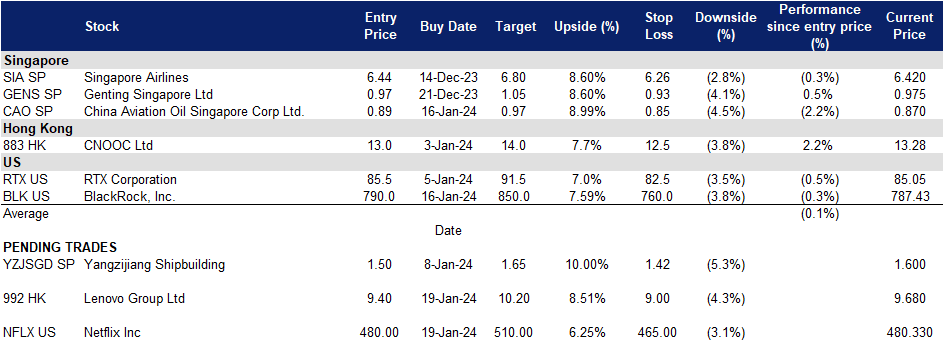

19 January 2024: China Aviation Oil Singapore Corp. Ltd. (CAO SP), Lenovo Group Ltd. (992 HK), Netflix Inc. (NFLX US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

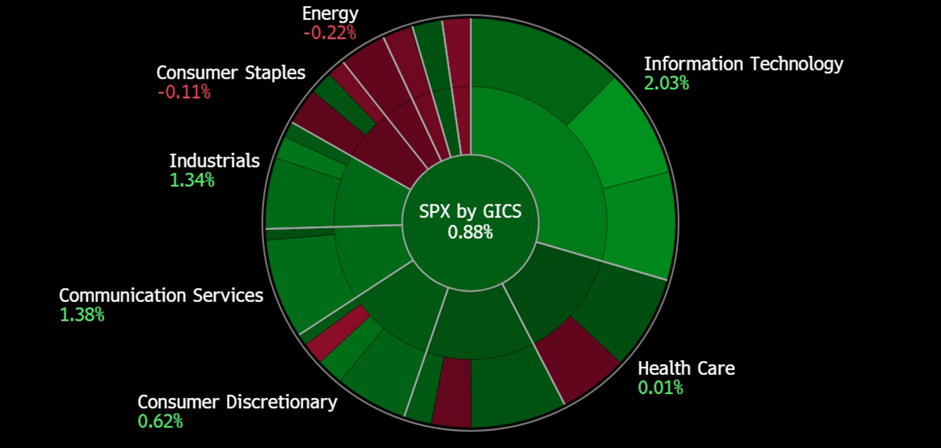

United States

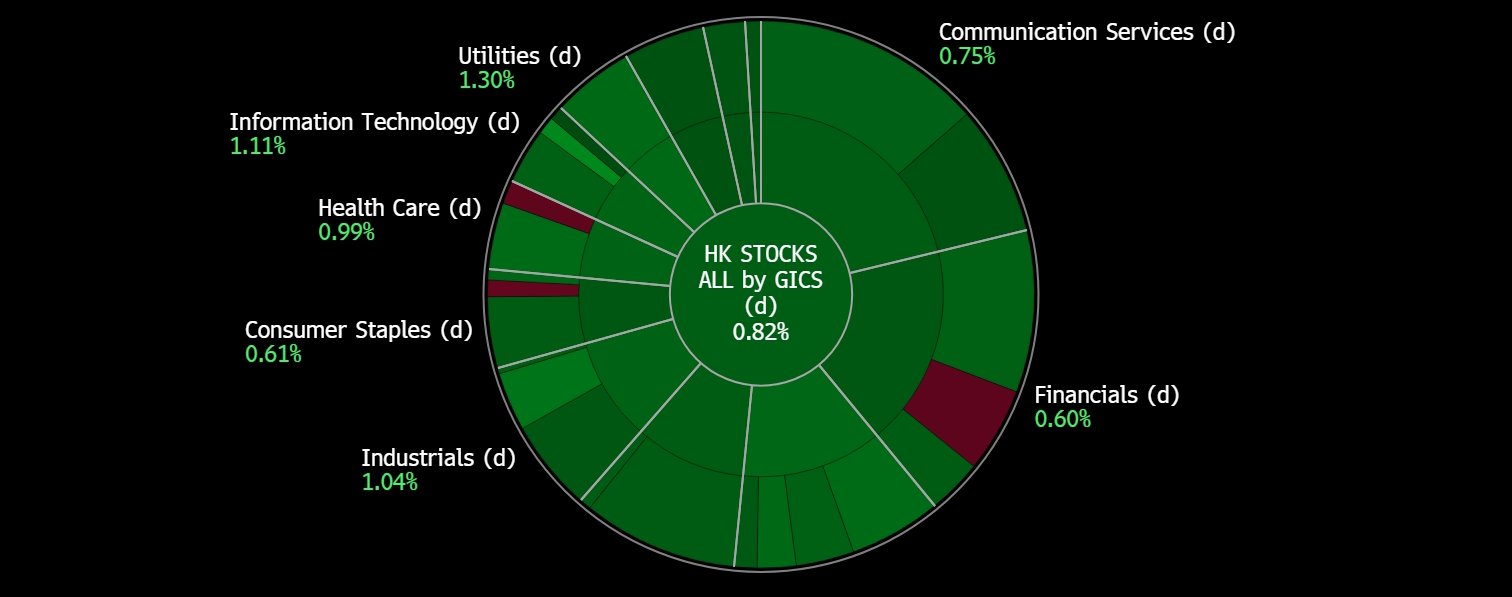

Hong Kong

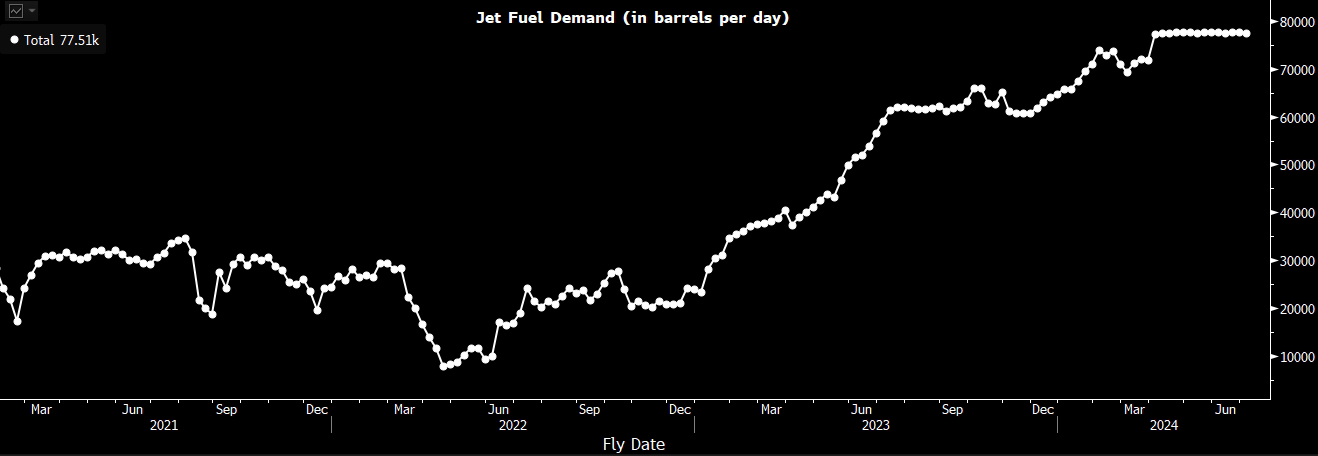

China Aviation Oil Singapore Corp. Ltd. (CAO SP): Lunar New Year highs

- RE-ITEREATE BUY Entry – 0.89 Target– 0.97 Stop Loss – 0.85

- China Aviation Oil Singapore Corporation Limited supplies jet fuel to foreign and domestic airlines flying through China’s airports. The Company also trades in other oil products such as fuel oil, gas oil, crude oil, petrochemical products, including physical and paper swaps, and futures trading.

- Spring festival demand. The Civil Aviation Administration of China (CAAC) predicts a record-high demand for flights during the upcoming 40-day Lunar New Year travel rush, with approximately 80mn passengers expected to travel by air from January 26 to March 5. This marks a 45% increase from the previous year and a 10% rise from pre-pandemic levels in 2019. The surge follows last year’s 39% increase in air passenger traffic during the Chinese New Year travel rush, the first after Covid-19 restrictions were eased. The Spring Festival is anticipated to witness an average of 16,500 daily passenger flights, a 24% increase from last year. Increased international flights are expected due to expanded routes and more lenient visa policies, with over 2,500 additional international flights planned for the 40-day period. Despite challenges, China’s aviation sector has shown resilience, with passenger traffic and cargo throughput reaching 94% and 98%, respectively, of 2019 levels in the previous year.

Scheduled jet fuel demand at Pudong International Airport

(Source: Bloomberg)

- Improved air travel. China’s international air travel market is predicted to further recover, with the CAAC expecting weekly flights to reach 80% of pre-Covid levels by the end of 2024. The regulator anticipates an increase in weekly international passenger flights from over 4,600 to 6,000 by the end of the year, compared to less than 500 at the beginning of 2023. CAAC also aims for a “significant increase” in direct flights between China and the US, aligning with the agreement between Presidents Joe Biden and Xi Jinping in November. However, the resumption of direct flights between the two nations has been sluggish, reaching only 63 per week by the end of 2023, in contrast to the pre-Covid figure of 340. Despite challenges such as flight capacity shortages, geopolitical tensions, and economic uncertainties affecting consumer sentiment, CAAC projects a robust recovery with a forecast of 690n passenger trips in 2024, marking an 11% increase from 2023. Additionally, the regulatory body aims to expand traffic rights with Belt and Road nations and deepen cooperation with regions including Central Asia, the Middle East, and Africa.

- 1H23 results review. 1H23 revenue plunged by 32.4% to US$6.3bn. Gross profit plunged by 50.6% YoY to US$10.6mn. Total supply and trading volume decreased by 16.1% YoY to 9.5mn tonnes. Net profit decreased by 1.07% YoY to US$19.4mn.

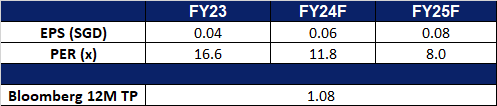

- Market Consensus.

(Source: Bloomberg)

Yangzijiang Shipbuilding (YZJSGD SP): A nice start in 2024

Yangzijiang Shipbuilding (YZJSGD SP): A nice start in 2024

- RE-ITEREATE BUY Entry– 1.50 Target– 1.65 Stop Loss – 1.42

- Yangzijiang Shipbuilding Holdings Limited builds a wide range of ships. The Company produces a wide range of commercial vessels, mini bulk carriers, multi-purpose cargo vessels, container ships, chemical tankers, offshore supply vessels, rescue and salvage vessels, and lifting vessels.

- Hedging against potential weakening RMB. The year-end rally in RMB against USD was due mainly to the pullback in US dollars as investors were optimistic about aggressive rate cuts from the Fed in 2024. However, the recent US labour market data showed the US economy remained strong, cooling down the previous rate-cut expectations. China’s economic recovery remains gloomy, and it will take longer to mitigate the impact of the property debt problem and rebuild confidence. Therefore, the RMB will weaken against the USD again once the previous positive expectations fail to be realised.

Share price and USD/RMB price trend comparison

(Source: Bloomberg)

- Growth in container vessel and tanker demand in 2024. According to Clarkson, 350 newly built container vessels were delivered in 2023, totalling 2.21mn TEU. China delivered more than 200 units. Clarkson estimates that the total container shipping capacity will grow by 7% and 5% in 2024 and 2025 respectively. According to shipbroker Xclusiv, the tankers market is expected to grow in 2024, mainly driven by the Asian oil demand. Southeast Asia and China will see 3.2% and 2.9% growth in oil demand this year.

- 1H23 orderbook exceeded the full-year target. As of June, the company has obtained orders for 72 vessels, amounting to a value of US$5.76 billion, surpassing its target of US$3 billion for 2023. This has resulted in the highest-ever outstanding orderbook value for Yangzijiang, standing at US$14.7 billion for 181 vessels. Among all ordered vessels, 91 are containerships, 29 are oil tankers, 53 are bulk carriers, and 8 are LNG/LPG/LEG.

- 1H23 results review. Revenue for 1H23 increased by 16% YoY to RMB11.3bn. Gross profit increased by 48% YoY to RMB2.1bn. GPM increased by 4ppts to 19%. PATMI increased by 26% YoY to RMB1.7bn.

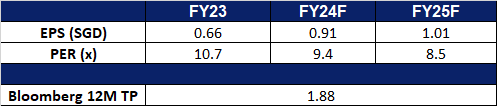

- Market Consensus.

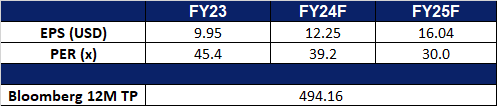

Lenovo Group Ltd. (992 HK): AI in PC

- BUY Entry – 9.40 Target – 10.20 Stop Loss – 9.00

- Lenovo Group Limited is an investment holding company principally engaged in personal computers and related businesses. The Company’s main products include Think-branded commercial personal computers and Idea-branded consumer personal computers, as well as servers, workstations and a family of mobile Internet devices, including tablets and smart phones. The Company operates its business through four geographical segments, including China, Asia Pacific (AP), Europe, the Middle East and Africa (EMEA) and Americas (AG). The Company also provides cloud service and other related services. The Company distributes its products in domestic market and to overseas markets.

- A new AI co-pilot keyboard function. Microsoft has recently unveiled a groundbreaking addition to Windows PC and laptop keyboards: a new key that summons Microsoft’s Copilot, an AI assistant. This innovative AI-powered chatbot assists users in tasks ranging from research and text drafting to image creation and even turning ideas into songs. This marks a significant departure from traditional keyboard design, reflecting Microsoft’s steadfast commitment to artificial intelligence. As businesses strive to adapt to the swiftly evolving technology landscape, this advancement in AI is anticipated to drive up demand for computer accessories and peripherals. Lenovo, a key customer of Microsoft, stands to benefit substantially from the surge in demand for these products spurred by advancements in AI technology.

- Unveiling new AI-Powered Creativity and Productivity Devices and Solutions. During the 2024 International CES, Lenovo made a significant debut by introducing over 40 new devices and solutions infused with AI, aligning with the company’s overarching vision of making AI accessible to everyone. The unveiled lineup encompasses innovative AI PC offerings spanning Lenovo’s Yoga™, ThinkBook™, ThinkPad™, ThinkCentre™, and Legion™ sub-brands, delivering a personalized computing experience unprecedented for both consumers and businesses. Complementing this, Lenovo presented two proof-of-concept products, a tablet, a software app, Motorola AI features, various accessories, and more, collectively forming a comprehensive and robust portfolio of cutting-edge technology solutions.

- PC demand recovery. PC demand has shown signs of recovery, and is expected to continue recovering in 2024, after a demand slump in 2023. This is also boosted by the boom in AI technology, which increase the demand for PCs equipped with new AI technologies. Furthermore, suppliers are also gearing up more for replacement demand, where many consumers are expected to replace their PCs, accessories and peripherals after more than 2 years of usage since the digital boom during the Covid-19 pandemic.

- 2Q23 earnings. Revenue fell by 15.7% YoY to US$14.4bn in 2Q2023, compared to US$17.1bn in 2Q22. Net profit fell YoY to US$289.1mn in 2Q2023, compared to US$553.8mn in 2Q22. Basic EPS fell YoY to US2.09 cents in 2Q23, compared to US4.54cents in 2Q22.

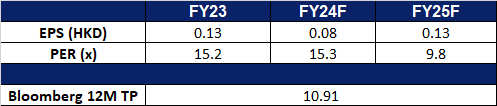

- Market consensus.

(Source: Bloomberg)

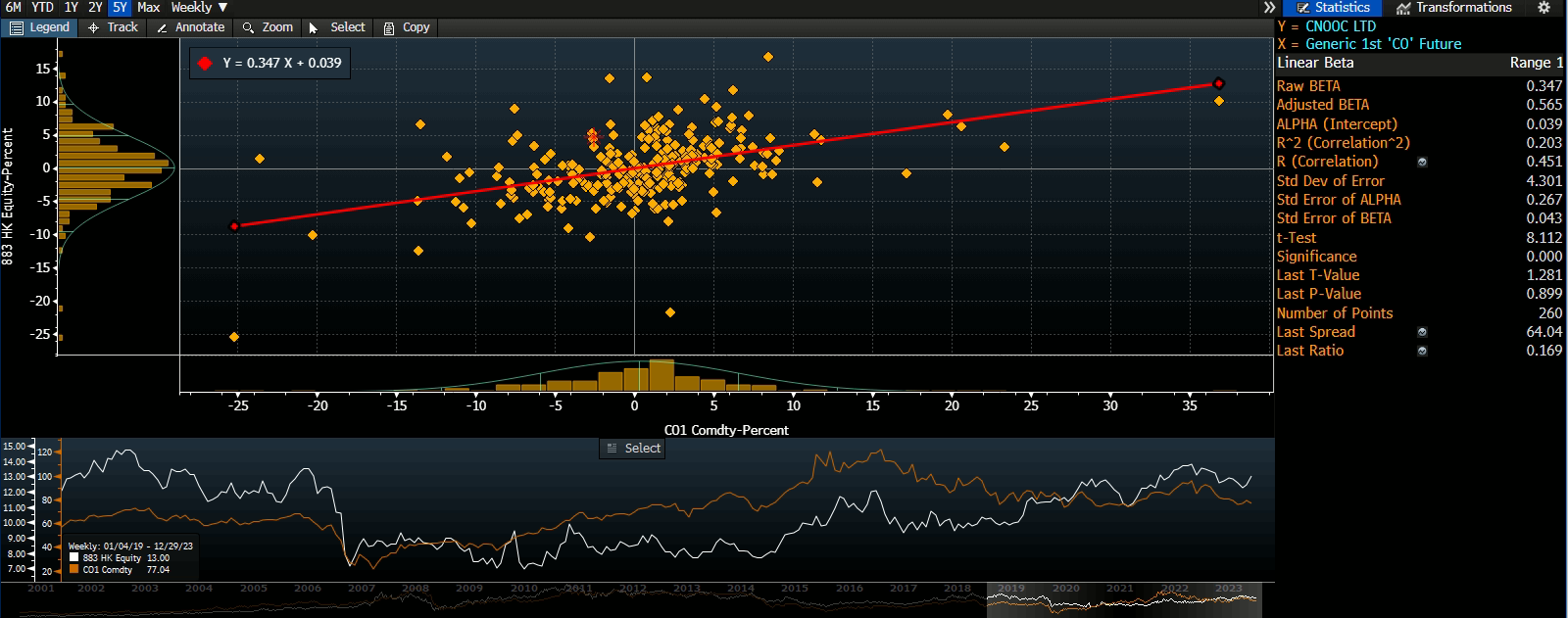

CNOOC Ltd. (883 HK): Focusing on Supply Chain

- RE-ITERATE BUY Entry – 13.0 Target – 14.0 Stop Loss – 12.5

- CNOOC Ltd is a China-based investment holding company principally engaged in the exploration, production and sales of crude oil and natural gas. The Company operates three segments. Exploration and Production segment is engaged in conventional oil and gas business, shale oil and gas business, oil sands business and other unconventional oil and gas businesses. Trading segment is engaged in entrepot trade of crude oil in overseas areas. Corporate segment is engaged in headquarter management, assets management, research & development, and other businesses. The Company mainly operates businesses in China, Canada, the United Kingdom, Nigeria, and Brazil, among others.

- Commencement of production. CNOOC recently announced that its Mero2 Project has begun production. The project consists of 16 development wells which are planned to be commissioned, including 8 production wells and 8 injectors. The Floating Production Storage and Offloading (FPSO) used in the project also has a designed storage capacity of approximately 1.4million barrels, one of the largest FPSO in the world. This project is expected to bring an additional 180,000 barrels of crude oil per day for the company.

- Approval of license for LPG Facility. Uganda’s cabinet recently approved CNOOC to proceed with the construction of a Liquified Petroleum Gas (LPG) facility in the Kingfisher development area in Uganda. The facility will produce clean and affordable energy for the local market in the East African country, facilities the country’s transition to green energy.

- Construction of underground oil reserve. CNOOC recently started construction in Ningbo, China, on its largest commercial underground oil reserve project. The oil reserve is designed with a capacity of 3 million cubic meters, encompassing crude oil caverns, along with surface crude oil storage, transportation, and other supporting facilities. The project would be receiving a total investment of around 3 bn yuan and is scheduled to be completed by 2026. Upon completion, the oil reserve would provide a steady supply of crude oil to surrounding cities and provinces.

- 3Q23 earnings. Revenue rose by 5.48% YoY to RMB114.8bn in 3Q2023, compared to RMB108.8bn in 3Q22. Net profit fell 8.23% YoY to RMB33.4bn, compared to RMB36.4bn in 3Q22. Basic EPS fell by 7.78% YoY to RMB0.71, compared to RMB0.77 in 3Q22.

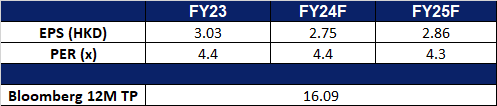

- Market consensus.

Share price and Brent crude oil price correlation

(Source: Bloomberg)

(Source: Bloomberg)

Netflix Inc. (NFLX US): Dominating your screens

- BUY Entry – 480 Target – 510 Stop Loss – 465

- Netflix Inc. operates as a subscription streaming service and production company. The Company offers a wide variety of TV shows, movies, anime, and documentaries on internet-connected devices. Netflix serves customers worldwide.

- Levelling up. Netflix’s entry into gaming 2 years prior, appears to be paying off, with a reported 180% YoY increase in game downloads in 2023, totalling 81.2mn downloads worldwide. The company’s gaming portfolio, initially launched with casual and show-tied games, expanded with acquisitions like Night School Studio and Spry Fox. Grand Theft Auto: San Andreas became Netflix’s most-downloaded game of all time, driving up interest. All three GTA mobile games collectively racked up over 6.4mn downloads in less than a week after arriving on Netflix, making up about 17% of Netflix’s 2023 gaming downloads. Despite the success, the data suggests that Netflix needs regular releases and ongoing promotion to sustain gaming engagement as daily game downloads have been seen to taper off after a while even for popular games such as GTA. The company is also building an AAA studio for a multi-platform game based on unique IP. As of December 2023, Netflix had a total of 89 total games across its platforms and had nearly 90 more games in development.

- Ad tier highs. Netflix’s ad-supported tier which launched in November 2022, has attracted over 23mn global active users per month, according to its advertising chief, Amy Reinhard. This marks a significant increase from the 15mn active users reported a year after the ad tier’s launch. The move aims to tap into a new revenue stream amid growing competition for online viewers. With 85% of ad-supported customers streaming for over two hours daily, Netflix is leveraging this tier to boost revenue, particularly as it raises prices on its ad-free options. Furthermore, with continued price hikes on its ad-free tiers and password-sharing crackdowns, we anticipate more users to shift towards Netflix ad-supported plans. With this ongoing momentum, Netflix’s ad-supported plan may even surpass Disney+ in US advertising dollars next year.

- 3Q23 results. Revenue rose to US$8.54bn, up 7.7% YoY, in line with expectations. GAAP EPS beat estimates by US$0.23 at US$3.73. Expect Q4 revenue of US$8.69bn vs US$8.54bn consensus. Revised its full-year operating margin upwards to 20%. FY24 operating margin to be between 22% and 23%.

- Market consensus.

(Source: Bloomberg)

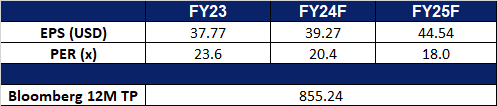

BlackRock, Inc. (BLK US): Good news, great results

- RE-ITEREATE BUY Entry – 790 Target – 850 Stop Loss – 760

- BlackRock, Inc. provides investment management services to institutional clients and to retail investors through various investment vehicles. The Company manages funds, as well as offers risk management services. BlackRock serves governments, companies, and foundations worldwide.

- SEC Bitcoin ETF approval. The approval of US-listed bitcoin exchange-traded funds (ETFs) by the Securities and Exchange Commission (SEC) on Wednesday triggered substantial trading activity. Eleven spot bitcoin ETFs, including those from BlackRock, Grayscale, and ARK, commenced trading, with Grayscale, BlackRock, and Fidelity dominating trading volumes. This approval prompted fierce competition among issuers, with some reducing fees below industry standards. The regulatory approval is expected to stimulate competition for market share and encourage the introduction of more innovative crypto ETFs. Cryptocurrency-related stocks initially surged but ended the day lower, reflecting market dynamics and lingering scepticism from some financial institutions. The iShares Bitcoin Trust (IBIT), BlackRock’s spot bitcoin exchange-traded fund (ETF), attracted approximately US$400mn within the initial 30 minutes of trading, signalling significant investor demand. The approval of spot bitcoin ETFs offers investors an accessible avenue for exposure to the digital asset without the need for physical bitcoin custody. The development is seen as a crucial milestone for the crypto industry, unlocking untapped demand from investors seeking regulated financial products for bitcoin ownership.

- Acquisition and streamlining. BlackRock revealed its acquisition of Global Infrastructure Partners (GIP) for approximately US$12bn in cash and stock. This move aligns with BlackRock’s heightened emphasis on infrastructure, identified by its CEO as a compelling long-term investment opportunity. Under the agreement, GIP’s management team will spearhead a unified infrastructure private markets investment platform within BlackRock. The deal is slated to conclude in the third quarter of this year. Additionally, BlackRock announced the integration of its ETF and Index businesses across the organization through the establishment of a new strategic Global Product Solutions business. Simultaneously, the company will introduce a new International Business structure to streamline leadership across Europe, the Middle East, India, and the Asia-Pacific region.

- Interest rate expectations. US Federal Reserve officials are cautious about interpreting consumer price data for future monetary policy decisions. Although overall consumer price inflation rose to 3.4% in December, excluding volatile items showed a decrease in the pace of price increases to 3.9%. This suggests ongoing moderation in underlying price pressures. While some officials note progress in reducing inflation, they emphasize the need for more evidence before considering interest rate cuts, with a March rate cut viewed as premature by some. The Fed is expected to maintain its policy rate at the January meeting, but markets anticipate rate cuts starting in March. Recent unexpected declines in US producer prices in December may indicate temporary relief from recent upticks in consumer prices, potentially allowing the Fed to consider interest rate cuts. The market anticipates a 72.4% chance of a rate cut by March, according to the CME FedWatch.

- FY23 results. Revenue was flat YoY at US$17.9bn. Operating income fell 2% YoY to US$6.6bn. FY23 EPS rose 7% YoY to US$37.77. 4Q23 revenue rose 6.7% YoY, to US$4.63bn. Non-GAAP EPS beat estimates by US$0.82 at US$9.66.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Add BlackRock (BLK US) at US$790. Cut loss on Thai Beverage PCL (THBEV SP) at S$0.515, Yankuang Energy (1171 HK) at HK$15.3, Trip.com Group Ltd. (9961 HK) at HK$280, Barrick Gold Corp. (GOLD US) at US$16.7 and ConocoPhillips (COP US) at US$108.