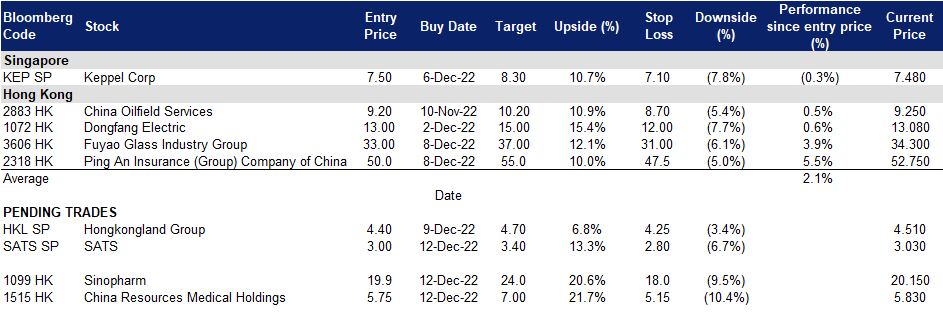

14 December 2022: SATS Ltd (SATS SP), Sinopharm Group Co., Ltd. (1099)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SATS Ltd (SATS SP): Expecting synergies from the WFS acquisition

- RE-ITERATE Entry – 3.00 Target – 3.40 Stop Loss – 2.80

- SATS – Singapore Airport Terminal Services – is a provider of Airport Services and Food Solutions. Its comprehensive scope of airport services encompasses airfreight handling, passenger services, ramp handling, baggage handling, aviation security and aircraft interior cleaning, while its food solutions business comprises inflight catering, food distribution and logistics, industrial catering as well as chilled and frozen food manufacturing. Today, its network of ground handling and inflight catering operations spans nearly 40 airports in the Asia Pacific region.

- WFS purchase. In order to raise the $1.8 billion needed for its purchase of European air cargo and logistics giant Worldwide Flight Services (WFS), SATS will generate the fund through a combination of $700 million in euro-denominated term loans and $800 million in a renounceable rights issue of new shares, with the balance coming from internal resources. The company said it would get the term loan at a favourable rate of 4 per cent to 4.5 per cent.

- Expansion. The plans to acquire the much larger WFS, would enable SATS to expand beyond just Singapore and the region to become the world’s largest air cargo and warehousing player. WFS is the market leader in North America and Europe for cargo handling, with 114 cargo stations and more than 800,000 sq m of warehouse space via 170 on-airport leased warehouses. Currently 85% of SATS revenue is from Singapore, when enlarged, 45% of revenue would come from Asia, 30% from Americas and the remaining 25% from the Middle East and Europe. Furthermore, with this acquisition, it would have a more diversified business mix, with half the revenue coming from cargo, almost a third from food solutions and the balance from ground handling.

- Updated market consensus of the EPS growth in FY23/24 is -81.5%/4,475.0% YoY respectively, which translates to 1,010x/19.8x forward PE. Bloomberg consensus average 12-month target price is S$3.68.

(Source: Bloomberg)

Hongkong Land Holdings Ltd (HKL SP): China easing Covid restrictions

Hongkong Land Holdings Ltd (HKL SP): China easing Covid restrictions

- RE-ITERATE Entry – 4.40 Target – 4.70 Stop Loss – 4.25

- Hongkong Land is a major listed property investment, management and development group. The Group owns and manages over 850,000 sq. m. of prime office and luxury retail property in key Asian cities, principally Hong Kong, Singapore, Beijing and Jakarta. The Group also has a number of high-quality residential, commercial and mixed-use projects under development in cities across China and Southeast Asia, including a 43% interest in a 1.1 million sq. m. mixed-use project in West Bund, Shanghai.

- Easing COVID measures. On 8 December, it was reported that Hong Kong may further loosen Covid-related restrictions. The government is considering scrapping its outdoor mask mandate and easing test requirements for inbound travelers. The Chinese government also recently announced that they would allow Covid patients with mild symptoms to isolate at home and drop the requirement for people to show negative tests when traveling between regions.

- Yuan strengthening. China’s onshore and offshore yuan is strengthening against the US dollar. The implementation of China’s policies would stabilise economic growth, restoring market confidence and supporting the yuan. With the Chinese economy expected to open up gradually in the coming year, the yuan will likely appreciate against the US dollar.

- Property sector supporting policy. On 23 November, China’s central bank and Banking and Insurance Regulatory Commission jointly announced 16 measures to ensure the stray and sound development of the housing sector. Additionally, they also urged financial institutions to support real estate financing through various channels. By providing financing to property developers, it can help to stabilise the housing market and prevent risks from spreading beyond the real estate sector. These new policies will also help to boost homebuyer confidence and help to release reasonable housing demand.

- Updated market consensus of the EPS growth in FY22/23 is -10.6%/10.3% YoY respectively, which translates to 12.0x/10.9x forward PE. Current PER is 12.7x. Bloomberg consensus average 12-month target price is S$5.17.

(Source: Bloomberg)

Sinopharm Group Co., Ltd. (1099): Growing demand for medicines and devices amidst rising infections

- RE-ITERATE Buy Entry – 19.9 Target – 24.0 Stop Loss – 18.0

- Sinopharm Group Co Ltd is a China-based company principally engaged in pharmaceutical and medical devices distribution business. The Company operates its business through four segments. Pharmaceutical Distribution segment is engaged in the distribution of pharmaceutical products to hospitals, other distributors, retail pharmacy stores and clinics. Medical Devices segment is engaged in the distribution of medical devices, as well as provides installation and maintenance services. Retail Pharmacy segment is engaged in the operation of chain pharmacy stores. Other Business segment is engaged in the distribution of laboratory supplies, manufacture and distribution of chemical reagents, production and sale of pharmaceutical products.

- Growing concerns and restocking of medicines after the U-turn of covid lockdowns. China has abandoned its long-lasting Zero-COVID measures and is actively normalising its economic activities. However, public concerns about ensuring infections result in the restocking of medicines for COVID and related respiratory treatments. The inventories of flu treatment drugs and other related OTC medicines are running low or even running out. Retail pharmacies are seeing a rush to re-stocking and ensuing jump in sale volumes.

- Upcoming large-scale COVID infections. The Chinese New Year travel rush will kick start in one month. This will be the first rush after China lifted COVID restrictions. The peak of this wave of infections has yet come. As the death rate of Omicron is around 0.3% to 0.4%, hundreds of thousands of patients are expected to be hospitalised in the next couple of months. Accordingly, the healthcare system will be under pressure, and the demand for related medical devices like oxygen tanks will jump.

- 9M22 earnings review. Total revenue increased by 13.8% YoY to RMB54.5bn in 9M22. Operating profit attributable to shareholders of the parent company rose by 13.8% YoY to RMB1.9bn. Profit attributable to the parent rose by 8.1% YoY to RMB769mn.

- The updated market consensus of the EPS growth in FY22/23/24 is -2.6%/9.4%/9.0% YoY respectively, translating to 6.8×/6.2x/5.7x forward PE. The current PER is 7.2x. Bloomberg consensus average 12-month target price is HK$22.14.

(Source: Bloomberg)

China Resources Medical Holdings Company Limited (1515 HK): Expecting a tight supply of beds and medical treatment

China Resources Medical Holdings Company Limited (1515 HK): Expecting a tight supply of beds and medical treatment

- RE-ITERATE Buy Entry – 5.75 Target –7.00 Stop Loss – 5.15

- China Resources Medical Holdings Company Limited, formerly China Resources Phoenix Healthcare Holdings Co., Ltd, is an investment holding company mainly engaged in the group purchasing organization (GPO) business. Along with subsidiaries, the Company operates its business through four segments. The GPO Business segment is involved in the sales of pharmaceuticals, medical devices and medical consumables to Jian Gong Hospital, the Internet of things (IOT) Hospitals and external customers. The General Healthcare Services segment provides hospital services provided through Jian Gong Hospital and 999 Medical Clinic (Shenzhen) Co., Ltd. The Hospital Management and Consulting Services segment provides comprehensive management and consulting services to IOT Hospitals and sponsored hospitals and receives an annual fee. The Other Hospital-Derived Services segment provides medical consultation service to third parties.

- Upcoming large-scale COVID infections. The Chinese New Year travel rush will kick start in one month. This will be the first rush after China lifted COVID restrictions. The peak of this wave of infections has yet come. As the death rate of Omicron is around 0.3% to 0.4%, hundreds of thousands of patients are expected to be hospitalised in the next couple of months. Accordingly, the healthcare system will be under pressure, and the demand for related medical treatment and beds will jump.

- 1H22 earnings review. Revenue jumped by 60.9% YoY to RMB2.9bn in 1H22. Profit attributable to the parent rose by 1.1% YoY to RMB201.6mn.

- The updated market consensus of the EPS growth in FY22/23/24 is -0.07%/13.9%/2.2% YoY respectively, translating to 15.1×/13.2x/12.9x forward PE. The current PER is 15.6x. Bloomberg consensus average 12-month target price is HK$7.27.

(Source: Bloomberg)

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Biotechnology | +3.09% | Why Moderna Stock Is Skyrocketing Today Amgen Inc (AMGN US) |

| Internet Software/Services | +2.58% | Stocks close higher on cooler inflation report, notch second day of gains Alphabet Inc (GOOG US) |

| Precious Metals | +2.36% | Gold Price Forecast: XAU/USD bulls cheer Fed pivot sentiment after US CPI miss Newmont Corporation (NEM US) |

Top Sector Losers

| Sector | Loss | Related News |

| Managed Health Care | -1.89% | UnitedHealth Group (UNH) Stock Sinks As Market Gains: What You Should Know UnitedHealth Group Inc (UNH US) |

| Motor Vehicles | -1.83% | Tesla Stock Rout Puts Market Cap Below $500 Billion Tesla Inc (TSLA US) |

| Regional Banks | -0.62% | JPMorgan keeps bearish view on regional banks, but upgrades First Hawaiian HDFC Bank Ltd (HDB US) |

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Semiconductors | +3.81% | Exclusive: China readying $143 billion package for its chip firms in face of U.S. curbs Semiconductor Manufacturing International Corp (981 HK) |

Gamble | +3.71% | Asia-Pacific stocks climb as Hong Kong scraps Covid restrictions for incoming travelers Galaxy Entertainment Group Limited (0027 HK) |

System Applications & IT Consulting | +3.12% | Hi Sun Technology (China) Ltd (818 HK) |

Top Sector Losers

Sector | Loss | Related News |

Electronic Component | -1.13% | Apple suppliers to hasten move out of China: report Sunny Optical Technology Group Co Ltd (2382 HK) |

Biotechnology | -0.98% | Pharmas Jumble; SHANDONG XINHUA Rallies Over 8%; But BRII, CLOVER BIO Slip Over 7-11% WuXi Biologics (Cayman) Inc (2269 HK) |

Alternative Energy | -0.97% | U.S. solar installations to fall 23% this year due to China goods ban -report Xinyi Energy Holdings Ltd (3868 HK) |

Trading Dashboard Update: No stocks additions/deletions.