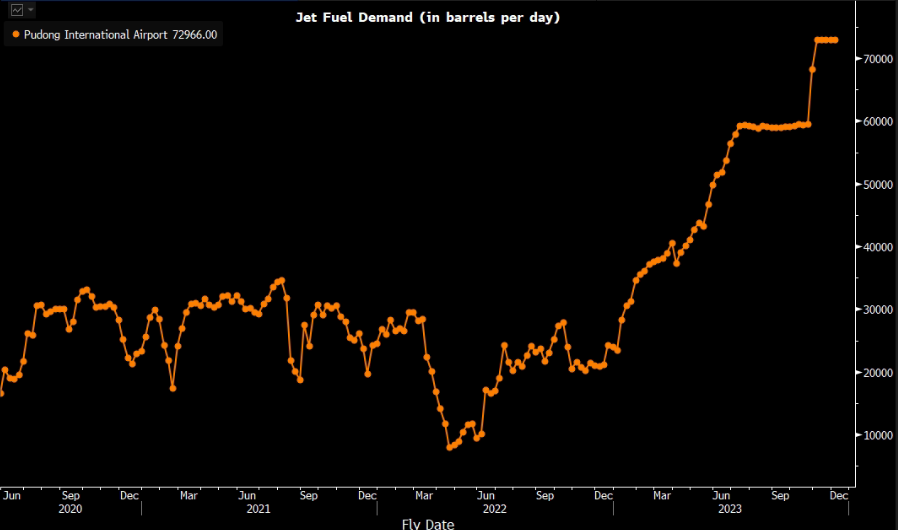

16 June 2023: Genting Singapore Ltd (GENS SP), Tencent Holdings Ltd. (700 HK), Unity Software Inc (U US)

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

Genting Singapore Ltd (GENS SP): Bracing peak visitor arrivals this summer

- Entry – 0.95 Target – 1.05 Stop Loss – 0.90

- Genting Singapore is best known for its award-winning flagship project Resorts World Sentosa, one of the largest fully integrated destination resorts in South East Asia. Genting Singapore is one of the constituent stocks of the FTSE Straits Times Index. The principal activities of Genting Singapore and its subsidiaries are in developing, managing and operating integrated resort destinations including gaming, hospitality, MICE, leisure and entertainment facilities.

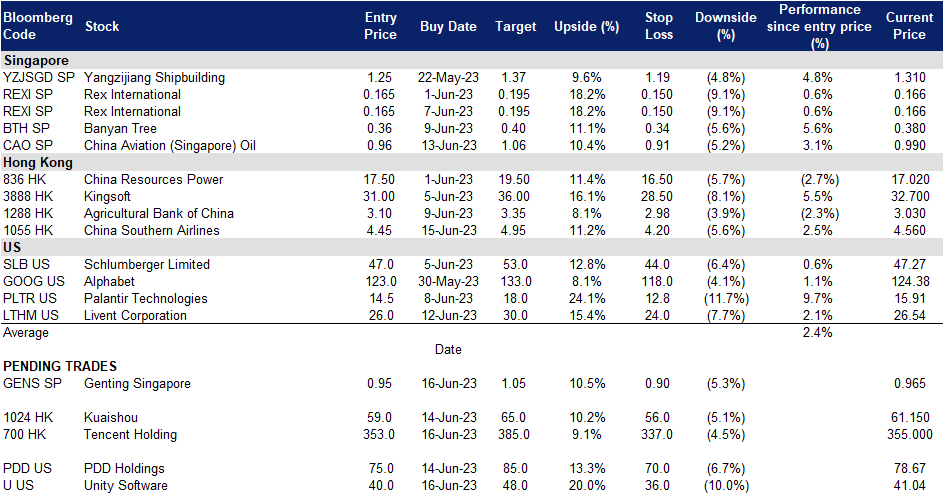

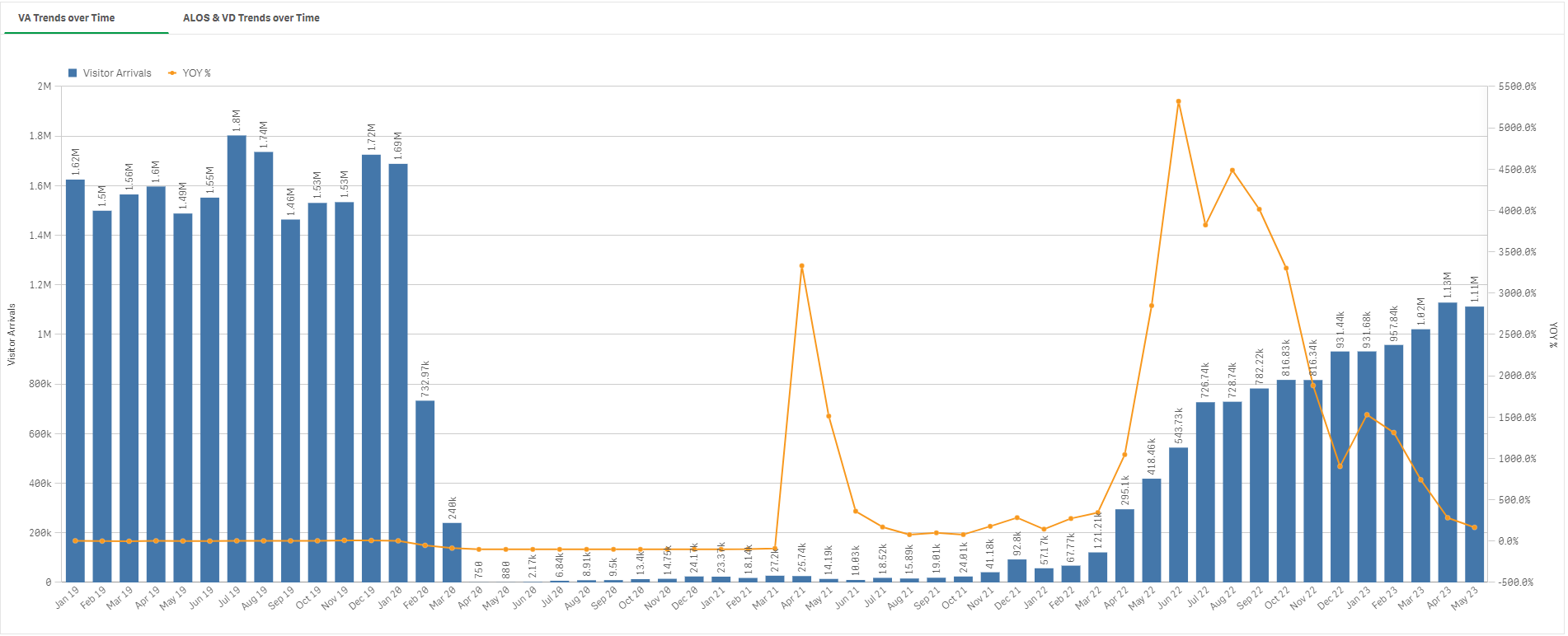

- Higher arrival levels. With Singapore’s international visitor arrivals continuing to surpass a million for the third consecutive month, May’s figures showed a slight decrease from the post-pandemic high recorded in April. According to the Singapore Tourism Board (STB), tourism arrivals in May reached 1.11mn, down from 1.13mn the previous month. However, these numbers were more than 2.5 times higher than the 418,458 visitors recorded in May 2022. Although arrivals remain below pre-pandemic levels, the steady increase indicates a growing demand for travel to Singapore, mainly due to increasing travel demand from South-East Asia. Generally, Singapore visitor arrivals peak during July and August. Genting Singapore’s 2023 revenue is likely to see exponential growth in the new year. This revenue boost will likely translate to higher profits, which can then be used to continue fueling their expansion effort.

Singapore Visitor Arrivals Trend

(Source: Singapore Tourism Analytics Network)

- Improving its attractions. In order to attract a more upscale market and meet the demands of its target audience, renovations have begun at The Forum at RWS, in May, with the aim of doubling its gross floor area to approximately 20,000 sqm across three levels. This expansion is scheduled to be completed by the end of 2024 and will provide an array of upscale restaurants, specialty shops, and concept stores. Additionally, construction is underway at Universal Studios Singapore’s Minion Land and the Singapore Oceanarium, both of which are set to have soft openings in early 2025. These developments align with the ongoing RWS 2.0 project and signify the company’s dedication to improving its destination appeal and catering to the evolving preferences of its clientele.

- Gross gaming revenue (GGR) recovery. RWS has been experiencing positive growth as regional travel and gaming demand continue to recover. In 1Q23, the company’s gaming business generated $339.9mn in revenue, reflecting a significant increase of 45% compared to the previous year’s figure of $234.5mn. This growth aligns with the overall forecasted trend of Singapore’s GGR recovering to more than 70% of pre-pandemic levels in 2023. Historically, GGR in Singapore has shown a correlation with tourist arrivals from China, with higher arrivals resulting in higher GGR. As tourist numbers from China approach pre-pandemic levels, it is expected that GGR will follow a similar trajectory of recovery. The ongoing recovery of regional travel and gaming demand, coupled with the resurgence of Chinese tourist arrivals, bodes well for RWS’s future prospects in the gaming sector.

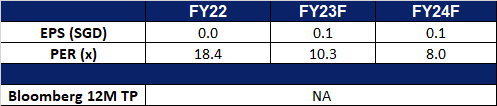

- Market consensus.

Genting Seasonality trend

(Source: Bloomberg)

(Source: Bloomberg)

China Aviation Oil Singapore Corp. Ltd. (CAO SP): Jet fuel demand to surge in the upcoming summer vacation

China Aviation Oil Singapore Corp. Ltd. (CAO SP): Jet fuel demand to surge in the upcoming summer vacation

- RE-ITERATE BUY Entry 0.96 – Target – 1.06 Stop Loss – 0.91

- China Aviation Oil Singapore Corporation Limited supplies jet fuel to foreign and domestic airlines flying through China’s airports. The Company also trades in other oil products such as fuel oil, gas oil, crude oil, and petrochemical products, including physical and paper swaps, and futures trading.

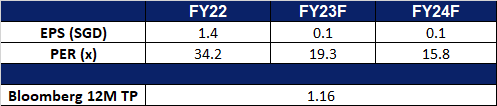

- Expecting travelling demand surge in the upcoming summer. The summer vacation is generally a travelling peak season as fresh graduates from primary/secondary/high schools and colleges go travelling with friends and families before they move to new schools in September. The upcoming summer is the first long holiday season after China’s full-blown reopening, and tourism is expected to brace a pent-up demand from fresh graduates and their families. Overseas travelling is poised to further recover due to the pent-up demand.

- Promising recovery in aircraft movement at Shanghai Pudong International Airport. According to the latest announcement, April aircraft movement at Pudong International Airport jumped by 726% YoY to 29074 flights. April passenger throughput jumped by 8155.9% YoY to 3.52mn. April freight throughput jumped by 145.8% YoY to 274.3 thousand tonnes.

Scheduled jet fuel demand at Pudong International Airport

(Source: Bloomberg)

(Source: Bloomberg)

- FY22 results review. Revenue for FY22 fell by 6.65% to US$16.46bn. Gross profit rose by 15.29% YoY to US$35.39mn. Total supply and trading volume decreased by 40.60% YoY to 20.26mn tonnes. Net profit decreased by 17.75% YoY to US$33.19mn.

- Market consensus.

(Source: Bloomberg)

Tencent Holdings Ltd. (700 HK): Release of Tencent Cloud Industry Model

- BUY Entry – 353 Target – 385 Stop Loss – 337

- Tencent Holdings Ltd is an investment holding company primarily engaged in the provision of value-added (VAS) services, online advertising services, as well as FinTech and business services. The Company primarily operates through four segments. The VAS segment is mainly engaged in the provision of online games, video account live broadcast services, paid video membership services and other social network services. The Online Advertising segment is mainly engaged in media advertising, social and other advertising businesses. The FinTech and Business Services segment mainly provides commercial payment, FinTech and cloud services. The Others segment is principally engaged in the investment, production and distribution of films and television program for third parties, copyrights licensing, merchandise sales and various other activities.

- Expected easing of US-China Tensions to drive economies. US Secretary of State Antony Blinken is set to travel to Beijing this weekend, as announced by the US Department of Sate. This visit holds significance as the Biden administration aims to navigate the complex relationship with China. The trip’s agenda includes establishing open communication channels, discussing concerns on various issues, and exploring potential cooperation on transnational challenges such as climate change and global stability. The talk for a better relationship between the world’s 2 large superpowers would drive economic recovery up for both side.

- Tencent Cloud Industry Large Model and Intelligent Application Technology Summit. Tencent has announced that it will host the Tencent Cloud Industry Large Model and Intelligent Application Technology Summit on June 19th. During the event, Tencent will unveil its technical solutions for industry large models and share updates on the progress of intelligent application upgrades and the implementation of these solutions in various industrial customer scenarios. Tencent is also likely to release their artificial intelligence tool, which is expected to be called HunyuanAide and built on large language model Hunyuan.

- 1Q23 earnings. The company revenue rose to RMB150 billion, +11.0% YoY compared to 1Q22. The company’s profit for the period was RMB33.4 billion, +27% YoY. Net margin also increased to 22% in 1Q23 compared to 19% in 1Q22. Basic earnings per share were RMB3.431, while diluted earnings per share were RMB3.353.

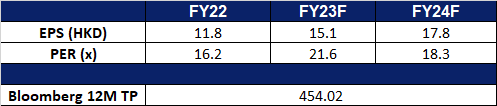

- Market Consensus

(Source: Bloomberg)

Kuaishou Technology (1024 HK): Expecting a sales boom in the upcoming online shopping spree

- RE-ITERATE BUY Entry – 59.0 Target – 65.0 Stop Loss – 56.0

- Kuaishou Technology is a China-based investment holding company mainly engaged in the operation of content communities and social platforms. The Company mainly provides live streaming services, online marketing services and other services. The online marketing solutions include advertising services, Kuaishou fans headline services and other marketing services. Other services include e-commerce, online games and other value-added services. The Company mainly conducts business within the domestic market.

- Online live-streaming sales growth. The online live-streaming shopping market in China is experiencing significant growth, reaching a total of $497 billion in 2022, as reported by Coresight Research. This upward trend can be attributed to consumers who are increasingly valuing their time and opting for the convenience of watching live stream shopping from anywhere, rather than simply browsing products online or visiting physical stores for purchases.

- Upcoming June 18th shopping festival. In anticipation of the annual June 18 shopping carnival, major e-commerce platforms in China have already initiated presales. This year, these platforms have introduced more extensive promotional events and direct subsidies, streamlining their promotional methods. Buyers no longer need to perform complex calculations or combine multiple orders to avail discounts. Additionally, live-streaming sessions continue to play a crucial role during the June 18 shopping festival. Short-video platforms like Douyin and Kuaishou have increased subsidies in an effort to attract more traffic and compete with e-commerce platforms. Overall, this promotional event is expected to stimulate consumption growth in the second quarter.

- 1Q23 earnings. The company swung to an adjusted net profit of 42mn yuan (HK$46.8mn) in the first quarter, the first time since its listing in Hong Kong in 2021, compared to a net loss of 3.7bn yuan a year ago. Revenue rose to 25.2bn yuan, a 20% increase YoY. The company also revealed plans to buy back up to HK$4 bn worth of shares over the period till the conclusion of the company’s AGM.

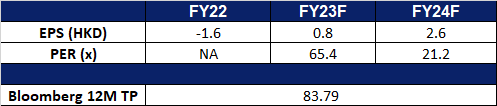

- Market Consensus

(Source: Bloomberg)

Unity Software Inc (U US): Our future reality

- BUY Entry – 40 Target – 48 Stop Loss – 36

- Unity software provides a software platform for creating and manipulating interactive real-time 3D content. The platform can be used to create, run and monetize interactive real-time 2D and 3D content for mobile phones, tablets, PCs, game consoles, and augmented and virtual reality devices.

- Apple Vision Pro is expected to drive related development. The Apple Vision Pro headset has sparked a renewed interest in spatial computing and the metaverse. As part of Apple’s strategy to build a strong third-party ecosystem, they have partnered with Unity, a leading platform for developing 3D games and spatial computing software. Through this collaboration, Unity will bring its popular Unity-based games and apps to Vision Pro, harnessing the headset’s advanced features like Passthrough, high-resolution rendering, and native gestures. This presents Unity with an opportunity to leverage its real-time 3D tools and empower its vast community of developers in creating innovative apps and games for the Apple Vision Pro. Despite previous challenges stemming from Apple’s iOS privacy changes, this collaboration signifies a positive step forward for Unity. It not only underscores the growing significance of spatial computing but also solidifies Unity’s role as a key player in this dynamic field. The partnership grants Unity a substantial advantage in the rapidly expanding spatial computing market and serves as a valuable platform to showcase its powerful 3D engine and capabilities to a broader audience.

- 1Q23 earnings review. Revenue rose 56.3% YoY to $500mn, beating estimates by $25.3 million. GAAP loss per share was $0.67, $0.03 below expectations. Sales are expected to rise 72% to 75% YoY to between $510mn and $520mn, as the company continues to look to gain share in the advertising market.

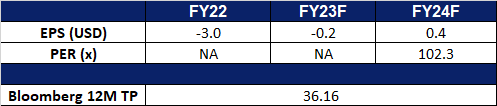

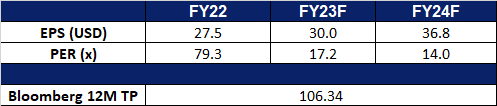

- Market consensus.

(Source: Bloomberg)

PDD Holdings Inc (PDD US): 618 “fire sale”

PDD Holdings Inc (PDD US): 618 “fire sale”

- RE-ITEREATE BUY Entry – 75 Target – 85 Stop Loss – 70

- PDD Holdings Inc. is a multinational commerce group that owns and operates a portfolio of businesses. The Company focuses on digital economy so that local communities and small businesses can benefit from the increased productivity and new opportunities. PDD Holdings has built a network of sourcing, logistics, and fulfillment capabilities for its underlying businesses.

- Expecting high volume from 618 sales. The ongoing 618 mid-year sales event in China is anticipated to generate high sales volumes for domestic e-commerce platforms. This shopping festival, following the country’s adjustment of COVID-19 measures, signals a recovery in consumer spending and reflects the rising demand for high-quality products. Chinese consumers, who have become more discerning, seek value for money and prioritise quality at reasonable prices. With attractive discounts and vouchers offered by domestic e-commerce platforms and brands, increased sales are expected, driven by pent-up demand and the preference for high-quality and new-generation products. The reported success of major Chinese e-commerce platforms during this event further affirms the recovery in consumer spending and manufacturing activity in China. PDD platform’s focus on fast-moving consumer goods (FMCG) and its unique approach of encouraging customers to join together in purchasing groups to maximise savings through bulk purchases will further contribute to its anticipated success during this sales period.

- Extra discounts. In preparation for the 618 shopping festival, PDD introduced a 10 bn yuan subsidy program targeting home appliances and consumer electronics. This program, launched on April 6th, includes major domestic and international brands such as Apple, Huawei, Xiaomi, Midea, Sony, Nintendo, Dyson, and more. PDD has also partnered with brands like Haier, Vivo, TCL, Asus, and others to offer factory-direct products, combining subsidies with direct sales to provide consumers with better discounts and benefits. By connecting popular factory products directly to consumers through subsidies and direct sales, this initiative aims to stimulate both the supply and demand sides, offering competitive prices to consumers and boosting the recovery of the manufacturing sector.

- Expansion to the West. Temu, PDD’s e-commerce platform, made its entry into the US market in September 2022. This Chinese-owned marketplace connects predominantly Chinese merchants with customers in the US, Canada, Europe, and Australia. Temu distinguishes itself with its focus on ultra-low prices, achieved by reducing supply chain inefficiencies and passing the savings to consumers. Its website and app heavily emphasize deals and discounts, with products often marked down by up to 80%. This approach has led some consumers to compare Temu to a dollar store. The platform has gained significant traction, surpassing popular platforms like Amazon, TikTok, and Instagram in download charts, indicating its appeal to budget-conscious customers seeking affordable goods online. Temu’s success lies in serving this specific customer segment and filling a void in the discount market.

- 1Q23 earnings review. Revenue rose 58% year-over-year to US$5.48bn, beating estimates by US$920mn. Non-GAAP EPADS of $1.01 beat expectations by $0.38.

- Market consensus.

(Source: Bloomberg)

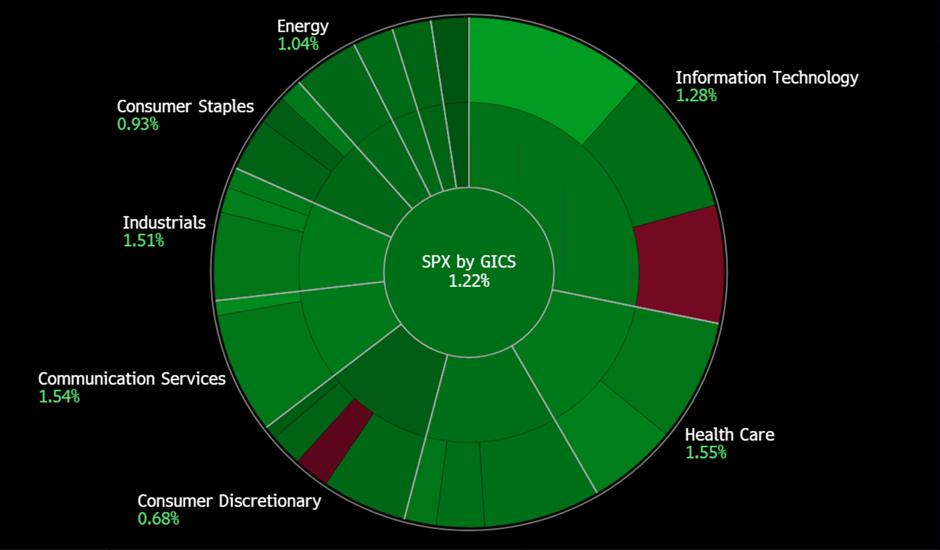

United States

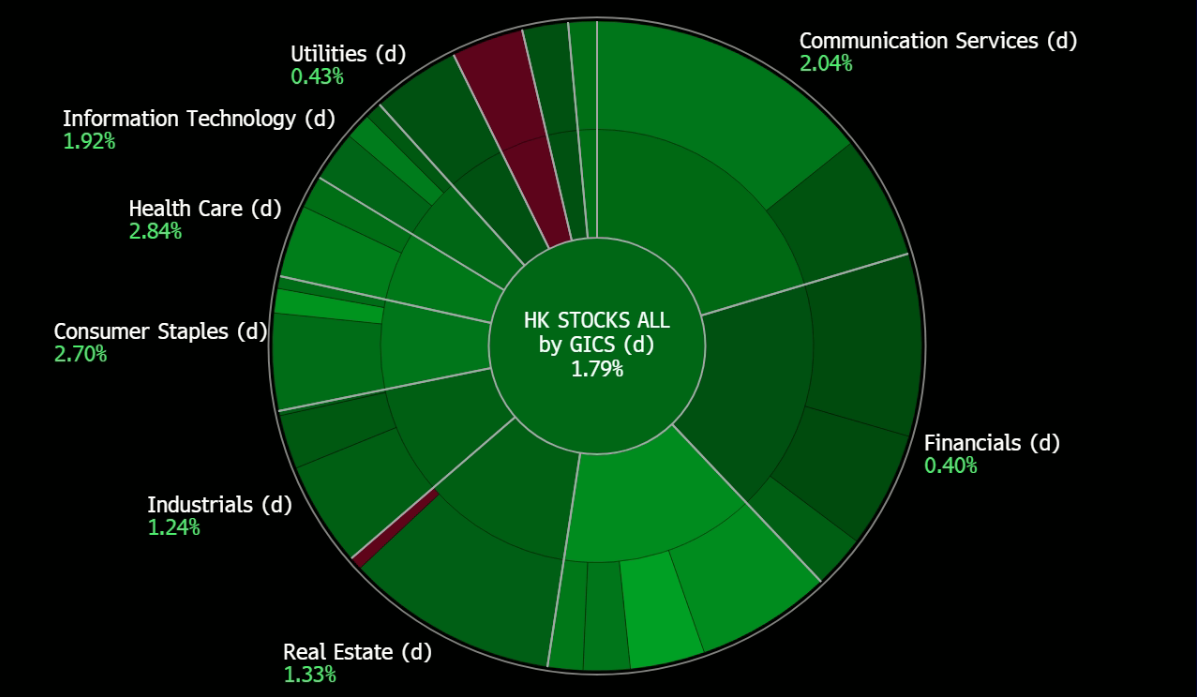

Hong Kong

Trading Dashboard Update: Add China Southern Airlines (1055 HK) at HK$4.45.