19 May 2023: Singapore Airlines Ltd. (SIA SP), China Mobile Ltd. (941 HK), Netflix Inc. (NFLX US)

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

Singapore Airlines Ltd. (SIA SP): Recovering back to the pre-COVID level

- BUY Entry 6.05 – Target – 6.55 Stop Loss – 5.85

- The Singapore Airlines Group has over 20 subsidiaries, covering a range of airline-related services, from cargo to engine overhaul. Its subsidiaries also include SIA Engineering Company, Scoot, Tiger Airways, Singapore Flying College and Tradewinds Tours and Travel. Principal activities of the Group consist of air transportation, engineering services and other airline related activities.

- Still more room for visitor arrivals recovery. In April, one year anniversary of Singapore’s full reopening of border, there were 1.13mn visitor arrivals to Singapore with 282.5% YoY growth. However, the number of arrivals is far below the pre-COVID level, compared to 1.69mn visitors in January 2020. The average monthly visitor arrivals in 2019 was above 1.5mn. Therefore, the normalisation of tourist visits is still on track.

Visitor arrivals trend

(Source: Singapore Tourism Analytics Network)

- To ride on the positive seasonality. The upcoming summer vacation (June to August) is the peak of the travelling season in a year. Meanwhile, this summer holiday is the first one after China’s full reopening. It is expected to see more visitors from China, as Singapore is a sweet spot of overseas traveling for families.

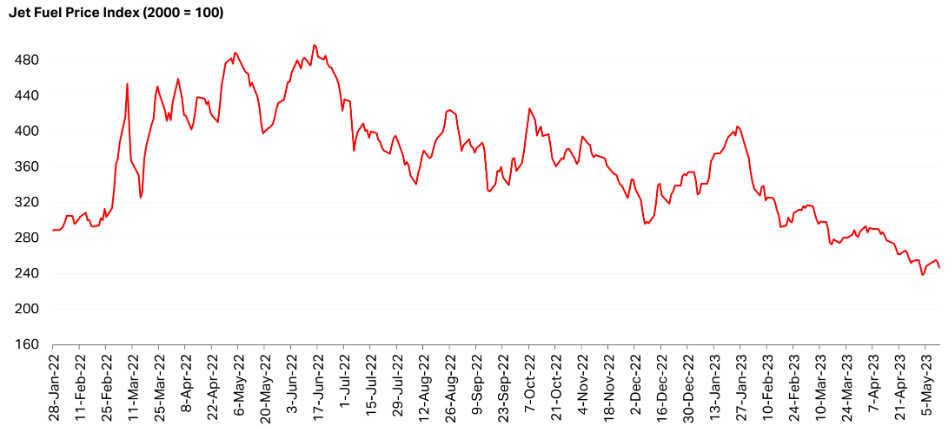

- Jet fuel prices trending down. Due to concerns over a slowdown of global economic growth and recession, international oil prices have been trending downward since mid-2022. Accordingly, prices of crude oil derivatives fall, benefiting airline companies as part of operating costs drops.

Jet fuel price trend

(Source: IATA, S&P Global)

- Record profit in FY23. Revenue more than doubled YoY from S$8.2bn to S$15.1bn as bookings soared and both SIA and Scoot substantially ramped up flights. The operating profit of S$2.7bn was a record for the group, reversing the S$610 mn operating loss in FY22. Net profit was S$2.16bn, the highest level achieved by the group since its inception 76 years ago in 1947.

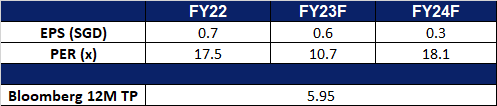

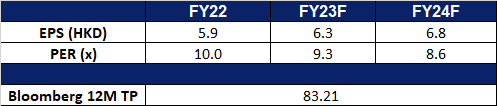

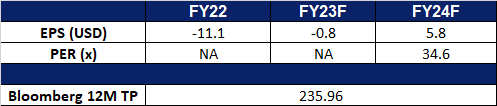

- Market consensus.

(Source: Bloomberg)

Wilmar International Ltd. (WIL SP): Rising Soft Commodities prices

Wilmar International Ltd. (WIL SP): Rising Soft Commodities prices

- RE-ITERATE BUY Entry 3.95 – Target – 4.20 Stop Loss – 3.83

- Wilmar International Limited operates as a food processing company. The Company offers oil palm cultivation, edible oil refining, crushing, and gains processing services, as well as provides sugar, flour, and rice. Wilmar International serves customers worldwide.

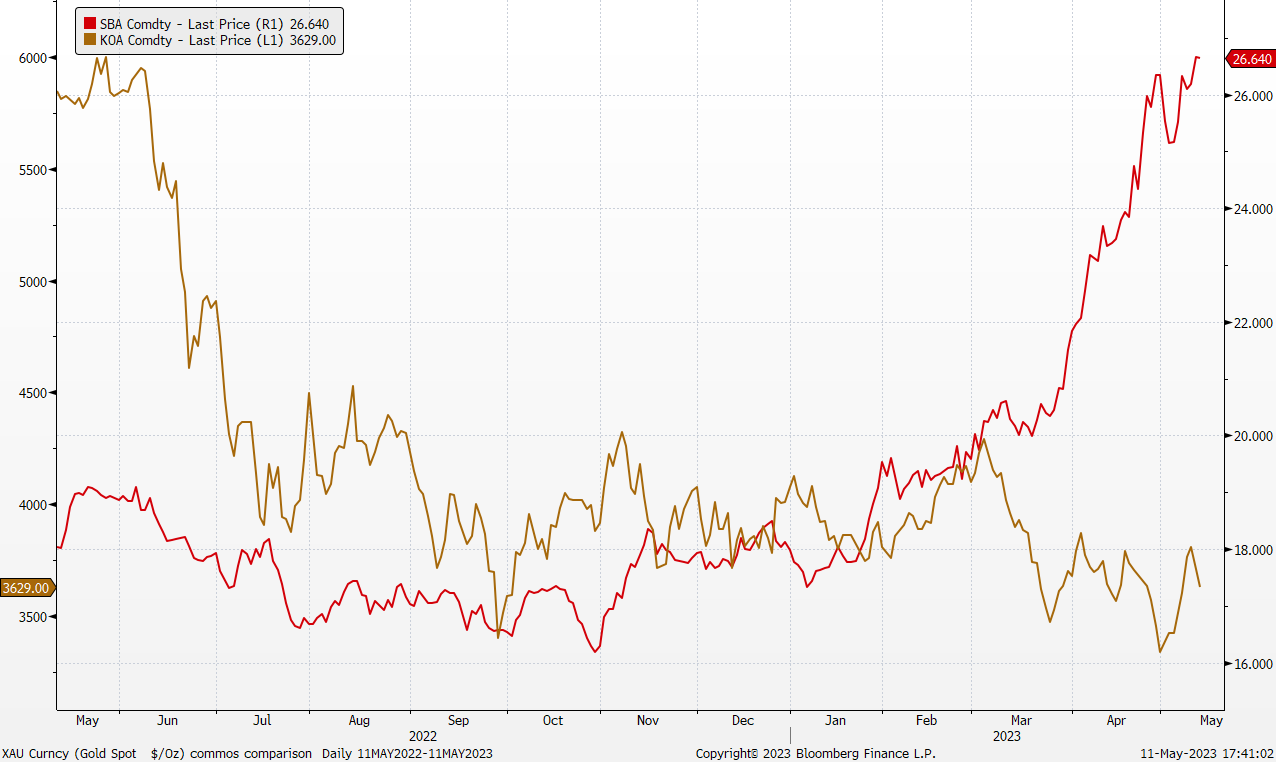

- Sugar Futures prices. Raw sugar futures have risen above 26 cents/pound, nearing the 11-year high of 27 cents/pound due to tight supply. Severe droughts in India’s Maharashtra region have cut output by 25% to 10.5 million tonnes this year, prompting the government of the world’s second-largest producer, to reduce national export licenses. Higher gasoline taxes in Brazil are incentivizing ethanol production over sugar, reducing supply from the world’s top producer.

- Palm Oil Futures Prices. Malaysian palm oil prices rose above MYR 3,700/tonne, driven by higher crude oil prices and tight supply. Alleviated recession concerns in North America boosted global energy benchmarks, raising demand for biodiesel in Southeast Asia. Malaysian palm oil inventories are expected to have dropped to an 11-month low in April due to strong domestic demand. Output expectations were muted for top producer Indonesia, reducing chances of restocking for key consumers. Foreign demand remains robust, despite a decrease in shipments compared to the previous month.

Raw sugar (red) and crude palm oil (brown) futures price trend

(Source: Bloomberg)

- FY22 results review. The company announced record earnings of US$2.4bn (S$3.2 bn) for FY22, a 27.1% growth from US$1.9bn in FY21; core net profit for FY22 improved 31% to US$2.42bn.

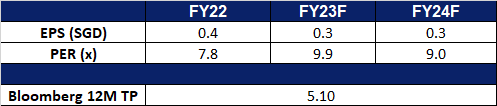

- Market consensus.

(Source: Bloomberg)

China Mobile Ltd. (941 HK): Theme of valuation system with Chinese characteristics

- BUY Entry – 65.0 Target – 70.0 Stop Loss – 62.5

- China Mobile Ltd is a China-based company mainly engaged in communication and information services. The Company’s businesses include personal market business, family market business, government enterprise market business and emerging market business. The personal market business mainly provides mobile communication services and Internet access services. The family market business mainly provides broadband access services. The government enterprise market business provides basic communication services, information application products and data, information, communication and technology (DICT) solutions. The emerging market businesses include emerging fields such as international business, digital content and mobile payment.

- Deepening State Owned Enterprises (SOEs) reforms. China has recently made an announcement regarding two special campaigns aimed at increasing the participation of market players in the reform of China’s State-owned Enterprises (SOEs). Investors in China’s stock market are showing a positive inclination towards State-owned enterprises listed in the A-share market due to the growing popularity of the “valuation system with Chinese characteristics” among market experts.

- Launch of first 5G cross-network trial service. Recently, China’s four major telecom operators made an announcement regarding their collaborative efforts to introduce the world’s inaugural trial commercial service for 5G cross-network roaming. This service will be launched in the Xinjiang Uygur autonomous region. It will allow users to access 5G networks of other telecom operators and continue utilizing 5G services even when their own network provider lacks coverage in that area. China Mobile Ltd., which has already established 1.55 million 5G base stations and provided gigabit broadband network coverage to 300 million households, is strategically positioned to reap the benefits of this 5G cross-network trial service launch.

- 1Q23 earnings reveiw. Operating revenue rose to RMB250.7bn, a 10.3% increase YoY. Net Income of RMB28.1bn was up 9.5% YoY. EBITDA rose to RMB79.9, up by 4.9% YoY. Mobile customers amounted to 983 mn, of which, 5G package customers amounted to 689mn. FY23F/24F dividend yield is 7.7%/8.5% respectively.

- Market Consensus

(Source: Bloomberg)

Tianqi Lithium Corp. (9696 HK): Lithium price rebounding

- RE-ITERATE BUY Entry – 59.5 Target – 65.5 Stop Loss – 56.5

- Tianqi Lithium Corp, formerly Sichuan Tianqi Lithium Industries Inc, is a China-based company principally engaged in the research and development, manufacture and distribution of lithium products. The Company’s products include two categories, lithium concentrate products and lithium compounds and derivatives. Lithium concentrate products include chemical grade and technical grade lithium concentrate. Lithium compounds and derivatives include lithium carbonate, lithium hydroxide, lithium chloride and lithium metal. The Company’s products are used in a wide variety of end markets, primarily electric vehicles, energy storage systems, air transportation, ceramics and glass. The Company mainly operates its businesses in the domestic and overseas markets.

- Ramping up lithium extraction. China is expected to account for nearly one-third of the world’s lithium supply by the mid-2020s, with its output set to increase significantly, according to UBS AG. Chinese-controlled mines, including projects in Africa, are projected to raise production to 705,000 tons by 2025, boosting China’s share of this vital mineral for electric-vehicle batteries to 32% of the global supply. This race to secure lithium resources is driven by nations like the US prioritizing access to materials for battery production amid the global transition away from fossil fuels, with China’s demand being particularly high as the world’s largest market for new energy vehicles.

- China’s increasing EV market share. China’s EV sales almost doubled in 2022 with 87% YoY growth, with one in 4 cars sold in China being an EV in the same year, led by BYD. With factory activities resuming, production of EVs and lithium batteries would continue at a much higher capacity. China’s EV sales are expected to exceed 8 million units in 2023. This would bring up the demand for Lithium to produce Lithium batteries for EVs.

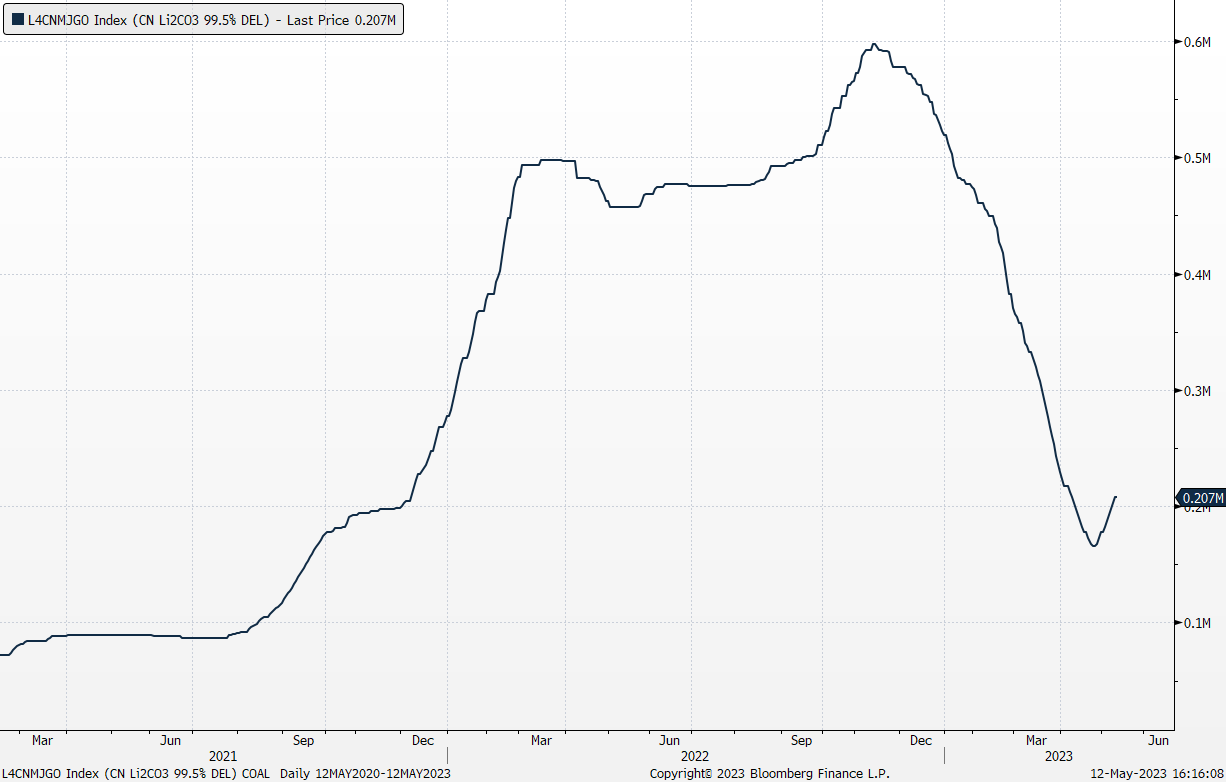

- Lithium Price Rebounding. Lithium carbonate prices rose past RMB200,000/ tone, extending its rebound from the 19-month low of RMB165,500/tonne on April 24th amid renewed optimism for electric battery demand. The recovery of lithium carbonate is also driven by seasonal repleniment of battery inventories.

China Lithium Carbonate Price Index (RMB/tonne)

(Source: Bloomberg)

- 1Q23 earnings reveiw. Revenue rose to RMB11.45bn, a 117.8% increase YoY. Net Income of RMB4.88bn was up 46.49% YoY. Net profit Margin fell to 42.6%, down 9 ppts YoY.

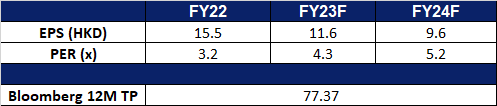

- Market Consensus

(Source: Bloomberg)

Netflix Inc. (NFLX US): Benefiting from new initiatives

- BUY Entry – 335 Target – 365 Stop Loss – 320

- Netflix, Inc. provides entertainment services. It offers TV series, documentaries, feature films, and mobile games across various genres and languages. The company provides members the ability to receive streaming content through a host of internet-connected devices, including TVs, digital video players, television set-top boxes, and mobile devices.

- Increased market share from competitors. Netflix has recently been making strategic moves to solidify its position in the industry by increasing its market share in the media streaming industry. For instance, Netflix recently introduced an ad-supported tier at USD$7/mth, which has reached nearly 5mn active users per month, allowing it to tap into a new revenue stream while also attracting a wider audience. This move not only showcases Netflix’s adaptability and willingness to explore different avenues to maintain its competitive edge, but it will also enable it to generate additional advertising revenue when working with advertisers to create long-form commercials to be streamed on its digital platform. As a result, Netflix’s market dominance will continue to strengthen, making it a favorable choice for investors seeking long-term growth opportunities.

- Looming account-sharing crackdown. Netflix is preparing to implement another strategic initiative that will address the issue of account sharing. Under this new approach, subscribers who share their account passwords will be required to pay an additional fee for each additional member accessing the account. This initiative aims to encourage account borrowers to either activate their own subscriptions, pay to be added as an official member, or risk losing access to Netflix altogether. Considering Netflix’s substantial user base of 232.5mn paying subscribers globally as of March, we anticipate a potential increase in the number of paying subscribers once Netflix rolls out this account-sharing crackdown in conjunction with its ongoing ad-supported tier.

- Hollywood writer strike is a dip-buying opportunity. Hollywood writers voted to strike after six weeks of negotiating with major entertainment and filming companies including Netflix. This is a strike since 2007, and it cost billions of dollars in lost output and a quarter of prime-time programming for the network TV season back then. However, this is a buying opportunity as Netflix’s productions are more diversified. In recent years, Korean films and dramas which increasingly gains attraction, and previously the company was set to invest US$2.5bn in Korean content over the next 4 years. The strike has a limited impact on those productions. Besides, the main crowd of the strike is scriptwriters but actors, hence, productions are expected to continue even when the strike is on.

- 1Q23 earnings review. 1Q23 revenue grew by 3.7% YoY to US$8.16bn, missing estimates by US$20mn. 1Q23 GAAP EPS was US$2.88, beating estimates by US$0.01. Average paid memberships grew by 4% YoY to 1.75mn.

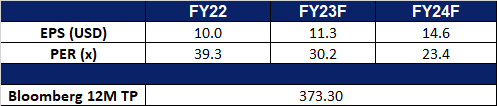

- Market consensus.

Boeing Co (BA US): Range bound trade

Boeing Co (BA US): Range bound trade

- RE-ITERATE BUY Entry – 195 Target – 215 Stop Loss –185

- The Boeing Company, together with its subsidiaries, designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide.

- Recent positive news. Ryanair plans to order at least 150 Boeing 737-10 Max jeliners along with an option for another 150 more. The order is the biggest by the European budget carrier. Boeing’s deliveries fell from 64 in March to 26 in April, and 17 out of which is 737 Max. However, the company maintained its target of 400-450 of its 737 MAX deliveries. Meanwhile, the company plans to ramp up the production to 50/month by 2025 to 2026.

- Ongoing contracts from the US defence department. Bell Boeing Joint Project Office was awarded a US$482.3M fixed-price incentive undefinitized modification to a previously awarded contract. Besides, It was awarded a US$216M modification (P00013) to previously awarded ID/IQ contract FA8526-21-D-0001 for C-17 Globemaster landing gear spares management services.

- Dragged by other Dow components performance. Boeing shares were sold down recently due mainly to the fall in Dow Jones Industrials Index as the financials sector were hammered. However, Boeing’s fundamentals are sound and resilient. Global economies enter the post-COVID era, and the normalisation of tourism is on track. The ensuing growth in airplane orders shows Boeing has been walking out of the wood.

- 1Q23 earnings review. Revenue grew by 27.9% YoY to US$17.9bn, beating estimates by US$340mn. Non-GAAP EPS was -US$1.27, missing estimates by US$0.22. Total backlog was US$411bn, including 4,500 commercial airplanes.

- Market consensus.

(Source: Bloomberg)

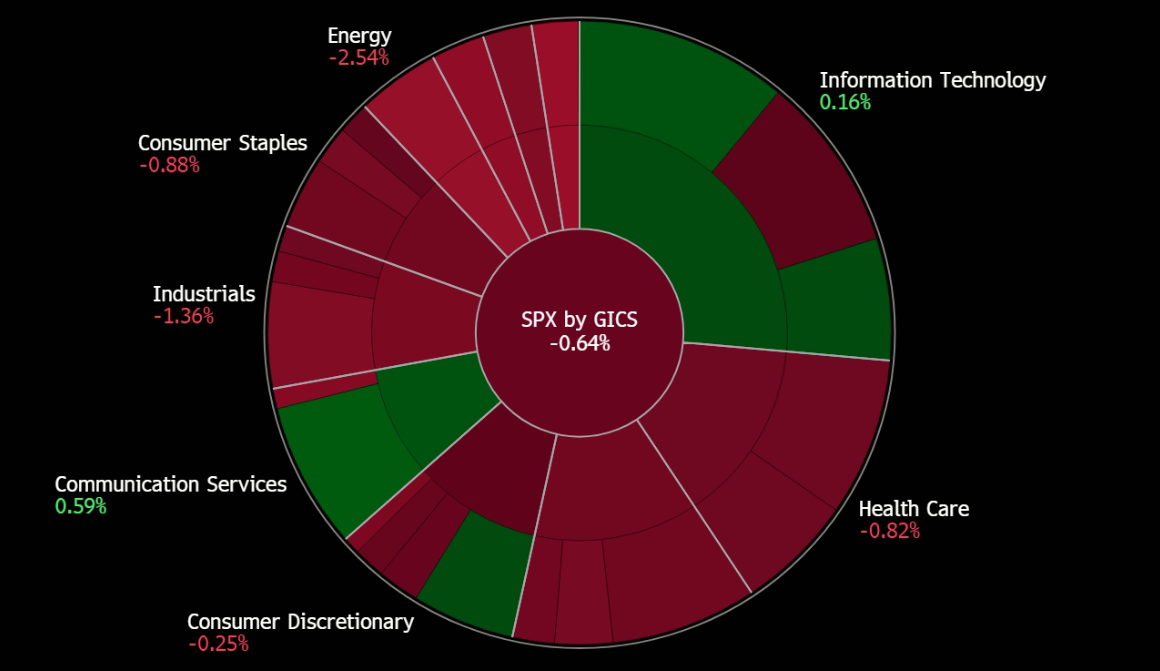

United States

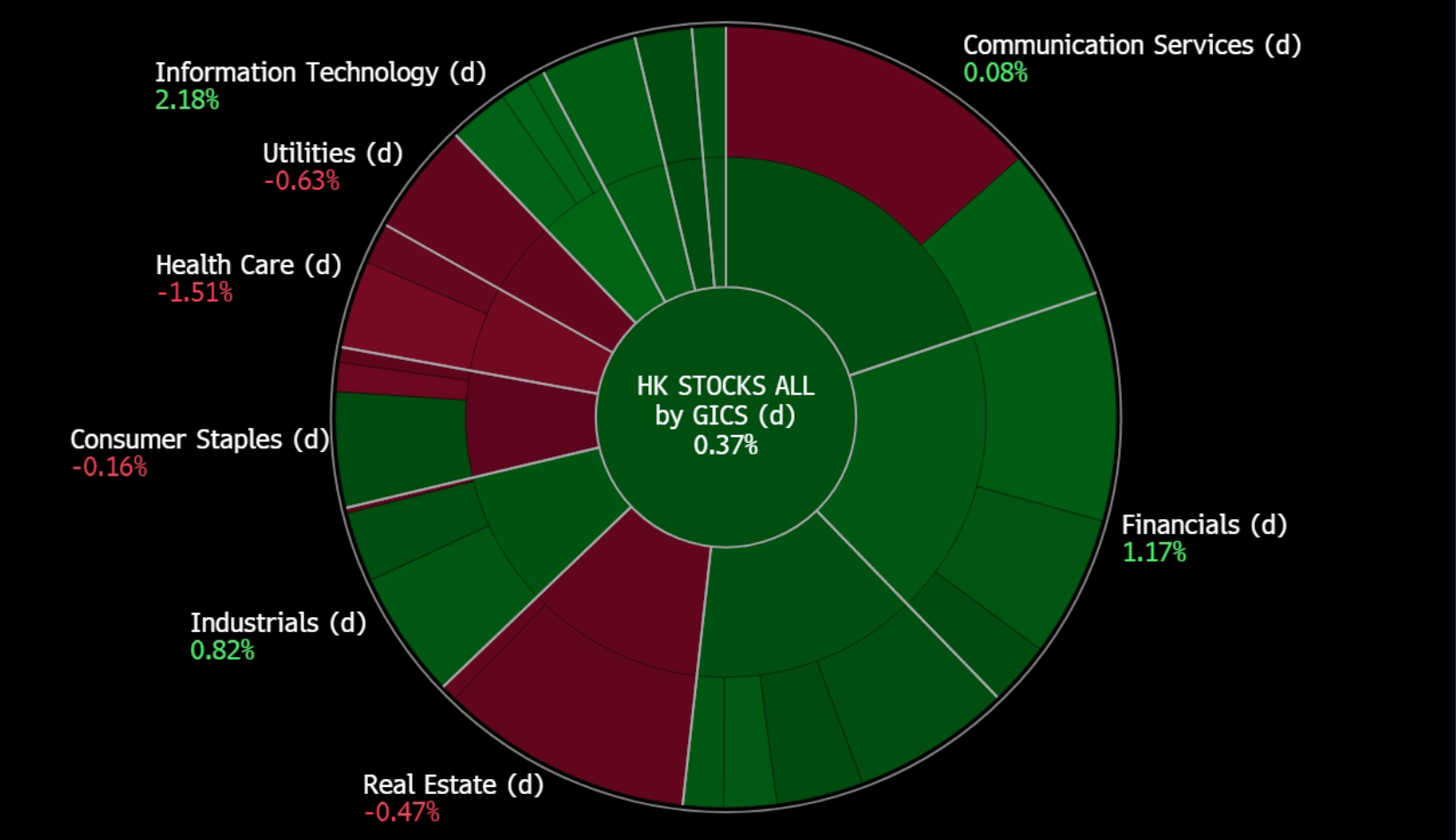

Hong Kong

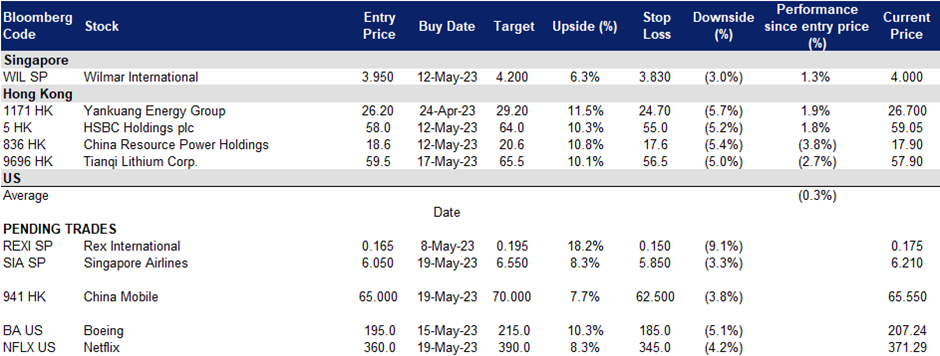

Trading Dashboard Update: Add Tianqi Lithium Corp. (9696 HK) at HK$59.50. Cut loss on OCBC (OCBC SP) at S$12.15, Bumitama Agri (BAL SP) at S$0.56, Chinese Traditional Chinese Medicine (570 HK) at HK$3.95, and Barrick Hold (GOLD US) at US$18.50.

(Source: Bloomberg)

(Source: Bloomberg)