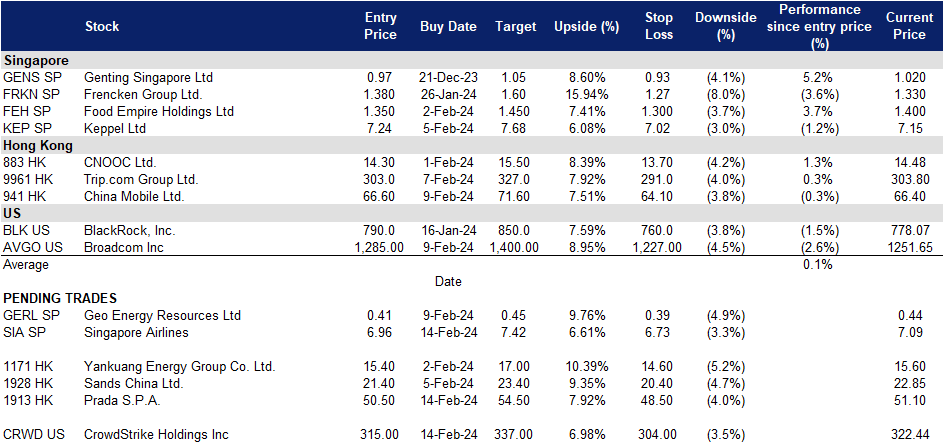

14 February 2024: Singapore Airlines Ltd. (SIA SP), China Mobile Ltd. (941 HK), CrowdStrike Holdings Inc (CRWD US)

Sector Performance | Hong Kong Trading Ideas |United States Trading Ideas | Singapore Trading Ideas| Trading Dashboard

United States

Hong Kong

Singapore Airlines Ltd. (SIA SP): Upbeat outlook in 2024

- Entry – 6.96 Target– 7.42 Stop Loss – 6.73

- Singapore Airlines Limited provides air transportation, engineering, pilot training, air charter, and tour wholesaling services. The Company’s airline operation covers Asia, Europe, the Americas, South West Pacific, and Africa.

- Signed MoC to target travellers. Recently, the Singapore Tourism Board (STB) renewed its partnership with Traveloka, emphasizing collaboration beyond marketing campaigns to enhance visitor experiences. The memorandum of cooperation (MOC) aims to target consumers more effectively through data sharing and introduce new Singaporean products on the Traveloka platform. Aligned with STB’s “Made in Singapore” campaign, the partnership seeks to showcase unique experiences and attract more visitors from Indonesia and Southeast Asia. The collaboration also focuses on knowledge-sharing and developing tailored promotional campaigns to elevate visitor engagement.

- Singapore visitors expected to rise. In January, Singapore welcomed 1.44mn visitors, marking a 54.2% YoY increase and a 16.1% sequential rise, with 1.07mn being overnight visitors. Despite the growth, the average length of stay decreased by 20.1% YoY to 3.45 days. Indonesia remained the top source market, followed by mainland China, which saw the largest YoY growth of 644.2%. Australia ranked third in visitor numbers. Singapore’s tourism board projected international visitor arrivals to reach 15-16mn in 2024, generating approximately $26-27.5bn in tourism receipts, driven by improved flight connectivity and the implementation of mutual visa-free travel with China. While post-pandemic arrivals have not yet reached pre-pandemic levels, Singapore’s robust performance signals promising recovery, with longer visitor stays and diverse attractions contributing to growth. Hotels experienced strong expansion and performance, while meetings and events continue to drive tourism, with significant events lined up for 2024, including the Singapore Airshow, a variety of performances, MICE events, and the World Architecture Festival.

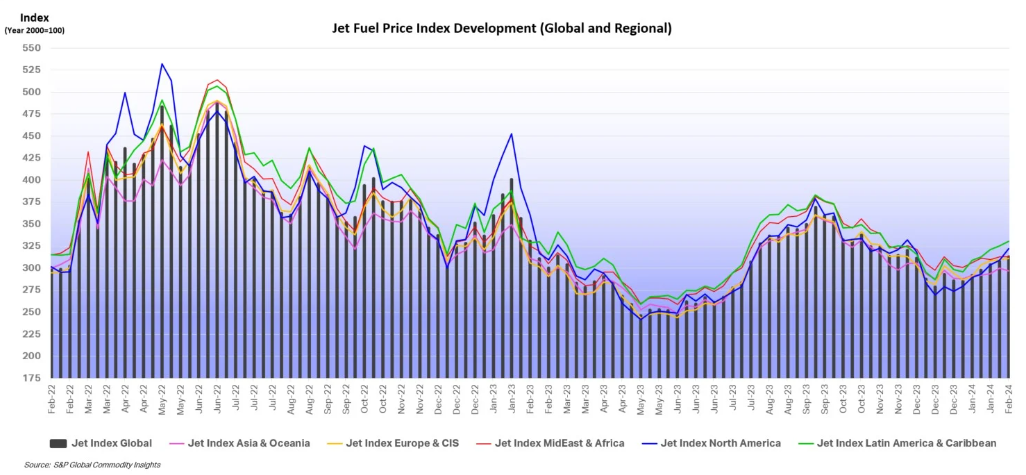

Jet Fuel Price Trend

(Source: International Air Transport Association)

- Lower jet fuel prices in Asia. Oil prices have surged amid escalating geopolitical tensions and product shortages, particularly in Europe, stemming from disruptions in jet fuel and diesel supplies caused by the Red Sea crisis. In Europe, jet fuel stocks have dwindled as imports diverted to higher-priced markets in the USA and Latin America, driving up prices despite reduced demand during the off-peak air travel period. In the USA, jet fuel prices remained elevated due to low inventories resulting from refinery maintenance, unplanned outages, and severe winter weather. Meanwhile, the Asian market has weakened due to lower regional demand but has been supported by arbitrage opportunities in other regions. For the week ending 9 February, average jet fuel prices rose by 1.7% WoW to US$114.59/bbl, while the price in the Asia & Oceania segment declined by 1.0% WoW to US$103.96/bbl. The decrease in jet fuel prices in the Asian market is poised to benefit Singapore Airlines by bolstering its profit margins.

- KrisFlyer promotions. KrisFlyer, the rewards program of the Singapore Airlines Group, has evolved into a comprehensive lifestyle program offering rewards beyond just flights. To celebrate its 25th anniversary, KrisFlyer has presented enticing promotions for members, including bonus miles on flights, exclusive deals on the Kris+ app, and special offers on KrisShop and Pelago. These promotions are likely to attract new members to the KrisFlyer program, expanding its audience and benefiting Singapore Airlines in the long term.

- 1H24 earnings. The company revenue rose to S$9,162mn, +8.9% YoY compared to 1H23. The company’s net profit for the period was S$1,441mn, a 55.4% increase YoY. SIA and Scoot carried 17.4mn passengers in 1H24, an increase of 52.3% YoY. Passenger traffic grew 38.0% from a year before, outpacing the capacity expansion of 29.0%. As a result, the Group passenger load factor (PLF) improved by 5.8 percentage points to 88.8%, the highest ever half-yearly PLF. SIA and Scoot achieved record PLFs of 88.0% and 91.3% respectively. The Company declared an interim dividend of 10 cents per share, amounting to S$297mn, for 1H24 which will be paid on 22 December 2023 for shareholders as of 7 December 2023.

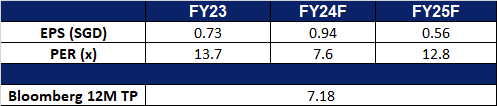

- Market Consensus.

(Source: Bloomberg)

Geo Energy Resources Ltd (GERL SP): Obtained good deals

Geo Energy Resources Ltd (GERL SP): Obtained good deals

- RE-ITEREATE Entry – 0.41 Target– 0.45 Stop Loss – 0.39

- Geo Energy Resources Limited is an integrated coal mining specialist. The Company owns and operates coal mines, offers mine contracting services to third party mine owners, and sells coal to both coal traders and coal export companies.

- Secured life-of-mine coal offtake and long-term multi-million-dollar equity investment. On 7 February, Geo Energy signed a life-of-mine coal offtake agreement with EP Resources, for the supply of coal from Geo Energy’s subsidiary, TRA coal mine, which was recently acquired. The Group will supply 75% to 85% of export volumes of TRA coal up to 12mn tonnes per annum, priced at an index-linked price less the offtake margin. Additionally, EP Resources will have a standby prepayment facility for the coal offtake amounting up to US$20mn which will further inflate Geo Energy’s working capital and cash position. Alongside the offtake deal, Resource Invest AG plans to invest US$35mn in shares of the company to acquire at least a 5.5% equity stake by 31 March 2026, including through market purchases and directly from the company. The equity investment includes purchasing US$10mn of the Company’s treasury shares in two equal tranches, expected to happen in February 2024 and February 2025, at the placement prices of S$0.45 per share and S$0.50 per share, which reflect 45% to 61% premiums compared to its average share buyback price of S$0.31. ResInvest will also receive 41,401,727 non-listed, transferrable, and free warrants, to be subscribed in two tranches and are exercisable within 3 years from the date of issue. The sale of its treasury shares will enable Geo Energy to raise about S$13.4mn, providing additional capital for its ongoing growth.

- Inorganic growth to expand sales volume. As of 31 December 2023, Geo Energy owns 73.11% of PT Golden Eagle Energy Tbk, listed on IDX, and it owns 85% of TRA mine. In December 2023, after the acquisition, TRA had its first export shipment of coal valued at around USD3.2mn based on the ASP of approximately USD58.98 per tonne, which was sold at a premium to the Indonesian Coal Index (ICI) price of USD58.05 per tonne at that time, indicating the favourable demand for TRA coal. TRA produces 3,800 kcal/kg gar coal and has 275Mt of 2P coal reserves, leading to a 262% increase in reserves after the acquisition.

- Long life of mine and low operating costs. Geo Energy obtains a strategic advantage stemming from the extensive lifespan and projected coal production of its mines, instilling confidence in long-term clients to engage in supply contracts with the company. Boasting over 351 million tonnes of thermal coal reserves, Geo Energy holds a prominent position in Indonesia. Additionally, its commendably low stripping ratio, approximately 4.8 for a large-scale coal operator, equips Geo Energy with resilience against cyclical fluctuations in volatile coal prices.

- Upbeat outlook after the acquisition. The recent EGM voting approved the acquisition of two promising companies, significantly expanding the group’s mining portfolio. The newly acquired mine boasts an estimated 275 million tonnes of reserves. Within 5-6 years, Geo Energy will scale up its production to up to 25 million tonnes from the current 8-10 million tonnes, implying a CAGR of 18.6%. The strategic move aligns with the robust demand for TRA coal, primarily fuelled by China and Korea. Despite challenges such as the Monsoon season impacting mining activities, the group anticipates sustained profitability, emphasizing the strategic imperative for acquiring additional mines.

- 3Q23 results review. 3Q23 revenue decreased by 33% YoY to US$111mn from US$164.7mn. Net profit fell 68% YoY to US$11.5mn from US$35.7mn. It attributed the lower revenue to lower sales volume and average selling price, noting that the average Indonesian Coal Index Price for 4,200 GAR coal fell to US$52.07 per tonne in Q3, from US$82.20 per tonne a year earlier. Coal sales declined from 2.4mn tonnes to 2.2mn tonnes.

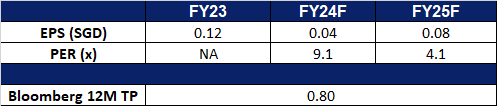

- Market Consensus. We have a fundamental coverage with a BUY recommendation and a TP of S$0.80. Please read the full report here.

(Source: Bloomberg)

Prada S.P.A. (1913 HK): Topping the Lyst Index

- BUY Entry – 50.5 Target – 54.5 Stop Loss – 48.5

- Prada SpA is an Italy-based company engaged in fashion industry. The Company is a parent of the Prada Group. The Company, along with its subsidiaries, is engaged in the design, production and distribution of leather goods, handbags, clothing, eyewear, fragrances, footwear and accessories. Prada SpA manufactures jackets, trousers, skirts, dresses, sweaters, blouses, as well as perfumes and watches, among others. The Company trades its products through several brands, such as Prada, Miu Miu, The Church and The Car Shoe. Prada SpA operates in approximately 70 countries through directly operated stores, franchise operated stores, a network of selected multi-brand stores and department stores. Prada Spa operates through a numerous subsidiaries, including Artisans Shoes Srl, Angelo Marchesi Srl, Prada Far East BV, Tannerie Megisserie Hervy SAS and Prada SA, among others.

- Partnership between Prada and L’Oreal. Prada has recently revealed a long-term licensing agreement with L’Oreal, marking a strategic partnership to globally create, develop, and distribute Miu Miu products. This collaboration aims to propel the brand’s growth, tapping into new markets and unlocking its full potential in the beauty industry. Utilizing this alliance, Miu Miu intends to enhance sales and broaden its footprint in the beauty market through the expertise of the renowned French cosmetic firm.

- Chinese New Year Campaign. Prada has recently launched its Chinese New Year campaign for the Year of the Dragon in 2024, drawing inspiration from the nostalgic charm of Wong Kar-wai’s iconic films. Infused with romanticism and vibrant red tones, the campaign features Du Juan, the latest muse prominently featured in Wong Kar-wai’s recently debuted TV series, Blossoms Shanghai. Notably, Zhao Lei, recognized as the face of Yang Fudong’s film, First Spring, is showcased at the Pradasphere II exhibition in Shanghai. The collection introduces Re-Nylon bucket hats, patent leather mini bags, and pouches in cherry red, as well as black leather wallets and belts. Additionally, Prada Home contributes to the ensemble with quirky porcelain cups, collectively capturing the essence of this thematic celebration. This well-curated selection provides consumers with several choices for wardrobe staples for the Year of the Dragon.

- Topping Lyst Index. Prada topped the Lyst Index in 4Q23, while Miu Miu, a Italian high fashion women’s clothing and accessory brand and a fully-owned subsidiary of Prada, came in 2nd place in the Lyst Index in 4Q23. The Lyst Index is a quarterly ranking of fashion’s hottest brands and products. The formula behind The Lyst Index takes into account Lyst shoppers’ behavior, including searches on and off the platform, product views, and sales. To track brand and product heat, the formula also incorporates social media mentions, activity and engagement statistics worldwide, over three months. Prada and Miu Miu topped the Lyst Index in 3Q23 as well, showcasing the strength of the company in staying relevant and up to date with consumers’ preferences.

- 9M23 earnings. Revenue rose by 10.3% YoY at constant exchange rates to €3.34bn in 9M2023, compared to €2.98bn in 9M22. Retail Sales rose 10.4% YoY at constant exchange rates to €298bn in 9M23, compared with €2.65bn in 9M22, driven by like-for-like and full-price sales.

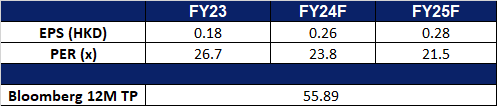

- Market consensus.

(Source: Bloomberg)

China Mobile Ltd. (941 HK): A buying target amidst the market bail-out

- RE-ITERATE BUY Entry – 66.6 Target – 70.6 Stop Loss – 64.1

- China Mobile Ltd is a China-based company mainly engaged in communication and information services. The Company’s businesses include personal market business, family market business, government enterprise market business and emerging market business. The personal market business mainly provides mobile communication services and Internet access services. The family market business mainly provides broadband access services. The government enterprise market business provides basic communication services, information application products and data, information, communication and technology (DICT) solutions. The emerging market businesses include emerging fields such as international business, digital content and mobile payment.

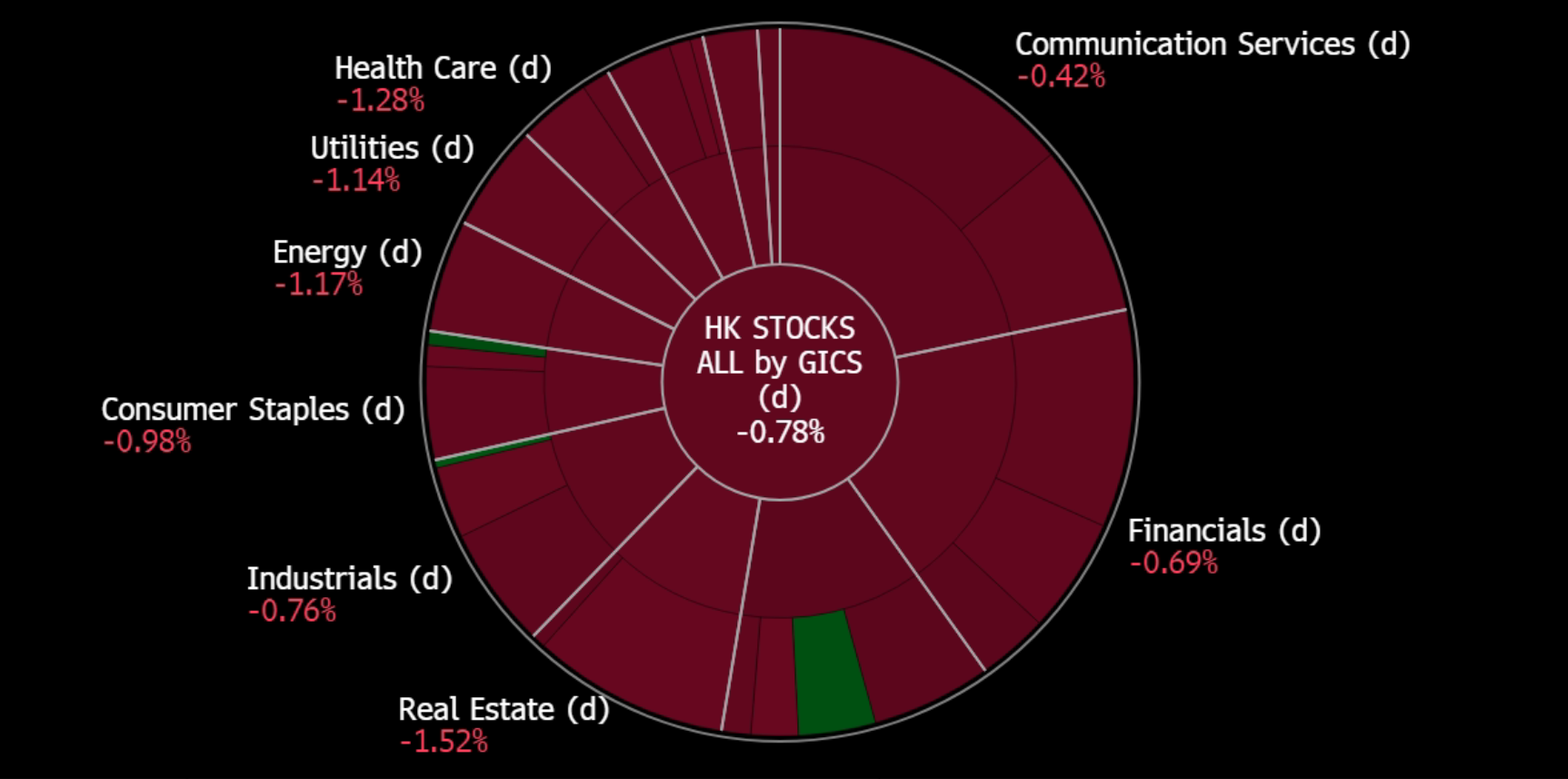

- Market bail-out. In recent efforts to bolster market confidence, Chinese regulators have introduced new policies to support economic growth and capital markets. Officials are emphasizing initiatives to advance the high-quality development of public companies to stabilize markets and sustain quality economic expansion. Central Huijin Investment Ltd, a sovereign wealth fund subsidiary, recently expanded exchange-traded fund (ETF) purchases and plans to further increase ETF holdings. Regulators also imposed additional short-selling restrictions following last week’s market plunge to five-year lows amid declining confidence in China’s struggling economy. This array of measures aims to buoy share prices and restore faith in the wake of substantial declines. SOEs such as China Mobile are primary beneficiaries to benefit from these policy supports.

- 6G test satellite. China Mobile recently launched the world’s first satellite to test 6G network architectures, representing a key milestone in exploring integrated space and ground communications tech. The company developed the distributed autonomous 6G architecture with the Chinese Academy of Sciences’ Innovation Academy for Microsatellites and integrated it into the test satellite. As a crucial platform for future converged space and terrestrial networks, low-earth orbit satellites can fill coverage gaps, delivering higher bandwidth satellite internet globally. China Mobile stated it intends to perform experiments using the test satellite to accelerate the integration and advancement of space-to-ground industries.

- Signs of smartphone recovery. The smartphone market has shown signs of recovery in China, picking up steam after the launch of new products by Apple and Huawei technology. China, the world’s largest smartphone market, is expected to ship 287mn units in 2024, a 3.6% YoY increase. The recovery smartphone market would bring about increased mobile data usage, as consumers upgrade their phones and utilize features like 5G connectivity, driving revenue for China Mobile.

- 9M23 earnings. Operating Revenue increased by 7.2% YoY to RMB775.6bn in 9M23, compared to RMB723.5bn in 9M22. Net profit rose by 7.1% YoY to RMB105.6bn in 9M23, compared to RMB98.6bn in 9M22. Basic EPS of RMB4.94 in 9M23, compared to RMB4.62 in 9M22.

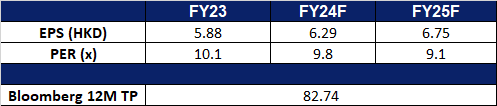

- Market consensus.

(Source: Bloomberg)

CrowdStrike Holdings Inc (CRWD US): Addressing cybersecurity demand

- BUY Entry – 315 Target – 337 Stop Loss – 304

- CrowdStrike Holdings, Inc. provides cybersecurity products and services to stop breaches. The Company offers cloud-delivered protection across endpoints, cloud workloads, identity and data, and leading threat intelligence, managed security services, IT operations management, threat hunting, Zero Trust identity protection, and log management. CrowdStrike serves customers worldwide.

- Partnership opportunities. On 13 February, CrowdStrike announced its partnership with Ignition Technology in the United Kingdom (UK) to enhance access to the CrowdStrike XDR Falcon platform for businesses. This collaboration merges Ignition’s cybersecurity expertise with CrowdStrike’s innovative platform to address the UK’s growing cybersecurity demands. The partnership highlights CrowdStrike’s dedication to supporting its partners and fostering business expansion. Leveraging Ignition’s extensive network, the alliance aims to provide advanced cloud and SaaS cybersecurity solutions to customers while generating new market prospects. Through this collaboration, CrowdStrike and Ignition can effectively tackle customer challenges and develop unique market offerings. The partnership is poised to deliver value, seize opportunities, and achieve mutual success for CrowdStrike, Ignition Technology, and their partners.

- Growing in the AI cybersecurity sector. CrowdStrike, a leader in cybersecurity, is well-positioned to capitalize on the growing investments in artificial intelligence (AI). The company leverages advanced AI capabilities to offer superior threat protection through its endpoint security software. It’s cohesive platform integrates multiple security modules, simplifying workflows for customers and providing proactive threat detection using AI-powered indicators of attack (IoAs). CrowdStrike’s unique data advantage and innovative AI solutions position it as a market leader in preventing malware and other cyber threats. Additionally, the company is poised to benefit from the increasing frequency and sophistication of cyberattacks, the shortage of cybersecurity talent, and regulatory changes mandating disclosure of cybersecurity incidents. CrowdStrike’s strategic initiatives and powerful tailwinds underscore its potential for long-term growth and success in the cybersecurity industry.

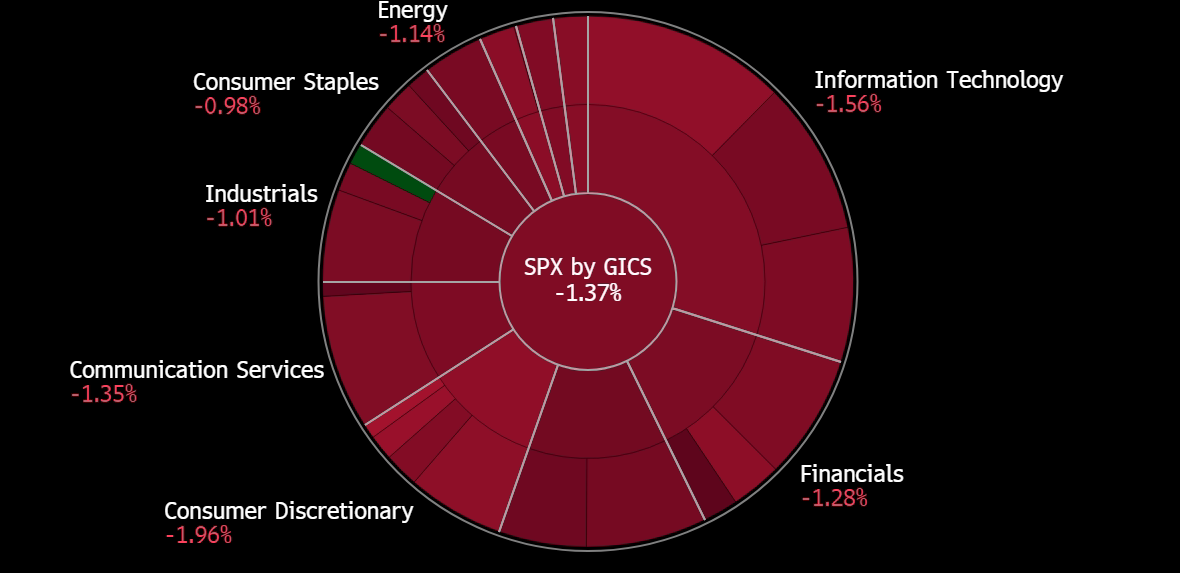

- Higher than expected CPI data. In January, inflation exceeded expectations, with the consumer price index (CPI) rising by 0.3%, according to the Bureau of Labor Statistics. The 12-month CPI stood at 3.1%, down from December’s 3.4%. The increase was primarily driven by rising shelter prices, which accounted for more than two-thirds of the overall rise. Economists had forecasted a 0.2% monthly increase and a 2.9% annual gain. Excluding volatile food and energy prices, the core CPI accelerated by 0.4% in January and was up 3.9% from a year ago, matching December’s figures. Despite the rise in prices, inflation-adjusted earnings increased by 0.3% for the month. However, adjusted for the decline in the average workweek, real weekly earnings fell by 0.3%. The release could complicate the Federal Reserve’s plans for monetary policy adjustments as it anticipates inflation to return to its 2% target. This, in turn, may negatively affect expectations of interest rates declining. Lower interest rates would benefit corporations and stocks to a greater extent. However, with CrowdStrike being a cybersecurity company, it will not be as heavily impacted as other AI stocks since having a strong cybersecurity is a core part of businesses even during recessionary periods given the rising number of cyber threats.

- 3Q24 earnings review. Revenue rose by 35.3% YoY to US$786mn, beating estimates by US$8.62mn. Non-GAAP EPS was US$0.82, beating estimates by US$0.08. Its ending ARR surpassed the US$3bn milestone and grew 35% YoY to reach US$3.15bn. In 4Q24, it expects revenue to be between US$836.6-840mn vs consensus of US$836.81mn and non-GAAP EPS to be between US$0.81-0.82 vs consensus of US$0.78. FY24 revenue is expected to be between US$3.046-3.05bn vs US$3.04bn and non-GAAP EPS to be US$2.95-2.96 vs US$2.83 consensus.

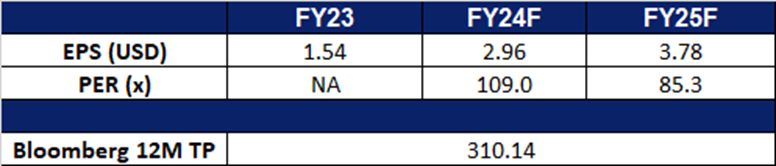

- Market consensus.

(Source: Bloomberg)

Broadcom Inc (AVGO US): Another leg-up soon

- RE-ITEREATE BUY Entry – 1285 (Buy stop) Target – 1400 Stop Loss – 1227

- Broadcom Inc. designs, develops, and supplies semiconductor and infrastructure software solutions. The Company offers storage adapters, controllers, networking processors, motion control encoders, and optical sensors, as well as infrastructure and security software to modernize, optimize, and secure the most complex hybrid environments. Broadcom serves customers worldwide.

- Expecting AI spending boom. Bank of America recently released a report which highlights an anticipated increase of US$45bn in cloud and AI capital spending by major hyperscalers like Microsoft, Alphabet, Amazon, and Meta. This upswing in spending is expected to benefit chipmakers over the next three years. Beyond tech giants, industries like healthcare and finance are embracing AI, further driving demand for chips. Broadcom leads in high-end AI ASIC market, collaborating with companies like Google to design custom chips for AI, known as Tensor Processing Units (TPUs). With Broadcom’s strong position in the AI semiconductor market, it presents an attractive opportunity for investors amidst soaring demand for AI semiconductors.

- Room for growth. In Q4, Broadcom’s revenue and adjusted profit per share surpassed estimates. However, the company forecasts annual revenue for FY24 below Wall Street estimates due to weak enterprise spending and competition, impacted by its acquisition of VMware. In FY24 revenue is expected to be around US$50.0bn, lower than analysts’ expectations of US$52.50bn. The company plans to divest VMware’s non-core businesses, such as end-user computing and Carbon Black and aims for an adjusted EBITDA of about 60% of projected revenue, approximately US$30bn. Transition costs related to VMware are estimated at about US$1bn. Revenue from telecom and enterprise clients has moderated, with concerns about the impact of a slowdown in new orders from major client Cisco Systems and growing competition from Nvidia also adding pressure. However, with the acquisition providing new synergies in the cloud computing domain that has yet to be reflected in its financial statement, there may still be room for growth and upside for Broadcom if it can utilise this acquisition to its fullest potential.

- 4Q23 earnings review. Revenue rose by 4.1% YoY to US$9.3bn, beating estimates by US$20mn. Non-GAAP EPS was US$11.06, beating estimates by US$0.10. In FY24 it expects revenue to be approximately US$50bn including contribution from VMware, an increase of 40% from the prior year period, and adjusted EBITDA guidance of approximately 60% of projected revenue.

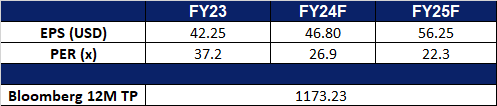

- Market consensus.

(Source: Bloomberg)

Trading Dashboard Update: Take profit on Palantir Technologies Inc (PLTR US) at US$24 and Las Vegas Sands Corp (LVS US) at US$54. Add China Mobile Ltd (941 HK) at HK$66.6 and Broadcom Inc (AVGO US) at US$1,285. Cut loss on Adobe Inc (ADBE US) at US$593.