2 December 2024: CSE Global Ltd (CSE SP), Trip.com Group Ltd. (9961 HK), 3M Co (MMM US)

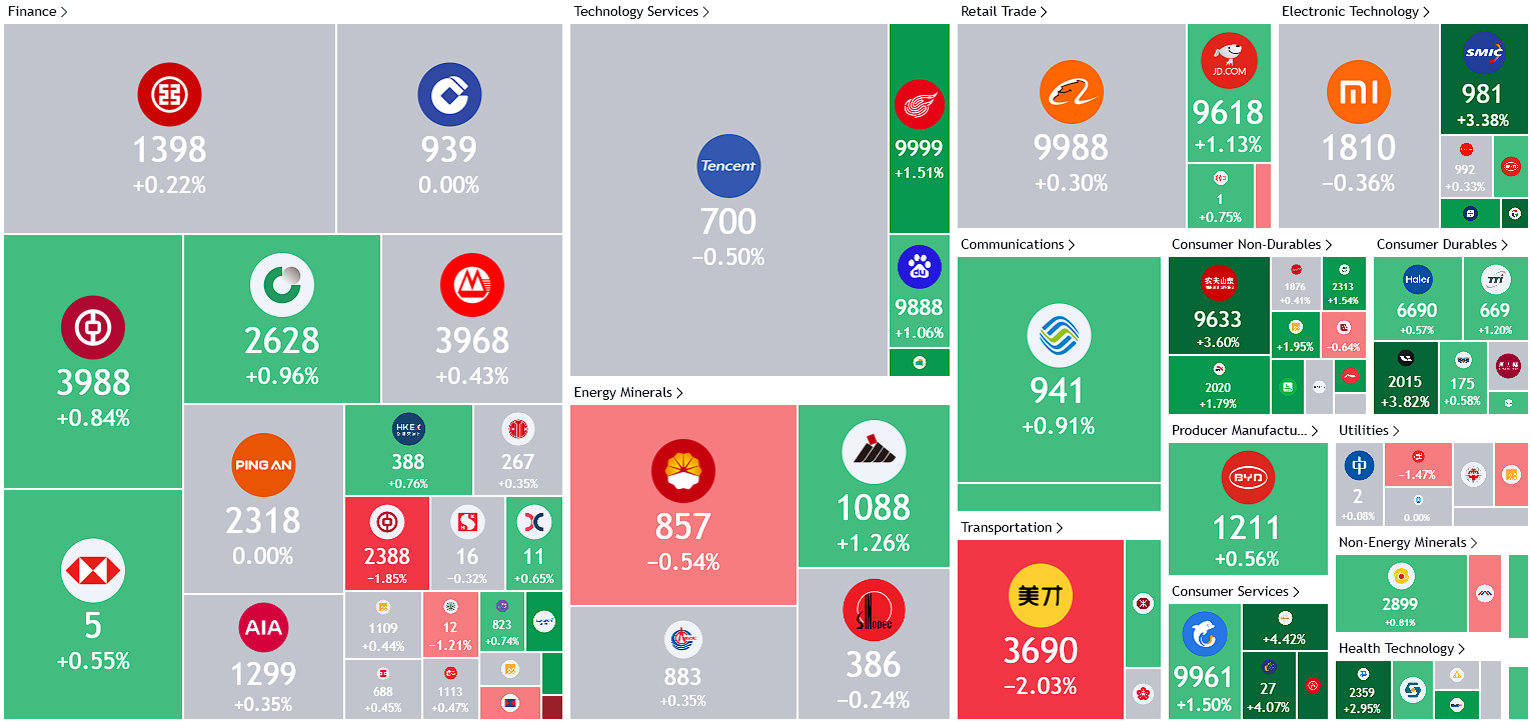

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

United States

Hong Kong

CSE Global Ltd (CSE SP): Benefitting from global trends

- BUY Entry – 0.460 Target– 0.490 Stop Loss – 0.445

- CSE Global Limited provides systems integration and information technology solutions, computer network systems, and industrial automation. The Company also designs, manufactures, and installs management information systems. CSE Global develops, manufactures, and sells electronic and micro processor monitoring equipment.

- Reaping benefits from the AI trend. The rapid growth of artificial intelligence, particularly generative AI, is driving a significant surge in energy demand from data centers due to the resource-intensive computing processes required. Companies like Google, Apple, and Tesla are enhancing AI capabilities, further increasing electricity consumption in energy-hungry data centers. By 2027, global AI-related electricity usage is projected to rise by 64%, reaching 134 terawatt-hours annually, with broader data center consumption potentially doubling by 2030 to account for 9% of U.S. electricity demand. The IEA estimates global electricity use for AI, data centers, and crypto will grow nearly 75% from 460 TWh in 2022 to 800 TWh by 2026. Generative AI is forecasted to become a $1.3 trillion market by 2032, expanding at a CAGR of 42%, driven by training infrastructure and inference devices. As AI adoption accelerates across industries, energy demand from data centers will continue to rise, presenting growth opportunities for CSE Global, which offers data center and electrification solutions within its business segments.

- To benefit from a transition to renewables. The global focus on renewable energy has intensified, with many nations accelerating its adoption as a cleaner alternative to fossil fuels. The IEA reports that global renewable electricity capacity grew by an estimated 507 GW in 2023—a nearly 50% increase from 2022—driven by policy support across more than 130 countries. Projections indicate renewable capacity additions will surpass 700 GW by 2028, with solar PV and wind contributing 96% of this growth due to declining costs and robust policy backing. The United States saw a record-breaking year for renewables in 2023, installing 31 GW of solar capacity (a 55% year-over-year increase) despite supply chain delays. Solar now provides 5% of U.S. electricity, while wind energy, representing 11% of electricity generation, reached 147 GW in capacity by Q3 of 2023. Globally, China has made remarkable progress, with wind and solar collectively surpassing coal in installed capacity as of mid-2024. This transition underscores a broader global shift toward cleaner energy sources. The rising adoption of renewables is expected to drive demand for electrification projects, presenting growth opportunities for CSE Global in its key markets.

- Continued strength in Order Intake & Order Book. CSE Global’s order book fell marginally by 0.7% to S$633.6mn in 3Q24, compared to S$638.0mn in 3Q23. On the other hand, order intake declined by 18.1% to S$565.4mn in 9M24, compared to S$690.0mn in 9M23, largely due to a stronger base in 3Q23 and 4Q23. CSE Global also announced in early November that the company has secured 2 major contracts totalling S$38.4mn in the U.S., which are slated for execution from 2024 to 2026. The company also secured another major electrification contract worth S$90.7mn in the U.S., slated for execution between 2025 and 2026. This is bound to provide a boost to the company’s order book and order intake in 4Q24. The company’s order book remains robust, and CSE Global continues to be well-positioned to achieve a healthy financial performance in 2024. The company’s robust order book also re-emphasizes the company’s credibility, and enhanced market position, allowing for the company to have stronger bargaining power.

- 9M24 business updates. CSE Global reported a total revenue of S$642.8mn for 9M24, increasing by 20.2% YoY, compared to S$534.7mn in 9M23, mainly attributed to growth across all business segments and geographical regions. In the company’s 1H24 financial results, net profit increased by 36.4% YoY to S$15.0mn, compared to S$11.0mn in 1H23. The group’s EPS was 2.31 Singapore cents in 1H24, compared to 1.79 Singapore cents in 1H23.

- We have fundamental coverage with a BUY recommendation and a TP of S$0.53. Please read the full report here.

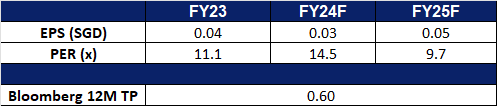

- Market Consensus.

(Source: Bloomberg)

Thai Beverage PCL (THBEV SP): Consumption recovery

- RE-ITERATE BUY Entry – 0.550 Target– 0.600 Stop Loss – 0.525

- Thai Beverage Public Company Limited produces a wide range of branded beer and spirits in Thailand.

- Expectations of more tourists to drive consumption levels. Thailand is actively revitalizing its tourism industry as the sector recovers from the downturn caused by the COVID-19 pandemic. To stimulate domestic tourism and promote longer trips, the Thai government has introduced three additional public holidays in 2025, aiming to boost economic activity nationwide. The rebound in tourism is evident, with Thailand welcoming 28.15 million international visitors in 2023 and exceeding 29 million arrivals by mid-2024. The government projects over 36.7 million arrivals by the end of 2024, surpassing pre-pandemic levels. This surge in tourist numbers is expected to drive higher consumption across the country. As ThaiBev generates approximately two-thirds of its revenue from the domestic market, the anticipated increase in consumption presents a significant growth opportunity for the company.

- Digital wallet to the stimulate economy. Thailand launched a US$14 billion stimulus program, with an initial phase distributing 10,000 baht to 14.5 million welfare recipients and disabled citizens to boost spending and economic activity. The government plans further phases, including a THB40 billion handout to 4 million senior citizens before Lunar New Year 2025. Originally designed as a digital wallet initiative, the program faced technical and budgetary adjustments but still aims to promote financial inclusion and encourage digital payment adoption. The scheme supports small businesses by enabling cashless transactions, reduces cash dependency, and enhances economic resilience post-pandemic. Retail sectors and the non-alcoholic beverage market have already seen positive impacts. This program is expected to stimulate domestic consumption, attract foreign investment, and position Thailand as a leader in digital finance, fostering long-term economic growth. Thailand’s consumer confidence also rebounded in October to 56.0, compared to a low of 55.3 in September.

- Potential IPO. Thai Beverage recently announced the revival of plans for an IPO of its beer unit, BeerCo, aiming to capitalize on recovering global stock markets. The IPO could happen as early as 3Q25 if a decision is finalized by December. The company is also exploring equity partnerships, with interest from two potential partners. ThaiBev had shelved similar plans two years ago due to weak market conditions but sees renewed opportunity amid falling interest rates and market rallies. Its CEO noted the IPO could pave the way for future listings of other divisions. The spirits business, including popular brands like Mekhong and Ruang Khao, is also under consideration for a separate Singapore IPO. ThaiBev reported steady revenue of 217.06 billion baht in 9M24, with beer EBITDA rising 10.2% to 11.9 billion baht. The potential IPOs would help ThaiBev to unlock valuation in its different business segments and better position its company for further growth.

- Long-term investment strategy. Thai Beverage has announced a THB18 billion investment plan for fiscal 2025 as part of its “Passion 2030” strategy, targeting domestic and international expansion. The strategy focuses on adapting to evolving consumer behaviour and leveraging digital solutions, with the service sector and digital platforms identified as key growth areas. Such as its spirits division with plans to expand internationally over the next five years. Regional investments like THB2.5 billion in Cambodia, and THB8 billion will go toward Malaysia’s AgriValley project to develop an integrated dairy farm with halal product capabilities. Furthermore, it plans to prioritise its core markets, non-alcoholic beverage operations in Thailand, Malaysia, Vietnam, and Myanmar, with strategic opportunities in Singapore, Cambodia, Laos, and Indonesia. The investments aim to strengthen ThaiBev’s presence across its product lines, from food to alcoholic and non-alcoholic beverages, while positioning the company for long-term growth in diverse markets.

- FY24 results review. ThaiBev’s revenue rose to 340.3 billion baht, a 2.2% YoY increase, due to growth in sales from its spirit and food business. It reported earnings of 27.2 billion baht, decreasing 0.8% YoY, EPS of 1.15 baht. The group declared a final dividend of 0.47 baht per share, with a full-year dividend of 0.62 baht per share.

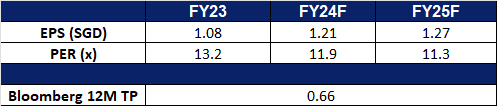

- Market Consensus.

(Source: Bloomberg)

Trip.com Group Ltd. (9961 HK): Travel seasonality is back

- BUY Entry – 480 Target 540 Stop Loss – 450

- Trip.com Group Ltd is a China-based company mainly engaged in the operation of one-stop travel platform. The Company’s platform integrates a comprehensive suite of travel products and services and differentiated travel content. Its platform aggregates its product and service offerings, reviews and other content shared by its users based on their real travel experiences, and original content from its ecosystem partners to enable leisure and business travelers to have access to travel experiences and make informed and cost-effective bookings. Users come to its platform for any type of trip, from in-destination activities, weekend getaways, and short-haul trips, to cross-border vacations and business trips.

- Winter travel seasonality. The approaching winter and festive seasons are anticipated to drive a surge in travel demand, as the period from early November to January is traditionally one of the busiest for travel. Many consumers are expected to take advantage of their remaining annual leave or seek seasonal getaways to escape extreme weather in their home countries. Festive celebrations during this time further amplify interest in holiday travel. Trip.com is well-positioned to capitalize on this peak travel season and the heightened demand it brings.

- Further expansion of visas. China will expand its visa-free arrangements to include Japan, Bulgaria, Romania, Croatia, Montenegro, and other countries, effective from November 30, 2024, to December 31, 2025, according to a foreign ministry spokesperson. Additionally, the visa-free stay period for citizens of all 38 countries in its program will be extended from 15 to 30 days, as reported by state broadcaster CCTV. These measures build on earlier visa-free agreements with South Korea and select European nations, aimed at stimulating tourism and trade amid economic headwinds. Furthermore, China has also eased visa rules for Shenzhen residents travelling to Hong Kong, allowing unlimited visits within a year instead of the previous one-trip-per-week limit. The expanded policy is expected to boost travel volumes to and from China, benefiting travel platforms such as Trip.com Group.

- More partnerships. Trip.com has launched a major brand campaign at Kuala Lumpur International Airport (KLIA) through a partnership with Meru Utama Sdn Bhd (VGI Airports). This initiative aligns with Trip.com’s strategy to strengthen its presence in the Southeast Asian market, leveraging KLIA’s role as a key regional hub. The campaign features prominent branding across high-traffic areas such as walkways, aerobridges, and other strategic locations, ensuring visibility to the millions of passengers passing through the airport. This collaboration enhances Trip.com’s brand visibility while reinforcing its commitment to supporting the recovery of global travel.

- 3Q24 earnings. Trip.com Group recorded better-than-expected third-quarter results amid robust local and international travel demand, with both domestic and international travel exhibiting robust growth. With increasing consumer confidence and heightened travel sentiment, the company is optimistic about the continued growth of the travel industry. The company’s revenue rose to RMB15.9bn in 3Q24, +15.6% YoY, compared to RMB13.7bn in 3Q23. The company reported a net profit of RMB6.77bn in 3Q24, compared to a net profit of RMB4.62bn in 3Q23. Basic EPS rose to RMB10.37 in 3Q24, compared to RMB7.05 in 3Q23.

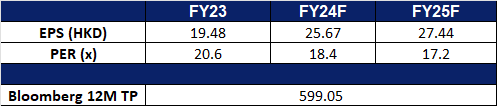

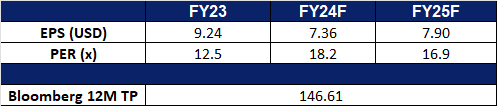

- Market consensus.

(Source: Bloomberg)

Keep Inc. (3650 HK): Medals as a social currency

- RE-ITERATE BUY Entry – 6.10 Target 7.10 Stop Loss – 5.60

- Keep Inc is a company principally engaged in the provision of comprehensive fitness solutions. The Company operates its business through three segments. The Self-branded Fitness Products segment is engaged in m the sale of self-branded fitness products, including smart fitness devices, such as Keep Bike, Keep Wristband, smart scale, and treadmill, and complementary fitness products including fitness gear, apparel and food. The Membership and Online Paid Contentt segment provides membership subscription and online paid content. The Advertising and Others segment is engaged in offline centers, advertising and others (excluding offline centers).

- Increasing popularity of Keep’s medals. Keep, a leading sports-tech platform, has seen remarkable success with its innovative online events and collectible “Keep Medals.” Known for their diverse themes, striking designs, and emotional resonance, these medals have become viral sensations. Keep’s approach involves strategic collaborations with popular intellectual properties (IPs) to create themed events. Participants can earn a coveted medal by selecting an event, registering, and completing its challenges. The initiative began in 2021 with the launch of a Cinnamoroll-themed medal and has since expanded to partnerships with Hello Kitty, Kuromi, Line Friends, Crayon Shin-chan, and gaming franchises like Genshin Impact and Honkai Star Rail. Over time, these medals have transformed into a form of social currency, enabling young people to express their individuality, share emotions, and connect with others who share similar interests. Fans of these IPs have also inspired new ideas and gameplay for Keep’s events. Recent themed collaborations have drawn widespread participation. For example, Keep’s Detective Conan online event series attracted over 600,000 participants, while a single Genshin Impact event saw more than 1 million registrations, underscoring the growing appeal of these highly sought-after medals.

- A rising Guzi Culture. China has seen a surge in interest among young consumers for “guzi”—merchandise featuring popular ACG (anime, comics, games) characters. The growing enthusiasm for anime culture is evident in the success of related films and promotional events. Fans span a wide demographic, from children purchasing affordable character cards to university students spending thousands of yuan on rare collectibles. The “guzi” market is currently valued at an estimated $31bn. To capitalize on this trend, brands are increasingly collaborating with ACG IP owners to offer limited-edition guzi merchandise, aiming to capture the attention of this youthful audience. Keep’s strategy of partnering with popular IPs positions the company well to benefit from the rising demand as more young consumers embrace this cultural phenomenon.

- A new way to connect. In response to increasingly isolated digital lifestyles, Gen Z is actively seeking ways to foster a sense of community in the physical world. This shift has led to a growing interest in hobby-specific clubs, niche sporting communities, and targeted social apps. According to a survey by Chinese social platform Soul, many in China are experiencing a “friendship recession,” with young people reporting an average of just 2.5 close friends. This has driven them to explore new ways to build and sustain meaningful relationships. Keep Inc. addresses this need by offering opportunities for physical connection through fitness activities, enabling users to relieve stress, stay active, and engage in sports-based socializing.

- 1H24 earnings. The company’s revenue rose to RMB1,037.3mn in 1H24, +5.4% YoY, compared to RMB984.7mn in 1H23. The company reported an adjusted net loss of RMB160.69mn in 1H24, compared to an adjusted net loss of RMB223.143mn in 1H23. Basic (diluted) earnings per share were -RMB0.35 (-RMB0.35) in 1H24, compared to RMB8.64 (-RMB0.52) in 1H23.

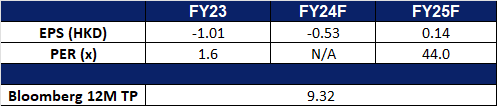

- Market consensus.

(Source: Bloomberg)

3M Co (MMM US): Manufacturing to revive

- BUY Entry – 132 Target – 146 Stop Loss – 125

- 3M Company conducts operations in electronics, telecommunications, industrial, consumer and office, health care, safety, and other markets. The Company businesses share technologies, manufacturing operations, marketing channels, and other resources. 3M serves customers worldwide.

- Manufacturing is expected to recover under Trump. Looking back at 2017, when Trump first took office, the U.S. ISM pharmaceutical industry PMI remained in the 55-60 range throughout the year, which was a period of expansion. At that time, Trump lowered the corporate tax rate from 35% to 21% and relaxed regulations on industries such as energy, finance and environment. That was also the first year of the trade war. The domestic manufacturing industry in the United States has recovered significantly under positive policy adjustments. The market expects that Trump will continue his governing philosophy in 2025 and implement it faster and more efficiently than in 2017. Therefore, the U.S. manufacturing industry is expected to return to expansion from the current contraction.

- Legal action expected to be resolved. 3M has faced multiple legal actions in recent years, the most important of which is environmental pollution liability issues related to per- and polyfluoroalkyl substances (PFAS, commonly known as “sustainable chemicals”). In addition, the company was sued collectively by members of the U.S. military over defective earplug products, claiming that the products failed to effectively protect hearing. The lawsuits have resulted in 3M paying huge settlements and putting pressure on its finances. At the same time, the company is taking steps to improve internal processes and address future legal and compliance challenges to restore investor confidence and stabilize business development.

- 3Q24 results. Revenue reached US$6.1 billion, down 26.6% from the same period last year, exceeding market expectations by US$40 million. Non-GAAP EPS were US$1.98, beating expectations by US$0.08. GAAP EPS from continuing operations was US$2.48, a YoY increase of 154%. Management raised full-year adjusted earnings per share to a range of US$7.20 to US$7.30, compared with the previous range of US$7.00 to US$7.30.

- Market consensus.

(Source: Bloomberg)

Walt Disney Co (DIS US): Holiday magic

- RE-ITERATE BUY Entry – 116 Target – 128 Stop Loss – 110

- The Walt Disney Company operates as an entertainment and media enterprise company. The Company’s business segments includes, media networks, parks and resorts, studio entertainment, consumer products, and interactive media. Walt Disney serves customers worldwide.

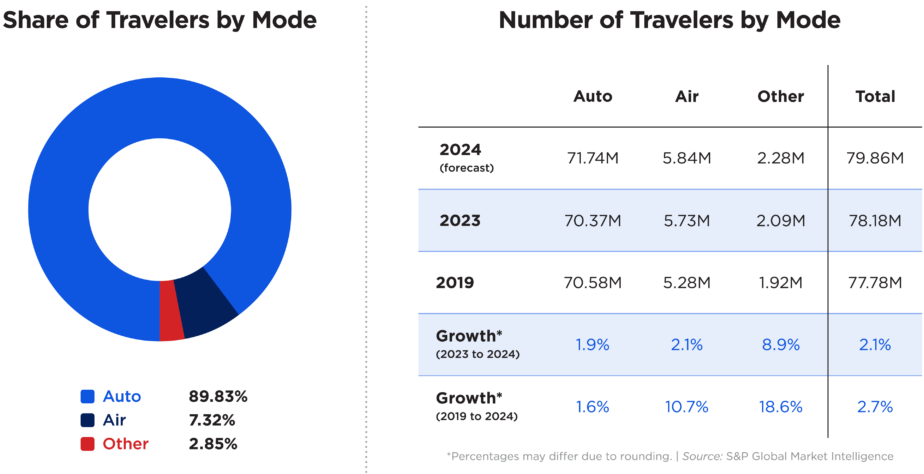

- Season to the thankful. Disney’s theme park division achieved record revenue and profit in fiscal 2024, with revenue rising 5% to US$34.15 bn and operating income up 4% to US$9.27bn. The experiences segment, which includes parks, cruises, and consumer products, outperformed other divisions in growth and is projected to see a 6%-8% profit increase in fiscal 2025. As part of its US$60 billion investment in parks, Disney plans new attractions, such as Coco-themed lands and Avengers Campus expansions, though these will debut in a few years. In the meantime, Disney is leveraging seasonal offerings like Halloween and winter holidays to drive revenue through higher ticket prices and in-park experiences. Limited-time events, such as holiday overlays on rides, themed merchandise, and parades, attract repeat visitors and boost attendance during peak travel months like October and December. Disney also anticipates strong performance from Thanksgiving holiday travel, with AAA projecting record car travel and lower gas prices, which may contribute to increased domestic park footfall. Additionally, Disney’s Moana 2 is poised for a significant box office debut, joining Wicked and Gladiator II to drive an expected US$200+ million in Thanksgiving ticket sales. With these initiatives, Disney is set to capitalize on the holiday season’s demand, driving its sales upwards.

AAA 2024 Thanksgiving Travel Forecast – between 26 Nov to 2 Dec

Source: Automotive, Travel, and Traffic Safety Information

- Disney cruise line fleet expansion. Disney Cruise Line is undergoing significant expansion, set to double its fleet by 2031. The Disney Treasure, launching in December 2024, will join the fleet as the sixth ship, with two more vessels — Disney Destiny and Disney Adventure — arriving in 2025. Additionally, Disney plans to introduce four more ships and enter the Asian market through a partnership with the Oriental Land Company, offering cruises from Singapore starting in 2025. Disney’s experiences division, which includes cruises, parks, and resorts, posted record revenue of US$34.15bn in fiscal 2024, up 5%.. The division outperformed other segments in revenue growth and is projected to see continued profit growth in fiscal 2025. Disney’s premium cruises are distinguished by guest-centric ship designs, storytelling, and integration of beloved Disney characters. Starting prices for its cruises are higher than competitors like Carnival and Royal Caribbean but offer comparable costs with upgrades. The Treasure’s seven-night cruises begin at US$4,277 for two guests. In Asia, bookings for Disney Adventure cruises will open in December 2024, with itineraries departing from Singapore through at least 2026 under a partnership with the Singapore Tourism Board. This strategic move aims to tap into key Southeast Asian markets, including China, India, and Indonesia. Despite a smaller fleet than competitors, Disney anticipates robust demand in the family cruising market, positioning its cruise segment for strong revenue growth in the coming year.

- Disney Plus new offerings. Disney Plus is expanding its portfolio of original Korean content to compete with Netflix, leveraging the global popularity of K-dramas. At the 2024 Disney APAC Content Showcase, the platform announced 10 new Korean series, including the second season of the hit show Moving, based on a webtoon by Kangfull. The first season became Disney Plus’ most-viewed original series globally in 2023. Another Kangfull adaptation, Light Shop, will premiere in December, alongside Disney’s first Korean historical drama, The Murky Stream. Since 2021, Disney Plus has launched over 130 original titles in the Asia Pacific, with Korean content dominating the platform’s top-performing international originals. In 2023, nine of the 15 best-performing international titles were Korean, including A Shop for Killers and BTS reality show Are You Sure?!, which resonated both regionally and globally. Disney sees Asia Pacific as a critical growth region, emphasizing its rich storytelling and global appeal. This strategic focus on exclusive K-dramas is poised to drive further subscriber growth for Disney Plus in FY25.

- 4Q24 results. Revenue increased 6% YoY to US$22.57 billion, exceeding expectations by US$80 million. Non-GAAP EPS was US$1.14 beating estimates by US$0.03. For FY25, Disney expects high single-digit adjusted EPS growth compared to FY24 vs estimated growth of 4.14% YoY. In 1Q25, it anticipates its sports segment operating income to grow 13% YoY and experiences to grow between 6% to 8% YoY. For FY26 and FY27, Disney anticipates double-digit adjusted EPS growth.

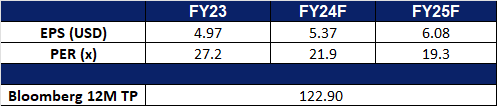

- Market consensus.

(Source: Bloomberg)

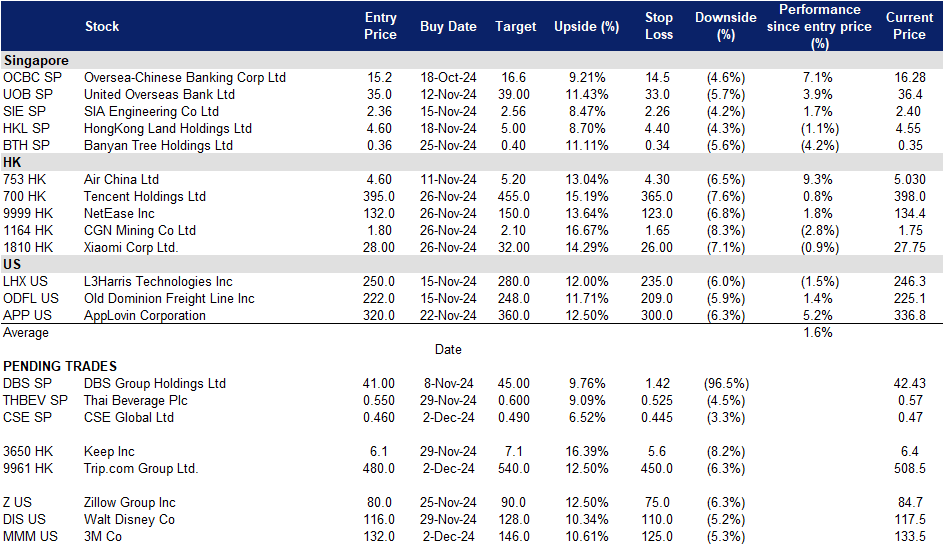

Trading Dashboard Update: No stock additions/deletions.