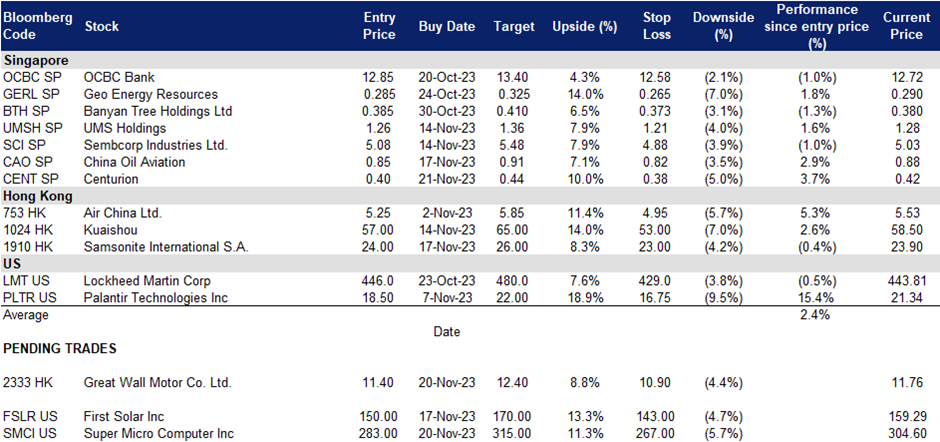

22 November 2023: Centurion Corp Ltd (CENT SP), Great Wall Motor Co Ltd. (233 HK), Super Micro Computer Inc (SMCI US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

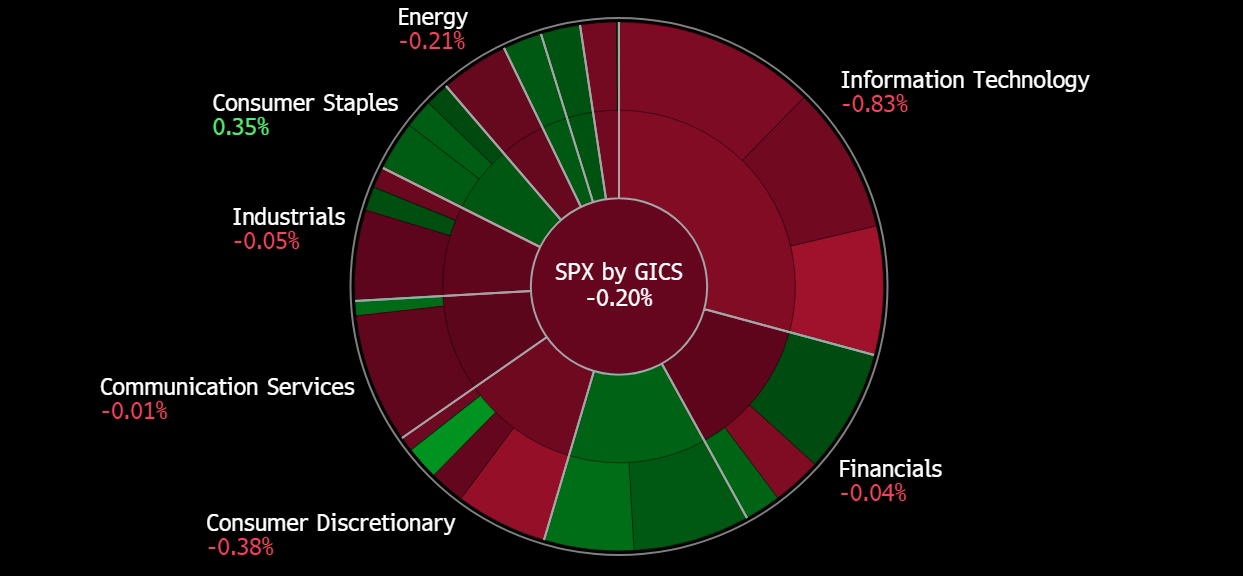

United States

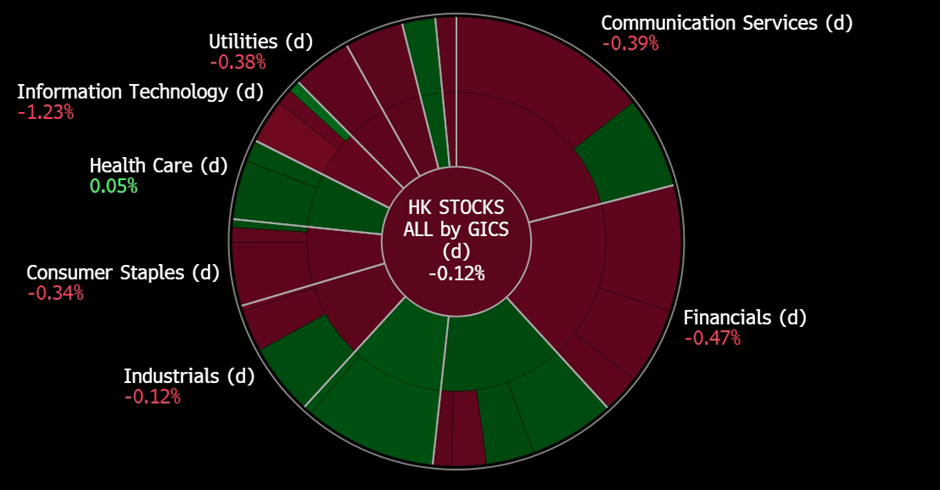

Hong Kong

Centurion Corp Ltd (CENT SP): Early signs of a re-rating catalyst

- BUY Entry 0.40 – Target – 0.44 Stop Loss – 0.38

- Centurion Corporation Limited specialises in owning and operating worker and student accommodation assets. It ranks among Singapore’s largest owner-operators of high-quality worker accommodations in Singapore and Malaysia. Additionally, the company manages student accommodation properties across Singapore, Australia, the United Kingdom, and the United States.

- Rate cut expectations. Global inflation is on track to decline, and major central banks increasingly signal peak rates. The October US inflation was unchanged, and the core CPI rose by 0.2% MoM and 4.0% YoY, further reinforcing the expectations of the end of rate hikes as the Fed weigh the inflation target as the key factor to decide its key rate path. The ECB signalled that it would maintain the current key rates for a couple of quarters. British inflation fell more than expected in October, mitigating the pressure of further rate hikes. Australia hiked another 25bps in November, and economists expected that this would be the last rate hike.

- Potential valuation pump-up and re-rating. Centurion remains its asset-heavy model, and hence, the peak rate and ensuing rate cut cycle is the largest tailwind for the company. Besides, the overall portfolio is healthy along with recovering cash flows as worker and student dormitories are in demand in the post-COVID period. Furthermore, the potential lower refinancing rate and interest burden will help improve profitability.

- 3Q23 business updates. Total revenue increased by 15% YoY to S$51.0mn. 9M23 revenue increased by 10% YoY to S$149.0mn. The respective 9M23 financial occupancy of PBWA and PBSA were 96% and 90%, up from 88% and 84% in 9M22. As of 3Q23, the total asset under management was S$1.9bn with 66,607 operations beds in 34 properties in 15 cities globally.

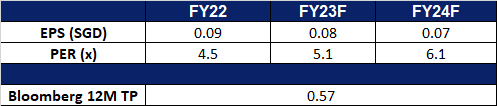

- Market Consensus. We have a fundamental coverage with a BUY recommendation and a TP of S$0.56. Please read the full report here.

(Source: Bloomberg)

China Aviation Oil Singapore Corp. Ltd. (CAO SP): Tailwinds from China-US summits

China Aviation Oil Singapore Corp. Ltd. (CAO SP): Tailwinds from China-US summits

- RE-ITEREATE BUY Entry 0.85 – Target – 0.91 Stop Loss – 0.82

- China Aviation Oil Singapore Corporation Limited supplies jet fuel to foreign and domestic airlines flying through China’s airports. The Company also trades in other oil products such as fuel oil, gas oil, crude oil, and petrochemical products, including physical and paper swaps, and futures trading.

- Positives for air travel between China and the US. There were several achievements between China and the US after the two countries’ leaders met at the APEC forum. Among them, two items are favourable for the air transportation industry. Both countries agreed to further increase air travel in early 2024 and expand educational, student, youth, cultural, sports, and business exchanges. As the most open city in China, Shanghai shall see a further increase in direct flights to the US. Temporary moderation of China-US relations shall help recovery in foreign visits in Shanghai accordingly.

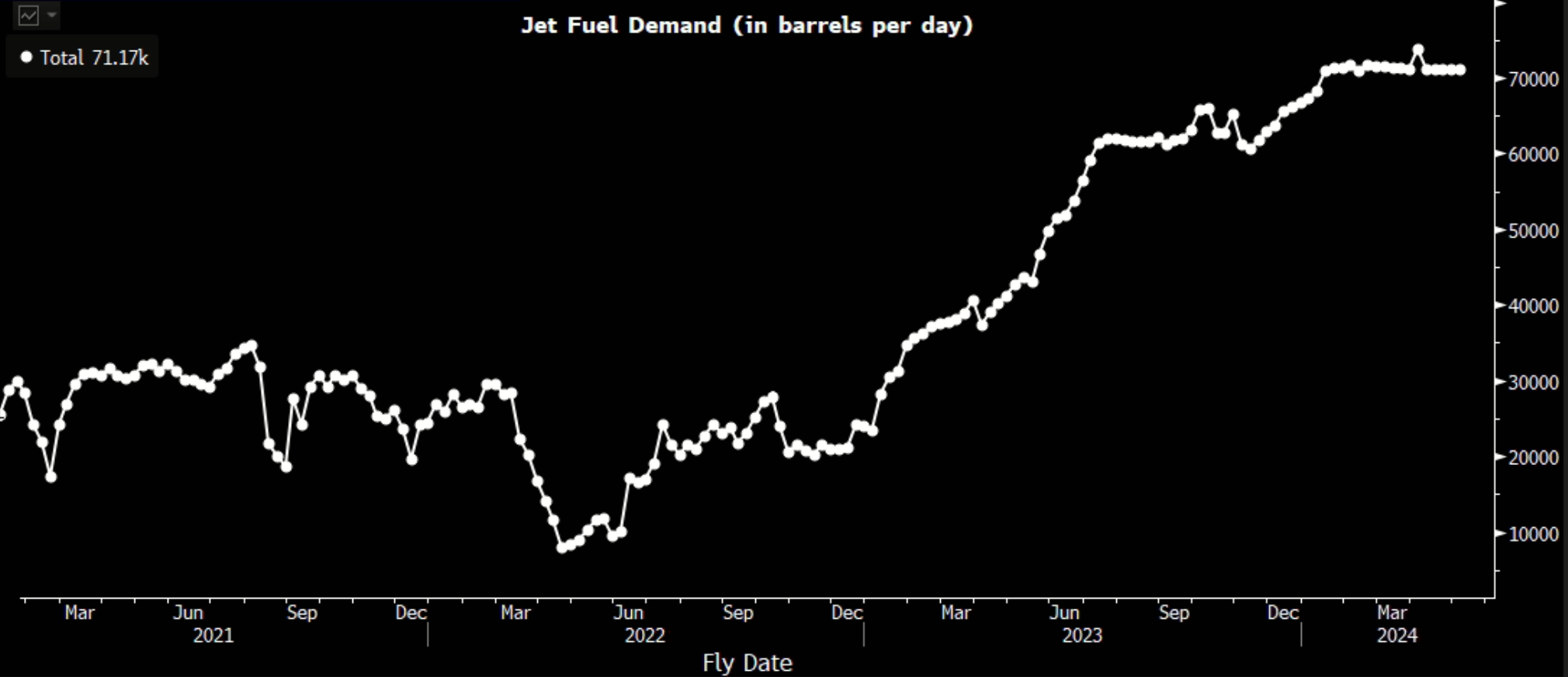

- Air traffic jumped in October. There were 41,559 takeoff and landing flights, an increase of 100.2% YoY in Shanghai Pudong Airport. The passenger traffic was 5.4 mn, an increase of 231.3% YoY. Freight turnover was 308,900 tonnes, an increase of 8.9% YoY.

Scheduled jet fuel demand at Pudong International Airport

(Source: Bloomberg)

- 1H23 results review. 1H23 revenue plunged by 32.4% to US$6.3bn. Gross profit plunged by 50.6% YoY to US$10.6mn. Total supply and trading volume decreased by 16.1% YoY to 9.5mn tonnes. Net profit decreased by 1.07% YoY to US$19.4mn.

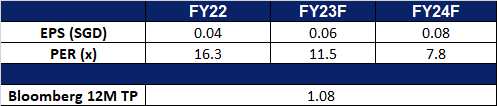

- Market consensus.

(Source: Bloomberg)

Great Wall Motor Co Ltd. (233 HK): Surging sales amidst uncertain demand

- BUY Entry – 11.40 Target – 12.40 Stop Loss – 10.90

- Great Wall Motor Company Limited is a sport utility vehicle (SUV) manufacturer in the People’s Republic of China (the PRC). The Company is principally engaged in the design, research and development, manufacture and sale, as well as distribution of SUVs, sedans, pick-up trucks and automobile-related parts and components. The Company has three brands, Great Wall, Havel and WEY, and its products include SUVs, sedans and pick-up trucks. The Company also manufactures and supplies relative automotive parts and components. The Company’s vertically integrated parts and components production unit manufactures various products, including engines, transmissions, chassis, electronics, interior and exterior decoration parts and molds. The Company manufactures cars, which include Great Wall C50 and Great Wall C30. The Company’s SUVs include Great Wall H6, Great Wall H5-E and Great Wall M4. The Company’s pick-up vehicles are Wingle 5, Wingle 6 and Wingle 5 Upgrade.

- Surging sales of vehicles. Great Wall Motor recently released its production and sales data for October 2023, with the company selling 131,308 new vehicles, marking a significant YoY growth of 31.04%. For the first ten months of 2023, overseas sales reached 247,046 units, marking an 86.03% YoY growth, while GWM’s new energy vehicle sales reached 200,897 units, a spectacular 86.24% increase from the previous year. GWM saw record-high monthly sales of both the overseas markets and the new energy in October 2023. These figures show that GWM’s business is resilient and still poised to capture the demand for vehicles despite worries about a demand slowdown for EVs and other vehicles.

- Alliance with TikTok’s Chinese counterpart. The company recently announced a partnership with Douyin Group, TikTok’s Chinese counterparts, to explore collaboration in smart mobility. This partnership encompasses nine key areas, including big data utilization, cloud infrastructure development, and advancements in smart driving and onboard features. By leveraging Douyin’s extensive user data, Great Wall Motor aims to gain a deeper understanding of customer preferences and enhance its product development process.

- Commencing production of GWM POER in Ecuador. The company recently kickstarted the production of pick-up vehicle POER in Ecuador. Being the star product in GWM that sold 10,000 units in 37 months in China, the pick-up vehicle is expected to receive great popularity in the Ecuador market. By locally manufacturing the GWM POER in Ecuador, GWM enhances its ability to cater to local preferences and showcases its unwavering commitment to innovation and global reach.

- 3Q23 results. Revenue improved to RMB 49.53bn, up 32.6% YoY, compared to RMB 37.3bn in 3Q22. Net profit rose to RMB3.63bn in 3Q23, up 41.9% YoY, compared to RMB2.56bn in 3Q22. Basic EPS was RMB0.42 in 3Q23, compared to RMB0.28 in 3Q22.

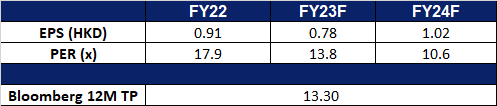

- Market Consensus.

(Source: Bloomberg)

Samsonite International S.A. (1910 HK): Benefit from the year-end travelling season

- RE-ITERATE BUY Entry – 24.0 Target – 26.0 Stop Loss – 23.0

- Samsonite International S.A. is a Hong Kong-based company principally engaged in the design, manufacture, sourcing and distribution of luggages, business and computer bags, outdoor and casual bags, travel accessories and slim protective cases for personal electronic devices. The Company operates its business through three segments. The Travel Bag segment is engaged in travel products with suitcases and carry-ons of three main categories, including hard-side, soft-side and hybrid luggages. The Casual Bags segment is engaged in daily use, including different types of backpacks, female and male shoulder bags and wheeled duffel bags. The Business Bags segment is engaged in business use, including rolling mobile office bags, briefcases and computer bags.

- Launch of Boss X Samsonite Collections. Samsonite recently launched a new collaboration with Hugo Boss on an exclusive aluminium capsule collection, which features cabin and check-in suitcases and a trunk, and introduces a new way to travel in style. This collection aims to showcase a shared passion for premium quality, innovation, and timeless design with a distinctive twist, and would appeal to those consumers who have a passion for travelling and exploration but refuse to compromise on style. The first launch of the collection of Hugo Boss and Samsonite stores has already been sold out, but consumers can expect more limited stocks soon. This partnership helps to promote Samsonite’s brand name indirectly, as well as showcasing the premium quality that Samsonite’s luggage is able to provide to its consumers.

- Upcoming winter travel season. The upcoming winter and festive seasons are expected to provide a boost to travel demand. The winter holidays spanning early November through January are usually one of the busiest travelling periods of the year. Consumers are likely to be clearing their work leaves, or finding time to escape the heat or cold in their countries. The upcoming winter holidays also mark the first winter season since China’s re-opening at the start of 2023. This increase in demand for travelling is likely to drive the sale of luggage for Samsonite.

- Increasing amount of flights showcasing strong travel demand. Several airlines globally have already announced plans to increase the number of flights globally across the incoming winter travel season. Chinese airlines have also seen a rise in scheduled flights for winter-spring, scheduling 96,651 domestic cargo and passenger flights each week for the upcoming winter-spring season, an increase of 33.95% from the same period in 2019-2020, according to the Civil Aviation Administration of China (CAAC). 516 new domestic routes will also be opened from Oct 29 to March 30 next year, providing 7,202 flights each week, according to the CAAC. In terms of international flights, 150 domestic and foreign airlines plan to arrange 16,680 flights per week, reaching 68 foreign countries. The US Department of Transportation announced that flights between China and the US will increase to 70 a week starting on 9 November, from the current 48 a week. The average flights between the two counties averaged 340 a week in the pre-COVID period.

- 3Q23 results. Net sales improved to US$957.7mn, up 21.1% YoY, compared to US$790.9mn in 3Q22. Net profit rose to US$123.2mn in 3Q23, up 88.3% YoY, compared to US$65.4mn in 3Q22. Adjusted Basic EPS was US$0.087 in 3Q23, compared to US$0.045 in 3Q22.

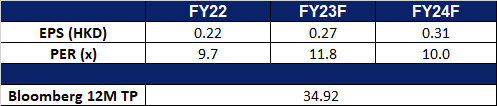

- Market Consensus.

(Source: Bloomberg)

Super Micro Computer Inc (SMCI US): Building more high processing power severs

- BUY Entry – 283 Target – 315 Stop Loss – 267

- Super Micro Computer, Inc. designs, develops, manufactures and sells server solutions based on modular and open-standard architecture. The Company offers servers, motherboards, chassis, and accessories. Super Micro Computer markets its products worldwide.

- Positive results. In 1Q24, the company reported revenue surpassing expectations despite challenges in AI GPU and component supply. The growth was primarily driven by demand for leading AI platforms, especially the LLM-optimised NVIDIA HGX-H100 solutions. The company is addressing the increasing demand for liquid-cooling solutions to tackle energy costs and thermal challenges. Despite component shortages, its net revenue showed a 14% YoY increase. The company anticipates continued growth, particularly in AI-related platforms for fiscal year 2024. The CEO highlighted the significance of AI technologies in various industries and the company’s focus on green computing. The strong Q1 results demonstrate the company’s leadership in the market, with plans for expansion and product development in the coming quarters.

- Rate pause expectations. The recent lower-than-expected consumer price index (CPI) data, showing slower demand, has ignited optimism amongst investors, The semiconductor and AI hardware sectors, known for their cyclicality, stand to gain from the prospect of easing inflation and lower interest rates, assuming a recession is avoided. The favourable market conditions, driven by hopes that the Federal Reserve is concluding interest rate hikes and with most traders eyeing rate cuts from May 2024, create a conducive environment for companies like SMCI. This will allow SMCI to raise funds at lower interest rates potentially, contributing to increased sales on its investments such as AI hardware. Furthermore, with a lower cost of capital, companies would be more willing to invest in AI technology, which would contribute to increased sales in the sector. The synergy between a lower-rate environment, reduced inflation, and the tech industry’s cyclical nature aligns well with the positive outlook for the semiconductor and AI hardware sector.

- 1Q24 results. Revenue rose to US$2.12bn, up 14.6% YoY, beating expectations by US$60mn. Non-GAAP EPS beat estimates by US$0.18 at US$3.43. Expect 2Q24 net sales of US$2.7bn to US$2.9bbn. Raised full-year net sales guidance from a range of US$10bn to US$11bn.

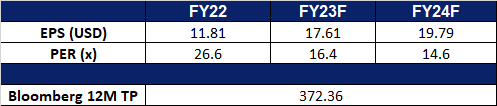

- Market consensus.

(Source: Bloomberg)

First Solar Inc (FSLR US): Time to shine

- RE-ITERATE BUY Entry – 150 Target – 170 Stop Loss – 143

- First Solar, Inc. designs and manufactures solar modules. The Company uses a thin film semiconductor technology to manufacture electricity-producing solar modules.

- China and US agreement. The United States and China recently pledged to jointly tackle global warming by ramping up wind, solar and other renewable energy sources to displace fossil fuel, which holds significant implications for global climate change. As major contributors to greenhouse gas emissions, their joint efforts are pivotal in achieving worldwide emission reduction goals and curbing the increase in average global temperatures. The US-China climate agreement, known as the Sunnylands statement, underscores practical and feasible measures, acknowledging the current political context. China’s commitment to setting targets for all greenhouse gases, including methane, is a noteworthy aspect. With COP28 approaching, this agreement is timely and critical, though challenges persist, particularly in addressing issues like fossil fuel phase-out, requiring sustained political efforts.

- COP28. The United Nations COP28 climate summit will be held from 30 November to 12 December in Dubai, the United Arab Emirates, this year with representatives from nearly 200 countries. The European Union has announced its commitment to a “substantial” financial contribution to a groundbreaking international fund addressing climate change-related loss and damage. This fund, known as the climate “loss and damage” fund, is expected to launch during the COP28 climate summit. The EU’s move aims to facilitate progress on climate finance discussions at COP28, where issues such as phasing out fossil fuels and emission reduction steps will be considered. The EU also plans to provide funding at COP28 to support countries in meeting the goal of tripling global renewable energy capacity by 2030. The size of the EU’s financial contribution was not specified.

- Module growth. First Solar recently entered an agreement to supply 500GW of thin film modules to Swift Current Energy, a utility-scale renewables developer. The modules, part of First Solar’s CdTe Series 7, will be delivered between 2027 and 2028. Swift Current Energy, which has already ordered 2GW and 1.2GW in previous agreements, aims to enhance its value chain and support domestic manufacturing. First Solar reported a 14% increase in module production in Q3, reaching a record 3.2GW, and secured 6.8GW of net bookings, bringing the total for the year to 27.8GW.

- 3Q23 results. Revenue rose to US$801.09mn, up 27.4% YoY, missing expectations by US$91.25mn. GAAP EPS beat estimates by US$0.46 at US$2.50. Maintain full-year revenue guidance and raise the mid-point of EPS guidance to $7.60. Expect FY23 net sales of US$3.4B to US$3.6B vs US$3.5B consensus.

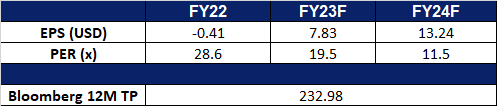

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take profit on Boeing Co. (BA US) at US$213. Add Centurion (CENT SP) at S$0.40.