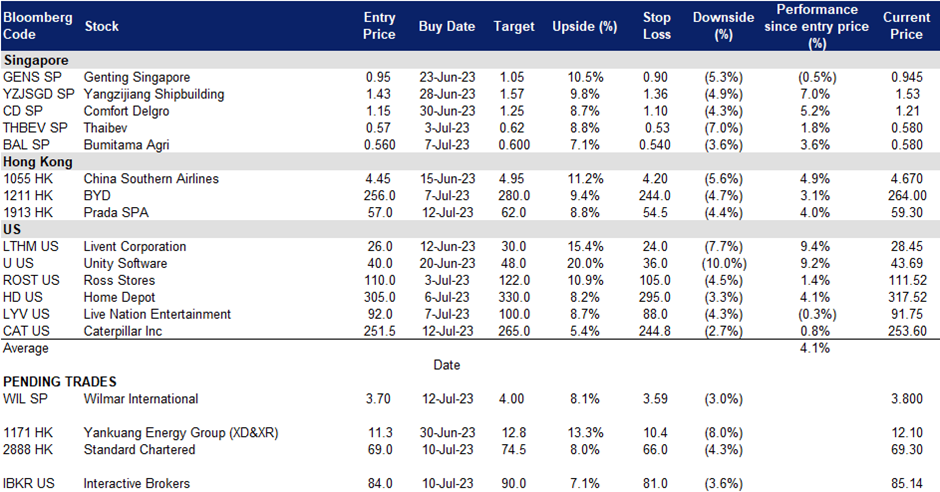

14 July 2023: Wilmar International Ltd. (WIL SP), Prada SPA (1913 HK), Caterpillar Inc (CAT US)

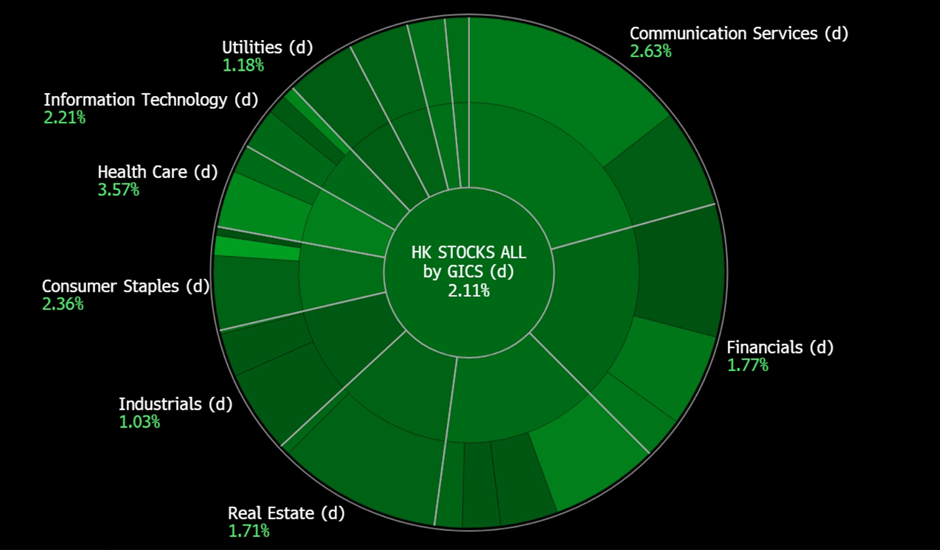

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

United States

Hong Kong

Wilmar International Ltd. (WIL SP): Sugar and Palm Oil productions decline

- BUY Entry 3.70 – Target – 4.00 Stop Loss – 3.59

- Wilmar International Limited operates as a food processing company. The Company offers oil palm cultivation, edible oil refining, crushing, and gains processing services, as well as provides sugar, flour, and rice. Wilmar International serves customers worldwide.

- Less sugar output in India. Due to scanty rainfall, a possible heat wave could hit sugarcane production summer season. According to the weather department data, key cane-growing districts of Maharashtra have received up to 71% less-than-normal rainfall so far this monsoon season that started on June 1. In Karnataka, the third-biggest sugar producer, the rainfall deficit is as high as 55% in cane-growing districts. Sugar output in the current year is expected to fall more than 8% to 32.8mn tonnes from last year. The global production was estimated to be 187.9mn tonnes, and India is expected to account for 19.2% of the world supply in May, according to the US Department of Agriculture. Hence, the recovery in sugar production will tumble, upholding sugar prices.

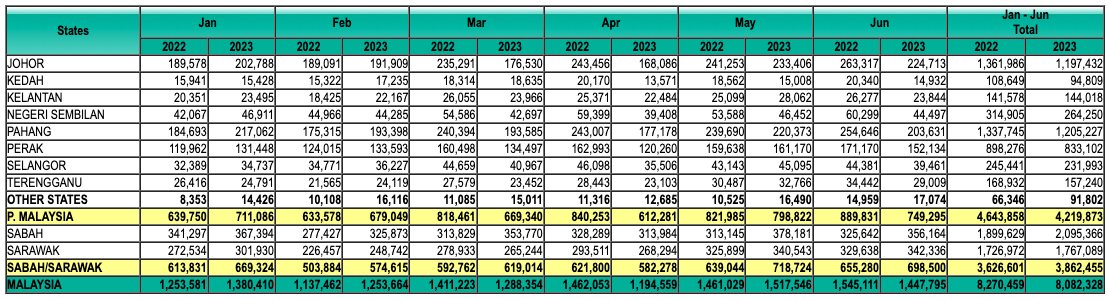

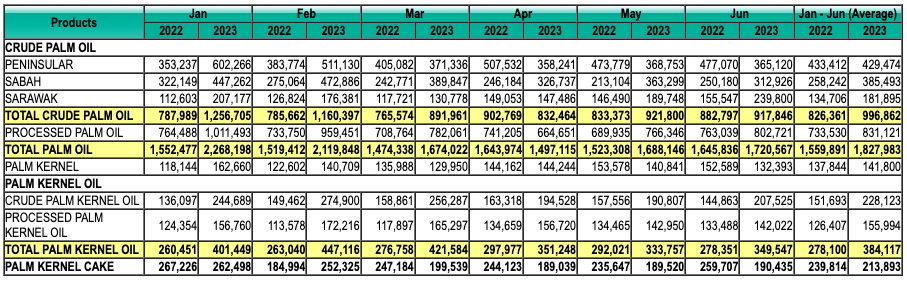

- Palm oil output fell in Malaysia in June. Crude palm oil output in June fell 4.6% MoM to 1.45mn tonnes. Exports rose 8.6% MoM to 1.17mn tonnes. Stockpiles gained 1.9% MoM to 1.72mn tonnes.

Monthly Crude Palm Oil Output

(Source: MPOB)

(Source: MPOB)

Monthly Closing Crude Palm Oil Inventory  (Source: MPOB)

(Source: MPOB)

- 1Q23 results review. Revenue dropped by 3.8% YoY to US$16.9bn. Net profit fell by 26.2% YoY to US$391.4mn. Food product sales volumes rose by 4.1% YoY to 7.2mn MT. Feed and Industrial Products sales volume jump by 15.2% YoY to 13.7mn MT.

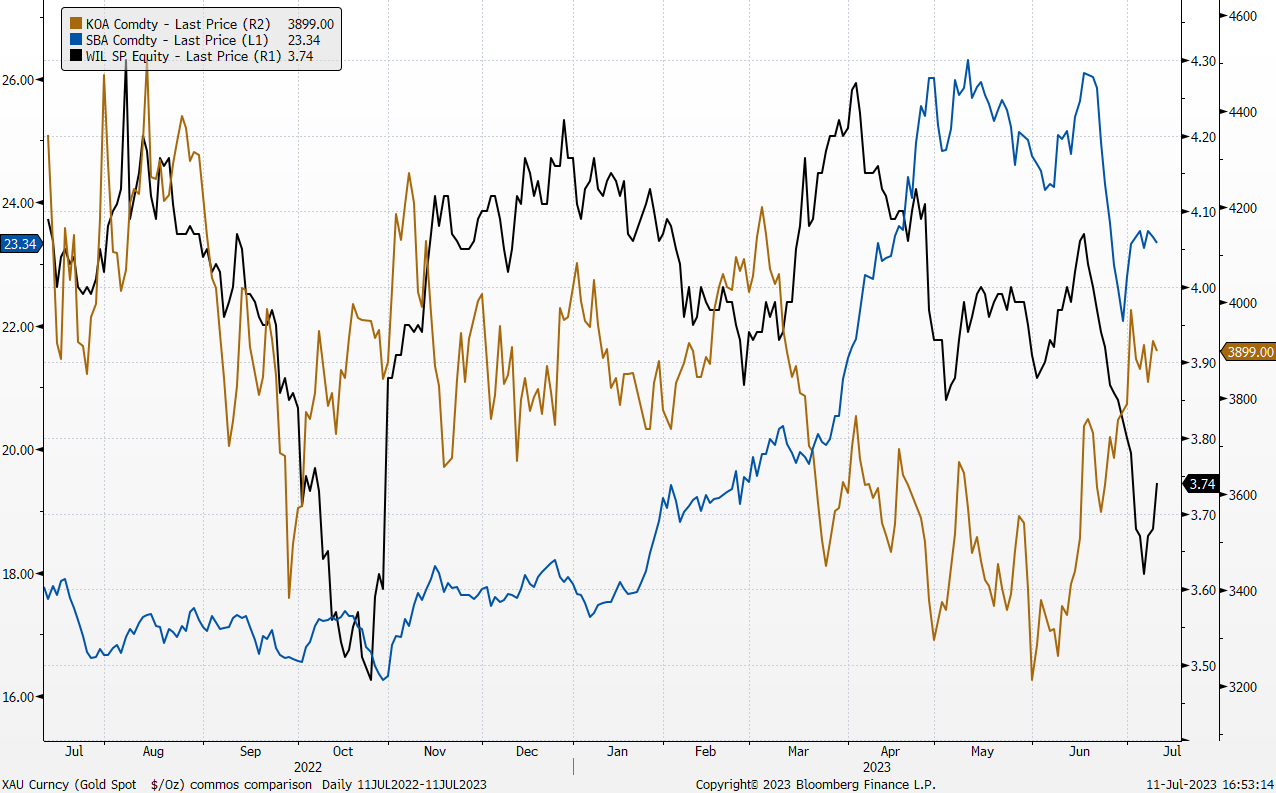

Sugar Futures, Crude Palm Oil Futres, and Share price comparison

(Source: Bloomberg)

(Source: Bloomberg)

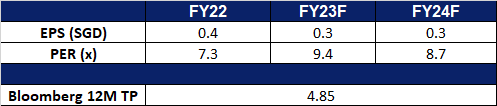

- Market consensus.

(Source: Bloomberg)

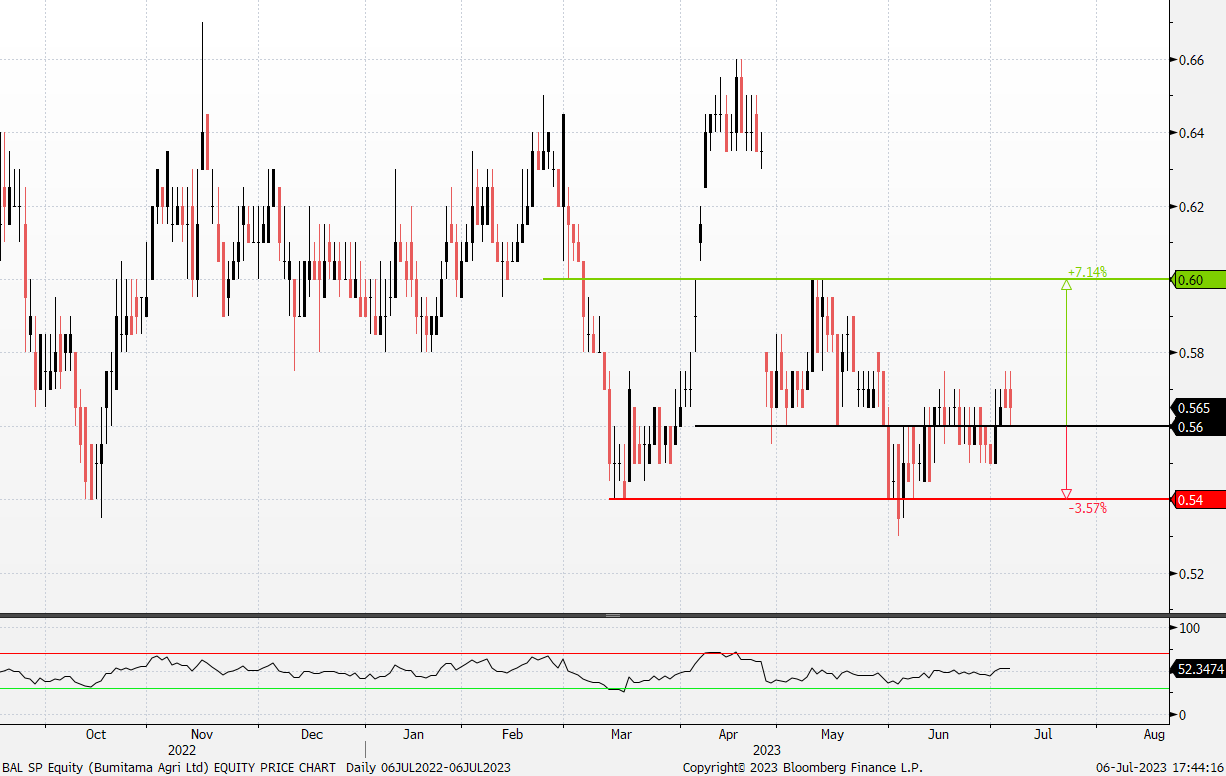

Bumitama Agri Ltd (BAL SP): Expecting a short-term rebound

- RE-ITERATE BUY Entry 0.560 – Target – 0.600 Stop Loss – 0.540

- Bumitama Agri Ltd. produces CPO and PK, with its oil palm plantations located in Indonesia. The Company’s primary business activities are cultivating and harvesting our oil palm trees, processing FFB from its oil palm plantations, its plasma plantations and third parties into CPO and PK, and selling CPO and PK in Indonesia.

- Palm Oil Futures Prices. Malaysian palm oil futures slightly pulled back to MYR 3,900/tonne after it jumped to near MYR4,000/tonne as a US acreage report showed smaller-than-expected soybean plantings shocked crop markets.

- Palm oil price support. Lower soybean production in the US, ongoing El Nino weather conditions affecting oilseeds and oil palm crops, and a weaker ringgit are anticipated to uphold the elevated prices of crude palm oil (CPO) above RM3,400/tonne. Palm oil prices experienced an increase as a result of strong shipments from Malaysia in early July, which alleviated concerns regarding heightened production levels in the country. Exports more than doubled compared to the previous month, suggesting a positive outlook for export demand in July and August, potentially slowing the rise in stockpiles. Furthermore, palm oil prices are being supported by gains in rival soybean oil prices, following the unexpected reduction in the US soybean planting estimate for this summer. Additionally, petroleum prices have been bolstered by supply cuts from OPEC+, which may enhance the attractiveness of vegetable oils as alternative fuels.

- 1Q23 earnings review. Revenue declined by 8% YoY to 3.6tn IDR from the previous 3.9tn IDR. Net profit fell 51% YoY, to 429.1bn IDR (S$40mn) from 873bn IDR. The decline in net profit is attributable to lower ASP alongside rising fertiliser prices.

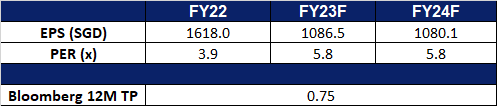

- Market consensus.

(Source: Bloomberg)

Prada SPA (1913 HK): Viral Hits

- BUY Entry – 57.0 Target – 62.0 Stop Loss – 54.5

- Prada SpA is an Italy-based company engaged in fashion industry. The Company is a parent of the Prada Group. The Company, along with its subsidiaries, is engaged in the design, production and distribution of leather goods, handbags, clothing, eyewear, fragrances, footwear and accessories. Prada SpA manufactures jackets, trousers, skirts, dresses, sweaters, blouses, as well as perfumes and watches, among others. The Company trades its products through several brands, such as Prada, Miu Miu, The Church and The Car Shoe. Prada SpA operates in approximately 70 countries through directly operated stores, franchise operated stores, a network of selected multi-brand stores and department stores. Prada Spa operates through a numerous subsidiaries, including Artisans Shoes Srl, Angelo Marchesi Srl, Prada Far East BV, Tannerie Megisserie Hervy SAS and Prada SA, among others.

- Viral Hits. Fashion enthusiasts worldwide have embraced the latest creations from Prada and Miu Miu, as evidenced by their immense popularity. Prada SpA, the Italian fashion conglomerate, experienced a significant increase in sales, thanks to the enthusiastic purchases of Prada loafers and Miu Miu pocket bags by shoppers. As a result, Prada SpA’s net revenue in the first quarter rose by 22% at constant exchange rates, a considerable contribution from these successful designs.

- Extensive partnership. Prada SPA has constantly been engaging in different partnership to bring out its brand name. Recently, Prada Group and IOC/UNESCO announce a new enhanced partnerships within the framework of SEA BEYOND, the educational programme dedicated to the dissemination of ocean literacy principles and ocean preservation, conducted together since 2019. Prada has also engaged with Enhypen, a K-POP group, to be the company’s newest brand ambassador. Prada SPA has also just announced that they will become the official partner of the Chinese Women’s National Football Team, just in time for the team’s participation in the FIFA Women’s World Cup 2023. These extensive partnerships are bound to bring the company’s name out and drive sales going forward.

- 1Q23 earnings. Revenue rose to €1.06bn, up 22% YoY at constant exchange rates. Retail Sales rose 23.2% YoY, driven by like-for-like and full-price sales.

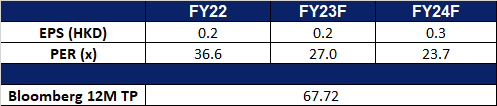

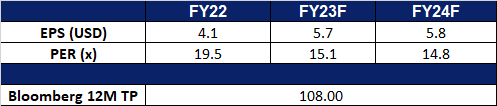

- Market Consensus.

(Source: Bloomberg)

Standard Chartered PLC (2888 HK): Improving profitability

Standard Chartered PLC (2888 HK): Improving profitability

- RE-ITERATE BUY Entry – 69.0 Target – 74.5 Stop Loss – 66.0

- Standard Chartered PLC is an international banking company. The Company’s segments include Corporate, Commercial Institutional Banking; Consumer, Private & Business Banking; Ventures, and Central & other items. The Corporate, Commercial & Institutional Banking segment supports companies across the world, from small and medium-sized enterprises to large corporates and institutions, both digitally and in person. The Consumer, Private & Business Banking segment supports small businesses and individuals, from mass retail clients to affluent and high-net-worth individuals, both digitally and in person. The Ventures segment includes financial technology, and a pipeline of over thirty ventures, which includes two cloud-native digital banks. Its products and services include macro, commodities and credit trading, financing and securities services, sales and structuring, debt capital markets and leveraged finance, cash management, working capital, portfolio management, mortgages, and deposits.

- Lowering US dollar deposits. China’s biggest banks have once again lowered interest rates on the nation’s $453 billion corporate US dollar deposits, aiming to bolster the struggling yuan. This marks the second rate cut within a short span of time. The move involved nine banks, including the prominent state lenders, eliminating the additional spread they previously offered over the US Secured Overnight Financing Rate for corporate clients. Prior to this adjustment, one-year deposits were offered at 5.7%, down from 6% a month earlier. Retail investors also witnessed significant reductions, with state banks slashing one-year rates on household deposits to around 2.8% from 4.5%-5%. These lower deposit rates are intended to make the yuan less attractive for individuals and businesses looking to convert their cash holdings into dollars, thereby supporting the Chinese currency.

- Acquisition of RBC Investor Services Trust Hong Kong Ltd. The objective of the acquisition is to strengthen Standard Chartered’s securities services capabilities and broaden its client base, aligning with its overall strategy to expand its custodian and fund servicing operations. Additionally, the company intends to enter the trusteeship business for the Mandatory Provident Fund (MPF) and Occupational Retirement Schemes Ordinance (ORSO) schemes in Hong Kong, further diversifying their offerings.

- Cost Cutting to improve profitability. Last month, as part of its ongoing efforts to reduce costs by over US$1 billion (S$1.35 billion) by 2024, the Asia-focused lender initiated workforce reductions in its Singapore, London, and Hong Kong branches. Over 100 positions were eliminated in these locations. Standard Chartered began streamlining its middle-office operations, which encompass areas such as human resources and digital transformation. The bank’s decision to implement targeted staff reductions aligns with the challenging economic conditions and subdued deal-making activity that have adversely affected revenue in the global financial industry.

- 1Q23 results. Operating Income rose to US$4,396mn (+8.0% YoY), compared to US$4,076mn in 1Q22. Pre-tax profit rose to US$1,808mn, (+21.0% YoY), compared to US$1,492mn in 1Q22. Diluted EPS stands at 40.7 US cents, (+6.0% YoY) compared to 34.6 US cents in 1Q22. 2Q23 results will be released on 28th July 2023.

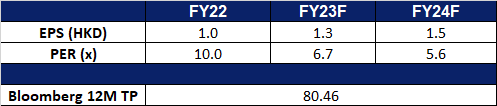

- Market Consensus.

(Source: Bloomberg)

Caterpillar Inc (CAT US): Benefiting from recovery in the US construct and global mining activies

- BUY Entry – 251.5 Target – 265.0 Stop Loss – 244.8

- Caterpillar Inc. designs, manufactures, and markets construction, mining, and forestry machinery. The Company also manufactures engines and other related parts for its equipment, and offers financing and insurance. Caterpillar distributes its products through a worldwide organization of dealers.

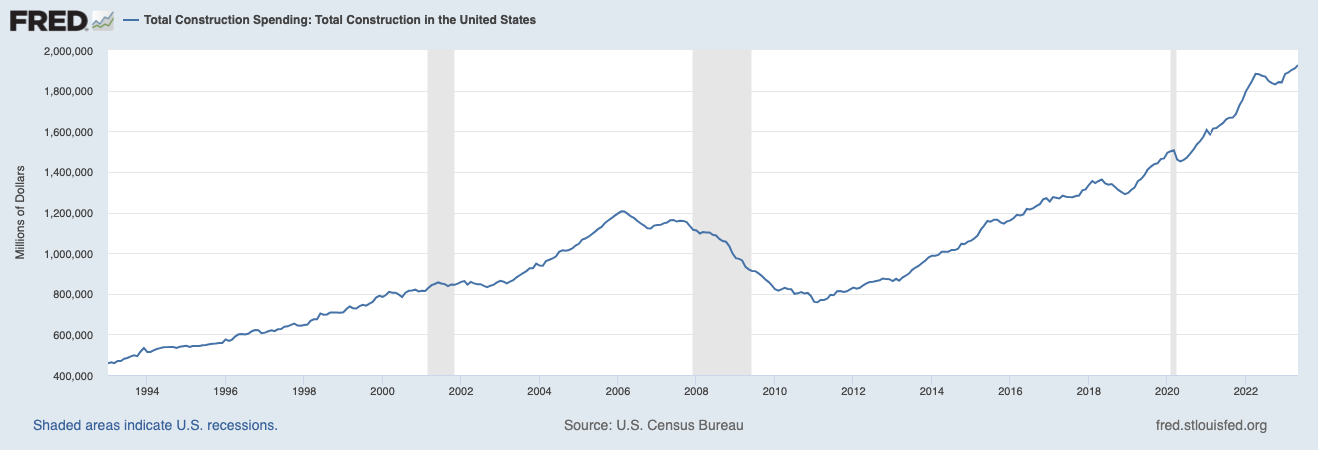

- U.S. construction spending hits record high. In May, construction spending in the United States experienced a 0.9% MoM rise, reaching a seasonally adjusted annual rate of $1,925.6bn. This growth followed a 0.4% increase in April and slightly exceeded market expectations of a 0.6% increase. Notably, this marked the most substantial increase in construction spending witnessed in the past four months.

US Total Construction Spending

(Source: Federal Reserve Economic Data)

(Source: Federal Reserve Economic Data)

- Global mining spending continues to grow. The global migration of supply chains and the growing adoption of electric vehicles have prompted countries to intensify their efforts in the mining industry. The latest findings from the World Energy Investment Report 2023, published by the International Energy Agency, indicate that capital expenditures on essential minerals rose by 30% YoY in 2022. Moreover, it is anticipated that the world’s leading mining companies will witness a 12.2% YoY increase in their capital expenditure for this year.

- 1Q23 earnings review. Revenue rose 16.9% YoY to $15.9bn, beating estimates by $630mn. Non-GAAP EPS of $4.91 beat estimates by $1.12.

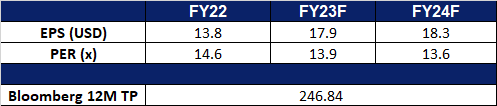

- Market consensus.

(Source: Bloomberg)

Interactive Brokers Group Inc (IBKR US): Benefiting from a bull market

Interactive Brokers Group Inc (IBKR US): Benefiting from a bull market

- RE-ITERATE BUY Entry – 84 Target – 90 Stop Loss – 81

- Interactive Brokers Group, Inc. is an automated electronic broker. The Company specializes in executing and clearing trades in stocks, options, futures, foreign exchange instruments, bonds, mutual funds, and exchange-traded funds, as well as offers custody, prime brokerage, securities, and margin lending services.

- Strong performance. Interactive Brokers reported strong performance in June, with positive growth across various metrics. The company saw a 5% monthly increase in daily average revenue trades (DARTs), although there was a 3% decline compared to the previous year. Ending client equity surged to $365B, 24% higher YoY and 6% higher than the prior month. Ending client margin loan balances were $41.9B, 2% down from last year and 5% higher MoM. Ending client credit balances of $98.9B, 7% up from prior year and about even with the previous month. The total number of client accounts rose by 19% YoY to 2.29M. It expanded its services in Asia, particularly in the digital asset space, and became the primary international broker for Sinopac Securities in Taiwan. Additionally, the company is broadening its market coverage by allowing clients to trade shares on Nasdaq Copenhagen and the Prague Stock Exchange, further diversifying its global offerings.

- Robust labour demand. The US economy added the fewest jobs in 2.5 years in June, signalling a slowdown in job growth, but strong wage growth suggests a tight labour market that will likely prompt the Federal Reserve to raise interest rates later this month. The Labour Department’s employment report revealed that nonfarm payrolls increased by 209,000 jobs, missing expectations, and indicating that higher borrowing costs affected businesses’ willingness to hire. However, the overall pace of job growth remains strong, and other data suggest that the economy is not heading toward a recession. Average hourly earnings continued to rise, and unemployment dropped to 3.6%. Labour force participation remained steady, but more people entered the workforce. With the US labour markets remaining robust despite facing challenges, more people are likely to invest their money, leading to increased trading activity for Interactive Brokers.

- 1Q23 earnings review. Revenue rose 64.3% YoY to US$1.06bn, in line with estimates. Non-GAAP earning per share was US$1.35, $0.06 below expectations.

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take profit on Samsonite International (1910 HK) at HK$24 and Whirlpool Corp (WHR US) at US$160. Add Prada SPA (1913 HK) at HK$57 and Caterpillar Inc (CAT US) at US$251.5.