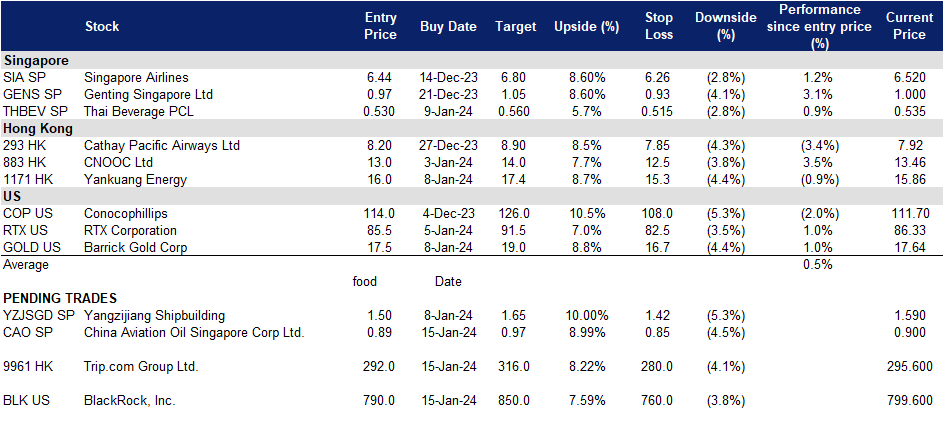

15 January 2024: China Aviation Oil Singapore Corp. Ltd. (CAO SP), Trip.com Group Ltd. (9961 HK), BlackRock, Inc. (BLK US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

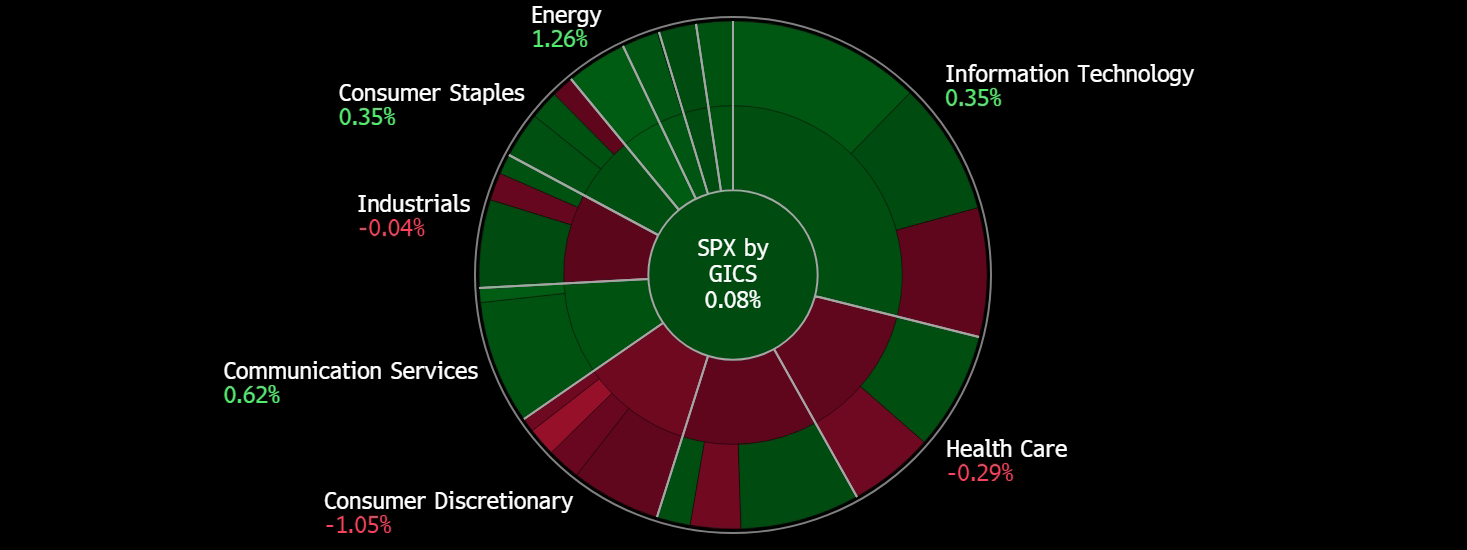

United States

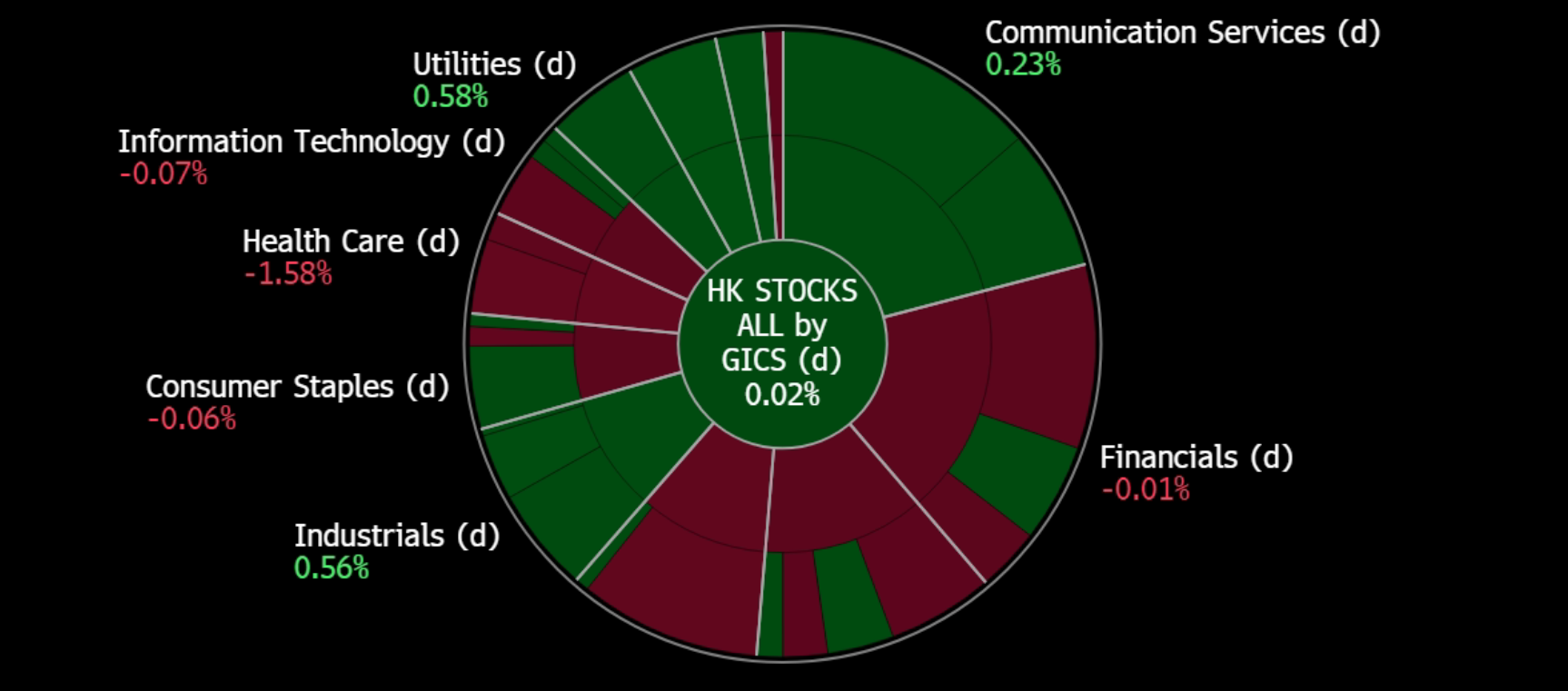

Hong Kong

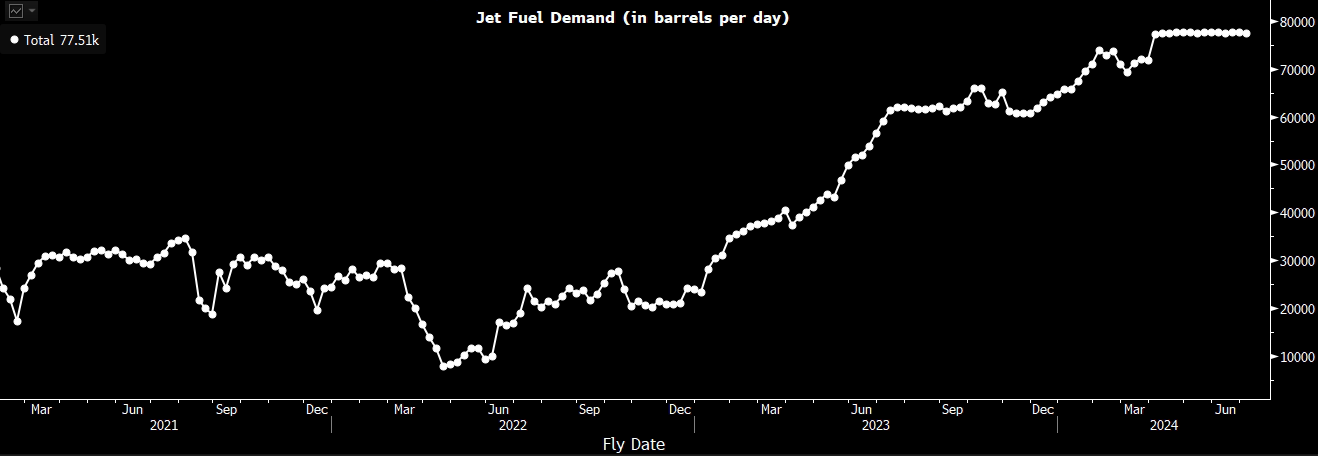

China Aviation Oil Singapore Corp. Ltd. (CAO SP): Lunar New Year highs

- BUY Entry – 0.89 Target– 0.97 Stop Loss – 0.85

- China Aviation Oil Singapore Corporation Limited supplies jet fuel to foreign and domestic airlines flying through China’s airports. The Company also trades in other oil products such as fuel oil, gas oil, crude oil, petrochemical products, including physical and paper swaps, and futures trading.

- Spring festival demand. The Civil Aviation Administration of China (CAAC) predicts a record-high demand for flights during the upcoming 40-day Lunar New Year travel rush, with approximately 80mn passengers expected to travel by air from January 26 to March 5. This marks a 45% increase from the previous year and a 10% rise from pre-pandemic levels in 2019. The surge follows last year’s 39% increase in air passenger traffic during the Chinese New Year travel rush, the first after Covid-19 restrictions were eased. The Spring Festival is anticipated to witness an average of 16,500 daily passenger flights, a 24% increase from last year. Increased international flights are expected due to expanded routes and more lenient visa policies, with over 2,500 additional international flights planned for the 40-day period. Despite challenges, China’s aviation sector has shown resilience, with passenger traffic and cargo throughput reaching 94% and 98%, respectively, of 2019 levels in the previous year.

Scheduled jet fuel demand at Pudong International Airport

(Source: Bloomberg)

- Improved air travel. China’s international air travel market is predicted to further recover, with the CAAC expecting weekly flights to reach 80% of pre-Covid levels by the end of 2024. The regulator anticipates an increase in weekly international passenger flights from over 4,600 to 6,000 by the end of the year, compared to less than 500 at the beginning of 2023. CAAC also aims for a “significant increase” in direct flights between China and the US, aligning with the agreement between Presidents Joe Biden and Xi Jinping in November. However, the resumption of direct flights between the two nations has been sluggish, reaching only 63 per week by the end of 2023, in contrast to the pre-Covid figure of 340. Despite challenges such as flight capacity shortages, geopolitical tensions, and economic uncertainties affecting consumer sentiment, CAAC projects a robust recovery with a forecast of 690n passenger trips in 2024, marking an 11% increase from 2023. Additionally, the regulatory body aims to expand traffic rights with Belt and Road nations and deepen cooperation with regions including Central Asia, the Middle East, and Africa.

- 1H23 results review. 1H23 revenue plunged by 32.4% to US$6.3bn. Gross profit plunged by 50.6% YoY to US$10.6mn. Total supply and trading volume decreased by 16.1% YoY to 9.5mn tonnes. Net profit decreased by 1.07% YoY to US$19.4mn.

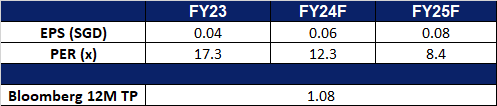

- Market Consensus.

(Source: Bloomberg)

Yangzijiang Shipbuilding (YZJSGD SP): A nice start in 2024

Yangzijiang Shipbuilding (YZJSGD SP): A nice start in 2024

- RE-ITEREATE BUY Entry– 1.50 Target– 1.65 Stop Loss – 1.42

- Yangzijiang Shipbuilding Holdings Limited builds a wide range of ships. The Company produces a wide range of commercial vessels, mini bulk carriers, multi-purpose cargo vessels, container ships, chemical tankers, offshore supply vessels, rescue and salvage vessels, and lifting vessels.

- Hedging against potential weakening RMB. The year-end rally in RMB against USD was due mainly to the pullback in US dollars as investors were optimistic about aggressive rate cuts from the Fed in 2024. However, the recent US labour market data showed the US economy remained strong, cooling down the previous rate-cut expectations. China’s economic recovery remains gloomy, and it will take longer to mitigate the impact of the property debt problem and rebuild confidence. Therefore, the RMB will weaken against the USD again once the previous positive expectations fail to be realised.

Share price and USD/RMB price trend comparison

(Source: Bloomberg)

- Growth in container vessel and tanker demand in 2024. According to Clarkson, 350 newly built container vessels were delivered in 2023, totalling 2.21mn TEU. China delivered more than 200 units. Clarkson estimates that the total container shipping capacity will grow by 7% and 5% in 2024 and 2025 respectively. According to shipbroker Xclusiv, the tankers market is expected to grow in 2024, mainly driven by the Asian oil demand. Southeast Asia and China will see 3.2% and 2.9% growth in oil demand this year.

- 1H23 orderbook exceeded the full-year target. As of June, the company has obtained orders for 72 vessels, amounting to a value of US$5.76 billion, surpassing its target of US$3 billion for 2023. This has resulted in the highest-ever outstanding orderbook value for Yangzijiang, standing at US$14.7 billion for 181 vessels. Among all ordered vessels, 91 are containerships, 29 are oil tankers, 53 are bulk carriers, and 8 are LNG/LPG/LEG.

- 1H23 results review. Revenue for 1H23 increased by 16% YoY to RMB11.3bn. Gross profit increased by 48% YoY to RMB2.1bn. GPM increased by 4ppts to 19%. PATMI increased by 26% YoY to RMB1.7bn.

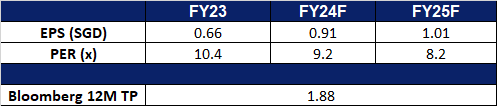

- Market Consensus.

(Source: Bloomberg)

Trip.com Group Ltd. (9961 HK): Happy Chinese New Year

- BUY Entry – 292 Target – 316 Stop Loss – 280

- Trip.com Group Ltd is a China-based company mainly engaged in the operation of one-stop travel platform. The Company’s platform integrates a comprehensive suite of travel products and services and differentiated travel content. Its platform aggregates its product and service offerings, reviews and other content shared by its users based on their real travel experiences, and original content from its ecosystem partners to enable leisure and business travelers to have access to travel experiences and make informed and cost-effective bookings. Users come to its platform for any type of trip, from in-destination activities, weekend getaways, and short-haul trips, to cross-border vacations and business trips.

- More flights for upcoming holiday season. According to Civil Aviation Administration of China (CAAC), China’s Civil Aviation Industry intends to continue its efforts to promote the resumption of international flights as they see a strong demand for international flights for the upcoming Chinese Spring Festival holidays. Airlines in China intend to add more than 2,500 new international scheduled flights and charter flights across the festive season to cater to the increased flight demand over this period. Travel demand are expected to be high as consumers celebrate Chinese New Year for the first time after fully reopening China’s borders in March 2023.

- Relaxing Visa rules. The Chinese government recently announced immediate changes to its visa-on-arrival policy. These measures help to facilitate foreign nationals coming to China, such as relaxing visa application requirements and simplifying visa application materials. These moves aim to boost trade, tourism, and people-to-people exchange, enticing more consumers to travel to China for both leisure and business purposes.

- Maintaining and strengthening strategic partnerships. Trip.com maintains its focus on partnerships to strengthen its business operations, making sure that the company can capture the higher demand from the recovery of tourism. The company recently announced that it has selected AWS as Its Strategic Cloud Provider to Enhance the Global Travel Experience. The company also recently extended its partnership agreement with Amadeus, supporting the Group’s global expansion strategies for both its OTA (Online Travel Agency) and Trip.Biz TMC (Travel Management Company).

- 3Q23 earnings. Revenue increase by 99.38% YoY to RMB13.75bn in 3Q2023, compared to RMB6.90bn in 3Q22. Net profit rose YoY to RMB4.64bn, compared to RMB245mn in 3Q22. Basic EPS rose YoY to RMB7.05, compared to RMB0.41 in 3Q22.

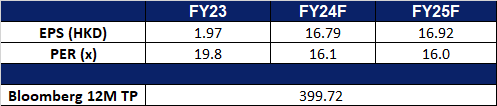

- Market consensus.

(Source: Bloomberg)

Yankuang Energy Group Co. Ltd. (1171 HK): A burning issue

- RE-ITEREATE BUY Entry – 16.0 Target – 17.4 Stop Loss – 15.3

- Yankuang Energy Group Co Ltd is a China-based international comprehensive energy company engaged in coal and coal chemical industry. The Company operates in five segments. The Coal Mining segment is engaged in underground and open-cut mining, preparation and sale of coal and potash mineral exploration. The Smart Logistics segment provides railway transportation services. The Electricity and Heating Supply segment provides electricity and related heat supply services. The Equipment Manufacturing segment is engaged in the manufacture of comprehensive coal mining and excavating equipment. The Chemical Products segment is engaged in the production and sale of chemical products. The coal products mainly include thermal coal, pulverized coal injection (PCI), and coking coal. The coal chemical products mainly include methanol, ethylene glycol, acetic acid, ethyl acetate and crude liquid wax, among others. The Company distributes products in the domestic market and to overseas markets.

- China reinstates coal tariffs. At the start of 2024, China has reinstated tariffs on coal imports. The reinstated tariffs include a 6% levy on coal for electricity and heating and a 3% tariff on coking coal used in steelmaking. Russia, South Africa, Mongolia, and the United States will be impacted by these tariffs, while Indonesia and Australia remain exempt due to free trade agreements with China. The implementation of these tariffs is likely to drive up domestic coal production and demand as there is less competition from foreign coal companies. This allows domestic producers like Yankuang Energy to extend their competitive edge in the Chinese market.

- Increasing coal use. China’s coal use remains high as the country has increased its reliance on coal-fired power generation, as hydroelectric power is severely reduced. The current winter season has also indirectly driven up the demand for coal due to increased usage of electricity and consumers keep themselves warm from the winter temperatures. Recently, China also reported that they have begun testing the production of ethanol through the use of coal, instead of using crops like corn or sugar cane. This allows China to “millions of tonnes” of grains annually which then can be used as food resources.

- 3Q23 earnings. Revenue fell by 28.01% YoY to RMB40.34bn in 3Q2023, compared to RMB56.03bn in 3Q22. Net profit fell 52.43% YoY to RMB4.52bn, compared to RMB9.49bn in 3Q22. Basic EPS fell by 55.36% YoY to RMB0.58, compared to RMB1.30 in 3Q22.

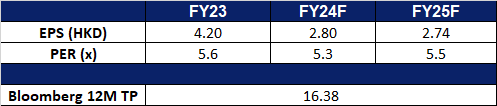

- Market consensus.

China Qinhuangdao thermal port coal 5,500 GAR spot price

(Source: Bloomberg)

(Source: Bloomberg)

BlackRock, Inc. (BLK US): Good news, great results

- BUY Entry – 790 Target – 850 Stop Loss – 760

- BlackRock, Inc. provides investment management services to institutional clients and to retail investors through various investment vehicles. The Company manages funds, as well as offers risk management services. BlackRock serves governments, companies, and foundations worldwide.

- SEC Bitcoin ETF approval. The approval of US-listed bitcoin exchange-traded funds (ETFs) by the Securities and Exchange Commission (SEC) on Wednesday triggered substantial trading activity. Eleven spot bitcoin ETFs, including those from BlackRock, Grayscale, and ARK, commenced trading, with Grayscale, BlackRock, and Fidelity dominating trading volumes. This approval prompted fierce competition among issuers, with some reducing fees below industry standards. The regulatory approval is expected to stimulate competition for market share and encourage the introduction of more innovative crypto ETFs. Cryptocurrency-related stocks initially surged but ended the day lower, reflecting market dynamics and lingering scepticism from some financial institutions. The iShares Bitcoin Trust (IBIT), BlackRock’s spot bitcoin exchange-traded fund (ETF), attracted approximately US$400mn within the initial 30 minutes of trading, signalling significant investor demand. The approval of spot bitcoin ETFs offers investors an accessible avenue for exposure to the digital asset without the need for physical bitcoin custody. The development is seen as a crucial milestone for the crypto industry, unlocking untapped demand from investors seeking regulated financial products for bitcoin ownership.

- Acquisition and streamlining. BlackRock revealed its acquisition of Global Infrastructure Partners (GIP) for approximately US$12bn in cash and stock. This move aligns with BlackRock’s heightened emphasis on infrastructure, identified by its CEO as a compelling long-term investment opportunity. Under the agreement, GIP’s management team will spearhead a unified infrastructure private markets investment platform within BlackRock. The deal is slated to conclude in the third quarter of this year. Additionally, BlackRock announced the integration of its ETF and Index businesses across the organization through the establishment of a new strategic Global Product Solutions business. Simultaneously, the company will introduce a new International Business structure to streamline leadership across Europe, the Middle East, India, and the Asia-Pacific region.

- Interest rate expectations. US Federal Reserve officials are cautious about interpreting consumer price data for future monetary policy decisions. Although overall consumer price inflation rose to 3.4% in December, excluding volatile items showed a decrease in the pace of price increases to 3.9%. This suggests ongoing moderation in underlying price pressures. While some officials note progress in reducing inflation, they emphasize the need for more evidence before considering interest rate cuts, with a March rate cut viewed as premature by some. The Fed is expected to maintain its policy rate at the January meeting, but markets anticipate rate cuts starting in March. Recent unexpected declines in US producer prices in December may indicate temporary relief from recent upticks in consumer prices, potentially allowing the Fed to consider interest rate cuts. The market anticipates a 72.4% chance of a rate cut by March, according to the CME FedWatch.

- FY23 results. Revenue was flat YoY at US$17.9bn. Operating income fell 2% YoY to US$6.6bn. FY23 EPS rose 7% YoY to US$37.77. 4Q23 revenue rose 6.7% YoY, to US$4.63bn. Non-GAAP EPS beat estimates by US$0.82 at US$9.66.

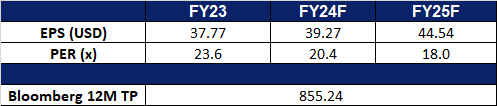

- Market consensus.

(Source: Bloomberg)

Barrick Gold Corp (GOLD US): Rate cut expectations driving gold prices upward

- RE-ITEREATE BUY Entry – 17.46 Target – 19.00 Stop Loss – 16.69

- Barrick Gold Corporation is an international gold company with operating mines and development projects in the United States, Canada, South America, Australia, and Africa.

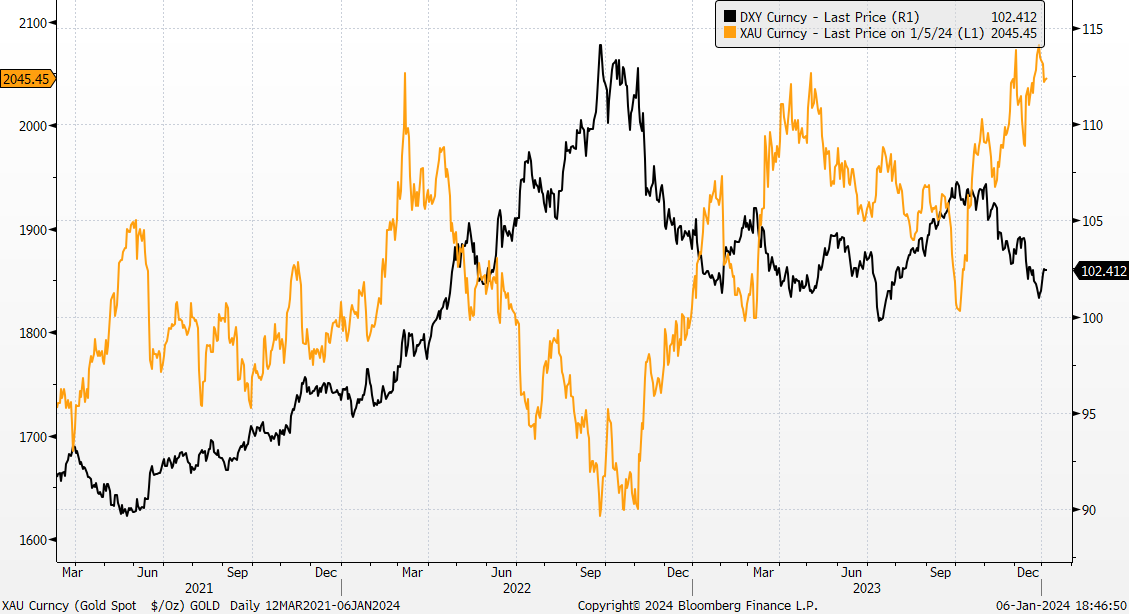

- Mixed US economic data, rate cuts still expected. The trend of gold price has been downwards, driving the prices of gold up since it is denominated in USD. This is mainly due to the change in the Fed’s stance towards interest rates, where they have indicated that a rate cut may be on the horizon. While the recent Nonfarm Payrolls exceeded expectations, causing the gold to see a slight rally, the decline in ISM Services PMI helped partially ease concerns that the Fed would delay their cuts. Despite rising US bond yields, the CME FedWatch Tool suggests increased expectations of earlier rate cuts by the Federal Reserve. Currently the market anticipates a 67% chance of a Fed rate cut by March, and with the decline in USD following these rate hikes, the upside potential for gold remains promising. This is especially beneficial for Barrick Gold Corp as the appreciation of Gold prices would in turn lead to a higher profit for them potentially boosting their share price.

Gold Price vs Dollar Index

(Source: Bloomberg)

- Geopolitical unease remains elevated. With Houthi rebel attacks on shipping in the Red Sea disrupting global supply chains and anticipated geopolitical uncertainties surrounding the Taiwan election in January and the US election in November, the economic outlook remains cautious. This risk aversion, along with ongoing wars in Europe and the Middle East, continues to underpin elevated gold prices.

- 3Q23 results. Revenue rose 13% YoY, to US$2.86bn. Non-GAAP EPS beat estimates by US$0.04 at US$0.24. Expect stronger 4Q23 results, but FY23 gold production to be slightly below previous guidance range of 4.2mn oz to 4.6mn oz.

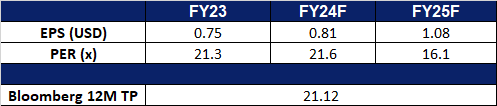

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: No changes to Trading Dashboard.