KGI DAILY TRADING IDEAS – 22 March 2021

IPO Watch

Bilibili (9626 HK): Leading video community for young people in China

- Bilibili’s IPO is open for subscription on Thursday, 18 March and closes on Tuesday, 23 March. Trading starts on Monday, 29 March.

- Public offer is 41x oversubscribed as of this morning.

- We have a write-up on it last Friday where we recommend subscribing. Read it here.

Baidu (9888 HK): Public offer 112x oversubscribed; Priced at HK$252

- Public offer price of HK$252 was 112x oversubscribed.

- Baidu starts trading tomorrow, 23 March.

Coinbase (COIN US): IPO listing pushed to April after CFTC fine

- COIN has delayed their direct listing on NASDAQ by a few weeks to April, after a US$6.5mn fine from CFTC against the company on wash trading charges and filing false reports.

- Despite the fine, COIN is still expected to list at over US$100bn valuation, as Coinbase futures on the FTX exchange held the US$440/share mark, implying US$110bn market cap.

DigitalOcean (DOCN US): Cloud computing infrastructure player to IPO at US$44-47/share

- DOCN is an Infrastructure-as-a-Service (IaaS) company providing cloud infrastructures to developers, startups and small-and-medium-sized businesses.

- DOCN has over 570,000 customers with 103% dollar based net retention rate in 2020, up from 2019’s rate of 100% despite the coronavirus pandemic situation. DOCN also grew at ~25% CAGR in the past 2 years, in line with the CAGR estimate for the public cloud market.

- DOCN will IPO at 15x Price/Sales at the midpoint of its indicated IPO range, with an initial market cap of close to US$4.8bn.

- DOCN’s valuation comes at a discount to other cloud players as their key metrics are fairly average. We expect first day trading to hit US$60-75/share before settling to a US$50-60 range.

- DOCN is expected to price on Tuesday and trade on Wednesday, 24 March.

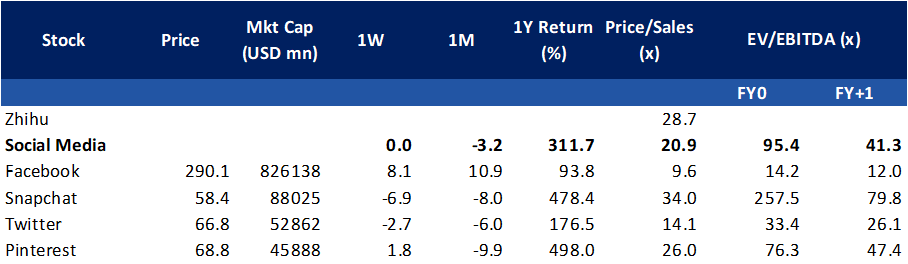

Zhihu (ZH US): A unique social media play hits the market; IPO pricing at US$9.5-11.5/ADS

- ZH is the largest Chinese question-and-answer website similar to Quora.

- ZH boasts 75.7mn average Monthly Active Users, a 33% year-on-year increase, while revenue has doubled in 2020. The 100% sales growth is possibly indicative of a turnaround for ZH, whom has struggled in its earlier years to monetize its user base.

- ZH’s indicated IPO range gives an initial market cap of US$6bn, at 28.7x Price/Sales.

- We expect ZH to perform well on its IPO, given its uniqueness over other publicly listed social media stocks, with a potential first day pop to reach US$18/share.

- ZH is expected to price on Thursday and trade on Friday, 26 March.

US Trading Ideas

American States Water (AWR US): Buy the essentials

- BUY Entry – 73 Target – 78.5 Stop Loss – 69.8

- AWR engages in the purchase, production, distribution and sale of water.

- AWR’s share price has undergone recent heavy selling pressure despite beating analyst estimates, as bond yields continue rising. However, AWR and most utility stocks have bottomed out at the beginning of March.

- AWR has formed a double bottom in the first week of March. We see strong buying volumes in the past 2 weeks as indicative of a strong support, and we expect the share price to return to its prior trading range between US$74-80.

Citigroup (C US): Buying the laggard

- BUY Entry – 70 Target – 82 Stop Loss – 63

- C is a multi-national bank providing a broad range of financial services to consumer and corporate customers, including investment banking, retail brokerage, corporate banking, and cash management products and services.

- While fellow major US banks and the financial sector (XLF US) is largely trading at post-GFC highs, C is currently still trading below pre-COVID price levels.

- We expect positive momentum in financial sector stocks to continue as the 10 year yield continues its uptrend, and we recommend C over other major banks as a catch-up play.

HK Trading Ideas

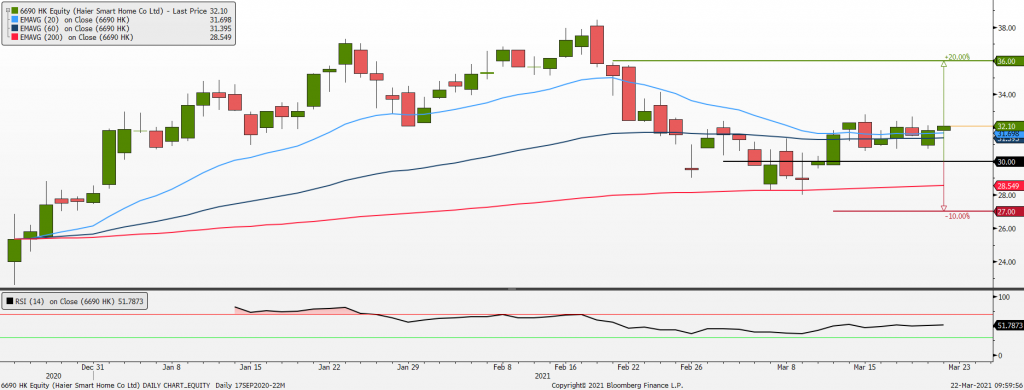

Haier Smart Home (6690 HK): Time to relook at the White Horse Stock

- Buy Entry – 30 Target – 36 Stop Loss – 27

- The company is a China-based company principally engaged in the research, development, manufacture and sales of household electrical appliances. The company’s main products include refrigerators/freezers, washing machines, air-conditioners, water heaters, kitchen appliances products, small home appliances and U-home smart home products. The company also provides customers with integrated smart home solutions. The company is also involved in channel integration service business, including logistics, as well as the distribution of home appliances and other products. It distributes its products in both domestic and overseas markets.

- According to All View Cloud, the retail sales of home appliances in FY20 dropped by 11.3% YoY to RMB705.6bn. Respectively, air conditioner, colour TV, and kitchen appliances were the top three categories that saw the highest decrease in sales, reported at 21.09%, 11.7%, and 7.7% YoY drop. However, with the economic recovery, policy support, and normalisation of consumption, retail sales of home appliances will have a V-shape rebound in FY21. The demand for high-end home appliances will continue to grow as the high-income crowd has been expanding. The demand for low-end home appliances is well supported by policy guidance as the authority continues to promote rural consumption.

- Haier is one of the top three home appliances retailers in China. In recent years, the company is moving to the smart home area as 5G is being rolled out gradually in China. The wave of upgrading home appliances has started as millennials who are more tech-savvy have been reaching the age of settling down with their own families in China. Hence, the demand for smart home appliances will be the next growth driver for the company.

- Market consensus of net profit growth in FY21 and FY22 are 22.24%YoY and 23.34% YoY, which implies forward PERs of 20.5x and 16.6x. Current PER is 25.0x. The consensus of the average 12-month target price is HK$38.22.

- The company will announce FY20 full year results on 30 March.

Shandong Chenming Paper Holdings (1812 HK): Chase the turnaround momentum

- RE-ITERATE Buy Entry – 7.1 Target – 9.1 Stop Loss – 5.9

- Shandong Chenming Paper Holdings is a China-based company principally engaged in paper making and finance lease businesses. The company’s paper products mainly consist of duplex press paper, copperplate paper, white paper boards, electrostatic paper, anti-sticking base paper, newsprint, tissue paper, light weight coated paper, writing paper and other machine-made paper. The Company is also involved in the provision of electricity and steam, construction materials and chemicals for paper making, as well as the operation of hotels. The company distributes its products in the domestic market and to overseas markets.

- Paper pulp price rose by 58.7% YoY to RMB6,404/tonne in the last week ended on 28th February. Recently, various paper products prices were raised by RMB500 to 1,700/tonne in China. The demand for paper products has moderately recovered but inventory is falling faster than expected as rising raw material prices have lengthened the turnover for SMEs. Hence, market leaders will benefit as their inventory and receivables turnover days are still intact.

- Market consensus of estimated net profit growth in FY21 and FY22 are 106.5% and 13.3% respectively, which translates to 4.4x and 3.9x forward PE. The current PE is 9.2x. The expected dividend yield in FY21 and FY22 are 5.7% and 6.0% respectively. Bloomberg consensus average 12-month target price is HK$10.6.

- The company will announce FY20 full year results on 25 March.

SG Trading Ideas

Hongkong Land (HKL SP): Buying the short-term correction as uptrend still intact

- RE-ITERATE BUY (USD) Entry –5.00 Target – 5.50 Stop Loss – 4.75

- HKL owns and manages more than 850,000sqm of prime office and retail properties in Hong Kong, Singapore, Beijing and Jakarta. Its portfolio of prime Hong Kong Central office space makes up around 50% of the company’s gross asset value.

- Valuations are still cheap despite the 20% run-up of its share price YTD as HKL trades at only 0.34x historical P/B. HKL’s shares are currently consolidating around the US$5.0 price levels, which we believe is a healthy correction and a buying opportunity.

- The company offers one of the highest dividend yield among Singapore-listed property developer. Bloomberg consensus is forecasting dividend yields of 4-5% for the next three years.

- The ongoing consolidation exercise of the Jardine Group of companies could be a short/medium rerating catalyst for HKL, as parent company, Jardine Matheson (JM SP), may seek to unlock value in its prime Hong Kong properties. Jardine Matheson is the major shareholder of HKL with a 50.4% ownership.

- We add HKL to our Trading Ideas today after hitting our entry price of US$5.00.

Yangzijiang (YZJSGD SP): Share price consolidation before potentially breaking out

- RE-ITERATE BUY Entry – 1.22 Target – 1.45 Stop Loss – 1.10

- The company continues to ride on strong order win momentum. On 5 March, the shipbuilder announced that it had secured new shipbuilding contracts worth a total of US$1.7bn for 31 vessels. The vessels are scheduled for delivery between 2022 to 2023.

- The company has secured a total of 60 shipbuilding contracts worth US$3.0bn year-to-date, and is likely to reach its historical peak of US$5.0bn orders that it won in 2007.

- Yangzijiang currently offers an attractive dividend yield of 4-5% for FY2021-2023 and trades at only 6-8x forward PEs. Consensus has a target price of S$1.41 vs its current price of S$1.25.

- Shares have gained 29% year-to-date and is consolidating at the S$1.20-S$1.30 range. The last time YZJSGD shares consolidated at this price range was in the fourth quarter of 2018, where it consolidated for 3 months before breaking out to S$1.60 in the following months.

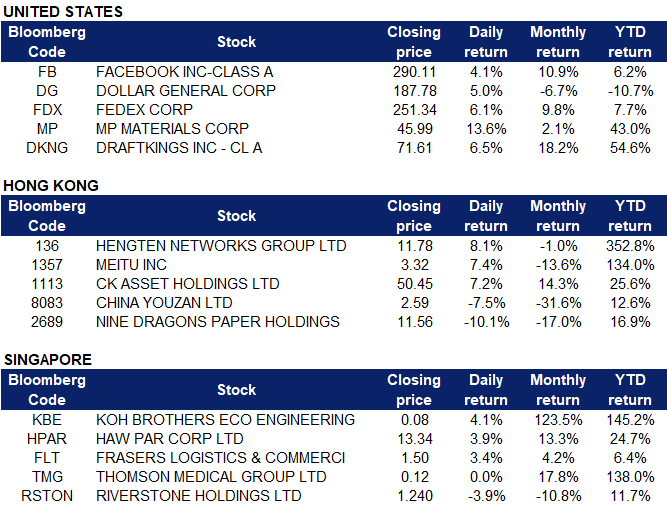

Market Movers – What’s Hot

United States

- Facebook (FB US) led gains for Big Tech, closing at a new high for the year. By forward Price/Earnings, FB remains the cheapest Big Tech at ~26x P/E.

- Dollar General (DG US) led gains in major retailers on a Friday that saw limited price movements in most other sectors.

- FedEx (FDX US) rallied to a new high for the year as fiscal 3Q results surpassed analyst expectations on the back of strong domestic and international shipping volumes. FDX also announced FY21 EPS expectations of US$17.6-18.2/share, ahead of analyst consensus.

- MP Materials (MP US) rose on Thursday’s earnings report with 100% year-on-year sales growth and 1000% adjusted net income growth. MP is up 43% year-to-date as rare earth stocks gain increasing attention from strong global demand as economies reopen.

- DraftKings (DKNG US) closed at an all-time high despite weak momentum in Blue Wave thematic.

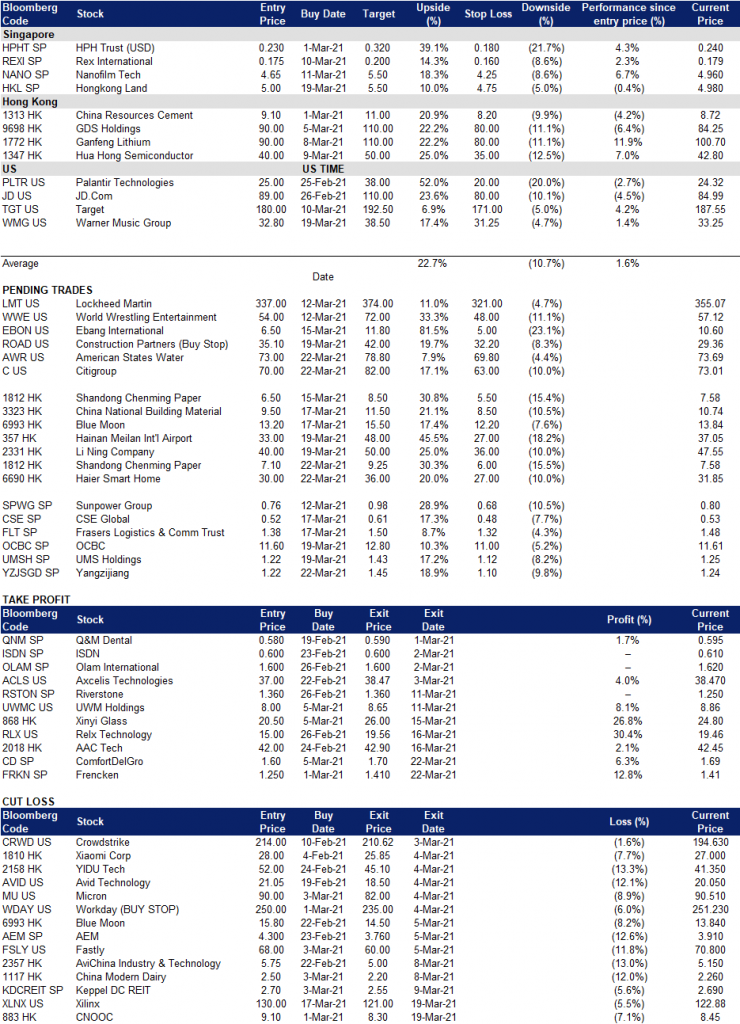

- Trading Dashboard: Cut loss on XLNX, include WMG into live trades.

Hong Kong

- HengTen Networks Group Limited (136 HK). The film “Hi, Mom”, where the company’s subsidiary Ruyi Films acted as the main producers and the largest guaranteed distributor, will extend its release to 11 April. As of 17 March, box office reached RMB5.28bn. The company will announce FY20 full year results on 30 March.

- Meitu Inc (1357 HK). Previously, the company announced that it bought another US$50mn worth of Etherum and Bitcoin on 17 March.

- CK Asset Holdings Ltd (1113 HK). CitiGroup upgraded TP to HK$51 from HK$34.5 and rating to NEUTRAL from UNDERWEIGHT. Previously, the company announced the acquisition of Target Holdcos from LKSF for HK$17bn. To fulfill the acquisition, the company will issue 333.33mn shares to LKSF at a price of HK$51. The company also suggested dividends in FY21 and FY22 to be more than in FY20, which is equivalent to HK$1.887.

- Nine Dragons Paper (Holdings) Ltd (2689 HK). Morgan Stanley upgraded TP to HK$15 from HK$10.3 and maintained its rating at NEUTRAL. Concerns over expectations of net debt to asset ratio hike from current 45% to 80% in two years due to capacity expansion accelerated the sell-off. However, the ramp-up of capacity will likely stabilize raw material prices in the long run.

- China Youzan Ltd (8083HK). SaaS sector was under selling pressure due to weak market sentiment and rising inflation worries.

Singapore

- Koh Brothers Eco Engineering (KBE SP) surged 111% for the week behind news of its new investor, Penta-Ocean Construction (1893 JP), buying 810 million shares at 4.7 Sct/share. The private placement will bring about S$37 million to the company, which will be used to strengthen the company’s financial position and enable it to bid for higher value projects.

- Haw Par Corp (HPAR SP) rose 6% week-on-week as a number of funds and accounts under Kayne Anderson Rudnick Investment Management, a US registered investment advisor, raised their stakes in the company.

- Frasers Logistics & Commercial Trust (FLT SP) closed the week higher by 8% on potential inclusion into the STI index, likely replacing Jardine Strategic (JS SP), and on media reports of acquisition of commercial and logistics assets in the UK. FLT valuations are attractive relative to peers. It currently trades at around 1.2x P/B compared to its much higher peers trading at 1.4-1-6x P/B, while offering a higher dividend yield of 5.7%. Its gearing of 36% is significantly below the 50% regulatory limit, thus providing it with more than S$1bn of debt headroom for acquisitions.

- Thomson Medical Group (TMG SP), with a strong double digit price gain for the week and closing near its one year high established at the beginning of the month. TMG’s share price has doubled since its earnings release, but have been trailing downwards in the prior two weeks.

- Riverstone (RSTON SP) closed 7% lower for the week as trading volume surged to the highest level since September 2020. Last Friday, 12mn shares out of the total 17mn traded for the day changed hands at S$1.24 in the pre-close session.

- Trading Dasboard: Added Hongkong Land (HKL SP) to replace ComfortDelGro (CD SP).

Trading Dashboard