without quarantine in April. Between January and August this year, there were a total of about 2.96 million visitors, a Y-o-Y increase of 1,833% as compared to the same period in 2021. In August alone, Singapore welcomed approximately 729 thousand visitors. However, visitor growth can be seen slowing as there was only a slight increase of 2000 visitors, from July to August.

- Tailwinds. Since the gradual reopening of borders globally, travel has resumed. Singapore Airlines Limited has benefited from this with growth in passenger traffic. It more than doubled its monthly available seat kilometres and boosted the number of passengers it flew by more than ten-fold. With both business and leisure travellers increasing, the airline will have to manage resources and manning shortages well.

- Travel growth. Aviation will continue to recover as we see more borders opening up and people take advantage of their freedom to travel. Additionally, with the upcoming events to be held in Singapore and the year-end holiday season coming up, we expect travel demand to remain robust for the rest of the year.

- 1Q23 results review. In1Q23 (YE March), net profit arrived at S$370 million, recovering from a S$409 million loss during the same period in 2021. This was a result of the sharp revival in travel demand after economies reopened their borders. Additionally, their operating statistics showed significant month-on-month passenger traffic growth since April, with August seeing a tapered increase.

- Updated market consensus of the EPS in FY23/24 is S$0.333/S$0.365 respectively, which translates to 16.1x/14.6x forward PE. Bloomberg consensus average 12-month target price is S$5.86.

(Source: Bloomberg)

ComfortDelGro Corp Ltd (CD SP): Range-bound trade

- RE-ITERATE BUY Entry 1.38 – Target – 1.50 Stop Loss – 1.33

- ComfortDelGro is a publicly listed passenger land transport company, with a fleet of more than 38,700 vehicles worldwide. ComfortDelGro’s businesses include taxi, bus, rail, car rental and leasing, automotive engineering and maintenance services, inspection, test and assessment services, learner drivers’ instruction services, insurance brokerage services and outdoor advertising. SBS Transit Ltd and VICOM Ltd are subsidiaries listed on the Singapore Exchange. SBS Transit is Singapore’s largest public bus transport operator with a fleet of more than 2,400 buses, as well as urban rail operation, serving more than 2 million passengers daily. VICOM provides inspection, test and assessment services. The Group is also Singapore’s largest taxi operator with more than 17,000 taxis. The Group’s overseas operations currently extend from the United Kingdom and Ireland to Vietnam and Malaysia, as well as across 12 cities in China, including Beijing, Shanghai, Guangzhou, Shenyang and Chengdu.

- Growth drivers. CDG plans to drive future growth through rail, electrification, logistics, and non-emergency medical transportation segments, with acquisitions and partnerships. On 1 September, its subsidiary, Scottish Citylink Coaches Limited, had successfully acquired the businesses and business assets relating to the retail and customer services operations for the marketing and sale of coach journeys within the United Kingdom under the ‘megabus’ brand and between Plymouth and Bristol under the ‘Falcon’ brand.

- 1H22 results. With COVID-19 restrictions easing in countries where the group operates, the land transport giant has reported better financials for the first half of FY 2022. Revenue for the group inched up 6.7% year on year to S$1.86 billion. Net profit rose 30.4% year on year to S$118.7 million, boosted by a S$38.8 million net gain on the disposal of property. With Singapore contributing 72% to its operating profit. Public transport services made up close to 80% of CDG’s group revenue and half of the group’s operating profit. With more people riding on public transport, operating profit for the division inched up from S$82.5 million to S$85.6 million.

- Disposal of property. CDG sold Alperton property in the UK for S$37.2 million. Resulting in the group’s cash flow statement reflecting a nearly four-fold jump in proceeds from the disposal of fixed assets, from S$16.1 million to S$63.1 million.

- Dividend distribution. CDG declared an interim dividend of S$0.0285, up 35.7% year on year from 1H2021’s S$0.021. Together with the special dividend of S$0.0141, rewarding shareholders from the gains it made from the disposal of a London property, the total dividend announced this round came up to S$0.0426. Coupled with last year’s final dividend of S$0.021, the trailing 12-month dividend stood at S$0.0636, giving CDG’s shares a trailing dividend yield of 4.8%.

- Updated market consensus of the EPS growth in FY23/24 is 49.5%/15.0% YoY respectively, which translates to 14.6x/13.5x forward PE. Bloomberg consensus average 12-month target price is S$1.75.

(Source: Bloomberg)

WH Group Ltd (288 HK): Record high pork price

- RE-ITERATE Buy Entry – 5.35 Target – 6.00 Stop Loss – 5.05

- WH Group Ltd is an investment holding company mainly engaged in the pork business. The Company operates its business through three segments. The Packaged Meats segment is engaged in the production, wholesale and retail of low temperature and high temperature meat products. The Pork segment is engaged in the slaughtering, wholesale and retail of fresh and frozen pork and hog farming businesses. The Others segment is engaged in the slaughtering and sales of poultry. The Segment is also engaged in the sales of ancillary products and services such as provision of logistics services, manufacturing of flavouring ingredients and natural casings, manufacture and sales of packaging materials, operating finance companies, property development companies, a chain of retail food stores, sales of biological pharmaceutical materials, trading of meat related products and others.

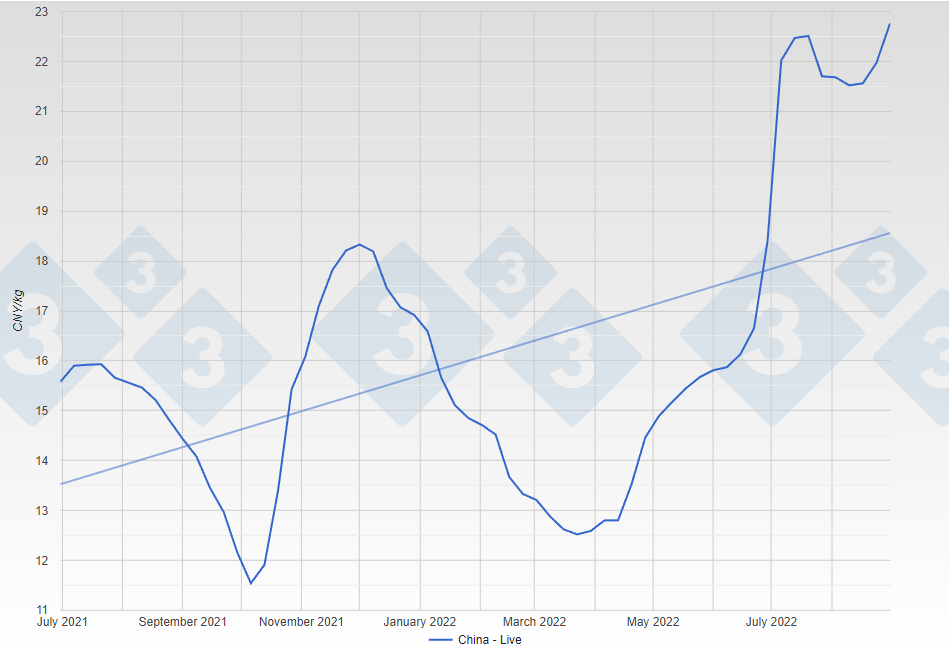

- Live pig price reached a YTD high. As of 31st August, the average live pig price arrived at RMB22.76/kg, the highest level YTD. Meanwhile, pig meat prices rose 22.5% YoY in August, following price hikes of 25.6% YoY in July and 14.8% YoY in June. As pork prices rose to a record high in August, the government started to use the nation’s meat reserves for the first time this year.

Pig price in China – Live

(Source: Pig333.com)

- 1H22 results review. Total operating income dropped by 19.9% YoY to RMB28.0bn. Net profit increased by 8.4% YoY to RMB2.8bn. The operating margin increased by 3.4ppts to 12.4%. Shuanghui Development’s external sales volume of meat products decreased by 3.3% YoY to 1.53mn metric tonnes.

- The updated market consensus of the EPS growth in FY22/23 is 43.9%/2.7%% YoY, respectively, translating to 6.3×/6.2x forward PE. The current PER is 7.7x. FY22F/23F dividend yield is 6.2%/6.4% respective. Bloomberg consensus average 12-month target price is HK$8.07.

(Source: Bloomberg)

Tsingtao Brewery Company Limited (168 HK): A FIFA World Cup themed play

- RE-ITERATE Buy Entry – 70 Target – 80 Stop Loss – 65

- Tsingtao Brewery Company Limited, together with its subsidiaries, engages in the production, distribution, wholesale, and retail sale of beer products worldwide. The company sells its beer products primarily under the Tsingtaoand and Laoshan brand names. It also provides wealth management, and agency collection and payment services; and financing, construction, and logistics services, as well as technology promotion and application services.

- FIFA World Cup Qatar 2022 in two months. The once in every four years FIFA World Cup is going to take place from November to December 2022. This is the global largest sports event after the Tokyo Olympic Games, and it is expected to attract a record high of spectators as most countries have eased COVID restrictions. Accordingly, it will stimulate sales of alcohol and other drinks. The beer feast will take place during the world cup period.

- 1H22 earnings review. Revenue grew by 5.4% YoY to RMB19.3bn. Gross profit dropped by 9.6% YoY to RMB7.3bn. GPM dropped by 6.3ppts to 38.1%. Net profit attributable to shareholders of the company grew by 18.1% YoY to RMB2.9bn. NPM increased by 1.3ppts to 14.8%. The growth of the bottom line was due mainly to the upgrade of the product mix and improvement of cost control.

- The updated market consensus of the EPS growth in FY22/23 is 1.5%/17.1% YoY, respectively, translating to 27.4×/23.4x forward PE. The current PER is 24.4x. Bloomberg consensus average 12-month target price is HK$89.35.

(Source: Bloomberg)

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Other Metals/Minerals | +1.48% | Copper price rebounds on weaker dollar Rio Tinto PLC (RIO US) |

| Steel | +1.41% | Iron ore rebounds on rising China steel output, stimulus hopes Vale SA (VALE US) |

| Pharmaceuticals: Major | +1.11% | Eli Lilly raised to Buy at UBS; named top large cap pick Eli Lilly and Co (LLY US) |

Top Sector Losers

| Sector | Loss | Related News |

| Other Consumer Services | -4.47% | Stocks close lower, major averages on pace for weekly declines as recession fears mount Expedia Group Inc (EXPE US) |

| Finance/Rental/Leasing | -3.18% | Wall Street ends down for third day as growth concerns weigh on tech American Express Co (AXP US) |

| Motor Vehicles | -2.86% | Why Tesla Dropped While Nio and Li Auto Shares Jumped Early Today Tesla Inc (TSLA US) |

- Novavax Inc (NVAX US) tumbled 13.3% after JPMorgan downgraded Novavax to underweight from neutral. The banks also slashed its price target on the stock, citing dwindling demand for Covid-19 vaccines.

- Darden Restaurants Inc (DRI US), Olive Garden’s parent company fell 4.4% after Darden’s fiscal first-quarter results showed lighter-than-expected revenue. The company reported $1.56 in earnings per share on $2.45 billion of revenue. Analysts surveyed by Refinitiv had penciled in $1.56 per share on $2.47 billion of revenue. Same store sales at Olive Garden rose just 2% year over year.

- Steelcase Inc (SCS US) dropped 10.1% after the furniture company announced it will cut 180 salaried positions in the third quarter. In a statement, Steelcase CFO Dave Sylvester cited “recent volume decline in our incoming orders and lower than expected return-to-office trends in the Americas.” The company also reported its second-quarter results, saying organic order growth in the second quarter declined in the Asia Pacific region even as total revenue grew.

- Trip.com Group Ltd (TCOM US) rose 4.8% despite Trip.com reporting shrinking revenue in the second quarter. Trip.com did report a much smaller net loss than in the first quarter. CEO Jane Sun said that bookings rebounded at the end of the second quarter and into the third.

- Li Auto Inc (LI US) jumped 4.9% after the Chinese electric vehicle manufacturer announced an “early launch” of Li L8, a smart SUV model. Li Auto is hosting a launch event on September 30, and plans to start delivery in early November.

Singapore

- SATS Ltd (SATS SP) dropped 5.1% yesterday, a 2.5-month low on Thursday (Sep 22). On Wednesday, the company said it was in discussions to acquire air cargo handler Worldwide Flight Services, although no definitive terms or formal legal documentation have been agreed upon.

- NIO Inc (NIO SP) fell 6.0% yesterday. Nio just announced that it shipped the first battery-swap station from its new facility in Hungary as it continues to expand in Europe. But it declined amid increased worries about Russo-Chinese ties, escalating Taiwan tensions, lingering lockdown effects and concerns over more rate hikes from the Fed.

- Yangzijiang Shipbuilding Holdings Ltd (YZJSGD SP) climbed 6.8% yesterday. CGS-CIMB Research analysts recently highlighted that YZJ obtained a licence from France-based Gaztransport & Technigaz (GTT) on Sept 8, which enables it to construct LNG vessels using GTT Mark III membrane technologies. The licence allows YZJ to build large LNG carriers above 100,000 cubic metres, for the shipment of domestic and international freight. In their previous report on Sept 8, they noted that YZJ could potentially secure 16 new bulk carrier or containership orders worth US$2.29 billion, though the timeline and contracts have yet to be announced by YZJ.

- Top Glove Corp Bhd (TOPG SP) continued to fall 2.0% yesterday, after its latest financial quarter showed a plunge into net loss as revenue dropped to below pre-pandemic levels. With the glove manufacturing industry suffering from an oversupply of gloves and the reduced glove demand globally, investors do not seem optimistic about a rebound in the glove industry. Riverstone Holdings Ltd (RSTON SP) also tumbled 4.2%.

Hong Kong

Top Sector Gainers

| Sector | Gain | Related News |

| Environmental Energy Material | +2.01% | Europe is replacing energy dependence on Russia with solar reliance on China GCL Technology Holdings Ltd (3800 HK) |

| Telecomm. Services | +0.97% | US assault on Chinese telecom firms to backfire: insiders say China Unicom Hong Kong Ltd (762 HK) |

| Investments & Assets Management | +0.50% | China Stocks Face More Grim Milestones as Fed Deals Fresh Blow ESR Group Ltd (1821 HK) |

Top Sector Losers

| Sector | Loss | Related News |

| Airline Services | -2.97% | Major Chinese airlines carry 24 million passengers in August, up 50% Air China Ltd (753 HK) |

| IT Hardware | -2.39% | HK stocks approach 11-year low on Fed hike; bargain-hunting caps China losses Lenovo Group Limited (992 HK) |

| Medical Equipment & Services | -2.09% | Machines to replace human hands in COVID testing Microport Scientific Corp (853 HK) |

- Central Holding Group Co Ltd (1735 HK) rose 9.1% yesterday. Zhonghuan Holdings issued an announcement stating that its two indirect wholly-owned subsidiaries entered into an equipment purchase agreement with the seller, Zhonghuan Aineng (Jiangsu) Technology. The equipment to be acquired is mainly used to set up two production lines of 2GW modules produced by the Group at the new plant in Fengtai County, Anhui Province. This will allow the Group to enter the photovoltaic business and diversify the Group’s business operations, and will contribute to the Group’s green building materials trading business. The Group believes that developing the photovoltaic business will bring synergies and strengthen the Group’s revenue base.

- Chinese EV stocks Xpeng Inc (9868 HK) and NIO Inc (9866 HK) tumbled 11.6% and 7.5% respectively yesterday. Nio just announced that it shipped the first battery-swap station from its new facility in Hungary as it continues to expand in Europe. XPeng formally launched its high-end G9 SUV yesterday, which it expects to quickly become its best-selling vehicle and challenge Tesla’s Model Y in China. But both stocks are being hit hard amid increased worries about Russo-Chinese ties, escalating Taiwan tensions, lingering lockdown effects and concerns over more rate hikes from the Fed.

- Zai Lab Ltd (9688 HK) and Tencent Music Entertainment Group (1698 HK) fell 9.4% and 5.6% respectively yesterday. Broad selling on concerns about the Federal Reserve’s relentless campaign to fight inflation and growing US-China tensions sent Hong Kong stocks tumbling to decade lows. The benchmark Hang Seng Index dropped as much 2.6% on Thursday to 17965.33, the lowest since December 2011, dragged down by technology shares. The Hong Kong Monetary Authority lifted its base rate by 75 basis points to 3.5 per cent with immediate effect on Thursday, in lockstep with the same increase by the Federal Reserve. The Fed raised its target interest-rate range to between 3 and 3.25 percent late Wednesday, warned of more pain ahead and pledged to “keep at it” on policy tightening to bring its target inflation to 2 per cent or slower.

Trading Dashboard Update: Cut loss on China State Construction International (3311 HK) at HK$8.5 and Fuyao Glass Industry Group (3606 HK) at HK$35.2. Add Singapore Airlines (SIA SP) at S$5.28.