17 May 2023: Bumitama Agri Ltd (BAL SP), Tianqi Lithium Corp. (9696 HK), Boeing Co (BA US)

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

Bumitama Agri Ltd (BAL SP): Expecting a short-term rebound

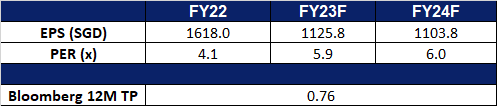

- BUY Entry 0.59 – Target – 0.65 Stop Loss – 0.56

- Bumitama Agri Ltd. produces CPO and PK, with its oil palm plantations located in Indonesia. The Company’s primary business activities are cultivating and harvesting our oil palm trees, processing FFB from its oil palm plantations, its plasma plantations and third parties into CPO and PK, and selling CPO and PK in Indonesia.

- Palm Oil Futures Prices. Malaysian palm oil futures dropped to MYR 3,600/tonne, falling from its one-month high of MYR 3,810 on May 9th. This was due to the weak performance of other vegetable oils and anticipation of strong supply, mainly from Indonesia, the world’s top producer. Soybean planting in the United States was progressing well with favorable weather, leading to lower soyoil prices, which limited buying of other vegetable oils and biodiesel feedstocks. However, fresh data showed that Malaysian palm oil exports for the first 10 days of May had increased by 10.3% compared to the previous month, preventing further declines.

- Decline in Malaysian inventory. Malaysia’s palm oil inventories fell to their lowest level in 11 months due to lower than anticipated production and exports, according to data from the Malaysian Palm Oil Board (MPOB). Palm oil stockpiles declined by 10.54% to 1.5mn tonnes, the lowest since May 2022, while crude palm oil production dropped by 7.13% to 1.2mn tonnes in April, its lowest level since February 2022, due to fewer harvesting days amid the Eid al-Fitr holiday season. Palm oil exports were also down 27.78% to 1.07mn tonnes, with imports falling by 15.3%. With Malaysia’s palm oil production down, Indonesia may have an opportunity to sell more palm oil due to the lower global supply. The easing of domestic palm oil sales rules in Indonesia is expected to provide a further boost to the country’s palm oil industry, potentially allowing more Indonesian producers to meet the increased demand for palm oil in the global market. Despite a decline in India’s palm oil imports, we believe that the impact will be offset by the surplus demand resulting from the decrease in Malaysian production.

Palm oil price trend

(Source: Bloomberg)

- Decline is priced in. The market has already factored in the drop in average selling prices (ASPs) for both crude palm oil (CPO) and palm kernel (PK) YoY, which is attributed to lower ASPs as commodity prices normalise, along with higher fertiliser prices. Despite this, revenue from the CPO business rose by 3% to 3.3tn rupiah, thanks to a 19% increase in sales volume following an inventory drawdown, which helped offset the 14% price decline during the period. In contrast to the previous year, when there was a high base effect, production during the first quarter was lower due to oil palms entering a normal low-cycle season.

- 1Q23 results review. The company announced net profit of 429.1bn rupiah (S$40bn) for 1Q23, a 51% YoY decline from 429.1bn rupiah in 1Q22; revenue for 1Q23 slid 8% YoY to 3.6tn rupiah.

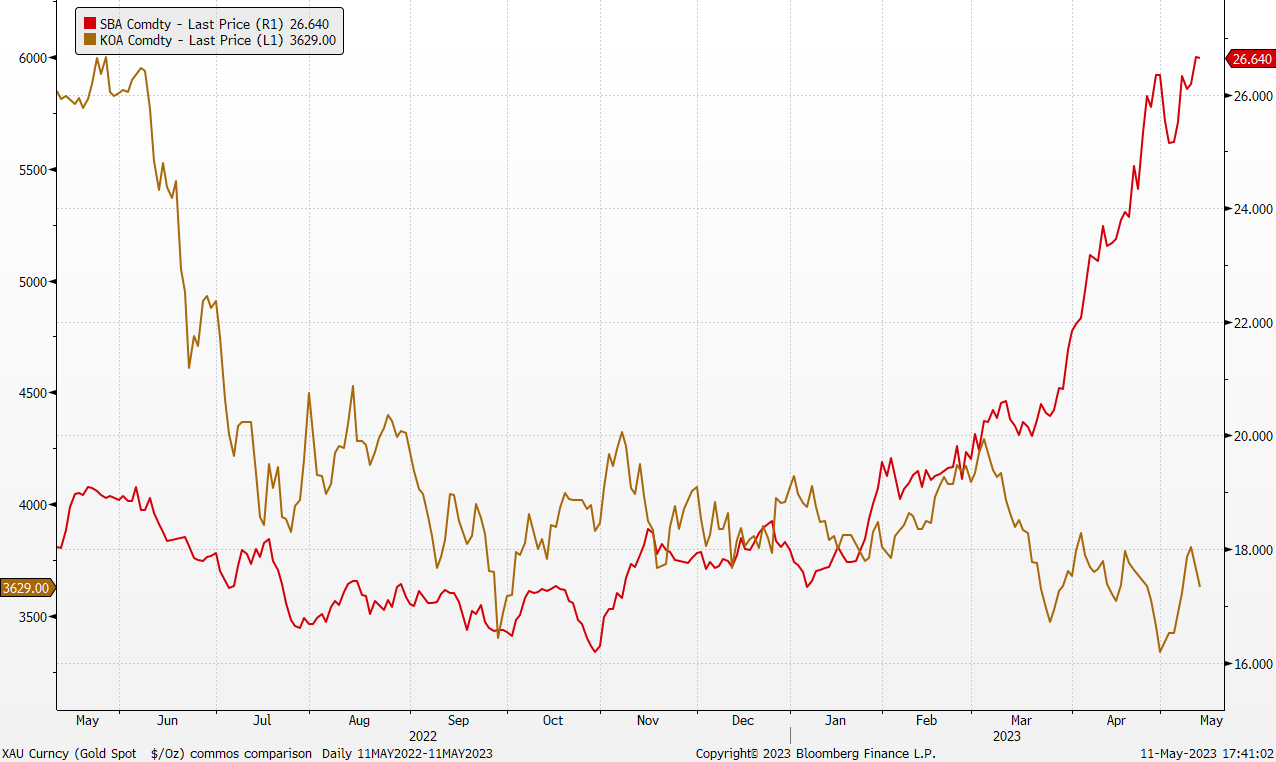

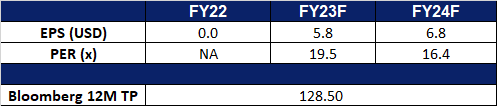

- Market consensus.

(Source: Bloomberg)

Wilmar International Ltd. (WIL SP): Rising Soft Commodities prices

Wilmar International Ltd. (WIL SP): Rising Soft Commodities prices

- RE-ITERATE BUY Entry 3.95 – Target – 4.20 Stop Loss – 3.83

- Wilmar International Limited operates as a food processing company. The Company offers oil palm cultivation, edible oil refining, crushing, and gains processing services, as well as provides sugar, flour, and rice. Wilmar International serves customers worldwide.

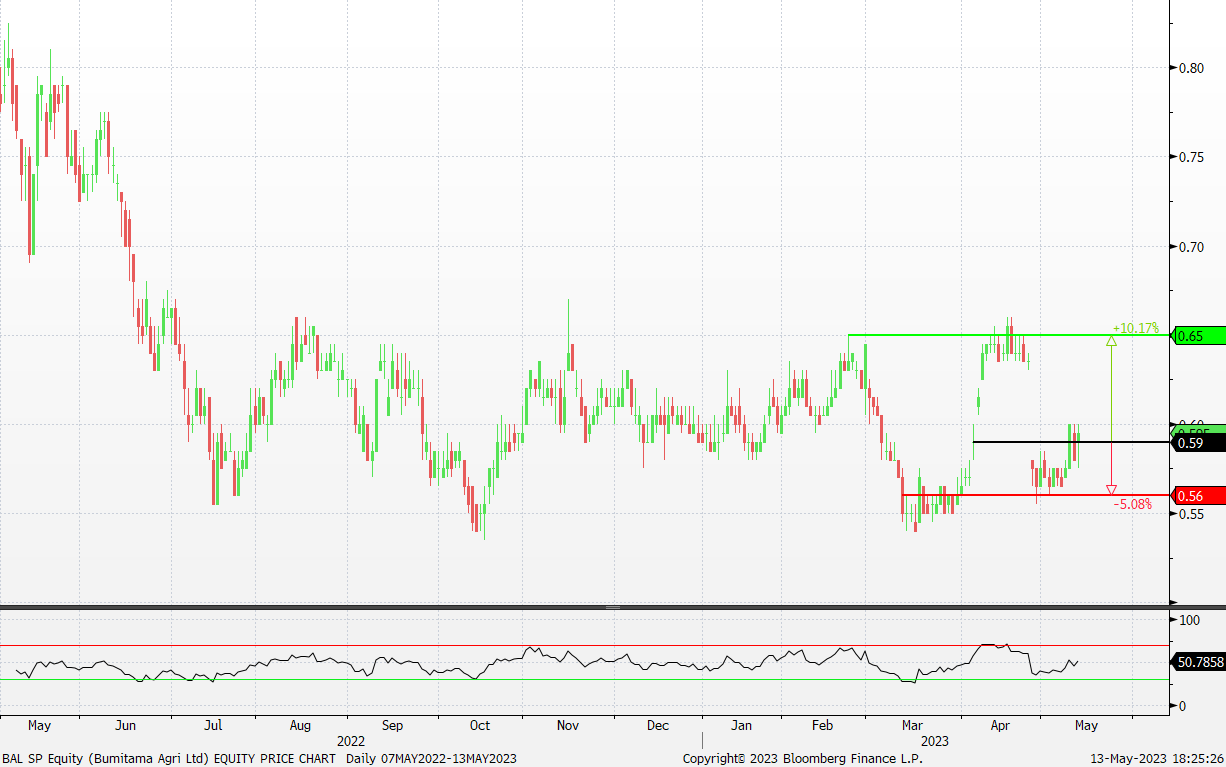

- Sugar Futures prices. Raw sugar futures have risen above 26 cents/pound, nearing the 11-year high of 27 cents/pound due to tight supply. Severe droughts in India’s Maharashtra region have cut output by 25% to 10.5 million tonnes this year, prompting the government of the world’s second-largest producer, to reduce national export licenses. Higher gasoline taxes in Brazil are incentivizing ethanol production over sugar, reducing supply from the world’s top producer.

- Palm Oil Futures Prices. Malaysian palm oil prices rose above MYR 3,700/tonne, driven by higher crude oil prices and tight supply. Alleviated recession concerns in North America boosted global energy benchmarks, raising demand for biodiesel in Southeast Asia. Malaysian palm oil inventories are expected to have dropped to an 11-month low in April due to strong domestic demand. Output expectations were muted for top producer Indonesia, reducing chances of restocking for key consumers. Foreign demand remains robust, despite a decrease in shipments compared to the previous month.

Raw sugar (red) and crude palm oil (brown) futures price trend

(Source: Bloomberg)

- FY22 results review. The company announced record earnings of US$2.4bn (S$3.2 bn) for FY22, a 27.1% growth from US$1.9bn in FY21; core net profit for FY22 improved 31% to US$2.42bn.

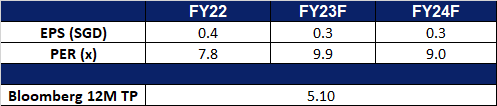

- Market consensus.

(Source: Bloomberg)

Tianqi Lithium Corp. (9696 HK): Lithium price rebounding

- BUY Entry – 59.5 Target – 65.5 Stop Loss – 56.5

- Tianqi Lithium Corp, formerly Sichuan Tianqi Lithium Industries Inc, is a China-based company principally engaged in the research and development, manufacture and distribution of lithium products. The Company’s products include two categories, lithium concentrate products and lithium compounds and derivatives. Lithium concentrate products include chemical grade and technical grade lithium concentrate. Lithium compounds and derivatives include lithium carbonate, lithium hydroxide, lithium chloride and lithium metal. The Company’s products are used in a wide variety of end markets, primarily electric vehicles, energy storage systems, air transportation, ceramics and glass. The Company mainly operates its businesses in the domestic and overseas markets.

- Ramping up lithium extraction. China is expected to account for nearly one-third of the world’s lithium supply by the mid-2020s, with its output set to increase significantly, according to UBS AG. Chinese-controlled mines, including projects in Africa, are projected to raise production to 705,000 tons by 2025, boosting China’s share of this vital mineral for electric-vehicle batteries to 32% of the global supply. This race to secure lithium resources is driven by nations like the US prioritizing access to materials for battery production amid the global transition away from fossil fuels, with China’s demand being particularly high as the world’s largest market for new energy vehicles.

- China’s increasing EV market share. China’s EV sales almost doubled in 2022 with 87% YoY growth, with one in 4 cars sold in China being an EV in the same year, led by BYD. With factory activities resuming, production of EVs and lithium batteries would continue at a much higher capacity. China’s EV sales are expected to exceed 8 million units in 2023. This would bring up the demand for Lithium to produce Lithium batteries for EVs.

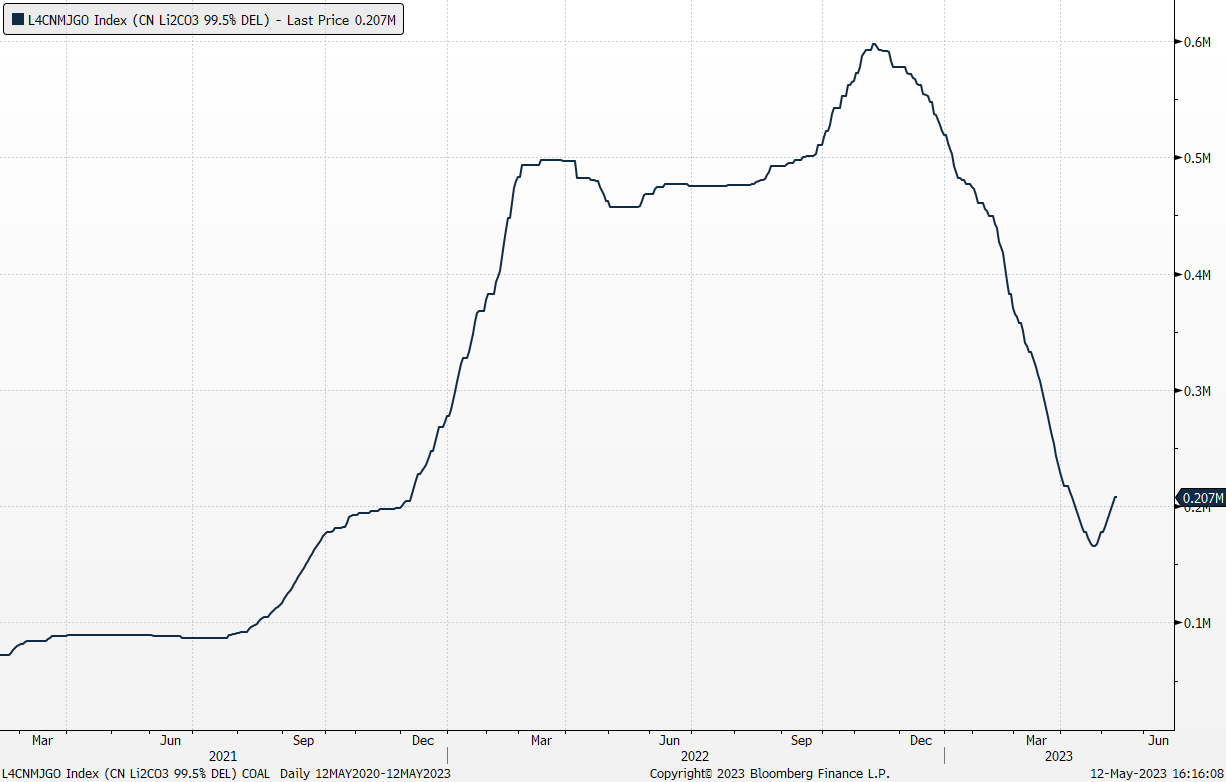

- Lithium Price Rebounding. Lithium carbonate prices rose past RMB200,000/ tone, extending its rebound from the 19-month low of RMB165,500/tonne on April 24th amid renewed optimism for electric battery demand. The recovery of lithium carbonate is also driven by seasonal repleniment of battery inventories.

China Lithium Carbonate Price Index (RMB/tonne)

(Source: Bloomberg)

- 1Q23 earnings reveiw. Revenue rose to RMB11.45bn, a 117.8% increase YoY. Net Income of RMB4.88bn was up 46.49% YoY. Net profit Margin fell to 42.6%, down 9 ppts YoY.

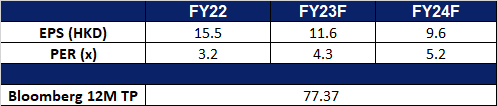

- Market Consensus

(Source: Bloomberg)

China Resources Power Holdings Company Limited (836 HK): A seasonality play

- RE-ITERATE BUY Entry – 18.6 Target – 20.6 Stop Loss – 17.6

- China Resources Power Holdings Company Limited is a Hong Kong-based investment holding company principally engaged in the investment, development and operation of power plants. The Company operates through three segments. Thermal Power segment is engaged in the investment, development, operation and management of coal-fired power plants and gas-fired power plants, as well as the sales of heat and electricity. Renewable Energy segment is engaged in wind power generation, hydroelectric power generation and photovoltaic power generation, as well as the sales of electricity. Coal Mining segment is engaged in the mining of coal mines, as well as the sales of coal. The Company mainly operates businesses in China.

- China’s rebounding economy. In March, China witnessed a notable increase in electricity consumption, as factory activities resumes after China’s re-opening. This surge in power usage reflected the gathering momentum of the nation’s post-pandemic recovery, leading manufacturers to ramp up production and instilling confidence in consumers. March saw a significant rise of 5.9% in power consumption, surpassing the growth experienced in the initial two months of the year, thus signalling an acceleration in economic revival. The recovery of economy will continue in 2H23.

- Ramping up coal power. Local governments in China recently approved more new coal power in the first three months of 2023 than in the whole of 2021, according to official documents. China’s coal imports from Australia also saw an increase following the easing of the ban on Coal imports from Australia. Local governments in energy-hungry Chinese provinces approved at least 20.45 gigawatts of coal-fired power in the first three months of 2023, Greenpeace said, which is more than double the 8.63 gigawatts Greenpeace reported for the same period last year.

- Strong seasonality. Summer and winter seasons are the top performing months for the company’s stock, shown in the chart below.

20-year historical monthly returns

(Source: Bloomberg)

(Source: Bloomberg)

- FY22 earnings. Revenue rose to HK$103.3bn, a 15.0% increase YoY. Net Income of HK$7.04bn was up 342% compared from FY2021.Net profit Margin rose to 6.8%, compared to 1.8% in FY2021.

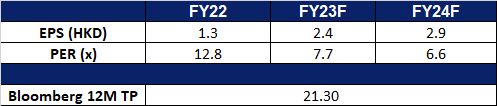

- Market Consensus

(Source: Bloomberg)

Boeing Co (BA US): Range bound trade

- BUY Entry – 195 Target – 215 Stop Loss –185

- The Boeing Company, together with its subsidiaries, designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide.

- Recent positive news. Ryanair plans to order at least 150 Boeing 737-10 Max jeliners along with an option for another 150 more. The order is the biggest by the European budget carrier. Boeing’s deliveries fell from 64 in March to 26 in April, and 17 out of which is 737 Max. However, the company maintained its target of 400-450 of its 737 MAX deliveries. Meanwhile, the company plans to ramp up the production to 50/month by 2025 to 2026.

- Ongoing contracts from the US defence department. Bell Boeing Joint Project Office was awarded a US$482.3M fixed-price incentive undefinitized modification to a previously awarded contract. Besides, It was awarded a US$216M modification (P00013) to previously awarded ID/IQ contract FA8526-21-D-0001 for C-17 Globemaster landing gear spares management services.

- Dragged by other Dow components performance. Boeing shares were sold down recently due mainly to the fall in Dow Jones Industrials Index as the financials sector were hammered. However, Boeing’s fundamentals are sound and resilient. Global economies enter the post-COVID era, and the normalisation of tourism is on track. The ensuing growth in airplane orders shows Boeing has been walking out of the wood.

- 1Q23 earnings review. Revenue grew by 27.9% YoY to US$17.9bn, beating estimates by US$340mn. Non-GAAP EPS was -US$1.27, missing estimates by US$0.22. Total backlog was US$411bn, including 4,500 commercial airplanes.

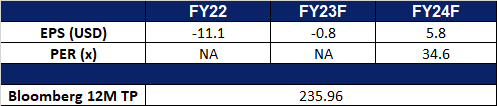

- Market consensus.

Alphabet Inc (GOOG US): Level the playing field

Alphabet Inc (GOOG US): Level the playing field

- RE-ITEREATE BUY Entry – 113 Target – 123 Stop Loss –108

- Alphabet Inc. operates as a holding company. The Company, through its subsidiaries, provides web-based search, advertisements, maps, software applications, mobile operating systems, consumer content, enterprise solutions, commerce, and hardware products.

- Sprinkling in more Artificial intelligence. Google has announced its plan to incorporate AI technology into its search engine and other products. As part of this effort, the company will launch a new version of its search engine, called Search Generative Experience. This updated engine is designed to craft responses to open-ended questions and retain a recognizable list of links to the web, all using AI technology. Products such as Gmail will be able to draft messages while Google Photos will be equipped with more advanced image editing features that allow AI to modify users photos in various ways. Additionally, since Google wishes to prioritise accuracy and authenticity, its search engine will generate information citing reliable sources and will mark up its images that are generated with the help of AI.

- International Bard. Bard is a chatbot created by Google to rival OpenAI’s ChatGPT-4, which is accessible to users globally. Bard can be prompted with not only images but also text. Furthermore, Google has also announced the presence of a more powerful AI model it is working on, PaLM 1, which would be able to solve tougher problems and work on smartphones.

- 1Q23 earnings review. 1Q23 revenue grew by 2.6% YoY to US$69.79bn, beating estimates by US$950mn. 1Q23 GAAP EPS was US$1.17, beating estimates by US$0.10.

- Market consensus.

(Source: Bloomberg)

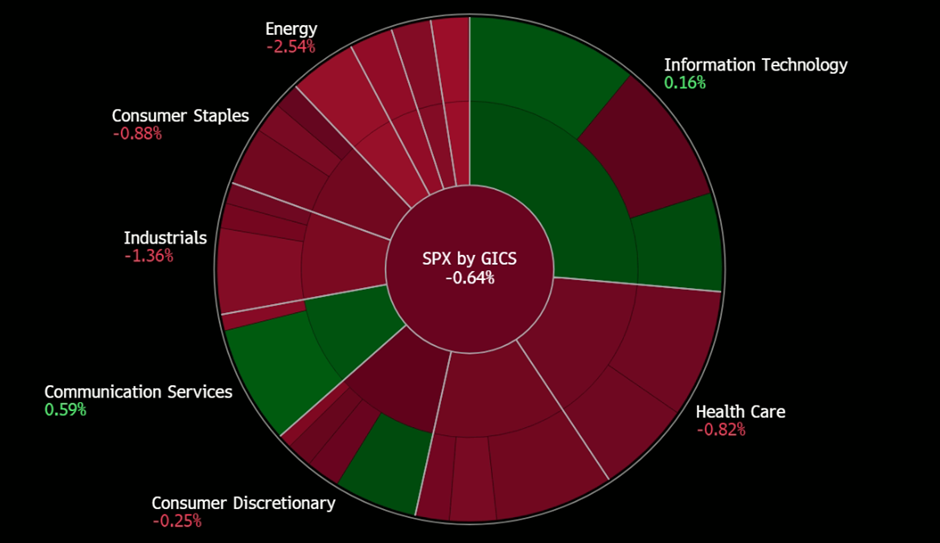

United States

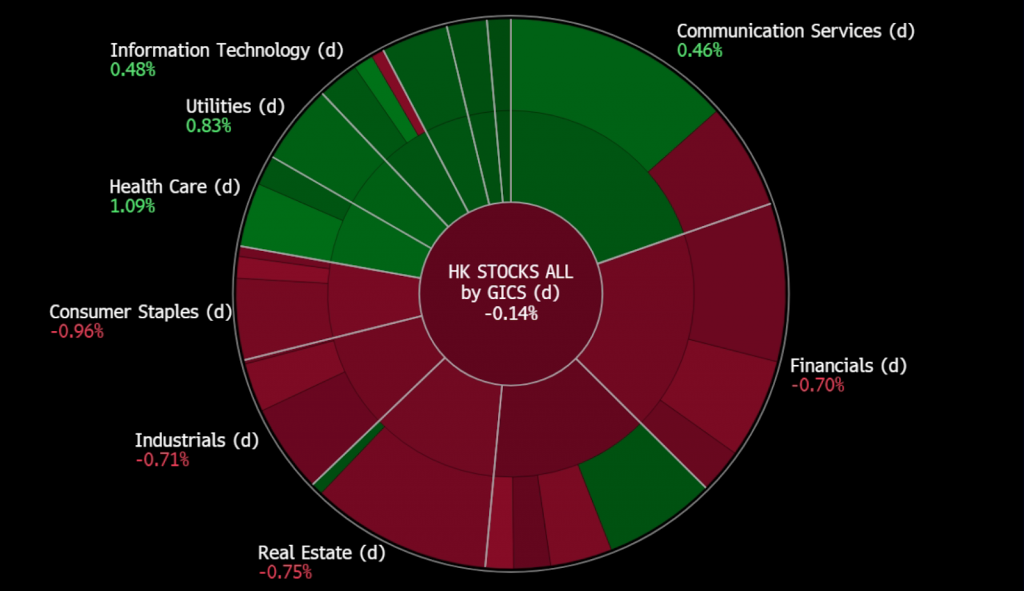

Hong Kong

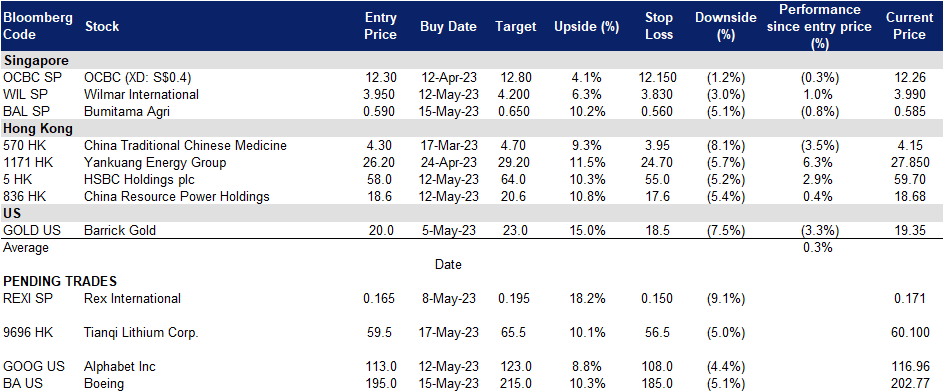

Trading Dashboard Update: Add Bumitana Agri (BAL SP) at S$0.59.

(Source: Bloomberg)

(Source: Bloomberg)