22 January 2025 : Winking Studios Ltd (WKS SP), Tencent Holdings Ltd. (700 HK), AppLovin Corporation (APP US)

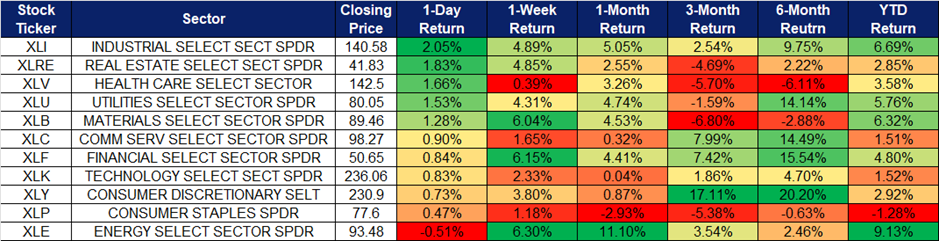

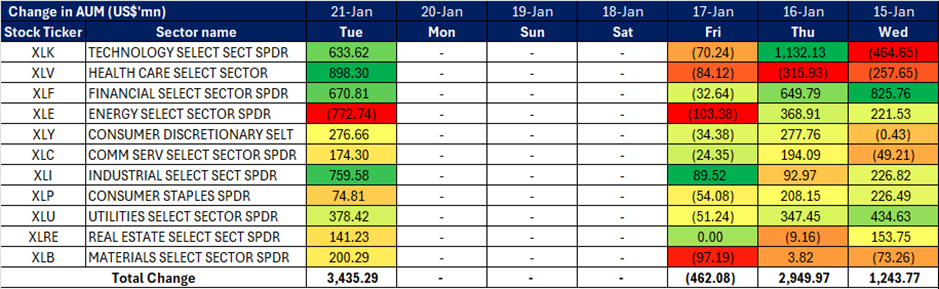

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

United States

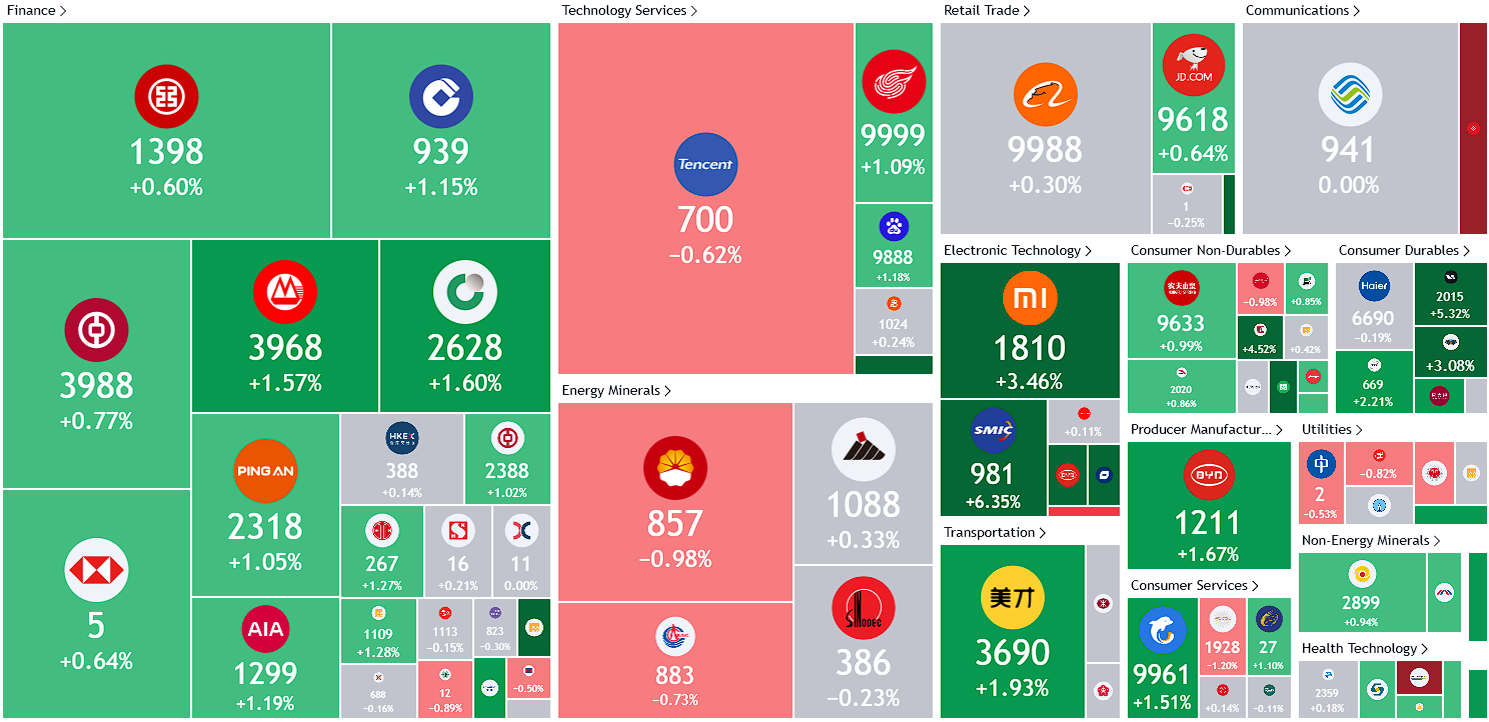

Hong Kong

Winking Studios Ltd (WKS SP): Continued momentum from M&A strategy

- RE-ITERATE BUY Entry – 0.300 Target– 0.330 Stop Loss – 0.285

- Winking Studios Limited operates as a game art outsourcing studio. The Company provides complete end-to-end art outsourcing and game development services across various platforms for the video games industry. Winking Studios serves customers worldwide.

- New acquisition. On 17 January, Winking Studios announced plans to acquire Shanghai Mineloader Digital Technology, a leading Asian game art outsourcing and development studio, for approximately RMB 146mn (S$27.2mn). Mineloader, with 466 employees and a strong focus on console platform games, generates 90% of its revenue from game art outsourcing. For the financial year ending 31 December 2023, Mineloader delivered EBITDA of approximately S$3.6mn. This deal aims to expand Winking Studios’ scale in Asia, access Western clients, and support global ambitions. Completion of the proposed acquisition is expected by 2Q25, with Mineloader’s leadership continuing under Winking Studios’ resources and expertise.

- M&A focused. Winking Studios’ largest peer Keywords Studios was previously listed on AIM in 2013, valued at £49mn. It was then acquired for £2.1bn, rewarding investors as the business grew 40-fold by providing services like music, art, and translation for video games. Winking Studios leverages key industry trends like art outsourcing and mobile gaming, attracting major clients like Ubisoft and EA. With a focus on high-quality, cost-effective services and a strong foundation with Acer as a major shareholder, Winking aims to replicate Keyword’s success. This includes organic growth, strategic acquisitions, and leveraging AI to enhance its offerings. As Winking Studios continues to execute its growth strategy and demonstrates increasing value, we anticipate its SGX share price to follow suit and expect continued strong performance and attractive returns for investors.

- Joint AI development project. Winking Studios entered a supplementary agreement with Acer for the second phase of their joint AI project to develop GenMotion.AI, a 3D animation generation tool. Acer will contribute US$200,000, with Winking providing resources. Both companies will share intellectual property 50/50 for any new inventions. GenMotion.AI converts text input into detailed 3D animations, enhancing efficiency and creativity for animators. GenMotion.AI leverages Winking’s proprietary, traceable training data, aiming to lead the way in AI adoption for digital art. The tool is expected to revolutionize workflows by improving visual quality, production speed, and ultimately, revenue per worker. This collaboration strengthens Winking’s position to handle more projects with tighter deadlines or larger projects, without the need for more manpower, unlocking significant growth potential.

- 1H24 results review. Total revenue for 1H24 increased by 7.1% YoY to US$15.23mn driven by strong growth in the Art Outsourcing Segment and Game Development segment, which saw a 6.6% and 8.1% rise respectively.

- We have fundamental coverage with a BUY recommendation and a TP of S$0.35. Please read the full report here.

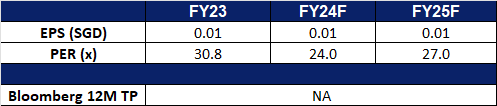

- Market Consensus.

(Source: Bloomberg)

Seatrium Ltd (STM SP): Potential growth from cross-border cooperation

- RE-ITERATE BUY Entry – 2.23 Target– 2.43 Stop Loss – 2.13

- Seatrium Ltd offers engineering solutions for the offshore, marine, and energy industries. The Company provides rigs and floaters, repairs and upgrades, offshore platforms, and specialized shipbuilding. Seatrium serves customers worldwide.

- Johor-Singapore Special Economic Zone project to support energy transition. Singapore and Malaysia launched the Johor-Singapore Economic Zone (JS-SEZ), a collaborative initiative focused on green energy, advanced manufacturing, and climate change mitigation. This comprehensive framework encompasses 11 key sectors, including manufacturing, logistics, food security, tourism, energy, digital economy, green economy, financial services, business services, education, and healthcare. The initiative aims to deliver 100 projects and create 20,000 jobs over the next decade. A key component of the JS-SEZ is the acceleration of renewable energy trading between the two nations. This includes a 50 MW green electricity deal and plans to import 1 GW of hydropower from Malaysia. With bilateral trade reaching $132.6 billion in 2023, the JS-SEZ strengthens economic ties and positions the region as a global leader in sustainability and energy transition. By leveraging its expertise in offshore energy, shipbuilding, and marine technologies, Seatrium can position itself to play a significant role in the success of the JS-SEZ and contribute to the region’s sustainable development goals.

- New contract with BP. Seatrium Ltd. recently announced the signing of an engineering, procurement, construction, and onshore commissioning (EPC) contract with BP Exploration and Production Inc. (bp) for the Kaskida Floating Production Unit (FPU) project in the U.S. Gulf of Mexico. The Kaskida project is a greenfield development located approximately 250 miles southwest of New Orleans in the Keathley Canyon area. In its first development phase, the FPU is designed to produce up to 80,000 barrels of crude oil per day from six wells. This contract is expected to provide a significant boost to Seatrium’s long-term revenue and profitability, enhancing its position in the offshore energy sector.

- Positive outlook with strong order book. As of the end of September 2024, Seatrium’s net order book stood at $24.4 billion, comprising 30 projects with scheduled deliveries through 2031. Gross orders amounted to nearly $38 billion, set to be delivered over the remainder of the decade. The company’s project pipeline remains robust, with continued interest from customers seeking partnerships. Seatrium anticipates a strong uptick in business activity and remains committed to reducing its debt while securing fresh capital to support ongoing and future projects.

- 1H24 results review. Revenue rose by 39.1% YoY to S$4.01bn in 1H24, compared to S$2.89bn in 1H23. Net profit was S$34.7mn in 1H24, compared to a net loss of S$240.5mn in 1H23. Basic EPS per share was 1.05 S cents in 1H24, compared to net loss per share of 9.40 S cents in 1H23.

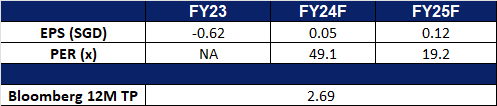

- Market Consensus.

(Source: Bloomberg)

Tencent Holdings Ltd. (700 HK): Continued growth to come

- RE-ITERATE BUY Entry – 375 Target – 425 Stop Loss – 350

- Tencent Holdings Ltd is an investment holding company primarily engaged in the provision of value-added services (VAS), online advertising services, as well as FinTech and business services. The Company primarily operates through four segments. The VAS segment is mainly engaged in the provision of online games, video account live broadcast services, paid video membership services and other social network services. The Online Advertising segment is mainly engaged in media advertising, social and other advertising businesses. The FinTech and Business Services segment mainly provides commercial payment, FinTech and cloud services. The Others segment is principally engaged in the investment, production and distribution of films and television program for third parties, copyrights licensing, merchandise sales and various other activities.

- Potential new venture. Tencent Holdings Ltd. and the Guillemot family, owners of Ubisoft, are reportedly exploring a new venture that could redefine the global gaming industry. According to Bloomberg, discussions are underway about leveraging some of Ubisoft’s key assets to establish a joint venture, potentially allowing Tencent to acquire a stake while ensuring the Guillemot family retains control of Ubisoft. This initiative could significantly bolster Tencent’s presence in the international gaming market, particularly beyond China. By securing a stake in the venture, Tencent would gain greater influence over Ubisoft’s renowned portfolio of games and franchises, many of which have a substantial global fanbase.

- Upgrades to products. Tencent has introduced a major upgrade to its Tencent Meeting platform, incorporating several enhanced features. On the intelligence front, the company has unveiled the Tencent Meeting AI Assistant Pro, powered by its advanced Tencent Hyper-Generative Model. For organizational collaboration, the platform now offers improved capabilities, including the ability to add contacts, make calls, and select participants seamlessly. Additionally, all users can now create organizations within Tencent Meetings. The update also enables users to display certified identities externally, fostering greater trust in online communication. This upgrade is designed to boost online collaboration efficiency, delivering a smarter, more efficient, and user-friendly meeting experience.

- Continued focused on new growth opportunities in AI. In its latest earnings release, Tencent outlined plans to pursue new growth avenues by advancing the adoption of its proprietary Hunyuan large language model across various industries and enhancing its AI infrastructure for enterprise clients. The company emphasized that it is already realizing tangible benefits from integrating AI across its products and operations, including in areas like marketing services and cloud computing, and remains committed to investing in AI-driven technologies, tools, and solutions to support users and partners. Tencent is also exploring new overseas opportunities in cloud computing, aiming to leverage global demand for AI technology to counteract increasing competition in China, where both established players and startups are engaged in intense price competition. These initiatives could pave the way for additional growth in the coming years.

- 3Q24 results review. Revenue increased 8% YoY to RMB167.2bn in 3Q24, compared with RMB154.6bn in 3Q23. Net profit rose 47% to RMB54.0bn in 3Q24, compared to RMB36.8bn in 3Q23. Basic earnings per share was RMB5.762 in 3Q24, compared to RMB3.828 in 3Q23, representing a 51% YoY increase.

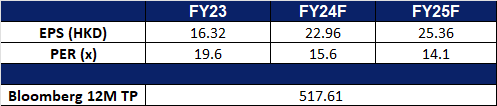

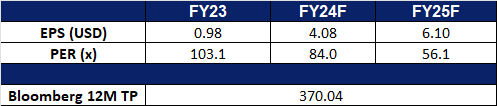

- Market consensus.

(Source: Bloomberg)

Aluminium Corp of China (2600 HK): Rebounding Aluminium Prices

- RE-ITERATE BUY Entry – 4.80 Target – 5.40 Stop Loss – 4.50

- Aluminum Corporation of China Ltd is a China-based company primarily engaged in the production and sale of primary aluminum and aluminum products. The Company conducts its business primarily through five segments. The Alumina segment is engaged in the mining and purchase of bauxite, the production and sale of alumina and alumina bauxite. The Primary Aluminum segment is engaged in the smelting of alumina, the production and sale of primary aluminum, carbon products, aluminum alloy and other aluminum products. The Energy segment is engaged in coal mining, electricity generation by thermal power, wind power and solar power, new energy related equipment manufacturing business. The Trading segment is engaged in the trading of alumina, primary aluminum, aluminum fabrication products, other non-ferrous metal products and coal products. The Corporate and Other Operating segment is engaged in the management of corporate, research and development activities and others.

- Aluminium Price rebound. Aluminum futures climbed above $2,600 per tonne, recovering sharply from the near four-month low of $2,490 on January 6th. The rally aligns with broader gains in base metals as China signaled additional measures to boost consumption, improving the demand outlook for manufacturing inputs. In December, aggregate financing and new yuan loans in China exceeded expectations, reflecting the initial impact of aggressive monetary stimulus introduced by the People’s Bank of China (PBoC). These developments follow the government’s commitment to increased deficit spending and looser monetary policy aimed at stimulating economic activity. Additionally, aluminum futures outside China received support from Beijing’s decision to end tax rebates on aluminum semi-manufactured products, which has bolstered demand for aluminum in markets outside the world’s largest producer.

Aluminium Spot Price

(Source: Bloomberg)

- Potential new sanctions on Aluminium. The European Union is reportedly considering imposing additional import restrictions on Russian aluminum as part of its 16th sanctions package against Moscow in response to the invasion of Ukraine. These measures would coincide with the third anniversary of the war. According to reports, the restrictions would be implemented gradually, with the specific timeline and scope yet to be finalized. Russia, the largest aluminum producer outside of China, accounts for approximately 5% of global aluminum production. If enacted, these sanctions could potentially disrupt the global aluminum supply chain, adding pressure to already tight markets. This may, in turn, contribute to higher aluminum prices, reflecting the anticipated reduction in supply.

- Embracing AI. Aluminum Corporation of China recently announced a strategic collaboration with peers in the nonferrous metals industry to advance the digital development and application of large AI models. This initiative is expected to gain support from the China Nonferrous Metals Industry Association, key government departments, and other relevant partners. As a leading enterprise in the nonferrous metals sector, Chalco has established an independently controlled AI computing center and developed Kun’an, the industry’s first general-purpose large language model. Kun’an leverages AI to enhance operational workflows across the industry, spanning exploration, mining, processing, and recycling. It also bolsters security in critical areas such as mineral resources, production processes, networks, data, and algorithms. Looking ahead, Chalco aims to further solidify the technological foundation of large AI models, accelerate advancements in cognitive intelligence operating systems and key industrial AI technologies, and foster deeper integration of capital, talent, technology, data, and computing power. This synergy is expected to drive coordinated innovation, empower the industry’s transformation towards high-quality development, and expedite the emergence of new, high-value productive forces.

- 3Q24 earnings. Revenue rose 16.04% YoY to RMB63.1bn in 3Q24, compared with RMB54.3bn in 3Q23. Net profit rose 3.34% to RMB2.0bn in 3Q24, compared to RMB1.94bn in 3Q23. Basic earnings per share was RMB0.116 in 3Q24, compared to RMB0.111 in 3Q23.

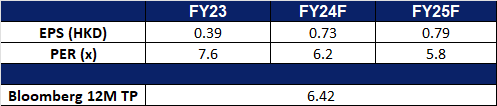

- Market consensus.

(Source: Bloomberg)

AppLovin Corporation (APP US): Unlocking advertising potential with AI

- RE-ITERATE BUY Entry – 330 Target – 370 Stop Loss – 310

- AppLovin Corporation develops technologies that help businesses of every size connect to their ideal customers. The company provides end-to-end software and AI solutions for businesses to reach, monetize, and grow their global audiences. AppLovin serves clients worldwide.

- AI + mobile advertising. The company’s third-quarter earnings surpassed Wall Street expectations, with its AI-powered ad recommendation engine, Axon, being a significant contributor to the performance boost. Axon leverages AI technology to analyze ad performance data and automate ad optimization, enabling advertisers to reach their target audience with greater precision. The engine seamlessly integrates with the company’s MAX platform to enhance ad monetization while ensuring a seamless user experience. Axon can automate multiple tests (such as A/B testing) and continuously adjust advertising strategies based on results, reducing the need for manual operations.

- Targeting mobile game ads. The company’s products reached 1.4 billion daily active users in 2024, and its applications primarily target the mobile game advertising market. While competitors in the mobile advertising market include Meta, Unity, and IronSource, the company’s strategic focus on mobile games makes its platform more appealing to game developers for ad placements.

- 2025 catalysts. The continued advancement of AXON AI technology not only enables the company to expand into new verticals such as e-commerce and connected TV but also drives significant growth in its core business of mobile game advertising.

- 3Q24 results. Applovin’s revenue increased by 38.8% YoY to US$1.2bn in 3Q24, compared to US$1.1bn in 3Q23. It delivered GAAP EPS of US$1.25, above estimates by US$0.32. Board of directors increased its share repurchase authorization by an incremental US$2.0bn, increasing its total aggregate remaining authorization to US$2.3bn, with future repurchases to be funded from Free Cash Flow.

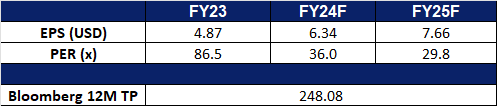

- Market consensus

(Source: Bloomberg)

Broadcom Inc (AVGO US): Orderbooks secured

- RE-ITERATE BUY Entry – 224 Target – 250 Stop Loss – 211

- Broadcom Inc. designs, develops, and supplies semiconductor and infrastructure software solutions. The Company offers storage adapters, controllers, networking processors, motion control encoders, and optical sensors, as well as infrastructure and security software to modernize, optimize, and secure the complex hybrid environments. Broadcom serves customers worldwide.

- Gaining AI market share. Broadcom is solidifying its role as a key AI hardware partner for hyperscale’s diversifying away from Nvidia. Its CEO revealed plans from three hyperscale customers to deploy one million XPU clusters each by 2027, with two more in advanced development. SK Hynix, a dominant HBM supplier, is scaling DRAM production by 70% in 2025 to meet surging demand from Broadcom and Nvidia, focusing on advanced HBM3E technology. Broadcom’s AI-driven semiconductor revenue reached US$30.1bn in 2024, reflecting a 220% YoY growth in AI revenue and highlighting its expanding influence in AI chip innovation.

- Continued innovation. Broadcom launched the Brocade G710, a 24-port 64G Fibre Channel SAN switch designed for small to mid-sized businesses. It offers low latency (460 ns), energy efficiency (65W), and scalability from 8 to 24 ports. Key features include cyber-resilient architecture, autonomous self-healing capabilities, and six nines (99.9999%) reliability. The G710 ensures robust data security with network isolation and root-of-trust validation. Backed by a lifetime warranty, it provides 24/7 support, firmware updates, and security patches, delivering a cost-effective solution for high-performance, secure, and reliable data canters.

- Data center growth prospects. According to JLL, global data center demand is expected to soar in 2025, with 10GW of capacity projected to break ground and 7GW expected to be completed. Market growth, driven by AI and advancements in semiconductors, is forecasted at a 15%–20% CAGR through 2027. AI workloads are driving higher power densities, with chips reaching up to 250kW per rack, though traditional workloads will remain significant, comprising over 50% of demand by 2030. The Biden administration has prioritized data center development, enabling the leasing of Department of Defense and Energy sites for gigawatt-scale AI projects. Developers are required to integrate sufficient clean energy resources to meet these facilities’ power demands. Additionally, a hyperscaler is planning 20 edge data centers across the US to reduce latency and improve redundancy. Globally, Spain will see two gigawatt-scale campuses developed through public-private partnerships, while Aligned Data Centers has raised US$12bn to fund its expansion. Macquarie Asset Management will invest US$5bn in Applied Digital, supporting its AI and HPC-focused facilities. Broadcom is well-positioned to benefit from this growth, offering solutions that optimize server speed, uptime, and storage connectivity, reducing the cost and complexity of hyperscale deployments. These developments will likely bolster its infrastructure software revenue as data center expansion accelerates globally.

- 4Q24 results. Broadcom’s revenue increased by 51% YoY to US$14.054bn in 4Q24, compared to US$9.295bn in 4Q23, driven by the successful integration of VMware and AI revenue growth. It delivered GAAP net income of US$4.324bn and non-GAAP net income of US$6.965bn for the fourth quarter. GAAP diluted EPS was US$0.90 and non-GAAP diluted EPS was US$1.42. The company also announced an increase in its quarterly common stock dividend by 11% YoY to US$0.59 per share. Looking ahead, Broadcom expects 1Q25 revenue of approximately US$14.6bn, an increase of 22% from the prior year period and an adjusted EBITDA guidance of approximately 66% of projected revenue.

- Market consensus

(Source: Bloomberg)

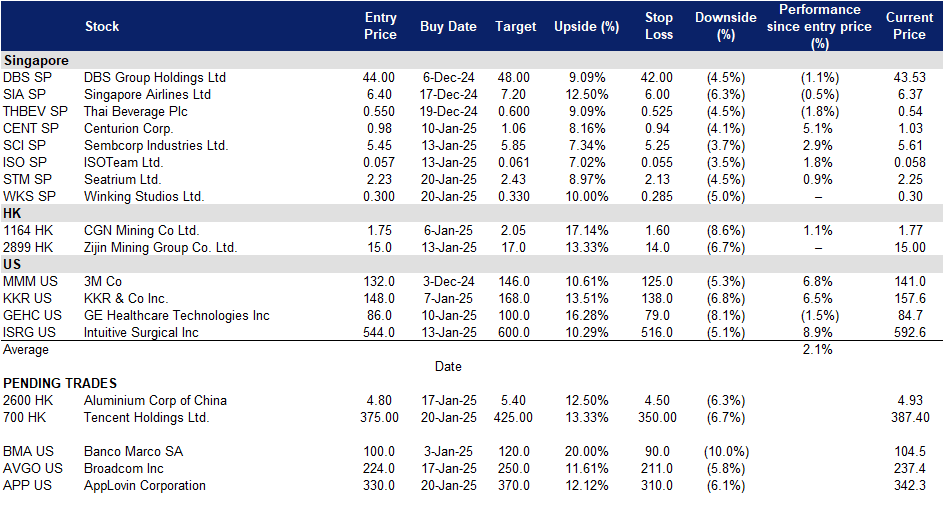

Trading Dashboard Update: Add Seatrium Ltd (STM SP) at S$2.23 and Winking Studios Ltd (WKS SP) at S$0.30.