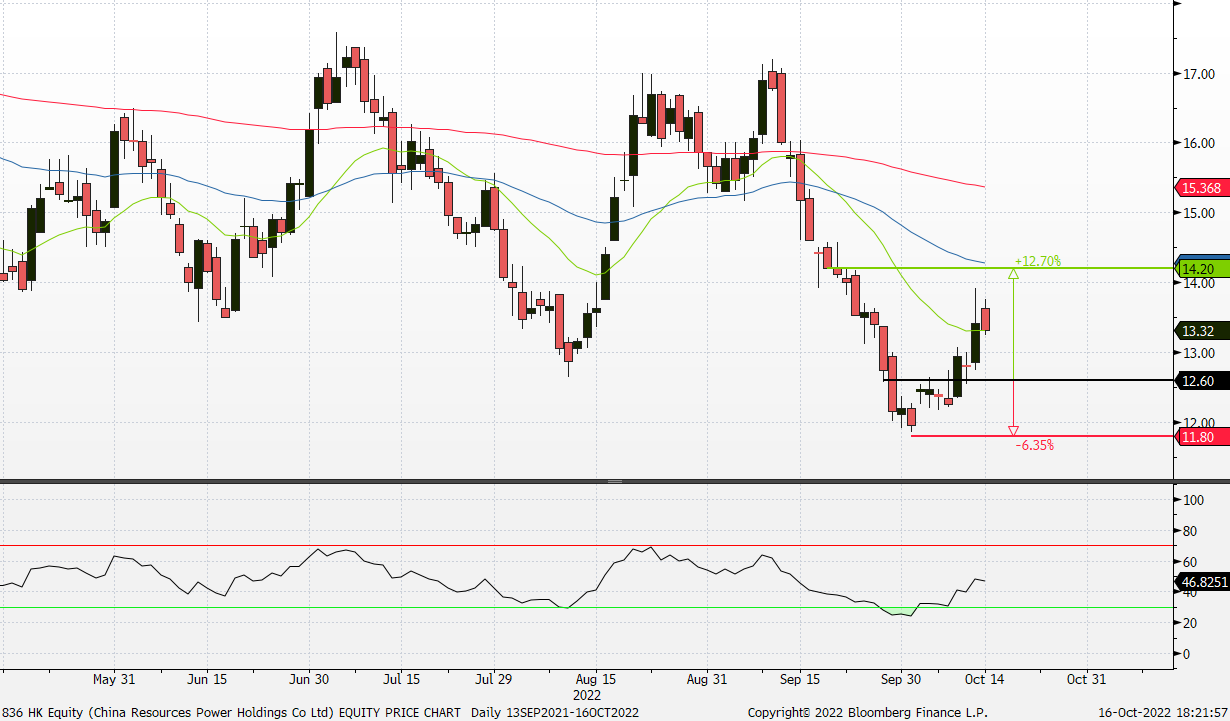

17 October 2022: Genting Singapore (GENS SP), Sinopharm Group Co., Ltd. (1099 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

Genting Singapore (GENS SP): “Rooms” are hot

- RE-ITERATE BUY Entry – 0.780 Target – 0.835 Stop Loss – 0.750

- Genting Singapore is best known for its award-winning flagship project Resorts World Sentosa, one of the largest fully integrated destination resorts in South East Asia. Genting Singapore is one of the constituent stocks of the FTSE Straits Times Index.

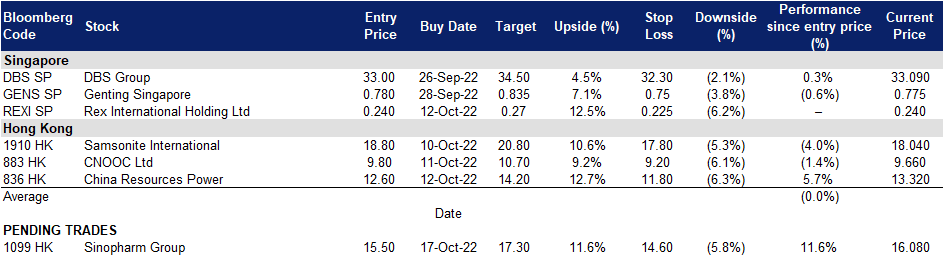

- Hotel prices hit a 10-year high. Singapore hotel room prices exceeded the pre-Covid level and hit a high in almost a decade in July 2022. As of July, the average room rate reached S$259/night, up c.70% YoY. The strong demand was driven by the increase in visitor arrivals amidst easing Covid-19 restrictions. Visitor arrivals in Singapore rose for the sixth straight month in July to 726,601, up from 543,733 in June, according to the tourism board.

Singapore hotel room price by tier

(Source: Singapore Tourism Analytics Network)

- Upcoming high-profile events pushing hotel prices higher. This week, hundreds of chief executives, crypto investors and innovators, and even a Bollywood star are flying in for a series of high-profile Mice events. The Singapore Tourism Board mentioned that nearly 90,000 delegates would be expected to attend about 25 Mice events around this period, similar to the number of events held pre-Covid-19. Some of the events held this week include the crypto conference – Token2049, the 20th Forbes Global CEO Conference, the ninth annual Milken Institute Asia Summit and the inaugural edition of the Time100 Leadership Forum. A number of these events will be held concurrently with the Formula One Grand Prix, taking place between Friday to Sunday. The entertainment lineup this weekend includes performances by Marshmello, Westlife and Green Day. Other big names in entertainment coming to Singapore later this year include Justin Bieber, Maroon Five, Guns N’ Roses and Jay Chou.

- Updated market consensus of the EPS growth in FY22/23 is 82.1%/60.7% YoY respectively, which translates to 28.2x/17.5x forward PE. Current PER is 53.1x. Bloomberg consensus average 12-month target price is S$0.95.

(Source: Bloomberg)

DBS Group Holdings Ltd (DBS SP): Tailwinds from rate hikes

DBS Group Holdings Ltd (DBS SP): Tailwinds from rate hikes

- RE-ITERATE BUY Entry 33.0 – Target – 34.5 Stop Loss – 32.3

- DBS Group Holdings Limited and its subsidiaries provide a variety of financial services. The company offers mortgage financing, lease and hire purchase financing, nominee and trustee, funds management, corporate advisory and brokerage services. DBS Group also is the primary dealer of Singapore government securities. DBS Bank Ltd operates as a bank offering wealth management, personal, and business banking services. DBS Bank serves customers worldwide.

- Housing loan rate adjustments. After the recent rate hike from the United States Federal Reserve, DBS announced that it would temporarily cease its fixed-rate home loans as the loan rates on these packages are being reviewed. The bank however continues to offer floating rate packages which are pegged to the SORA. By putting a pause on fixed-rate home loan packages in this volatile interest rate market, they are mitigating their risks and passing them on to their borrowers.

- Benefiting from higher Interest rates. With the constant rise in interest rates, DBS will be able to increase its margins when lending money to borrowers. Additionally, by taking advantage of the difference between the interest paid out to lenders and the interest earned from short-term investments, their profits will grow.

- Expansion of services. With the rapid boom of the cryptocurrency sector and the surge in the volume of crypto transactions carried out on its members-only platform, DBS recently expanded access to its crypto trading services. It announced the roll-out of self-directed crypto trading on DBS digibank, enabling 100,000 of the bank’s wealth clients who are accredited investors to trade cryptocurrencies on the DBS Digital Exchange (DDEx) at their convenience. These clients will be able to trade four cryptocurrencies – Bitcoin, Bitcoin Cash, Ether and Ripple – on DDEx with a minimum investment of S$500.

- The updated market consensus of the EPS growth in FY22/23 is 15.2%/18.7% YoY, respectively, translating to 11.1×/9.4x forward PE. The current PER is 12.8x. Bloomberg consensus average 12-month target price is S$39.31.

Sinopharm Group Co., Ltd. (1099 HK): A value and defensive counter amidst market sell-off

- Buy Entry – 15.5 Target – 17.3 Stop Loss – 14.6

- Sinopharm Group Co Ltd is a China-based company principally engaged in pharmaceutical and medical devices distribution business. The Company operates its business through four segments. Pharmaceutical Distribution segment is engaged in the distribution of pharmaceutical products to hospitals, other distributors, retail pharmacy stores and clinics. Medical Devices segment is engaged in the distribution of medical devices, as well as provides installation and maintenance services. Retail Pharmacy segment is engaged in the operation of chain pharmacy stores. Other Business segment is engaged in the distribution of laboratory supplies, manufacture and distribution of chemical reagents, production and sale of pharmaceutical products.

- 1H22 earnings review. 1H22 revenue grew by 8.9% YoY to RMB36.1bn. Net profit attributable to shareholders dropped by 9.1% YoY to RMB674mn. The decrease in profit was mainly attributable to the decline in the results of Sinopharm Accord’s associates due to the impact of the scattered and frequent outbreaks of the Covid-19 pandemic, which resulted in a decline in the store traffic and a slowdown in the sales growthof the retail sector. In addition, the retail business segment opened new directly-operated stores in2021and the first half of 2022 with large initial investment in new stores, the benefits of which have not yet been realized, resulting in a decrease in the margin levels. At the same time, the performanceof Sinopharm Accord’s associates declined, leading to a decrease in investment income. The company will announce its 3Q22 results on 26th October.

- A defensive stock amidst a market downturn. The Hong Kong market has been hammered by both a slowdown in China’s economy and geopolitical risks. Growth, value, and cyclical sectors, as well as other thematic stocks, have been sold off indiscriminately. However, this stock is relatively outperforming the rest as its business is largely immune to inflation and policy risks. The business driver is the distribution volume rather than profit margins. The growth in demand for medicines and medical devices is stable with low price sensitivity.

- The updated market consensus of the EPS growth in FY22/23 is -3.0%/9.3% YoY respectively, which translates to 5.6x/5.1x forward PE. The current PER is 5.9x. The FY22F/23F dividend yield is 5.5%/6.0%. Bloomberg consensus average 12-month target price is HK$22.4.

(Source: Bloomberg)

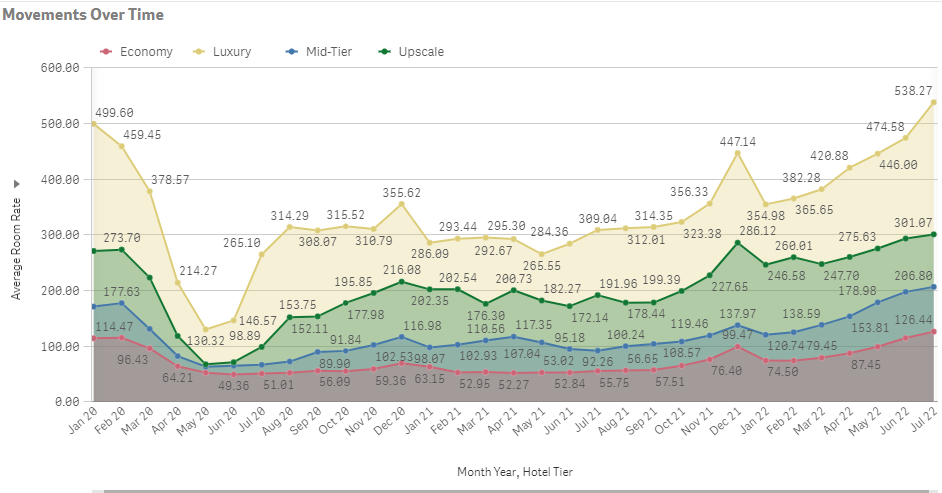

China Resources Power Holdings Company Limited (836 HK): A value stock in play

China Resources Power Holdings Company Limited (836 HK): A value stock in play

- RE-ITERATE Buy Entry – 12.6 Target – 14.2 Stop Loss – 11.8

- China Resources Power Holdings Company Limited is a Hong Kong-based investment holding company principally engaged in the investment, development and operation of power plants. The Company operates through three segments. Thermal Power segment is engaged in the investment, development, operation and management of coal-fired power plants and gas-fired power plants, as well as the sales of heat and electricity. Renewable Energy segment is engaged in wind power generation, hydroelectric power generation and photovoltaic power generation, as well as the sales of electricity. Coal Mining segment is engaged in the mining of coal mines, as well as the sales of coal. The Company mainly operates businesses in China.

- Power is a defensive sector. The downturn of the Hong Kong equity market persisted due mainly to the global rate hike cycle, China’s economy slowdown, and deteriorating China-US relations. The broad market selloff has yet ended, however, power sector is one of the few relatively outperforms. Not only does the sector provide consistent and positive cash flows, but also expand businesses into clean energy fields which are in line with global ESG theme and supported by the domestic policies.

- August operations update. Total net generation of subsidiary power plants in August-22 increased by 24.9% YoY to 19,734,839MWh, among which, subsidiary wind farms increased by 43.5% YoY to 2,753,235MWh, subsidiary photovoltaic plants increased by 6.7% YoY to 115,859MWh.

- 1H22 earnings review. Turnover grew by 17.78% YoY to HK$50.4bn. The increase was mainly attributable to a YoY increase of 23.9% in the average on-grid tariffs (tax exclusive) of subsidiary coal-fired power plants and a YoY increase of 19.9% in the average sales price of heat supply of subsidiary coal-fired power plants. Net profit attributable to shareholders of the company dropped by 22.46% YoY to HK$4.4bn. The fall in net profit was due to the increase in operating expenses resulted from higher raw material costs.

- The updated market consensus of the EPS growth in FY22/23 is 283.8%/27.9% YoY, respectively, translating to 6.7×/5.2x forward PE. The current PER is 72.0x. FY22F/23F dividend yield is 6.3%/8.2% respectively. Bloomberg consensus average 12-month target price is HK$20.85.

(Source: Bloomberg)

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Managed Health Care | +0.06% | Wall St drops as consumer data stokes inflation worry UnitedHealth Group Inc (UNH US) |

Top Sector Losers

| Sector | Loss | Related News |

| Motor Vehicles | -5.42% | Tesla Sinks 50% From November Record High as Troubles Pile Up Tesla Inc (TSLA US) |

| Internet Retail | -4.78% | Amazon shoppers shrug off second Prime Day sale Amazon.com Inc (AMZN US) |

| Other Metals/Minerals | -4.72% | Gold heads for worst week in 2 months as dollar rises Freeport-McMoRan Inc (FCX US) |

- Northrop Grumman Corp (NOC US) stock shed 6% on Friday amid a downgrade to neutral by JPMorgan. The bank cited Northop Grumman’s recent outperformance as the reason for the shift.

- Albertsons Companies Inc (ACI US) dropped 7% on news that Kroger has agreed to purchase Albertsons in a deal valued at $24.6 billion, or $34.10 a share. Kroger Co (KR US) shares slipped 4.8%.

- Morgan Stanley (MS US) slumped 4.6% after the bank posted weaker-than-expected third-quarter earnings. Revenue also fell short of expectations as a result of a decline in investment banking.

- JPMorgan Chase & Co (JPM US) gained 2.8% after topping estimates for the recent quarter. JPMorgan Chase said net interest income surged 34% to $17.6 billion in the period due to higher rates.

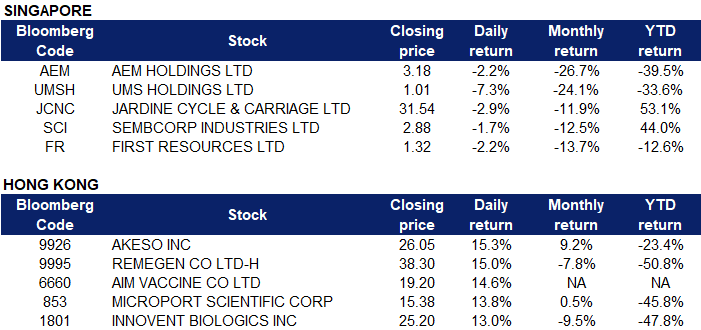

Singapore

- AEM Holdings Ltd (AEM SP) and UMS Holdings Ltd (UMSH SP) shares fell 2.2% and 7.3% on Friday respectively. Local tech manufacturers continued to lose in the broader market, amid reports that Intel was planning to cut thousands of jobs.

- Jardine Cycle & Carriage Ltd (JCNC SP) and Sembcorp Industries Ltd (SCI SP) shares tumbled 2.9% and 1.7% respectively on Friday. There was no company specific news. Local stocks continued their losing streak on Friday (Oct 14), even as most Asian markets rallied, following robust overnight gains on Wall Street. The benchmark Straits Times Index (STI) fell for the seventh straight day, dipping 0.03 per cent or 0.84 points to 3,039.61, hitting a fresh 19-month low. For the week, the market barometer was down 3.4 per cent or 106.20 points.

- First Resources Ltd (FR SP) declined 2.2% on Friday. India has slashed the base import prices of crude and refined palm oil, crude soya oil and gold, the government said in a statement on Friday, as prices corrected in the world market. India is the world’s biggest importer of edible oils and silver and the second-biggest consumer of gold.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Biotechnology | +4.61% | Healthcare Stocks Rise On Policy Support, Week In Review WuXi Biologics (Cayman) Inc (2269 HK) |

Alcoholic Drinks & Tobacco | +4.54% | Asia Earnings Week Ahead: CATL, Moutai, HKEX, Hindustan Unilever Budweiser Brewing Company APAC Limited (1876 HK) |

Semiconductors | +3.80% | Asian Stocks Rally as Focus Turns to China’s Party Congress Semiconductor Manufacturing International Corp (981 HK) |

Top Sector Losers

Sector | Loss | Related News |

Electronic Component | -1.01% | China’s zero-COVID policies save lives – but not livelihoods Sunny Optical Technology Group Co Ltd (2382 HK) |

Travel & Tourism | -0.94% | Trip.com Group Ltd (9961 HK) |

Real Estate Investment Trust | -0.70% | Link REIT (823 HK) |

- Akeso Inc (9926 HK) Shares soared 15.3% after announcing that the company’s self-developed new bispecific antibody drug Evoxil (PD-1/VEGF, AK112) combined with the company’s Zoslimumab (CD73, The efficacy and safety phase Ib/II clinical trial of AK119) in the treatment of patients with advanced solid tumours has been approved by the National Medical Products Administration.

- RemeGen Co Ltd (9995 HK) Shares rose 15.0% on Friday. A few days ago, the company’s main commercial product, tetacept, was granted orphan drug designation by the FDA for the treatment of myasthenia gravis. East Asia Qianhai Securities commented that this move will accelerate its release of value in the US market. It was reported that the company completed the Phase II clinical trial of tetacept for the treatment of myasthenia gravis in the mainland in the first quarter, and achieved positive results.

- AIM Vaccine Co Ltd (6660 HK) Shares rose 14.6% on Friday. There was no company specific news. The healthcare sector gained 8.24% in Mainland China and 7.04% in Hong Kong on news that the State Medical Security Bureau will exempt ”innovative” medical equipment from China’s centralised drug procurement program.

- Microport Scientific Corp (853 HK) Shares climbed 13.8% on Friday. Recently, the company’s “Integrated Membrane Oxygenator” was approved for listing, becoming the first domestic highly integrated ECMO product. GF Securities recently stated that the company will continue to benefit from the realisation of research and development and the continuous increase in product volume, maintaining a “buy” rating.

- Innovent Biologics Inc (1801 HK) Shares rose 13.0% on Friday. Northeast Securities released a research report giving an Innovent Biologics an “overweight” rating, and it is expected to achieve revenue of 5.739/7.618 billion yuan in 2022-24/9.372 billion yuan, earnings per share -1.14/-0.52/0.05 Yuan, the company focuses on the development of innovative oncology drugs, with promising potential. Recently, Eli Lilly announced that both sabrutinib and ramucirumab have been approved by the NMPA for marketing. Among them, sabrutinib and ramucirumab have been approved by the NMPA, and Innovent Bio has the exclusive commercialization of the two products in mainland China.

Trading Dashboard Update: No stock additions/deletions.