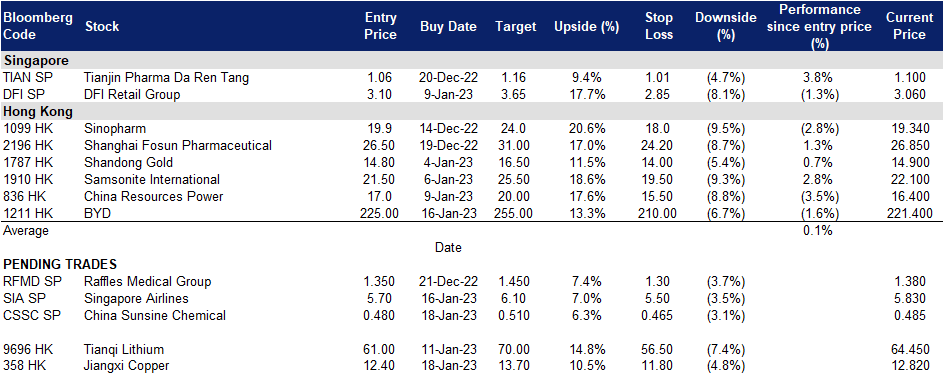

18 January 2023: China Sunsine Chemical Holdings Ltd (CSSC SP), Jiangxi Copper Company Limited (358 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

China Sunsine Chemical Holdings Ltd (CSSC SP): Rise in domestic demand

- BUY Entry 0.480 – Target – 0.510 Stop Loss – 0.465

- China Sunsine Chemical Holdings Ltd is a leading specialty chemical producer. It is the largest producer of rubber accelerators in the world and the largest producer of insoluble sulphur in the PRC. They also have products sold under the “Sunsine” brand with over 700 customers around the world, consisting of more than 65% of the Global Top 75 tire makers, such as Bridgestone, Michelin, Goodyear, Pirelli, Sumitomo, Yokohama, Hankook, Cooper, Kumho Tires, as well as PRC tire giants such as Hangzhou Zhongce, GITI Tire, Shanghai Double Coin Tyre etc.

- Domestic demand recovery. China has recently eased their tight Covid measures which consisted of aggressive testing, mass lockdowns and restricted travel policies. With their newfound freedom, Chinese residents would need to service their cars and change their tyres after prolonged periods of curbed movement. Hence, increasing the domestic demand for rubber tyres for the various vehicles owned by residents.

- Chinese New Year. Furthermore, with the upcoming one week Chinese New Year Holiday in China, residents will travel across the country to visit their relatives that they have not been able to meet during the restrictive period. The residents that decide to drive across the country for visitations during this anticipated holiday will be more inclined to change their tyres for long distance travel.

- 3Q22 results review. China Sunsine reported a core net profit of RMB128 million ($24.5 million) for 3Q22, which was 28% higher YoY but 45% lower QoQ.

- Updated market consensus of the EPS growth in FY23/24 is -24.8%/12% respectively, which translates to 5.0x/4.4x forward PE. Bloomberg consensus average 12-month target price is S$0.53.

(Source: Bloomberg)

Raffles Medical Group Ltd (RFMD SP): Increasing healthcare demand

- RE-ITERATE Entry – 1.35 Target – 1.45 Stop Loss – 1.30

- Raffles Medical Group is a leading integrated private healthcare provider in the region, operating medical facilities in thirteen cities in Singapore, China, Japan, Vietnam and Cambodia. The Group is the first Asian member of the Mayo Clinic Care Network. RafflesMedical clinics form one of the largest networks of private family medicine centres in Singapore. RafflesHospital, the flagship of Raffles Medical Group, is a private tertiary hospital located in the heart of Singapore offering a wide range of specialist medical and diagnostic services for both inpatients and outpatients.

- Surge in Covid cases. With China easing its Covid restrictions and Covid cases surging in China, Raffles Medical will benefit from this as their medical facilities will be visited by Chinese residents. Raffles Medical has a total of 3 hospitals and 4 clinics located around China. Additionally, they have 3 online stores serving 3 districts in China.

- Increase in tourism. With worldwide borders being opened up, the pent-up demand for travel is finally being satisfied. With an influx of tourist into Singapore, healthcare providers are expecting a wave of travellers requiring pre-departure PCR test in the coming months. With a 15 – 20% increase in PCR demand in the month of november, these numbers are expected to rise even higher as measures are continually relaxed.

- Rise in demand for services. Singapore is currently facing a surge in foreign demand in the healthcare sector, with many foreigners opting for treatment in Singapore. As Singapore opens up its borders, foreign patients return to seek treatment at RafflesHospital. Singapore residents who postponed their elective surgeries also returned for treatment.

- 3Q22 results. Raffles Medical reported strong 3Q results ended in September, with a net profit growth of S$98.2 million, up 57.3% YoY. For the period, revenue grew 6.5% YoY to S$199.5 million while net profit surged by 62.1% YoY to S$38.3 million.

- Updated market consensus of the EPS growth in FY23/24 is -8.0%/6.9% YoY respectively, which translates to 25.9x/24.0x forward PE. Current PER is 24.5x. Bloomberg consensus average 12-month target price is S$1.61.

Jiangxi Copper Company Limited (358 HK): A good start in 2023

- BUY Entry – 12.4 Target – 13.7 Stop Loss – 11.8

- Jiangxi Copper Company Limited is a China-based company, principally engaged in the mining, smelting and processing of copper. The Company is also engaged in the extraction and processing of precious metals and dissipated metals, sulfur chemical industry business, and financial and trading businesses. The company’s products include cathode copper, gold, silver, sulfuric acid, copper rods, copper foils, selenium, tellurium, rhenium, bismuth and others. The Company mainly conducts its businesses within Mainland China and Hongkong.

- China bailing out the property market. The People’s Bank of China and the China Banking and Insurance Regulatory Commission jointly issued a notice to financial institutions laying out plans to ensure the “stable and healthy development” of the property sector in December. The notice includes 16 measures that range from addressing the liquidity crisis faced by developers to loosening down-payment requirements for homebuyers. Meanwhile, developers’ outstanding bank loans and trust borrowings due within the next six months can be extended for a year, while repayment on their bonds can also be extended or swapped through negotiations. The authorities also told the nation’s second-tier banks to dole out another RMB 400bn (US$56bn) of financing for the property sector in the final two months of 2022.

- Copper prices rallied and the dollar index fell. Copper futures closed at US$413.6/pound, last June’s level, and the dollar index pulled back to 102.4. China has released supportive policies for the property market, and the construction activities will widely resume after Chinese New Year. On the other hand, China is expected to continue its infrastructure expansion, especially the renewable energy segment. Both catalysts are tailwinds for the commodities market as both positive pricing and demand factors are expected to uphold the near-term recovery of the metal market.

- Copper futures seasonality. Copper performs the best in February in a year based on the last 15-year’s track record.

- 3Q22 earnings review. 3Q22 operating revenue grew by 2.2% YoY to RMB112.9bn. Net profit attributable to shareholders of the company dropped by 13.8% YoY to RMB1.3bn. 9M22 operating revenue grew by 9.2% YoY to RMB368.2bn. Net profit attributable to shareholders of the company increased by 4.9% YoY to RMB4.8bn.

- The updated market consensus of the EPS growth in FY22/23 is -3.8%/-23.8% YoY respectively, which translates to 6.2x/8.1x forward PE. The current PER is 5.7x. Bloomberg consensus average 12-month target price is HK$11.36.

(Source: Bloomberg)

(Source: Bloomberg)

BYD Co Ltd (1211 HK): A growing EV market leader

BYD Co Ltd (1211 HK): A growing EV market leader

- RE-ITERATE Buy Entry – 225 Target – 255 Stop Loss – 210

- BYD COMPANY LIMITED is a China-based company principally engaged in the manufacture and sales of transportation equipment. The Company is also engaged in the manufacture and sales of electronic parts and components and electronic devices for daily use. The Company’s products include rechargeable batteries and photovoltaic products, mobile phone parts and assembly, and automobiles and related products. The Company mainly conducts its businesses in China, the United States and Europe.

- Vehicle sales recovered in China. According to the China Passenger Car Association (CPCA), China’s passenger car sales rose 2.4% YoY in December as consumers rushed to make use of a subsidy for electric vehicles before they expired. The CPCA predicted that passenger vehicle sales were likely to remain largely flat or slightly up in 2023. However, it expected sales of new energy cars, mainly EVs, to hit 8.5mn units in 2023, accounting for 36% of total new car sales.

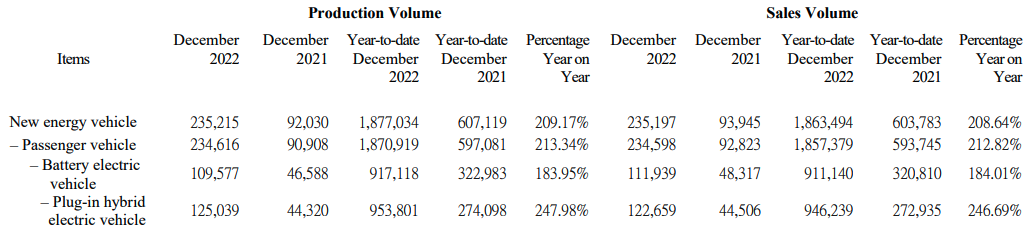

- New energy vehicle production and sales in December.

- 2023 Outlook. The actual NEV sales last year were 1.86mn units, below management’s 2022 target of 1.88mn units. The guidance of NEV sales in 2023 from management was 3mn units, up 61.3% YoY.

- 3Q22 earnings review. Revenue from operations jumped by 84.4% YoY to RMB117.1bn. Net profit attributable to shareholders jumped by 281.1% YoY to RMB 5.7bn.

- The updated market consensus of the EPS growth in FY23/24 is 56.6%/42.0% YoY, respectively, translating to 25.9×/18.2x forward PE. The current PER is 58.3x. Bloomberg consensus average 12-month target price is HK$332.47.

United States

Top Sector Gainers

| Sector | Gain/ Loss | Related News |

| Consumer Durables | +2.70% | Xpeng Follows Tesla With Major Price Cuts on China Electric Cars Tesla, Inc.(TSLA US) |

| Electronic Technology | +0.49% | The worst is over for the global chip shortage, ABB chairman says: ‘I’m quite optimistic’ Apple Inc.(AAPL US) |

| Energy Minerals | +0.28% | Oil prices settle higher on hopes of China demand rebound Exxon Mobil Corp.(XOM US) |

Top Sector Losers

| Sector | Gain/ Loss | Related News |

| Non-Energy Mineral | -1.86% | India Diamond Traders Hit by Rupee Risks Amid Russia Supply Woes BHP Group Ltd.(BHP US) |

| Retail Trade | -1.09% | Retailers Are Looking For Ways To Sell Smarter In 2023 And Beyond Amazon.com, Inc.(AMZN US) |

| Process Industries | -0.56% | Henkel Signs Agreement with Shell on Renewable-Based Ingredients for Persil®, Purex® and all® brands Linde PLC(LIN US) |

Hong Kong

Top Sector Gainers

Sector | Gain/ Loss | Related News |

Footwears | +1.66% | China reports 3% GDP growth for 2022 as December retail sales, industrial production beat estimates Xtep International Holdings Ltd (1368 HK) |

Textile & Apparels | +1.21% | China’s online retail sales up 4% in 2022 ANTA Sports Products Ltd (2020 HK) |

Environmental Energy Material | +1.17% | China’s top nuclear operator installs record high clean energy Xinyi Solar Holdings Ltd (968 HK) |

Top Sector Losers

Sector | Gain/ Loss | Related News |

Biotechnology | -3.13% | WuXi Biologics (Cayman) Inc (2269 HK) |

Medical Equipment & Servicees | -1.81% | Shandong Weigao Group Medical Polymer Co Ltd (1066 HK) |

Petroleum & Gases | -1.69% | China’s 2022 oil refinery runs fall for first year since 2001 CNOOC Ltd (883 HK) |

Trading Dashboard Update: Add BYD (1211 HK) at HK$225.0

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)