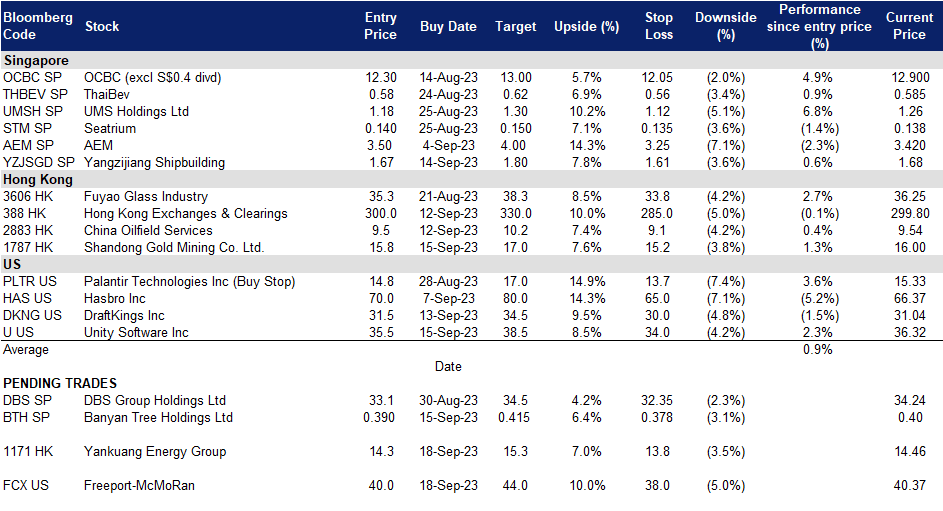

18 September 2023: Banyan Tree Holdings Ltd. (BTH SP), Yankuang Energy Group Co. Ltd. (1171 HK), Freeport-McMoRan (FCX US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

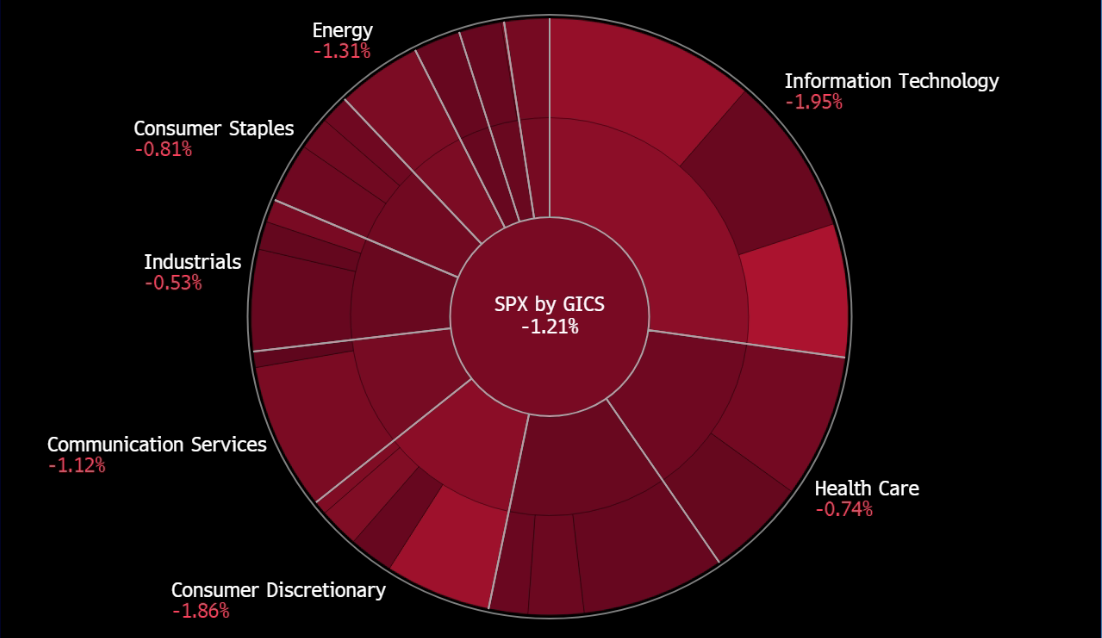

United States

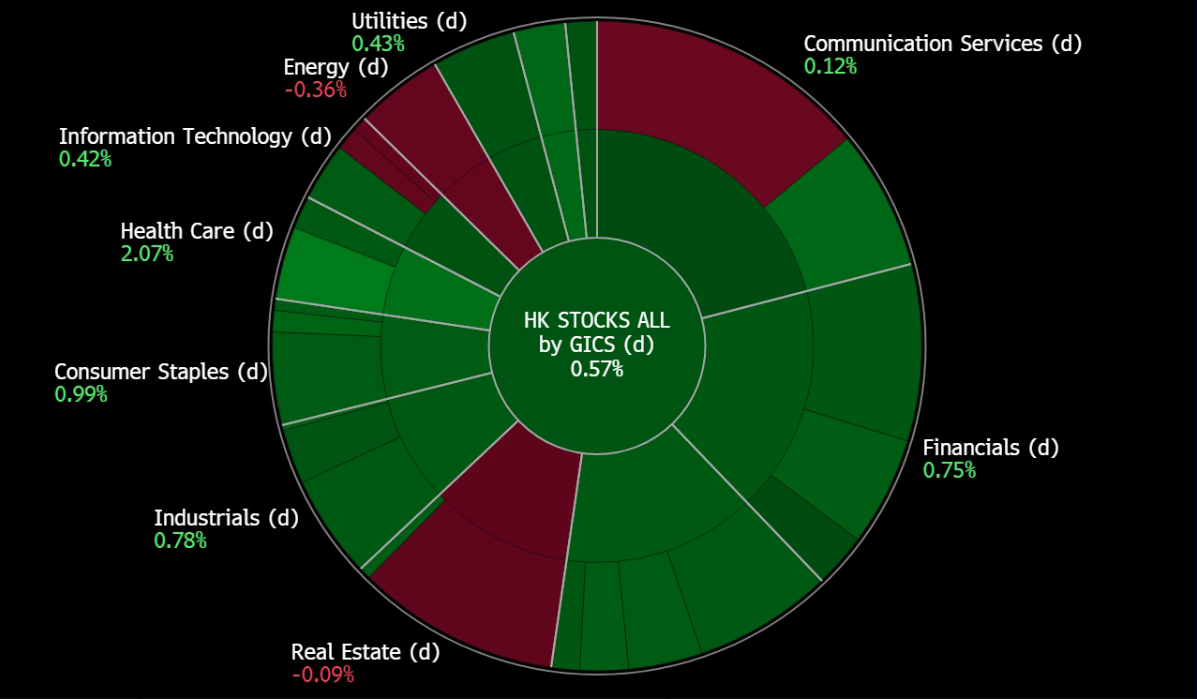

Hong Kong

Banyan Tree Holdings Ltd. (BTH SP): Fear not, tourism is here to stay

- RE-ITERATE BUY Entry 0.390 – Target – 0.415 Stop Loss – 0.378

- Banyan Tree Holdings Limited operates as a holding company. The Company, through its subsidiaries, owns and manages hotel groups. The Company focuses on hotels, resorts, spas, galleries, golf courses, and residences, as well as provides investments, design, construction, and project management services. Banyan Tree Holdings serves customers worldwide.

- Visa-free travel. Thailand will temporarily waive tourist visa requirements for visitors from China and Kazakhstan from 25 September 2023 to 29 February 2024, in an effort to attract more tourists and spur spending during the year-end high season to stimulate the economy, which is slowing due to weak exports. The business sector has welcomed the government’s new policy, and airlines are preparing to increase flights and add more capacity to accommodate the expected increase in tourists. The tourism industry is optimistic that the visa-free scheme will be a success and boost tourism spending in Thailand. This would also benefit businesses such as Banyan Tree, which has multiple properties in the country. The visa-free scheme would make it easier and more convenient for Chinese tourists to visit Thailand, which could lead to an increase in bookings at Banyan Tree’s properties.

- Banyan Tree Dubai. Banyan Tree Group, Ennismore, and Dubai Holding have partnered to open a new Banyan Tree hotel in Dubai, replacing the existing Caesars Palace Dubai on Bluewaters Island. The new hotel will be co-operated by Banyan Tree Group and Ennismore and is scheduled to open in November 2023. It will have 179 rooms, including 30 suites and a brand-new four-bedroom villa, a Banyan Tree spa, a mini rainforest, five F&B outlets, and 96 private residences. This is the first of many hotel and brand development projects that Accor and Dubai Holding plan to collaborate on, to further develop and grow the hospitality sector in Dubai.

- Confidence in recovery. Ho Kwon Ping, founder of Banyan Tree Holdings, expects the tourism sector to benefit from the return of Chinese tourists, although the mass market is taking longer to recover. He is not worried about the lack of Chinese tourists, as Banyan Tree does not cater to mass market travellers. He is also confident that the Chinese real estate market will not collapse, as the banking system is strong. Additionally, he mentioned that Banyan Tree’s exposure to the Chinese real estate bubble is not large due to the sale of a few hotels in China before the bubble.

- 1H23 results review. Revenue for 1H23 increased 21% to S$143.7mn, from S$118.6mn a year ago. It achieved a 68% increase in core operating profit to S$18.7mn in 1H23 from S$11.1mn in 1H22. RevPAR rose 64% in 1H23 (on a same-store basis) vs 1H22.

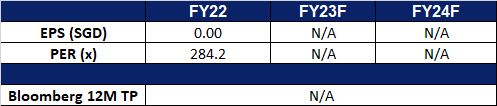

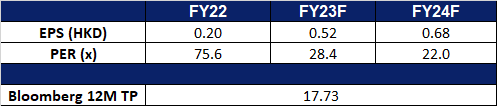

- Market consensus.

(Source: Bloomberg)

ThaiBev (THBEV SP): Expecting a tourism boost in Thailand during China’s upcoming golden week

- RE-ITERATE BUY Entry 0.58 – Target – 0.62 Stop Loss – 0.56

- Thai Beverage Public Company Limited is Thailand’s largest and leading beverage producer and distributor. Its operation is considered among the leading distillers and brewers and in Southeast Asia. ThaiBev’s leading products include a variety of well-established spirits brands, including its famous brew Chang Beer. In the non-alcoholic beverage category, key products include water, tonic soda, energy drink, ready-to-drink coffee and green tea.

- Visa-free travel. Thailand will temporarily waive tourist visa requirements for visitors from China and Kazakhstan from 25 September 2023 to 29 February 2024, in an effort to attract more tourists and spur spending during the year-end high season to stimulate the economy, which is slowing due to weak exports. The business sector has welcomed the government’s new policy, and airlines are preparing to increase flights and add more capacity to accommodate the expected increase in tourists. The tourism industry is optimistic that the visa-free scheme will be a success and boost tourism spending in Thailand.

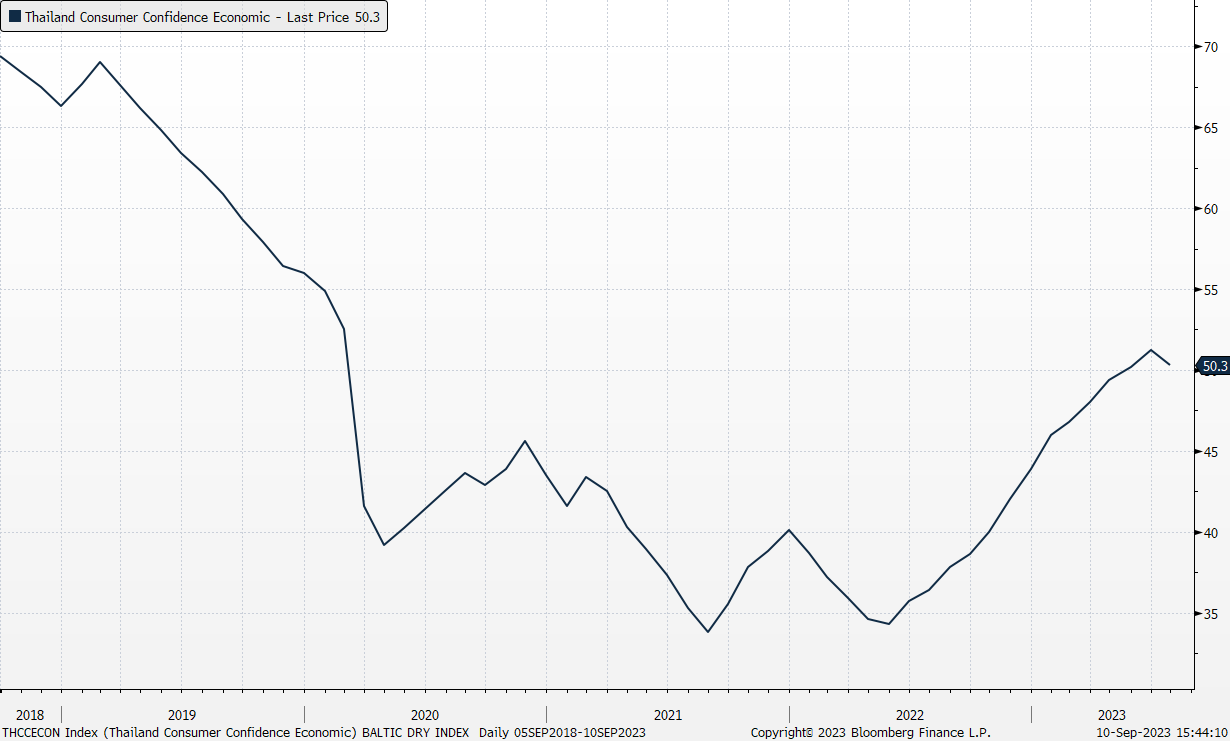

- Consumer confidence remains strong. According to the latest consumer confidence survey, the index recovered to the highest level since the COVID outbreak, reaching 51.2 in June before declining slightly to 50.3 in July. This promising recovery was driven by the growth in tourism and the demand for industrial and agricultural goods.

Thailand Consumer Confidence Economic Index

(Source: Bloomberg)

- Tourism to drive alcohol consumption. Thailand’s economy is expected to have grown by 3.1% in 2Q23, up from 2.7% in 1Q23. The growth was driven by increased foreign tourist arrivals, which have been recovering since the country reopened its borders in late 2022. However, exports, a key driver of growth, have contracted since October 2022, indicating weak global demand. Despite the challenges, the Thai economy is still expected to grow by an average of 3.7% in 2023, in line with the Bank of Thailand’s estimate. With alcohol being readily available in Thailand and as more foreign tourists visit Thailand, it is anticipated that the amount of alcohol consumed will increase alongside tourism arrivals. Thailand is expected to see another peak in tourism during the upcoming golden week in China (China’s National Day holiday) as the Chinese still favour Thailand as an overseas travelling destination.

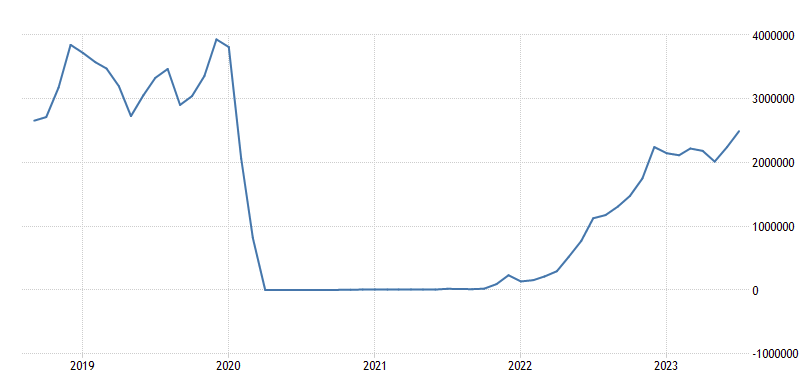

Thailand Tourists Arrivals

(Source: Trading Economics)

- 3Q23 earnings review. Revenue grew mildly by 3.8% YoY to 215.9bn THB. EBITDA was down 3.4% YoY to 37.8bn THB. Its largest revenue contributor, the spirits business revenue was 93.7bn THB a 3.3% rise YoY.

- Market consensus.

(Source: Bloomberg)

Yankuang Energy Group Co. Ltd. (1171 HK): Coal price rebounding

- BUY Entry – 14.3 Target – 15.3 Stop Loss – 13.8

- Yankuang Energy Group Co Ltd is a China-based international comprehensive energy company engaged in coal and coal chemical industry. The Company operates in five segments. The Coal Mining segment is engaged in underground and open-cut mining, preparation and sale of coal and potash mineral exploration. The Smart Logistics segment provides railway transportation services. The Electricity and Heating Supply segment provides electricity and related heat supply services. The Equipment Manufacturing segment is engaged in the manufacture of comprehensive coal mining and excavating equipment. The Chemical Products segment is engaged in the production and sale of chemical products. The coal products mainly include thermal coal, pulverized coal injection (PCI), and coking coal. The coal chemical products mainly include methanol, ethylene glycol, acetic acid, ethyl acetate and crude liquid wax, among others. The Company distributes products in the domestic market and to overseas markets.

- High demand for coal China has continued to accelerate its coal-fired power plant construction. As the continued drought in China severely reduced hydroelectric power in the southern provinces, the country has increased its reliance on coal-fired power generation. The upcoming winter season is likely to drive the demand for electricity up, and as a result, driving up the demand for coal as well. China’s coal output in August also increased by 2% compared to the previous year, signalling a modest rebound after safety measures had restricted mining operations the previous month.

- Coal prices recovering. Coal prices on the global market have risen to their highest level in four months, driven by a surge in activity at Chinese coal-fired power plants, as Chinese power plants burn more coal to make up for the shortage of hydroelectricity caused by the drought. The spot price of thermal coal at Australia’s Newcastle port reached more than $159 per tonne on Monday, the highest level since mid-May, representing a 31% increase from the recent low in late June. Coal mining companies such as Yankuang Energy Group is likely to benefit from this surge in coal prices.

Thermal Coal Price

(Source: Bloomberg)

(Source: Bloomberg)

- Yancoal’s improving operational efficiency. Yancoal Australia, a subsidiary of Yankuang Energy Group, recently announced that they have entered into a partnership with TPG Telecom to deploy a private mobile network at its Hunter Valley mines. This is set to bolster Yancoal’s ability to track and communicate with vehicles, equipment, and personnel across the site, increasing the efficiency of the mines, and hence increasing production levels.

- 1H23 results. Revenue fell to RMB84.4bn, down 15.8% YoY, compared to RMB100.3bn in 1H22. Net profit attributable to shareholders fell to RMB10.2bn in 1H23, down 43.4% YoY, compared to RMB18.0bn in 1H22. Basic EPS was RMB2.09 in 1H23, compared to RMB3.70 in 1H22.

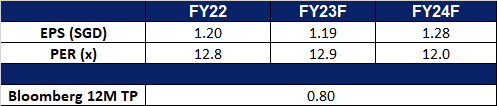

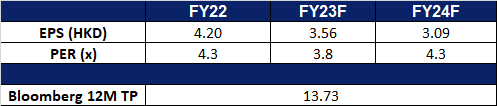

- Market Consensus.

(Source: Bloomberg)

Shandong Gold Mining Co. Ltd. (1787 HK): Go for Gold

- RE-ITERATE BUY Entry – 15.8 Target – 17.0 Stop Loss – 15.2

- Shandong Gold Mining Co., Ltd. is a China-based company principally engaged in the mining, processing and sales of gold. The Company operates two segments. The Gold Mining segment is engaged in the mining of gold ore. The Gold Refining segment is engaged in the production and sales of gold. The Company is also engaged in the distribution of other metals extracted during the gold ore smelting process, such as silver, copper, iron, lead and zinc. The Company conducts its businesses in domestic and overseas markets.

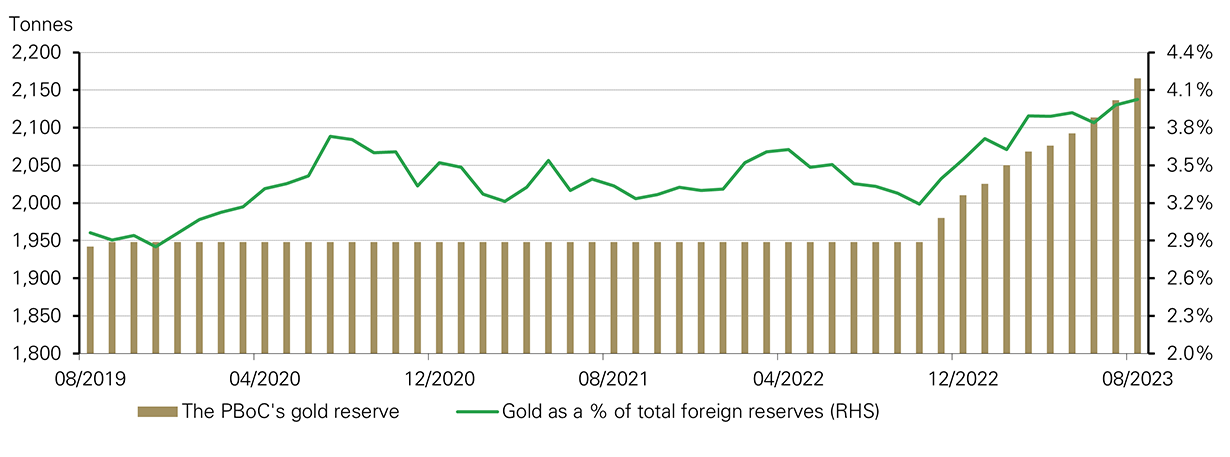

- China increasing its gold reserves. China has been buying gold for 10 consecutive months, increasing its already sizable holdings as part of a strategy to reduce its reliance on the US dollar. China’s central bank increased its gold holdings by 930,000 troy ounces, or around 29 tonnes in August, according to the bank’s statement recently. Gold now makes up 4.03% of China’s foreign exchange reserves in US dollars, the highest level ever recorded.

PBOC Gold Reserves

(Source: PBoC, World Gold Council)

- New discovery of Gold resources. Shandong Gold Group Co. announced that the estimated total gold reserves at the Xiling gold mine in Shandong province have increased to about 592.2 metric tons, up more than 200 tons from previous estimates. The gold reserves have a potential value of more than 200bn yuan (US$27.7 bn), making Xiling the largest single gold reserve mine in China. Accordingly to the company. the Xiling gold mine is also expected to maintain production for about 40 years, if its annual processing capacity is 3.3mn tons.

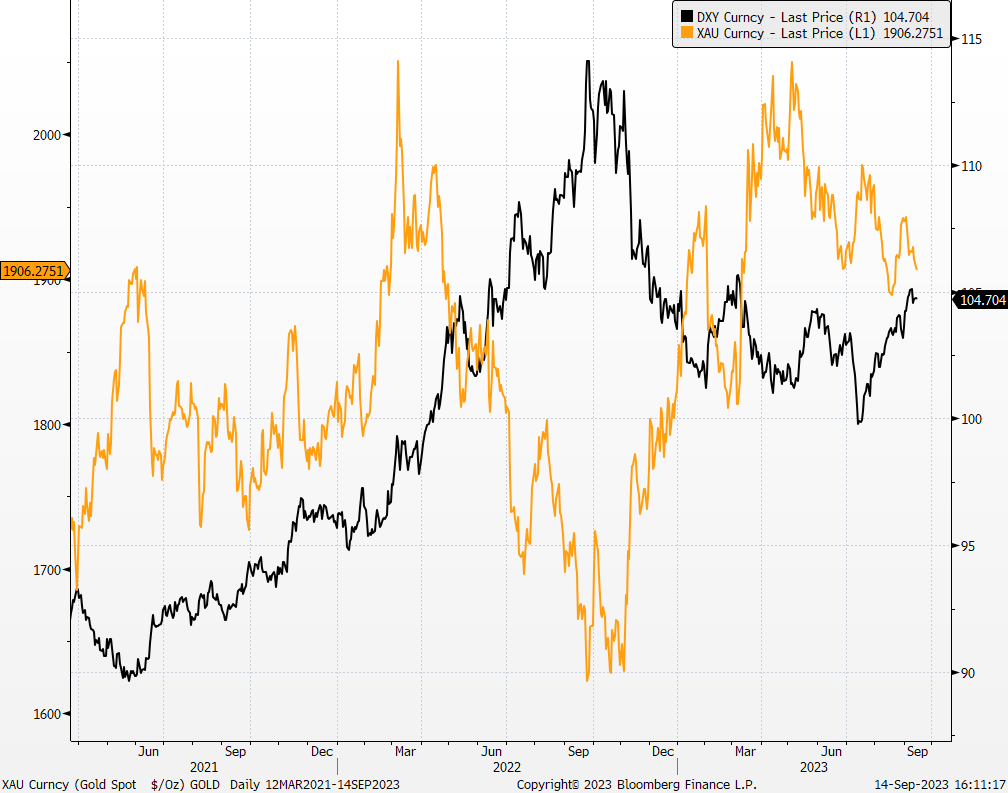

- Interest Rates expectations near its peak. Investors expects the Federal Reserve to leave Fed Fund Rate unchanged in September, and is only expected to start its rate cuts in 2Q2024 or later, with the current Fed Fund Rate atn 5.25% to 5.50%.With interest rates reaching its peak, the price of gold may see some positives, given that inflation continues to show signs of slowing down.

Gold Price and Dollar Index Trend

(Source: Bloomberg)

- 1H23 results. Revenue fell slightly to RMB27.4bn, down 8.1% YoY, compared to RMB29.8bn in 1H22. Net profit rose to RMB979.8mn in 1H23, up 69.8% YoY, compared to RMB577.1mn in 1H22. Basic EPS was RMB0.14 cents in 1H23, compared to RMB0.09 in 1H22.

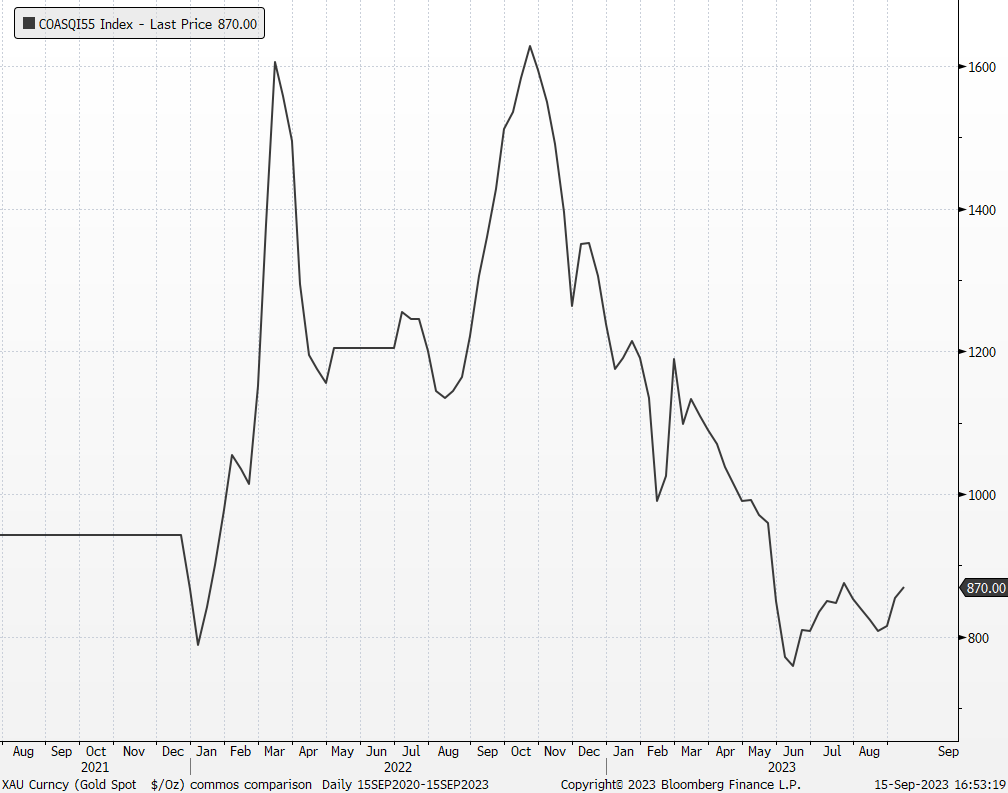

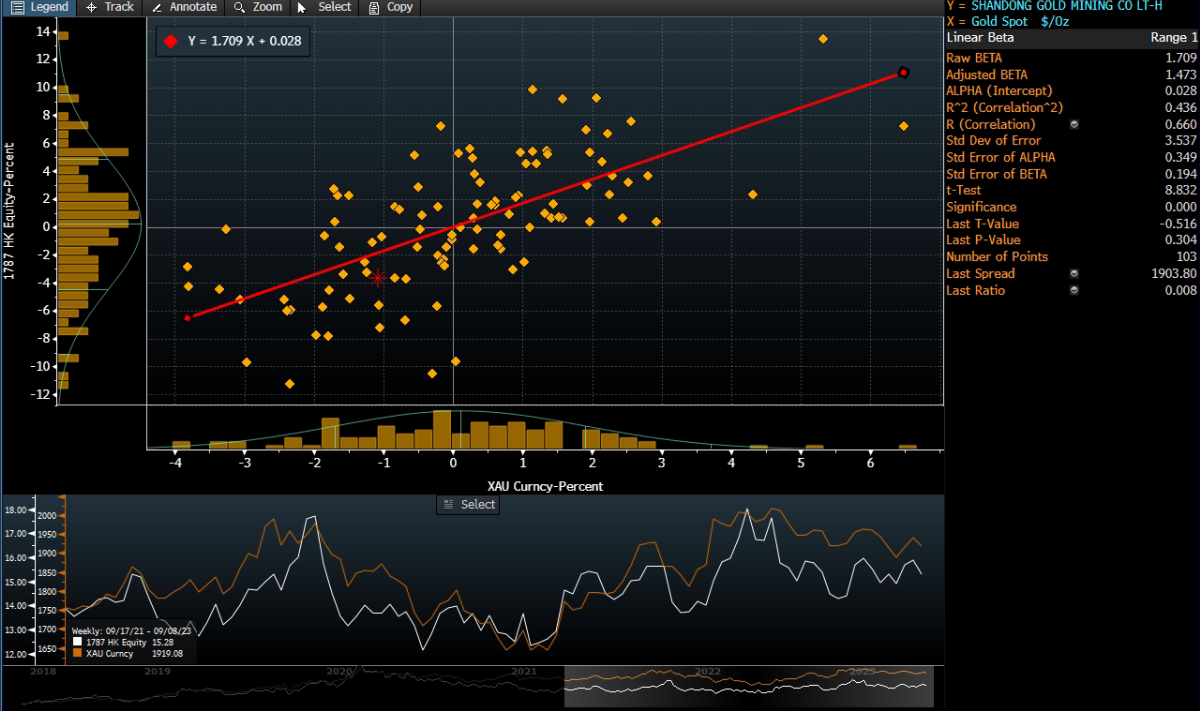

Shandong Gold vs Gold Price

- Market Consensus.

(Source: Bloomberg)

Freeport-McMoRan (FCX US): Copper price stabilising

- BUY Entry – 40.0 Target – 44.00 Stop Loss – 38.0

- Freeport-McMoRan Inc. is an international natural resources company. The Company operates large, long-lived, geographically diverse assets with significant reserves of copper, gold, molybdenum, cobalt, oil, and gas.

- Copper prices stabilising. Copper prices stabilised despite a stronger dollar, which countered China’s central bank’s efforts to boost stimulus. The US dollar gained strength following data indicating persistent inflationary pressures in the US economy, causing copper to lose some of its earlier gains due to the influence of the dollar. The People’s Bank of China had recently lowered the reserve requirement ratio for most banks by 25 basis points, marking the second such cut this year as part of its relatively modest stimulus measures. China’s slow recovery from COVID-19 restrictions has weighed on the metal markets in 2023, along with tighter US monetary policy. Additionally, traders are watching Beijing’s actions to stabilise the yuan against the surging dollar. A stronger yuan can make imports cheaper for domestic traders and fabricators in China, the world’s largest metals consumer.

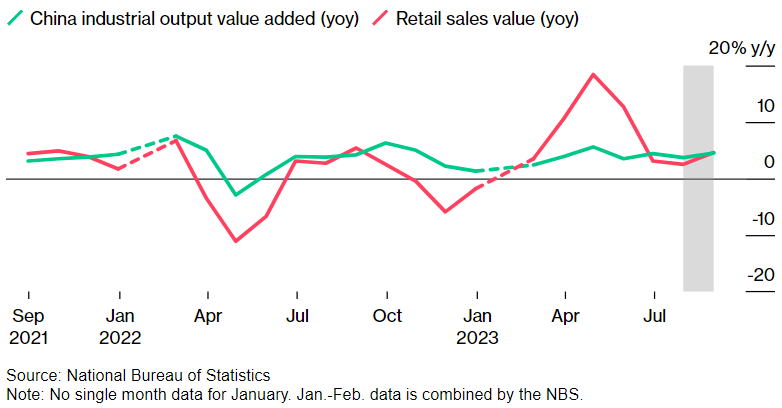

China’s August industrial and retail figures improving

(Source: NBS)

- China’s economic recovery. In August, China’s economy showed signs of improvement, with industrial output growing by 4.5% and retail sales increasing by 4.6%. These positive figures prompted banks like JP Morgan to raise their GDP forecasts for China. Government efforts to boost growth, including increased spending on home goods and relaxed housing restrictions, have played a role in this improvement. However, challenges persist, especially in the property sector, where conditions are weakening. Investment growth in both fixed assets and property has slowed, and infrastructure investment has eased slightly. While there are positive signs, it’s too early to confirm a sustained recovery. To address uncertainties in the global environment and domestic demand, more policy support may be needed. The Chinese government is expected to continue implementing measures to support the economy, as indicated by recent actions like reducing the reserve requirement ratio and injecting liquidity into the financial system. Consequently, a potential strengthening of the Chinese yuan is likely to provide additional support to global copper prices.

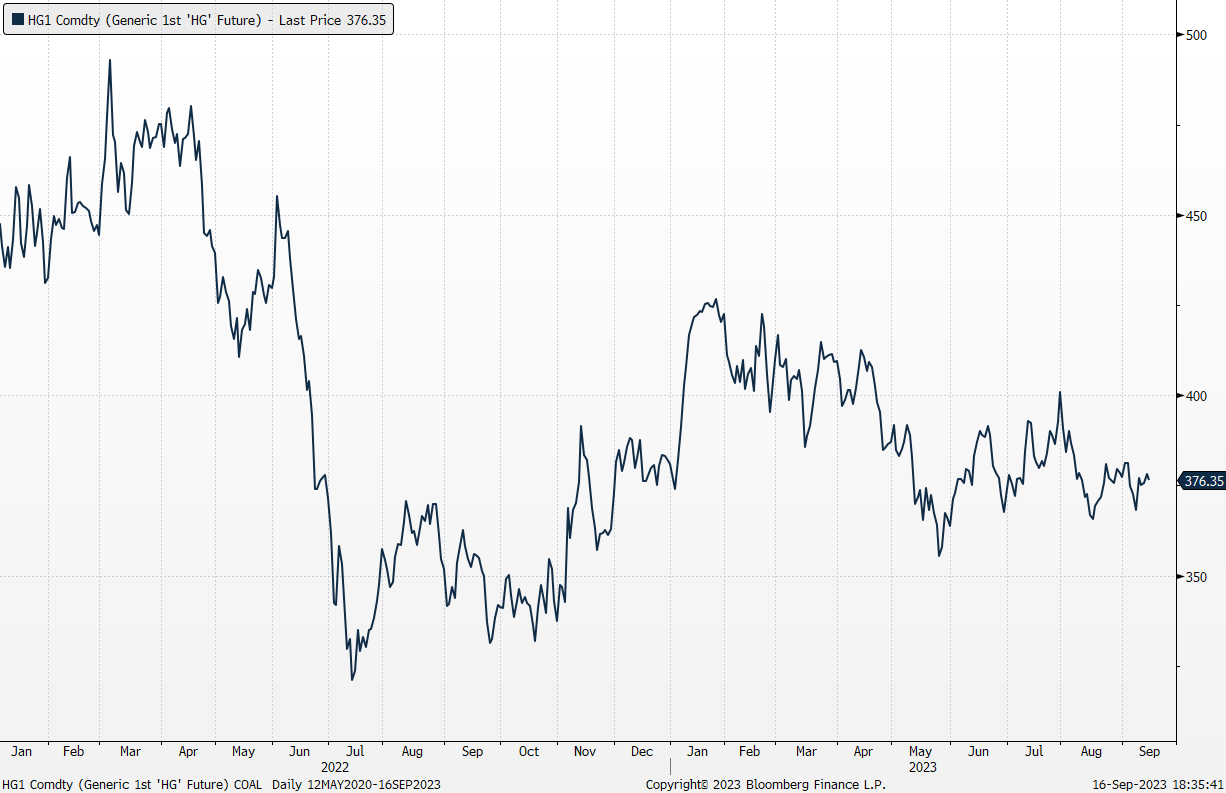

Copper price trend

(Source: Bloomberg)

- Copper futures rising. Copper futures have climbed above $3.75 per pound, extending their recovery from a three-week low of $3.68 on September 8th. This rise was supported by a temporary weakening of the US dollar and optimistic expectations of increased demand for industrial materials in China.

- 2Q23 earnings review. Revenue rose 5.9% year-over-year to US$5.74bn, beating estimates by US$80mn. Non-GAAP EPS of $0.35 missed expectations by $0.02. The company’s Q2 sales of copper fell 5.3% to 1.03bn pounds while production fell 1% to 1.07bn pounds. It expects sales of 1bn pounds of copper in Q3, if exports from Indonesia resume.

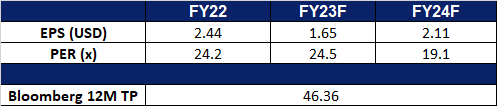

- Market consensus.

(Source: Bloomberg)

Unity Software Inc (U US): Buy the dip

Unity Software Inc (U US): Buy the dip

- RE-ITERATE BUY Entry – 35.5 Target – 38.5 Stop Loss – 34.0

- Unity Software Inc. provides software solutions. The Company offers graphic tools to create, run, and monetize real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices. Unity Software serves customers worldwide.

- Introduction of Runtime Fee. On 13 September, Unity announced that it would introduce a new “Unity Runtime Fee” at the start of 2024 that will charge developers for every game install. The fee will be charged to developers who have crossed specific revenue and install thresholds, and will vary depending on the licence and region. Unity is also making some updates to its licensing plan, such as allowing developers to use a Unity Personal license even if they are making revenue from their game. The company has stated that the fee will not impact the majority of its customers, but some developers have expressed concern that it will disproportionately impact indie developers and smaller studios. This initial install-based fee would allow creators to keep the ongoing financial gains from player engagement, as opposed to a revenue share model, which would require them to give up a portion of their revenue. Although the share price of Unity fell after the announcement of the new fee, we believe that this fee will be beneficial for the company in the long run. The fee may encourage users to become paying subscribers, while most of the current user base is likely to remain with Unity, as developers are unlikely to switch to alternative game engines, especially larger corporations with significant in-game users. Therefore, we believe that this is a good opportunity to buy the dip in Unity’s stock price.

- 2Q23 earnings review. Revenue rose 79.6% year-over-year to US$533.48mn, beating estimates by US$16.13mn. GAAP EPS of -$0.51 beat expectations by $0.11.

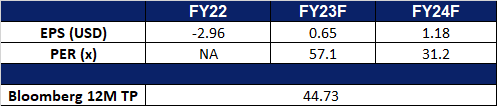

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Add Shandong Gold Mining Co. Ltd. (1787 HK) at HK$15.8 and Unity Software Inc (U US) at US$35.5. Cut loss on Baidu Inc (9888 HK) at HK$133.