21 March 2022: OxPay Financial Ltd (OPFL SP), Xinte Energy Co Ltd (1799 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SINGAPORE

OxPay Financial Ltd (OPFL SP): From losses to profits

- BUY Entry – 0.175 Target – 0.200 Stop Loss – 0.160

- The turnaround. OxPay announced adjusted net profit of S$3.2mn in FY21 VS FY20’s net loss of S$1.9mn, driven by a surge in revenue of 53.2% YoY in FY21. Gross profit margin jumped to 62% in FY21, from 32% in FY20, mainly due to an increase in remittance activities from its merchants.

- Riding on the BNPL trend. OxPay recently entered into multiple partnerships in the “Buy Now Pay Later” (BNPL) space, such as with IOU Pay and PaySlowSlow. Pursuant to the partnership with IOU Pay, OxPay will be able to add the BNPL option into its online e-invoicing, Quickpay and web payment acceptance platform in Malaysia, thereby catering to the growing consumer demand for deferred payment choices. OxPay has also collaborated with BNPL brand PaySlowSlow in Singapore and will provide the brand with payment gateway and merchant acquiring services. PaySlowSlow Singapore targets to roll out BNPL services in 1Q22, with 500 merchants and monthly gross transaction value of approximately S$1.0mn, which is expected to translate into additional processing volume for OxPay.

- Reinforcing foothold in the F&B and retail space. Capitalising on its specialty in the F&B and retail space, OxPay has also acquired up to 20% stake in AppPOS, a network of over 300 F&B and retail merchants. AppsPOS has more than 1mn users on its mobile apps/website in Asia, facilitating over S$300mn worth of Gross Merchant Value annually.

- Neobanking in UK and European markets. OxPay announced earlier this year that it has partnered with TranSwap, a global banking-as-a-service platform with multiple central bank licenses across the UK, Singapore, Hong Kong and Indonesia. TranSwap will integrate its neobank technology stack in OxPay’s current platform. With this partnership, OxPay will offer neobanking products such as the issuance of local and global virtual name bank accounts to clients for collection, payment and conversion of currencies, as well as global cross-border payment and issuance of cards.

- Summary. Despite being a fintech company, OxPay managed to turnaround its losses from the previous year and generated adjusted net profits in FY21. The company has low levels of debt, a negative net gearing ratio and the business is free from large capex commitments, inventory and operates on a straightforward revenue model.

- While we have a technical buy TP of S$0.200, we have a fundamental outperform rating and TP of S$0.30 based on 18x P/E (Previously 25x) to FY22F EPS of S$0.017. Read our fundamental report here.

Golden Energy and Resources (GER SP): Fastest growing diversified miner in Asia

- RE-ITERATE BUY Entry – 0.47 Target – 0.55 Stop Loss – 0.425

- KGI Securities (Singapore) was the placement agent for Golden Energy and Resources’ S$86.9mn private placement that was completed on 7 March 2022.

- Diversified resources play. GEAR is a diversified mining and natural resources investment company. Having its roots as one of Indonesia’s largest coal miners, the group is on track to become the dominant metallurgical coal player in Australia with the acquisition of Mitsui Coal Pty Ltd (BMC) from BHP Group (BHP AU). GEAR will further diversify into base metals that will be utilised for clean energy uses such as copper, cobalt, zinc and nickel.

- Transformational year. Golden Energy & Resources (GEAR) is on track to significantly expand its production capacity and profits with the acquisition of BHP Mitsui Coal Pty Ltd (BMC). The acquisition will cement GEAR, through its ASX-listed Stanmore subsidiary, as a major metallurgical coal (coking coal) provider in the region. Metallurgical coal is the key ingredient in the steel industry, whose demand is driven by China now and India in the future.

- Metallurgical and thermal coal are hot. Coal prices have surged through the roof given the need from importing countries to source non-Russian coal. Australian and Indonesian coal miners are expected to be key beneficiaries.

- Gold’s back. GEAR, through 50% owned Ravenswood Gold (Ravenswood), is on track to increase production capacity to around 200koz of gold per annum in 1H2022. Timing could not be better given the recent return of demand for the precious metal.

- Technical TP of S$0.55; fundamental TP of S$1.29. While we have a Technical TP of S$0.55 based on short-term technical factors, we raised our fundamentals-based TP to S$1.29 after we factor in the game-changing acquisition of BMC. Our fundamental TP is based on the SOTP valuation of its majority stakes in Stanmore Resources (metallurgical coal), PT Golden Energy Mines (thermal coal) and Ravenswood Gold (gold). Stanmore will increasingly drive GEAR’s valuations, which currently makes up 48% of GEAR’s fair value, while GEMS drops to 42% of our fair value, down from 85% in our initiation report (25 Aug 2021). Read the full fundamentals-based report here.

HONG KONG

Xinte Energy Co Ltd (1799 HK): Substitution effect in play

- BUY Entry – 16.8 Target – 18.5 Stop Loss – 15.5

- Xinte Energy Co., Ltd. is an investment holding company principally engaged in the provision of solar energy and wind power solutions. The Company operates through seven segments. Polysilicon Production segment is engaged in the production and sales of polysilicon. Engineering and Construction Contracting (ECC) segment is engaged in the provision of ECC services for solar energy plants and wind power plants. Inverter Manufacturing segment is engaged in the manufacture of inverters. Sales of Electricity segment is engaged in the generation and sales of electricity. Photovoltaic (PV) Wafer and Module Manufacturing segment is engaged in the manufacture and sales of PV wafers and modules. Build-Own-Operate (BOO) segment is engaged in the building and operation of solar energy plants and wind power plants. Others segment is engaged in related trading businesses and the provision of design and logistics services.

- High oil prices are tailwins for renewable energy. The Russia-Ukraine conflict results in unprecedented sanctions on Russia which is a main crude oil exporter. The unexpected widening supply gap of 4mn bbl/d boosted oil prices to 2014 highs. Europe and the US are rushing to secure alternative sources of supply and ramp up domestic oil output amidst the looming energy crisis. Meanwhile, the situation will also accelerate the deployment of renewable energy supply, especially solar. Photovoltaic sector is expected to revive after months of correction. The concerns over potential sanctions on China photovoltaic companies should be relieved as the US priorities reining in inflation by increasing energy supplies at the moment.

- Positive FY21 earnings alert. Net profit attributable to shareholders of the company is expected to be no less than RMB5.0bn compared to RMB0.7bn in FY20. The increase in the Group’s profit is mainly due to the increase in sales volume of polysilicon products, the significant increase in the sales price of polysilicon products, as well as the increase in the scale and power generation volume of the group’s self-operated wind power and photovoltaic power plants.

- Updated market consensus of the EPS growth in FY22/23 is 8.6%/-18.6% YoY respectively, which translates to 3.4x/4.2x forward PE. Current PER is 8.7x. FY22F/23F dividend yield is 5.1%/3.1%. Bloomberg consensus average 12-month target price is HK$20.94.

Hua Hong Semiconductor Ltd (1347 HK): Be greedy when others are fearful

- RE-ITERATE BUY Entry – 32.0 Target – 37.5 Stop Loss – 29.5

- Hua Hong Semiconductor Ltd is an investment holding company engaged in production and sales of semiconductor wafers. The Company produces 200mm and 300mm-wafers. Its products are applied in general microcontroller (MCU), Type-C interface chips, image stabilization chips, touch control chips, and smart meter controller chips. The products also serve Internet of Things (IoT), new energy vehicles, artificial intelligence and other markets. The Company operates its businesses through its subsidiaries.

- Another record high quarter in 4Q21. Revenue hit an all-time high of US$528.3 million, up 88.6% YoY and 17.0% QoQ. Gross margin was 29.3%, up 3.5 ppts YoY and 2.2 ppts QoQ. Net profit attributable to shareholders of the parent company was US$84.1 million, up 92.9% YoY and 65.6%. 1Q22 guidance remains upbeat. Revenue is expected to be approximately US$560 million. Gross margin is expected to be in the range of 28% to 29%.

- Most bearish sentiment has been released. Since the Russian invasion started on 24th February, the Hong Kong market had been selling off, and the panic selling happened early this week. However, the retaliatory rebound started after China’s authority vowed support for economic growth and capital markets. Meanwhile, the Fed rate hike decision, balance reduction and economic growth projection aligned with market expectations. Lastly, the peace talks between Russia and Ukraine saw positive progress. After the sharp fall in the market along with heavy short selling, short- covering and potential squeeze will ensue. After all, valuations are the anchors of the prices.

- Prolonged chip shortage. Sanctions on Russia and China’s current lockdown will deter the normalisation of the supply chain. And the shortage of chips has been proved to be a benefit for semiconductors during the 2-year COVID pandemic, as elevated selling prices translate to higher profit margins. Therefore, Huahong will continue to ride on the tailwinds.

- Updated market consensus of the EPS growth in FY22/23 is 41.9%/6.8% YoY respectively, which translates to18.6x/17.2x forward PE. Current PER is 26.4x. Bloomberg consensus average 12-month target price is HK$51.55.

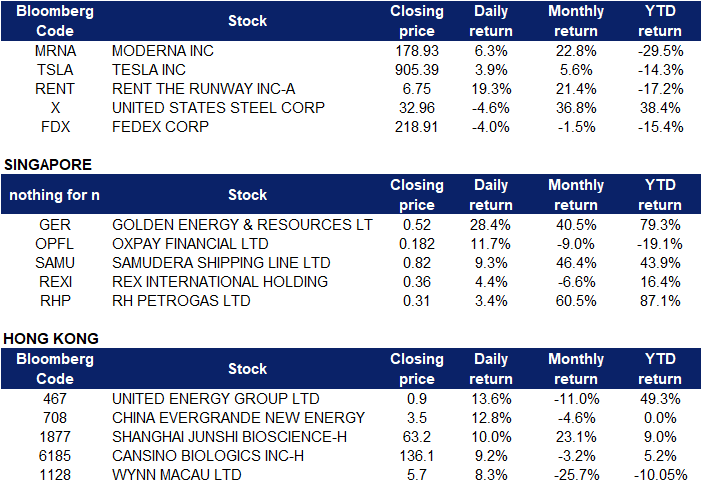

MARKET MOVERS

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Automobiles & Components | +3.55% | Japan chip heavyweights halt output after quake, in another blow for auto industry Rivian Automotive Inc (RIVN US) |

| Semiconductors & Semiconductor Equipment | +2.90% | How Will New Export Controls Impact The Global Semiconductor Shortage? NVIDIA Corporation (NVDA US) |

| Consumer Durables & Apparel | +2.31% | US Consumer Sentiment Stays Weak in March: Will ETFs Suffer? Dillard’s, Inc. (DDS US) |

Top Sector Losers

| Sector | Loss | Related News |

| Telecommunication Services | -1.51% | FCC revokes US authorisation of Chinese telecom firm Pacific Networks Verizon Communications Inc. (VZ US) |

| Utilities | -0.90% | Regulators OK Purchase of Solar Park Despite Objections Enphase Energy Inc (ENPH US) |

| Transportation | -0.51% | IEA urges reduced transport to cut oil use amid supply crunch FedEx Corporation (FDX US) |

- Moderna Inc (MRNA US) shares rose 6.3% on Friday, after announcing that it is seeking FDA approval for a second Covid-19 booster shot for adults 18 years or older. Pfizer and its partner BioNTech requested approval for a Covid-19 booster for those 65 and older this week.

- Tesla Inc (TSLA US) shares gained 3.9% on Friday after Morgan Stanley reiterated its overweight rating on Tesla. The call came after CEO Elon Musk tweeted that he was “Working on master plan part 3.” Morgan Stanley said it sees “Part 3 as mass industrialization, a network flywheel and ‘connecting the dots’ across adjacent TAMs.”

- Rent the Runway Inc (RENT US) shares soared 19.3% after Jefferies initiated coverage of the company with a buy rating, noting the company’s high barrier to entry could help it drive as much as 50% top-line growth. Jefferies also initiated coverage of the RealReal, Farfetch and ThredUp with buy ratings. The stocks rose 8%, 5% and 4%, respectively.

- United States Steel Corp (X US) shares fell 4.6% on Friday after the company issued weaker-than-expected guidance for the current quarter. The company cited increasing raw materials costs, among other factors.

- FedEx Corp (FDX US) shares fell 4% on Friday after the company missed earnings estimates for the quarter. The company beat on revenue but said worker shortages amid the omicron variant outbreak hurt its bottom line.

Singapore

- Golden Energy & Resources Ltd (GER SP) shares surged 28.4% on Friday. We issued a company update on Golden Energy last Thursday, maintaining our Outperform recommendation and raised our TP to S$1.29, taking into account the acquisition of BMC. Golden Energy & Resources is on track to significantly expand its production capacity and profits with the acquisition of BHP Mitsui Coal Pty Ltd (BMC). The acquisition will cement GEAR, through its ASX-listed Stanmore subsidiary, as a major metallurgical coal (coking coal) provider in the region. Metallurgical coal is the key ingredient in the steel industry, whose demand is driven by China now and India in the future. Read our full report here.

- OxPay Financial Ltd (OPFL SP) shares rose 11.7% on Friday. We issued a company update on OxPay on 15 March, maintaining our Outperform recommendation but revised our TP down to S$0.30 due to the overall de-rating of valuation multiples across the sector. OxPay announced adjusted net profit of S$3.2mn in FY21 VS FY20’s net loss of S$1.9mn, driven by a surge in revenue of 53.2% YoY in FY21. Gross profit margin jumped to 62% in FY21, from 32% in FY20. OxPay recently entered into multiple partnerships in the “Buy Now Pay Later”(BNPL) space and expanded service offerings for merchants via neobanking facilities with its partnership with TranSwap. Capitalising on its specialty in the F&B and retail space, OxPay has also acquired up to 20% stake in AppPOS, a network of over 300 F&B and retail merchants. Read our full report here.

- Samudera Shipping (SAMU SP) shares rose 9.3% on Friday. SAC Capital analyst Lim Shu Rong is optimistic about Samudera Shipping Line as it rides on a “bumper year” for shipping lines. In an unrated report dated March 15, Lim notes freight rates are still “buoyant and favourable” to shipping companies as the capacity imbalance persists, adding that the China containerized freight index was up 76% y-o-y as at March 11. However, Lim is less upbeat on Samudera’s operating margin, which is expected to come under pressure, due to the Russia-Ukraine conflict.

- Rex International Holding Ltd (REXI SP) and RH Petrogas Ltd (RHP SP) shares rose 4.4% and 3.4% respectively yesterday. WTI crude futures jumped more than 2% to above $105 per barrel on Friday, extending an 8% rally in the previous session as ongoing peace talks between Russia and Ukraine did not yield significant progress, raising fears of further sanctions and prolonged disruption to oil supply. Meanwhile, Brent crude futures jumped about 2% to around $109 per barrel on Friday, extending an 8.8% rally in the previous session.

Hong Kong

Top Sector Gainers

| Sector | Gain | Related News |

| Public Transport | +4.50% | Coronavirus: Hong Kong could ease flight bans, class suspensions next week, city leader says, as 21,650 cases reported MTR Corp Ltd (66 HK) |

| Leisure & Recreation | +3.46% | Call by Xi Jinping on mainland Covid-19 outbreak a timely reminder for Carrie Lam Haichang Ocean Park Holdings Ltd (2255 HK) |

| Coal | +5.45% | Australia bans alumina exports to Russia, sources coal for Ukraine Yankuang Energy Group Company Limited (1171 HK) |

Top Sector Losers

| Sector | Loss | Related News |

| Property Management & Agency | -1.17% | Ping An posts 29per cent profit drop on China property woes, but sees losses easing A Living Smart City Services Co Ltd (3319 HK) |

| E-Commerce & Internet Services | -0.77% | China’s tech surge: regulator chimes in with market-friendly policies to cheer beleaguered stock investors Baidu Inc (9888 HK) |

| Software | -0.62% | Chinese tech hub Shenzhen eases lockdown restrictions in industrial districts as manufacturing resumes Kingdee International Software Group Co. (268 HK) |

- United Energy Group Ltd (467 HK) shares rose 13.6% on Friday. WTI crude futures jumped more than 2% to above $105 per barrel on Friday, extending an 8% rally in the previous session as ongoing peace talks between Russia and Ukraine did not yield significant progress, raising fears of further sanctions and prolonged disruption to oil supply. Meanwhile, US natural gas futures rose past $4.9 per million British thermal units, the highest since March 7th, as traders weighed slightly stronger demand prospects. Government data showed utilities withdrew 79 bcf of natural gas from inventories, 6 bcf more than analysts had expected.

- China Evergrande New Energy Vehicle Group Ltd (708 HK) shares rose 12.8% on Friday, after it was announced that the electric vehicle unit obtained sales approval from authorities for its initial vehicle. China Evergrande New Energy Vehicle Group has already “lined off” its first mass-produced car under the Hengchi brand and will start selling the SUV soon. The start of Hengchi sales will be the first step for China Evergrande to recoup the vast amount of money it has invested. But given that China’s EV market is dominated by BYD, Tesla Motors and Chinese startups, many observers think it will not be easy for China Evergrande, as a latecomer, to break into the already crowded market.

- Shanghai Junshi Biosciences Co Ltd (1877 HK) shares rose 10% on Friday, after the company announced that the first patient has completed dosage in its Phase III trial of VV116 for the treatment of moderate to severe COVID-19. The study is an international multicenter, randomised, double-blind, controlled Phase III study to evaluate the efficacy and safety of VV116 against standard therapy in subjects with moderate to severe COVID-19.

- Cansino Biologics Inc (6185 HK) shares rose 9.2% on Friday. It was announced last week that the aerosolized AD5-Ncov third-generation vaccine developed by CanSino BIO proved to be a better choice for mixed vaccination booster, the latest research data revealed. The inhaled vaccine simulates the process of natural infection and it can induce human respiratory mucosal immunity with a higher level of protection. Zhu Tao, chief scientist of CanSinoBIO has called on the government to approve and adopt new-generation COVID-19 vaccines with improved quality and safety as early as possible to enhance national immunisation levels.

- Wynn Macau Ltd (1128 HK) shares rose 8.3% on Friday. In February, according to data released by Macau SAR, inbound tourists increased 53.5% YoY to 655,500, while mainland tourists increased 60.1% YoY to 609,200. In the first two months, visitor arrivals totalled 1.35 million, up 37.2% YoY. CICC believes that there are two potential positive factors for the sector, namely the 80% local vaccination rate in Macau, which may see the resumption of group tours and self-service endorsements, as well as the recovery of quarantine-free travel between Macau SAR, Hong Kong SAR and the mainland.

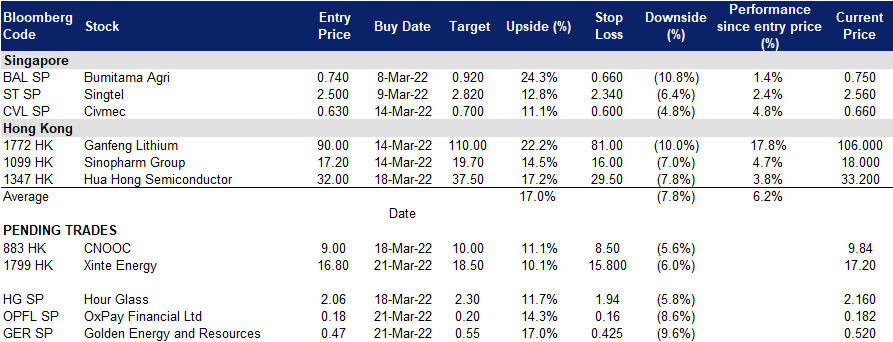

Trading Dashboard

Trading Dashboard Update: No additions or deletions to trading dashboard.

(Click to enlarge image)